22 Hard and Soft Skills to Put On Financial Planner Resume for 2025

As a Financial Planner, showcasing the right skills on your resume is essential to stand out in a competitive job market. Employers are looking for professionals who not only possess technical knowledge but also demonstrate strong interpersonal abilities and strategic thinking. In this section, we will outline the top skills that can enhance your resume and highlight your qualifications, making you a compelling candidate for financial planning positions.

Best Financial Planner Soft Skills

In the competitive field of financial planning, possessing strong soft skills is essential for building client relationships, understanding their needs, and effectively communicating complex information. These interpersonal skills complement technical expertise and are crucial for delivering exceptional service and achieving client satisfaction.

Communication Skills

Effective communication is vital for Financial Planners to convey complex financial concepts in an understandable way to clients. It fosters trust and ensures that clients feel valued and informed.

How to show it: Highlight your ability to explain financial strategies in clear terms and include any client feedback or testimonials that showcase your communication effectiveness.

Problem-solving

Financial Planners often encounter unique challenges that require innovative solutions. Strong problem-solving skills enable them to analyze situations, identify issues, and devise effective strategies for clients.

How to show it: Provide examples of how you have resolved complex financial issues for clients, detailing the strategies used and the positive outcomes achieved.

Time Management

Managing multiple clients and their varying needs requires excellent time management skills. Financial Planners must prioritize tasks efficiently to meet deadlines and maintain high service standards.

How to show it: Quantify your ability to manage a client portfolio by detailing the number of clients handled and the timely completion of financial plans.

Teamwork

Collaboration with other professionals, such as accountants, lawyers, and investment advisors, is often necessary for comprehensive financial planning. Strong teamwork skills facilitate effective partnerships and enhance client service.

How to show it: Illustrate your experience working in team settings, emphasizing successful collaborative projects and any specific roles you played in achieving team goals.

Empathy

Understanding clients' emotions and perspectives is crucial for Financial Planners to provide personalized advice. Empathy helps build strong client relationships and enhances trust.

How to show it: Share examples of how you have adapted your approach based on clients' emotional needs and the positive impact it had on your client relationships.

Adaptability

The financial landscape is constantly changing, and being adaptable allows Financial Planners to stay relevant and responsive to new regulations and market conditions.

How to show it: Discuss instances where you successfully adapted your strategies in response to market changes or client needs, highlighting the outcomes.

Attention to Detail

Financial planning involves intricate details and accuracy in financial data. Attention to detail ensures that plans are precise and compliant with regulations.

How to show it: Provide examples of how your attention to detail has prevented errors or improved the quality of financial plans, including any metrics that demonstrate this.

Negotiation Skills

Negotiation is often necessary in financial planning when discussing fees, investment options, or terms with clients and other professionals. Strong negotiation skills lead to better outcomes for clients.

How to show it: Detail successful negotiations you've led, including the context, your approach, and the resultant benefits to clients.

Critical Thinking

Critical thinking enables Financial Planners to analyze data, assess risks, and make informed decisions that align with client goals. It is essential for developing sound financial strategies.

How to show it: Share examples of how you used critical thinking to analyze complex financial scenarios and the positive results that followed.

Customer Service Orientation

Providing excellent customer service is key to retaining clients and attracting new ones. A strong customer service orientation ensures that clients feel supported and valued throughout their financial journey.

How to show it: Include metrics on client retention rates or positive feedback from clients that demonstrate your commitment to exceptional service.

Persuasion Skills

Persuasion is necessary for Financial Planners to help clients understand the value of particular financial strategies or products. This skill is crucial for guiding clients toward informed decisions.

How to show it: Provide instances where your persuasive communication led to clients making beneficial financial decisions or investments.

How to List Financial Planner Skills on Your Resume

Effectively listing your skills on a resume is crucial to standing out to potential employers. Highlighting your qualifications can make a significant difference in grabbing the attention of hiring managers. There are three main sections where you can showcase your skills: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

