Foreign Exchange Trader Core Responsibilities

A Foreign Exchange Trader is responsible for buying and selling currency pairs to capitalize on market fluctuations, requiring strong analytical skills and a deep understanding of economic indicators. This role bridges finance, risk management, and compliance, necessitating technical proficiency in trading platforms and operational insight into market trends. Problem-solving abilities are crucial for navigating volatility and executing strategies aligned with organizational goals. A well-structured resume that highlights these competencies can effectively showcase a trader's qualifications, enhancing their appeal to potential employers.

Common Responsibilities Listed on Foreign Exchange Trader Resume

- Conducting market analysis to identify trading opportunities

- Executing buy and sell orders in various currency pairs

- Monitoring global economic news and financial events

- Developing and implementing trading strategies

- Managing risk through effective position sizing and stop-loss orders

- Collaborating with compliance and operations teams for regulatory adherence

- Utilizing trading platforms and software for market analysis

- Maintaining detailed records of trades and performance metrics

- Communicating market insights and forecasts to stakeholders

- Adapting strategies based on changing market conditions

- Performing technical analysis to predict price movements

- Building and maintaining relationships with brokers and financial institutions

High-Level Resume Tips for Foreign Exchange Trader Professionals

In the competitive world of foreign exchange trading, a well-crafted resume is essential for professionals seeking to make their mark. Your resume is often the first impression you make on a potential employer, and it serves as your marketing tool to showcase your skills and achievements in a fast-paced financial environment. It needs to effectively reflect not just your qualifications but also your understanding of the market dynamics and trading strategies. This guide will provide practical and actionable resume tips specifically tailored for Foreign Exchange Trader professionals, ensuring that your application stands out in a crowded field.

Top Resume Tips for Foreign Exchange Trader Professionals

- Tailor your resume to the job description, using keywords and phrases from the listing to demonstrate your alignment with the role.

- Highlight relevant experience by detailing your trading history, including specific markets, currencies, and trading strategies employed.

- Quantify your achievements, such as profit margins, percentage increases in portfolio value, or successful trades executed, to showcase your impact.

- Include industry-specific skills, such as technical analysis, risk management, and familiarity with trading platforms like MetaTrader or Bloomberg.

- Demonstrate continuous learning by mentioning certifications, courses, or seminars relevant to foreign exchange trading.

