26 Insurance Compliance Officer Skills for Your Resume: List Examples

As an Insurance Compliance Officer, having the right skills on your resume is crucial to demonstrate your ability to navigate the complex regulatory landscape of the insurance industry. This role demands a keen understanding of legal requirements, risk management, and ethical standards to ensure that organizations adhere to all applicable laws and regulations. Below, we outline the top skills that can help you stand out as a qualified candidate in this competitive field.

Best Insurance Compliance Officer Technical Skills

Technical skills are crucial for an Insurance Compliance Officer as they ensure adherence to regulatory standards, enhance risk management, and streamline compliance processes. Proficiency in these skills not only aids in maintaining legal and ethical standards but also contributes to the overall efficiency of insurance operations. Here are some essential technical skills to highlight on your resume.

Regulatory Knowledge

Understanding of insurance regulations and compliance requirements at both federal and state levels is essential for an Insurance Compliance Officer. This knowledge helps in identifying compliance risks and implementing strategies to mitigate them.

How to show it: Detail your experience with specific regulations you have worked with, such as the Affordable Care Act or state-specific insurance laws. Include examples of how you ensured compliance and any audits passed under your oversight.

Risk Assessment

Ability to evaluate and identify potential risks associated with insurance operations. This skill is critical for developing risk management strategies that protect the organization from non-compliance penalties.

How to show it: Quantify your risk assessment outcomes, such as the percentage of risks mitigated or successful implementation of compliance strategies that reduced exposure to fines or penalties.

Data Analysis

Proficiency in analyzing compliance data to identify trends, anomalies, and areas for improvement. Data analysis supports decision-making processes and enhances compliance reporting.

How to show it: Provide examples of data analysis projects you’ve completed, including specific metrics or software tools used and how your analysis contributed to improved compliance practices.

Audit Management

Experience in preparing for and managing internal and external audits. This skill ensures that the organization is always ready for compliance checks and minimizes disruption during audit processes.

How to show it: Include details about the audits you managed, highlighting successful outcomes and any improvements made post-audit based on your findings.

Policy Development

Ability to develop, implement, and update compliance policies and procedures. This skill ensures that all employees are aware of the compliance standards and practices they must follow.

How to show it: Describe specific policies you have developed, including how these policies improved compliance rates or reduced incidents of non-compliance.

Communication Skills

Effective communication is vital for relaying compliance requirements and training staff. Strong verbal and written communication skills facilitate clear understanding and adherence to compliance protocols.

How to show it: Highlight instances where your communication efforts led to successful compliance training sessions or clearer understanding of compliance requirements across departments.

Technological Proficiency

Familiarity with compliance management software and tools that streamline compliance tracking and reporting. Proficiency in technology improves efficiency and reduces errors in compliance management.

How to show it: List specific software and tools you have used, emphasizing any efficiencies gained or improvements in compliance tracking you achieved through technology implementation.

Investigative Skills

Strong investigative skills allow an Insurance Compliance Officer to thoroughly investigate compliance breaches and recommend corrective actions. This skill is crucial for maintaining organizational integrity.

How to show it: Provide examples of investigations you led, including the issues addressed and the outcomes that resulted from your findings and recommendations.

Training and Development

Experience in developing and delivering training programs on compliance topics. This skill ensures that all employees understand their compliance obligations and the importance of adherence.

How to show it: Quantify the number of training sessions you conducted and the percentage increase in compliance knowledge among staff post-training, using feedback or assessment results to illustrate effectiveness.

Project Management

Ability to manage compliance projects from inception to completion, ensuring that all aspects are executed efficiently and effectively. Project management skills enhance the organization’s compliance initiatives.

How to show it: Detail specific projects you managed, including timelines, budgets, and the successful completion of compliance objectives within those projects.

Ethical Judgment

Possessing a strong sense of ethics is paramount for an Insurance Compliance Officer. This skill guides decision-making processes and ensures that compliance practices align with the organization’s values.

How to show it: Share instances where your ethical judgment played a key role in compliance decisions, highlighting how you navigated complex situations to uphold compliance standards.

Best Insurance Compliance Officer Soft Skills

Soft skills are essential for an Insurance Compliance Officer, as they not only enhance individual performance but also contribute to the overall effectiveness of the compliance team. Mastering these skills can help in navigating the complexities of regulatory requirements, fostering collaboration among stakeholders, and ensuring that compliance objectives are met efficiently and effectively.

Attention to Detail

Attention to detail is crucial for an Insurance Compliance Officer, as it ensures that all regulatory documents are accurate and complete, minimizing the risk of non-compliance.

How to show it: Highlight specific instances where your keen eye for detail helped identify discrepancies in reports or improved accuracy in compliance documentation. Use quantifiable results to demonstrate the impact of your attention to detail.

