Investment Analyst Core Responsibilities

An Investment Analyst plays a crucial role in evaluating investment opportunities, requiring a blend of technical, operational, and problem-solving skills. They analyze financial data, forecast market trends, and assess risks, bridging the gap between finance, research, and strategy departments. These skills are vital for making informed investment decisions that align with the organization’s objectives. A well-structured resume can effectively showcase these qualifications, demonstrating the analyst's ability to contribute to the company's success.

Common Responsibilities Listed on Investment Analyst Resume

- Conduct financial modeling and valuation analysis

- Analyze market trends and economic conditions

- Prepare investment reports and presentations

- Perform due diligence on potential investments

- Collaborate with cross-functional teams for strategic insights

- Monitor and evaluate investment performance

- Assist in portfolio management and asset allocation

- Identify and assess investment risks

- Maintain relationships with stakeholders and clients

- Utilize advanced financial software and tools

- Stay updated on industry developments and news

- Provide recommendations based on quantitative analysis

High-Level Resume Tips for Investment Analyst Professionals

In the competitive landscape of finance, a well-crafted resume is crucial for Investment Analyst professionals. As the first impression a candidate makes on a potential employer, the resume must effectively communicate not only the candidate's skills but also their achievements in the industry. A strong resume serves as a marketing tool that highlights your qualifications, sets you apart from other candidates, and ultimately opens doors to lucrative opportunities. This guide will provide practical and actionable resume tips specifically tailored for Investment Analyst professionals, ensuring your resume stands out in a crowded job market.

Top Resume Tips for Investment Analyst Professionals

- Tailor your resume to the specific job description by using keywords and phrases from the listing.

- Highlight relevant experience in investment analysis, financial modeling, and portfolio management to demonstrate your expertise.

- Quantify your achievements with metrics, such as portfolio growth percentages or cost savings, to provide concrete evidence of your impact.

- Emphasize industry-specific skills, including proficiency in financial software (e.g., Bloomberg, Excel) and familiarity with regulatory frameworks.

- Include a strong summary statement at the top of your resume that captures your career goals and key qualifications.

- Utilize bullet points for easy readability, focusing on accomplishments rather than just responsibilities.

- Incorporate relevant certifications, such as CFA or CIMA, to showcase your commitment to professional development.

- Keep your resume concise, ideally one page, while ensuring it contains all essential information.

- Use a professional format and clear headings to enhance the overall presentation and organization of your resume.

By implementing these tips, you can significantly increase your chances of landing a job in the Investment Analyst field. A polished and targeted resume not only showcases your qualifications but also demonstrates your understanding of the industry, making you a more attractive candidate to potential employers.

Why Resume Headlines & Titles are Important for Investment Analyst

In the competitive field of investment analysis, a strong resume headline or title plays a critical role in capturing the attention of hiring managers. A well-crafted headline not only summarizes a candidate's key qualifications in one impactful phrase but also serves as an immediate hook that can make a significant difference in the initial stages of the hiring process. It should be concise, relevant, and directly related to the job being applied for, allowing candidates to present their strengths and set themselves apart from the competition right from the start.

Best Practices for Crafting Resume Headlines for Investment Analyst

- Keep it concise—aim for one impactful phrase.

- Be specific—use industry-related keywords that reflect the investment analyst role.

- Highlight key qualifications—focus on skills, certifications, or relevant experience.

- Avoid jargon—ensure clarity and accessibility for all readers.

- Tailor to the job description—align the headline with the specific requirements of the position.

- Use action-oriented language—incorporate strong verbs to convey confidence.

- Reflect your unique value proposition—consider what sets you apart from other candidates.

- Keep the tone professional—maintain a level of professionalism appropriate for the finance industry.

Example Resume Headlines for Investment Analyst

Strong Resume Headlines

Results-Driven Investment Analyst with 5+ Years of Experience in Equities and Fixed Income Analysis

Detail-Oriented Financial Analyst Specializing in Risk Assessment and Portfolio Management

Seasoned Investment Analyst with Proven Record of Delivering High-Impact Investment Strategies

Dynamic Investment Professional with Expertise in Data-Driven Decision Making and Financial Modeling

Weak Resume Headlines

Investment Analyst

Experienced Worker in Finance

The strong headlines are effective because they convey specific skills, relevant experience, and the candidate's unique strengths, all of which immediately resonate with the priorities of hiring managers in the investment field. In contrast, the weak headlines fail to impress due to their vagueness and lack of detail, offering no insight into the candidate’s qualifications or potential contributions to the role. A compelling headline sets the tone for the entire resume, making it an essential element in the job application process.

