KYC Analyst Core Responsibilities

A KYC Analyst plays a crucial role in ensuring compliance with regulatory standards by verifying customer identities and monitoring transactions. This position requires strong analytical skills, attention to detail, and proficiency in data analysis tools to assess risks and identify potential fraudulent activities. KYC Analysts often collaborate with compliance, legal, and operations teams, bridging various functions to enhance organizational integrity. A well-crafted resume highlighting these technical, operational, and problem-solving abilities is essential for showcasing qualifications and contributing to the organization's overall success.

Common Responsibilities Listed on KYC Analyst Resume

- Conduct thorough customer due diligence and risk assessments.

- Verify customer identities using various documentation and databases.

- Monitor transactions for suspicious activity and report findings.

- Maintain up-to-date knowledge of regulatory requirements and industry standards.

- Collaborate with internal teams to enhance compliance processes.

- Prepare detailed reports for management and regulatory bodies.

- Assist in the development of KYC policies and procedures.

- Train staff on KYC practices and compliance requirements.

- Utilize data analysis tools to identify trends and anomalies.

- Engage with external stakeholders, including regulators and auditors.

- Manage and update customer information in compliance systems.

Why Resume Headlines & Titles are Important for KYC Analyst

In the competitive field of KYC (Know Your Customer) analysis, a well-crafted resume headline or title is essential for standing out among numerous applicants. A strong headline captures the attention of hiring managers instantly, summarizing a candidate's key qualifications and unique selling points in a single impactful phrase. It acts as a first impression, providing a snapshot of a candidate's expertise in compliance, risk assessment, and regulatory knowledge. Therefore, crafting a concise, relevant, and role-specific headline can significantly enhance a resume, making it more appealing and increasing the chances of landing an interview.

Best Practices for Crafting Resume Headlines for KYC Analyst

- Keep it concise—aim for one impactful phrase.

- Make it role-specific by including relevant keywords related to KYC analysis.

- Highlight your most significant qualifications or experiences.

- Use strong action verbs to convey confidence and expertise.

- Avoid jargon or overly complex language that may confuse the reader.

- Tailor the headline to match the specific job description you are applying for.

- Focus on quantifiable achievements to demonstrate your impact.

- Consider including your years of experience to add credibility.

Example Resume Headlines for KYC Analyst

Strong Resume Headlines

Detail-Oriented KYC Analyst with 5+ Years of Experience in Risk Assessment

KYC Compliance Specialist Skilled in Regulatory Analysis and Customer Due Diligence

Experienced KYC Analyst | Proven Track Record in Fraud Prevention and Investigation

Results-Driven KYC Analyst with Expertise in AML Regulations and Enhanced Due Diligence

Weak Resume Headlines

KYC Analyst

Hardworking Professional Seeking Opportunities

Experienced Worker in Finance

Strong headlines are effective because they clearly convey the candidate's specific skills and accomplishments, making them memorable and relevant to the role. They showcase a commitment to the KYC field and offer a glimpse of the candidate's unique qualifications. In contrast, weak headlines fail to impress because they lack detail, specificity, and relevance, blending in with countless other generic titles. By avoiding vague phrases and focusing on impactful language, candidates can significantly improve their chances of capturing the attention of hiring managers.

Writing an Exceptional KYC Analyst Resume Summary

A resume summary is a critical component for a KYC Analyst, as it serves as the first impression a hiring manager will have of a candidate. An exceptional summary quickly captivates attention by effectively showcasing key skills, relevant experience, and significant accomplishments that align with the requirements of the job. This concise and impactful statement should be carefully tailored to the specific position being applied for, ensuring that it highlights the most pertinent qualifications and sets the stage for the rest of the resume.

Best Practices for Writing a KYC Analyst Resume Summary

- Quantify Achievements: Use specific figures to demonstrate your impact, such as the number of cases reviewed or compliance rates achieved.

- Highlight Relevant Skills: Focus on key skills that are directly related to KYC, such as risk assessment, data analysis, and regulatory knowledge.

- Tailor for the Job: Customize your summary for each position by incorporating keywords from the job description.

- Keep it Concise: Limit your summary to 2-4 sentences to maintain clarity and focus.

- Use Action Verbs: Start sentences with strong action verbs to convey a sense of initiative and impact.

- Showcase Industry Knowledge: Mention familiarity with compliance regulations and industry standards to establish credibility.

- Focus on Outcomes: Emphasize the results of your efforts, such as improved compliance rates or reduced risk levels.

- Maintain a Professional Tone: Ensure the language is formal and reflective of the professional standards in the financial services industry.

Example KYC Analyst Resume Summaries

Strong Resume Summaries

Detail-oriented KYC Analyst with over 5 years of experience in financial crime prevention, successfully reducing compliance breaches by 30% through meticulous risk assessments and enhanced due diligence processes.

Results-driven KYC professional with expertise in anti-money laundering (AML) practices, having conducted over 1,200 customer due diligence reviews, leading to a 25% improvement in onboarding efficiency and a significant reduction in false positives.

Dynamic KYC Analyst skilled in utilizing data analytics tools to identify high-risk clients, contributing to a 40% increase in actionable insights for compliance teams, and ensuring adherence to regulatory standards.

Weak Resume Summaries

KYC Analyst with experience in the financial sector looking for a new opportunity.

Dedicated professional with some skills in compliance and KYC processes, interested in contributing to a team.

The examples provided highlight the differences between strong and weak resume summaries. Strong summaries are characterized by specific achievements, quantifiable results, and relevant skills that directly pertain to the KYC Analyst role. They offer a clear picture of the candidate’s capabilities and contributions. In contrast, weak summaries are vague, lack concrete outcomes, and fail to demonstrate the candidate's fit for the position, making them less impactful in the competitive job market.

Work Experience Section for KYC Analyst Resume

The work experience section of a KYC Analyst resume is a critical component that allows candidates to effectively showcase their technical skills, leadership abilities, and their capacity to deliver high-quality products. This section not only highlights the candidate's previous roles and responsibilities but also quantifies achievements in a way that aligns with industry standards. Demonstrating specific outcomes and contributions can significantly enhance a candidate's appeal to potential employers, making it essential to present this information clearly and compellingly.

Best Practices for KYC Analyst Work Experience

- Emphasize technical expertise in KYC processes, regulatory compliance, and risk assessment.

- Quantify achievements (e.g., reduction in processing time, increase in accuracy) to demonstrate impact.

- Highlight collaboration with cross-functional teams to illustrate teamwork and communication skills.

- Use action verbs to convey a proactive approach in previous roles.

- Align experiences with industry standards and best practices to showcase relevance.

- Incorporate specific tools or software used in KYC analysis to reflect technical proficiency.

- Detail any leadership roles or mentoring experiences to display team management skills.

- Tailor the descriptions to match the job description of the position being applied for.

Example Work Experiences for KYC Analyst

Strong Experiences

- Led a team of 5 analysts to streamline the KYC onboarding process, resulting in a 30% reduction in processing time and improved client satisfaction scores.

- Implemented a new data validation system that enhanced accuracy by 25%, significantly reducing the number of compliance-related issues.

- Collaborated with IT and compliance departments to overhaul the KYC software, which increased efficiency and reduced manual errors by 40%.

- Conducted training sessions for junior analysts on regulatory changes, improving team knowledge and compliance adherence by 50%.

Weak Experiences

- Responsible for KYC tasks.

- Helped with compliance-related activities.

- Worked on a team to process client information.

- Participated in training sessions.

The examples provided illustrate the difference between strong and weak experiences. Strong experiences are characterized by specific, quantifiable achievements and clear demonstrations of leadership and collaboration. They provide a detailed picture of the candidate's contributions and impact within their roles. In contrast, weak experiences lack specificity and fail to convey the candidate's skills and achievements effectively, which can lead to a less compelling resume overall.

