Financial Planner Core Responsibilities

A Financial Planner plays a crucial role in guiding clients towards their financial goals by analyzing their current financial situations and developing tailored strategies. This position requires strong technical skills in finance and investment, operational expertise to manage various financial products, and exceptional problem-solving abilities to navigate complex financial scenarios. By bridging departments such as marketing, compliance, and customer service, Financial Planners contribute to the organization's overall objectives. A well-structured resume can effectively highlight these skills, showcasing the candidate's ability to drive success.

Common Responsibilities Listed on Financial Planner Resume

- Conducting comprehensive financial assessments for clients.

- Developing personalized financial plans and investment strategies.

- Analyzing market trends to inform investment decisions.

- Monitoring and reviewing clients' financial progress and strategies.

- Providing retirement planning and wealth management advice.

- Educating clients on financial products and services.

- Ensuring compliance with financial regulations and standards.

- Building and maintaining strong client relationships.

- Collaborating with other financial professionals and departments.

- Preparing detailed reports and presentations for clients.

- Staying updated on financial industry trends and changes.

- Identifying and mitigating financial risks for clients.

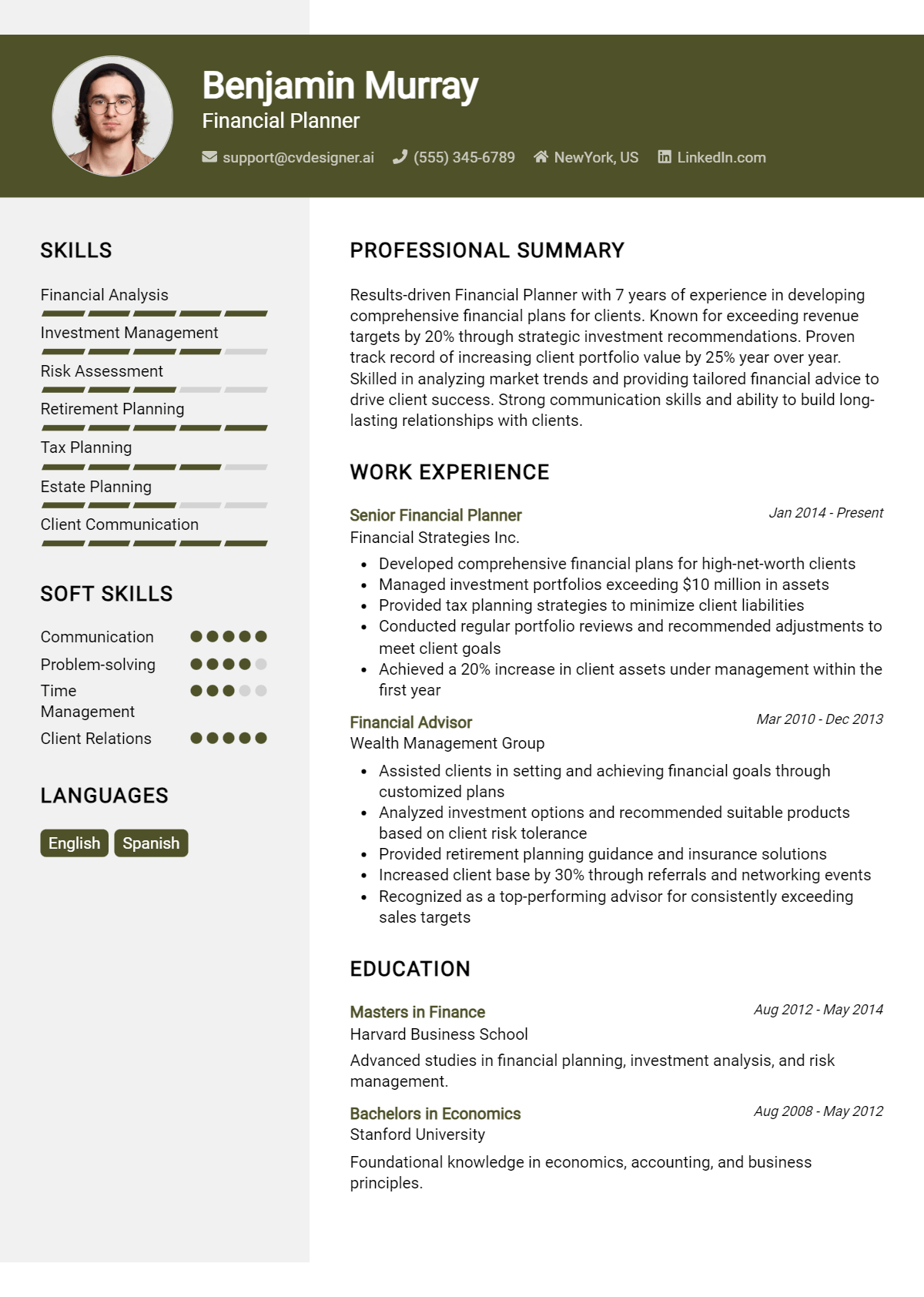

High-Level Resume Tips for Financial Planner Professionals

In the competitive world of financial planning, a well-crafted resume serves as your first impression with potential employers. It's essential that this document not only highlights your skills and achievements but also demonstrates your suitability for the role. A strong resume can differentiate you from other candidates and showcase your understanding of financial strategies, client management, and industry regulations. This guide will provide practical and actionable resume tips specifically tailored for Financial Planner professionals, ensuring that your application stands out in a crowded field.

Top Resume Tips for Financial Planner Professionals

- Tailor your resume to each job description, using keywords and phrases that align with the specific requirements of the position.

- Showcase relevant experience prominently, emphasizing roles that involved financial analysis, client interaction, or portfolio management.

- Quantify your achievements by including specific metrics, such as percentage increases in client portfolios or the number of clients serviced.

- Highlight industry-specific skills, including knowledge of financial software, investment strategies, and regulatory compliance.

