Leveraged Finance Analyst Core Responsibilities

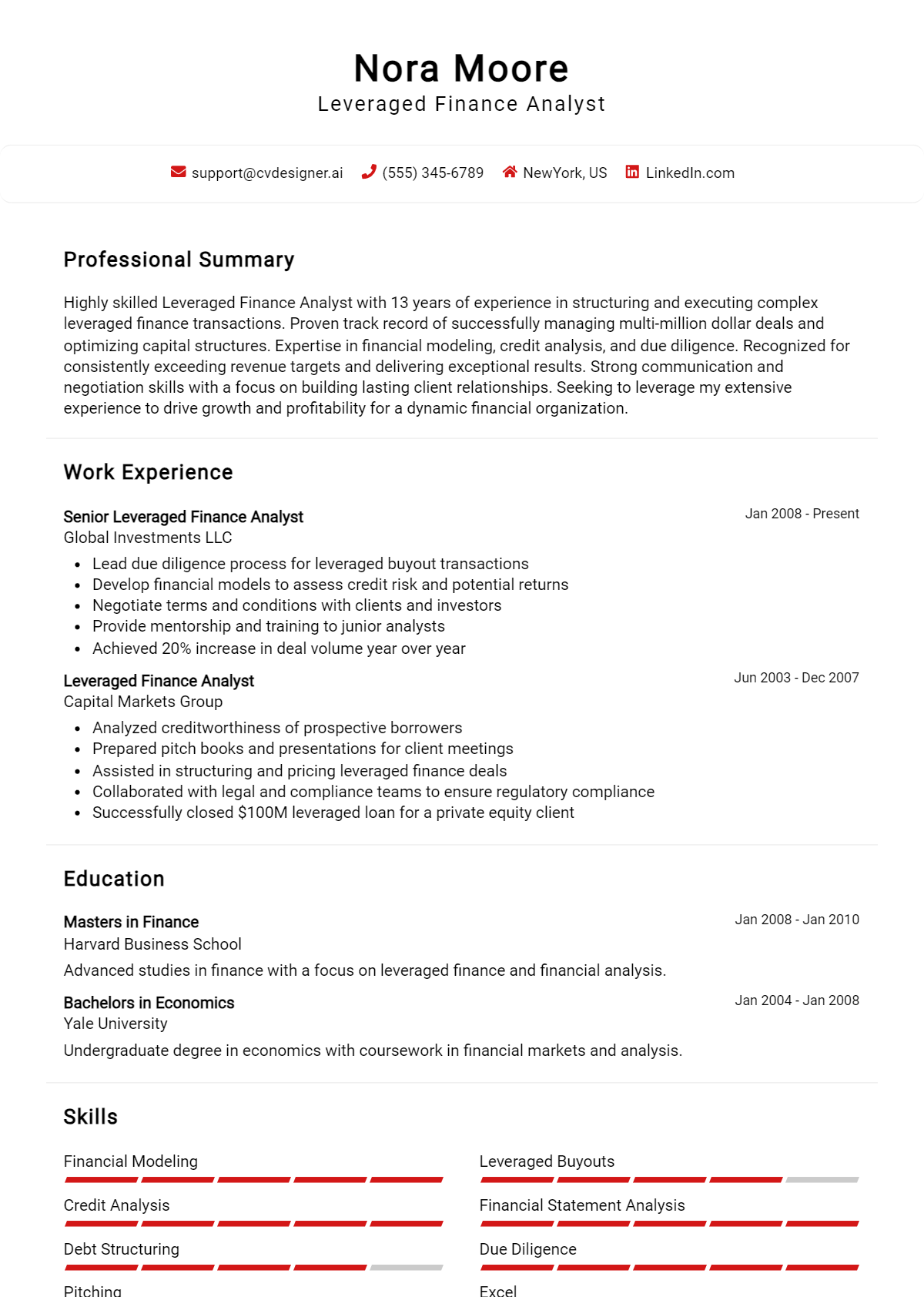

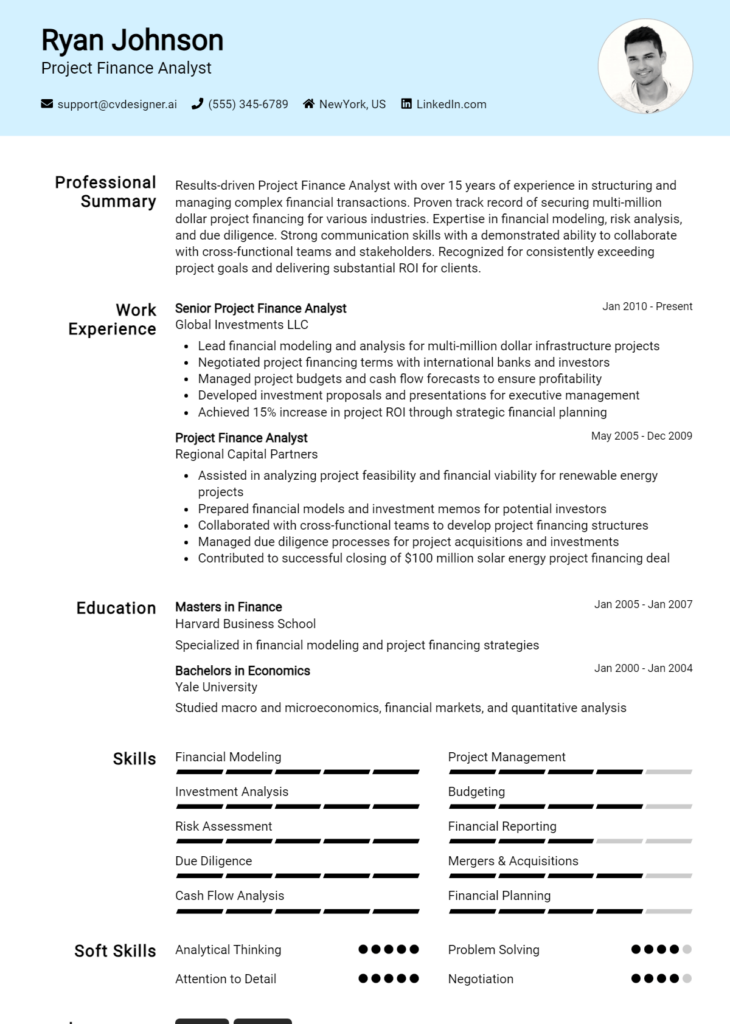

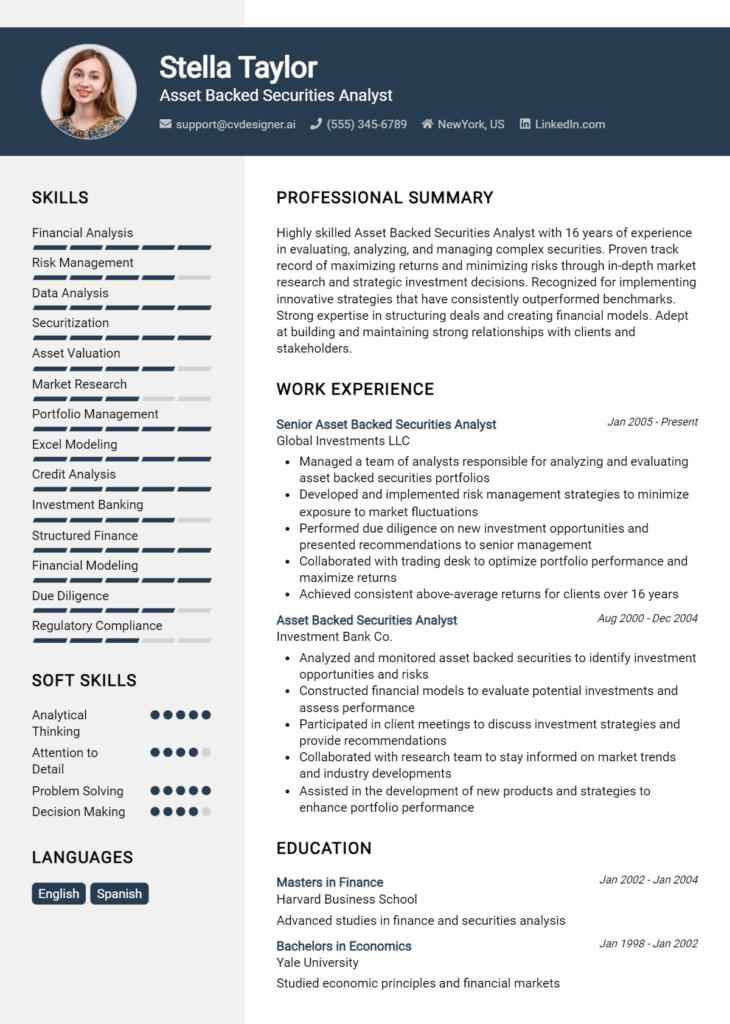

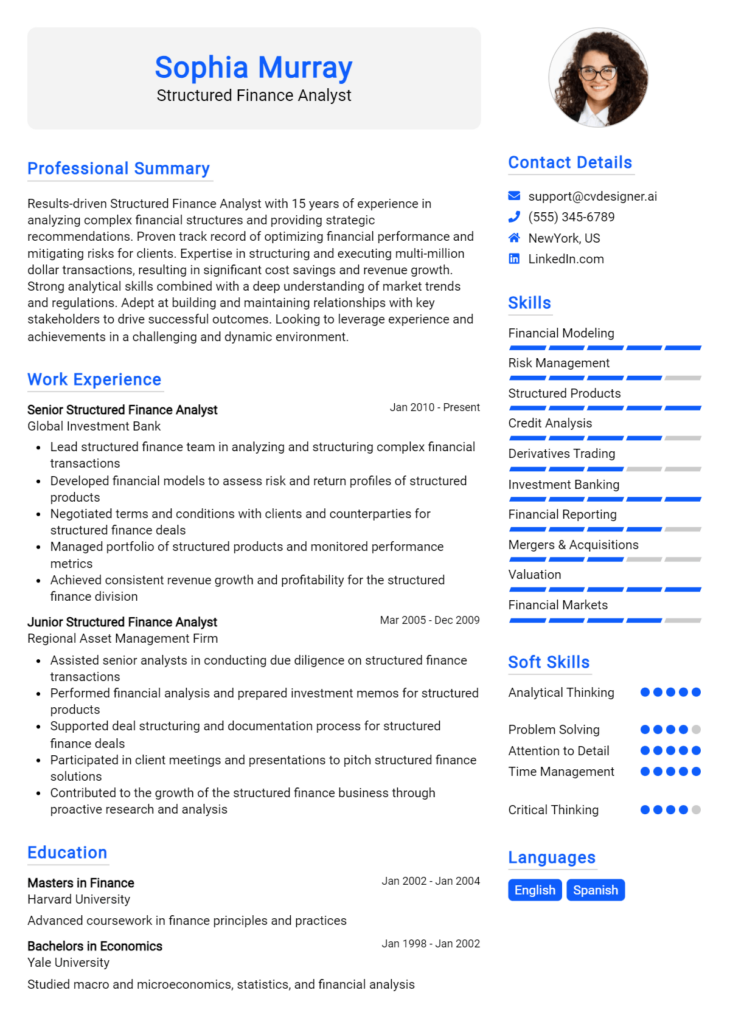

A Leveraged Finance Analyst plays a crucial role in evaluating investment opportunities and structuring financial transactions, serving as a bridge between finance, operations, and client relations. Key responsibilities include financial modeling, credit analysis, and risk assessment, requiring strong technical, operational, and problem-solving skills. These competencies are vital to aligning departmental goals with the organization’s strategic objectives. A well-structured resume highlighting these qualifications can effectively showcase a candidate’s readiness to contribute to the firm’s success.

Common Responsibilities Listed on Leveraged Finance Analyst Resume

- Conduct in-depth financial analysis and modeling to support investment decisions.

- Assist in the structuring and negotiation of leveraged buyouts and debt financings.

- Evaluate creditworthiness and risk metrics of potential investments.

- Prepare detailed presentations for internal and external stakeholders.

- Collaborate with legal and compliance teams to ensure adherence to regulations.

- Monitor market trends and economic indicators affecting leveraged finance.

- Perform due diligence on target companies and industry sectors.

- Maintain relationships with lenders, clients, and investment partners.

- Support the execution of transactions and post-merger integration processes.

- Assist in the preparation of quarterly and annual reports to senior management.

