Top 27 High Frequency Trader Resume Skills with Examples for 2025

As a high frequency trader, possessing a unique set of skills is crucial for navigating the fast-paced and competitive landscape of financial markets. This role demands not only a strong analytical mindset but also proficiency in advanced technology and quantitative methods. Below, we outline the essential skills that will enhance your resume and help you stand out in this dynamic field.

Best High Frequency Trader Technical Skills

In the fast-paced world of high-frequency trading (HFT), possessing strong technical skills is crucial for success. These skills enable traders to develop algorithms, analyze vast datasets, and execute trades at lightning speed. Highlighting relevant technical skills on your resume not only demonstrates your expertise but also showcases your ability to thrive in a competitive trading environment.

Algorithm Development

Creating and optimizing trading algorithms is essential for HFT. This skill involves programming and modeling to develop strategies that capitalize on market inefficiencies.

How to show it: Highlight specific algorithms you’ve developed, their performance metrics, and the strategies implemented. Use quantifiable results to demonstrate their impact on trading outcomes.

Statistical Analysis

Statistical analysis is vital for evaluating trading strategies and market trends. This skill involves using statistical tools to interpret data and make informed trading decisions.

How to show it: Include examples of statistical methods you’ve applied, such as regression analysis or time-series forecasting, along with the results achieved from your analyses.

Programming Languages

Proficiency in programming languages such as Python, C++, and R is fundamental for developing trading systems and algorithms efficiently.

How to show it: List the programming languages you are proficient in and describe projects or systems you’ve built using those languages, focusing on their relevance to HFT.

Data Structures and Algorithms

A solid understanding of data structures and algorithms is crucial for optimizing the performance of trading systems and minimizing latency.

How to show it: Discuss specific data structures you’ve implemented and the algorithms you’ve optimized, along with the resulting performance improvements.

Machine Learning

Machine learning techniques can enhance trading strategies by identifying patterns and predicting market movements based on historical data.

How to show it: Detail any machine learning models you have developed, including their accuracy and how they influenced trading decisions or profitability.

Low-Latency Networking

Understanding low-latency networking is critical for HFT, as it directly impacts the speed at which trades are executed and information is processed.

How to show it: Describe your experience optimizing network configurations or protocols that reduced latency, including any measurable improvements in trade execution times.

Financial Modeling

Financial modeling allows traders to simulate different trading scenarios and assess their potential impact on trading strategies.

How to show it: Provide examples of financial models you’ve created, emphasizing their accuracy and how they informed trading strategies or risk assessments.

Market Microstructure Knowledge

A deep understanding of market microstructure helps traders navigate the complexities of market behavior and order execution.

How to show it: Illustrate your knowledge of market microstructure by discussing how it influenced your trading strategies and the outcomes achieved.

Risk Management

Effective risk management techniques are essential to minimize potential losses and protect capital in high-frequency trading environments.

How to show it: Detail specific risk management strategies you’ve implemented, along with the quantifiable results or improvements in risk-adjusted returns.

Database Management

Proficiency in database management is important for handling large datasets efficiently and ensuring quick access to critical trading information.

How to show it: Discuss your experience with database systems, including any improvements in data retrieval times and how that contributed to trading efficiency.

API Integration

Integrating APIs allows traders to connect their trading systems with external platforms for real-time data and trading execution.

How to show it: Provide examples of successful API integrations you’ve completed and how they enhanced trading capabilities or data access.

Best High Frequency Trader Soft Skills

In the fast-paced world of high-frequency trading, technical skills are crucial, but soft skills play an equally significant role in achieving success. These interpersonal and cognitive skills help traders navigate complex market dynamics, collaborate with teams, and make swift, informed decisions under pressure. Highlighting these soft skills on your resume can set you apart from other candidates and showcase your holistic capabilities.

Analytical Thinking

Analytical thinking allows high-frequency traders to dissect large sets of data and derive actionable insights, essential for making rapid trading decisions.

How to show it: Demonstrate your analytical prowess by providing examples of data-driven decisions that led to profitable trades. Use metrics to quantify the impact of your analysis on overall performance.

Adaptability

In high-frequency trading, market conditions can change in an instant. Adaptability ensures that traders can pivot strategies quickly to capitalize on new opportunities.

How to show it: Share specific instances where you successfully adapted to changing market conditions. Highlight your ability to modify strategies and the positive outcomes that resulted.

Attention to Detail

Attention to detail is critical for high-frequency traders, as even the smallest oversight can lead to significant financial losses.

