Insurance Sales Agent Core Responsibilities

Insurance Sales Agents play a crucial role in connecting clients with the right coverage options while collaborating with underwriting, claims, and customer service departments. Their key responsibilities include assessing client needs, explaining policy features, and providing quotes. Successful agents exhibit strong technical skills in product knowledge, operational efficiency in managing client relationships, and problem-solving abilities to address client concerns. These competencies align with organizational goals, and a well-structured resume can effectively highlight these qualifications, demonstrating the agent's potential impact on the organization.

Common Responsibilities Listed on Insurance Sales Agent Resume

- Assessing client insurance needs and recommending appropriate policies.

- Explaining coverage options and benefits to clients.

- Providing quotes and negotiating terms to secure sales.

- Building and maintaining relationships with clients for repeat business.

- Staying updated on industry trends and regulatory changes.

- Collaborating with underwriting teams to facilitate approvals.

- Managing renewals and follow-ups to ensure customer satisfaction.

- Assisting clients with claims processes and inquiries.

- Developing marketing strategies to attract new clients.

- Maintaining accurate records of client interactions and transactions.

- Participating in training sessions to enhance sales skills and product knowledge.

High-Level Resume Tips for Insurance Sales Agent Professionals

In the competitive world of insurance sales, a well-crafted resume serves as a vital tool in a candidate's job search arsenal. For Insurance Sales Agent professionals, this document often acts as the first impression made on potential employers, and therefore, it must effectively showcase both skills and achievements. A strong resume not only highlights relevant experience and qualifications but also demonstrates a candidate's understanding of the insurance industry and their ability to drive sales. This guide will provide practical and actionable resume tips specifically tailored for Insurance Sales Agent professionals, helping you to stand out in a crowded field.

Top Resume Tips for Insurance Sales Agent Professionals

- Tailor your resume to the specific job description, incorporating keywords and phrases from the posting.

- Highlight relevant experience in insurance sales, including any previous roles and responsibilities that align with the job you’re applying for.

- Quantify your achievements, such as sales targets met, revenue generated, or client retention rates, to provide concrete evidence of your success.

- Showcase your knowledge of various insurance products and services, demonstrating your ability to cater to diverse client needs.

- Include any certifications or licenses relevant to the insurance industry, such as a state insurance license or specialized training.

- Emphasize soft skills that are crucial in sales, such as communication, negotiation, and relationship-building abilities.

- Utilize a clean, professional format that enhances readability and allows key information to stand out.

- Incorporate industry-specific metrics, such as customer acquisition costs or average policy sizes, to demonstrate your understanding of the business.

- Keep your resume concise and focused, ideally fitting it onto one page without sacrificing important content.

- Regularly update your resume to reflect your most recent accomplishments and skills, ensuring it stays relevant to the evolving job market.

By implementing these tips, Insurance Sales Agent professionals can significantly increase their chances of landing a job in the field. A targeted and compelling resume that effectively highlights your skills and accomplishments will not only capture the attention of hiring managers but also position you as a strong candidate ready to excel in the competitive insurance market.

Why Resume Headlines & Titles are Important for Insurance Sales Agent

In the competitive field of insurance sales, a resume's headline or title serves as a critical first impression that can capture the attention of hiring managers. For an Insurance Sales Agent, a strong headline succinctly encapsulates the candidate's key qualifications, experience, and skills in a way that is relevant to the role. By summarizing their professional identity in one impactful phrase, candidates can effectively communicate their value proposition and differentiate themselves from other applicants. A well-crafted headline should be concise, directly related to the job being applied for, and tailored to highlight the most pertinent aspects of the candidate's background.

Best Practices for Crafting Resume Headlines for Insurance Sales Agent

- Keep it concise: Aim for a headline that is no longer than 10-12 words.

- Be specific: Use terminology that directly relates to the insurance sales industry.

- Highlight key strengths: Focus on your most relevant skills and achievements.

- Use action-oriented language: Engage the reader with dynamic verbs and phrases.

- Tailor to the job description: Align your headline with the requirements of the position.

