26 Investment Analyst Skills for Your Resume: List Examples

As an Investment Analyst, possessing a diverse skill set is essential to navigating the complexities of financial markets and making informed investment decisions. Highlighting the right skills on your resume can set you apart from other candidates and showcase your capability to analyze data, assess risks, and identify profitable investment opportunities. In the following section, we will outline the top skills that every Investment Analyst should consider including on their resume to enhance their employability and demonstrate their expertise in the field.

Best Investment Analyst Technical Skills

Technical skills are crucial for an Investment Analyst, as they provide the analytical tools and methodologies needed to evaluate investment opportunities and make informed decisions. These skills not only enhance the analyst's ability to interpret data and trends but also contribute to stronger investment strategies and superior portfolio management. Below are some of the top technical skills that can significantly bolster your resume.

Financial Modeling

Financial modeling involves creating representations of a company's financial performance to support investment decisions. This skill is essential for forecasting and scenario analysis.

How to show it: Highlight specific models you have developed, such as DCF or LBO models, and quantify their impact on investment outcomes or decision-making processes.

Data Analysis

Data analysis is the process of inspecting and interpreting data to extract meaningful insights, which is vital for identifying trends and making data-driven investment decisions.

How to show it: Include examples of data analytics tools you have used, such as Excel or SQL, and mention any significant findings that influenced investment strategies.

Valuation Techniques

Valuation techniques assess the worth of an asset or company, which is crucial for determining buy/sell decisions. Familiarity with methods like comparable company analysis and precedent transactions is key.

How to show it: List specific valuation methods you have applied in real scenarios, and provide metrics on the accuracy of your valuations compared to market performance.

Risk Assessment

Risk assessment involves identifying and analyzing potential risks that could impact investment performance. This skill helps in developing strategies to mitigate these risks.

How to show it: Describe instances where you conducted risk assessments and how your findings led to adjustments in investment strategies or portfolio allocations.

Portfolio Management

Portfolio management encompasses the selection and management of a mix of investments to achieve specific financial goals. It requires a strong understanding of asset allocation and performance tracking.

How to show it: Provide details about your experience in managing investment portfolios, including performance metrics that demonstrate your effectiveness in achieving client objectives.

Statistical Analysis

Statistical analysis involves using statistical methods to analyze data sets, which assists in making informed predictions and identifying market trends.

How to show it: Mention specific statistical tools or software you have used, and give examples of how your analyses led to successful investment decisions.

Financial Software Proficiency

Proficiency with financial software such as Bloomberg, FactSet, or Morningstar is essential for accessing real-time data and analytics, enhancing research capabilities.

How to show it: List the financial software you are familiar with and describe how you utilized them in your analysis or reporting processes.

Market Research

Market research involves gathering and analyzing information about market conditions and trends, which is essential for identifying investment opportunities.

How to show it: Detail your experience in conducting market research, including specific sectors or trends you focused on and how this research guided your investment recommendations.

Excel Expertise

Excel expertise is critical for performing complex calculations, creating financial models, and analyzing data efficiently.

How to show it: Specify advanced Excel functions you are proficient in, and give examples of how you utilized these skills to improve efficiency or accuracy in your analyses.

Presentation Skills

Presentation skills are vital for effectively communicating investment ideas and analyses to stakeholders, ensuring that complex information is conveyed clearly.

How to show it: Share experiences where you presented findings to clients or executives, emphasizing the clarity and impact of your presentations on decision-making.

Best Investment Analyst Soft Skills

In the competitive field of investment analysis, possessing strong soft skills is just as vital as technical expertise. These interpersonal skills enhance collaboration, improve communication, and enable analysts to navigate complex situations effectively. Highlighting these soft skills on your resume can set you apart from other candidates and demonstrate your holistic approach to investment analysis.

Analytical Thinking

Analytical thinking allows investment analysts to evaluate data critically, identify trends, and make informed decisions. This skill is crucial for interpreting financial reports and market conditions.

How to show it: Provide examples of how your analytical skills led to successful investment decisions, quantify the impact on portfolio performance, and highlight the tools you used for analysis.

Communication

Effective communication is essential for conveying complex financial information clearly to stakeholders. This skill fosters collaboration with team members and builds trust with clients.

How to show it: Include specific instances where you simplified complex financial concepts for clients or team members, and mention any presentations or reports you created that were well-received.

For more on this skill, visit our [Communication](https://resumedesign.ai/communication-skills/) page.