Analytical Thinking

Analytical thinking allows Insurance Compliance Officers to assess complex information and identify potential compliance risks, helping to develop effective strategies to mitigate them.

How to show it: Provide examples of situations where your analytical skills led to improved compliance processes or risk assessments. Include metrics that showcase the improvements achieved through your analysis.

Communication

Effective communication is vital for conveying compliance requirements to various stakeholders, ensuring everyone understands their responsibilities and the importance of adhering to regulations.

How to show it: Demonstrate your communication skills by sharing examples of presentations or training sessions you've conducted. Highlight feedback received and any measurable outcomes, such as increased compliance awareness among staff. For more tips, visit our [Communication](https://resumedesign.ai/communication-skills/) section.

Problem-solving

Problem-solving skills enable Insurance Compliance Officers to navigate challenges and develop solutions effectively, ensuring compliance issues are resolved promptly.

How to show it: Include specific examples of compliance challenges you faced and the solutions you implemented. Quantify the results, such as reduced compliance breaches or improved response times. Learn more about this skill in our [Problem-solving](https://resumedesign.ai/problem-solving-skills/) section.

Time Management

Time management is essential for balancing multiple compliance tasks and meeting deadlines, ensuring that all regulatory requirements are adhered to in a timely manner.

How to show it: Share examples of how you prioritized tasks and met tight deadlines, highlighting any tools or methods you used to stay organized. Quantify your achievements, such as completing audits ahead of schedule. For tips on this skill, check our [Time Management](https://resumedesign.ai/time-management-skills/) page.

Teamwork

Teamwork is crucial for collaborating with various departments and stakeholders to ensure compliance initiatives are understood and implemented effectively across the organization.

How to show it: Illustrate your teamwork skills by providing examples of successful cross-departmental projects you contributed to. Highlight collaborative achievements and any positive feedback received from team members. Explore more about this skill in our [Teamwork](https://resumedesign.ai/teamwork-skills/) section.

Adaptability

Adaptability is important in the ever-changing landscape of insurance regulations. Being able to adjust quickly to new laws and policies is vital for maintaining compliance.

How to show it: Provide clear examples of times when you adapted to changes in regulations and the proactive measures you took to stay compliant. Quantify how these adaptations positively affected your organization.

Integrity

Integrity is foundational for an Insurance Compliance Officer, as it builds trust with stakeholders and ensures that compliance practices are adhered to ethically and transparently.

How to show it: Share examples of situations where you upheld ethical standards in compliance practices, particularly in challenging circumstances. Emphasize any recognition received for your commitment to integrity.

Critical Thinking

Critical thinking enables Insurance Compliance Officers to evaluate complex situations and make informed decisions that align with regulatory requirements.

How to show it: Demonstrate your critical thinking skills by detailing instances where your analysis led to significant compliance improvements or risk mitigation strategies. Include measurable outcomes to showcase effectiveness.

Leadership

Leadership skills are essential for guiding teams in compliance initiatives and fostering a culture of compliance within the organization.

How to show it: Provide examples of how you've led compliance projects or initiatives, emphasizing the results achieved and any feedback received from team members.

Interpersonal Skills

Interpersonal skills help Insurance Compliance Officers build strong relationships with colleagues and stakeholders,

