High-Frequency Trader Core Responsibilities

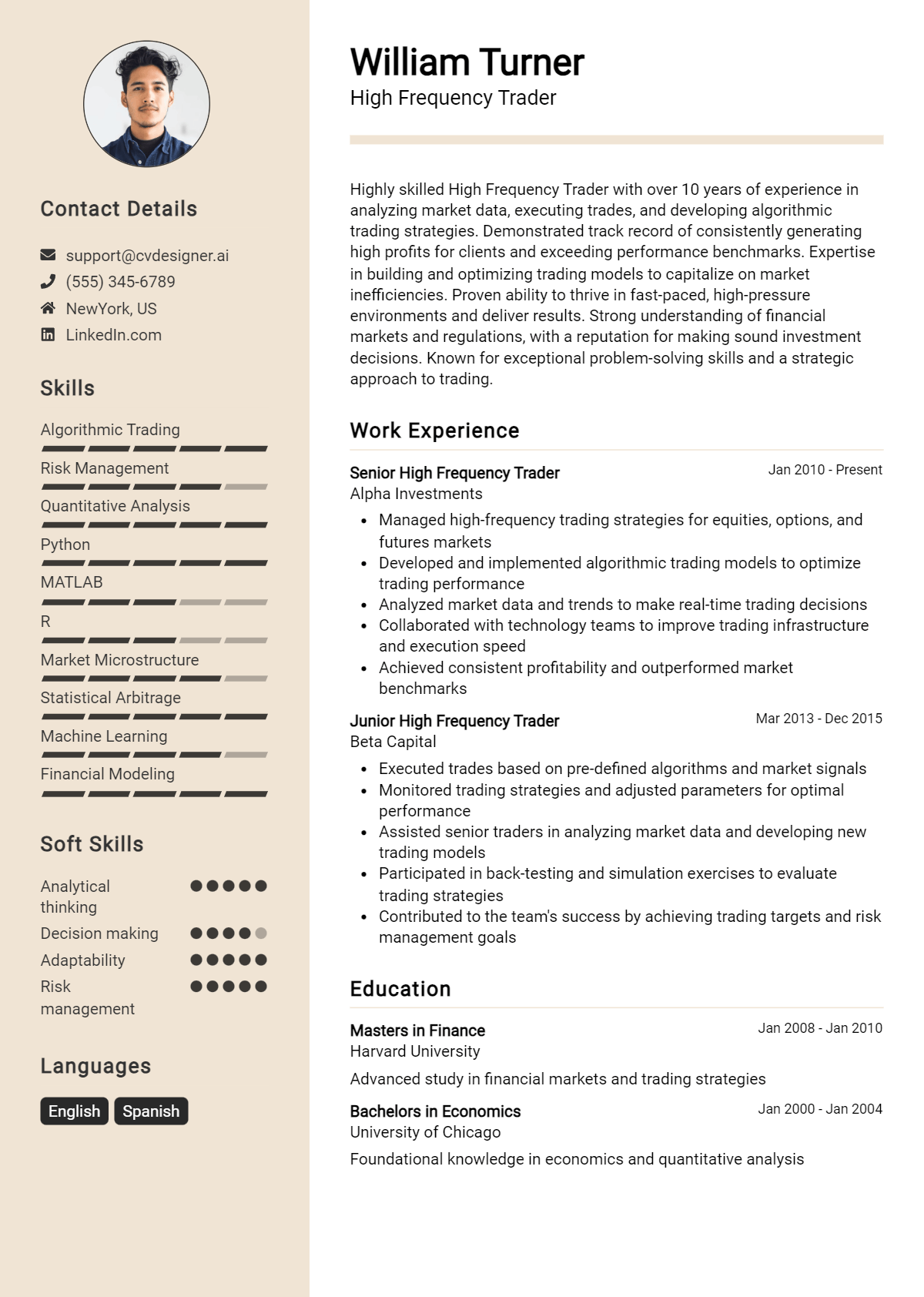

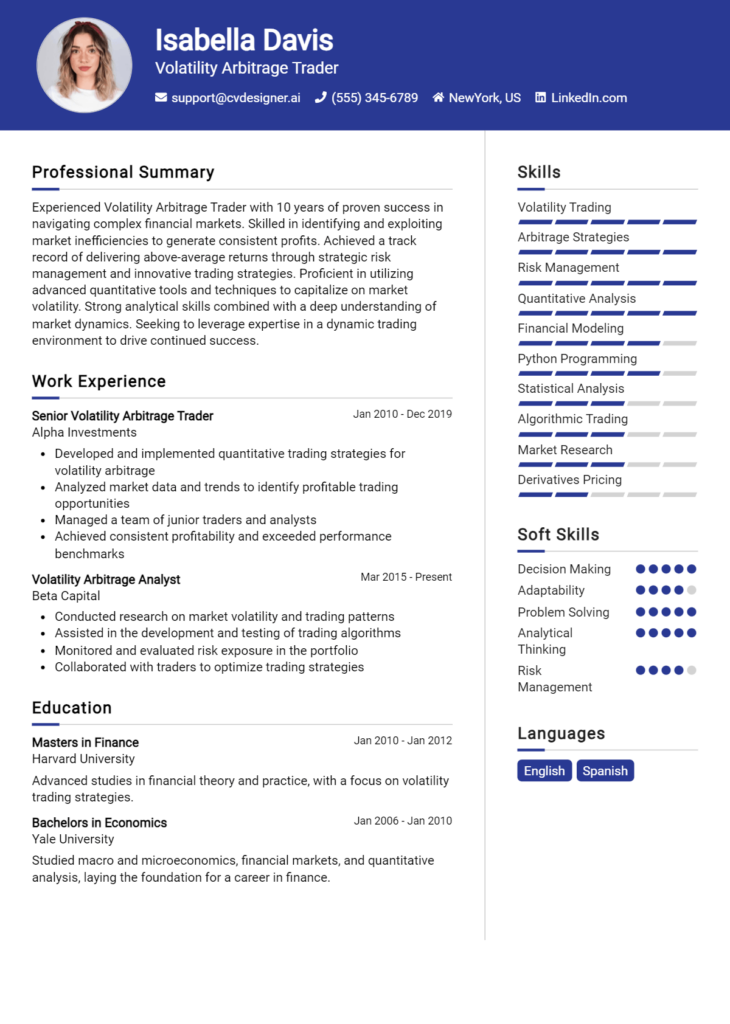

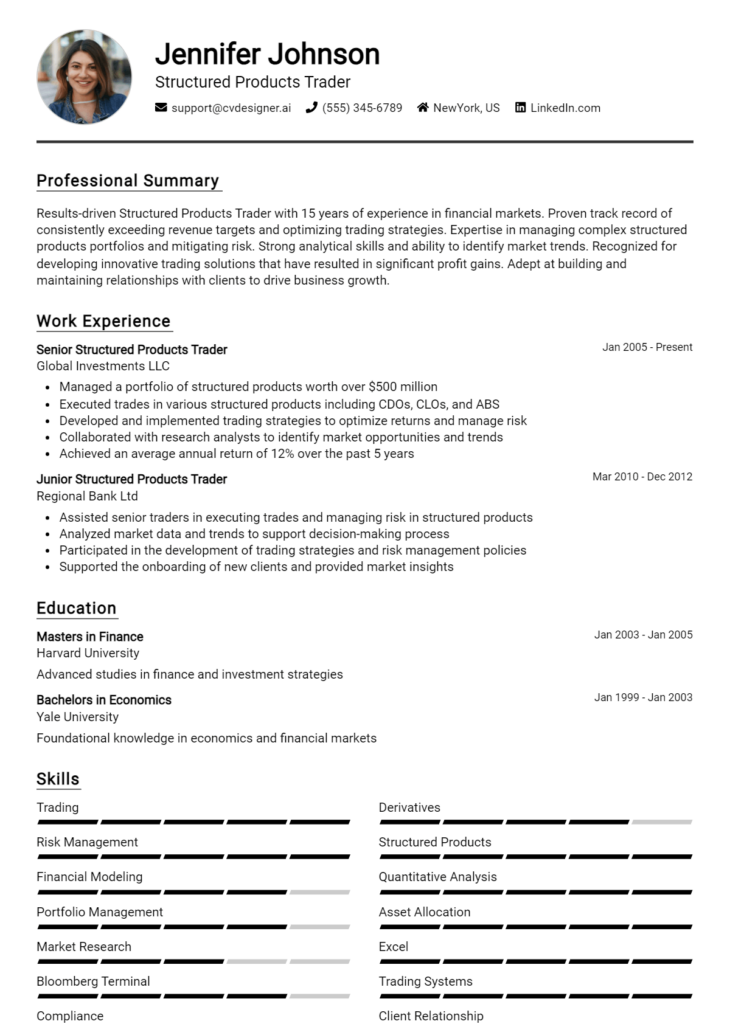

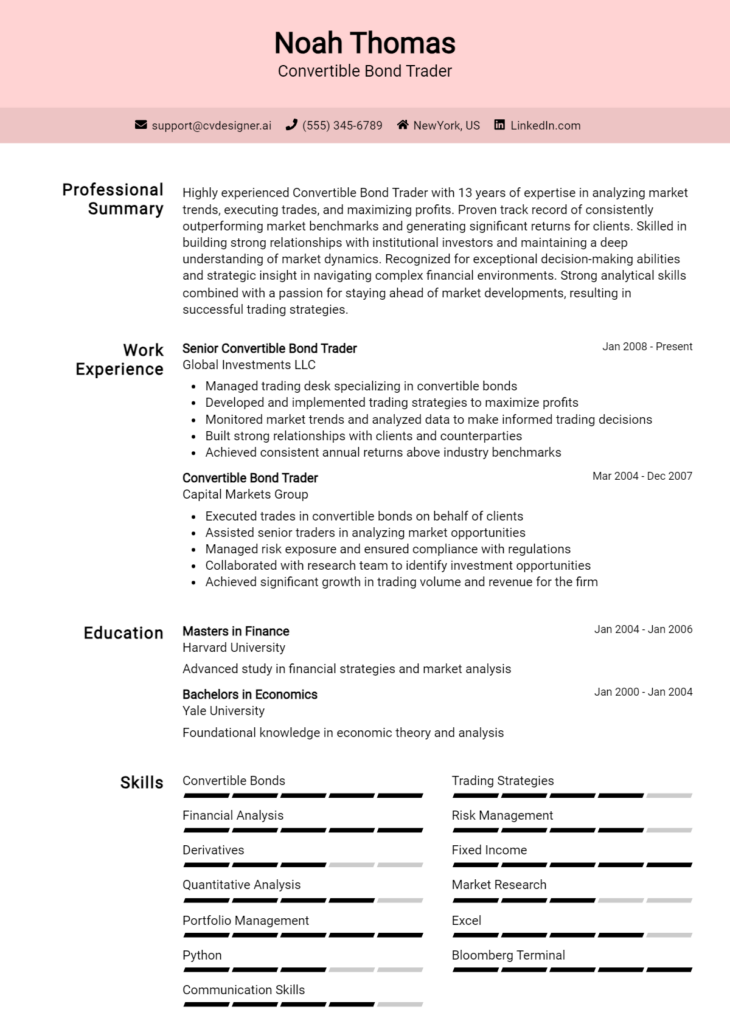

A High-Frequency Trader (HFT) is responsible for executing a large number of orders at extremely high speeds, leveraging complex algorithms and quantitative analysis. This role requires a unique blend of technical expertise in programming and data analysis, alongside strong operational skills for risk management and regulatory compliance. HFT professionals work closely with IT, risk management, and trading desks, ensuring seamless communication across departments. Problem-solving abilities are crucial in adapting to market changes, ultimately contributing to the organization's profitability. A well-structured resume highlighting these skills can effectively showcase a candidate's qualifications in this competitive field.

Common Responsibilities Listed on High-Frequency Trader Resume

- Develop and implement high-frequency trading strategies

- Analyze market data to identify trading opportunities

- Utilize statistical models to predict price movements

- Monitor and optimize algorithm performance in real-time

- Conduct risk assessments and manage exposure

- Collaborate with software developers to enhance trading systems

- Ensure compliance with industry regulations and standards

- Perform backtesting of trading strategies on historical data

- Maintain and document trading logs and performance metrics

- Engage with financial analysts to refine trading approaches

- Stay updated on market trends and technological advancements

High-Level Resume Tips for High-Frequency Trader Professionals

In the fast-paced world of finance, where milliseconds can mean the difference between profit and loss, a well-crafted resume is crucial for High-Frequency Trader professionals. Your resume is often the first impression you make on potential employers, serving as a marketing tool that must effectively reflect your skills, accomplishments, and understanding of the trading landscape. Given the competitive nature of this field, it’s essential that your resume not only highlights your technical abilities but also showcases your unique achievements. This guide aims to equip you with practical and actionable resume tips specifically tailored for High-Frequency Trader professionals, ensuring you stand out in a crowded job market.