Education and Certifications Section for KYC Analyst Resume

The education and certifications section of a KYC Analyst resume plays a crucial role in establishing the candidate's qualifications and expertise in the field. This section not only showcases the academic background that provides foundational knowledge but also highlights industry-relevant certifications and continuous learning efforts that are essential for staying current in a rapidly evolving regulatory landscape. By including relevant coursework, certifications, and any specialized training, candidates can significantly enhance their credibility and demonstrate their alignment with the specific requirements of the KYC Analyst role.

Best Practices for KYC Analyst Education and Certifications

- Prioritize relevant degrees in finance, business, law, or related fields.

- Include industry-recognized certifications such as the CAMS (Certified Anti-Money Laundering Specialist) or CFE (Certified Fraud Examiner).

- Highlight any specialized training focused on KYC compliance, AML regulations, or financial crime prevention.

- Be specific about relevant coursework that pertains to risk assessment, compliance, and regulatory frameworks.

- Showcase any ongoing education efforts, such as workshops or online courses related to KYC processes.

- Use clear formatting to differentiate between degrees, certifications, and training for easy readability.

- Tailor the section to the specific job description, emphasizing qualifications that align with the employer’s needs.

- Keep the section updated to reflect the most recent and relevant qualifications.

Example Education and Certifications for KYC Analyst

Strong Examples

- Bachelor of Science in Finance, XYZ University, Graduated May 2020

- Certified Anti-Money Laundering Specialist (CAMS), ACAMS, Obtained June 2021

- Certificate in Financial Crime Prevention, ABC Institute, Completed December 2022

- Relevant Coursework: Risk Management, Regulatory Compliance, and Fraud Detection Techniques

Weak Examples

- Bachelor of Arts in English Literature, XYZ University, Graduated May 2018

- Basic Computer Skills Certificate, Online Course, Completed January 2020

- High School Diploma, ABC High School, Graduated June 2016

- Certification in Office Administration, 2019

The strong examples are considered effective because they directly relate to the skills and knowledge required for a KYC Analyst, demonstrating the candidate's commitment to the field through relevant degrees and certifications. In contrast, the weak examples highlight qualifications that lack relevance to KYC analysis, such as unrelated degrees or certifications that do not contribute to the candidate's ability to perform in the role. This distinction emphasizes the importance of tailoring educational qualifications to the specific demands of the KYC Analyst position.

Top Skills & Keywords for KYC Analyst Resume

As a KYC Analyst, possessing the right skills is crucial for success in this role. These professionals are responsible for ensuring that financial institutions comply with regulatory requirements and effectively mitigate risks associated with money laundering and fraud. A well-crafted resume highlighting both hard and soft skills can set candidates apart in a competitive job market. Emphasizing relevant skills showcases not only technical proficiency but also the ability to communicate, analyze, and navigate complex regulatory environments. To enhance your chances of landing an interview, it’s vital to carefully curate your resume to reflect these skills, drawing attention to both your work experience and your skills.

Top Hard & Soft Skills for KYC Analyst

Soft Skills

- Attention to Detail

- Analytical Thinking

- Effective Communication

- Problem-Solving

- Adaptability

- Team Collaboration

- Time Management

- Critical Thinking

- Decision Making

- Interpersonal Skills

- Ethical Judgment

- Stress Management

- Conflict Resolution

- Customer Service Orientation

Hard Skills

- Knowledge of KYC Regulations

- Risk Assessment Techniques

- Familiarity with AML Compliance

- Data Analysis and Interpretation

- Proficiency in KYC Software (e.g., Actimize, SAS)

- Financial Crime Investigation

- Report Writing Skills

- Database Management

- Understanding of Financial Products

- Knowledge of Geographic Risk Factors

- Regulatory Framework Familiarity

- Microsoft Excel Proficiency

- Research Skills

- Identity Verification Techniques

- Data Privacy Regulations (e.g., GDPR)

- Familiarity with Blockchain and Cryptocurrencies

- Experience with Case Management Systems

- Knowledge of Sanctions Lists and PEP Screening

Stand Out with a Winning KYC Analyst Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the KYC Analyst position at [Company Name] as advertised on [where you found the job posting]. With a solid background in compliance and risk management, coupled with my keen attention to detail, I am well-equipped to contribute effectively to your team. My experience in analyzing customer data and ensuring regulatory compliance aligns seamlessly with the responsibilities outlined in your job description.

In my previous role at [Previous Company Name], I successfully managed the KYC processes for a diverse portfolio of clients, ensuring that all necessary documentation was collected and verified in compliance with local and international regulations. My analytical skills allowed me to identify potential risks and suspicious activities, enabling the company to mitigate risks proactively. I implemented streamlined processes that improved efficiency and enhanced our ability to maintain accurate customer records, which resulted in a 20% reduction in processing time.

I am particularly drawn to the commitment of [Company Name] to upholding the highest standards of compliance and customer service. I admire your innovative approach to KYC processes and would welcome the opportunity to contribute to your ongoing success. I am adept at utilizing various compliance software and tools, and I am continually seeking to expand my knowledge in the ever-evolving regulatory landscape. I am confident that my proactive approach, combined with my strong communication skills, would make me a valuable addition to your team.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experience can benefit [Company Name] in ensuring robust KYC compliance. I am eager to bring my expertise to your esteemed organization and help further enhance your KYC operations.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a KYC Analyst Resume

In the competitive field of KYC (Know Your Customer) analysis, crafting an effective resume is crucial for standing out to potential employers. However, many candidates make common mistakes that can undermine their chances of landing an interview. To help you avoid these pitfalls, here are some frequent errors to watch out for when writing your KYC Analyst resume:

Generic Objective Statement: Using a one-size-fits-all objective statement can make your resume feel impersonal. Tailor your objective to reflect your specific interest in the KYC role and the company.

Lack of Relevant Keywords: Failing to include industry-specific keywords can hurt your chances of passing through Applicant Tracking Systems (ATS). Research the job description and incorporate relevant terms.

Overemphasis on Duties Instead of Achievements: Listing job duties without highlighting your achievements can make your resume less impactful. Focus on what you accomplished in previous roles, such as improved compliance rates or successful project completions.

Ignoring Quantifiable Metrics: Not providing quantifiable data to back up your achievements can make your contributions seem vague. Whenever possible, include metrics such as percentages, dollar amounts, or timeframes.

Inconsistent Formatting: A resume with inconsistent formatting can appear unprofessional and difficult to read. Ensure that font sizes, bullet points, and spacing are uniform throughout the document.

Neglecting Soft Skills: While technical skills are crucial for a KYC Analyst, neglecting to showcase soft skills, such as communication and problem-solving abilities, can be a missed opportunity. Highlight these skills in your experience descriptions.

Too Much Jargon: Overloading your resume with industry jargon can make it difficult for non-specialist hiring managers to understand your qualifications. Aim for clarity and balance technical language with accessible descriptions.

Ignoring the Importance of Proofreading: Typos and grammatical errors can undermine your professionalism. Always proofread your resume multiple times and consider having someone else review it as well.

Conclusion

As a KYC Analyst, you play a pivotal role in ensuring financial institutions comply with regulations and mitigate risks associated with money laundering and terrorist financing. Throughout this article, we have discussed the essential skills required for KYC Analysts, including attention to detail, analytical thinking, and knowledge of regulatory frameworks. We also highlighted the importance of effective communication and proficiency in data analysis tools.

To excel in this competitive field, it’s crucial to have a well-structured and impactful resume that showcases your qualifications and experiences. A strong resume not only highlights your skills but also demonstrates your understanding of compliance and risk management principles.