Problem-Solving

Investment analysts often face unexpected challenges that require innovative solutions. Strong problem-solving skills enable them to navigate obstacles and seize opportunities in the market.

How to show it: Describe situations where you identified a problem, the steps you took to resolve it, and the positive outcomes that resulted from your intervention.

Learn more about this skill on our [Problem-solving](https://resumedesign.ai/problem-solving-skills/) page.

Time Management

Time management is critical in the fast-paced world of investment analysis, where deadlines are frequent and time-sensitive decisions are the norm. Efficiently prioritizing tasks can lead to better outcomes.

How to show it: Highlight your ability to manage multiple projects simultaneously by providing examples of how you met tight deadlines and the results achieved.

For tips on this skill, check out our [Time Management](https://resumedesign.ai/time-management-skills/) page.

Teamwork

Investment analysts often collaborate with colleagues from various departments. Strong teamwork skills enhance collaboration and facilitate the sharing of ideas, leading to more robust investment strategies.

How to show it: Detail your experience working in teams, your role in projects, and any successful outcomes that resulted from collaborative efforts.

For additional insights on this skill, visit our [Teamwork](https://resumedesign.ai/teamwork-skills/) page.

Adaptability

The investment landscape is constantly evolving, and adaptability is key for analysts to stay relevant and responsive to change. This skill helps in adjusting strategies as market conditions shift.

How to show it: Provide examples of how you adapted to changing market trends or client needs, and discuss the outcomes of those adjustments.

Attention to Detail

Attention to detail ensures accuracy in financial analyses, reports, and presentations. This skill is vital for minimizing errors that could lead to significant financial losses.

How to show it: Share specific instances where your attention to detail prevented mistakes or improved the quality of your analyses.

Negotiation

Negotiation skills are essential for securing favorable terms and conditions in investment deals. This skill can lead to better outcomes for clients and the firm.

How to show it: Include examples of successful negotiations you’ve led, emphasizing the impact on financial results or client satisfaction.

Emotional Intelligence

Emotional intelligence allows analysts to understand and manage their emotions and those of others, fostering stronger relationships and improving decision-making under pressure.

How to show it: Describe situations where your emotional intelligence influenced a team dynamic or client relationship positively.

Research Skills

Strong research skills are critical for gathering and interpreting data. Investment analysts must be able to sift through vast amounts of information to find valuable insights.

How to show it: Detail your research methodologies and highlight specific outcomes that resulted from thorough research efforts.

Critical Thinking

Critical thinking enables analysts to evaluate information rigorously and make sound judgments. This skill is crucial in assessing investment opportunities and risks.