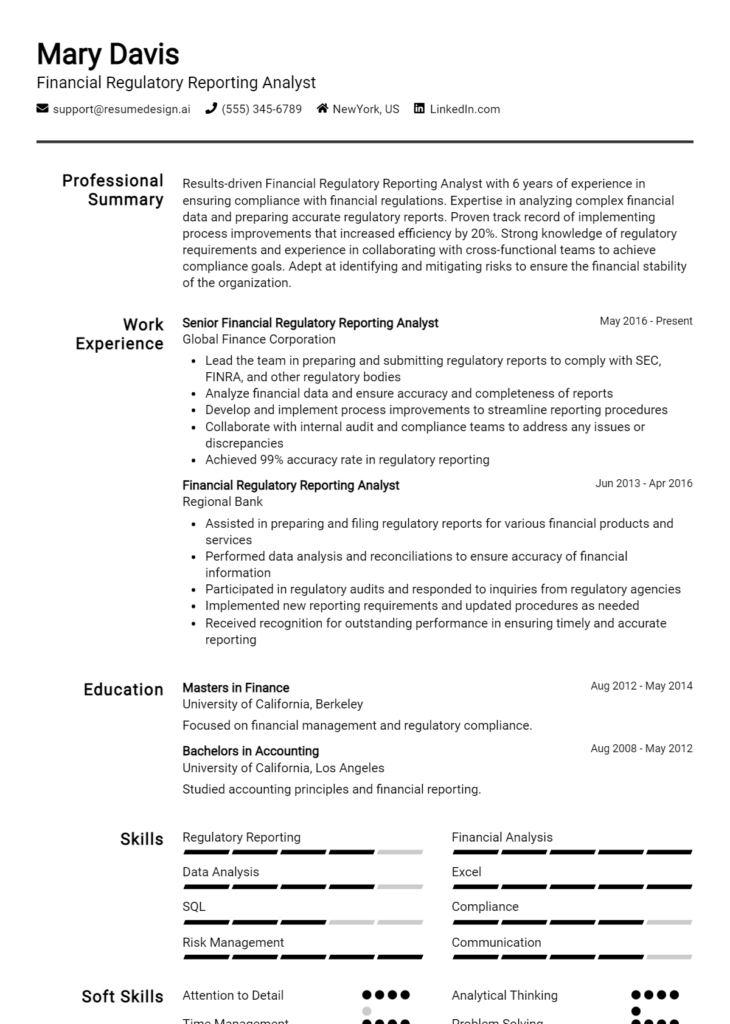

Writing an Exceptional Investment Analyst Resume Summary

A well-crafted resume summary is essential for an Investment Analyst as it serves as a snapshot of your professional identity, quickly capturing the attention of hiring managers. In a competitive field where analytical skills and financial acumen are paramount, a strong summary highlights your key skills, relevant experience, and noteworthy accomplishments, setting the tone for the rest of your resume. It should be concise and impactful, tailored specifically to the job you are applying for, ensuring that the most pertinent information is presented right at the outset.

Best Practices for Writing a Investment Analyst Resume Summary

- Quantify Achievements: Use specific numbers and metrics to showcase the impact of your work.

- Focus on Key Skills: Highlight the analytical and technical skills that are most relevant to the role.

- Tailor for the Job Description: Customize your summary to align with the specific requirements and language of the job listing.

- Be Concise: Keep your summary brief, ideally within 3-5 sentences, to maintain the reader's attention.

- Use Action Words: Start sentences with strong action verbs to convey confidence and proactivity.

- Highlight Relevant Experience: Mention specific roles or projects that directly relate to the responsibilities of an Investment Analyst.

- Showcase Soft Skills: Include interpersonal skills such as communication and teamwork that enhance your technical abilities.

- Keep It Professional: Maintain a formal tone and avoid unnecessary jargon or overly casual language.

