Top 29 Hard and Soft Skills for 2025 Foreign Exchange Trader Resumes

As a Foreign Exchange Trader, possessing the right skills is crucial for success in the fast-paced and dynamic world of forex trading. Highlighting your expertise in key areas can make a significant difference in attracting potential employers and demonstrating your capability to navigate the complexities of currency markets. Below, we outline the essential skills that should be featured on your resume to showcase your qualifications and enhance your appeal as a candidate in this competitive field.

Best Foreign Exchange Trader Technical Skills

Technical skills play a crucial role in the success of a Foreign Exchange Trader. Mastering these skills enables traders to analyze market trends, execute trades effectively, and manage risks associated with currency trading. Highlighting these competencies on your resume can significantly enhance your appeal to potential employers.

Market Analysis

Market analysis involves evaluating various factors that impact currency prices, including economic indicators, geopolitical events, and market sentiment. This skill is essential for making informed trading decisions.

How to show it: Detail specific analysis strategies you employed, such as technical analysis or fundamental analysis, and illustrate how they contributed to profitable trades or minimized losses.

Technical Analysis

Technical analysis focuses on historical price movements to predict future trends. It uses charts and indicators to identify entry and exit points for trades.

How to show it: Include examples of trading strategies you developed using technical analysis, highlighting measurable outcomes like percentage returns or successful trade ratios.

Risk Management

Risk management is vital for protecting capital and minimizing potential losses. This skill involves setting stop-loss orders and managing position sizes based on market volatility.

How to show it: Quantify how your risk management strategies saved or gained capital during volatile market conditions, such as specifying the percentage of capital protected.

Order Execution

Order execution is the process of placing buy or sell orders in the market. Quick and accurate execution can significantly impact trading performance and profitability.

How to show it: Provide statistics on your order execution speed and accuracy, linking them to successful trades or reduced slippage costs.

Algorithmic Trading

Algorithmic trading involves using automated systems to execute trades based on predefined criteria. This skill enhances trading efficiency and can capitalize on market opportunities quickly.

How to show it: Describe any algorithms you have created or used, and include metrics on their performance, such as profit margins or trade volume.

Charting Software Proficiency

Proficiency in charting software enables traders to visualize market data effectively. It aids in analyzing trends and making informed decisions based on graphical representations of data.

How to show it: List specific charting software tools you are proficient in and provide examples of how they helped you identify successful trading opportunities.

Fundamental Analysis

Fundamental analysis evaluates economic indicators, interest rates, and news events to forecast currency movements. It is essential for understanding the broader economic landscape.

How to show it: Showcase specific cases where your fundamental analysis accurately predicted market shifts, detailing the impact on your trading results.

Portfolio Management

Portfolio management involves managing a collection of investments to achieve specific financial goals while balancing risk. This skill is key for long-term trading success.

How to show it: Highlight the performance metrics of your managed portfolio, such as overall returns or risk-adjusted return ratios over a given time period.

Economic Indicator Awareness

Awareness of economic indicators helps traders anticipate market movements. Understanding how indicators like GDP, unemployment rates, and inflation impact currencies is crucial.

How to show it: Reference specific instances where your knowledge of economic indicators influenced your trading decisions and the resulting outcomes.

Currency Pair Correlation

Understanding the correlation between currency pairs enables traders to develop strategies that capitalize on interdependencies in the forex market.

How to show it: Provide examples of trades where you leveraged currency correlations to enhance profitability, specifying the pairs involved and the results achieved.

Software and Trading Platforms

Familiarity with trading platforms and software is essential for executing trades efficiently. Mastery of these tools can enhance trading performance and efficiency.

How to show it: List the trading platforms you are experienced with and describe how your proficiency led to improved trading outcomes.

Best Foreign Exchange Trader Soft Skills

In the fast-paced and volatile world of foreign exchange trading, possessing strong soft skills is just as important as having technical knowledge. These workplace skills enhance a trader's ability to make informed decisions, communicate effectively, and work collaboratively, ultimately leading to greater success in trading activities.

Communication

Effective communication is vital for foreign exchange traders, as it enables them to articulate strategies, share insights, and collaborate with team members and clients.

How to show it: Highlight instances where you successfully communicated complex trading strategies to clients or colleagues. Use metrics to show how your communication improved team performance or client satisfaction.

Problem-solving

The ability to quickly analyze situations and devise effective solutions is crucial for traders, especially when facing unexpected market changes.