<strong

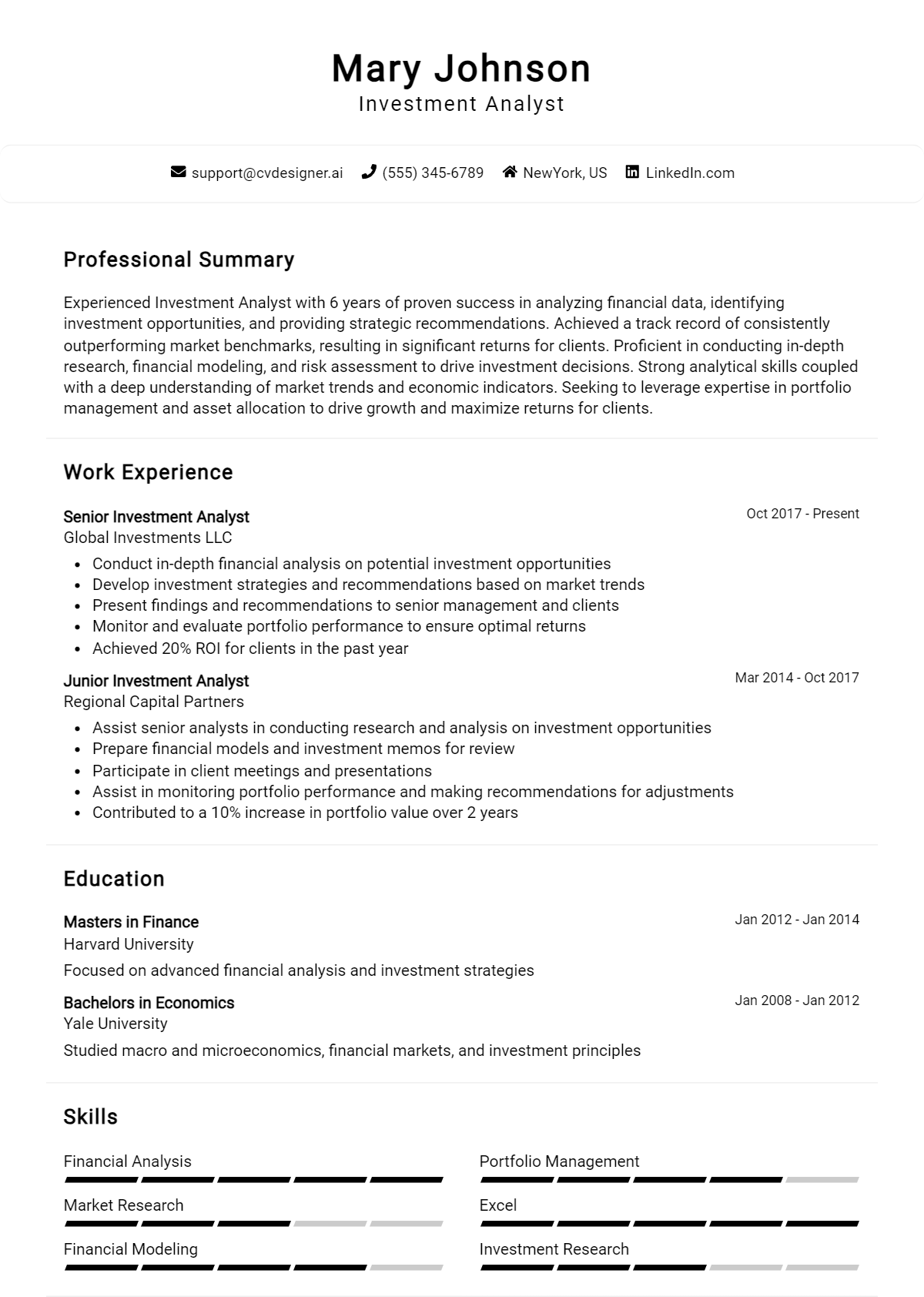

How to List Investment Analyst Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to employers. It provides a quick snapshot of your qualifications and shows that you have the necessary expertise for the role. There are three main sections where skills can be highlighted: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

Showcasing your Investment Analyst skills in the summary section allows hiring managers to quickly grasp your qualifications. This introduction sets the tone for your entire resume.

Example

As an accomplished Investment Analyst with a strong background in financial modeling and market analysis, I consistently deliver insightful investment recommendations that drive strategic decision-making and contribute to portfolio growth.

for Resume Work Experience

The work experience section is an excellent opportunity to demonstrate how you’ve applied your Investment Analyst skills in real-world scenarios. This is where you can provide evidence of your capabilities.

Example

- Conducted comprehensive financial analysis to identify investment opportunities, leading to a 15% increase in portfolio returns.

- Utilized quantitative modeling to forecast market trends and assist in risk assessment.

- Collaborated with cross-functional teams to present investment strategies that aligned with client objectives.

- Maintained strong relationships with stakeholders, enhancing client satisfaction and retention rates.

for Resume Skills

The skills section of your resume can showcase both technical and transferable skills. A balanced mix of hard and soft skills is essential to strengthen your qualifications.

Example

- Financial Modeling

- Market Research

- Data Analysis

- Risk Management

- Communication Skills

- Investment Strategies

- Portfolio Management

- Time Management

for Cover Letter

Your cover letter allows you to expand on the skills mentioned in your resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate their relevance.

Example

In my previous role, my expertise in financial analysis and risk assessment directly improved our investment strategies, resulting in a 20% increase in client returns. I believe these skills will significantly contribute to your team and drive impactful results.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job. For more details, check out our sections on skills, Technical Skills, and work experience.

The Importance of Investment Analyst Resume Skills

In the competitive field of investment analysis, a candidate's resume serves as a critical tool for making a strong first impression on recruiters. Highlighting relevant skills not only showcases a candidate's qualifications but also demonstrates their alignment with the specific requirements of the position. A well-crafted skills section can effectively differentiate a candidate from others, making it easier for hiring managers to identify the most suitable applicants for their investment teams.

- Investment analysts must possess a strong analytical mindset. Skills in data interpretation and financial modeling are essential, as they enable analysts to evaluate investment opportunities and assess potential risks effectively.

- Technical proficiency in financial software and tools is crucial. Familiarity with programs like Excel, Bloomberg, and other analytical platforms can significantly enhance an analyst's efficiency and accuracy in data analysis.

- Effective communication skills are vital for investment analysts. The ability to articulate complex financial concepts and present findings clearly to stakeholders is essential for driving informed investment decisions.