- Include quantifiable achievements: Whenever possible, highlight measurable results you have achieved.

- Avoid clichés: Steer clear of overused phrases that may dilute your message.

- Make it relevant: Ensure that the headline reflects the specific role of an Insurance Sales Agent.

Example Resume Headlines for Insurance Sales Agent

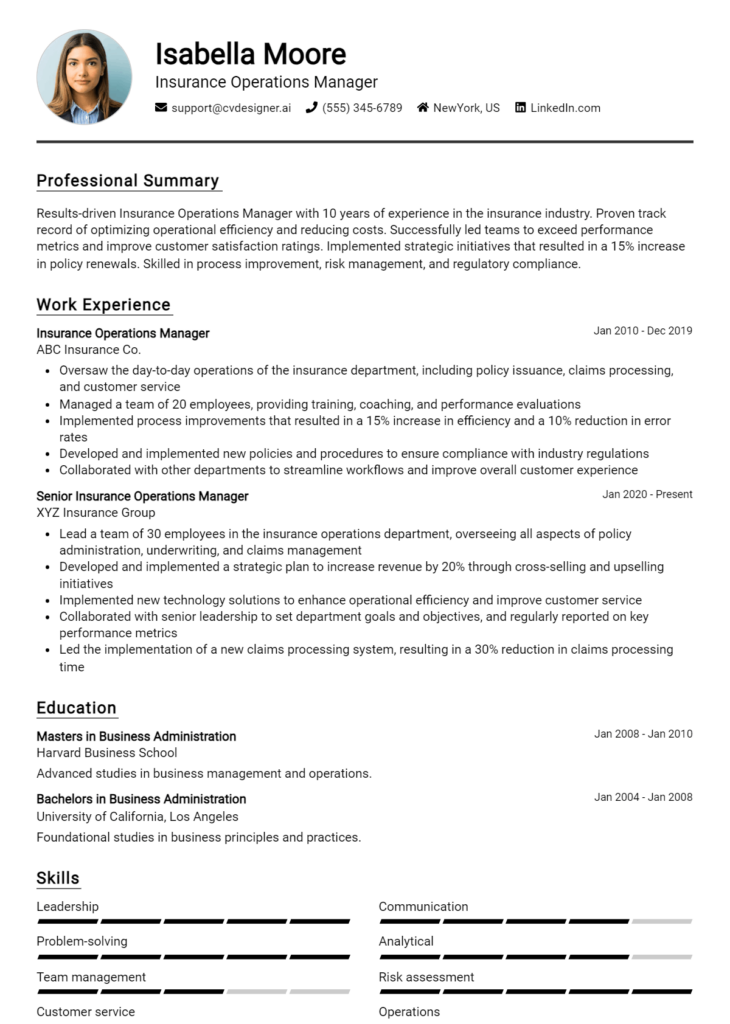

Strong Resume Headlines

Dynamic Insurance Sales Agent with 5+ Years of Proven Success in Client Acquisition

Results-Driven Insurance Specialist | Expert in Policy Solutions and Risk Management

Top-Performing Sales Agent | Consistently Exceeded Quarterly Sales Targets by 30%

Licensed Insurance Professional with a Track Record of Building Long-Term Client Relationships

Weak Resume Headlines

Insurance Sales Agent

Experienced in Sales

Seeking Opportunities in Insurance

The strong headlines are effective because they convey specific competencies, achievements, and a clear professional identity that aligns with the expectations of the insurance industry. They stand out due to their focus on measurable results and relevant skills that hiring managers seek. In contrast, the weak headlines fail to impress because they are vague, overly general, and do not provide any insight into the candidate's unique qualifications or value, making it easy for them to be overlooked in a crowded applicant pool.

Writing an Exceptional Insurance Sales Agent Resume Summary

A well-crafted resume summary is essential for an Insurance Sales Agent as it serves as the first impression a hiring manager receives. It encapsulates the candidate's key skills, relevant experience, and notable accomplishments in a concise format. By quickly capturing attention, a strong summary can set a candidate apart from the competition, demonstrating their value and readiness for the role. Tailoring the summary to reflect the specific job description ensures that it resonates with the employer, making it impactful and engaging.