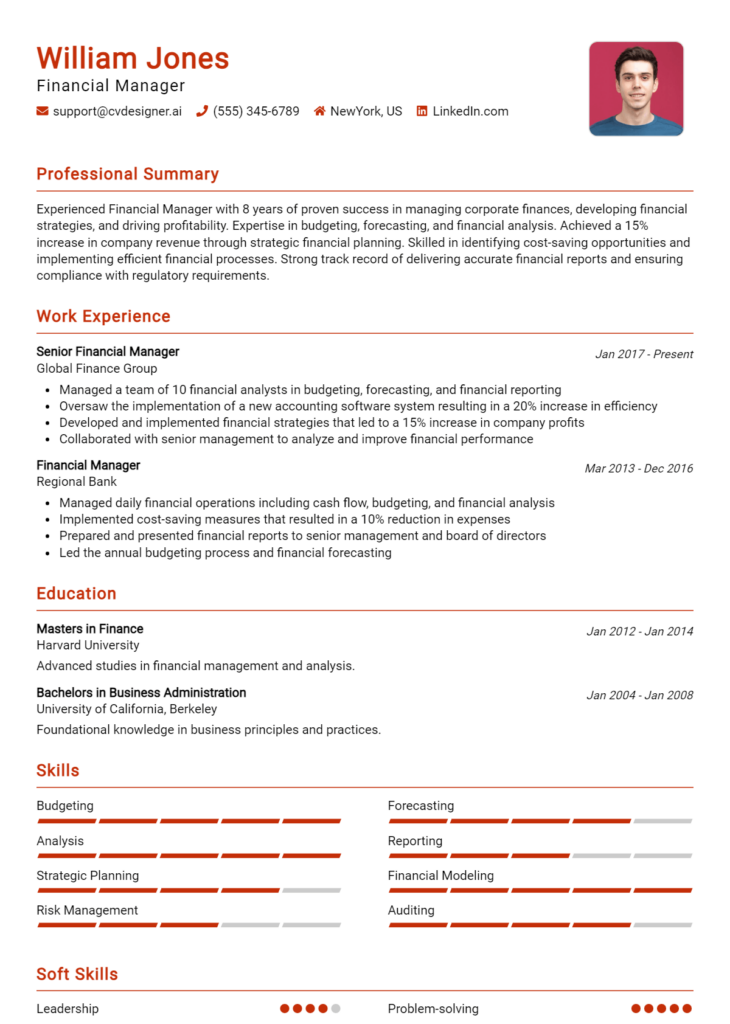

- Include a professional summary at the top of your resume that succinctly outlines your expertise and career goals.

- Utilize bullet points for clarity, making your accomplishments easy to read and understand at a glance.

- Incorporate relevant certifications such as CFP, CFA, or CPA to establish your qualifications and commitment to the profession.

- Demonstrate your ability to build and maintain client relationships through examples of successful client interactions or testimonials.