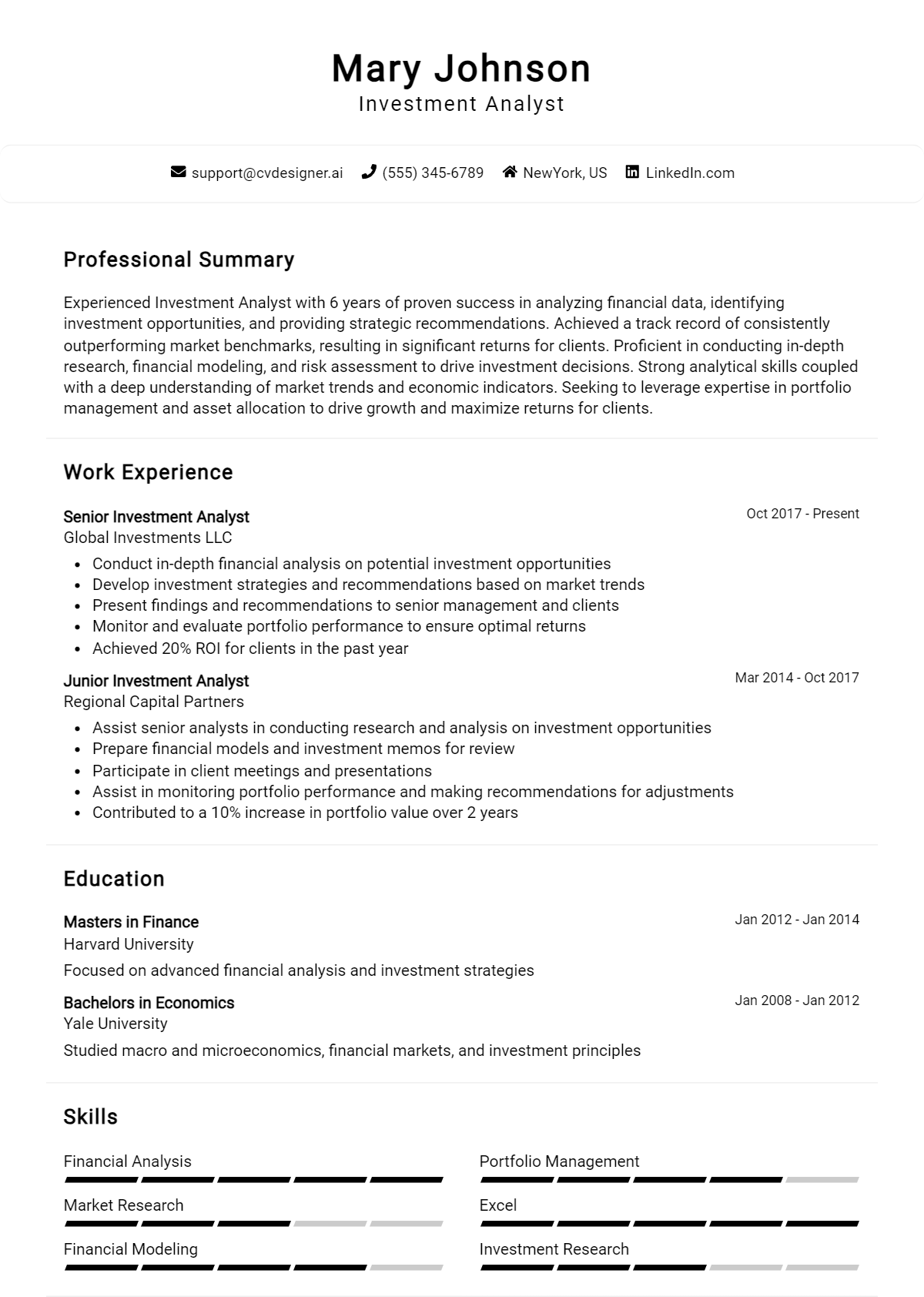

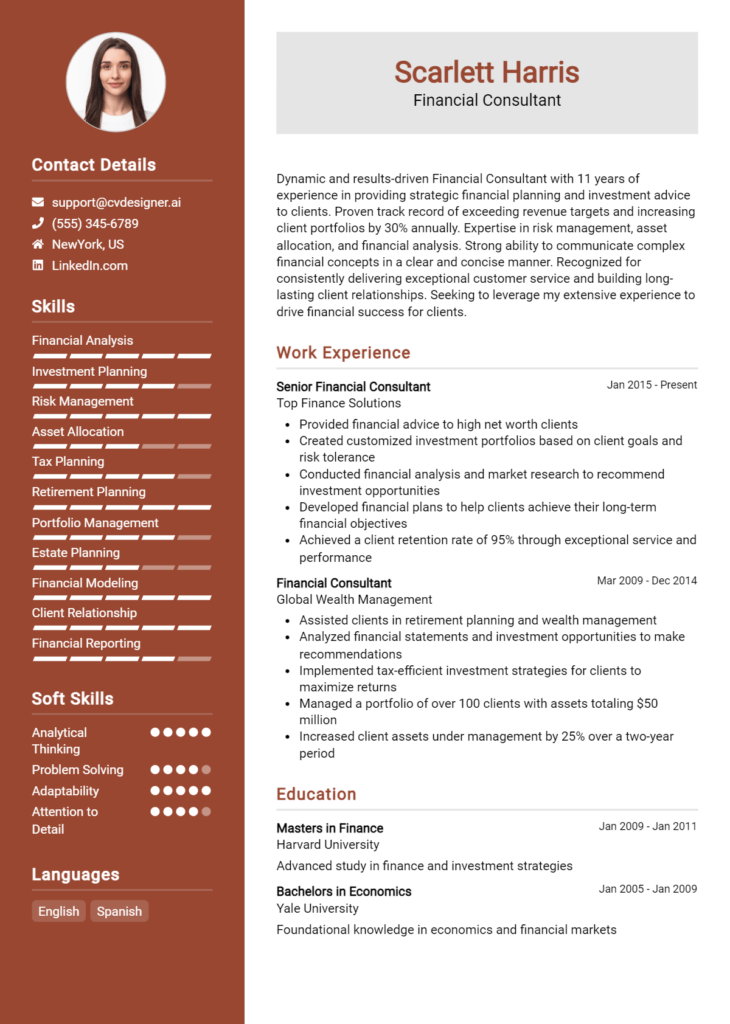

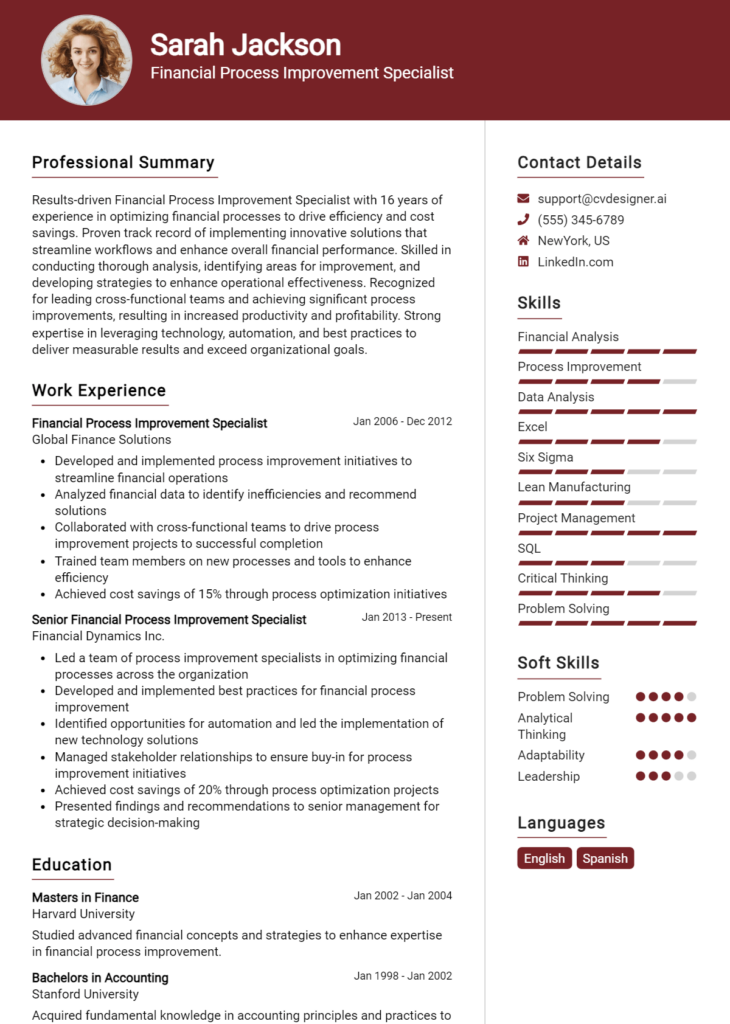

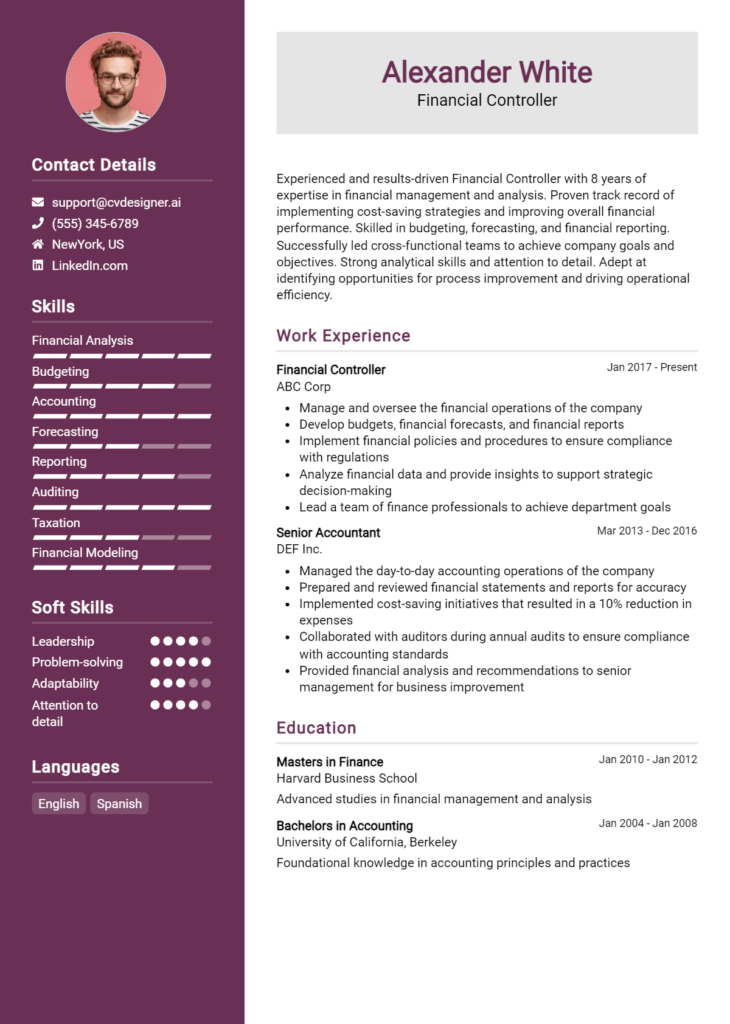

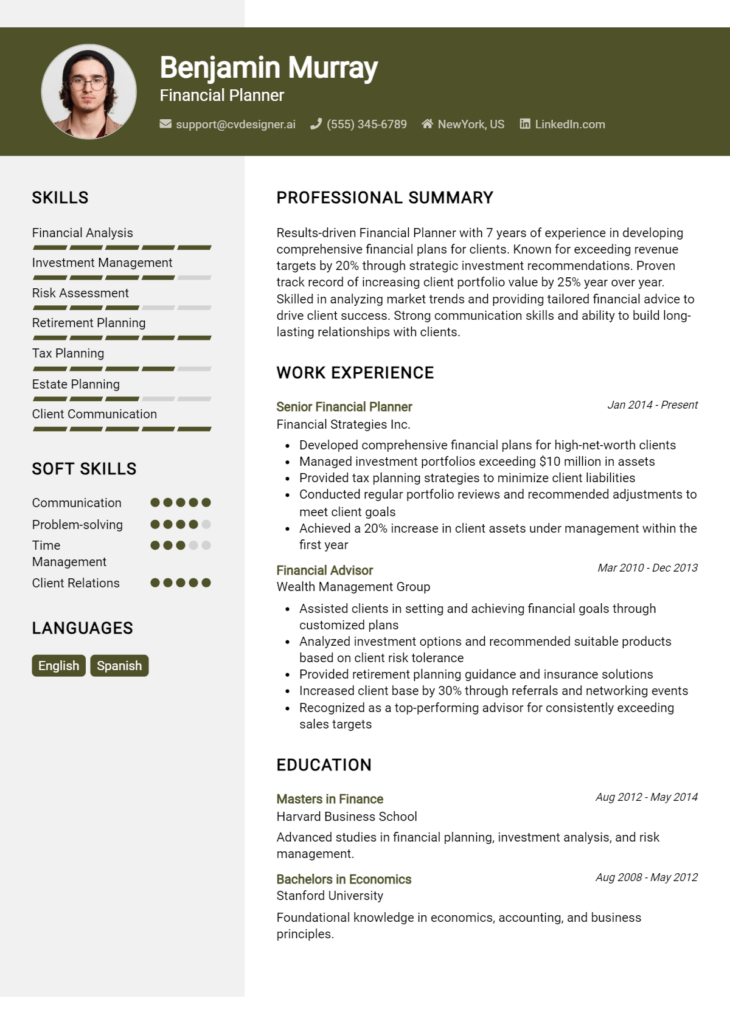

Example Investment Analyst Resume Summaries

Strong Resume Summaries

Results-oriented Investment Analyst with over 5 years of experience in financial modeling and valuation. Successfully managed a portfolio worth $50 million, achieving a 15% annual return through strategic asset allocation and market analysis.

Detail-driven Investment Analyst skilled in conducting thorough market research and providing actionable insights. Increased client portfolio performance by 20% through data-driven recommendations and risk assessment strategies.

Analytical Investment Analyst with a proven track record in financial analysis and investment strategy formulation. Delivered a comprehensive analysis that led to a cost-saving initiative of $1 million for a major client in the last fiscal year.

Weak Resume Summaries

Investment Analyst with experience in finance looking for a new opportunity. Skilled in various areas of investment analysis and research.

Dedicated professional seeking to leverage analytical skills in a challenging investment role. Open to learning and development in the finance sector.

The strong resume summaries are considered effective because they provide specific and quantifiable achievements, clearly showcasing the candidate's skills and relevance to the Investment Analyst role. Each example connects the applicant's experience to measurable outcomes, demonstrating their value to potential employers. In contrast, the weak summaries lack detail and specificity, failing to convey the candidate's unique strengths and contributions, making them less compelling to hiring managers.