We encourage you to take this opportunity to review your KYC Analyst resume to ensure it reflects your strengths and achievements effectively. Consider utilizing various tools available to enhance your application:

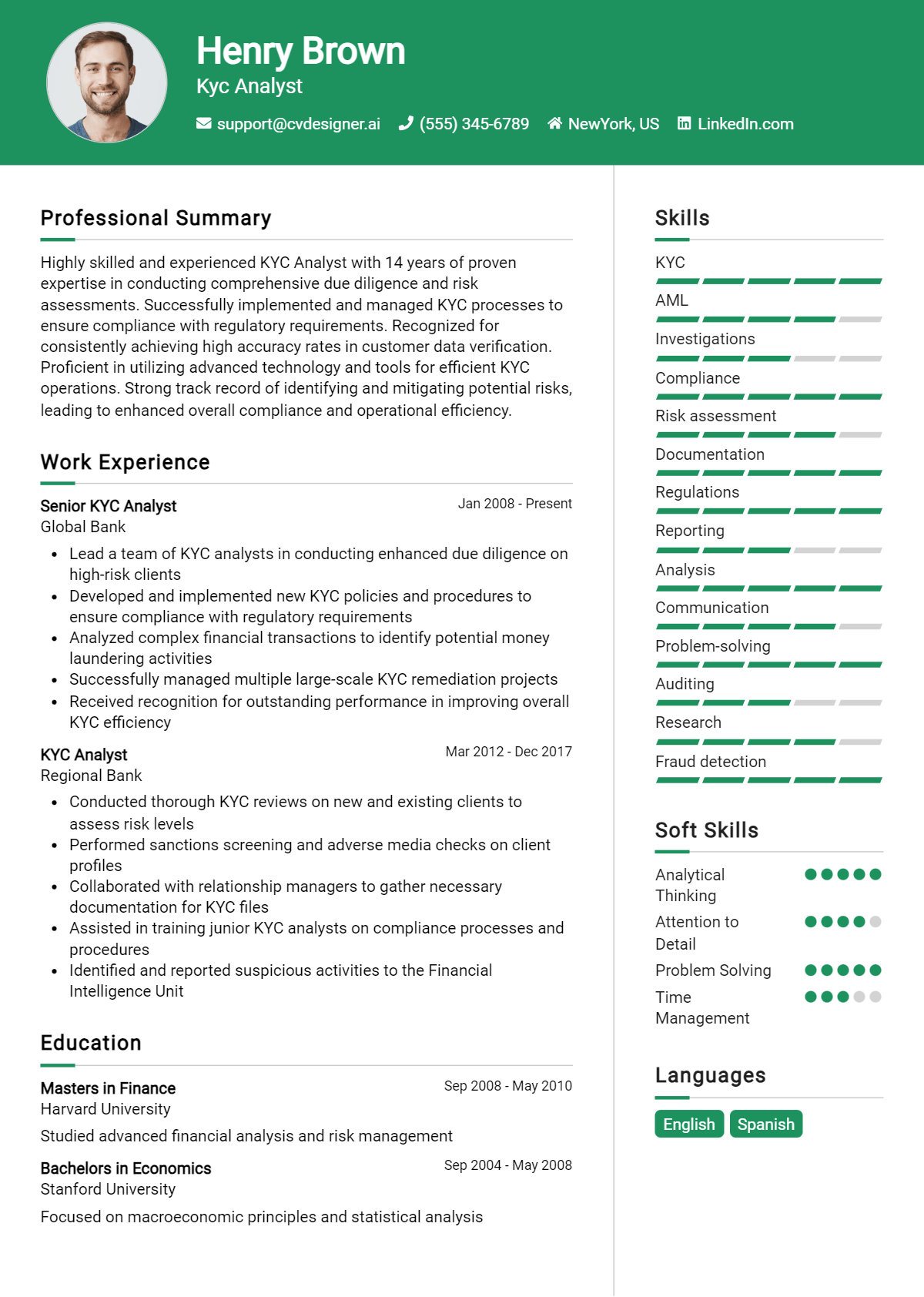

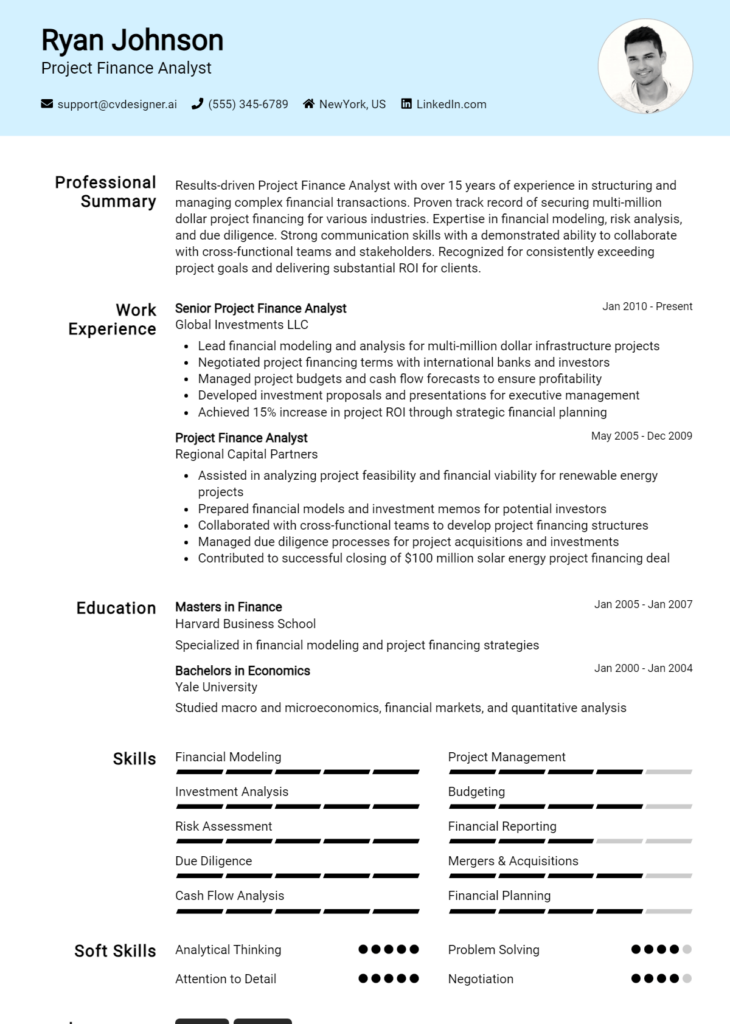

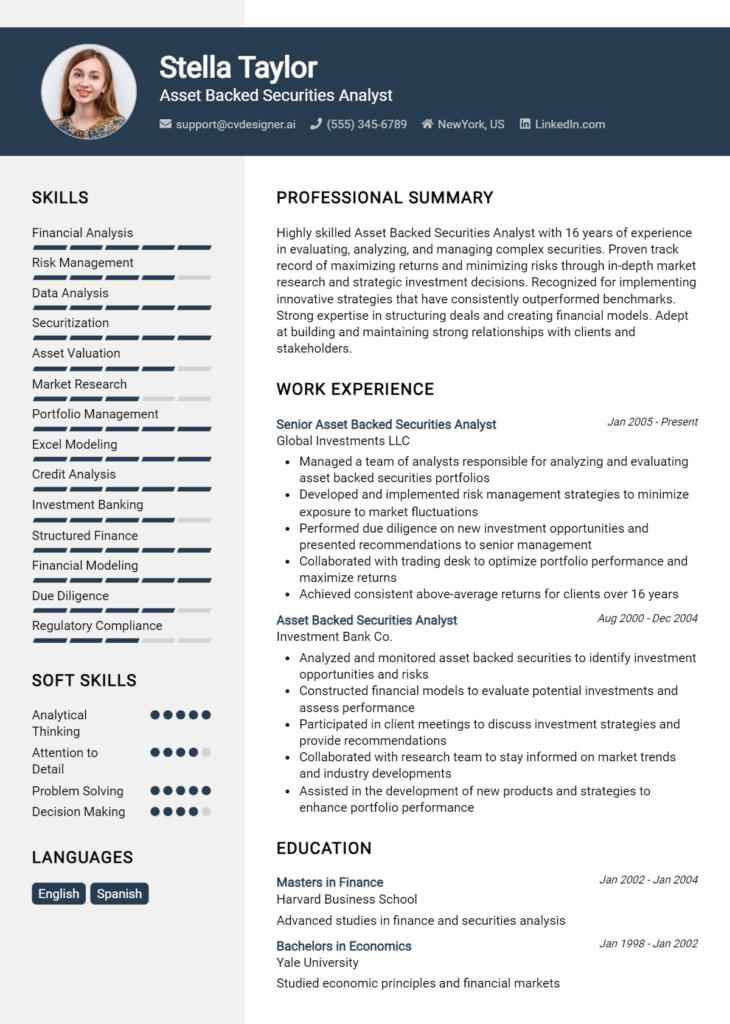

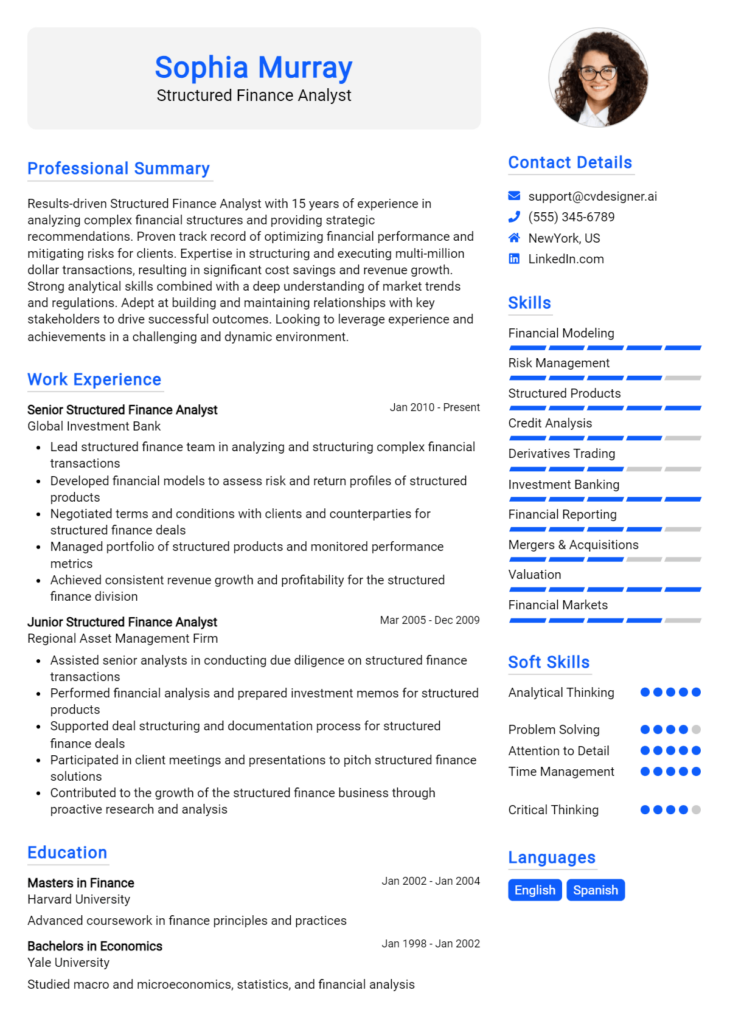