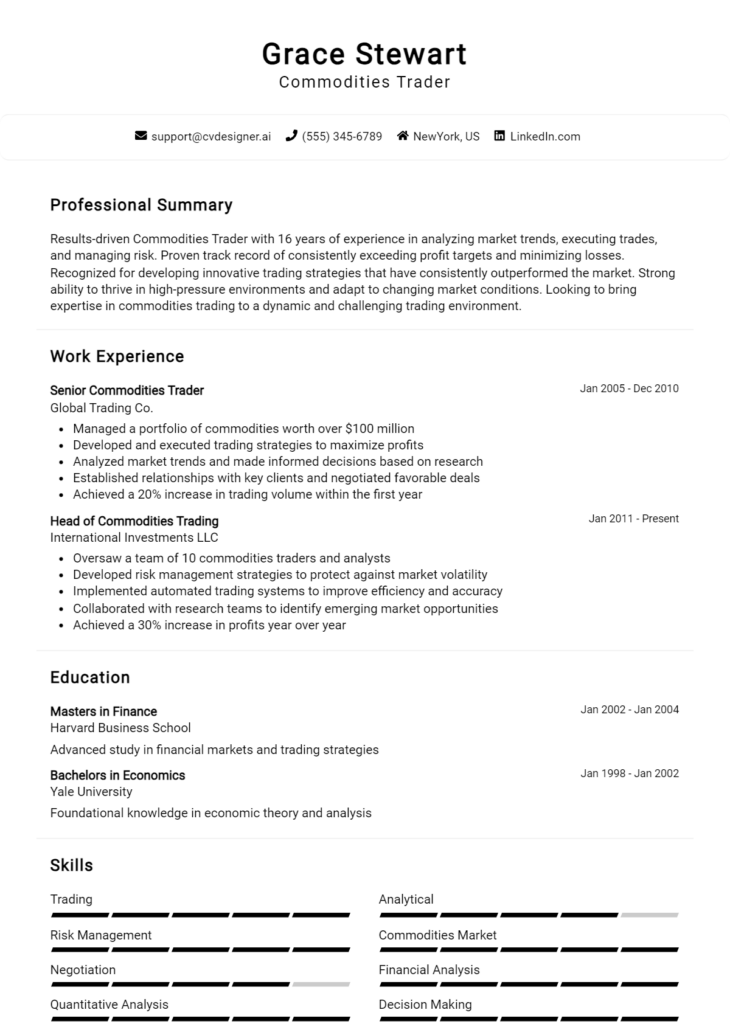

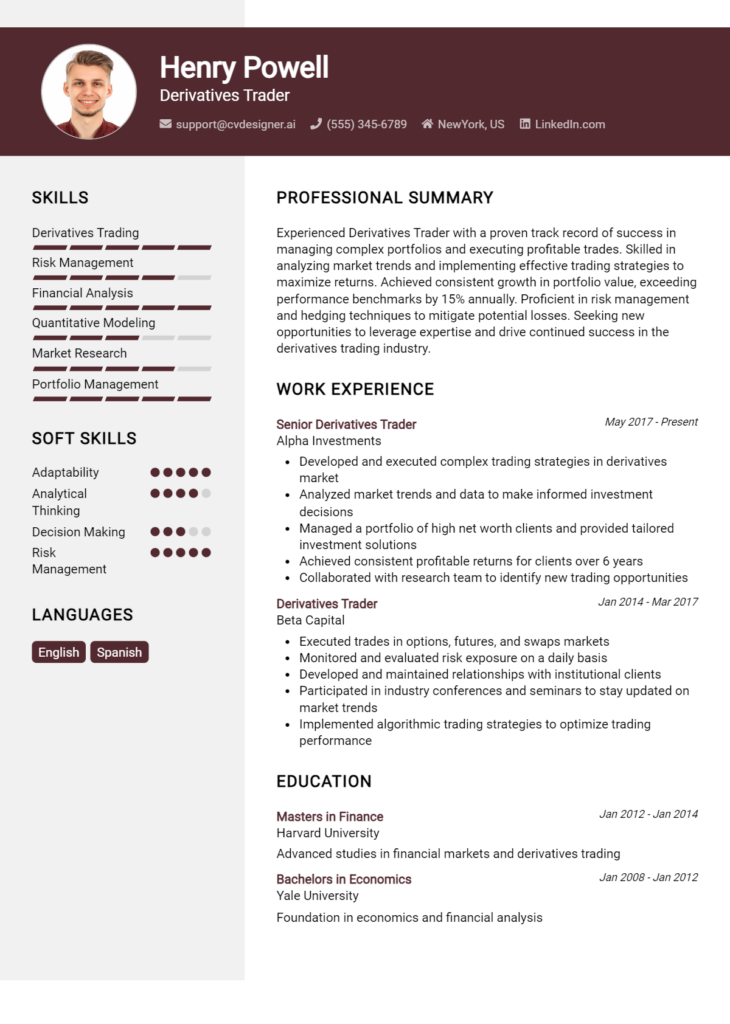

- Utilize a clean and professional format that enhances readability and allows key information to stand out.

- Incorporate soft skills such as analytical thinking, decision-making under pressure, and effective communication that are crucial in trading environments.

- Keep the resume concise, focusing on the most relevant information and limiting it to one or two pages.

- Include a section for professional affiliations or memberships, such as the CFA Institute or local trading clubs, to show your commitment to the industry.

By implementing these tailored resume tips, Foreign Exchange Trader professionals can significantly enhance their chances of landing a desirable position in the field. A thoughtfully constructed resume not only highlights your qualifications but also conveys your passion for trading and your readiness to contribute to a potential employer’s success.

Why Resume Headlines & Titles are Important for Foreign Exchange Trader

In the competitive world of foreign exchange trading, a well-crafted resume headline or title can serve as a powerful first impression. It is the first element hiring managers see, and it has the potential to immediately capture their attention while summarizing a candidate's key qualifications in a succinct and impactful manner. A strong headline should be concise, relevant, and tailored to the specific role being applied for, effectively showcasing the candidate's unique value proposition. By doing so, it sets the tone for the rest of the resume and encourages hiring managers to delve deeper into the applicant's experience and skills.

Best Practices for Crafting Resume Headlines for Foreign Exchange Trader

- Keep it concise: Aim for one to two impactful phrases.

- Be role-specific: Use terminology that reflects the foreign exchange trading industry.

- Highlight key skills: Include specific skills relevant to foreign exchange trading, such as risk management or technical analysis.

- Showcase achievements: Consider mentioning measurable accomplishments or results.

- Use action-oriented language: Start with strong action verbs that convey confidence and expertise.

- Tailor for each application: Customize your headline for each job to align with the job description.

