29 Kyc Analyst Skills For Your Resume with Exampels in 2025

As a KYC Analyst, possessing a diverse set of skills is essential to effectively navigate the complexities of customer due diligence and regulatory compliance. The following section outlines the key competencies that can enhance your resume, demonstrating your expertise in identifying risks, conducting thorough investigations, and ensuring adherence to industry standards. Highlighting these skills will not only showcase your qualifications but also your commitment to maintaining the integrity of financial systems.

Best Kyc Analyst Technical Skills

As a KYC Analyst, possessing a strong set of technical skills is crucial for ensuring compliance and mitigating risks associated with customer onboarding and due diligence processes. These skills not only enhance your ability to analyze customer data but also facilitate effective communication with regulatory bodies and internal stakeholders. Below are some key technical skills you should highlight on your resume.

Data Analysis

Data analysis skills enable KYC Analysts to interpret large volumes of customer data, identifying trends and anomalies that may indicate potential risks.

How to show it: Quantify your experience by stating the number of datasets analyzed or the percentage increase in risk detection rates due to your analysis.

Regulatory Knowledge

Understanding of relevant regulations (e.g., AML, KYC) is essential for ensuring compliance and implementing effective monitoring strategies.

How to show it: Detail specific regulations you are familiar with and any compliance initiatives you successfully led or contributed to.

Risk Assessment

Risk assessment skills help KYC Analysts evaluate the potential risks associated with customers and transactions, facilitating informed decision-making.

How to show it: Provide examples of risk assessments you conducted and how they led to improved risk management strategies or reduced incidents of fraud.

Database Management

Proficiency in database management allows KYC Analysts to efficiently organize and retrieve customer information, ensuring data integrity and accessibility.

How to show it: Mention the databases you have managed and any improvements in data retrieval times or accuracy you achieved.

Investigative Research

Investigative research skills are vital for conducting thorough background checks and due diligence on customers to uncover any red flags.

How to show it: Highlight specific cases where your research led to the identification of potential risks or compliance issues.

Technical Proficiency in KYC Software

Familiarity with KYC and AML software solutions enhances efficiency in customer verification and monitoring processes.

How to show it: List the specific software tools you are proficient in and any efficiencies gained through their use, such as processing time reductions.

Excel Skills

Advanced Excel skills are essential for data manipulation, reporting, and analysis, enabling KYC Analysts to present findings effectively.

How to show it: Provide examples of complex spreadsheets or reports you created that contributed to decision-making or operational improvements.

Fraud Detection Techniques

Knowledge of fraud detection techniques allows KYC Analysts to proactively identify and mitigate fraudulent activities during the onboarding process.

How to show it: Describe specific techniques you implemented that resulted in a measurable decrease in fraud cases.

Attention to Detail

Strong attention to detail is critical in reviewing documents and data to ensure accuracy and compliance with regulatory standards.

How to show it: Share instances where your attention to detail prevented errors or compliance breaches, emphasizing the outcomes.

Communication Skills

Effective communication skills are necessary for collaborating with team members and presenting findings to stakeholders in a clear and concise manner.

How to show it: Illustrate your communication successes, such as training sessions you led or presentations that influenced key decisions.

Knowledge of Global Financial Systems

Understanding global financial systems and their implications on KYC processes is vital for operating in an increasingly interconnected world.

How to show it: Detail your experience with international regulations or how your knowledge improved compliance in diverse markets.

Best Kyc Analyst Soft Skills

In the dynamic field of KYC (Know Your Customer) analysis, possessing strong soft skills is just as important as technical knowledge. These skills not only enhance your ability to interpret data and assess risk, but they also improve communication, collaboration, and problem-solving capabilities within the team and with clients. Here are some of the top soft skills that KYC Analysts should highlight on their resumes.

Attention to Detail

Attention to detail is critical for KYC Analysts, as even minor oversights can lead to significant compliance issues. Analysts must meticulously review documents and data to ensure accuracy. How to show it: Provide examples of projects where attention to detail led to successful outcomes or prevented errors. Quantify by mentioning the number of documents reviewed or discrepancies identified.

Analytical Thinking

This skill allows KYC Analysts to evaluate complex information and identify patterns or anomalies in customer data, which is essential for risk assessment. How to show it: Highlight instances where analytical skills helped in making data-driven decisions. Use metrics to demonstrate how your analysis improved processes or compliance rates.

