Insurance Compliance Officer Core Responsibilities

An Insurance Compliance Officer plays a critical role in ensuring that insurance practices adhere to regulatory standards and internal policies. Key responsibilities include monitoring compliance, conducting audits, and providing training across departments. This role necessitates strong technical skills, operational awareness, and adept problem-solving capabilities to navigate complex regulations. Effective communication is essential, as the officer collaborates with legal, underwriting, and claims departments. A well-structured resume that highlights these qualifications can significantly contribute to the organization's overall compliance goals.

Common Responsibilities Listed on Insurance Compliance Officer Resume

- Monitor and ensure compliance with insurance regulations and policies.

- Conduct regular audits and assessments of practices and procedures.

- Develop and implement compliance training programs for staff.

- Review and update company policies to align with current regulations.

- Collaborate with legal teams to address compliance issues.

- Prepare detailed reports on compliance findings and recommendations.

- Investigate compliance-related complaints and issues.

- Maintain records of compliance activities and documentation.

- Stay updated on changes in insurance laws and regulations.

- Advise management on compliance strategies and risk management.

High-Level Resume Tips for Insurance Compliance Officer Professionals

In the competitive field of insurance compliance, a well-crafted resume is not just a document; it's your first chance to make a lasting impression on potential employers. As an Insurance Compliance Officer, your resume should effectively showcase not only your skills and qualifications but also your achievements in ensuring regulatory adherence and risk management. Given the critical role that compliance plays in the insurance industry, your resume must reflect your expertise and dedication to maintaining industry standards. This guide aims to equip you with practical and actionable tips specifically tailored for Insurance Compliance Officer professionals, ensuring that your resume stands out in a crowded job market.

Top Resume Tips for Insurance Compliance Officer Professionals

- Tailor your resume to the specific job description by incorporating keywords and phrases that match the requirements and responsibilities outlined in the posting.

- Highlight relevant experience in the insurance and compliance sectors, including any specific roles you've held that demonstrate your understanding of regulations and standards.

- Quantify your achievements by using metrics and data to illustrate your impact, such as the number of successful audits conducted or compliance issues resolved.

- Showcase industry-specific skills such as risk assessment, regulatory reporting, and knowledge of relevant laws and guidelines.

- Include certifications and training that are pertinent to compliance, such as a Certified Compliance and Ethics Professional (CCEP) designation.

- Utilize a clear and professional format that enhances readability, making it easy for hiring managers to quickly identify your key qualifications.

- Incorporate action verbs to convey your contributions dynamically, such as "developed," "implemented," and "monitored."

- Consider adding a summary statement at the top of your resume that succinctly encapsulates your expertise and career goals in the insurance compliance field.

- Keep your resume concise, ideally one page for less experienced candidates or two pages for those with extensive experience, focusing on the most relevant information.

- Proofread your resume for errors and ensure consistency in formatting, as attention to detail is paramount in the compliance profession.

By implementing these resume tips, you can significantly enhance your chances of standing out to potential employers in the Insurance Compliance Officer field. A polished, tailored resume will not only highlight your qualifications but also demonstrate your commitment to compliance and your ability to navigate the complexities of the insurance industry. With a strong first impression, you increase your opportunity to progress through the hiring process and secure a role that matches your expertise.

Why Resume Headlines & Titles are Important for Insurance Compliance Officer

In the competitive field of insurance compliance, having a well-crafted resume is essential to stand out among numerous applicants. One of the most critical elements of an effective resume is the headline or title, which serves as the first impression for hiring managers. A strong headline can immediately grab attention and encapsulate a candidate's key qualifications in a concise and impactful phrase. It should be directly relevant to the specific role of an Insurance Compliance Officer, summarizing essential skills and experiences that align with the job requirements. By doing so, candidates can effectively communicate their value proposition right from the start, increasing their chances of being noticed in a crowded job market.

Best Practices for Crafting Resume Headlines for Insurance Compliance Officer

- Keep it concise and to the point, ideally no more than 10-12 words.

- Make it role-specific by including the title "Insurance Compliance Officer."

- Highlight key qualifications or certifications relevant to compliance, such as "Certified Compliance Professional."

- Use action-oriented language to convey a proactive approach, like "Driving Compliance Excellence."