- Avoid jargon: Ensure clarity by avoiding overly technical terms that may confuse non-specialized hiring managers.

- Make it eye-catching: Use formatting techniques such as capitalization or strategic wording to draw attention.

Example Resume Headlines for Foreign Exchange Trader

Strong Resume Headlines

"Results-Driven Foreign Exchange Trader with 7+ Years of Proven Success in High-Volume Markets"

“Expert in Currency Risk Management and Technical Analysis, Delivering Consistent Profitability”

“Dynamic Forex Trader Specializing in Algorithmic Trading and Market Forecasting”

Weak Resume Headlines

“Trader Looking for Opportunities”

“Experienced Professional”

The strong headlines are effective because they provide specific information about the candidate's experience, skills, and accomplishments, making a compelling case for their suitability for the role. In contrast, the weak headlines fail to impress as they lack specificity and clarity, making it difficult for hiring managers to assess the candidate's qualifications quickly. By avoiding generic phrases and instead focusing on relevant strengths, candidates can significantly enhance their chances of making a positive impression.

Writing an Exceptional Foreign Exchange Trader Resume Summary

A well-crafted resume summary is crucial for a Foreign Exchange Trader, as it serves as the first impression for hiring managers who often sift through numerous applications. A strong summary quickly captures attention by highlighting key skills, relevant experience, and notable accomplishments that align with the job role. It should be concise, impactful, and tailored to the specific position the candidate is applying for, setting the stage for the rest of the resume and demonstrating the candidate’s suitability for the role.

Best Practices for Writing a Foreign Exchange Trader Resume Summary

- Quantify Achievements: Use specific numbers to illustrate past successes, such as percentage gains or profits generated.

- Focus on Relevant Skills: Highlight critical skills such as technical analysis, risk management, and market research.

- Tailor for the Job Description: Customize the summary to reflect the requirements and language used in the job posting.

- Be Concise: Aim for 2-4 sentences that deliver maximum impact without unnecessary fluff.

- Use Action Verbs: Start sentences with strong action verbs to convey competence and initiative.

- Showcase Industry Knowledge: Mention familiarity with trading platforms, tools, or specific currencies to demonstrate expertise.

- Highlight Problem-Solving Abilities: Include examples of how you navigated market challenges effectively.

- Maintain Professional Tone: Ensure the summary reflects a professional demeanor suitable for the finance industry.

Example Foreign Exchange Trader Resume Summaries

Strong Resume Summaries

Results-driven Foreign Exchange Trader with over 5 years of experience in the global forex market, consistently achieving a 15% annual return on investment through strategic trading and risk management. Proficient in using MetaTrader 4 and TradingView to analyze market trends and execute trades effectively.

Dynamic Forex Trader with a proven track record of generating over $2 million in profit for clients through expert analysis and risk mitigation strategies. Skilled in developing algorithmic trading strategies and adept at both technical and fundamental analysis.

Analytical Foreign Exchange Trader with 7 years of experience managing multi-million dollar portfolios. Successfully increased client portfolios by 30% in volatile market conditions through disciplined trading and thorough market research.

Weak Resume Summaries

Experienced trader looking for a position in foreign exchange. I have a background in finance and am eager to learn more.

Foreign Exchange Trader with a general understanding of the market. I am a team player and willing to collaborate.

The examples of strong resume summaries are considered effective because they provide specific outcomes, quantify achievements, and demonstrate a clear understanding of the skills relevant to the Foreign Exchange Trader role. In contrast, the weak summaries lack detail, fail to showcase any measurable success, and come across as generic, which does not capture the interest of hiring managers or highlight the candidate's qualifications effectively.

Work Experience Section for Foreign Exchange Trader Resume

The work experience section is a crucial component of a Foreign Exchange Trader resume, as it provides prospective employers with insights into a candidate's practical skills and expertise in the dynamic world of forex trading. This section effectively showcases the technical skills acquired through previous roles, highlighting the candidate's ability to analyze market trends, execute trades, and manage risk effectively. Additionally, it reflects the candidate's capacity to collaborate with teams, fostering a culture of high performance and delivering exceptional results. Quantifying achievements—such as increased profitability percentages or reduced trade execution times—and aligning experiences with industry standards is essential to demonstrate the candidate's value to potential employers.

Best Practices for Foreign Exchange Trader Work Experience

- Quantify your achievements with specific metrics, such as profit margins, return on investment, or trade volume.

- Highlight technical skills relevant to forex trading, including familiarity with trading platforms and analytical tools.

- Demonstrate leadership by detailing experiences where you managed a trading team or led significant trading initiatives.