Communication

Effective communication is vital for KYC Analysts to convey findings clearly to team members and stakeholders, ensuring everyone is aligned on compliance strategies. How to show it: Provide examples of reports or presentations created that effectively communicated complex information. Mention feedback received from peers or supervisors on your communication style. Learn more about communication skills.

Problem-Solving

KYC Analysts often face challenges that require innovative solutions, making problem-solving a crucial skill in navigating compliance issues and customer queries. How to show it: Share specific challenges faced in previous roles and the solutions you implemented. Quantify the impact of your solutions, such as reduced processing time or improved compliance rates. Explore more on problem-solving skills.

Time Management

Time management skills are essential for KYC Analysts to handle multiple tasks efficiently and meet deadlines, especially when dealing with high volumes of applications. How to show it: Discuss how you prioritized tasks in a busy work environment and provide metrics on how your time management skills led to timely completions or enhanced productivity. Find out more about time management skills.

Teamwork

Collaboration with colleagues and other departments is critical in KYC roles to ensure comprehensive compliance checks and information sharing. How to show it: Provide examples of successful team projects and your role in those collaborations. Highlight any measurable outcomes that resulted from effective teamwork. Discover more about teamwork skills.

Adaptability

The ability to adapt to changing regulations and processes is crucial for KYC Analysts to remain compliant and effective in their roles. How to show it: Include instances where you successfully navigated changes in regulations or company processes. Highlight the outcomes that resulted from your adaptability.

Critical Thinking

Critical thinking enables KYC Analysts to assess situations objectively and make informed decisions based on thorough evaluations. How to show it: Share examples where your critical thinking led to improved assessments or strategies. Quantify the benefits realized from your approach.

Interpersonal Skills

Interpersonal skills are essential for building relationships with clients and colleagues, facilitating smoother interactions and information exchanges. How to show it: Highlight experiences where your interpersonal skills positively influenced client relationships or team dynamics. Include feedback from others where applicable.

Organizational Skills

Strong organizational skills help KYC Analysts manage large volumes of information and maintain compliance documentation efficiently. How to show it: Provide examples of how your organizational skills improved workflow or compliance tracking. Mention any systems or processes you implemented that enhanced organization.

Negotiation Skills

Negotiation skills can be beneficial for KYC Analysts when discussing terms with clients or resolving issues that arise during the compliance process. How to show it: Share examples of successful negotiations and the impact they had on