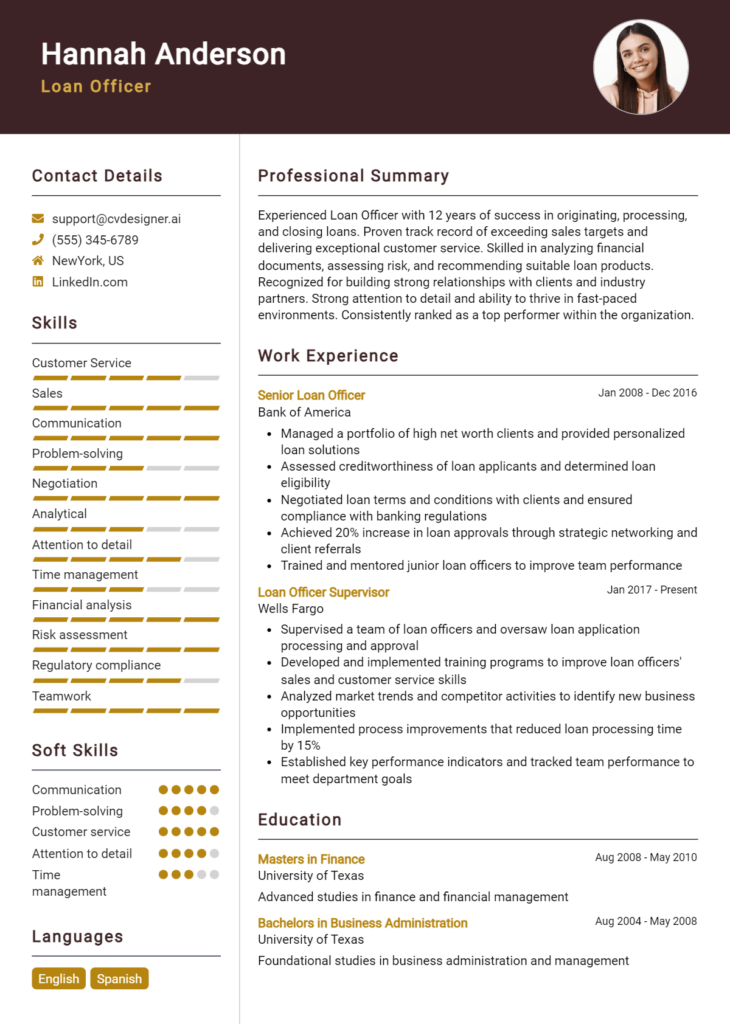

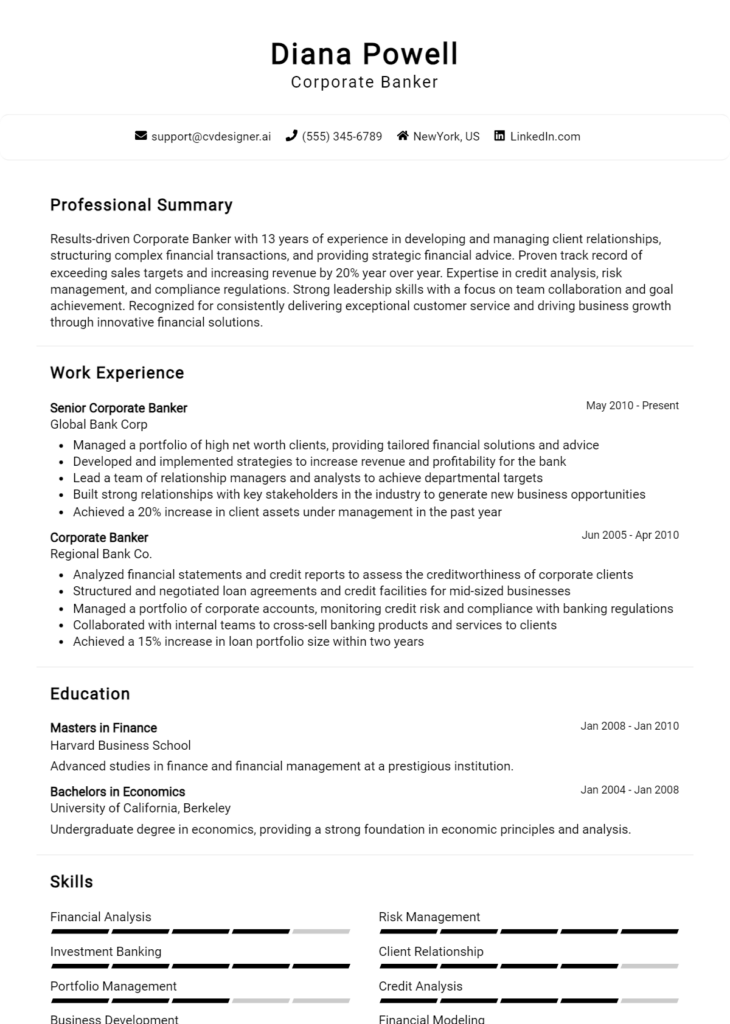

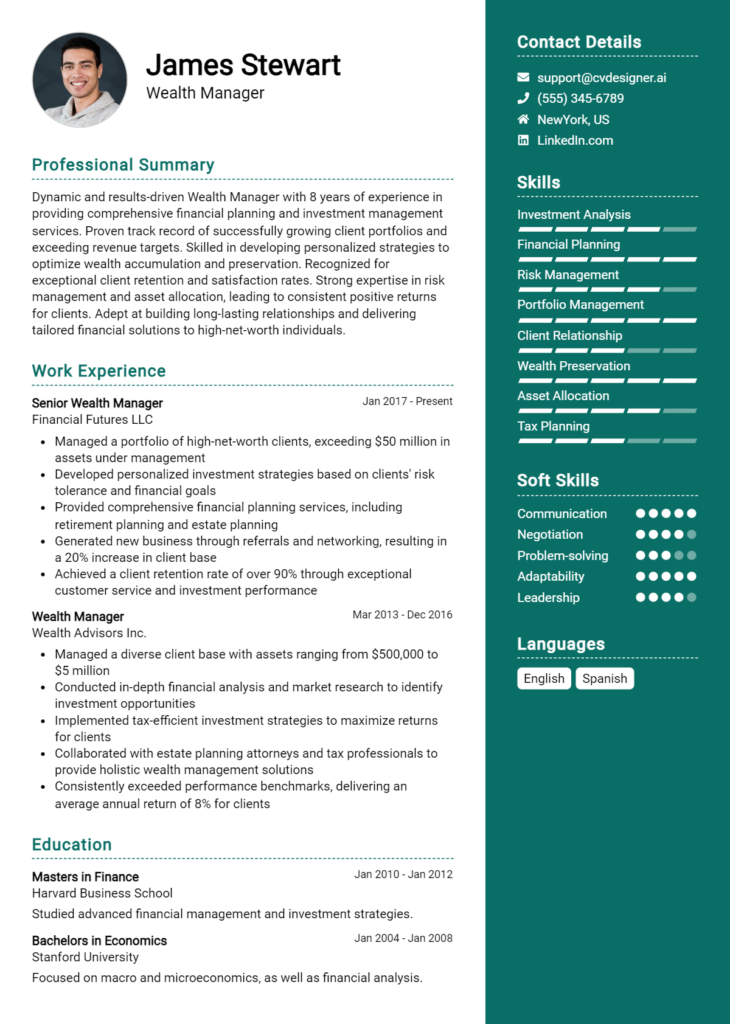

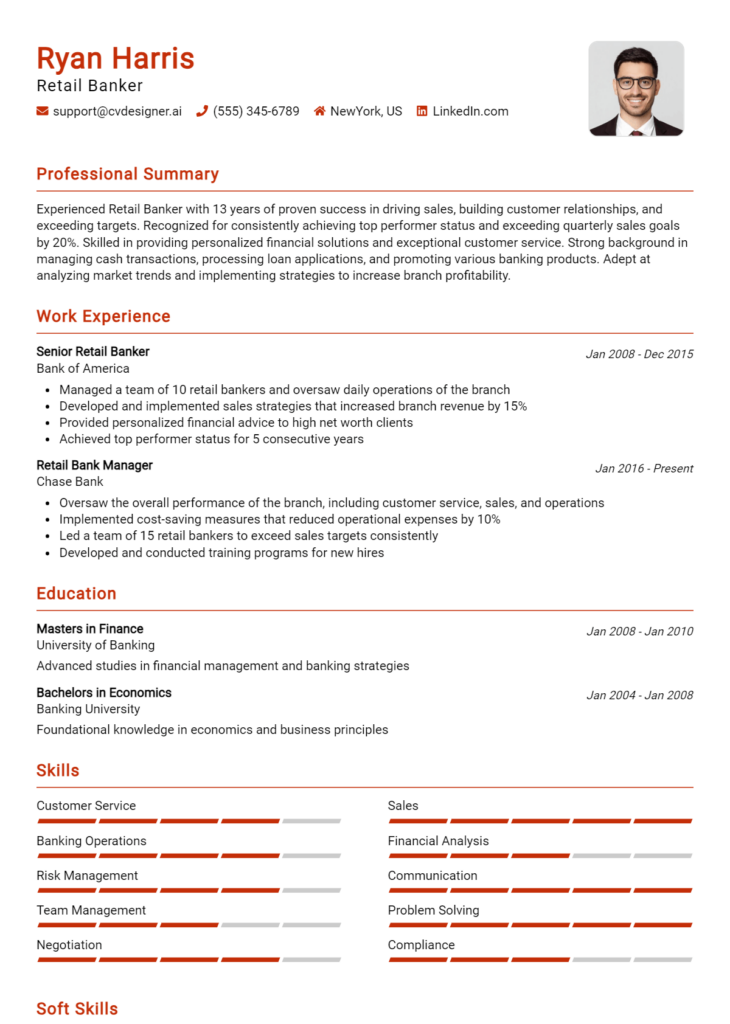

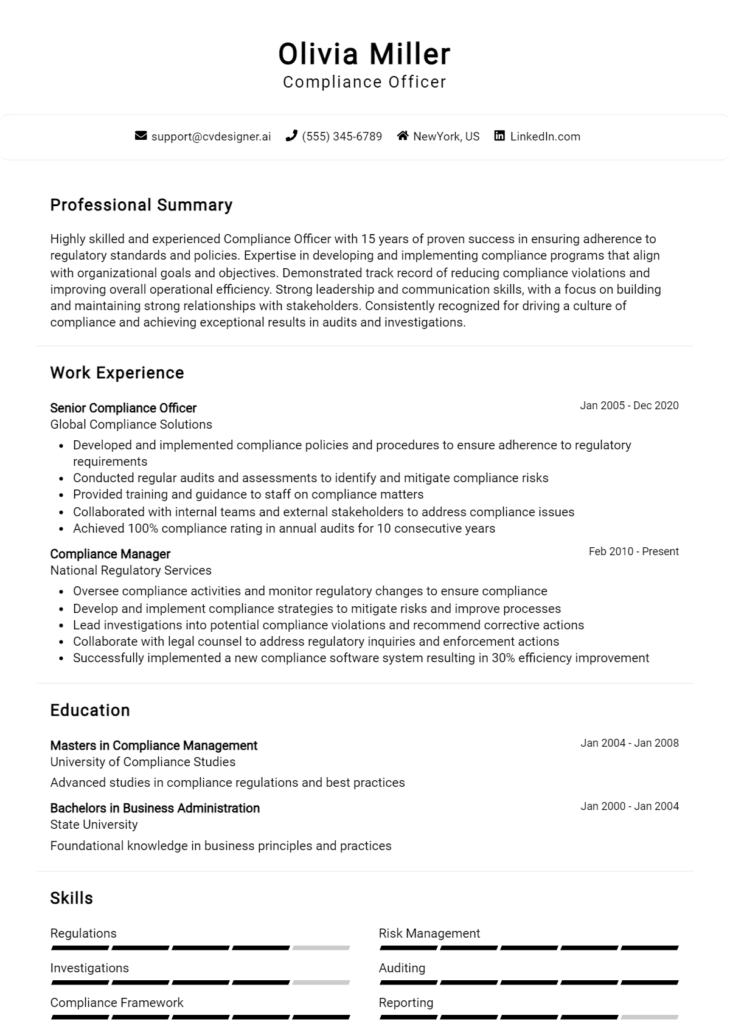