How to show it: Provide examples of specific challenges you encountered and the innovative solutions you implemented. Quantify the results to demonstrate the effectiveness of your problem-solving skills.

Time Management

Foreign exchange traders must efficiently manage their time to monitor multiple markets, execute trades, and analyze data without compromising performance.

How to show it: Detail your ability to prioritize tasks and meet deadlines under pressure. Include metrics that showcase how your time management led to increased productivity or improved trading results.

Teamwork

Collaboration with colleagues is essential in trading environments where sharing insights and strategies can lead to better decision-making and outcomes.

How to show it: Illustrate your experience working in team settings, emphasizing your role and contributions. Use success stories to demonstrate how teamwork led to achieving trading goals or overcoming challenges.

Adaptability

The foreign exchange market is constantly changing, and being adaptable allows traders to respond effectively to new information and market conditions.

How to show it: Share examples of how you successfully adjusted your strategies in response to market shifts. Quantify the impact of your adaptability on trade outcomes.

Analytical Thinking

Traders need strong analytical skills to assess market trends, interpret data, and make informed decisions based on their analyses.

How to show it: Highlight your experience in data analysis and how it contributed to successful trading strategies. Provide specific metrics or outcomes to demonstrate your analytical prowess.

Attention to Detail

Precision is key in foreign exchange trading, as small errors can lead to significant financial losses. Attention to detail helps traders minimize risks.

How to show it: Include examples of how your attention to detail led to successful trade executions or error reductions. Quantify your achievements to support your claims.

Emotional Intelligence

Understanding and managing emotions, both yours and those of others, can significantly impact decision-making and stress management in trading.

How to show it: Discuss experiences where your emotional intelligence positively affected team dynamics or trading outcomes. Use specific examples to illustrate your capability.

Negotiation Skills

Strong negotiation skills can lead to better deal terms and improved relationships with clients and brokers in the trading industry.

How to show it: Share specific instances where your negotiation skills resulted in favorable outcomes. Include quantifiable results to enhance your credibility.

Critical Thinking

Critical thinking enables traders to assess complex scenarios and make decisions based on logical reasoning and sound judgment.

How to show it: Provide examples of how your critical thinking led to successful trades or risk management strategies. Quantify the benefits of your decision-making processes.