Best Practices for Writing a Insurance Sales Agent Resume Summary

- Quantify achievements by including specific numbers, percentages, or milestones.

- Focus on key skills that align with the job requirements, such as customer service, negotiation, and sales strategies.

- Tailor the summary to the job description to highlight relevant experience and skills.

- Keep it concise, ideally within 2-4 sentences, to maintain the reader's attention.

- Use strong action verbs to convey a sense of initiative and results-driven performance.

- Highlight any industry-specific certifications or licenses to enhance credibility.

- Showcase personal attributes that contribute to success in sales, such as resilience or relationship-building skills.

- Avoid jargon or overly complex language; clarity is key to effective communication.

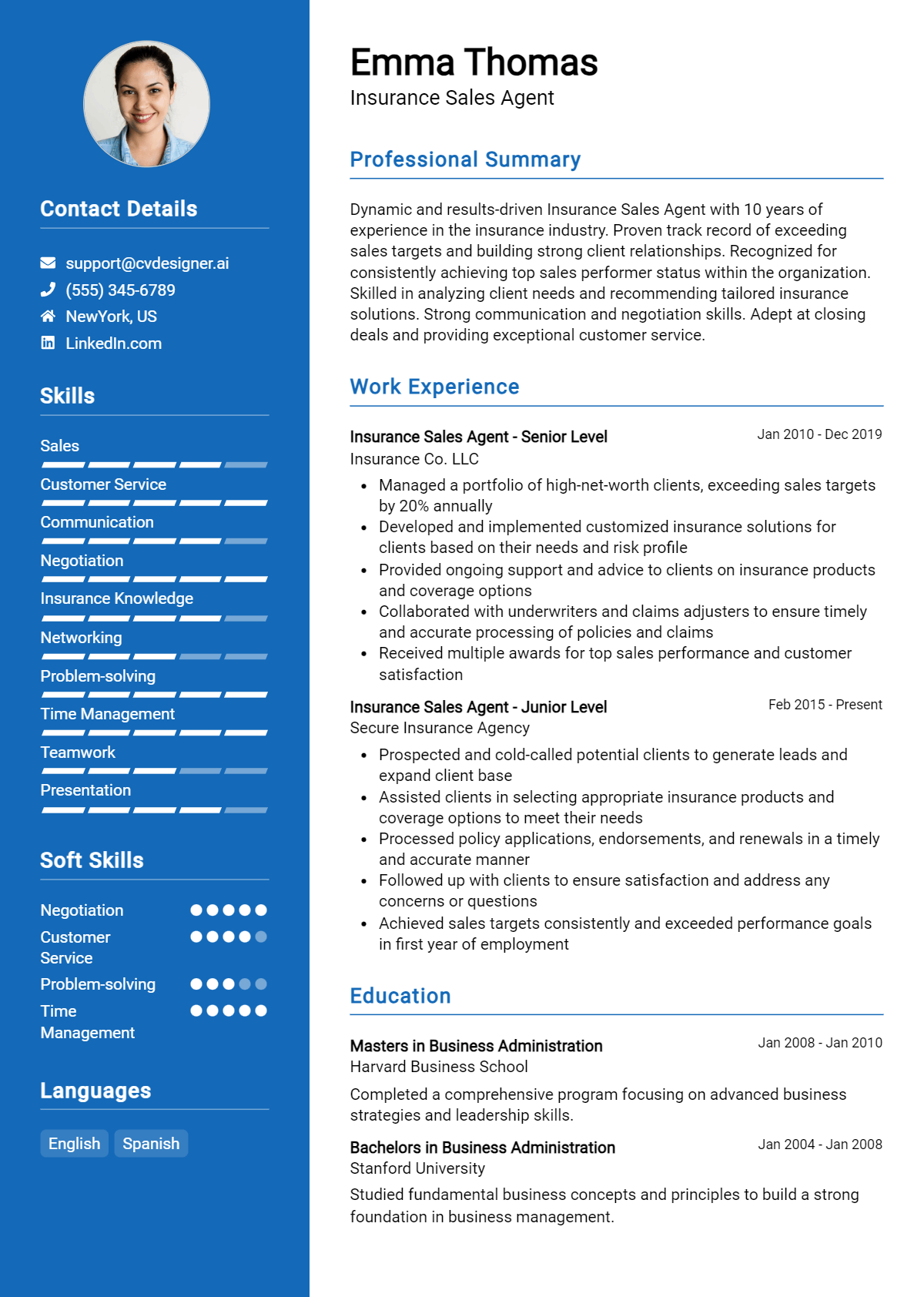

Example Insurance Sales Agent Resume Summaries

Strong Resume Summaries

Dynamic Insurance Sales Agent with over 5 years of experience in the industry, achieving a 30% increase in annual sales through strategic relationship-building and personalized customer service.

Results-oriented professional with a proven track record of exceeding sales targets by 25% year over year. Skilled in identifying client needs and providing tailored insurance solutions that enhance customer satisfaction.

Licensed Insurance Agent with expertise in life and health insurance, recognized for closing complex deals and generating over $1 million in revenue within a 12-month period. Strong communicator dedicated to fostering long-lasting client relationships.

Weak Resume Summaries

Dedicated insurance sales professional with experience in the field. Looking to contribute to a new company.

Insurance agent with various skills and a background in sales. Seeking a position to apply my knowledge.