How to List Kyc Analyst Skills on Your Resume

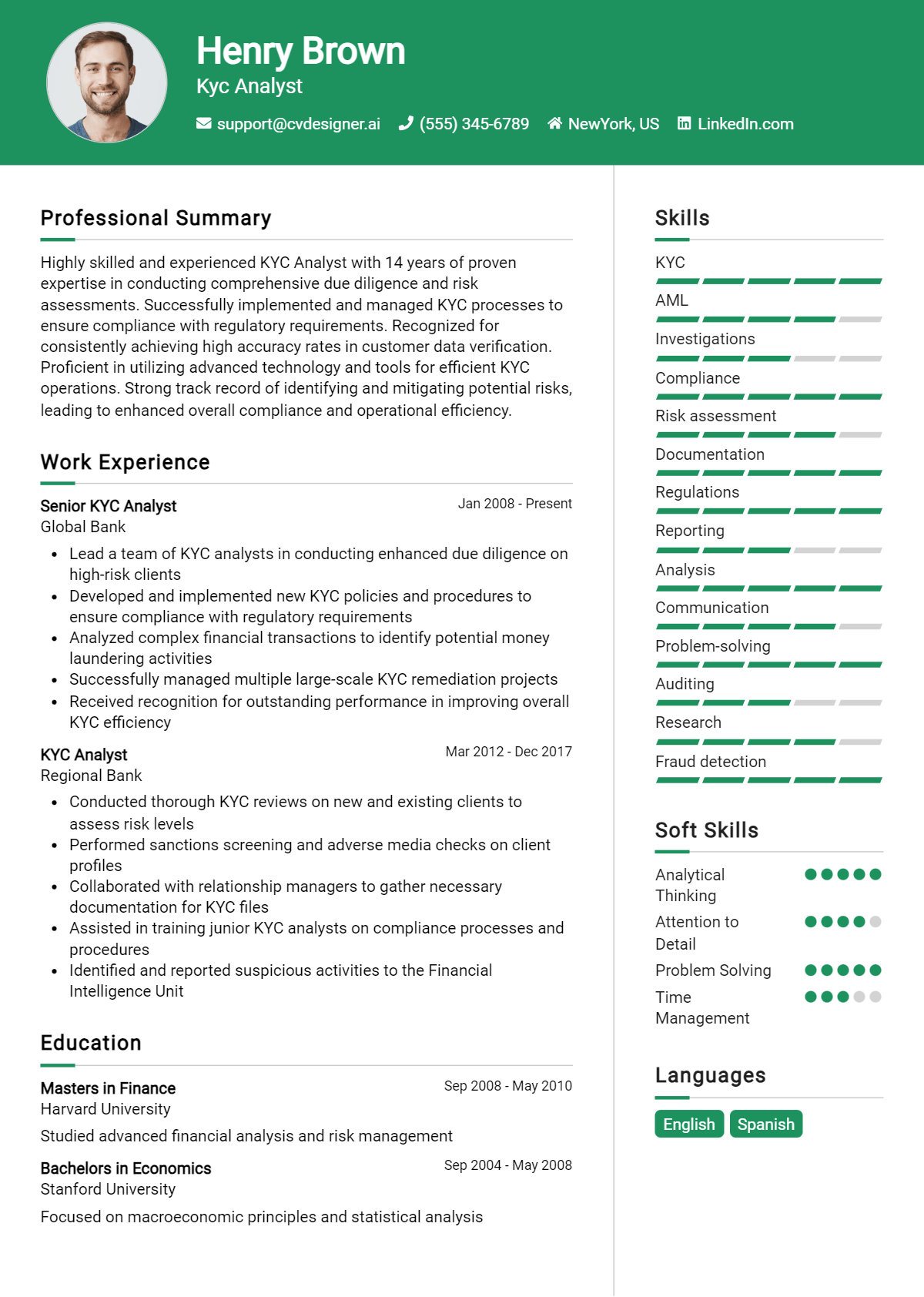

Effectively listing your skills on a resume is crucial for standing out to potential employers. It allows hiring managers to quickly identify your qualifications and how they align with the job requirements. You can highlight your KYC Analyst skills in three main sections: the Resume Summary, the Resume Work Experience, the Resume Skills Section, and the Cover Letter.

for Resume Summary

Showcasing KYC Analyst skills in the introduction section gives hiring managers a quick overview of your qualifications and sets the tone for the rest of your resume.

Example

Dedicated KYC Analyst with expertise in risk assessment, regulatory compliance, and data analysis. Proven track record in improving customer verification processes and enhancing anti-money laundering measures. Strong analytical and problem-solving skills.

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how your KYC Analyst skills have been applied in real-world scenarios, showcasing your contributions and achievements.

Example

- Conducted comprehensive customer due diligence procedures, reducing compliance-related issues by 30%.

- Developed and implemented risk assessment frameworks that improved fraud detection by 25%.

- Collaborated with cross-functional teams to enhance regulatory compliance initiatives.

- Utilized data analysis tools to identify trends and anomalies in customer behavior.

for Resume Skills

The skills section can showcase both technical and transferable skills. A balanced mix of hard and soft skills should be included to strengthen your qualifications.

Example

- Risk Assessment

- Regulatory Compliance

- Data Analysis

- Customer Due Diligence

- Anti-Money Laundering

- Problem Solving

- Attention to Detail

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can showcase how those skills have positively impacted your previous roles.

Example

In my previous role as a KYC Analyst, my strong skills in data analysis and risk assessment enabled me to significantly enhance the customer verification process. By implementing new compliance protocols, I reduced potential risks, ensuring our operations remained aligned with regulatory standards.

By linking the skills mentioned in your resume to specific achievements in your cover letter, you reinforce your qualifications for the job, making a compelling case for your candidacy. For more tips, check out our sections on skills, Technical Skills, and work experience.

The Importance of Kyc Analyst Resume Skills

Highlighting relevant skills on a KYC Analyst resume is crucial for attracting the attention of hiring managers and recruiters. A well-crafted skills section not only showcases a candidate's qualifications but also aligns their expertise with the specific requirements of the job. By emphasizing the right skills, candidates can effectively demonstrate their value and increase their chances of landing an interview.

- Demonstrates Expertise: A well-defined skills section provides a clear snapshot of your expertise in KYC processes, regulatory compliance, and risk assessment, making it easy for recruiters to gauge your fit for the role.

- Aligns with Job Requirements: Tailoring your skills to match the job description helps you align with the employer's needs, making your resume more relevant and increasing the likelihood of catching a recruiter's eye.

- Enhances ATS Compatibility: Many companies use Applicant Tracking Systems (ATS) to filter resumes. Including relevant keywords and skills ensures your resume passes through these systems and reaches human eyes.