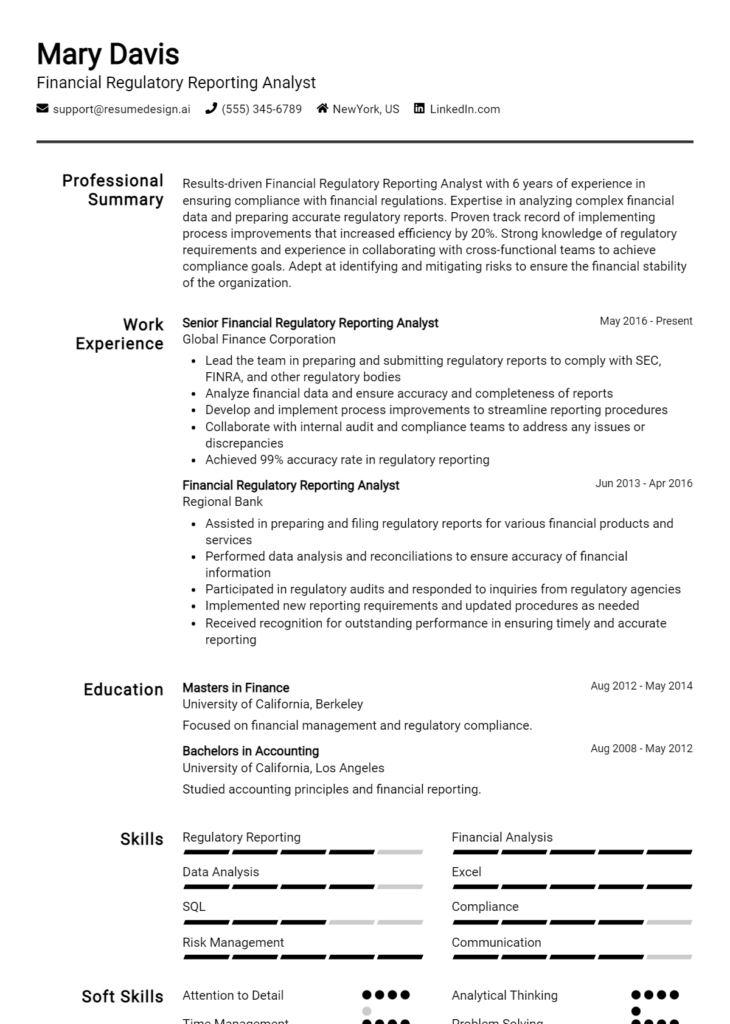

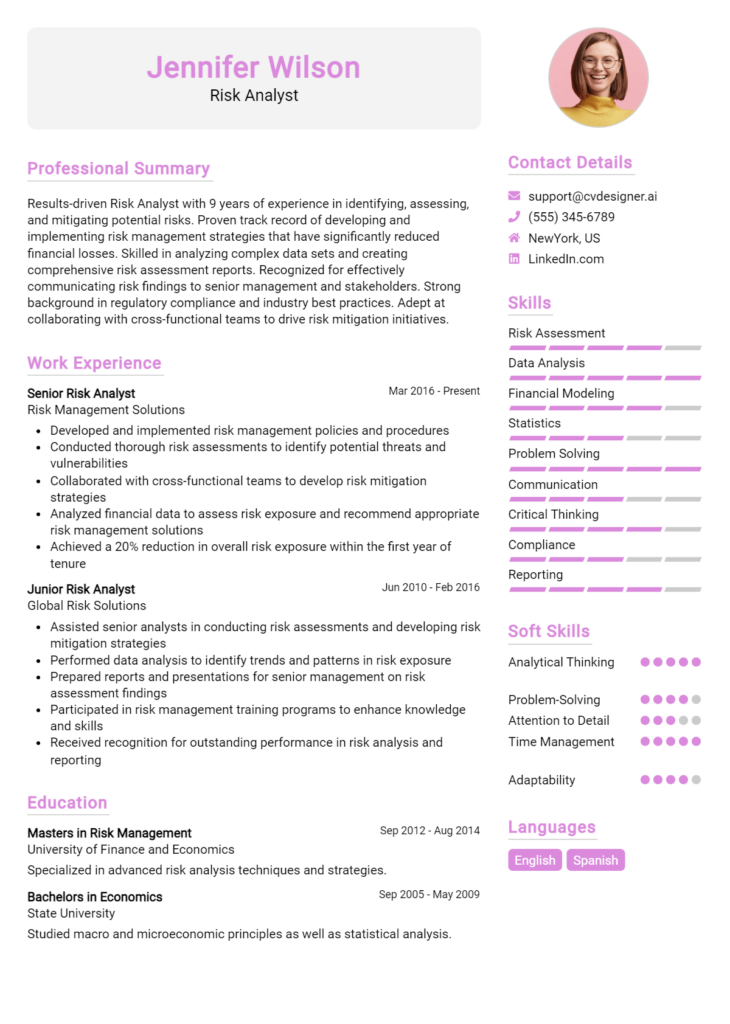

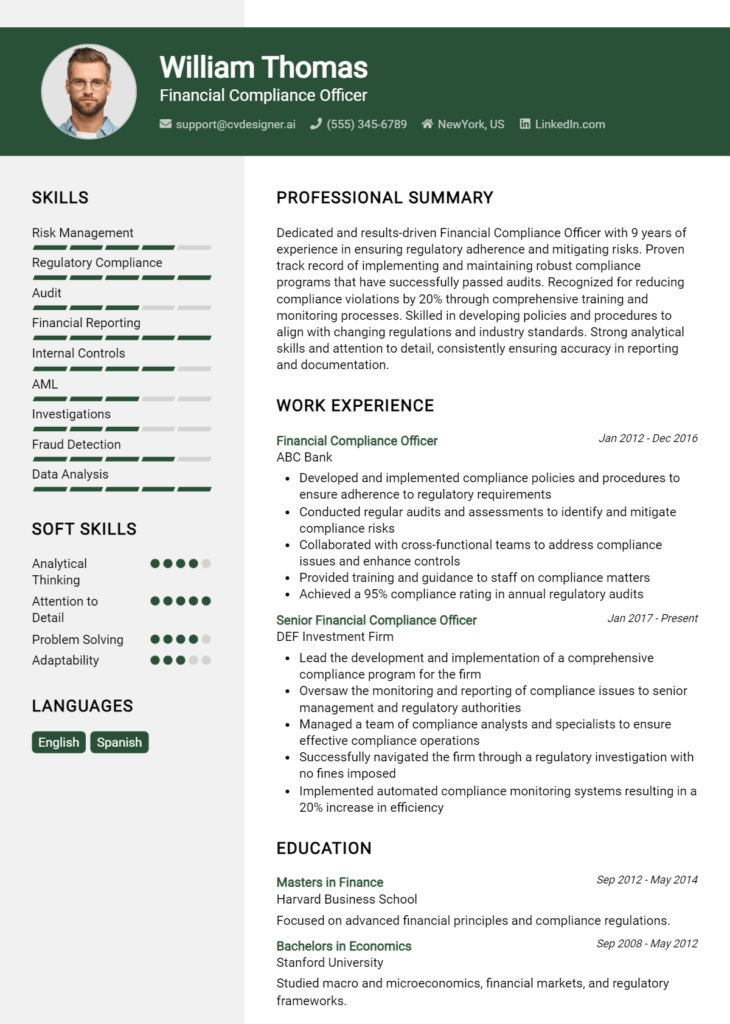

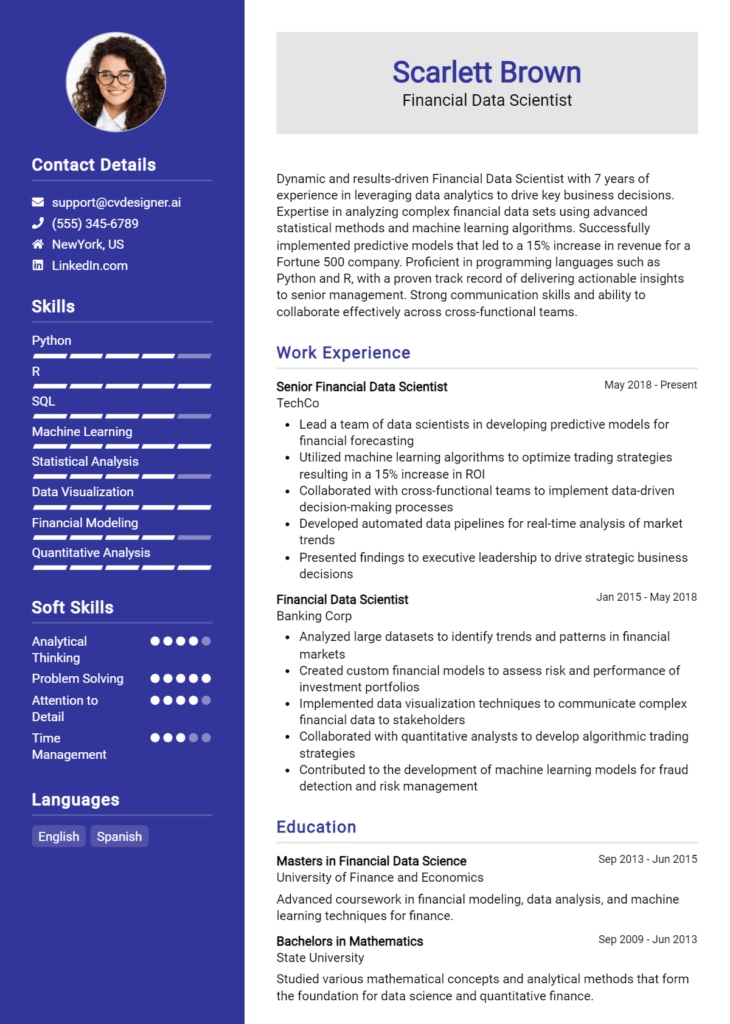

- Keep the design clean and professional, using appropriate fonts and formatting to enhance readability.

- Proofread thoroughly to eliminate any errors, as attention to detail is critical in the financial planning industry.

By implementing these tips, you can significantly increase your chances of landing a job in the Financial Planner field. A polished and targeted resume will not only demonstrate your qualifications but also convey your professionalism and attention to detail, qualities that are essential for success in this industry.

Why Resume Headlines & Titles are Important for Financial Planner

In the competitive field of financial planning, a well-crafted resume headline or title is essential for standing out among a pool of candidates. This succinct phrase serves as the first impression for hiring managers, summarizing a candidate's key qualifications and career aspirations in a way that captures attention immediately. A strong headline not only enhances the overall presentation of the resume but also helps to convey the relevance of the candidate's experience and skills to the specific job being applied for. Therefore, it's crucial for financial planners to ensure their headlines are concise, relevant, and directly aligned with the job description they are targeting.