Top Resume Tips for High-Frequency Trader Professionals

- Tailor your resume to each job description by incorporating relevant keywords and phrases that reflect the requirements of the position.

- Highlight your technical skills, including programming languages (such as Python or C++), trading platforms, and data analysis tools that are pertinent to high-frequency trading.

- Showcase relevant experience with specific examples, emphasizing your role in developing algorithms or strategies that improved trading performance.

- Quantify your achievements with metrics, such as percentage increases in trading volume, profitability, or efficiency gains from your strategies.

- Include certifications or advanced degrees related to finance, mathematics, or computer science to demonstrate your commitment to the field.

- Demonstrate your understanding of market microstructures and trading strategies that are unique to high-frequency trading environments.

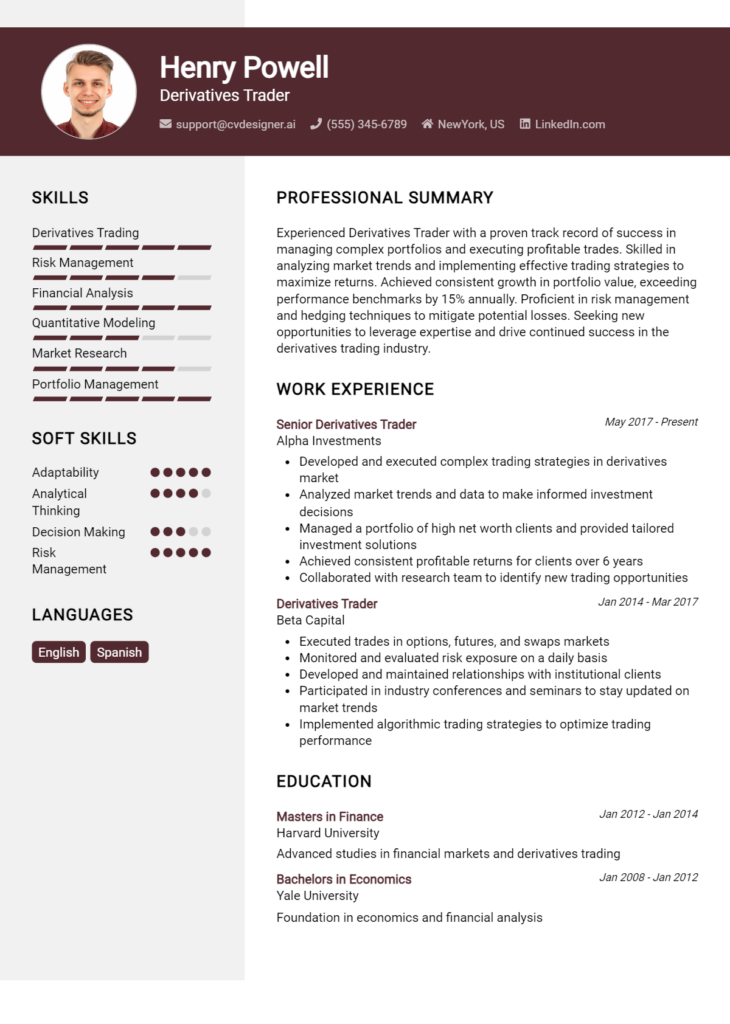

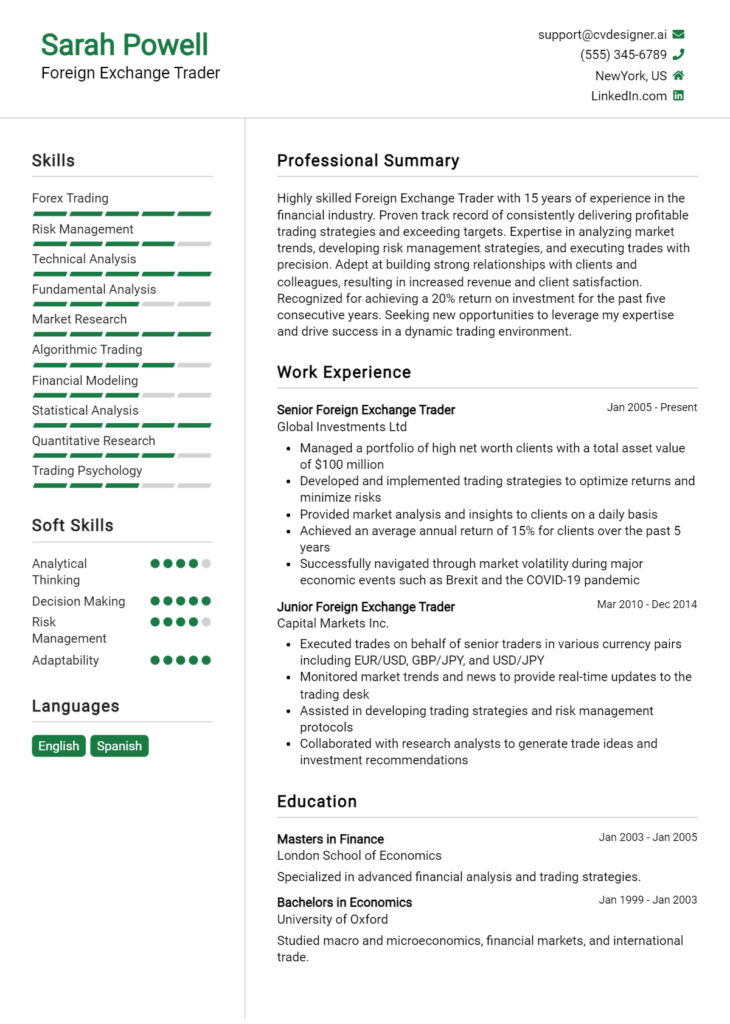

- Use a clean, professional format that enhances readability and makes key information easily accessible for hiring managers.

- Incorporate relevant projects or internships that involve quantitative analysis or algorithmic trading, even if they were not full-time roles.

- Keep your resume concise, ideally one page, focusing on the most relevant information that aligns with the job you are applying for.

- Proofread meticulously to avoid any typos or errors, as attention to detail is critical in both trading and resume presentation.

By implementing these tailored tips, you can significantly enhance your resume's effectiveness, increasing your chances of landing a job in the highly competitive field of High-Frequency Trading. A polished and optimized resume not only showcases your qualifications but also demonstrates your professionalism and commitment to potential employers.

Why Resume Headlines & Titles are Important for High-Frequency Trader

