Top 24 Insurance Sales Agent Skills to Put on Your Resume for 2025

As an Insurance Sales Agent, possessing the right skills is essential to thrive in a competitive market. Employers look for candidates who not only understand the intricacies of insurance products but also excel in communication, relationship-building, and strategic selling techniques. In the following section, we will explore the top skills that can enhance your resume and set you apart in the field of insurance sales.

Best Insurance Sales Agent Technical Skills

Technical skills are essential for Insurance Sales Agents as they enable agents to navigate the complexities of insurance products, utilize technology efficiently, and meet clients' needs effectively. Highlighting these skills on your resume can significantly enhance your appeal to potential employers and help demonstrate your capability in the competitive insurance industry.

Product Knowledge

Understanding different insurance products, including life, health, auto, and property insurance, is vital for providing clients with tailored solutions.

How to show it: List specific insurance products you have sold and any certifications related to them. For example, "Successfully sold 100+ life insurance policies within a year, contributing to a 20% increase in annual revenue."

Customer Relationship Management (CRM) Software

Proficiency in CRM software helps agents manage client interactions and streamline sales processes, improving customer satisfaction and retention.

How to show it: Mention specific CRM systems you have experience with, such as Salesforce or HubSpot, and quantify how you used them to improve client retention rates.

Data Analysis

The ability to analyze market trends and client data enables agents to make informed decisions and develop effective sales strategies.

How to show it: Include examples of how your data analysis led to actionable insights, such as "Utilized data analytics to identify target demographics, resulting in a 30% increase in outreach effectiveness."

Regulatory Compliance Knowledge

Understanding industry regulations is crucial for ensuring that sales practices adhere to legal standards, thereby protecting both the agent and the client.

How to show it: Highlight any training or certifications in compliance and provide examples of how your knowledge positively impacted your agency's compliance record.

Sales Techniques

Mastery of various sales techniques, such as consultative selling, can help agents effectively identify and meet client needs.

How to show it: Quantify your sales achievements, such as "Achieved a 150% quota attainment through the implementation of consultative selling strategies."

Negotiation Skills

Strong negotiation skills facilitate favorable terms for clients and can lead to increased sales and customer satisfaction.

How to show it: Provide examples of successful negotiations, such as "Negotiated premium discounts for clients, leading to a retention rate increase of 25%."

Lead Generation Techniques

Effective lead generation strategies are essential for building a strong client base and increasing sales opportunities.

How to show it: Describe specific lead generation methods you have employed and their results, like "Generated 200+ qualified leads within six months through targeted marketing campaigns."

Financial Acumen

A solid understanding of financial principles helps agents explain policy benefits and premiums in a way clients can understand.

How to show it: Demonstrate your financial knowledge by showcasing how you helped clients save money or maximize their benefits, such as "Advised clients on policy selection that saved them an average of 15% in premiums."

Time Management

Effective time management allows agents to handle multiple clients and tasks efficiently, ensuring that deadlines are met and client needs are prioritized.

How to show it: Provide metrics on how you managed your time effectively, such as "Reduced follow-up time by 30% through improved scheduling techniques."

Technical Proficiency

Familiarity with various technological tools and platforms enhances efficiency in managing policies and client interactions.

How to show it: List the software and tools you are proficient in, and quantify how they improved your workflow, such as "Increased processing speed by 40% by implementing an automated policy tracking system."

Best Insurance Sales Agent Soft Skills

In the competitive field of insurance sales, having strong soft skills is just as important as having product knowledge. These interpersonal and professional skills enable Insurance Sales Agents to build relationships, communicate effectively, and navigate challenges with ease. Highlighting your soft skills on your resume can greatly enhance your appeal to potential employers, showcasing your ability to not only sell insurance products but also to provide exceptional service and support to clients.

Communication

Effective communication is essential for Insurance Sales Agents. It involves not only conveying information clearly but also listening to clients' needs and concerns. Strong communication skills can help agents build trust and rapport with clients, leading to successful sales.

How to show it: Provide examples of successful client interactions, such as how you resolved a client’s concern or closed a sale through effective dialogue. Quantify achievements, like increasing customer satisfaction ratings or achieving a high follow-up success rate.

Problem-solving

Problem-solving skills allow Insurance Sales Agents to identify client needs and offer tailored solutions. This skill is crucial in navigating complex insurance products and addressing client issues effectively.

How to show it: Highlight instances where you developed creative solutions for clients, such as customizing a policy to suit their unique needs or successfully resolving a claim dispute. Use metrics to demonstrate the impact of your problem-solving skills, such as the number of claims resolved or policies customized.

Time Management

Time management is vital for managing a busy schedule, meeting deadlines, and prioritizing tasks. Insurance Sales Agents must balance client meetings, follow-ups, and administrative work efficiently.