- Attention to detail is a hallmark of a successful investment analyst. Skills in meticulous data review and validation help ensure that analyses are accurate, thereby reducing the risk of costly investment errors.

- Understanding market trends and economic indicators is imperative. Analysts need to stay informed about global financial markets and possess the skills to analyze how these factors impact investment strategies.

- Strong problem-solving abilities are essential for navigating complex investment scenarios. Analysts must be equipped to identify challenges and develop strategic solutions that align with client objectives.

- Collaboration skills are increasingly important in team-based environments. Investment analysts often work alongside other professionals, and being able to cooperate effectively can lead to enhanced investment outcomes.

- Time management skills are critical for handling multiple projects simultaneously. Analysts must prioritize tasks efficiently to meet tight deadlines while maintaining high-quality analysis.

For more examples and guidance on crafting an effective resume, you can explore various Resume Samples.

How To Improve Investment Analyst Resume Skills

In the dynamic field of investment analysis, continuously improving your skills is crucial for staying competitive and effectively contributing to your organization. The investment landscape is constantly evolving, and possessing up-to-date skills not only enhances your resume but also boosts your confidence and performance in the role. Here are some actionable tips to help you enhance your investment analyst skills:

- Engage in Continuous Learning: Enroll in relevant courses or certifications such as CFA, CAIA, or specialized investment analysis programs to deepen your knowledge and expertise.

- Stay Informed on Market Trends: Regularly read financial news, research reports, and analysis blogs to keep abreast of current market trends and investment strategies.

- Practice Financial Modeling: Enhance your technical skills by practicing financial modeling and valuation techniques using Excel or other financial software.

- Network with Industry Professionals: Attend industry conferences, webinars, and networking events to learn from experienced professionals and expand your knowledge base.

- Develop Soft Skills: Improve your communication, analytical, and problem-solving skills by participating in team projects, presentations, or public speaking workshops.

- Utilize Investment Simulation Tools: Use investment simulation platforms to practice real-world trading scenarios and refine your decision-making process.

- Seek Mentorship: Find a mentor in the investment field who can provide guidance, share experiences, and help you navigate your career development.

Frequently Asked Questions

What key skills should I highlight in my Investment Analyst resume?

When crafting your Investment Analyst resume, focus on highlighting analytical skills, financial modeling, and proficiency in financial analysis software. Additionally, emphasize your ability to interpret financial data, conduct market research, and assess investment opportunities. Strong communication and presentation skills are also crucial, as they demonstrate your capability to convey complex information to stakeholders effectively.

How important are technical skills for an Investment Analyst?

Technical skills are vital for an Investment Analyst, as they enable you to manipulate and analyze large sets of financial data. Familiarity with tools such as Excel, Bloomberg, and various statistical software is essential. Moreover, understanding programming languages like SQL or Python can give you a competitive edge by allowing you to automate analysis and enhance data processing capabilities.

Should I include soft skills in my Investment Analyst resume?

Yes, including soft skills in your Investment Analyst resume is important. Skills such as critical thinking, problem-solving, and adaptability are crucial in navigating the complexities of financial markets. Additionally, strong interpersonal skills are necessary for collaborating with team members and presenting findings to clients or stakeholders, making them an important aspect of your overall skill set.

How can I demonstrate analytical skills on my resume?

To effectively demonstrate your analytical skills on your resume, include specific examples of past projects or experiences where you utilized these skills. Mention any quantitative analyses you performed, investment strategies you developed, or financial models you created. Quantifying your achievements, such as improvements in investment performance or cost savings, can also help illustrate your analytical capabilities.

What certifications can enhance my resume as an Investment Analyst?

Certifications can significantly enhance your resume and credibility as an Investment Analyst. Consider pursuing the Chartered Financial Analyst (CFA) designation, which is highly regarded in the industry. Other certifications, such as the Chartered Alternative Investment Analyst (CAIA) or Financial Risk Manager (FRM), can also be beneficial, showcasing your commitment to professional development and expertise in specific areas of investment analysis.

Conclusion

Incorporating Investment Analyst skills into your resume is crucial for demonstrating your expertise and suitability for the role. By effectively showcasing relevant skills, candidates can distinguish themselves from the competition and highlight the value they can bring to potential employers. Remember, a well-crafted resume not only reflects your qualifications but also your dedication to the profession. So, take the time to refine your skills and enhance your application; your dream job awaits!

For more resources, check out our resume templates, utilize our resume builder, explore resume examples, and don't forget to look at our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.