- Participate in team meetings to strategize potential investment opportunities.

High-Level Resume Tips for Leveraged Finance Analyst Professionals

In the competitive landscape of leveraged finance, a well-crafted resume is crucial for professionals aiming to stand out to potential employers. Your resume often serves as the first impression you make, encapsulating your skills, achievements, and unique qualifications in a concise manner. It is essential that your resume not only highlights your expertise in financial analysis, modeling, and deal structuring but also showcases your accomplishments in a way that aligns with the specific requirements of the role. This guide will provide practical and actionable resume tips tailored specifically for Leveraged Finance Analyst professionals, helping you create a document that effectively communicates your value to prospective employers.

Top Resume Tips for Leveraged Finance Analyst Professionals

- Tailor your resume for each job application by aligning your skills and experiences with the job description.

- Begin with a strong summary statement that highlights your key qualifications and career objectives related to leveraged finance.

- Showcase relevant work experience prominently, focusing on positions that involved financial analysis, modeling, and transaction support.

- Quantify your achievements with specific metrics, such as deal sizes, percentage increases in revenue, or cost savings generated.

- Highlight industry-specific skills, including financial modeling, valuation techniques, and familiarity with leveraged buyouts (LBOs) and debt structuring.

- Include technical proficiencies, such as advanced Excel skills, experience with financial software, and knowledge of data analysis tools.

- Utilize action verbs to convey your contributions and impact effectively, such as "analyzed," "developed," and "executed."

- Incorporate relevant certifications or educational qualifications, such as CFA or an MBA, that enhance your credibility in the finance realm.

- Keep your resume concise and focused, ideally one page, ensuring that every piece of information adds value to your candidacy.

- Proofread your resume meticulously to eliminate any errors and ensure a professional presentation.

By implementing these tips, you can significantly increase your chances of landing a job in the Leveraged Finance Analyst field. A well-structured and tailored resume not only highlights your relevant experience and accomplishments but also demonstrates your commitment to the role, making a compelling case for why you should be considered for the position.

Why Resume Headlines & Titles are Important for Leveraged Finance Analyst

In the competitive field of leveraged finance, a well-crafted resume headline or title serves as a crucial first impression for candidates vying for analyst positions. A strong headline can immediately capture the attention of hiring managers, summarizing a candidate's key qualifications in a succinct and impactful phrase. It functions not only as a way to stand out in a sea of applicants but also provides a quick snapshot of the candidate's expertise, making it easier for recruiters to assess their fit for the role. Therefore, the headline should be concise, relevant, and directly aligned with the job being applied for, showcasing the candidate’s unique value proposition.

Best Practices for Crafting Resume Headlines for Leveraged Finance Analyst

- Keep it concise—aim for one impactful sentence.

- Use keywords relevant to the leveraged finance industry.

- Highlight specific skills or experiences that set you apart.

- Tailor your headline to align with the job description.

- Focus on quantifiable achievements when possible.

- Avoid jargon or overly technical language that may confuse readers.

- Ensure it reflects your professional brand and career goals.

- Revise and refine for clarity and impact.

Example Resume Headlines for Leveraged Finance Analyst

Strong Resume Headlines

Results-Driven Leveraged Finance Analyst with 5 Years of Experience in High-Stakes Transactions

Detail-Oriented Analyst Specializing in Debt Structuring and Financial Modeling

Leveraged Finance Expert with Proven Track Record in Maximizing Returns for Private Equity Clients

Dynamic Financial Analyst with Expertise in Risk Assessment and Portfolio Management

Weak Resume Headlines

Finance Analyst

Experienced Professional in Finance

Seeking Opportunities in Finance

The strong headlines effectively convey specific strengths and experiences, allowing hiring managers to quickly understand the candidate's qualifications and areas of expertise relevant to leveraged finance. In contrast, the weak headlines lack specificity and fail to highlight any unique skills or achievements, making them less memorable and impactful. By focusing on clarity and relevance, strong headlines can significantly enhance a candidate's chances of making a positive impression in the competitive job market.