Best Practices for Crafting Resume Headlines for Financial Planner

- Keep it concise: Aim for a headline that is no longer than one sentence.

- Be specific: Tailor your headline to reflect the financial planning role you are applying for.

- Highlight key skills: Include relevant certifications or areas of expertise.

- Use active language: Choose impactful words that showcase your achievements.

- Focus on results: Mention quantifiable achievements if possible.

- Reflect your professional brand: Ensure your headline aligns with your overall career narrative.

- Avoid jargon: Use clear and straightforward language to convey your message.

- Update regularly: Revise your headline for each application to match the job requirements.

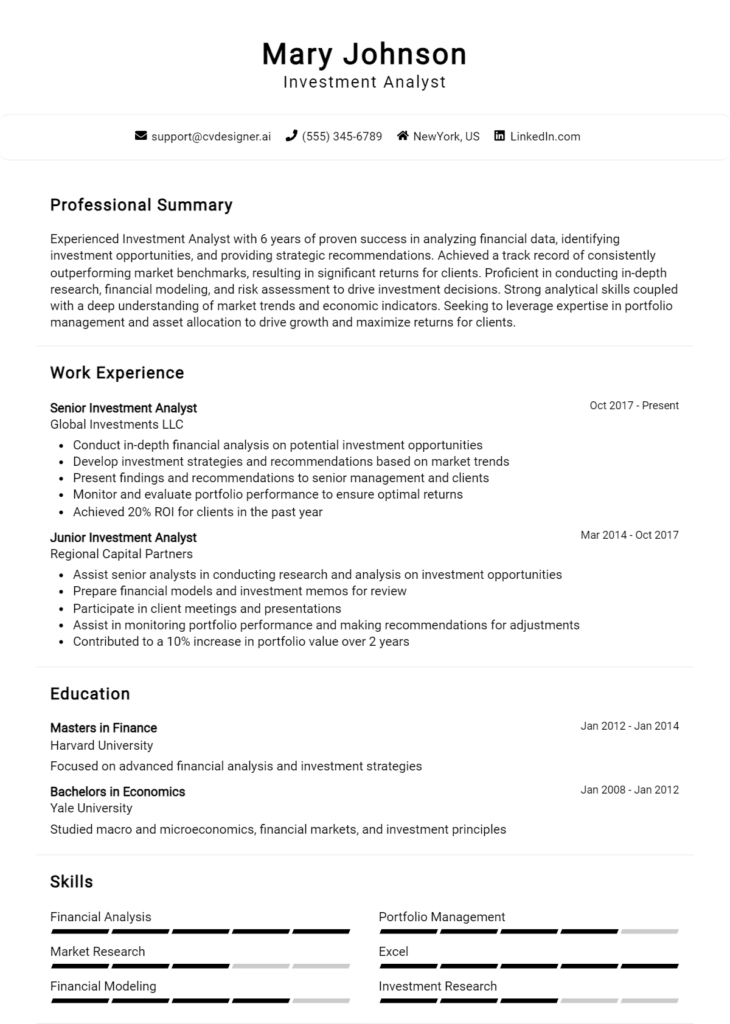

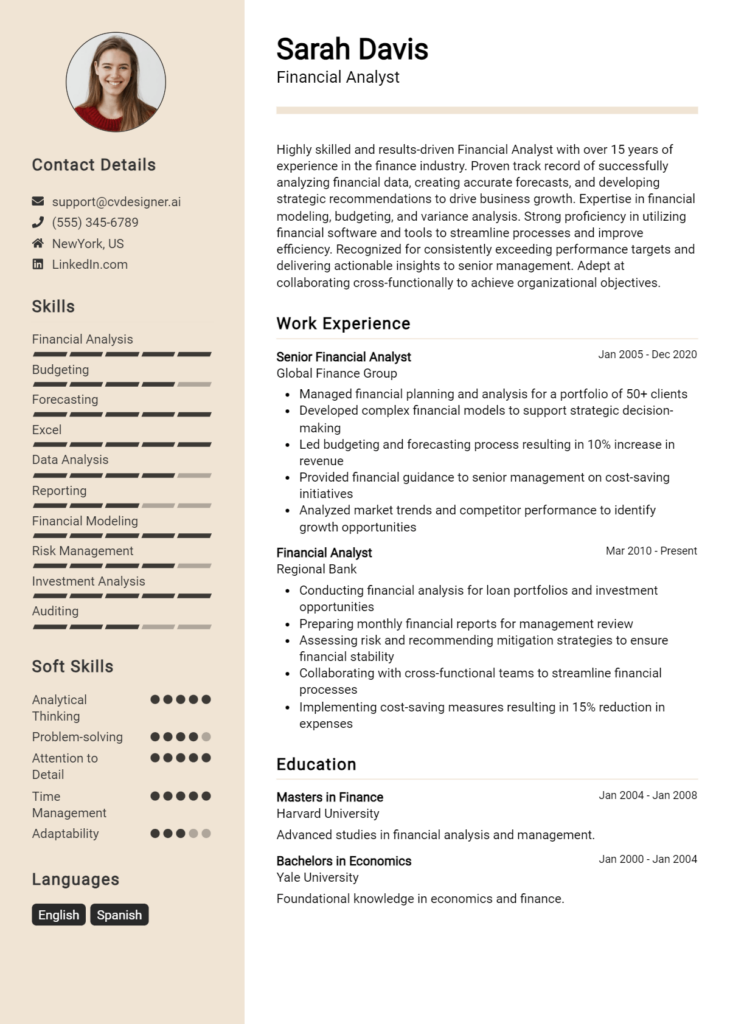

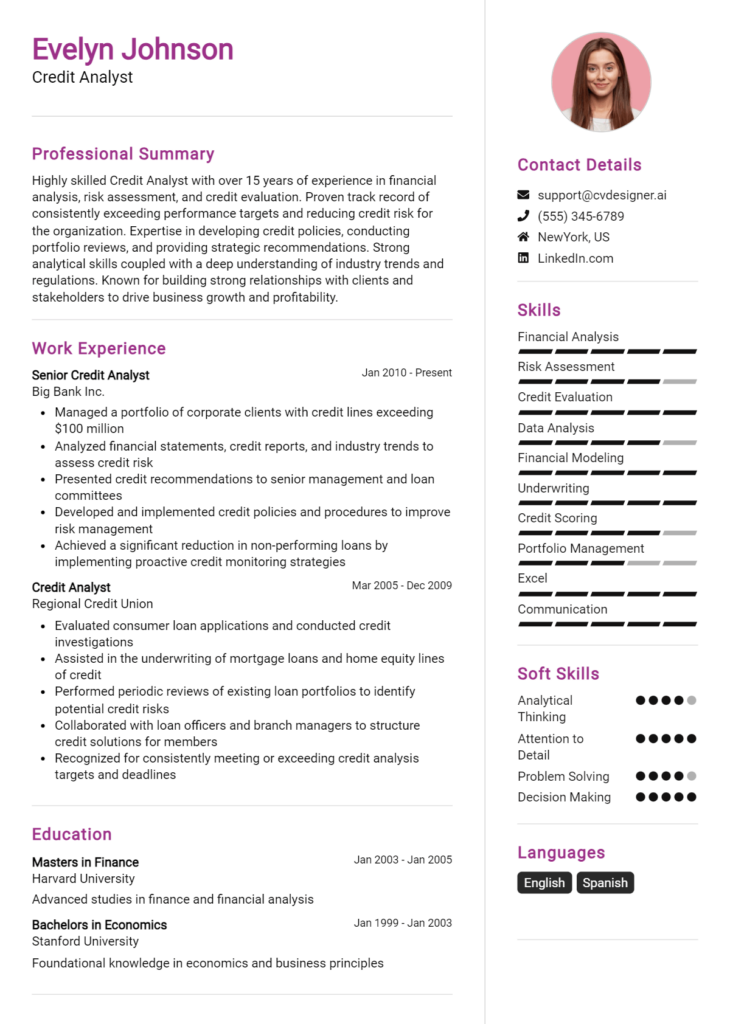

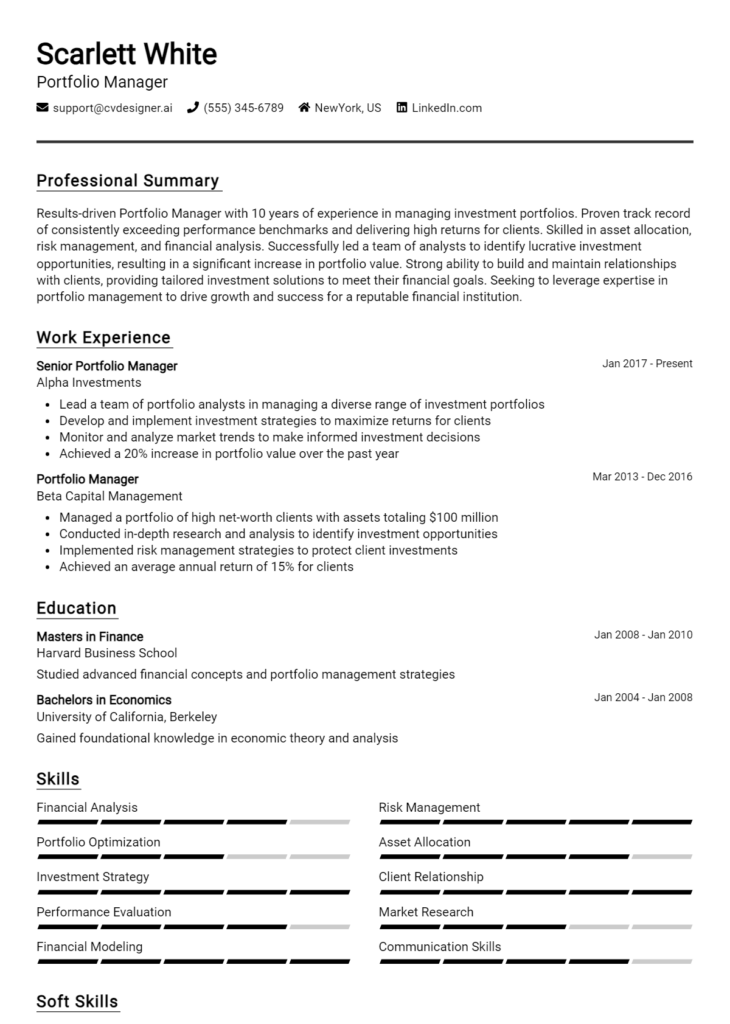

Example Resume Headlines for Financial Planner

Strong Resume Headlines

Certified Financial Planner with 10+ Years of Experience in Wealth Management

Results-Driven Financial Advisor Specializing in Retirement and Tax Planning

Strategic Financial Planner with Proven Track Record in Client Retention and Growth

Weak Resume Headlines

Financial Planner

Experienced Professional in Finance

The strong headlines are effective because they immediately communicate specific competencies and experiences that are relevant to the financial planning role, making them memorable to potential employers. They highlight the candidate's strengths and unique value propositions, which helps to set them apart from other applicants. In contrast, the weak headlines fail to impress as they are vague and generic, offering no insight into the candidate's qualifications or areas of expertise, thereby missing the opportunity to engage hiring managers effectively.