In the competitive field of high-frequency trading, a resume headline or title plays a critical role in capturing the attention of hiring managers. A strong headline distills a candidate's core qualifications into a single, impactful phrase that resonates with the specific demands of the role. It serves as a first impression, highlighting key skills and experience relevant to high-frequency trading while inviting further exploration of the candidate's resume. To be effective, these headlines should be concise, relevant, and directly aligned with the job being applied for, ensuring that candidates stand out in a crowded applicant pool.

Best Practices for Crafting Resume Headlines for High-Frequency Trader

- Keep it concise: Aim for a headline that's no more than 10-15 words.

- Be specific: Tailor your headline to match the job description and required skills.

- Highlight key achievements: Use quantifiable results to demonstrate your impact.

- Use industry terminology: Incorporate terms familiar to hiring managers in the trading sector.

- Focus on skills: Emphasize critical skills relevant to high-frequency trading, such as algorithm development or risk management.

- Showcase experience: Include years of relevant experience to establish credibility.

- Avoid clichés: Steer clear of overused phrases that lack substance.

- Test different versions: Experiment with variations to find the most compelling option.

Example Resume Headlines for High-Frequency Trader

Strong Resume Headlines

"Quantitative Analyst with 5+ Years in High-Frequency Trading & Algorithm Optimization"

“Proven High-Frequency Trader Specializing in Market Microstructure and Data Analysis”

“Expert in Developing High-Frequency Trading Strategies with 20% Yearly ROI”

Weak Resume Headlines

“Trader Looking for Opportunities”

“Experienced Professional in Financial Markets”

The strong headlines are effective because they provide specific information about the candidate's qualifications and accomplishments, making it clear why they would be a valuable addition to the team. They highlight relevant experience and skills that align with the needs of high-frequency trading firms. In contrast, the weak headlines fail to impress due to their vagueness and lack of focus. They do not convey any concrete value or unique selling points, leaving hiring managers uninterested and uncertain about the candidate's fit for the role.