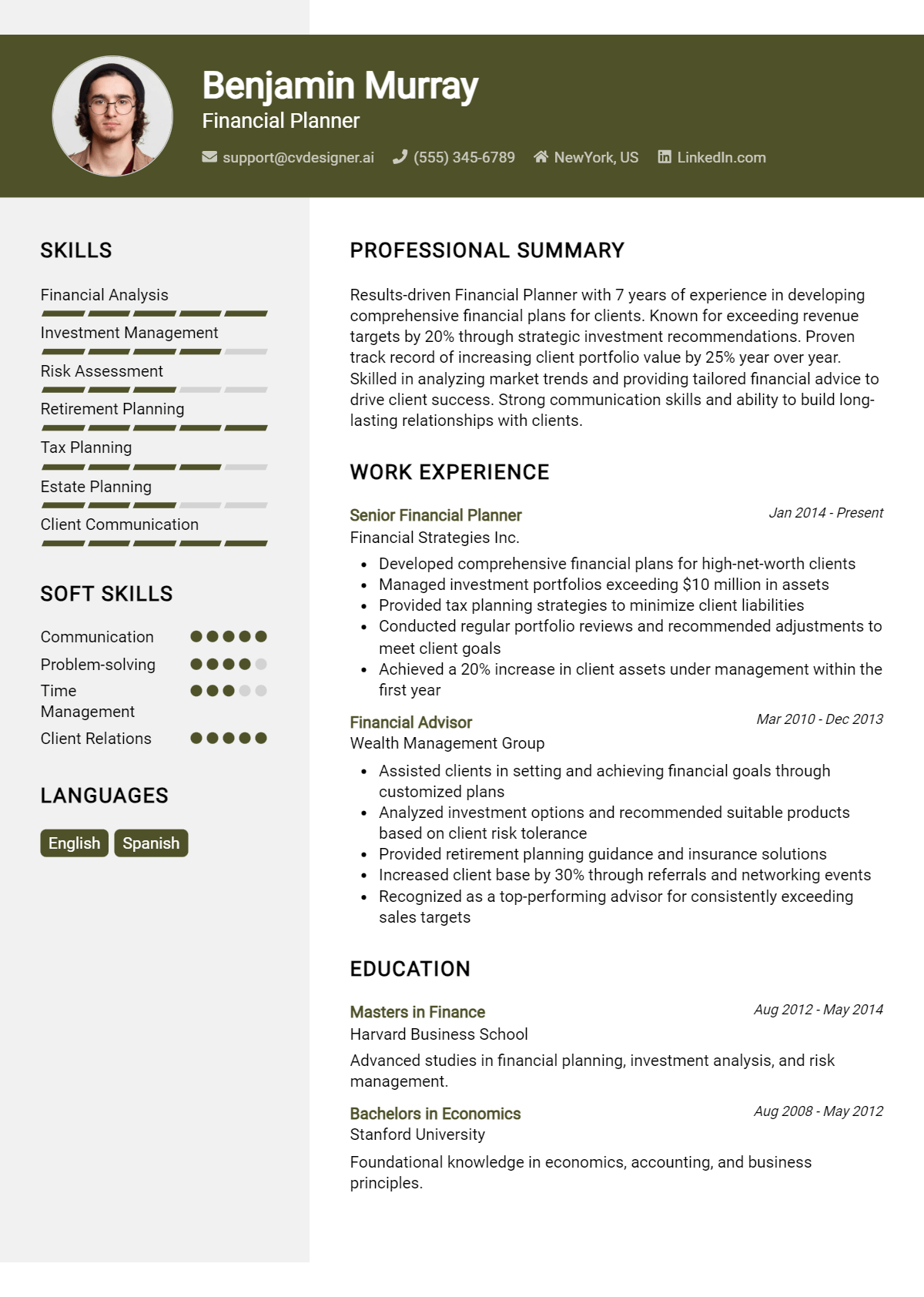

for Resume Summary

Showcasing Financial Planner skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications. This sets the tone for the rest of your resume.

Example

Dynamic Financial Planner with expertise in investment strategies, risk assessment, and client relationship management. Proven track record of delivering tailored financial solutions to enhance client portfolios and achieve their financial goals.

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how your Financial Planner skills have been applied in real-world scenarios. This is where you can show your impact and effectiveness.

Example

- Developed customized financial plans utilizing strong analytical skills to enhance client investment strategies.

- Provided comprehensive risk assessment services that resulted in a 25% increase in client satisfaction.

- Collaborated with clients to improve their portfolio management, leading to a 15% growth in assets under management.

- Utilized communication skills to educate clients on financial products, strengthening relationships and trust.

for Resume Skills

The skills section can showcase either technical or transferable skills. It is important to include a balanced mix of hard and soft skills to strengthen your qualifications.

Example

- Financial Analysis

- Investment Strategies

- Risk Management

- Client Relationship Management

- Regulatory Compliance

- Effective Communication

- Financial Planning Software Proficiency

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in their resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate how those skills have positively impacted your previous roles.

Example

In my previous role, my expertise in investment strategies and risk assessment enabled me to guide clients effectively through market fluctuations, fostering a 30% increase in client trust and satisfaction. I am eager to bring this skill set to your team and help clients reach their financial goals.

Encourage candidates to link the skills mentioned in their resume to specific achievements in their cover letter, reinforcing their qualifications for the job. For more details on crafting your resume, explore our sections on skills, Technical Skills, and work experience.