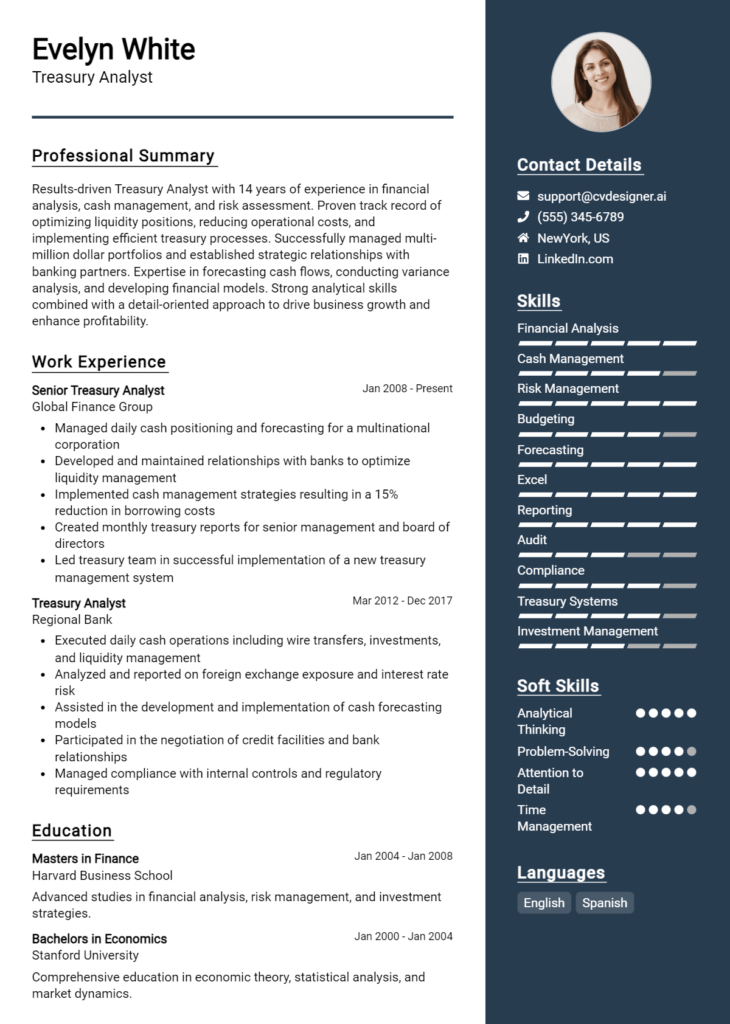

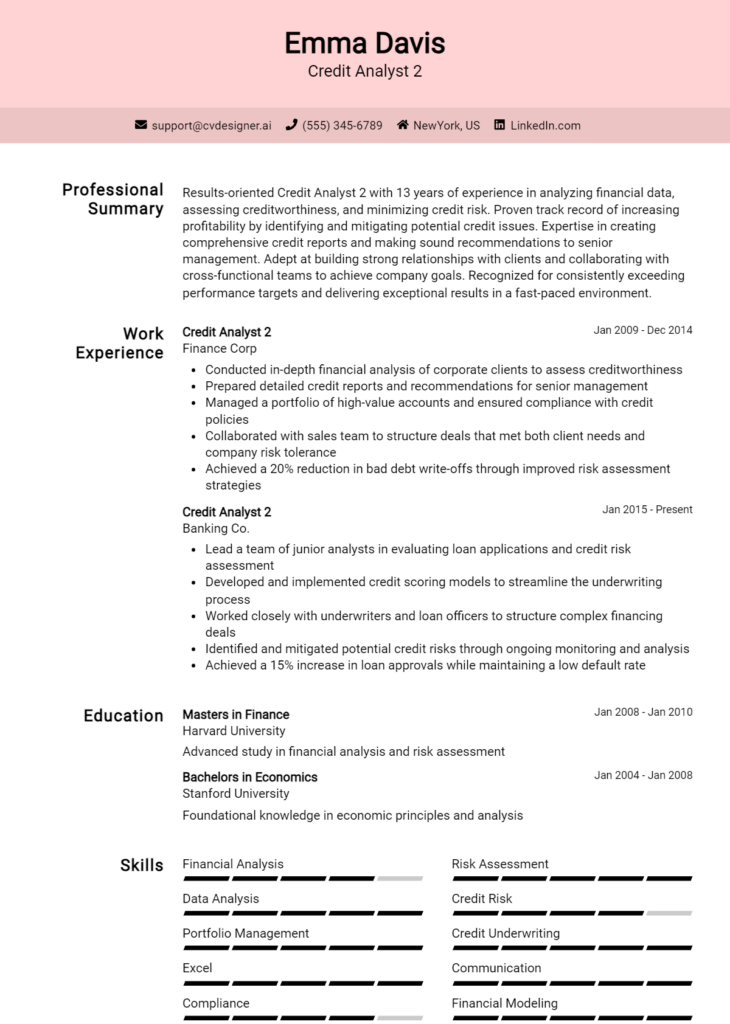

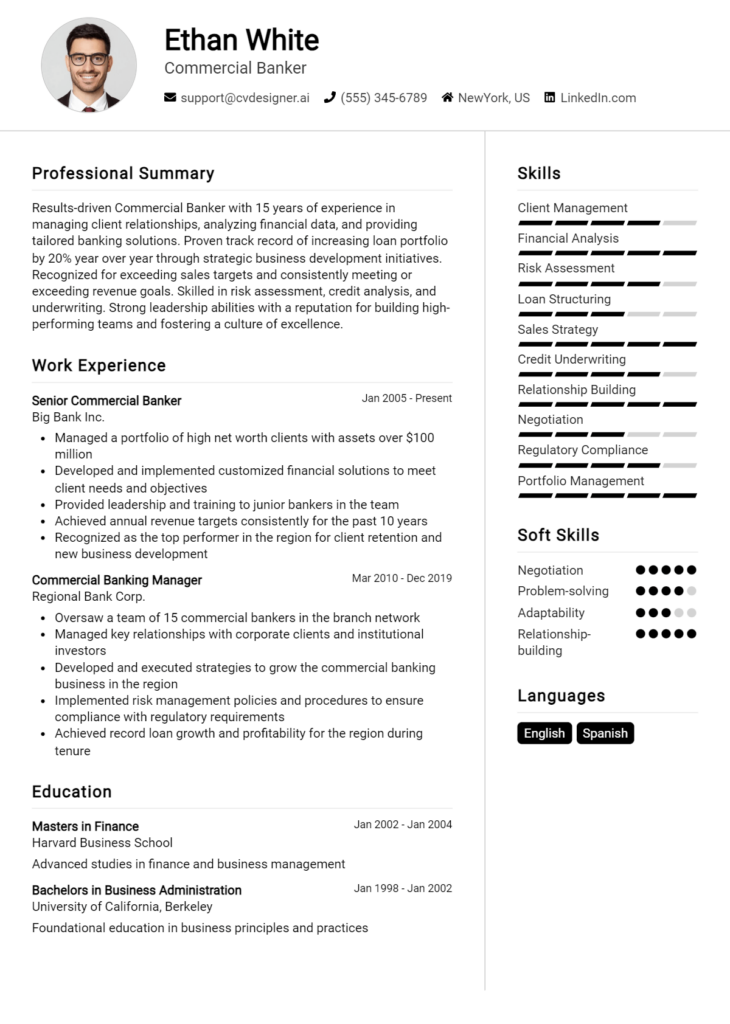

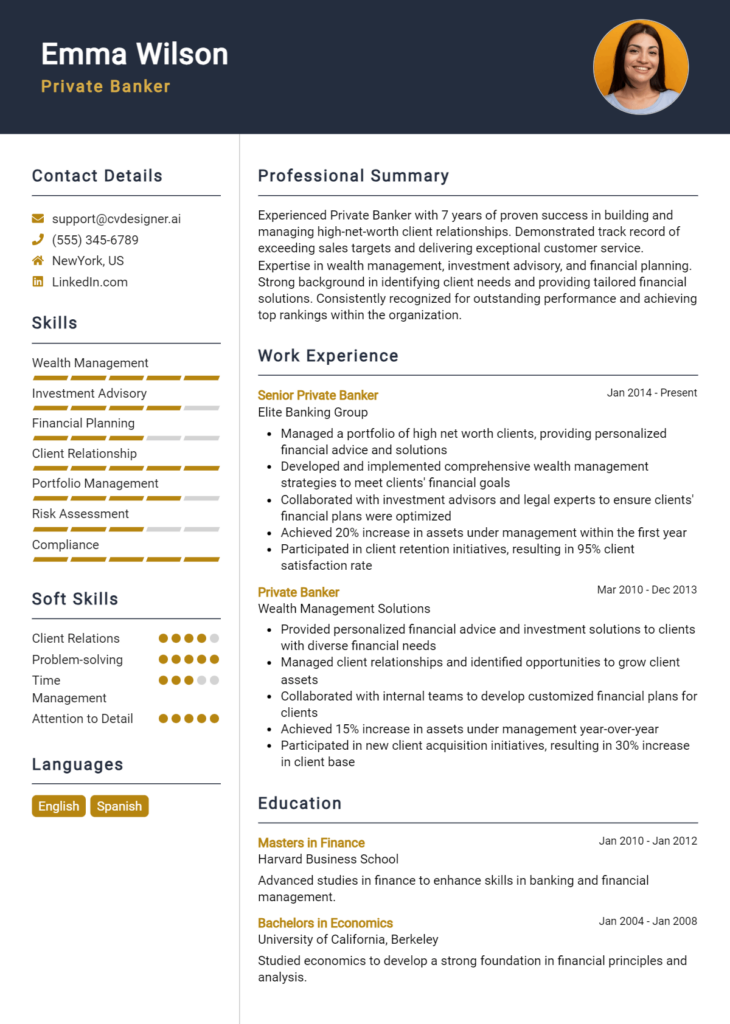

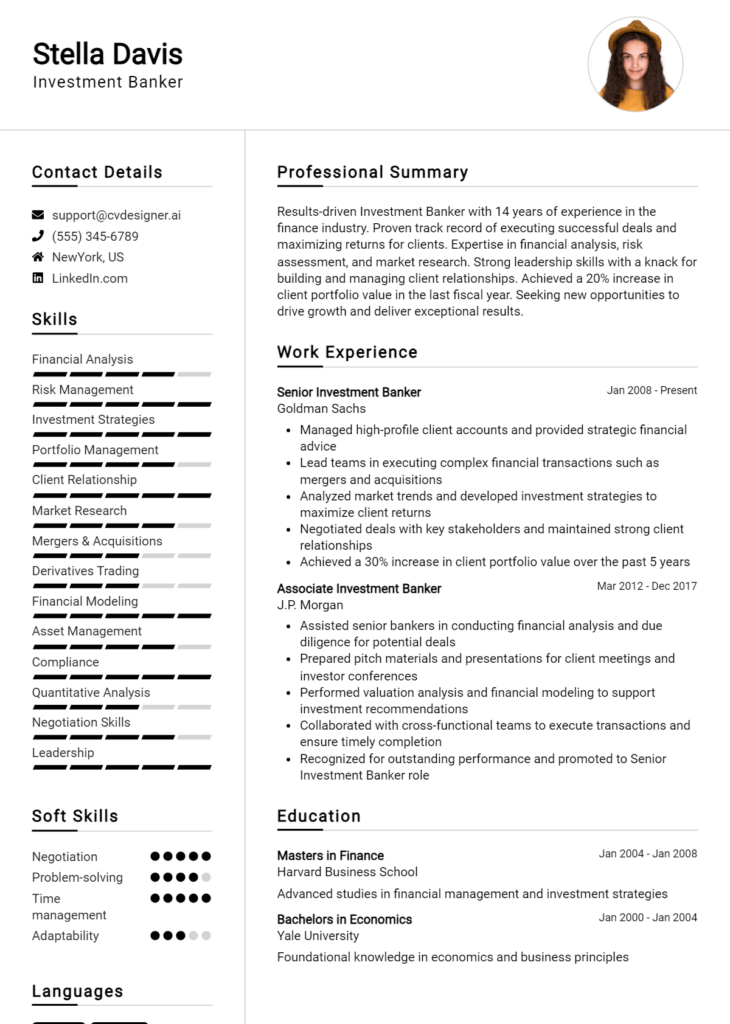

- Explore resume templates to find a design that best represents your professional style.

- Use the resume builder for a straightforward way to create a polished and tailored resume.