Writing an Exceptional High-Frequency Trader Resume Summary

A resume summary is a critical component for high-frequency traders, as it serves as the first impression a hiring manager will have of a candidate. A well-crafted summary quickly captures attention by highlighting key skills, relevant experience, and notable accomplishments that directly align with the demands of the role. In a competitive field such as high-frequency trading, where precision and efficiency are paramount, a concise and impactful summary tailored to the specific job can set a candidate apart from others, making it an essential tool for success in the job application process.

Best Practices for Writing a High-Frequency Trader Resume Summary

- Quantify achievements: Use numbers and metrics to demonstrate your impact, such as increased trading volumes or improved profitability.

- Focus on relevant skills: Highlight specific skills that are essential for high-frequency trading, such as quantitative analysis, algorithm development, and risk management.

- Tailor the summary: Customize your resume summary for each job application to reflect the skills and experiences that align with the job description.

- Be concise: Keep your summary brief, ideally 2-4 sentences, while ensuring it effectively communicates your professional value.

- Use industry-specific terminology: Incorporate terms and phrases that resonate with the high-frequency trading industry to showcase your expertise.

- Highlight technology proficiency: Mention experience with trading platforms, programming languages, and data analysis tools relevant to the role.

- Showcase teamwork and collaboration: Emphasize experiences that demonstrate your ability to work with cross-functional teams in a fast-paced environment.

- Include market knowledge: Mention any relevant knowledge of markets, trading strategies, or financial instruments that could benefit the employer.

Example High-Frequency Trader Resume Summaries

Strong Resume Summaries

Results-driven high-frequency trader with over 5 years of experience leveraging algorithmic trading strategies to achieve a 30% increase in annual returns. Proficient in Python and C++ programming, with a proven track record of optimizing trading algorithms for enhanced performance in volatile markets.

Dynamic high-frequency trading professional with a robust background in quantitative analysis and risk management. Successfully developed and implemented proprietary trading models that generated over $2 million in profits within the first year, while maintaining a Sharpe ratio above 2.0.

Innovative high-frequency trader specializing in market microstructure and high-speed execution techniques. Achieved a 25% reduction in latency through the deployment of cutting-edge technology and rigorous backtesting of strategies, resulting in consistent profitability across diverse asset classes.

Weak Resume Summaries

Experienced trader with a background in finance looking for a new opportunity in high-frequency trading.

High-frequency trader skilled in various trading strategies and technologies, seeking to apply my skills in a challenging environment.

The strong resume summaries are considered effective because they provide specific metrics, highlight relevant skills, and showcase direct achievements that demonstrate the candidate's value. They are tailored to the high-frequency trading role, making them impactful and memorable. In contrast, the weak resume summaries lack detail, fail to quantify achievements, and come across as generic, which diminishes their effectiveness in capturing the hiring manager's attention.

Work Experience Section for High-Frequency Trader Resume

The work experience section of a High-Frequency Trader resume is a critical component that significantly influences a candidate's appeal to potential employers. This section serves as a platform to showcase not only technical skills and achievements but also the ability to manage teams and deliver high-quality trading strategies and products. By quantifying achievements and aligning experiences with industry standards, candidates can effectively demonstrate their capability to thrive in fast-paced trading environments and their contribution to the overall success of trading operations.

Best Practices for High-Frequency Trader Work Experience

- Highlight relevant technical skills such as programming languages, trading algorithms, and data analysis tools.

- Quantify achievements using metrics such as percentage gains, profit margins, or reduction in latency.

- Emphasize leadership roles in managing teams or projects to underline collaboration and teamwork.

- Align experiences with industry standards and practices to showcase familiarity with market regulations.

- Use action verbs to convey proactivity and impact, making statements more compelling.

- Incorporate specific examples of high-pressure decision-making and risk management.

- Tailor the work experience section to reflect the requirements of the job description.

- Include any relevant certifications or training that bolster credibility in the field.

Example Work Experiences for High-Frequency Trader

Strong Experiences

- Developed and implemented a high-frequency trading algorithm that increased trading efficiency by 25%, resulting in an additional $3 million in annual profits.

- Led a team of five traders in optimizing a proprietary trading strategy, achieving a 15% reduction in execution time and improving overall portfolio returns by 10%.

- Conducted rigorous back-testing and validation of trading models, which enhanced predictive accuracy by 30%, minimizing risk exposure during volatile market conditions.