- Showcases Soft Skills: Apart from technical skills, highlighting soft skills such as attention to detail, analytical thinking, and communication can set you apart, demonstrating your ability to work effectively in a team-oriented environment.

- Builds Confidence in Your Abilities: A concise skills section helps reinforce your confidence in your qualifications, allowing you to present yourself assertively during interviews.

- Facilitates Career Progression: A clear representation of your skills can also aid in professional development, as it helps you identify areas for improvement and growth in your career as a KYC Analyst.

- Attracts Attention: A compelling skills section can captivate the reader’s attention, prompting them to want to learn more about your experiences and qualifications.

- Supports Personal Branding: Your skills are a key aspect of your professional identity. Highlighting them effectively on your resume can enhance your personal brand in the job market.

For more insights and examples, check out these Resume Samples.

How To Improve Kyc Analyst Resume Skills

In the ever-evolving financial landscape, the role of a KYC (Know Your Customer) Analyst is crucial for ensuring compliance and mitigating risks associated with customer onboarding and ongoing due diligence. Continuously improving your skills not only enhances your competency in the field but also positions you as a valuable asset to your organization. Here are some actionable tips to help you enhance your KYC Analyst skills:

- Stay Updated on Regulations: Regularly review and familiarize yourself with the latest AML (Anti-Money Laundering) laws and KYC regulations to ensure compliance.

- Enhance Data Analysis Skills: Take online courses or workshops to improve your proficiency in data analysis tools and techniques, aiding in better customer risk assessments.

- Develop Strong Communication Skills: Practice writing clear and concise reports, and enhance your verbal communication to effectively convey findings and collaborate with teams.

- Network with Professionals: Attend industry conferences, webinars, and networking events to learn from peers and gain insights into best practices in KYC.

- Utilize Technology: Familiarize yourself with KYC software and tools to streamline processes and improve efficiency in data collection and analysis.

- Participate in Training Programs: Seek out training opportunities offered by your employer or industry organizations to deepen your knowledge and skills in KYC practices.

- Engage in Case Studies: Analyze real-world case studies related to KYC failures and successes to understand the implications of various practices and strategies.

Frequently Asked Questions

What are the essential skills required for a KYC Analyst?

A KYC Analyst should possess strong analytical skills to assess customer information and identify potential risks. Excellent attention to detail is crucial for scrutinizing documents and data entries. Proficiency in compliance regulations and understanding of financial products are also important. Additionally, strong communication skills are necessary to liaise with clients and internal teams effectively.

How important is knowledge of regulatory requirements for a KYC Analyst?

Knowledge of regulatory requirements is paramount for a KYC Analyst, as it ensures compliance with laws such as the Anti-Money Laundering (AML) and the Bank Secrecy Act (BSA). Understanding these regulations helps analysts to conduct thorough due diligence and mitigate risks associated with financial crimes, thereby protecting the organization from legal repercussions.

What technical skills should a KYC Analyst include in their resume?

A KYC Analyst's resume should highlight technical skills such as proficiency in data analysis tools (e.g., Excel, SQL) and familiarity with KYC software platforms. Knowledge of customer relationship management (CRM) systems and experience with databases for tracking customer information are also valuable. Additionally, comfort with digital verification technologies can enhance an analyst's effectiveness.

How can effective communication skills benefit a KYC Analyst?

Effective communication skills are vital for a KYC Analyst as they often need to explain complex regulatory requirements to clients and colleagues. Clear communication aids in gathering accurate information from clients during the onboarding process and ensures that any potential issues are understood and addressed promptly. This skill also facilitates collaboration with other departments to streamline KYC processes.

What role does attention to detail play in a KYC Analyst's work?

Attention to detail is crucial for a KYC Analyst because the role involves meticulously reviewing customer documentation and data to identify discrepancies or red flags. An error in this process can lead to significant compliance issues and financial losses for the organization. Therefore, being detail-oriented helps ensure that all information is accurate and complete, thereby maintaining the integrity of the KYC process.

Conclusion

Including KYC Analyst skills in your resume is vital for demonstrating your expertise in compliance, risk assessment, and client due diligence. By showcasing relevant skills, you not only highlight your qualifications but also differentiate yourself from other candidates, providing added value to potential employers who seek meticulous and knowledgeable professionals in this field. Take the time to refine your skills and tailor your application materials for the best chance at success in your job search. Remember, every small improvement can lead to big opportunities!

For assistance in crafting a standout application, explore our resume templates, utilize our resume builder, check out resume examples, and enhance your application with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.