- Incorporate industry-specific keywords to pass through Applicant Tracking Systems.

- Showcase relevant achievements or experiences that set you apart, such as "10+ Years in Regulatory Compliance."

- Avoid generic phrases that do not provide specific information about your qualifications.

- Make sure the headline aligns with the rest of your resume content for consistency.

Example Resume Headlines for Insurance Compliance Officer

Strong Resume Headlines

"Dedicated Insurance Compliance Officer with 7 Years of Regulatory Experience"

“Proven Track Record in Driving Compliance Initiatives for Fortune 500 Companies”

“Certified Compliance Professional Specializing in Risk Management and Auditing”

“Results-Driven Insurance Compliance Officer with Expertise in Federal Regulations”

Weak Resume Headlines

“Insurance Professional Seeking Opportunities”

“Hardworking Individual Looking for Compliance Role”

The strong headlines are effective because they provide specific information about the candidate's experience, qualifications, and accomplishments in the field of insurance compliance. They are tailored to the role, which helps hiring managers quickly understand the candidate's fit for the position. In contrast, the weak headlines fail to impress because they are vague, overly generic, and do not convey any unique strengths or relevant skills. This lack of specificity can lead to candidates being overlooked in favor of those who present themselves more decisively and clearly.

Writing an Exceptional Insurance Compliance Officer Resume Summary

The resume summary is a critical component for an Insurance Compliance Officer, serving as the first impression that can quickly capture the attention of hiring managers. A well-crafted summary effectively showcases key skills, relevant experience, and significant accomplishments that align with the specific demands of the role. In a competitive job market, a concise and impactful summary can differentiate a candidate by highlighting their qualifications and expertise in insurance compliance, helping to set the tone for the rest of the resume and increasing the chances of securing an interview.

Best Practices for Writing a Insurance Compliance Officer Resume Summary

- Quantify achievements to provide concrete evidence of your impact, such as reduced compliance violations by a specific percentage.

- Focus on relevant skills such as regulatory knowledge, risk assessment, and policy development.

- Tailor the summary to the specific job description, using keywords and phrases that reflect the requirements.

- Keep it concise, ideally between 3-5 sentences, ensuring every word adds value.

- Highlight specific accomplishments that demonstrate your effectiveness and contributions to previous employers.

- Use action verbs to convey confidence and proactivity, such as "developed," "implemented," or "managed."

- Showcase your understanding of industry regulations and compliance frameworks that are pertinent to the role.

- Maintain a professional tone while conveying enthusiasm for compliance and regulatory excellence.