The strong resume summaries are effective because they include specific achievements, quantifiable results, and relevant skills that directly align with the role of an Insurance Sales Agent. In contrast, the weak summaries lack detail, are vague, and do not provide any compelling reasons for a hiring manager to consider the candidate. They fail to highlight tangible accomplishments or the candidate's unique value, making them less engaging.

Work Experience Section for Insurance Sales Agent Resume

The work experience section is a critical component of an Insurance Sales Agent's resume, as it highlights the candidate's technical skills, leadership capabilities, and ability to deliver high-quality insurance products. This section allows potential employers to assess how well the candidate can apply their knowledge in real-world scenarios, manage teams effectively, and achieve measurable results. By quantifying achievements and aligning experiences with industry standards, candidates can demonstrate their value and readiness to excel in the insurance sales field.

Best Practices for Insurance Sales Agent Work Experience

- Focus on quantifying achievements with specific metrics (e.g., sales growth percentages, customer retention rates).

- Highlight technical expertise relevant to the insurance industry, such as knowledge of underwriting processes or risk assessment tools.

- Showcase leadership abilities by detailing experiences in managing teams or mentoring junior agents.

- Use action verbs to convey a proactive approach and emphasize contributions to team successes.

- Align experiences with industry standards and best practices to demonstrate familiarity with market trends.

- Incorporate customer feedback or testimonials to validate the effectiveness of your sales strategies.

- Tailor the work experience section to match the specific requirements of the job you are applying for.

- Include a mix of both individual and collaborative achievements to illustrate versatility.