How to List Insurance Compliance Officer Skills on Your Resume

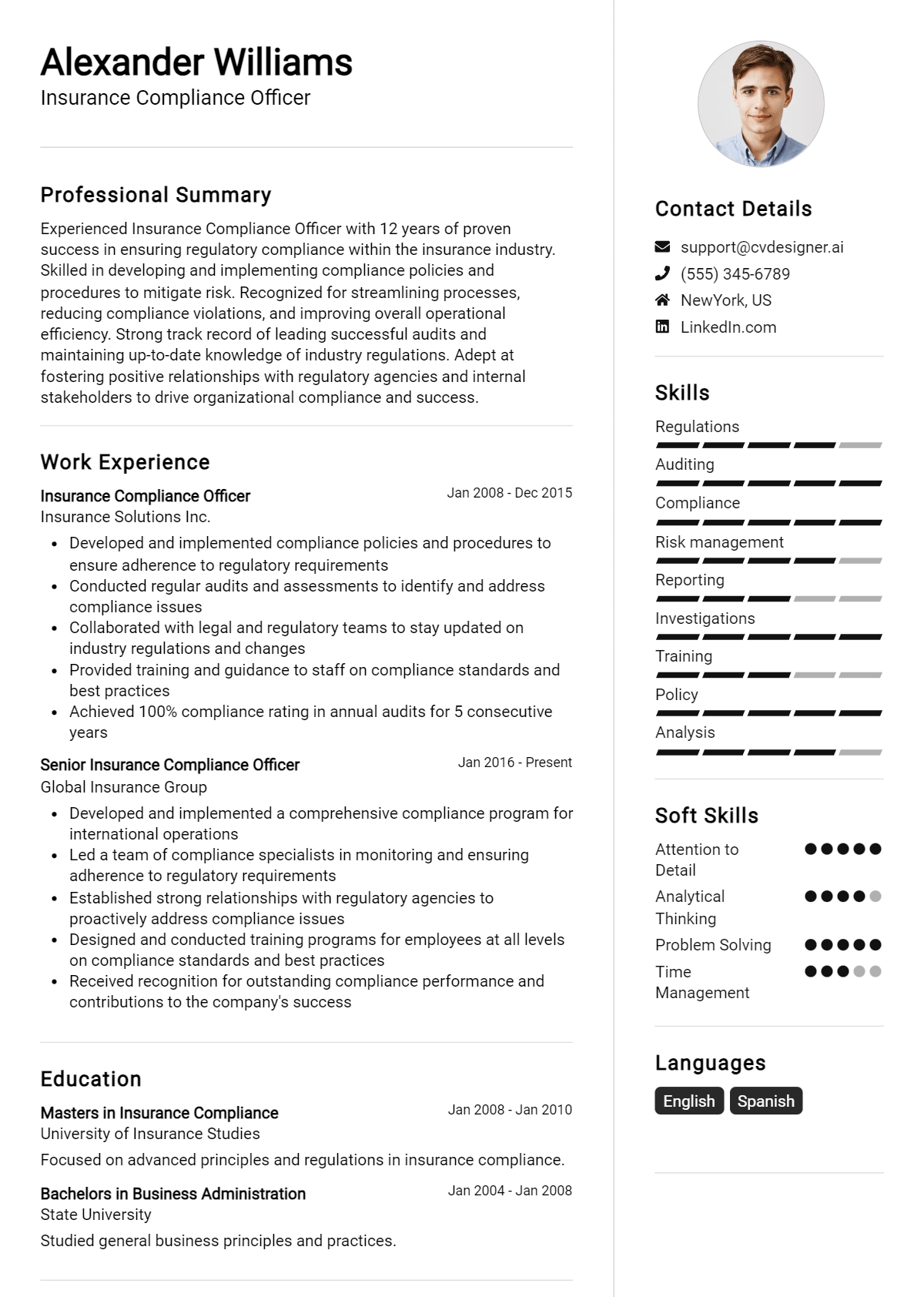

Effectively listing your skills on a resume is crucial for standing out to employers in a competitive job market. Highlighting your qualifications in three main sections—Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter—can significantly enhance your chances of landing an interview.

for Resume Summary

Showcasing your Insurance Compliance Officer skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications and suitability for the role.

Example

Dedicated Insurance Compliance Officer with strong regulatory knowledge and excellent analytical skills, seeking to enhance compliance programs by implementing risk assessment strategies and ensuring adherence to industry standards.

for Resume Work Experience

The work experience section offers the perfect opportunity to demonstrate how your Insurance Compliance Officer skills have been applied in real-world scenarios, showcasing your impact on previous employers.

Example

- Developed and implemented compliance training programs, enhancing employee awareness of regulatory requirements.

- Conducted audits to identify compliance gaps, resulting in a 20% reduction in violations.

- Collaborated with cross-functional teams to streamline processes, improving overall efficiency by 15%.

- Utilized data analysis to assess risk factors, leading to the development of targeted mitigation strategies.

for Resume Skills

The skills section can showcase both technical and transferable skills. A balanced mix of hard and soft skills strengthens your overall qualifications and appeal to potential employers.

Example

- Regulatory Compliance

- Risk Management

- Data Analysis

- Communication Skills

- Attention to Detail

- Problem-Solving

- Project Management

- Policy Development

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume, providing a more personal touch. Highlighting 2-3 key skills that align with the job description helps illustrate your fit for the role and how you have positively impacted previous positions.

Example

In my previous role, my strong regulatory knowledge enabled me to successfully implement compliance programs that reduced violations by 30%. Additionally, my analytical skills have allowed me to assess complex data efficiently, ensuring our operations align with industry standards.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job. For further details on how to enhance your resume, you can explore [skills](https://resumedesign.ai/resume-skills/), [Technical Skills](https://resumedesign.ai/technical-skills/), and [work experience](https://resumedesign.ai/resume-work-experience/).

The Importance of Insurance Compliance Officer Resume Skills

Highlighting relevant skills in an Insurance Compliance Officer resume is crucial for standing out in a competitive job market. A well-crafted skills section not only showcases a candidate's qualifications but also aligns their expertise with the specific requirements of the role. This strategic presentation helps recruiters quickly identify the candidate's fit for the position, increasing the chances of landing an interview.