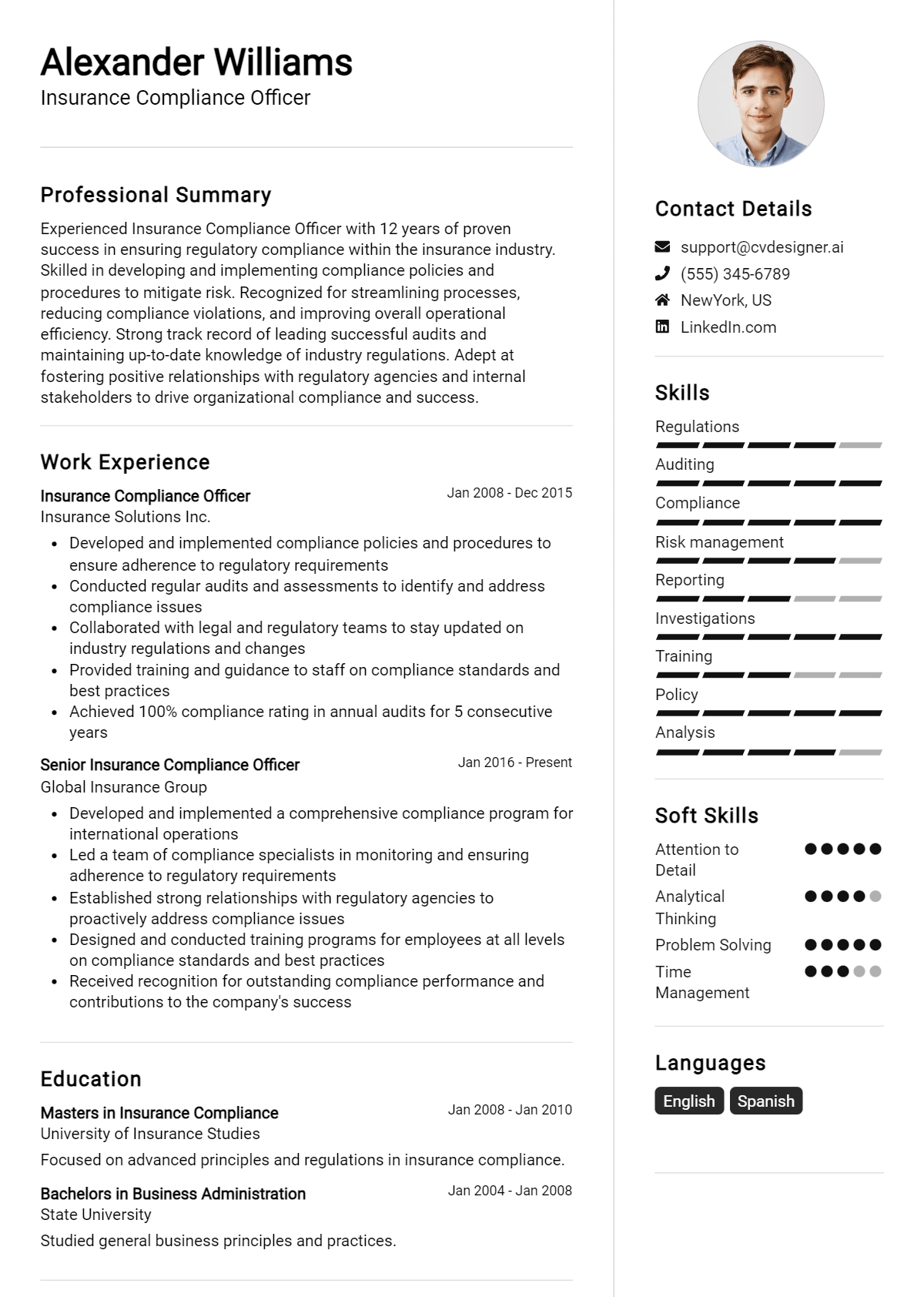

Example Insurance Compliance Officer Resume Summaries

Strong Resume Summaries

Results-driven Insurance Compliance Officer with over 5 years of experience in regulatory analysis and risk management. Successfully reduced compliance violations by 30% through the implementation of robust training programs and streamlined reporting processes.

Detail-oriented compliance professional with expertise in federal and state insurance regulations. Played a key role in achieving a 95% compliance audit score by developing comprehensive policy frameworks and conducting thorough internal audits.

Dynamic Insurance Compliance Officer with a proven track record of enhancing compliance programs across multiple states. Spearheaded a cross-departmental initiative that improved reporting accuracy by 40%, significantly minimizing regulatory fines.

Weak Resume Summaries

Experienced compliance officer looking for a new opportunity in insurance. I have worked in compliance for several years.

Dedicated professional with knowledge of regulations and policies. I am interested in a compliance role in the insurance industry.

The strong resume summaries stand out because they include quantifiable results, specific skills, and relevant experiences tailored to the role of an Insurance Compliance Officer. They clearly demonstrate the candidates' capabilities and achievements. In contrast, the weak summaries are vague, lack measurable outcomes, and fail to convey the candidates' unique qualifications or enthusiasm for the position, making them less compelling to hiring managers.

Work Experience Section for Insurance Compliance Officer Resume

The work experience section of an Insurance Compliance Officer resume is a critical component that illustrates a candidate's professional journey and capabilities in the insurance sector. This section not only highlights technical skills and expertise in regulatory compliance but also showcases the ability to manage diverse teams and ensure the delivery of high-quality products and services. By quantifying achievements and aligning experiences with industry standards, candidates can effectively demonstrate their value to potential employers, making this section an essential focal point of the resume.

Best Practices for Insurance Compliance Officer Work Experience

- Use specific metrics to quantify achievements, such as percentage improvements in compliance rates or reductions in audit discrepancies.

- Highlight relevant technical skills, including familiarity with regulatory frameworks and compliance software.

- Emphasize leadership and team management experience, demonstrating the ability to guide teams through compliance processes.