How to show it: Discuss how you organized your daily activities to maximize productivity, such as using CRM tools to track leads or implementing a follow-up schedule. Quantify outcomes, like the number of new policies sold within a specific timeframe.

Teamwork

Teamwork skills are important for collaborating with colleagues, underwriters, and claims adjusters. Being able to work effectively in a team can lead to better service for clients and improved outcomes.

How to show it: Include examples of collaborative projects or initiatives you participated in, such as a team effort to improve customer service processes or joint sales campaigns. Highlight any measurable results, like increased sales due to teamwork.

Adaptability

Adaptability is crucial for Insurance Sales Agents as the insurance market can change rapidly. Being adaptable allows agents to adjust their strategies and approaches to meet evolving client needs and market conditions.

How to show it: Provide examples of how you adapted to changes in insurance regulations or market trends. Quantify the impact of your adaptability, such as successfully launching a new product line in response to market demands.

Empathy

Empathy helps Insurance Sales Agents connect effectively with clients. Understanding clients’ emotions and perspectives can lead to better service and stronger relationships.

How to show it: Share stories that demonstrate your ability to empathize with clients, especially in sensitive situations. Quantify the outcomes, such as client retention rates or testimonials that reflect your empathetic approach.

Negotiation

Negotiation skills are essential for Insurance Sales Agents when discussing terms and conditions with clients or resolving issues with underwriters. Effective negotiators can secure better deals for their clients and themselves.

How to show it: Include specific examples of successful negotiations, such as closing a deal that benefited both the client and your agency. Quantify results, like the percentage of successful negotiations or average savings achieved for clients.

Customer Service Orientation

A strong customer service orientation ensures that Insurance Sales Agents prioritize client needs and satisfaction. This skill is crucial for building long-term relationships and maintaining a positive reputation.

How to show it: Highlight your commitment to customer service with examples, such as achieving high customer satisfaction scores or receiving positive feedback from clients. Quantify achievements, like the number of repeat clients or referrals generated.

Attention to Detail

Attention to detail is critical in the insurance industry to avoid errors in policy documentation and ensure compliance with regulations. It helps agents provide accurate information to clients and maintain trust.

How to show it: Provide examples of how your attention to detail prevented errors or improved client documentation processes. Use metrics to demonstrate the effectiveness of your detail-oriented approach, such as error rates or compliance audit results.

Persuasiveness

Persuasiveness is a key skill for Insurance Sales Agents, enabling them to convince clients of the benefits of various insurance products. This skill is essential