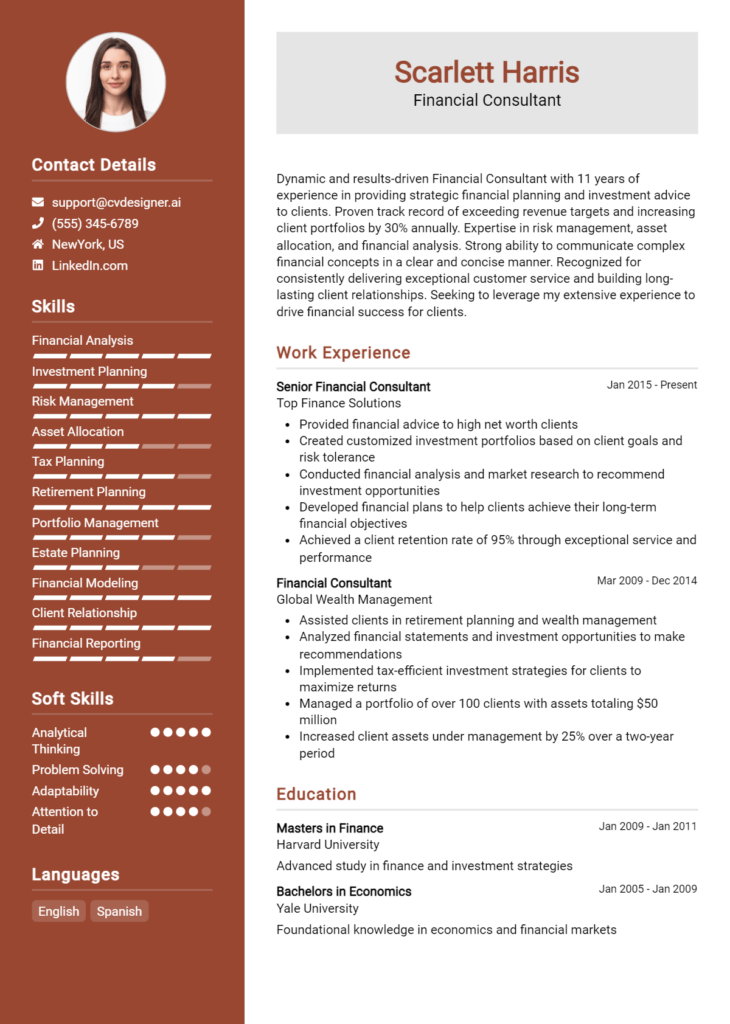

Writing an Exceptional Financial Planner Resume Summary

A well-crafted resume summary is crucial for Financial Planners, as it serves as the first impression a hiring manager will have of a candidate. This brief yet impactful section succinctly highlights key skills, relevant experience, and notable accomplishments, allowing professionals in the financial sector to quickly assess a candidate's fit for the role. A strong summary should be concise, engaging, and specifically tailored to the job description, ensuring that it captures the attention of potential employers in a competitive job market.

Best Practices for Writing a Financial Planner Resume Summary

- Quantify Achievements: Use numbers and percentages to illustrate your successes, such as the amount of assets managed or client satisfaction rates.

- Focus on Relevant Skills: Highlight skills that are directly applicable to the Financial Planner position, such as financial analysis, investment strategies, and tax planning.

- Tailor to the Job Description: Customize your summary for each job application to reflect the specific requirements and preferences outlined in the job listing.

- Be Concise: Keep the summary to 2-4 sentences to ensure it remains impactful and easy to read.

- Use Action Verbs: Start sentences with strong action verbs to convey confidence and proactivity.

- Include Industry Keywords: Integrate relevant keywords from the financial planning field to increase visibility in applicant tracking systems.

- Showcase Soft Skills: Highlight interpersonal skills, such as communication and relationship-building, which are vital for success in financial planning.

- Reflect Professional Goals: Mention your career aspirations to show alignment with the prospective employer's objectives.

Example Financial Planner Resume Summaries

Strong Resume Summaries

Detail-oriented Financial Planner with over 8 years of experience managing a portfolio of high-net-worth clients, achieving an average annual return of 12% on investments. Proven track record of enhancing client satisfaction by 30% through personalized financial strategies and comprehensive market analysis.

Certified Financial Planner with expertise in retirement and estate planning, successfully generating over $5 million in new client assets within a year. Recognized for developing innovative investment solutions that align with clients' long-term financial goals.

Results-driven Financial Planner skilled in building and maintaining client relationships, resulting in a 95% client retention rate. Adept at analyzing financial data to provide tailored solutions that improve clients’ overall financial health.

Weak Resume Summaries

Experienced Financial Planner looking for new opportunities in the finance sector.

Financial professional with a background in various financial services. Interested in helping clients with their financial needs.

The strong resume summaries are considered effective because they provide specific examples of achievements and skills that are directly relevant to the Financial Planner role. They quantify results, indicate key competencies, and reflect a clear understanding of the position's requirements. In contrast, the weak summaries lack specificity and measurable outcomes, making them less impactful and memorable to hiring managers.

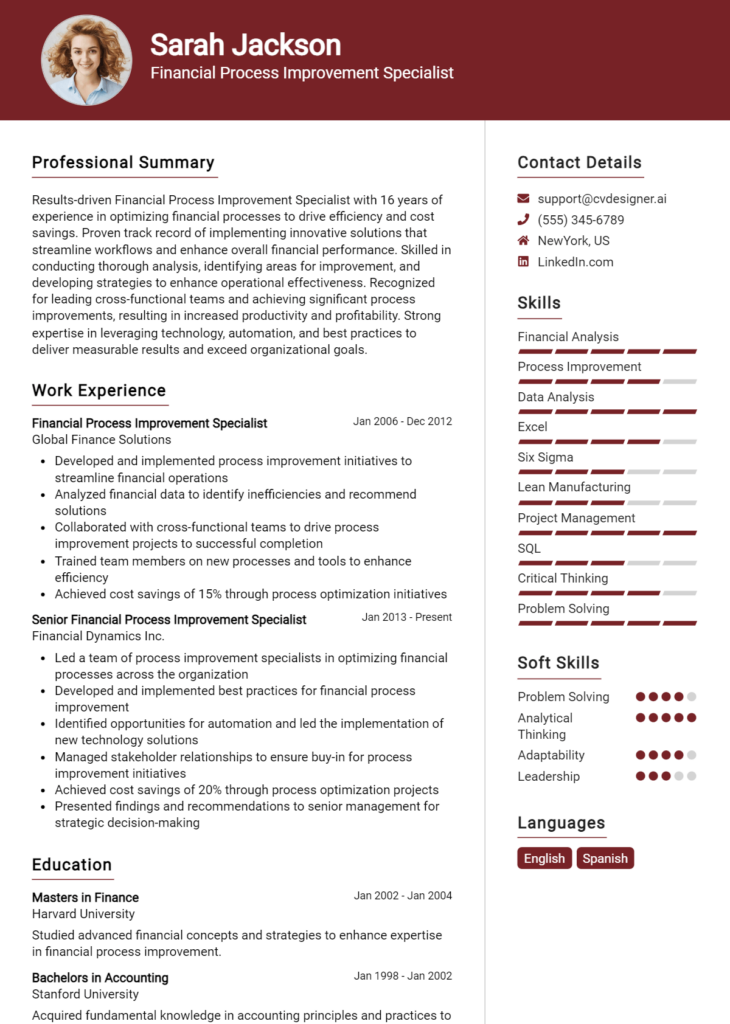

Work Experience Section for Financial Planner Resume

The work experience section of a Financial Planner resume serves as a critical component that allows candidates to demonstrate their technical skills, leadership abilities, and capacity to deliver high-quality financial products. This section is where applicants can effectively showcase their previous roles, detailing how their experiences align with industry standards and expectations. By quantifying achievements, such as successfully managing client portfolios or increasing client satisfaction rates, candidates can create a compelling narrative that highlights their value to potential employers. Moreover, illustrating collaboration within teams adds depth to their qualifications, showing they can work effectively in a professional environment.

Best Practices for Financial Planner Work Experience

- Use specific metrics to quantify achievements, such as percentage increases in client portfolios or revenue growth.

- Highlight relevant technical skills, including software proficiency and financial analysis techniques.

- Emphasize leadership roles or responsibilities in team settings to showcase collaboration and management abilities.