- Showcase successful collaborations with cross-functional teams to illustrate the ability to work effectively across departments.

- Tailor your work experience to align with the specific requirements of the insurance industry.

- Include any relevant certifications or training that enhance your qualifications in compliance management.

- Use action-oriented language to convey initiative and impact in previous roles.

- Structure your experience in reverse chronological order to highlight your most recent and relevant positions.

Example Work Experiences for Insurance Compliance Officer

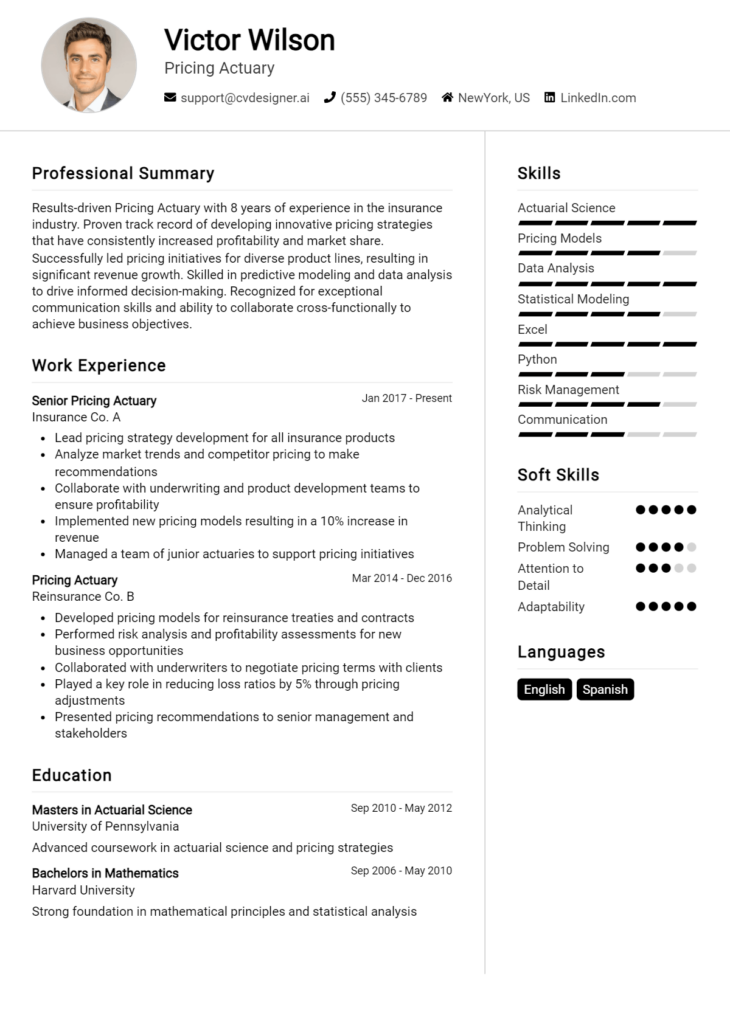

Strong Experiences

- Developed and implemented a new compliance training program that increased employee adherence to regulatory standards by 30% within six months.

- Led a team of five compliance analysts in conducting risk assessments, resulting in a 40% reduction in compliance-related penalties over two years.

- Collaborated with the IT department to enhance compliance tracking systems, which improved reporting accuracy by 25% and decreased response times to regulatory inquiries.

- Managed the successful completion of 10+ audits with a 100% compliance rate, directly contributing to the company's reputation for regulatory excellence.

Weak Experiences

- Responsible for compliance tasks in the insurance department.

- Worked on various projects related to insurance regulations.

- Assisted with compliance audits occasionally.

- Participated in meetings to discuss compliance issues.

The examples of strong experiences are considered effective because they provide specific, quantifiable outcomes and demonstrate leadership and collaborative efforts in compliance management. In contrast, the weak experiences lack detail, specificity, and measurable results, making it difficult for potential employers to understand the candidate's true contributions and impact in their previous roles.

Education and Certifications Section for Insurance Compliance Officer Resume

The education and certifications section of an Insurance Compliance Officer resume plays a crucial role in establishing a candidate's qualifications and credibility in the field. This section not only highlights the academic background and specialized training of the applicant but also showcases their commitment to continuous learning and professional development. By providing relevant coursework, industry-recognized certifications, and any specialized training, candidates can significantly enhance their appeal to potential employers, demonstrating their alignment with job requirements and current industry standards.