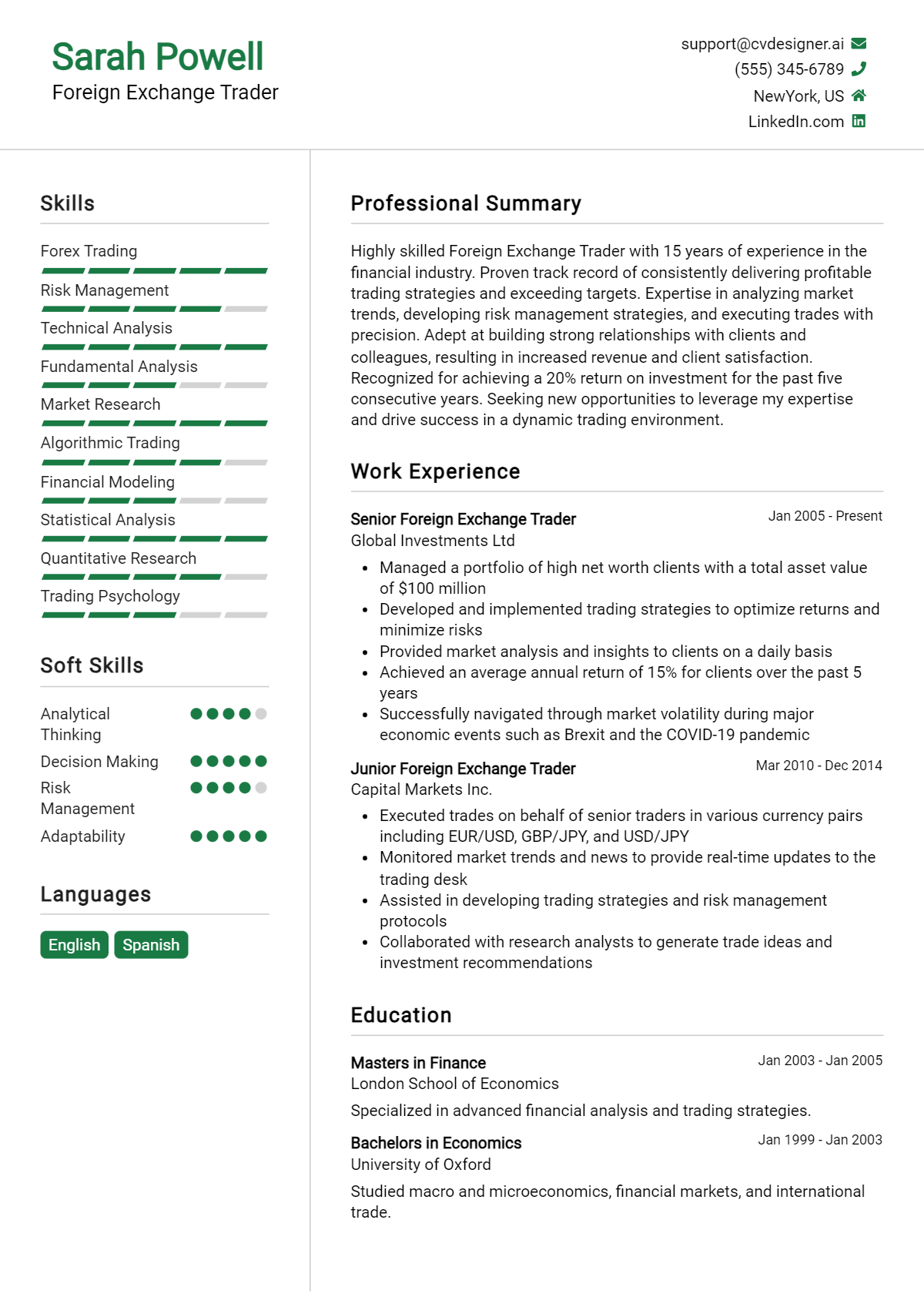

How to List Foreign Exchange Trader Skills on Your Resume

Effectively listing your skills on a resume is crucial to stand out to employers, particularly in competitive fields like foreign exchange trading. There are three main sections where skills can be highlighted: Resume Summary, Resume Work Experience, and the Resume Skills Section, as well as the Cover Letter.

for Resume Summary

Showcasing your Foreign Exchange Trader skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications. This is your chance to make a strong first impression.

Example

Analytical thinking, risk management, and market analysis are my core strengths as a Foreign Exchange Trader, enabling me to make informed decisions and capitalize on market trends effectively.

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how your Foreign Exchange Trader skills have been applied in real-world scenarios. Use this space to match your experience with specific skills mentioned in job listings.

Example

- Executed daily trades in foreign exchange markets, leveraging technical analysis to optimize profit margins.

- Maintained a risk management strategy that resulted in a 20% reduction in losses year-over-year.

- Collaborated with a team to develop trading algorithms, enhancing trading efficiency by 30%.

- Utilized market research skills to provide insights that informed trading strategies and decisions.

for Resume Skills

The skills section can either showcase technical or transferable skills. It’s essential to include a balanced mix of hard and soft skills that strengthen your overall qualifications.

Example

- Technical Analysis

- Risk Management

- Market Research

- Trade Execution

- Data Analysis

- Communication Skills

- Decision Making

- Financial Modeling

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate how those skills have positively impacted your previous roles.

Example

In my previous role as a Foreign Exchange Trader, my technical analysis and risk management skills led to a consistent increase in profitability, achieving an average annual return of 15%. I am eager to bring this expertise to your organization and contribute to your trading success.

Remember to link the skills mentioned in your resume to specific achievements in your cover letter, reinforcing your qualifications for the job.

The Importance of Foreign Exchange Trader Resume Skills

In the competitive field of foreign exchange trading, a well-structured resume that highlights relevant skills is crucial for standing out to recruiters. A carefully crafted skills section not only showcases a candidate's expertise but also aligns their qualifications with the specific requirements of the job. This alignment is essential in demonstrating to potential employers that the candidate possesses the necessary competencies to succeed in a fast-paced trading environment.

- Effective communication skills are vital for a Foreign Exchange Trader, as they need to articulate complex market trends and insights clearly to stakeholders. This ability enhances collaboration within teams and ensures that strategies are understood and executed properly.

- A strong analytical mindset is crucial for evaluating market data and making informed trading decisions. Traders must demonstrate proficiency in analyzing charts, economic indicators, and global events that influence currency fluctuations.

- Risk management skills are essential for minimizing potential losses in trading. Candidates should highlight their ability to implement strategies that safeguard investments and manage exposure to various currencies effectively.

- Technical proficiency in trading platforms and software is increasingly important in today's digital trading landscape. Familiarity with tools that assist in analysis and execution can give candidates a competitive edge.