- Align experiences with industry standards, showcasing knowledge of current regulations and practices.

- Include relevant certifications or training completed during previous roles to bolster credibility.

- Tailor job descriptions to reflect the responsibilities and achievements most applicable to the role being applied for.

- Incorporate action verbs to convey a sense of initiative and accomplishment.

- Focus on outcomes that directly benefited clients, demonstrating a commitment to client success.

Example Work Experiences for Financial Planner

Strong Experiences

- Managed a diverse portfolio of over 50 clients, achieving a 15% average annual return on investments, significantly above industry benchmarks.

- Led a team of 5 financial advisors in developing a comprehensive financial planning strategy that improved client satisfaction scores by 30%.

- Implemented a new financial planning software that streamlined client onboarding processes, reducing setup time by 40%.

- Developed and conducted quarterly financial workshops that attracted over 100 participants, resulting in a 25% increase in new client acquisition.

Weak Experiences

- Worked in a financial planning role for a few years.

- Assisted with client meetings and documentation.

- Helped a team with various tasks related to finance.

- Participated in workshops and training sessions.

The examples considered strong demonstrate clear, quantifiable outcomes and specific achievements that highlight the candidate's technical expertise and collaborative skills. They provide measurable results that potential employers can assess. In contrast, the weak experiences lack detail, specificity, and quantifiable results, making them less compelling and failing to convey the candidate's true potential or contributions in previous roles.

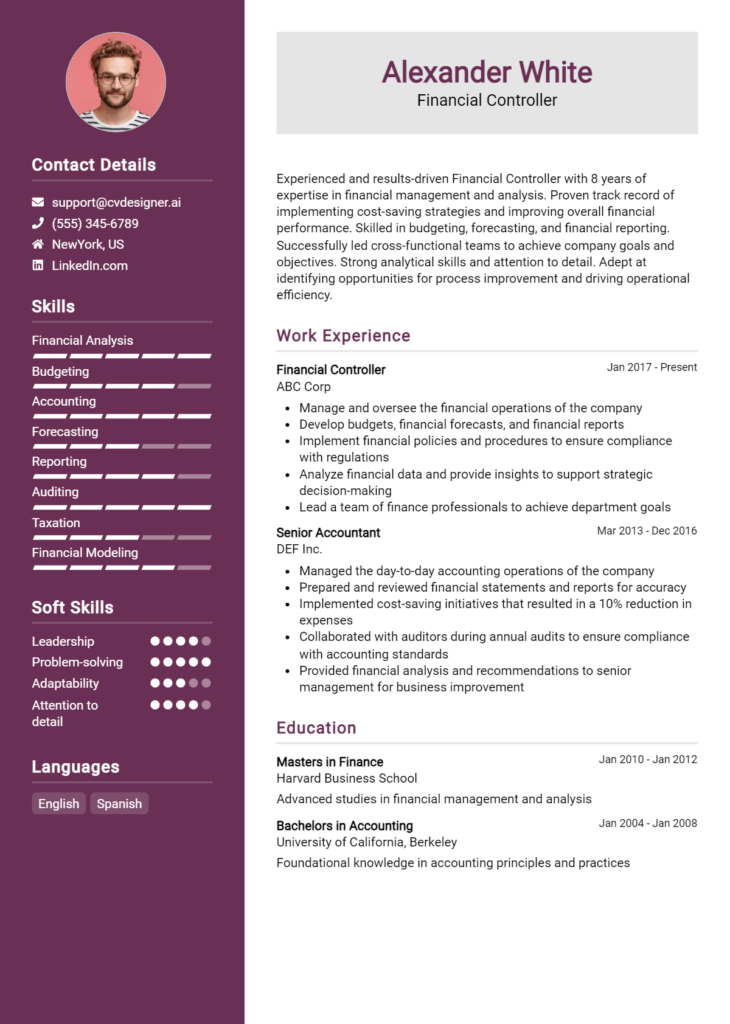

Certifications and Education for a Financial Planner Resume

When crafting a resume for a Financial Planner position, it's essential to emphasize your certifications and educational background, as these are crucial indicators of your expertise and commitment to the field. Here are some guidelines to effectively list these qualifications:

Certifications

Start by prioritizing industry-recognized certifications that demonstrate your knowledge and professionalism in financial planning. Here are some key certifications to consider including:

Certified Financial Planner (CFP): This is one of the most respected certifications in the financial planning industry. It signifies that you have met rigorous education, examination, experience, and ethics requirements.

Chartered Financial Analyst (CFA): While more investment-focused, the CFA credential is highly regarded and can enhance your credibility, especially if you work with high-net-worth clients.

Certified Public Accountant (CPA): If you have a background in accounting, this certification can be advantageous, as it provides a strong framework in tax planning and financial analysis.

Chartered Financial Consultant (ChFC): This designation focuses on the financial planning process and can be beneficial for those looking to enhance their comprehensive planning skills.

Education

In addition to certifications, your educational background should reflect your foundation in finance, economics, or related fields. Here are some relevant degrees to consider:

Bachelor's Degree in Finance: A fundamental degree that provides essential knowledge in financial principles, investment strategies, and market analysis.

Bachelor's Degree in Accounting: This degree offers expertise in financial reporting, tax regulations, and auditing, which are critical components of financial planning.

Bachelor's Degree in Economics: An economics degree equips you with analytical skills and a deeper understanding of market dynamics, which can be beneficial for strategic financial planning.

Master of Business Administration (MBA) with a Concentration in Finance: An MBA can enhance your business acumen and leadership skills, making you more competitive in the financial planning field.

Formatting Tips

When listing your certifications and education, use a clear and organized format:

- Certifications: List them in reverse chronological order, including the year obtained or expected.

- Education: Include the degree, major, institution, and graduation date. You may also want to mention honors or relevant coursework if applicable.

By strategically highlighting your certifications and educational background, you will present yourself as a qualified candidate for a financial planner role, ready to help clients achieve their financial goals.

Top Skills & Keywords for Financial Planner Resume

As a Financial Planner, showcasing the right skills on your resume is crucial for standing out in a competitive job market. Employers seek candidates who not only possess technical knowledge but also demonstrate strong interpersonal abilities. A well-rounded skill set can enhance your credibility, showcase your problem-solving capabilities, and illustrate your ability to build lasting relationships with clients. By effectively highlighting both hard and soft skills, you can present a comprehensive picture of your qualifications and readiness for the role. For further insights into crafting your resume, consider exploring essential skills and emphasizing relevant work experience that aligns with the demands of this profession.