Best Practices for Insurance Compliance Officer Education and Certifications

- Prioritize relevant degrees, such as a Bachelor's or Master's in Finance, Business Administration, or Risk Management.

- Include certifications from recognized industry bodies, such as the Certified Insurance Counselor (CIC) or Chartered Property Casualty Underwriter (CPCU).

- Highlight any specialized training in compliance regulations, risk assessment, or insurance law.

- Detail any relevant coursework that specifically pertains to insurance compliance and regulatory standards.

- Keep the information concise and focused on qualifications that directly relate to the role of an Insurance Compliance Officer.

- Update the section regularly to reflect any new certifications or courses completed.

- Consider including professional memberships in relevant organizations, which can further demonstrate commitment to the field.

- Use clear formatting to make this section easily scannable for hiring managers.

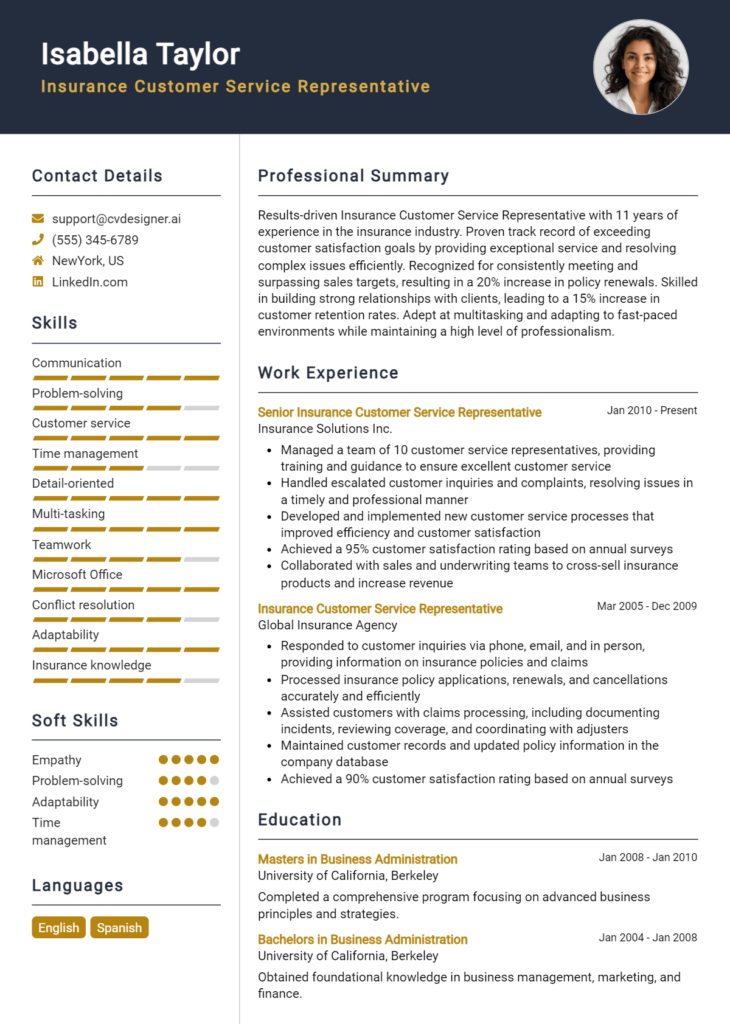

Example Education and Certifications for Insurance Compliance Officer

Strong Examples

- Bachelor of Science in Risk Management, University of XYZ, 2020

- Certified Insurance Counselor (CIC), National Alliance for Insurance Education and Research, 2021

- Coursework in Insurance Regulation and Compliance, University of XYZ, 2019

- Master of Business Administration (MBA) with a focus on Compliance, ABC University, 2022

Weak Examples

- Bachelor of Arts in History, University of XYZ, 2010

- Certification in Basic Computer Skills, Online Learning Platform, 2020

- High School Diploma, ABC High School, 2005

- Outdated certification in General Insurance, 2015

The examples provided are considered strong because they directly align with the qualifications and skills necessary for the role of an Insurance Compliance Officer, showcasing relevant degrees and recognized certifications. In contrast, the weak examples highlight irrelevant educational backgrounds or outdated credentials that do not provide value in the context of this specialized field, making them less effective in demonstrating a candidate's suitability for the position.