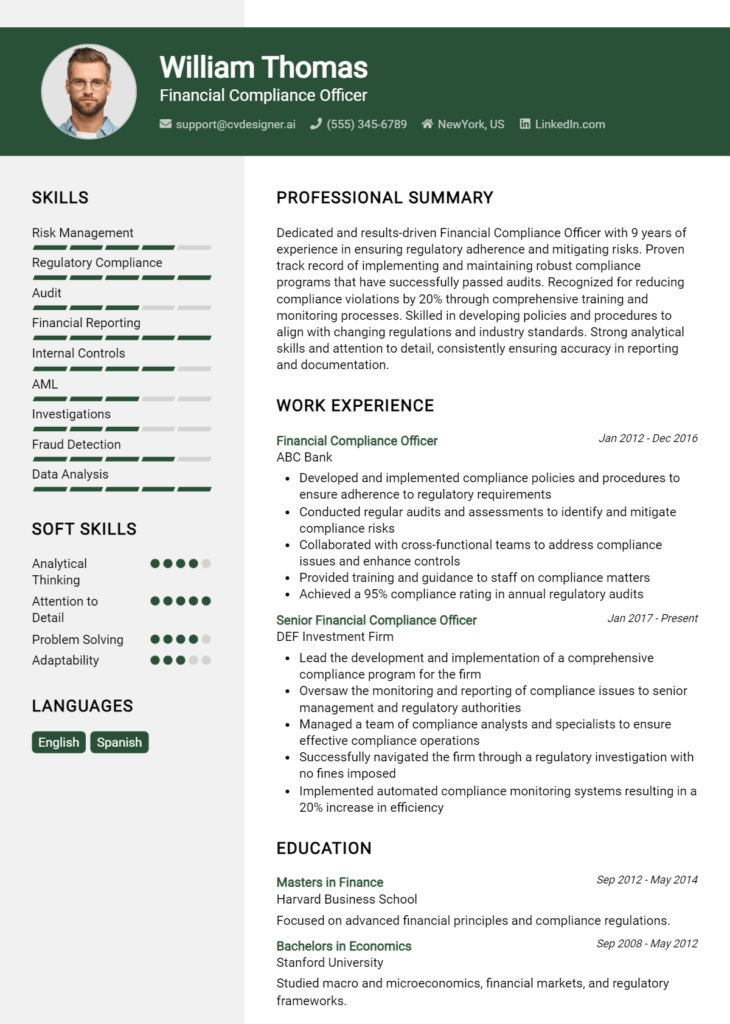

Work Experience Section for Investment Analyst Resume

The work experience section of an Investment Analyst resume is critical as it serves as a testament to the candidate's technical proficiency, teamwork capabilities, and their ability to produce high-quality outcomes in a competitive financial landscape. This section not only showcases relevant skills but also provides a platform for candidates to demonstrate their accomplishments in quantifiable terms. Aligning these experiences with industry standards is essential to effectively communicate the value one can bring to potential employers, making this section a focal point in crafting a compelling resume.

Best Practices for Investment Analyst Work Experience

- Highlight specific technical skills relevant to investment analysis, such as financial modeling, data analysis, and valuation methods.

- Quantify achievements whenever possible, using metrics such as percentage improvements, cost savings, or revenue growth to illustrate impact.

- Demonstrate collaboration by detailing team projects and your role in achieving shared goals.

- Use industry-specific terminology to resonate with hiring managers and applicant tracking systems.

- Tailor your experience to align with the job description, emphasizing the most relevant roles and accomplishments.

- Include any certifications or specialized training that enhance your qualifications as an Investment Analyst.

- Focus on results-driven narratives that showcase how your contributions led to successful outcomes.

- Keep descriptions concise and impactful, using action verbs to convey your responsibilities and achievements effectively.

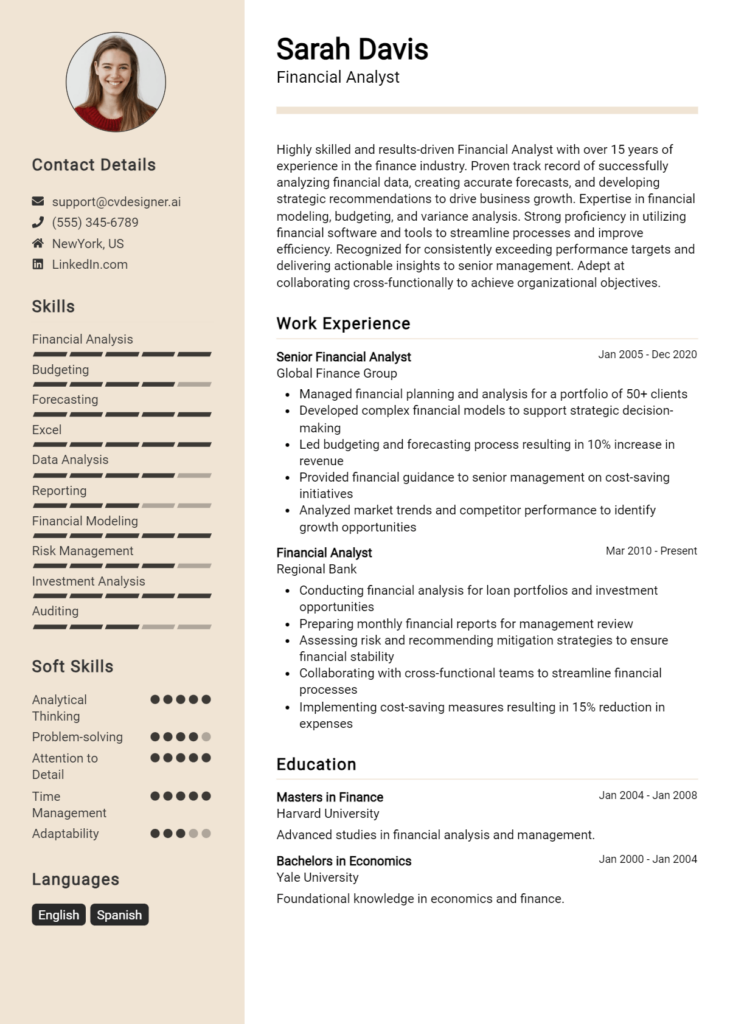

Example Work Experiences for Investment Analyst

Strong Experiences

- Conducted comprehensive financial analyses that led to a 30% increase in portfolio performance over two years, directly contributing to $5 million in additional revenue.

- Led a team of three analysts in the development of a proprietary financial model, which improved forecasting accuracy by 25% and was adopted firm-wide.

- Collaborated with cross-functional teams to create investment strategies that reduced risk exposure by 15%, enhancing client satisfaction ratings.