Writing an Exceptional Leveraged Finance Analyst Resume Summary

A well-crafted resume summary is essential for a Leveraged Finance Analyst as it serves as the first impression for hiring managers. This concise paragraph should effectively capture attention by highlighting key skills, significant experience, and notable accomplishments that are directly relevant to the role. A strong summary not only showcases the candidate’s qualifications but also sets the tone for the rest of the resume, ensuring it aligns with the specific job description. By being impactful and tailored, the summary can significantly enhance a candidate’s chances of securing an interview.

Best Practices for Writing a Leveraged Finance Analyst Resume Summary

- Quantify achievements to demonstrate impact, such as "increased revenue by 20%."

- Focus on relevant skills, including financial analysis, modeling, and due diligence.

- Tailor the summary for each job application to align with the specific job description.

- Use industry terminology and keywords to ensure alignment with hiring manager expectations.

- Keep it concise, ideally within 3-5 sentences, to maintain the reader's attention.

- Highlight unique accomplishments that set you apart from other candidates.

- Maintain a professional tone while reflecting your personality and enthusiasm for the role.

- Proofread carefully to avoid any grammatical errors or typos that could undermine professionalism.

Example Leveraged Finance Analyst Resume Summaries

Strong Resume Summaries

Results-driven Leveraged Finance Analyst with over 5 years of experience in conducting in-depth financial analysis and modeling for high-stakes mergers and acquisitions. Successfully led a team that identified and executed a $200 million investment opportunity, yielding a 25% ROI within the first year.

Detail-oriented financial professional specializing in leveraged buyouts and capital structure optimization. Proven track record of developing comprehensive financial models that supported $500 million in transactions, enhancing decision-making processes for senior management.

Dynamic Leveraged Finance Analyst with expertise in structuring complex financing solutions. Achieved a 30% reduction in financing costs for clients by implementing innovative strategies, resulting in increased client retention and satisfaction.

Weak Resume Summaries

Experienced finance professional with a background in analysis. Looking for a position in leveraged finance.

Motivated individual seeking to leverage skills in finance and analysis. I am eager to contribute to a finance team.

The examples above illustrate the significance of specificity and quantifiable outcomes in a resume summary. The strong summaries effectively communicate the candidate's achievements, relevant skills, and direct applicability to the role, making them compelling to hiring managers. In contrast, the weak summaries lack detail, are overly generic, and fail to showcase any unique qualifications, making them less memorable and impactful.

Work Experience Section for Leveraged Finance Analyst Resume

The work experience section of a Leveraged Finance Analyst resume is a critical component that effectively demonstrates a candidate's technical skills, leadership capabilities, and commitment to delivering high-quality results. This section allows candidates to present their relevant experience in a way that aligns with industry standards, showcasing their ability to analyze complex financial data, manage teams, and execute successful financial transactions. By quantifying achievements and highlighting specific contributions, candidates can differentiate themselves in a competitive job market, making it essential to craft this section with care and precision.

Best Practices for Leveraged Finance Analyst Work Experience

- Highlight technical skills relevant to leveraged finance, such as financial modeling, valuation techniques, and credit analysis.

- Quantify achievements with specific metrics to demonstrate impact, such as revenue growth percentages or cost savings.

- Include collaborative projects that showcase teamwork and leadership in managing cross-functional teams.

- Use action verbs to convey a sense of proactivity and ownership in your roles.

- Tailor your experience to align with the specific requirements of the role you are applying for.

- Focus on outcomes and results rather than just responsibilities to illustrate effectiveness.

- Include relevant certifications or training that enhance your technical expertise.

- Maintain clarity and conciseness to ensure your experiences are easily digestible for hiring managers.

Example Work Experiences for Leveraged Finance Analyst

Strong Experiences

- Led a cross-functional team in a $250 million leveraged buyout transaction, resulting in a 15% increase in ROI over three years.

- Developed intricate financial models that accurately projected cash flows, supporting a successful bond issuance that raised $100 million for corporate expansion.

- Conducted comprehensive credit analysis for a portfolio of 10+ clients, successfully reducing default risk by 20% through strategic recommendations.

- Collaborated with senior management in preparing detailed investment presentations, directly contributing to securing a $50 million investment from private equity partners.

Weak Experiences

- Worked on various financial transactions without specific details or outcomes provided.

- Assisted in financial modeling and analysis with no quantifiable impact mentioned.

- Participated in team meetings and discussions without outlining specific contributions or leadership roles.