How to show it: Include examples of how your meticulousness helped identify discrepancies or led to successful trades. Highlight any processes you implemented to enhance accuracy.

Communication

Effective communication is vital for collaborating with team members and stakeholders, ensuring everyone is aligned on strategies and objectives.

How to show it: Illustrate your communication skills by detailing presentations or reports you created that successfully conveyed complex information. Mention feedback received from peers or supervisors.

Learn more about Communication.

Problem-solving

High-frequency traders frequently encounter unexpected challenges. Strong problem-solving skills enable them to devise effective solutions quickly.

How to show it: Provide examples of challenges faced in trading and the innovative solutions you implemented. Quantify the results of these solutions to showcase your impact.

Discover more about Problem-solving.

Time Management

Time management is essential in high-frequency trading, where decisions need to be made in fractions of a second. Efficiently managing time ensures that traders can execute trades promptly.

How to show it: Highlight your ability to prioritize tasks and manage multiple responsibilities under tight deadlines. Use specific examples where effective time management led to successful trading outcomes.

Read more about Time Management.

Teamwork

Collaboration with other traders, analysts, and IT personnel is often necessary to develop successful trading strategies and resolve issues effectively.

How to show it: Illustrate your ability to work within a team by describing collaborative projects or initiatives. Share the results achieved through teamwork and any leadership roles you held.

Explore more on Teamwork.

Resilience

Resilience allows high-frequency traders to cope with the high-stress environment and recover quickly from setbacks or losses.

How to show it: Share stories of how you bounced back from adverse trading scenarios and the lessons learned. Quantify how your resilience positively affected your overall performance.

Strategic Thinking

Strategic thinking enables high-frequency traders to formulate long-term plans and anticipate market trends, essential for developing competitive advantages.

How to show it: Provide examples of strategic initiatives you've led or contributed to that resulted in improved trading performance. Highlight any metrics that showcase the success of these strategies.

Initiative

Taking the initiative can lead to discovering new trading opportunities and optimizing existing processes within the trading environment.

How to show it: Detail instances where you proactively identified opportunities or improved processes. Quantify the impact of your initiatives on trading performance or efficiency.

Emotional Intelligence

Emotional intelligence helps traders understand their own emotions and those of others, enhancing decision-making and collaboration in a high-stress environment.</