- Attention to detail is a critical skill for a Foreign Exchange Trader, as even minor discrepancies can lead to significant financial repercussions. Candidates should emphasize their meticulous nature in reviewing trades and market conditions.

- Adaptability and quick decision-making abilities are crucial in the dynamic world of forex trading. Candidates must showcase their capacity to respond swiftly to changing market conditions and emerging trends.

- Knowledge of global economies and geopolitical factors can significantly impact trading strategies. Candidates should highlight their understanding of how these elements influence currency movements, demonstrating their comprehensive market awareness.

- Networking and relationship-building skills can play a pivotal role in a trader's success. Highlighting the ability to forge connections with industry professionals can open doors to lucrative opportunities and market insights.

For additional insights and examples, consider exploring Resume Samples that align with the Foreign Exchange Trader role.

How To Improve Foreign Exchange Trader Resume Skills

In the fast-paced world of foreign exchange trading, staying ahead of the curve is crucial for success. Continuous skill improvement not only enhances trading performance but also makes a trader more attractive to potential employers. As the forex market evolves, so too must the strategies and techniques employed by traders. Here are some actionable tips to help you enhance your skills and stand out in your resume.

- Engage in Regular Market Analysis: Dedicate time to analyze currency trends and market news to sharpen your analytical skills.

- Take Advanced Trading Courses: Enroll in online courses or workshops that focus on advanced trading strategies and risk management techniques.

- Practice with Demo Accounts: Utilize demo trading accounts to practice strategies without the financial risk, allowing for real-time skill improvement.

- Stay Updated with Financial News: Follow reputable financial news sources to keep abreast of global economic events that may impact currency markets.

- Network with Other Traders: Join trading forums or groups to exchange insights and learn from the experiences of other traders.

- Implement a Trading Journal: Maintain a trading journal to document your trades, strategies, and outcomes for continual learning and adjustment.

- Utilize Trading Tools and Software: Familiarize yourself with trading platforms and software that can enhance your trading efficiency and decision-making process.

Frequently Asked Questions

What are the essential skills for a Foreign Exchange Trader?

A Foreign Exchange Trader should possess strong analytical skills, which enable them to assess market trends and make informed trading decisions. Additionally, proficiency in technical analysis, familiarity with trading platforms, and understanding of economic indicators are crucial. Effective risk management and decision-making skills are also essential, along with the ability to remain calm under pressure and adapt to rapidly changing market conditions.

How important is knowledge of global economics for a Foreign Exchange Trader?

Knowledge of global economics is vital for a Foreign Exchange Trader as currency values are heavily influenced by economic indicators such as interest rates, inflation, and employment data. Understanding how these factors interact within different economies helps traders predict currency movements and make strategic trading decisions that align with global economic trends.

What role does technical analysis play in Forex trading?

Technical analysis is a critical skill for Foreign Exchange Traders as it involves the use of historical price data and charts to identify patterns and trends in currency movements. By applying various indicators and tools, traders can forecast potential price movements and determine optimal entry and exit points for their trades, enhancing the likelihood of profitable outcomes.

How does risk management factor into a Foreign Exchange Trader's skill set?

Risk management is a fundamental skill for Foreign Exchange Traders, as it involves identifying, analyzing, and mitigating potential losses. Traders must develop strategies to protect their capital, such as setting stop-loss orders and maintaining a balanced portfolio. Effective risk management helps traders maintain discipline, avoid emotional decision-making, and ultimately achieve long-term trading success.

What soft skills are beneficial for a Foreign Exchange Trader?

In addition to technical skills, soft skills play a significant role in a Foreign Exchange Trader's success. Communication skills are essential for collaborating with team members and sharing insights. Emotional intelligence helps traders manage stress and maintain focus during high-pressure situations. Moreover, adaptability and a strong work ethic are important for continuously learning and evolving in the fast-paced Forex market.

Conclusion

Including Foreign Exchange Trader skills in your resume is crucial for standing out in a competitive job market. By showcasing relevant skills such as market analysis, risk management, and trading strategies, candidates can demonstrate their value to potential employers and highlight their expertise in the foreign exchange sector. Remember, a well-crafted resume not only reflects your qualifications but also opens doors to new opportunities. So, take the time to refine your skills and enhance your application to make a lasting impression.

For further assistance in polishing your resume, explore our resume templates, utilize our resume builder, check out resume examples, and enhance your job application with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.