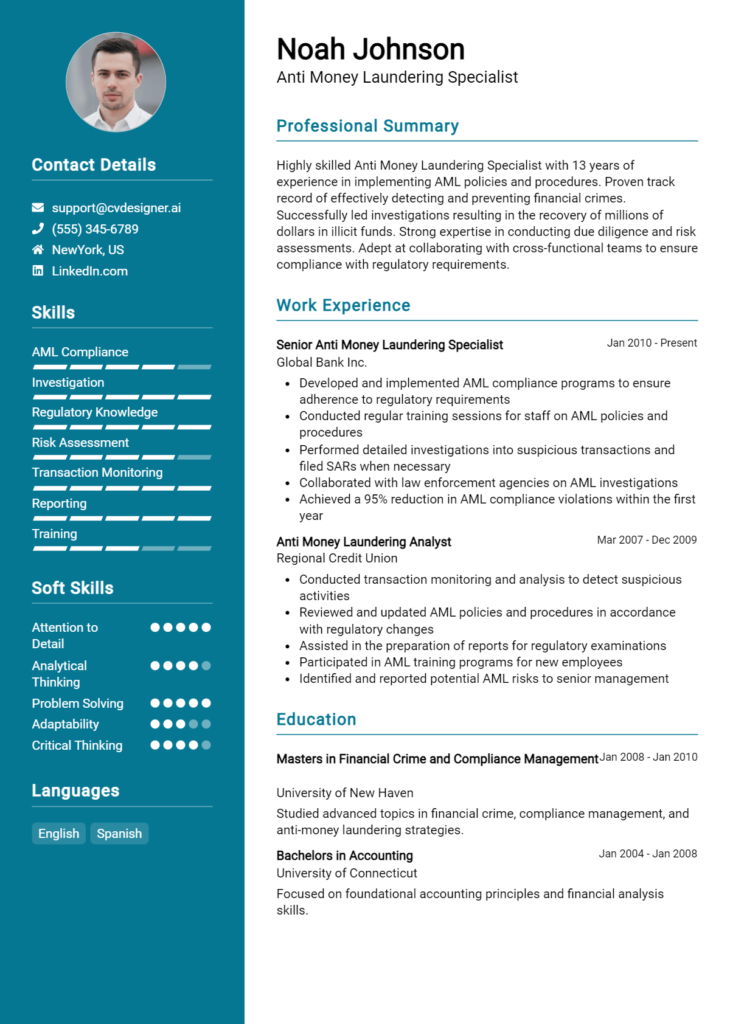

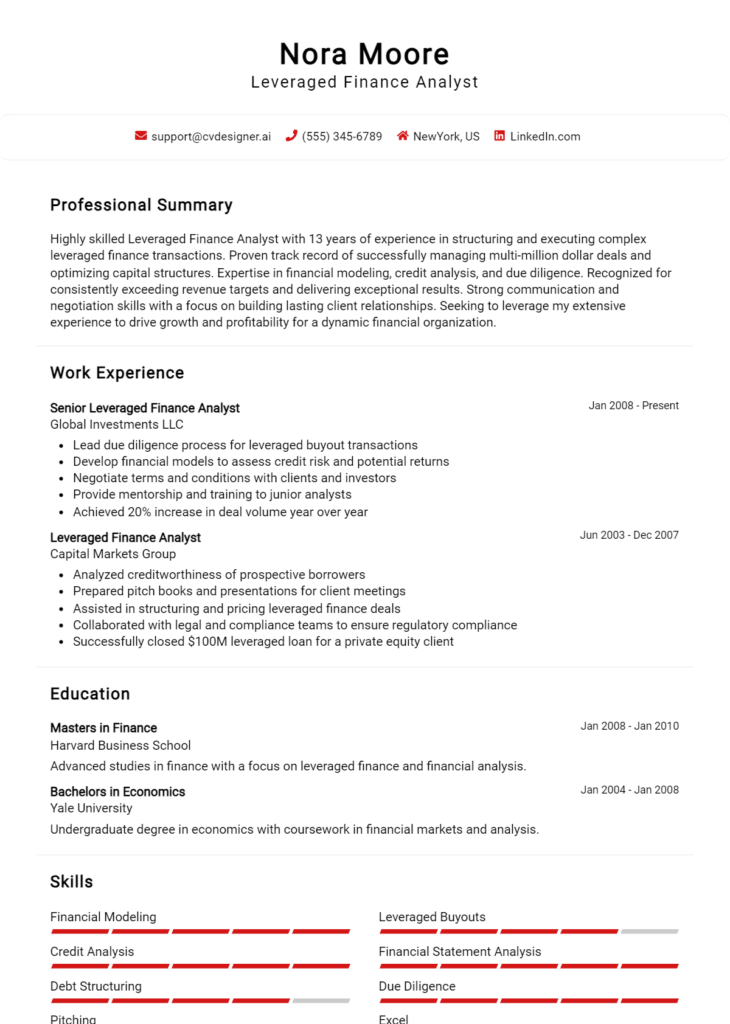

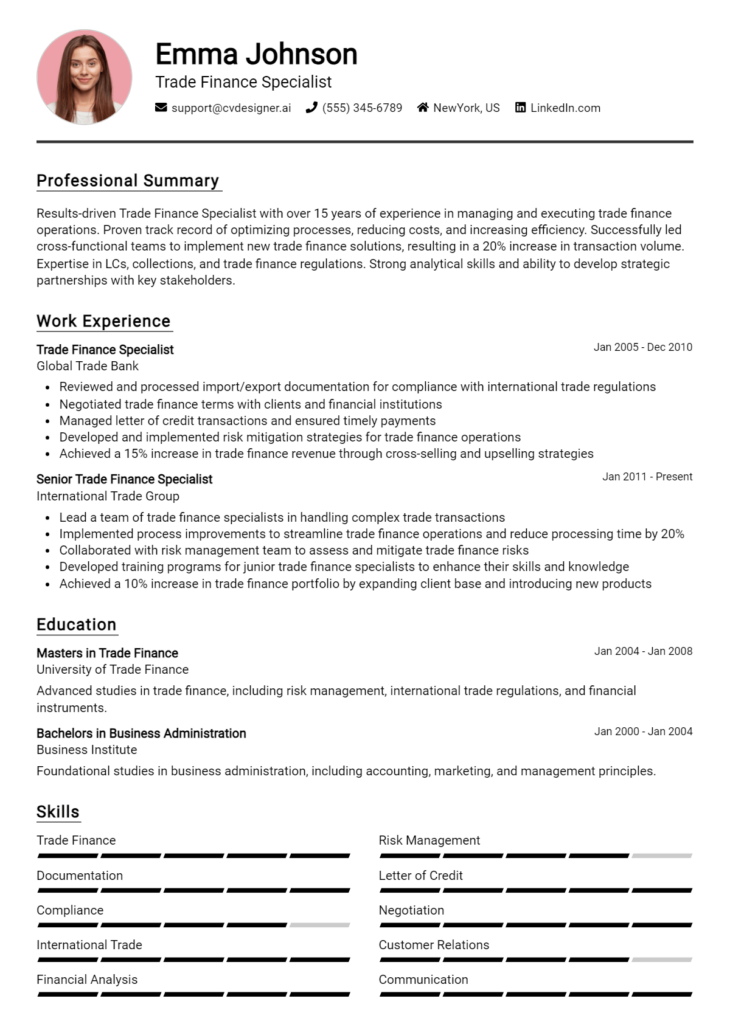

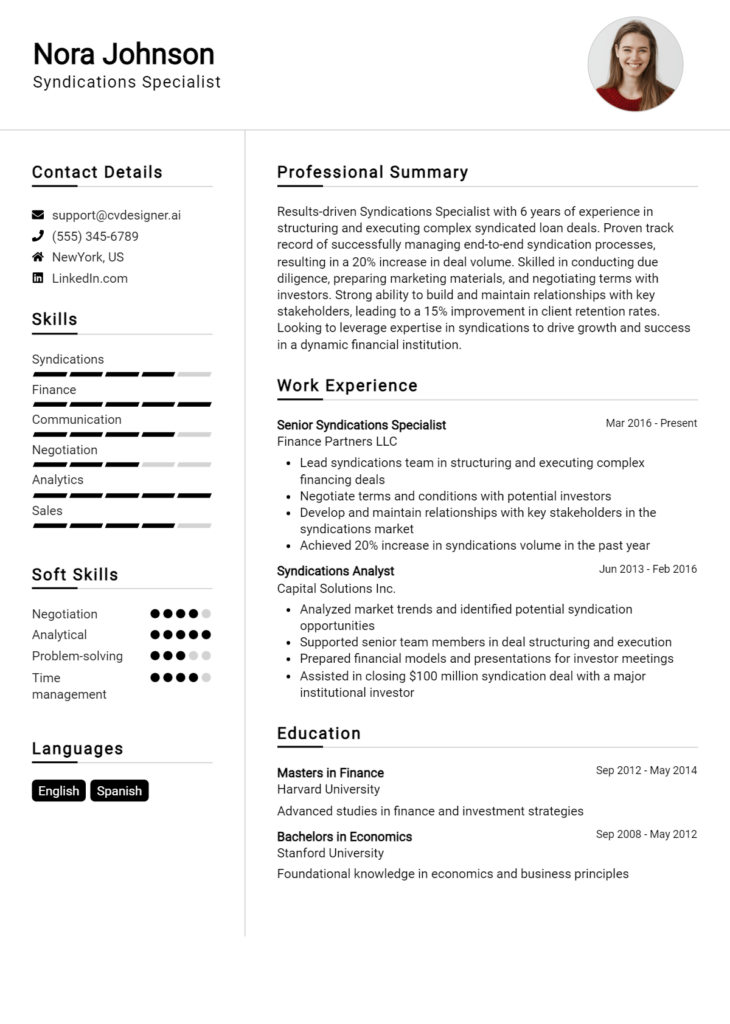

- Check out resume examples to gather inspiration and understand what successful KYC Analysts include in their resumes.

- Don’t forget the importance of a strong introduction; browse cover letter templates to craft a compelling cover letter that complements your resume.

Taking the time to enhance your resume can significantly improve your chances of landing your next KYC Analyst position. Start today and put your best foot forward in your job search!