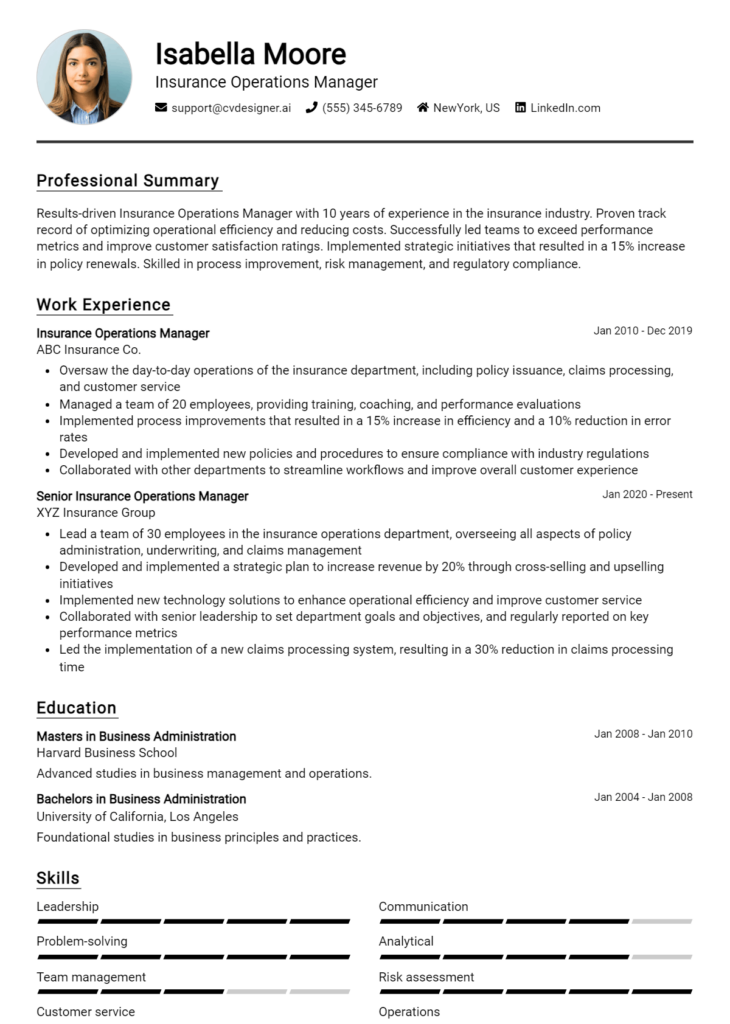

Top Skills & Keywords for Insurance Compliance Officer Resume

As an Insurance Compliance Officer, possessing the right skills is crucial for ensuring that an organization adheres to legal regulations and internal policies. A compelling resume should effectively highlight both hard and soft skills, as they demonstrate your ability to navigate complex compliance landscapes while also collaborating with various stakeholders. By showcasing these skills, you can significantly enhance your employability and show potential employers that you are well-equipped to manage compliance risks and maintain industry standards. For more insights on how to effectively present your skills, check out our skills guide.

Top Hard & Soft Skills for Insurance Compliance Officer

Soft Skills

- Attention to Detail

- Analytical Thinking

- Communication Skills

- Problem Solving

- Time Management

- Team Collaboration

- Adaptability

- Ethical Judgment

- Conflict Resolution

- Interpersonal Skills

Hard Skills

- Knowledge of Insurance Regulations

- Risk Assessment Techniques

- Data Analysis

- Compliance Auditing

- Legal Research

- Policy Development

- Training and Development

- Report Writing

- Proficiency in Compliance Software

- Financial Acumen

- Project Management

- Regulatory Reporting

- Familiarity with ISO Standards

- Microsoft Office Suite Proficiency

- Knowledge of Anti-Money Laundering (AML) Regulations

- Understanding of Privacy Laws (e.g., GDPR)

These skills play a vital role in ensuring that you can effectively contribute to your organization’s compliance efforts. Additionally, highlighting relevant work experience will further bolster your resume, showcasing your practical application of these skills in real-world scenarios.