- Showcase collaboration by mentioning cross-functional projects or partnerships that enhanced trading strategies.

- Use industry-specific terminology to align your experiences with the expectations of potential employers.

- Tailor your work experience descriptions to match the job requirements outlined in the job posting.

- Include continuous professional development, such as certifications or training related to forex trading.

- Focus on results-oriented language that highlights the impact of your contributions.

Example Work Experiences for Foreign Exchange Trader

Strong Experiences

- Increased portfolio profitability by 30% over 12 months by implementing advanced trading algorithms and risk management strategies.

- Led a team of five traders in executing a high-frequency trading strategy, resulting in a 25% reduction in trade execution time and a 15% increase in overall revenue.

- Collaborated with quantitative analysts to develop predictive models that improved trade accuracy, contributing to a 20% rise in successful trades within the first quarter.

- Trained and mentored junior traders, enhancing team performance and achieving a 40% improvement in their trading outcomes over six months.

Weak Experiences

- Responsible for trading activities without specifying the outcomes or impact on the company's bottom line.

- Worked on a trading team; however, no details on contributions or achievements were provided.

- Engaged in forex trading tasks but failed to quantify results or describe specific technical skills utilized.

- Participated in meetings about trading strategies with no mention of the role played or results achieved.

The examples of strong experiences are characterized by their specificity and quantifiable results, demonstrating the candidate's technical expertise and leadership in the forex trading domain. In contrast, the weak experiences lack detail, metrics, and clear outcomes, making it difficult for potential employers to assess the candidate's effectiveness and contributions in previous roles. Strong experiences reflect a proactive approach to trading and collaboration, while weak experiences fail to convey meaningful impact.

Education and Certifications Section for Foreign Exchange Trader Resume

The education and certifications section of a Foreign Exchange Trader resume is crucial as it showcases the candidate's academic background, relevant industry certifications, and commitment to continuous learning. This section not only provides potential employers with insight into the candidate's foundational knowledge in finance, economics, and trading strategies, but it also highlights any specialized training or certifications that can enhance credibility. By including relevant coursework and recognized credentials, candidates can significantly improve their alignment with the job role and demonstrate their preparedness for the challenges of the foreign exchange market.

Best Practices for Foreign Exchange Trader Education and Certifications

- Focus on relevant degrees in finance, economics, or business administration.

- Highlight industry-recognized certifications such as CFA, CMT, or FDM.

- Include any specialized training related to forex trading or risk management.

- List relevant coursework that demonstrates your understanding of market analysis and trading strategies.

- Be specific about the level of your education (e.g., Bachelor's, Master's, etc.).

- Keep the information up-to-date and remove any outdated qualifications.

- Use clear and concise language to convey your qualifications effectively.

- Consider including online courses or workshops that are relevant to current market trends.

Example Education and Certifications for Foreign Exchange Trader

Strong Examples

- Bachelor of Science in Finance, University of XYZ, 2020

- Chartered Financial Analyst (CFA) Level I, 2021

- Certified Market Technician (CMT), 2022

- Advanced Forex Trading Strategies Course, Online Academy, 2023

Weak Examples

- Bachelor of Arts in History, University of ABC, 2015

- Basic Computer Skills Certificate, 2019

- High School Diploma, 2012

- Certificate in Photography, 2020

The strong examples are considered effective because they directly relate to the skills and knowledge required for a Foreign Exchange Trader position, showcasing relevant degrees and recognized certifications that enhance the candidate's profile. In contrast, the weak examples lack relevance to the trading role, either due to their focus on unrelated fields or because they represent outdated qualifications that do not contribute to the candidate’s credibility in the forex market.

Top Skills & Keywords for Foreign Exchange Trader Resume

The role of a Foreign Exchange Trader demands a unique blend of skills that can make or break success in the fast-paced world of currency trading. A well-crafted resume that highlights the right skills not only showcases a trader’s capabilities but also enhances their appeal to potential employers. In this competitive field, both hard and soft skills play a crucial role in navigating financial markets, analyzing trends, and making informed decisions. By emphasizing these skills in a resume, candidates can effectively demonstrate their qualifications and readiness for the challenges of the trading environment.