- Collaborated with quantitative analysts to refine data feeds and reduce latency, resulting in a significant decrease in market impact and slippage during trades.

Weak Experiences

- Worked on trading strategies that were not fully developed or tested.

- Participated in team meetings without any specific contributions or leadership roles.

- Assisted in general trading activities without detailing the impact or results.

- Engaged in data analysis tasks but did not quantify the outcomes or improvements achieved.

The examples provided illustrate the distinction between strong and weak experiences in a High-Frequency Trader resume. Strong experiences highlight quantifiable outcomes, technical leadership, and collaboration, demonstrating a clear impact on trading success. In contrast, weak experiences lack specificity and measurable results, which can leave employers questioning the candidate's actual contributions and capabilities in a fast-paced trading environment.

Education and Certifications Section for High-Frequency Trader Resume

The education and certifications section of a High-Frequency Trader resume is vital as it showcases the candidate's academic foundation, relevant industry certifications, and commitment to continuous learning in a fast-paced trading environment. This section not only illustrates the candidate's theoretical knowledge but also highlights applicable skills that are critical for success in high-frequency trading. By including relevant coursework, certifications, and specialized training, candidates can significantly boost their credibility and demonstrate a strong alignment with the demands of the job role, making them more attractive to potential employers.

Best Practices for High-Frequency Trader Education and Certifications

- Focus on degrees in finance, mathematics, computer science, or related fields to emphasize quantitative skills.

- Include industry-recognized certifications such as CFA, FRM, or Series 7 to showcase professional credibility.

- List relevant coursework that pertains to algorithmic trading, statistical analysis, or data science.

- Highlight any specialized training in trading systems, quantitative analysis, or programming languages like Python or R.

- Use clear formatting to ensure easy readability and quick reference for hiring managers.

- Keep the section concise but informative, emphasizing only the most relevant educational experiences.

- Consider including any ongoing education efforts, such as workshops, seminars, or online courses.

- Tailor the content to align with the specific requirements mentioned in the job description.

Example Education and Certifications for High-Frequency Trader

Strong Examples

- Master of Financial Engineering, Columbia University, 2021.

- Chartered Financial Analyst (CFA) Level I, CFA Institute, 2022.

- Relevant Coursework: Algorithmic Trading Strategies, Machine Learning for Finance, Advanced Statistics.

- Certificate in Quantitative Finance, New York Institute of Finance, 2023.

Weak Examples

- Bachelor of Arts in History, University of Example, 2018.

- Certification in Basic Excel Skills, Online Learning Platform, 2020.

- High School Diploma, Example High School, 2016.

- Outdated Series 7 License, 2015 (not renewed).

The strong examples are considered relevant because they directly align with the skills and knowledge necessary for a High-Frequency Trader, demonstrating advanced education and current industry certifications. In contrast, the weak examples illustrate a lack of relevance to the trading field, with degrees and certifications that do not support the technical and analytical requirements of high-frequency trading roles. This distinction underscores the importance of selecting education and certifications that resonate with the targeted job position.

Top Skills & Keywords for High-Frequency Trader Resume

In the fast-paced world of high-frequency trading, possessing the right skills is crucial for success. A well-crafted resume that highlights both hard and soft skills can significantly enhance a candidate's chances of standing out in a competitive job market. High-frequency traders must demonstrate analytical prowess, quick decision-making abilities, and a deep understanding of financial markets. Additionally, interpersonal skills and the ability to work under pressure are equally important, as they contribute to effective collaboration and adaptability in a rapidly changing environment. Crafting a resume that effectively showcases these skills can make a substantial difference in landing the desired position.

Top Hard & Soft Skills for High-Frequency Trader

Soft Skills

- Strong analytical thinking

- Excellent communication skills

- Ability to work under pressure

- Quick decision-making

- Problem-solving abilities

- Attention to detail

- Team collaboration

- Adaptability

- Time management

- Emotional intelligence

Hard Skills

- Proficiency in quantitative analysis

- Expertise in algorithmic trading strategies

- Knowledge of financial modeling

- Familiarity with programming languages (e.g., Python, C++)

- Understanding of market microstructure

- Experience with trading platforms (e.g., Bloomberg, Eikon)

- Data analysis and visualization skills

- Strong mathematical foundation

- Risk management techniques

- Knowledge of regulatory compliance

For more insights on the importance of skills and how to effectively showcase your work experience in your resume, consider the above lists as a guideline to tailor your application for a high-frequency trading role.