Example Work Experiences for Insurance Sales Agent

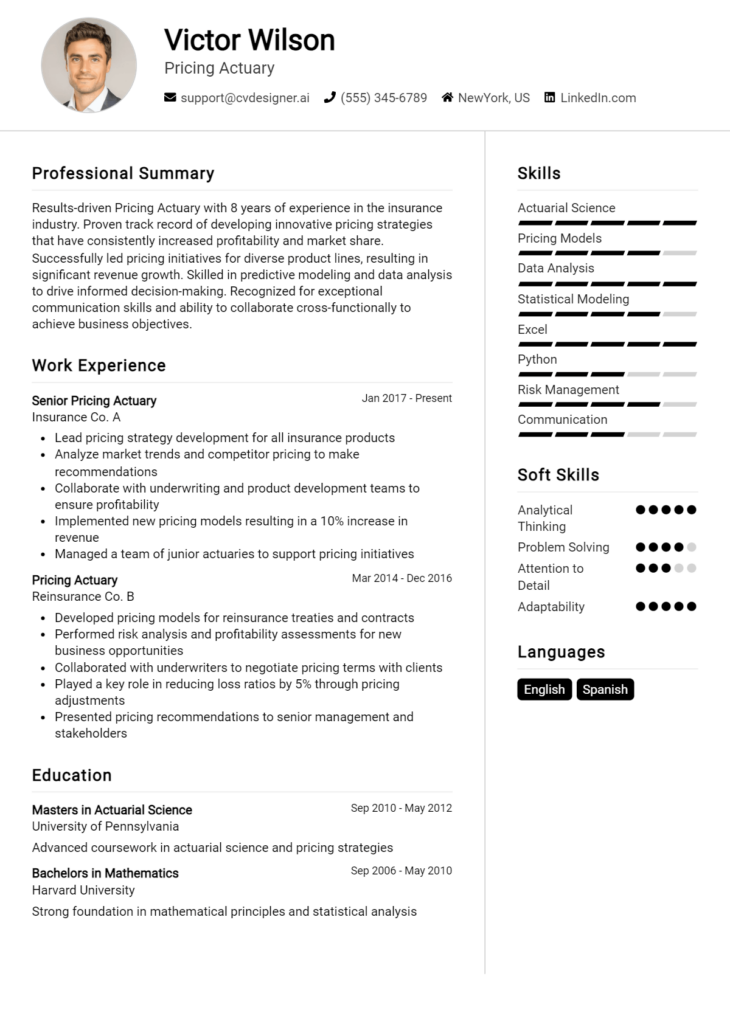

Strong Experiences

- Increased annual sales by 35% through targeted marketing strategies and personalized client interactions, resulting in a revenue boost of $150,000.

- Led a team of 5 agents, implementing training programs that improved closing rates by 20% and enhanced customer satisfaction scores by 15%.

- Developed and executed a comprehensive client onboarding process that reduced policy cancellation rates by 30% within the first year.

Weak Experiences

- Responsible for selling insurance policies and handling customer inquiries.

- Worked with a team to achieve sales goals.

- Managed client accounts and provided assistance when needed.

The examples of strong experiences are characterized by their use of quantifiable outcomes, showcasing specific achievements that demonstrate the candidate's effectiveness and impact on the company's success. In contrast, the weak experiences lack detail and measurable results, making them less compelling and failing to illustrate the candidate's skills and contributions effectively. Strong experiences convey a clear narrative of success and expertise, while weak experiences appear vague and uninspiring.

Education and Certifications Section for Insurance Sales Agent Resume

The education and certifications section of an Insurance Sales Agent resume plays a crucial role in showcasing the candidate's academic credentials and commitment to the insurance industry. This section not only reflects the foundational knowledge acquired through formal education but also highlights specialized certifications that are vital for success in the field. By outlining relevant coursework, industry-recognized certifications, and any ongoing professional development, candidates can significantly enhance their credibility and demonstrate their alignment with the specific requirements of the role. This information reassures employers of the candidate's preparedness and dedication to staying current in a constantly evolving industry.

Best Practices for Insurance Sales Agent Education and Certifications

- Focus on relevant degrees and certifications that pertain specifically to the insurance industry.

- Include details about specialized training or workshops that enhance your skill set.

- List certifications in order of relevance, emphasizing those most recognized within the industry.

- Provide context for certifications, such as the duration of the program or the skills gained.

- Highlight any honors or distinctions received during educational pursuits.

- Keep the section concise, ensuring that only the most pertinent information is included.

- Use clear formatting to make the information easy to read and navigate.

- Regularly update this section to reflect any recent achievements or new certifications obtained.