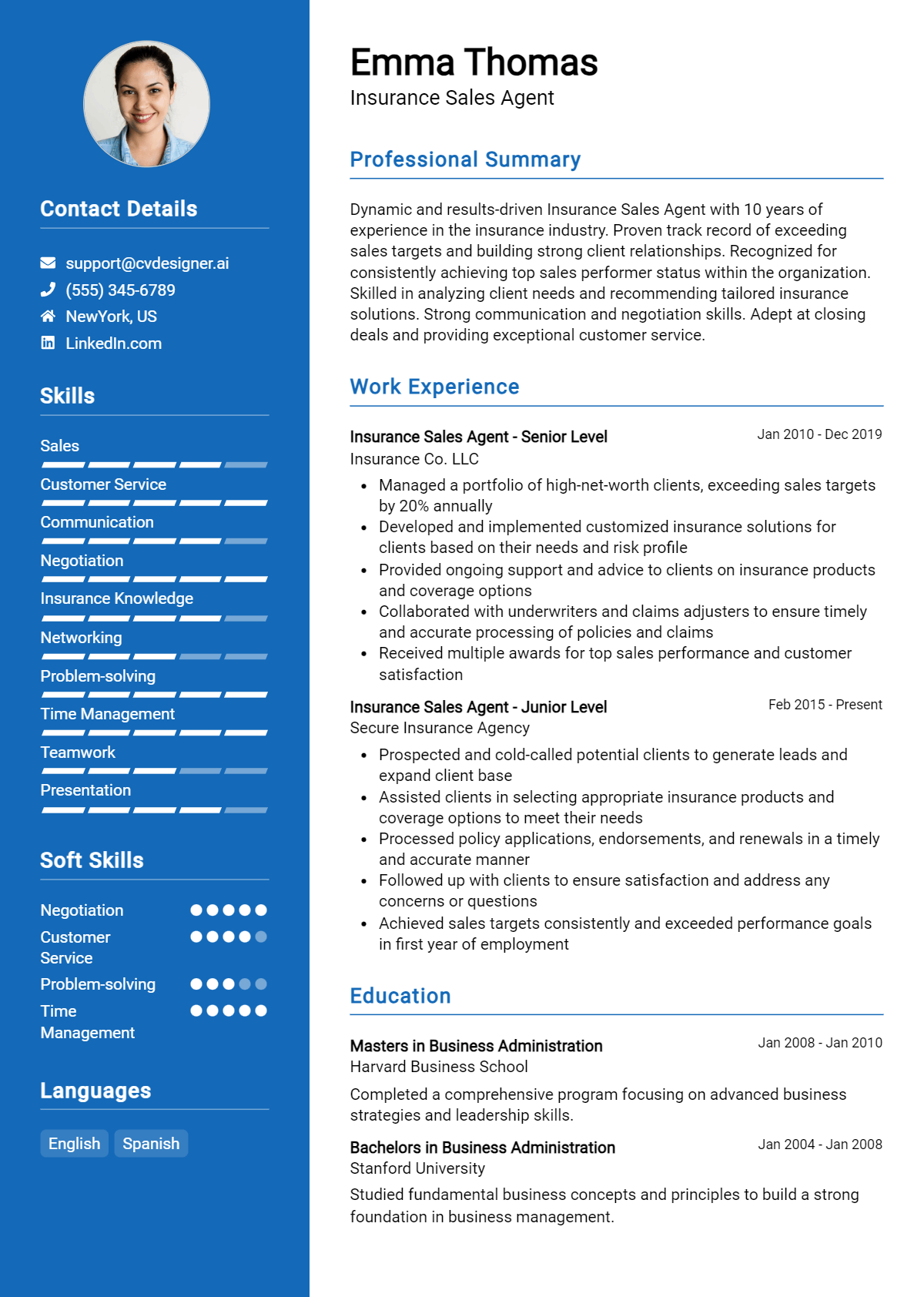

How to List Insurance Sales Agent Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to employers in a competitive job market. Highlighting your capabilities in the right sections can provide hiring managers with a quick overview of your qualifications. There are three main areas where skills can be emphasized: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

Showcasing your Insurance Sales Agent skills in the introduction section helps hiring managers quickly assess your qualifications. A strong summary can set the tone for the rest of your resume.

Example

Results-driven Insurance Sales Agent with over 5 years of experience in customer relationship management and policy negotiation. Proven track record of exceeding sales targets and delivering exceptional client service.

for Resume Work Experience

The work experience section is the ideal place to demonstrate how your Insurance Sales Agent skills have been applied in real-world scenarios. Use this section to align your experience with the skills listed in job postings.

Example

- Developed and maintained strong client relationships, resulting in a 30% increase in customer retention.

- Utilized market analysis to tailor insurance solutions that met client needs.

- Conducted in-depth needs assessments to identify potential sales opportunities and provide personalized service.

- Collaborated with team members to improve sales strategies, leading to a 20% boost in quarterly sales.

for Resume Skills

The skills section can showcase both technical and transferable skills. Including a balanced mix of hard and soft skills will strengthen your overall qualifications.

Example

- Customer Relationship Management

- Policy Negotiation

- Sales Strategy Development

- Effective Communication

- Market Research and Analysis

- Time Management

- Problem Solving

for Cover Letter

A cover letter offers a chance to expand on the skills highlighted in your resume while providing a personal touch. It's important to emphasize 2-3 key skills that align with the job description and demonstrate their impact in your previous roles.

Example

My experience in customer relationship management has allowed me to foster strong client connections, leading to increased satisfaction and loyalty. Additionally, my expertise in policy negotiation has consistently resulted in favorable terms for clients, contributing to a significant rise in overall sales performance.

Linking the skills mentioned in your resume to specific achievements in your cover letter can further reinforce your qualifications for the job.

The Importance of Insurance Sales Agent Resume Skills

In the competitive field of insurance sales, highlighting relevant skills on a resume is crucial for candidates aiming to make a lasting impression on recruiters. A well-crafted skills section not only showcases a candidate's qualifications but also aligns their expertise with the specific requirements of the job. This alignment can significantly enhance the chances of securing an interview, as it demonstrates to potential employers that the candidate possesses the necessary capabilities to excel in the role.

- Effective communication skills are essential for an Insurance Sales Agent, as they must articulate complex insurance concepts clearly to clients. This fosters trust and helps clients make informed decisions about their coverage needs.

- Strong negotiation skills enable agents to close deals effectively. Demonstrating an ability to negotiate favorable terms for clients while maximizing sales opportunities can distinguish an agent from others in the field.

- Sales skills are at the core of an Insurance Sales Agent's role. Highlighting proven sales achievements and strategies on a resume can illustrate an agent's ability to exceed targets and drive revenue growth.

- Knowledge of insurance products is vital. Agents must be well-versed in various policies and coverage options, which allows them to provide tailored solutions to meet the diverse needs of clients.