How to List High Frequency Trader Skills on Your Resume

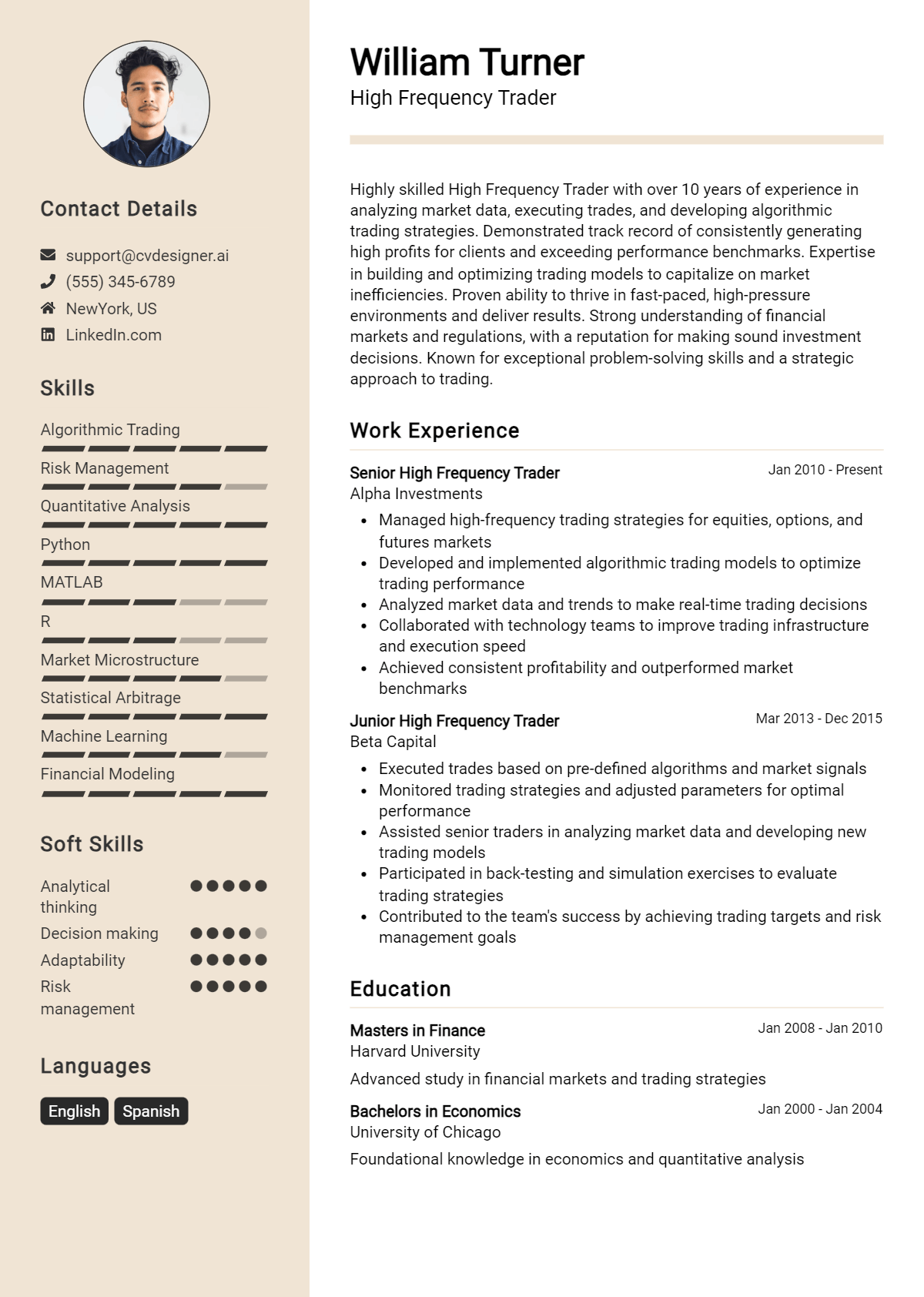

Effectively listing your skills on a resume is crucial for standing out to potential employers. Highlighting your abilities can create a strong first impression and showcase your qualifications. You can emphasize your skills in three main areas: the Resume Summary, Resume Work Experience, and Resume Skills Section, as well as in your Cover Letter.

for Resume Summary

Showcasing your High Frequency Trader skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications. This sets the tone for the rest of your resume.

Example

Dynamic High Frequency Trader with expertise in algorithm development and market analysis. Proven track record in risk management and trade execution, delivering consistent results in high-pressure environments.

for Resume Work Experience

The work experience section offers the perfect opportunity to demonstrate how your High Frequency Trader skills have been applied in real-world scenarios. Use this space to provide actionable examples that match the specific skills mentioned in job listings.

Example

- Implemented advanced trading algorithms that increased trading efficiency by 30%.

- Conducted thorough market research to identify profitable trading opportunities.

- Collaborated with cross-functional teams to enhance risk management strategies.

- Utilized data analysis tools to evaluate performance metrics and optimize trading strategies.

for Resume Skills

The skills section can showcase both technical and transferable skills. A balanced mix of hard and soft skills will strengthen your overall qualifications and appeal to hiring managers.

Example

- Algorithm Development

- Statistical Analysis

- Market Research

- Risk Management

- Data Visualization

- Critical Thinking

- Effective Communication

- Team Collaboration

for Cover Letter

A cover letter allows you to expand on the skills mentioned in your resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate how those skills have positively impacted your previous roles.

Example

In my previous role, my expertise in algorithm development led to a 25% increase in trading efficiency, while my strong risk management skills ensured compliance with industry regulations. I thrive in fast-paced environments, consistently achieving targets through effective data analysis and collaboration with my team.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job. For more information, check out our sections on skills, Technical Skills, and work experience.

The Importance of High Frequency Trader Resume Skills

In the competitive field of high-frequency trading, showcasing relevant skills on a resume is crucial for standing out to recruiters and potential employers. A well-crafted skills section not only demonstrates a candidate's qualifications but also aligns them with the specific demands of the job. By effectively highlighting their expertise, candidates can increase their chances of securing interviews and advancing in the selection process.

- High-frequency trading relies heavily on technical skills, such as proficiency in programming languages like Python, C++, or Java. Demonstrating these skills shows that a candidate can develop algorithms that effectively execute trades in microseconds.

- Quantitative analysis is at the heart of successful trading strategies. Candidates should highlight their ability to analyze large datasets, apply statistical methods, and derive insights that can lead to profitable trades.

- Familiarity with trading platforms and tools is essential in this role. Listing experience with platforms like Bloomberg, MetaTrader, or proprietary trading software showcases a candidate’s readiness to hit the ground running.