- Helped with report preparation but lacked details on the nature of the reports or their significance to the company.

The examples listed as strong experiences illustrate clear outcomes, demonstrating the candidate's ability to deliver measurable results and lead effectively in high-stakes financial environments. In contrast, the weak experiences lack specificity and quantifiable achievements, making it difficult for potential employers to gauge the candidate's true impact or expertise. Crafting experiences in a way that emphasizes results and collaboration is crucial for standing out in the leveraged finance field.

Education and Certifications Section for Leveraged Finance Analyst Resume

The education and certifications section of a Leveraged Finance Analyst resume is critical as it showcases the candidate's academic credentials and industry-relevant qualifications. This section not only reflects the foundational knowledge gained through formal education but also emphasizes the candidate's commitment to continuous learning through relevant certifications and specialized training. By highlighting pertinent coursework, recognized certifications, and ongoing professional development efforts, candidates can significantly enhance their credibility and demonstrate alignment with the specific demands of the leveraged finance role.

Best Practices for Leveraged Finance Analyst Education and Certifications

- Include only relevant degrees that pertain to finance, economics, or business.

- List certifications that are widely recognized in the finance industry, such as CFA or CFI.

- Highlight advanced degrees, such as an MBA, that can provide a competitive edge.

- Detail relevant coursework that applies to leveraged finance, such as corporate finance or financial modeling.

- Keep the section concise while providing enough detail to demonstrate qualifications.

- Order the educational qualifications chronologically, starting with the most recent.

- Consider including any specialized training or workshops relevant to leveraged finance.

- Regularly update this section to reflect newly acquired qualifications or certifications.

Example Education and Certifications for Leveraged Finance Analyst

Strong Examples

- MBA in Finance, New York University Stern School of Business, 2022

- CFA Level I Candidate, Chartered Financial Analyst, 2023

- Bachelor of Science in Finance, University of California, Berkeley, 2020

- Financial Modeling and Valuation Analyst (FMVA) Certification, Corporate Finance Institute, 2021

Weak Examples

- Associate’s Degree in General Studies, Community College, 2018

- Certificate in Basic Accounting, Online Course, 2020

- Bachelor of Arts in History, University of Chicago, 2019

- Certification in Microsoft Office, 2017

The strong examples are considered relevant because they reflect advanced degrees and industry-recognized certifications that align directly with the requirements of a Leveraged Finance Analyst. They highlight the candidate’s financial expertise and readiness for the role. In contrast, the weak examples are less impactful as they include outdated or irrelevant qualifications that do not contribute to the candidate's ability to perform in a leveraged finance environment. Such qualifications can detract from the overall professionalism and focus of the resume.

Top Skills & Keywords for Leveraged Finance Analyst Resume

As a Leveraged Finance Analyst, possessing the right skills is crucial for success in a competitive financial landscape. A well-crafted resume that highlights relevant skills can set you apart from other candidates, demonstrating your capability to analyze complex financial data, assess risk, and contribute to strategic decision-making. Employers seek candidates who not only have strong technical abilities but also excel in soft skills that enhance teamwork and communication. By showcasing a balanced mix of both hard and soft skills, you can effectively convey your qualifications and readiness for the role.

Top Hard & Soft Skills for Leveraged Finance Analyst

Soft Skills

- Excellent communication skills

- Strong analytical thinking

- Attention to detail

- Problem-solving abilities

- Team collaboration

- Adaptability

- Time management

- Critical thinking

- Negotiation skills

- Client relationship management

- Ability to work under pressure

- Conflict resolution

- Emotional intelligence

- Creativity

- Leadership potential

Hard Skills

- Financial modeling

- Credit analysis

- Valuation techniques (e.g., DCF, comparables)

- Knowledge of leveraged buyouts (LBOs)

- Proficiency in Excel and financial software

- Risk assessment methodologies

- Understanding of capital markets

- Data analysis and interpretation

- Proficiency in financial reporting standards

- Familiarity with investment banking processes

- Knowledge of accounting principles

- Experience with debt structuring

- Quantitative analysis

- Regulatory compliance understanding

- Financial statement analysis

- Scenario analysis

- Industry research capabilities

Incorporating these skills into your resume will enhance your appeal to potential employers. Moreover, highlighting your relevant work experience will demonstrate how you have applied these skills in real-world situations, further solidifying your candidacy for a Leveraged Finance Analyst position.