Stand Out with a Winning Insurance Compliance Officer Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Insurance Compliance Officer position at [Company Name] as advertised on [where you found the job listing]. With a solid background in insurance regulations and a proven track record in compliance management, I am excited about the opportunity to contribute to your team's efforts in ensuring adherence to industry standards and enhancing operational efficiency.

In my previous role at [Previous Company Name], I successfully developed and implemented compliance programs that not only aligned with state and federal regulations but also fostered a culture of transparency and accountability within the organization. My keen eye for detail allowed me to identify potential compliance risks and proactively address them, resulting in a 30% reduction in compliance-related incidents over a two-year period. I also led training sessions for staff on regulatory updates and best practices, ensuring that all team members were well-informed and equipped to uphold compliance standards.

I am particularly drawn to [Company Name] because of its commitment to ethical practices and customer-centric service. I believe that my proactive approach to compliance and my ability to communicate complex regulations in an understandable manner would make me a valuable asset to your team. I am eager to bring my expertise in regulatory analysis and risk management to [Company Name] and help safeguard the organization against compliance issues while supporting its mission and values.

Thank you for considering my application. I look forward to the opportunity to discuss how my experience and skills align with the needs of your team. Please feel free to contact me at [your phone number] or [your email address] to schedule a conversation.

Sincerely,

[Your Name]

Common Mistakes to Avoid in a Insurance Compliance Officer Resume

When crafting a resume for the position of an Insurance Compliance Officer, it’s crucial to avoid common pitfalls that can undermine your chances of landing an interview. A well-structured and error-free resume not only showcases your qualifications but also reflects your attention to detail—an essential trait for compliance roles. Below are several common mistakes that candidates often make, along with explanations to help you steer clear of them.

Using Generic Language: Avoid vague terms that fail to convey your specific skills and accomplishments. Tailor your resume to highlight relevant experience and expertise in insurance compliance.

Neglecting Keywords: Many employers use Applicant Tracking Systems (ATS) to filter resumes. Failing to incorporate industry-specific keywords can result in your resume being overlooked.

Overloading with Jargon: While it's important to demonstrate familiarity with compliance terminology, overusing jargon can confuse hiring managers. Strive for clarity and balance in your language.

Ignoring Compliance Regulations: Highlight your knowledge of key regulations (like HIPAA, FCRA, etc.) relevant to the insurance industry. Omitting this information can signal a lack of expertise.

Lack of Quantifiable Achievements: Instead of listing duties, focus on quantifiable achievements that demonstrate your impact, such as reducing compliance risks or improving processes.

Formatting Issues: A cluttered or inconsistent format can detract from your professionalism. Use clear headings, bullet points, and a readable font to enhance readability.

Inconsistent Employment History: Gaps in employment or frequent job changes can raise red flags. If you have gaps, briefly explain them or emphasize relevant volunteer work or certifications.

Failing to Customize for Each Application: Sending out a one-size-fits-all resume can diminish your chances. Always customize your resume to align with the specific job description and requirements.

Conclusion

As an Insurance Compliance Officer, your role is critical in ensuring that insurance companies adhere to industry regulations and standards. Throughout this article, we have highlighted the essential skills and qualifications necessary for this position, including a thorough understanding of insurance laws, excellent analytical skills, and strong attention to detail. We also discussed the importance of communication skills, as you'll often need to collaborate with various stakeholders and convey complex regulatory information clearly.

Moreover, we covered the significance of staying updated on changes in legislation and compliance requirements, as this knowledge is vital for protecting your organization from legal risks. Continuous professional development and obtaining relevant certifications can further enhance your credibility and effectiveness in this role.

In conclusion, if you're looking to advance your career as an Insurance Compliance Officer or are preparing to enter this field, it's crucial to have a polished resume that showcases your qualifications and experience. We encourage you to review your Insurance Compliance Officer resume to ensure it reflects your skills and achievements accurately.

To assist you in this process, consider utilizing the following resources: explore resume templates to find a professional layout, use the resume builder for ease of customization, browse through resume examples for inspiration, and ensure your application stands out with our cover letter templates. Take action now and enhance your resume to align with your career aspirations in insurance compliance!