- Clearly defined skills help demonstrate a candidate's understanding of regulatory frameworks, which is essential in ensuring that the insurance company adheres to all legal guidelines and industry standards.

- Showcasing analytical skills reflects a candidate's ability to interpret complex regulations and assess compliance risks, vital for maintaining the integrity of insurance operations.

- Effective communication skills are crucial for conveying compliance requirements to various stakeholders, ensuring that everyone is informed and aligned with the organization's policies.

- Detail-oriented individuals can spot discrepancies and potential compliance issues, which is a key skill for preventing financial and reputational damage to the insurance company.

- Highlighting project management skills shows an ability to oversee compliance initiatives effectively, ensuring that all aspects of regulatory adherence are executed timely and efficiently.

- Incorporating knowledge of industry-specific software and tools illustrates a candidate's readiness to utilize technology in streamlining compliance processes and reporting.

- Having a strong ethical foundation is fundamental for an Insurance Compliance Officer, and emphasizing this trait can attract employers looking for integrity and accountability in their teams.

- Focusing on adaptability and continuous learning demonstrates a candidate's commitment to staying updated with evolving regulations, which is crucial in the fast-paced insurance landscape.

For more insights and examples, check out these Resume Samples.

How To Improve Insurance Compliance Officer Resume Skills

In the ever-evolving landscape of the insurance industry, it is crucial for Insurance Compliance Officers to continuously enhance their skills. This not only ensures adherence to regulatory requirements but also contributes to the overall integrity and reputation of the organization. Improving your skill set can lead to greater career opportunities, increased job performance, and a deeper understanding of the complexities within the insurance sector.

- Stay Updated with Regulations: Regularly review changes in insurance laws and regulations to ensure compliance and adjust practices accordingly.

- Enhance Analytical Skills: Engage in training that sharpens your analytical abilities, enabling you to assess compliance risks more effectively.

- Develop Communication Skills: Practice clear and concise communication, both written and verbal, to effectively convey compliance policies to stakeholders.

- Attend Industry Workshops: Participate in seminars and workshops focused on compliance trends and best practices to expand your knowledge network.

- Gain Certifications: Pursue relevant certifications, such as Certified Compliance and Ethics Professional (CCEP) or others specific to the insurance industry, to enhance your credentials.

- Utilize Technology: Familiarize yourself with compliance software and tools that can streamline processes and improve efficiency in monitoring compliance.

- Network with Professionals: Join industry associations or online forums to connect with other compliance professionals and share insights and experiences.

Frequently Asked Questions

What are the key skills required for an Insurance Compliance Officer?

An Insurance Compliance Officer should possess a strong understanding of insurance regulations and laws, excellent analytical skills to assess compliance risks, and the ability to create and implement compliance policies. Additionally, strong communication skills are essential for effectively collaborating with various departments and training staff on compliance issues.

How important is attention to detail for an Insurance Compliance Officer?

Attention to detail is critical for an Insurance Compliance Officer as they must review policies, procedures, and documentation meticulously to identify potential compliance issues. This skill ensures that all regulatory requirements are met and helps prevent costly errors that could result in penalties or legal challenges for the organization.

What role does risk assessment play in an Insurance Compliance Officer's job?

Risk assessment is a fundamental aspect of an Insurance Compliance Officer's role, as it involves identifying, analyzing, and mitigating compliance risks within the organization. By conducting thorough risk assessments, the officer can prioritize compliance initiatives and allocate resources effectively to areas that pose the greatest risk to the company.

How do communication skills benefit an Insurance Compliance Officer?

Effective communication skills are vital for an Insurance Compliance Officer, as they need to articulate complex regulatory requirements clearly to various stakeholders, including upper management and employees. These skills also aid in fostering a culture of compliance within the organization and ensuring that everyone understands their responsibilities regarding compliance matters.

What is the significance of ongoing education for an Insurance Compliance Officer?

Ongoing education is significant for an Insurance Compliance Officer due to the ever-evolving nature of insurance regulations and compliance standards. Staying updated through continuous learning, attending workshops, and obtaining relevant certifications ensures that the officer maintains their expertise and can adapt to changes in the regulatory landscape effectively.

Conclusion

Incorporating Insurance Compliance Officer skills into your resume is crucial for demonstrating your expertise and commitment to the field. By showcasing relevant skills, candidates not only distinguish themselves from other applicants but also highlight their value to potential employers seeking qualified professionals to navigate complex regulatory environments. Remember, refining your skills and presenting them effectively can significantly enhance your job application and open doors to exciting career opportunities.

Take the next step in your career journey by exploring our resume templates, utilizing our resume builder, reviewing resume examples, and crafting the perfect cover letter templates. Empower yourself with the right tools and watch your career flourish!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.