The Importance of Financial Planner Resume Skills

In the competitive field of financial planning, showcasing relevant skills on your resume is crucial for capturing the attention of recruiters and hiring managers. A well-crafted skills section not only highlights your qualifications but also demonstrates your alignment with the specific requirements of the job. By effectively presenting your abilities, you can distinguish yourself from other candidates and increase your chances of securing an interview.

- Financial planners must possess strong analytical skills to assess clients' financial situations accurately. These skills enable them to create tailored strategies that align with their clients' goals and risk tolerance.

- Effective communication is essential for financial planners. They need to convey complex financial concepts in an understandable way, ensuring clients are informed and confident in the decisions being made.

- Interpersonal skills are paramount as financial planners often work closely with clients over extended periods. Building trust and maintaining robust relationships can significantly impact client satisfaction and retention.

- Attention to detail is crucial in financial planning. A minor error in calculations or documentation can lead to significant financial repercussions for clients. Highlighting this skill shows your commitment to accuracy and thoroughness.

- Time management abilities are vital for financial planners who juggle multiple clients and deadlines. Demonstrating your organizational skills can assure employers that you can handle a busy workload effectively.

- Adaptability is essential in the ever-changing financial landscape. A financial planner must stay updated on market trends and regulatory changes, showcasing your ability to pivot strategies as needed.

- Strategic thinking skills are necessary for developing comprehensive financial plans. They allow planners to foresee potential challenges and opportunities, ensuring that clients are prepared for the future.

- Knowledge of financial software and tools is increasingly important in the digital age. Proficiency in these technologies can streamline processes and enhance the quality of service provided to clients.

For additional insights and examples, you can explore [Resume Samples](https://resumekraft.com/resume-samples/).

How To Improve Financial Planner Resume Skills

In the ever-evolving landscape of finance, it is crucial for financial planners to continuously improve their skills to stay competitive and provide the best service to their clients. By enhancing your expertise, you not only elevate your resume but also increase your ability to make informed decisions, build client trust, and adapt to changing market conditions.

- Attend industry workshops and seminars to stay updated on the latest financial trends and regulations.

- Obtain relevant certifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA), to demonstrate your commitment to professional development.

- Engage in networking opportunities with other financial professionals to share knowledge and gain insights from their experiences.

- Read financial literature, including books, articles, and journals, to deepen your understanding of complex financial concepts.

- Utilize financial planning software and tools to enhance your analytical skills and improve the efficiency of your planning processes.

- Seek mentorship from experienced financial planners to gain practical advice and guidance on navigating the industry.

- Participate in online courses or webinars that focus on specific aspects of financial planning, such as retirement planning or tax strategies.

Frequently Asked Questions

What skills are essential for a financial planner's resume?

Essential skills for a financial planner's resume include strong analytical abilities to assess clients' financial situations, excellent communication skills for conveying complex information clearly, and proficiency in financial software and tools. Additionally, attention to detail and a solid understanding of investment strategies, tax laws, and retirement planning are crucial for effectively advising clients.

How important is certification for a financial planner?

Certification is highly important for a financial planner as it demonstrates a commitment to the profession and adherence to ethical standards. Credentials such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) not only enhance credibility but also signify that the planner has met specific education and experience requirements, which can attract more clients and potentially lead to higher earning potential.

What role does client relationship management play in financial planning?

Client relationship management is a critical skill for financial planners as it fosters trust and loyalty between the planner and their clients. Building strong relationships allows planners to better understand their clients' financial goals, concerns, and preferences, ultimately leading to more tailored and effective financial strategies that meet individual needs.

Why is it important for financial planners to stay updated with financial regulations?

Staying updated with financial regulations is crucial for financial planners as it ensures compliance with current laws and practices, protecting both the planner and their clients from legal issues. Regularly reviewing changes in regulations helps planners provide accurate advice, maintain professional integrity, and enhance their reputation in the industry.

How can effective time management skills benefit a financial planner?

Effective time management skills benefit financial planners by enabling them to prioritize tasks, meet deadlines, and efficiently manage multiple client accounts. This skill set helps planners allocate time for research, client meetings, and ongoing education, ultimately leading to improved client service, increased productivity, and a balanced work-life dynamic.

Conclusion

Including Financial Planner skills in your resume is essential for effectively communicating your expertise and value to potential employers. By showcasing relevant skills, you not only stand out among other candidates but also demonstrate your capability to contribute significantly to their financial goals. Remember, a well-crafted resume can open doors to exciting career opportunities, so take the time to refine your skills and present them compellingly.

For further assistance in creating a standout resume, explore our resume templates, utilize our resume builder, check out resume examples, and enhance your application with our cover letter templates. Your future starts here—make it count!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.