Weak Experiences

- Worked on financial reports and analysis, contributing to various projects.

- Assisted in the preparation of investment presentations for clients.

- Participated in team meetings to discuss investment opportunities.

The examples provided illustrate a clear distinction between strong and weak experiences. Strong experiences are characterized by quantifiable outcomes, specific technical leadership roles, and collaborative efforts that demonstrate a direct impact on business results. In contrast, weak experiences are vague and lack specificity, failing to convey the candidate's actual contributions or the value they added to their teams or organizations. This highlights the importance of articulating achievements and responsibilities effectively in a resume for an Investment Analyst role.

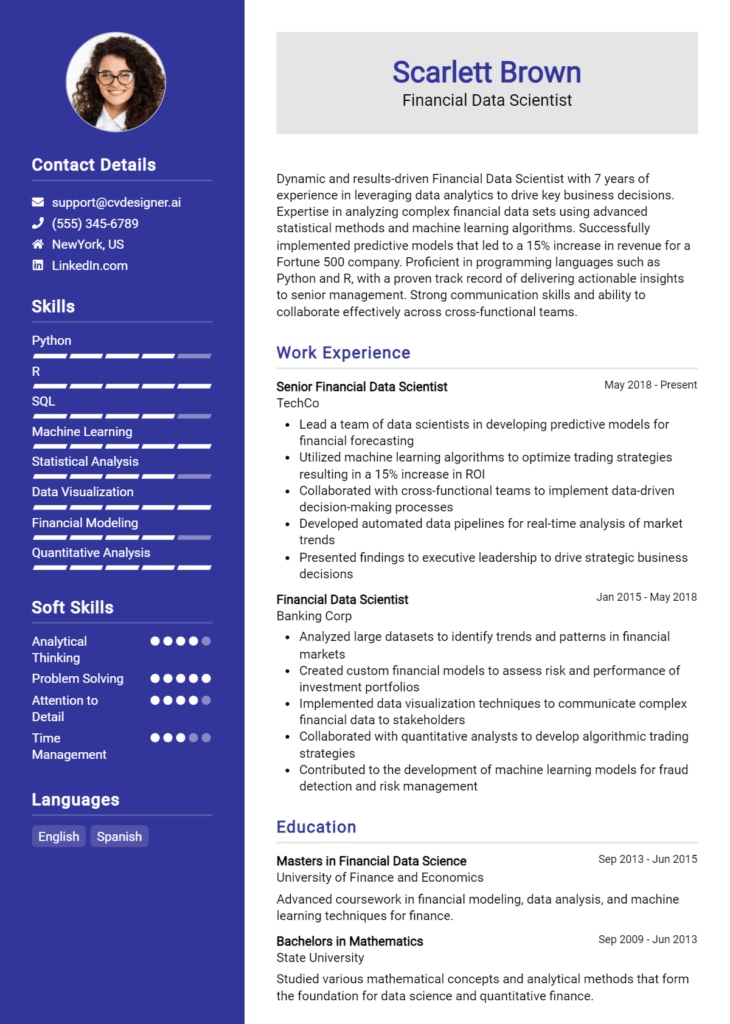

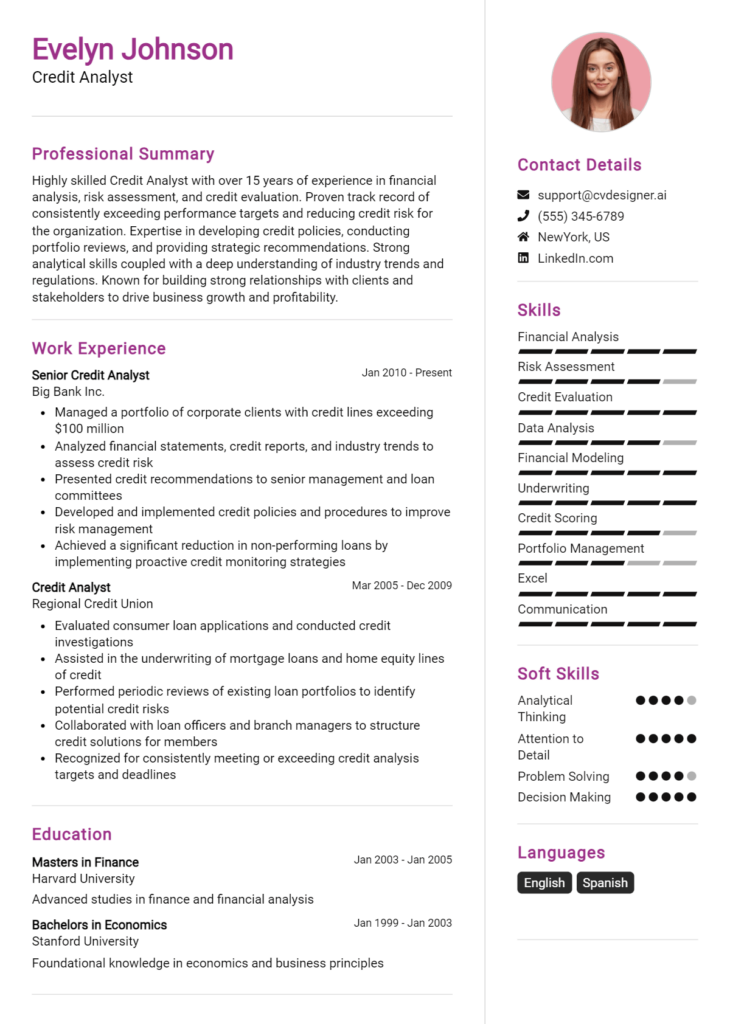

Certifications and Education for a Investment Analyst Resume

When crafting a resume for an Investment Analyst position, it is crucial to emphasize your educational background and relevant certifications. This not only highlights your qualifications but also demonstrates your commitment to the field. Here are some guidelines on how to effectively list your certifications and education:

Certifications to Prioritize:

Chartered Financial Analyst (CFA): This is one of the most recognized certifications in the investment industry. It indicates a high level of expertise in investment analysis, portfolio management, and financial reporting.