Stand Out with a Winning High-Frequency Trader Cover Letter

I am writing to express my interest in the High-Frequency Trader position at [Company Name], as advertised on your careers page. With a strong background in quantitative analysis, algorithm development, and a keen understanding of market dynamics, I am excited about the opportunity to leverage my skills in a fast-paced trading environment. My academic background in finance and computer science, combined with my hands-on experience in algorithmic trading, positions me uniquely to contribute to your team’s success.

During my previous role at [Previous Company Name], I successfully designed and implemented trading algorithms that improved our execution speed by 30% and generated consistent returns on our investments. I possess a deep understanding of market microstructure and have utilized high-frequency trading techniques to capitalize on fleeting market opportunities. My proficiency in programming languages such as Python, C++, and R has allowed me to develop innovative solutions that optimize trading strategies and enhance performance. I thrive in high-pressure environments and am adept at making swift, data-driven decisions that align with firm objectives.

Moreover, I am committed to continuous learning and staying ahead of the curve in this ever-evolving field. I regularly participate in workshops and forums to enhance my knowledge of trading technologies and market trends. I am particularly impressed by [Company Name]'s commitment to innovation and excellence in high-frequency trading, and I am eager to contribute my analytical skills and passion for trading to your esteemed team. I believe that my proactive approach to problem-solving and my collaborative spirit will make a positive impact at [Company Name].

Thank you for considering my application. I look forward to the possibility of discussing how my experience and skills align with the goals of [Company Name]. I am excited about the opportunity to contribute to your team and help drive success in the dynamic world of high-frequency trading.

Common Mistakes to Avoid in a High-Frequency Trader Resume

When crafting a resume for a high-frequency trader position, it's crucial to present your skills and experiences effectively, as this is a highly competitive field. Many candidates make common mistakes that can detract from their qualifications and reduce their chances of landing an interview. Avoiding these pitfalls can enhance the clarity and impact of your resume, ensuring that hiring managers recognize your potential as a high-frequency trader.

Lack of Quantitative Focus: High-frequency trading relies heavily on quantitative analysis. Failing to highlight your mathematical skills or relevant coursework can make your resume less compelling.

Ignoring Technical Skills: High-frequency traders use sophisticated algorithms and trading platforms. Not mentioning your proficiency in programming languages (like Python or C++) or trading software could be a significant oversight.

Vague Job Descriptions: Using generic descriptions for past roles can dilute your achievements. Be specific about your responsibilities, tools used, and the impact of your work on trading performance.

Poor Formatting: A cluttered or overly complex resume can be off-putting. Stick to a clean, professional format that makes it easy for recruiters to scan your qualifications quickly.

Omitting Relevant Certifications: Certifications such as CFA or FRM can enhance your credibility. Not including these can make you appear less qualified compared to other candidates.

Neglecting Soft Skills: While technical skills are paramount, high-frequency trading also requires teamwork and communication. Failing to mention these soft skills can give an incomplete picture of your capabilities.

Not Tailoring the Resume: Sending out the same resume for every job application can be detrimental. Tailor your resume to each specific role, emphasizing the skills and experiences that align with the job description.

Overlooking Achievements: Simply listing job duties without highlighting accomplishments can diminish the impact of your experience. Use quantifiable metrics to showcase your successes and contributions in previous roles.

Conclusion

High-frequency trading (HFT) is a complex and dynamic field that requires a unique blend of technical skills, quantitative analysis, and a deep understanding of financial markets. In this article, we explored the essential skills and qualifications needed to become a successful high-frequency trader, including expertise in programming languages like Python and C++, proficiency in algorithm development, and a strong foundation in statistics and financial theory.

We also highlighted the importance of staying updated with market trends and having a solid grasp of risk management strategies, as well as the role of technology in executing trades at lightning speed. Networking and continuous learning were emphasized as critical components for career advancement in this highly competitive industry.

In conclusion, if you're looking to break into or advance your career as a high-frequency trader, it's crucial to ensure your resume effectively showcases your skills and experiences. We encourage you to take a moment to review your High-Frequency Trader Resume to ensure it reflects your qualifications accurately. To assist you, there are several valuable resources available, including resume templates, a resume builder, resume examples, and cover letter templates. Leverage these tools to enhance your application and stand out in the competitive field of high-frequency trading!