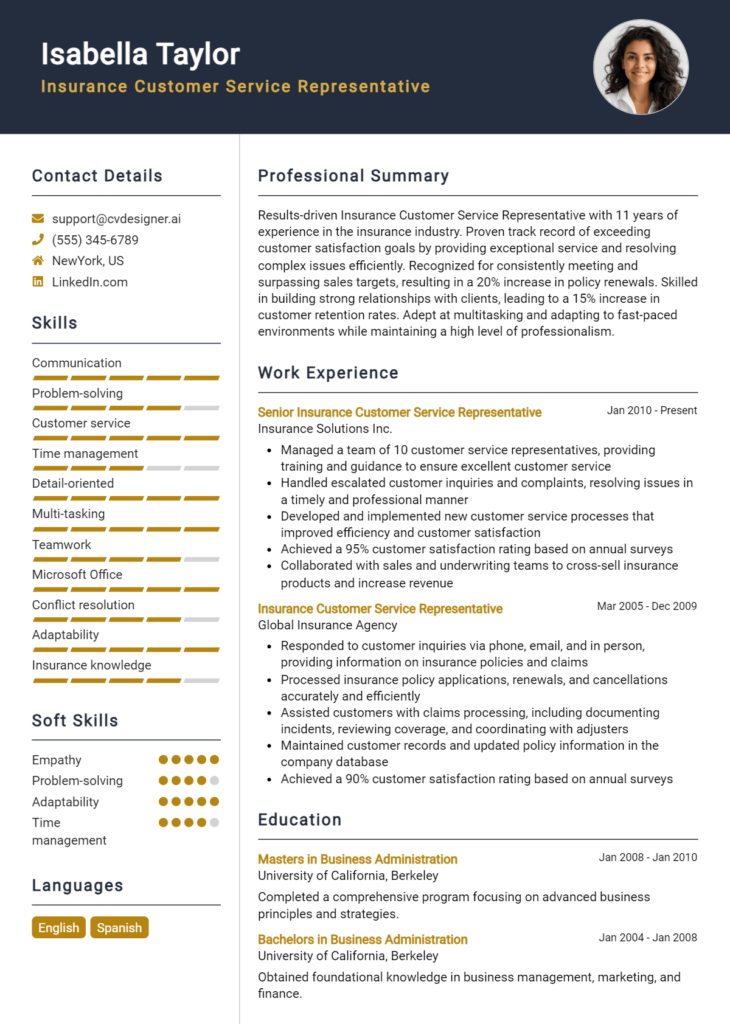

Example Education and Certifications for Insurance Sales Agent

Strong Examples

- Bachelor of Science in Business Administration with a concentration in Finance, University of XYZ, 2020

- Licensed Insurance Agent, State of ABC (Life & Health, Property & Casualty), 2021

- Certified Insurance Counselor (CIC), National Alliance for Insurance Education & Research, 2022

- Completed coursework in Risk Management and Insurance, University of XYZ, 2019

Weak Examples

- Associate Degree in General Studies, Community College of ABC, 2015

- Certification in Microsoft Office, 2018

- High School Diploma, XYZ High School, 2012

- Outdated designation in Life Insurance, from 2010

The strong examples are considered effective as they directly align with the requirements and expectations of the Insurance Sales Agent role, showcasing relevant education and certifications that enhance professional credibility. In contrast, the weak examples highlight qualifications that lack direct relevance to the insurance industry, demonstrating outdated or general skills that do not contribute to the candidate's suitability for the position. This distinction is essential for making a compelling case to potential employers.

Top Skills & Keywords for Insurance Sales Agent Resume

As an Insurance Sales Agent, possessing the right skills is crucial for building a successful career in this competitive field. A well-crafted resume highlighting both hard and soft skills can significantly enhance your chances of landing a job. Employers look for candidates who not only have the technical knowledge required to understand various insurance products but also possess interpersonal skills that enable them to build and maintain client relationships. By showcasing your skills effectively, you demonstrate your capability to meet client needs, navigate complex situations, and contribute positively to the company's objectives. For more insights on how to present your skills effectively, check out this guide on skills.

Top Hard & Soft Skills for Insurance Sales Agent

Soft Skills

- Communication Skills

- Active Listening

- Problem-Solving

- Empathy

- Negotiation Skills

- Time Management

- Adaptability

- Customer Service Orientation

- Persuasiveness

- Relationship Building

Hard Skills

- Knowledge of Insurance Products

- Sales Techniques

- Risk Assessment

- Market Analysis

- Compliance Regulations

- Policy Underwriting

- Claims Processing

- Financial Literacy

- CRM Software Proficiency

- Data Analysis

Incorporating these essential skills into your resume can effectively showcase your qualifications and experiences, helping you stand out to potential employers. Additionally, detailing your work experience related to these skills can further enhance your application and demonstrate your readiness for the role.