Certified Investment Management Analyst (CIMA): This certification focuses on asset management, investment consulting, and portfolio construction, making it highly relevant for investment analysts.

Financial Risk Manager (FRM): This certification is particularly valuable if you are interested in risk analysis and management, which are crucial aspects of investment analysis.

Chartered Alternative Investment Analyst (CAIA): If you have an interest in alternative investments such as hedge funds, private equity, or real estate, this certification can set you apart.

Relevant Educational Backgrounds:

Bachelor’s Degree in Finance: A solid foundation in financial principles, investment strategies, and market analysis. Coursework typically includes financial modeling, corporate finance, and investment analysis.

Bachelor’s Degree in Economics: This degree provides an understanding of market dynamics, economic theory, and data analysis, all of which are essential for an investment analyst role.

Master of Business Administration (MBA) with a Concentration in Finance: An MBA can enhance your analytical skills and provide leadership training, making you a strong candidate for investment analysis positions.

Master’s Degree in Financial Engineering or Quantitative Finance: These programs focus on advanced financial modeling and quantitative analysis, equipping you with the skills needed to analyze complex investment scenarios.

In your resume, clearly list your degrees and certifications in reverse chronological order, ensuring that the most recent and relevant information is easily accessible. Include the institution's name, degree received, and graduation date for educational qualifications, and the certification body, certification name, and date obtained for any certifications. This structured approach will help potential employers quickly assess your qualifications and expertise in the investment field.