Stand Out with a Winning Leveraged Finance Analyst Cover Letter

I am excited to apply for the Leveraged Finance Analyst position at [Company Name], where I can leverage my analytical skills and financial acumen to contribute to your team. With a solid foundation in finance through my degree in Finance from [University Name] and hands-on experience in financial modeling and valuation, I am well-prepared to support [Company Name] in delivering innovative financing solutions that drive growth and optimize capital structures for clients.

During my internship at [Previous Company Name], I had the opportunity to work closely with senior analysts, where I was involved in conducting extensive due diligence and financial analysis for leveraged buyouts and mergers and acquisitions. My responsibilities included building complex financial models, performing sensitivity analyses, and creating presentations for client meetings. This experience honed my ability to interpret financial statements and market trends, equipping me with the skills necessary to evaluate investment opportunities and assess risk effectively.

I am particularly drawn to [Company Name] due to its reputation for excellence in the leveraged finance market and commitment to fostering a collaborative workplace. I am eager to bring my strong quantitative skills and attention to detail to your esteemed team. I thrive in high-pressure environments and am passionate about helping clients achieve their financial objectives through tailored financing strategies. I am confident that my proactive approach and dedication to excellence will make a meaningful impact at [Company Name].

Thank you for considering my application. I look forward to the opportunity to discuss how my background, skills, and enthusiasm align with the goals of your team. I am excited about the possibility of contributing to [Company Name] and helping to navigate the complexities of leveraged finance in today’s dynamic market.

Common Mistakes to Avoid in a Leveraged Finance Analyst Resume

When crafting a resume for a Leveraged Finance Analyst position, it is crucial to present your skills and experiences effectively. However, many candidates make common mistakes that can undermine their chances of landing an interview. Understanding and avoiding these pitfalls can significantly enhance your resume's impact and showcase your qualifications in the best light. Here are some common mistakes to watch out for:

Generic Objective Statements: Using a vague or generic objective can make your resume blend in with others. Tailor your statement to reflect specific goals related to leveraged finance.

Lack of Quantifiable Achievements: Failing to include quantifiable metrics can weaken your accomplishments. Use numbers to demonstrate your impact, such as "increased portfolio returns by 15%."

Neglecting Relevant Skills: Omitting critical skills specific to leveraged finance, such as financial modeling, credit analysis, or familiarity with leveraged buyouts, can make your resume less compelling.

Overly Complex Language: Using jargon-heavy language or complex terminology can obscure your qualifications. Aim for clarity and conciseness to ensure your resume is easily understood.

Inconsistent Formatting: Irregular formatting can distract from the content of your resume. Maintain a consistent style for headings, bullet points, and font throughout the document.

Ignoring Tailored Content: Sending out a one-size-fits-all resume without customizing it for each job application can lead to missed opportunities. Tailor your resume to highlight experiences and skills that align with the job description.

Lack of Professional Experience: Including irrelevant work experience or omitting pertinent internships can weaken your application. Focus on experiences that are directly related to leveraged finance.

Grammatical Errors and Typos: Spelling mistakes and grammatical errors can create a negative impression. Always proofread your resume to ensure it is polished and professional.

Conclusion

As a Leveraged Finance Analyst, your role is critical in evaluating complex financial transactions, analyzing credit risk, and providing insights into leveraged buyouts and other financing structures. The key skills required for this position include strong analytical abilities, proficiency in financial modeling, and a deep understanding of the capital markets. Additionally, effective communication skills are essential to present findings and recommendations to stakeholders.

To excel in this competitive field, it’s crucial to have a standout resume that highlights your relevant experience and achievements. Make sure to tailor your resume to showcase your expertise in leveraged finance, including any specific transactions you've worked on, your proficiency with financial software, and your ability to assess risk and return.

If you're looking to enhance your resume and make a lasting impression on potential employers, we encourage you to review your Leveraged Finance Analyst resume today. Utilize resources like resume templates, resume builder, resume examples, and cover letter templates. These tools can help you create a polished and professional presentation of your skills and experiences, setting you on the path to success in your career. Take action now and ensure your resume reflects the best version of you!