Stand Out with a Winning Insurance Sales Agent Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Insurance Sales Agent position at [Company Name] as advertised on [Job Board/Company Website]. With a solid background in sales and a deep understanding of insurance products, I am excited about the opportunity to contribute to your team. My passion for providing exceptional customer service, combined with my ability to identify clients' needs, makes me a strong candidate for this role.

In my previous role as a Sales Associate at [Previous Company Name], I consistently exceeded sales targets by leveraging my in-depth knowledge of various insurance products, including auto, home, and life insurance. I developed strong relationships with clients by actively listening to their concerns and tailoring insurance solutions to meet their unique needs. My commitment to transparency and integrity has earned me a reputation for building trust, which I believe is essential in the insurance industry.

I am particularly drawn to the mission of [Company Name] to provide personalized insurance solutions that empower clients to protect their assets and achieve peace of mind. I am eager to bring my skills in relationship-building and problem-solving to your team. I am confident that my proactive approach to sales and ability to adapt to diverse client scenarios will contribute positively to your agency’s growth and success.

Thank you for considering my application. I look forward to the opportunity to further discuss how my experience and enthusiasm for the insurance industry align with the goals of [Company Name]. I am excited about the possibility of working together to provide clients with the exceptional service they deserve.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Insurance Sales Agent Resume

When crafting a resume for the role of an Insurance Sales Agent, it is crucial to present your qualifications and experiences in the best light possible. However, many candidates make common mistakes that can hinder their chances of securing an interview. By avoiding these pitfalls, you can create a more effective resume that stands out to potential employers.

Lack of Specificity: Failing to tailor your resume to the specific insurance role can make it seem generic. Use keywords from the job description to highlight relevant skills and experiences.

Ignoring Quantifiable Achievements: Many candidates list duties without showcasing achievements. Instead of stating you "managed client accounts," say you "increased client retention rates by 20% over one year."

Excessive Length: A resume that is too long can overwhelm hiring managers. Aim for a one-page resume unless you have extensive experience; keep it concise and relevant.

Poor Formatting: A cluttered or disorganized resume can be off-putting. Use clean formatting, bullet points, and clear headings to improve readability.

Typos and Grammatical Errors: Mistakes in spelling or grammar can give a negative impression. Always proofread your resume or have someone else review it to catch any errors.

Lack of Professional Summary: Omitting a professional summary can make it harder for hiring managers to quickly understand your value. Include a brief overview highlighting your key skills and experiences.

Overemphasis on Responsibilities: Simply listing job responsibilities without discussing how you excelled in those roles can weaken your resume. Focus on how your actions led to successful outcomes.

Neglecting Soft Skills: Insurance sales agents require strong interpersonal skills. Failing to highlight traits like communication, empathy, and negotiation can make your application less compelling.

Conclusion

As we wrap up our discussion on the vital role of an Insurance Sales Agent, it's important to reflect on the key aspects that make this position both challenging and rewarding. Insurance Sales Agents are responsible for developing client relationships, understanding their unique needs, and providing tailored insurance solutions. This role requires strong communication skills, a deep understanding of various insurance products, and the ability to navigate complex regulations. Additionally, a successful agent must be adept at prospecting new clients and maintaining existing accounts, ensuring customer satisfaction and loyalty.

In light of these responsibilities, it's crucial to present yourself effectively in your resume. A polished resume can make a significant difference in how potential employers perceive your qualifications. Take a moment to review your Insurance Sales Agent resume and ensure it highlights your skills, experience, and achievements in a compelling manner.

To assist you in this process, consider utilizing the following resources:

- Explore a variety of resume templates to find a design that suits your style and profession.

- Use our resume builder to create a professional resume that stands out.

- Check out resume examples for inspiration and guidance on how to structure your content.

- Don't forget to complement your resume with a strong application by crafting a personalized cover letter using our cover letter templates.

Take action today to refine your resume and enhance your job prospects in the competitive field of insurance sales!