- Customer service skills play a significant role in client retention. An agent's ability to address concerns and provide ongoing support can lead to long-term relationships and referrals, which are key to success in the insurance industry.

- Time management skills are crucial for juggling multiple clients and administrative tasks. Demonstrating the ability to prioritize tasks effectively can assure recruiters of a candidate's organizational capabilities.

- Analytical skills help agents assess client needs and market trends, enabling them to offer the best possible advice. Highlighting these skills can show recruiters that a candidate is proactive and data-driven.

- Adaptability is important in the ever-evolving insurance landscape. A candidate's ability to learn new products and adjust to changing regulations can set them apart as a versatile agent.

- Building rapport with clients is essential for trust and credibility. Emphasizing interpersonal skills on a resume can indicate a candidate's ability to connect with clients on a personal level, enhancing their overall effectiveness.

For more guidance, you can explore various Resume Samples to inspire your own resume creation.

How To Improve Insurance Sales Agent Resume Skills

In the competitive field of insurance sales, continuously improving your skills is crucial for staying ahead of the game and maximizing your potential for success. As an insurance sales agent, the ability to connect with clients, understand their needs, and effectively communicate the benefits of various insurance products can significantly impact your sales performance. By enhancing your skill set, you not only improve your resume but also increase your chances of achieving your sales targets and advancing your career.

- Attend industry-related workshops and seminars to stay updated on the latest trends and regulations in insurance.

- Participate in sales training programs that focus on effective communication, negotiation, and closing techniques.

- Seek mentorship from experienced insurance agents to gain insights and tips for improving your sales strategies.

- Enhance your product knowledge by regularly studying the insurance products you sell and understanding their features and benefits.

- Develop your customer service skills by practicing active listening and empathy to better understand client needs.

- Utilize technology and CRM tools to streamline your sales process and improve follow-up with potential clients.

- Network with other professionals in the industry to share best practices and learn from their experiences.

Frequently Asked Questions

What skills are essential for an Insurance Sales Agent?

Essential skills for an Insurance Sales Agent include strong communication and interpersonal skills, which allow agents to build rapport with clients. Additionally, sales skills are crucial for effectively presenting insurance products and closing deals. Agents should also possess analytical skills to assess clients' needs and recommend appropriate coverage options. Knowledge of the insurance industry and its regulations is vital, as is proficiency in using customer relationship management (CRM) software to track leads and manage client interactions.

How can I improve my sales skills as an Insurance Sales Agent?

Improving sales skills as an Insurance Sales Agent can be achieved through continuous learning and practice. Engaging in sales training workshops, reading relevant literature, and role-playing sales scenarios can enhance your ability to persuade and negotiate. Additionally, seeking feedback from peers or mentors can provide insights into your sales techniques. Regularly analyzing your performance and understanding customer behaviors can also help refine your approach and increase your effectiveness in closing sales.

What role does customer service play in an Insurance Sales Agent's job?

Customer service is a vital aspect of an Insurance Sales Agent's job as it directly impacts client satisfaction and retention. Providing excellent customer service involves being responsive to client inquiries, resolving issues promptly, and maintaining open communication. A strong customer service orientation helps agents build trust and loyalty with clients, which is essential for long-term success in the insurance industry. Agents who prioritize customer service are more likely to receive referrals and repeat business.

What are the benefits of being knowledgeable about different insurance products?

Being knowledgeable about various insurance products allows an Insurance Sales Agent to provide tailored solutions that meet clients' specific needs. This expertise enables agents to effectively explain the differences between policies, helping clients make informed decisions. Furthermore, having a deep understanding of product features and benefits enhances the agent's credibility and instills confidence in clients. It also positions the agent as a trusted advisor, which can lead to increased sales and customer loyalty.

How important is networking in the insurance sales industry?

Networking is extremely important in the insurance sales industry as it helps agents establish connections that can lead to new business opportunities. Building a strong professional network allows agents to share referrals, gain insights into market trends, and collaborate with other professionals. Attending industry events, joining local business organizations, and leveraging social media platforms can all enhance an agent's visibility and credibility. A robust network not only facilitates client acquisition but also contributes to ongoing professional development.

Conclusion

Incorporating the essential skills of an Insurance Sales Agent into your resume is crucial for standing out in a competitive job market. By effectively showcasing relevant skills, candidates can demonstrate their value and potential contribution to prospective employers, ultimately increasing their chances of securing an interview. Remember, refining your skills not only enhances your resume but also empowers you to present yourself confidently in the job application process. Take the time to invest in your professional development, and watch your opportunities grow!

For more resources to enhance your job application, check out our resume templates, utilize our resume builder, explore resume examples, and create a compelling introduction with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.