Top Hard & Soft Skills for Foreign Exchange Trader

Hard Skills

- Technical analysis

- Fundamental analysis

- Risk management

- Trading platforms (e.g., MetaTrader, Bloomberg Terminal)

- Market research

- Currency pairs knowledge

- Algorithmic trading

- Financial modeling

- Data analysis

- Economic indicators comprehension

- Charting tools proficiency

- Execution strategies

- Hedging techniques

- Regulatory compliance

- Performance metrics analysis

- Quantitative analysis

- Forex market operations

Soft Skills

- Strong analytical thinking

- Decision-making under pressure

- Effective communication

- Emotional resilience

- Problem-solving abilities

- Attention to detail

- Adaptability to change

- Time management

- Team collaboration

- Negotiation skills

- Stress management

- Critical thinking

- Strategic planning

- Interpersonal skills

- Initiative and proactivity

- Customer service orientation

- Networking skills

To further enhance your resume, consider incorporating relevant skills and highlighting your work experience that aligns with the demands of the Foreign Exchange Trader role.

Stand Out with a Winning Foreign Exchange Trader Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Foreign Exchange Trader position at [Company Name] as advertised on [Where You Found the Job Posting]. With a solid background in financial markets, a keen analytical mindset, and a passion for currency trading, I am eager to contribute to your team and help drive profitable trading strategies. My experience with both technical and fundamental analysis, combined with my ability to thrive in high-pressure environments, makes me a strong candidate for this role.

In my previous role at [Previous Company Name], I successfully managed a diverse portfolio of currency trades, utilizing advanced trading platforms and tools to execute strategies that consistently outperformed market benchmarks. My analytical skills allowed me to identify emerging trends and make informed decisions quickly, resulting in a significant increase in returns over a three-year period. Additionally, my proficiency in risk management ensured that I maintained a balanced approach to trading, protecting the company's assets while maximizing potential gains.

I am particularly drawn to [Company Name] because of its innovative approach to forex trading and commitment to leveraging cutting-edge technology. I believe that my proactive nature and continuous desire to learn will allow me to adapt and thrive in your dynamic environment. I am excited about the opportunity to collaborate with a talented team and contribute to the development of strategies that align with your company's goals.

Thank you for considering my application. I am looking forward to the opportunity to discuss how my skills and experiences align with the needs of your team. I am eager to bring my passion for foreign exchange trading and my commitment to excellence to [Company Name].

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Foreign Exchange Trader Resume

When crafting a resume for a Foreign Exchange Trader position, it’s crucial to present yourself in the best light possible. However, many candidates make common mistakes that can hinder their chances of landing an interview. By avoiding these pitfalls, you can create a polished and effective resume that highlights your skills, experience, and understanding of the forex market. Here are some common mistakes to watch out for:

Generic Objective Statements: Using a one-size-fits-all objective statement can make your resume blend in with others. Tailor your objective to reflect your specific goals and what you can bring to the role.

Lack of Quantifiable Achievements: Failing to include measurable results can weaken your resume. Highlight your accomplishments with specific figures, such as percentage gains or trading volume, to demonstrate your impact.

Ignoring Relevant Skills: Omitting key skills relevant to forex trading, such as technical analysis, risk management, or market research, can make your resume less appealing. Make sure to include a skills section that reflects your expertise.

Overly Complex Language: Using jargon or overly technical language can alienate hiring managers who may not be familiar with all the terms. Aim for clear and concise language that conveys your qualifications effectively.

Neglecting to Highlight Education and Certifications: Not emphasizing your educational background or relevant certifications, such as CFA or FRM, can be a missed opportunity. Make sure these credentials are prominently displayed.

Poor Formatting: A cluttered or unprofessional format can detract from your qualifications. Use a clean, organized layout with consistent fonts and headings to enhance readability.

Including Irrelevant Experience: Listing unrelated job experience can dilute the impact of your resume. Focus on positions that showcase your trading skills or related financial expertise.

Failing to Tailor for Each Application: Submitting the same resume for different job applications can be a major mistake. Customize your resume to align with the specific requirements and language of each job description.

Conclusion

As a Foreign Exchange Trader, your role is pivotal in navigating the complex world of currencies and making informed trading decisions. Key skills include a deep understanding of market analysis, risk management, and the ability to stay calm under pressure. Additionally, proficiency in trading platforms and technologies is essential for maximizing efficiency and profitability.

Successful traders continuously educate themselves about global economic indicators and geopolitical events that can influence currency fluctuations. Networking with other professionals and staying updated on market trends are also crucial for career growth and success in this dynamic field.

In conclusion, ensuring that your resume effectively highlights your skills and experiences is vital for standing out in the competitive landscape of foreign exchange trading. We encourage you to review your Foreign Exchange Trader Resume and utilize available resources to enhance it. Explore resume templates, take advantage of our resume builder, check out resume examples, and consider our cover letter templates to create a compelling application that showcases your expertise and readiness for your next trading opportunity.