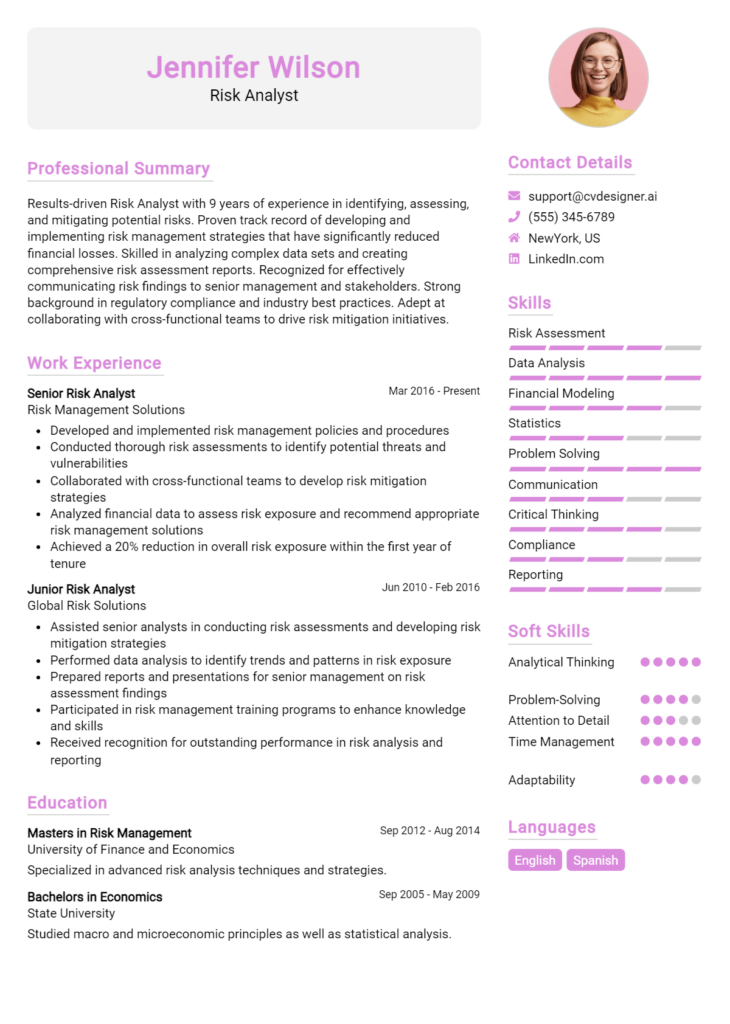

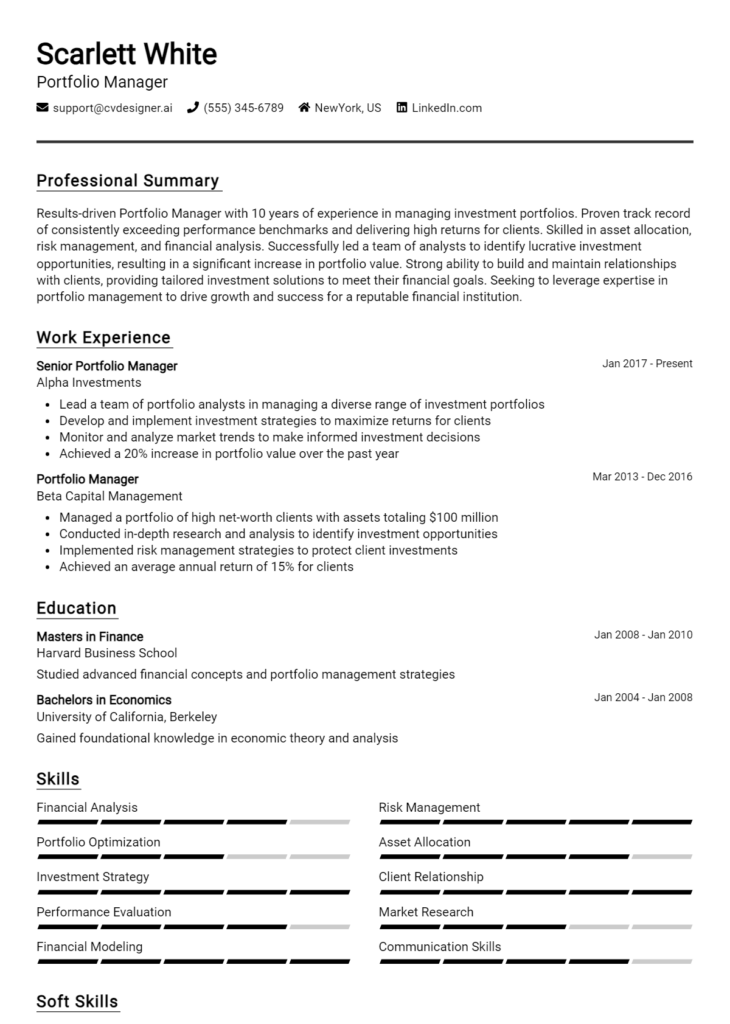

Top Skills & Keywords for Investment Analyst Resume

As an Investment Analyst, possessing the right skills is crucial for success in this competitive field. A well-crafted resume that highlights both hard and soft skills can significantly enhance your chances of landing your desired position. Employers look for candidates who not only have the technical expertise to analyze financial data and market trends but also the interpersonal skills needed to communicate insights effectively and collaborate with teams. By strategically showcasing your skills, you can demonstrate your value as an investment professional and make a compelling case for why you should be chosen over other applicants. For more information on the importance of skills in your resume, be sure to explore additional resources.

Top Hard & Soft Skills for Investment Analyst

Soft Skills

- Analytical Thinking

- Attention to Detail

- Communication Skills

- Problem-Solving

- Team Collaboration

- Time Management

- Adaptability

- Critical Thinking

- Decision-Making

- Interpersonal Skills

- Negotiation

- Emotional Intelligence

- Leadership

- Creativity

- Networking

Hard Skills

- Financial Modeling

- Market Research

- Data Analysis

- Portfolio Management

- Risk Assessment

- Investment Strategies

- Valuation Techniques

- Excel Proficiency

- Statistical Analysis

- Familiarity with Financial Software (e.g., Bloomberg, FactSet)

- Technical Analysis

- Financial Reporting

- Accounting Principles

- Knowledge of Securities Regulations

- Forecasting

- Quantitative Analysis

- Understanding of Macroeconomic Indicators

By developing and emphasizing a robust mix of these skills in your resume, alongside relevant work experience, you position yourself as a well-rounded candidate ready to tackle the challenges of the investment industry.

Stand Out with a Winning Investment Analyst Cover Letter

Dear Hiring Manager,

I am writing to express my interest in the Investment Analyst position at [Company Name], as advertised on [Job Board/Company Website]. With a robust background in finance and investment analysis, coupled with my passion for identifying market trends and opportunities, I am excited about the prospect of contributing to your esteemed team. My academic credentials, including a Bachelor’s degree in Finance from [University Name] and a CFA Level I certification, have equipped me with the analytical skills and financial knowledge necessary to excel in this role.

During my previous role at [Previous Company Name], I successfully conducted comprehensive financial analyses and created detailed reports that informed investment strategies. My ability to interpret complex financial data allowed me to identify emerging market trends and recommend strategic investment opportunities, resulting in a 15% increase in portfolio performance over six months. I am proficient in utilizing various financial modeling techniques and tools, including Excel and Bloomberg, to evaluate the potential risks and returns associated with different investment vehicles.

I am particularly drawn to [Company Name] because of its innovative approach to investment management and its commitment to sustainable investing. I share your vision of leveraging data-driven insights to make informed investment decisions, and I am eager to bring my analytical expertise and collaborative spirit to your team. I am confident that my proactive approach and attention to detail will contribute positively to your investment strategies and client relations.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences align with the goals of [Company Name] and how I can contribute to the continued success of your investment team.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Investment Analyst Resume

Crafting an effective resume as an Investment Analyst is crucial to standing out in a competitive job market. However, many candidates make common mistakes that can undermine their chances of landing an interview. Understanding these pitfalls can help you create a polished and compelling resume that showcases your skills and experiences. Here are some common mistakes to avoid:

Generic Objective Statement: Using a vague objective statement that doesn't specify your goals or the position can make your resume blend in with the rest. Tailoring this section to the specific job you are applying for is essential.

Lack of Quantifiable Achievements: Failing to include quantifiable results can weaken your impact. Instead of just stating responsibilities, highlight accomplishments with specific numbers (e.g., "Increased portfolio performance by 15% over two years").

Overly Complex Language: Using jargon or overly technical language can alienate hiring managers. Aim for clear and concise language that is easy to understand while still demonstrating your expertise.

Ignoring the Job Description: Not aligning your resume with the job description can lead to missed opportunities. Make sure to incorporate relevant keywords and skills mentioned in the posting to show you’re a good fit.

Inconsistent Formatting: A resume that lacks consistency in font, spacing, and layout can appear unprofessional. Stick to a clean, easy-to-read format throughout the document.

Too Much Focus on Education: While educational background is important, overemphasizing it at the expense of practical experience can be a mistake. Highlight relevant work experience and skills that demonstrate your capabilities as an analyst.

Neglecting Soft Skills: Failing to mention soft skills such as communication, teamwork, or analytical thinking can be detrimental. These skills are often just as important as technical abilities in the investment field.

Including Irrelevant Information: Listing unrelated work experiences or outdated skills can clutter your resume. Focus on relevant experiences that showcase your qualifications for the role of an Investment Analyst.

Conclusion

As we’ve explored the essential skills, responsibilities, and qualifications of an Investment Analyst, it’s clear that this role demands a blend of analytical prowess, financial knowledge, and effective communication skills. From assessing market trends and conducting financial analysis to preparing reports and making investment recommendations, an Investment Analyst plays a crucial role in guiding investment strategies.

To stand out in this competitive field, it's vital to present a polished and professional resume that highlights your relevant experience and skills. Take a moment to review your Investment Analyst Resume and ensure it aligns with industry standards and showcases your unique strengths.

For your convenience, there are excellent resources available to enhance your job application materials. Consider utilizing resume templates designed specifically for finance professionals, or try out the resume builder to create a tailored resume with ease. Additionally, don’t overlook the importance of a compelling introduction; check out the cover letter templates to help craft a strong narrative that complements your resume.

Take action today to refine your application and position yourself for success in the dynamic world of investment analysis!