- Attention to detail is critical in high-frequency trading, where even the slightest error can lead to significant financial losses. Highlighting this skill can reassure employers of a candidate's meticulous approach to trading.

- Strong problem-solving skills are necessary for navigating the fast-paced trading environment. Candidates should illustrate their ability to think critically and adapt quickly to changing market conditions.

- Effective communication skills are important, as traders often need to collaborate with other team members or departments. Emphasizing this skill can indicate a candidate's ability to work well in a team-oriented setting.

- Risk management is a key component of high-frequency trading strategies. Candidates should highlight their understanding of risk assessment and mitigation techniques to demonstrate their capability in minimizing losses.

- Knowledge of market microstructure and trading strategies is essential for high-frequency traders. By showcasing this knowledge, candidates can illustrate their strategic mindset and ability to capitalize on market inefficiencies.

For more insights and examples, check out these Resume Samples.

How To Improve High Frequency Trader Resume Skills

In the fast-paced world of high-frequency trading (HFT), the ability to continuously improve your skills is crucial for staying competitive and maximizing profits. As technology evolves and markets become more complex, traders must adapt and enhance their expertise to succeed. A well-crafted resume that reflects these ongoing improvements can significantly enhance your job prospects and career growth in this demanding field.

- Stay updated with market trends and news by subscribing to financial journals and news platforms.

- Enhance your programming skills by learning languages commonly used in HFT, such as C++, Python, or R.

- Participate in trading competitions or simulations to practice strategies and refine your decision-making under pressure.

- Network with other traders and professionals in the industry to exchange insights and best practices.

- Take advanced courses or certifications in quantitative finance, algorithmic trading, or data analysis.

- Utilize backtesting tools to analyze past trading strategies and improve future performance.

- Develop a solid understanding of machine learning techniques to leverage data for predictive modeling in trading.

Frequently Asked Questions

What key skills should be highlighted on a High Frequency Trader resume?

When crafting a resume for a High Frequency Trader position, it is essential to highlight skills such as quantitative analysis, algorithmic trading proficiency, and proficiency in programming languages like Python, C++, or Java. Additionally, showcasing strong statistical and mathematical skills, familiarity with trading platforms, and experience with data analysis tools can significantly enhance your resume. Emphasizing problem-solving abilities and a deep understanding of market dynamics will also make your application stand out.

How important is programming knowledge for a High Frequency Trader?

Programming knowledge is critically important for a High Frequency Trader, as it enables the development and implementation of trading algorithms that operate at high speeds. Proficiency in languages like C++ or Python allows traders to analyze vast amounts of data, optimize trading strategies, and automate trading processes. Being able to code effectively not only improves the efficiency of trading operations but also provides a competitive edge in a fast-paced trading environment.

What role does quantitative analysis play in high-frequency trading?

Quantitative analysis is fundamental in high-frequency trading, as it involves using mathematical models and statistical techniques to identify trading opportunities and assess risks. Traders employ quantitative analysis to interpret large datasets, evaluate market trends, and develop algorithms that can execute trades based on real-time data. A strong background in quantitative methods is crucial for making informed trading decisions and maximizing profitability in a highly competitive market.

Are there specific certifications that can enhance a High Frequency Trader resume?

Yes, obtaining relevant certifications can significantly enhance a High Frequency Trader's resume. Certifications such as the Chartered Financial Analyst (CFA), Financial Risk Manager (FRM), or certifications in quantitative finance can demonstrate a trader's expertise and commitment to the field. Additionally, completing courses in algorithmic trading or data science can showcase specialized knowledge that may attract potential employers in the competitive trading industry.

How can networking benefit a High Frequency Trader?

Networking can provide substantial benefits to a High Frequency Trader by helping to build valuable connections within the industry. Engaging with professionals through conferences, seminars, or online forums can lead to job opportunities, mentorship, and insights into market trends and trading strategies. Networking can also facilitate collaborations and partnerships that enhance trading performance and provide access to proprietary trading tools and technologies.

Conclusion

Including High Frequency Trader skills in your resume is crucial for standing out in a competitive job market. By showcasing your relevant skills, you not only highlight your expertise but also demonstrate the value you can bring to potential employers. A well-crafted resume that emphasizes your trading acumen and technical proficiency can significantly enhance your chances of landing your desired position.

As you refine your skills and tailor your resume, remember that each improvement brings you one step closer to your career goals. Embrace the journey of self-improvement and make the most of your job application efforts. For additional resources, consider exploring our resume templates, resume builder, resume examples, and cover letter templates to help you stand out even more.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.