Top Hard & Soft Skills for Financial Planner

Soft Skills

- Excellent communication skills

- Active listening

- Empathy

- Relationship building

- Problem-solving

- Critical thinking

- Time management

- Adaptability

- Negotiation skills

- Customer service orientation

- Detail-oriented

- Team collaboration

- Ethical judgment

- Conflict resolution

Hard Skills

- Financial analysis

- Investment strategies

- Tax planning

- Retirement planning

- Risk management

- Knowledge of financial software (e.g., QuickBooks, Excel)

- Budgeting

- Estate planning

- Regulatory compliance

- Portfolio management

- Market research

- Data analysis

- Financial forecasting

- Sales skills

- Performance tracking

- Economic principles

- Presentation skills

Stand Out with a Winning Financial Planner Cover Letter

As a dedicated financial planner with over five years of experience in providing tailored financial advice and solutions, I am excited to apply for the Financial Planner position at [Company Name]. My strong background in investment strategies, retirement planning, and risk management, along with my commitment to educating clients on their financial options, makes me a perfect fit for your team. I am particularly impressed by [Company Name]'s dedication to client satisfaction and innovative financial solutions, and I am eager to contribute to this mission.

In my previous role at [Previous Company Name], I successfully managed a diverse portfolio of clients, helping them to achieve their financial objectives through personalized planning and consistent follow-up. By leveraging data-driven strategies and market analysis, I was able to increase client investment returns by an average of 15% year-over-year. My ability to build strong, trust-based relationships with clients has been instrumental in fostering long-term partnerships and enhancing overall client retention rates.

I hold a Certified Financial Planner (CFP) designation and continuously seek to expand my knowledge of financial markets and regulations. I am skilled at conducting comprehensive financial assessments and developing actionable plans that align with clients' goals, whether they are saving for retirement, purchasing a home, or planning for their children's education. My proactive approach in risk assessment and management has equipped my clients to navigate uncertainties with confidence.

I am excited about the opportunity to bring my expertise in financial planning to [Company Name]. I am confident that my analytical skills, attention to detail, and dedication to client service will make a meaningful contribution to your team. Thank you for considering my application. I look forward to the possibility of discussing how my background, skills, and enthusiasms align with the goals of your organization.

Common Mistakes to Avoid in a Financial Planner Resume

When crafting a resume for a Financial Planner position, it's crucial to present your skills and experiences effectively to stand out in a competitive job market. However, many candidates make common mistakes that can hinder their chances of landing an interview. Understanding these pitfalls can help you create a stronger, more impactful resume that highlights your qualifications and expertise. Here are some common mistakes to avoid:

Generic Objective Statement: Using a vague objective statement that lacks specificity can make your resume blend in with others. Instead, tailor your objective to reflect your career goals and how they align with the prospective employer's needs.

Not Quantifying Achievements: Failing to include quantifiable results or metrics can weaken your accomplishments. Always provide specific figures, such as percentage increases in client portfolios or the number of clients served, to demonstrate your effectiveness.

Lack of Relevant Keywords: Many employers use applicant tracking systems (ATS) to filter resumes. Not incorporating industry-specific keywords can result in your resume being overlooked. Research the job description and include relevant terms to enhance visibility.

Overloading with Jargon: While industry terminology can showcase your expertise, overusing jargon can make your resume difficult to read. Strive for a balance that reflects your knowledge without alienating potential employers.

Ignoring Soft Skills: Financial planning is not just about numbers; strong interpersonal skills are equally important. Omitting soft skills like communication, empathy, and problem-solving can underrepresent your qualifications.

Poor Formatting: A cluttered or unprofessional layout can detract from your content. Ensure your resume is well-organized, with clear headings, consistent font usage, and adequate white space to improve readability.

Including Irrelevant Experience: Listing unrelated work experience can dilute the focus of your resume. Only include positions and responsibilities that directly relate to financial planning or demonstrate transferable skills.

Neglecting Continuing Education: The financial industry is constantly evolving, and failing to mention relevant certifications or ongoing education can make you appear outdated. Highlight any recent courses, workshops, or certifications that demonstrate your commitment to professional development.

Conclusion

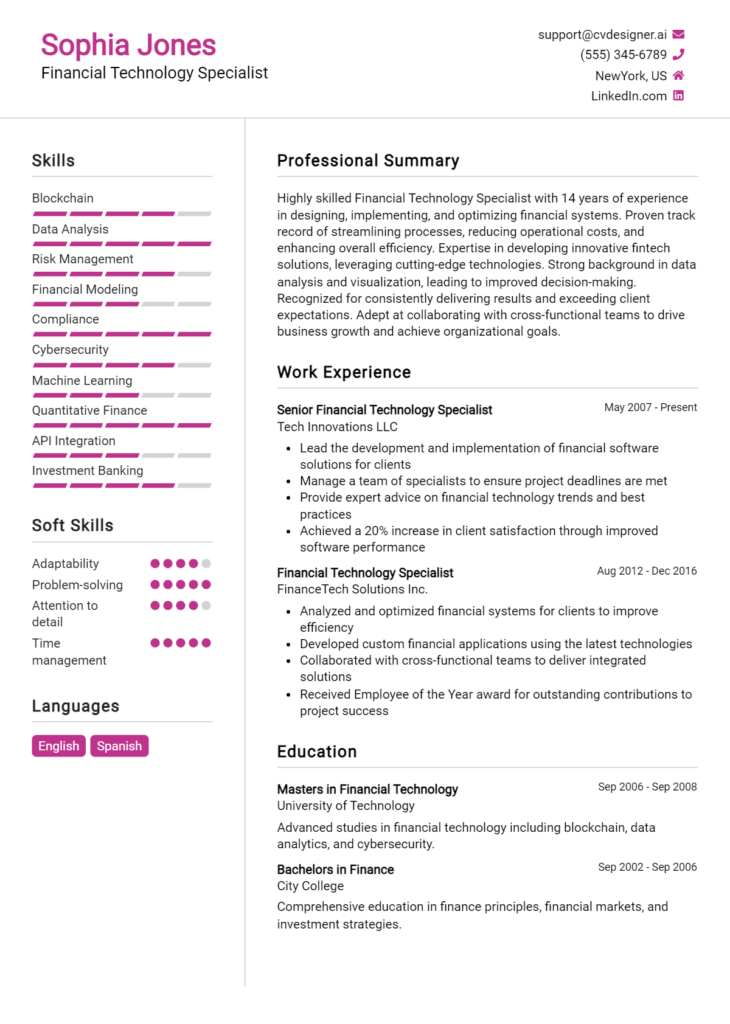

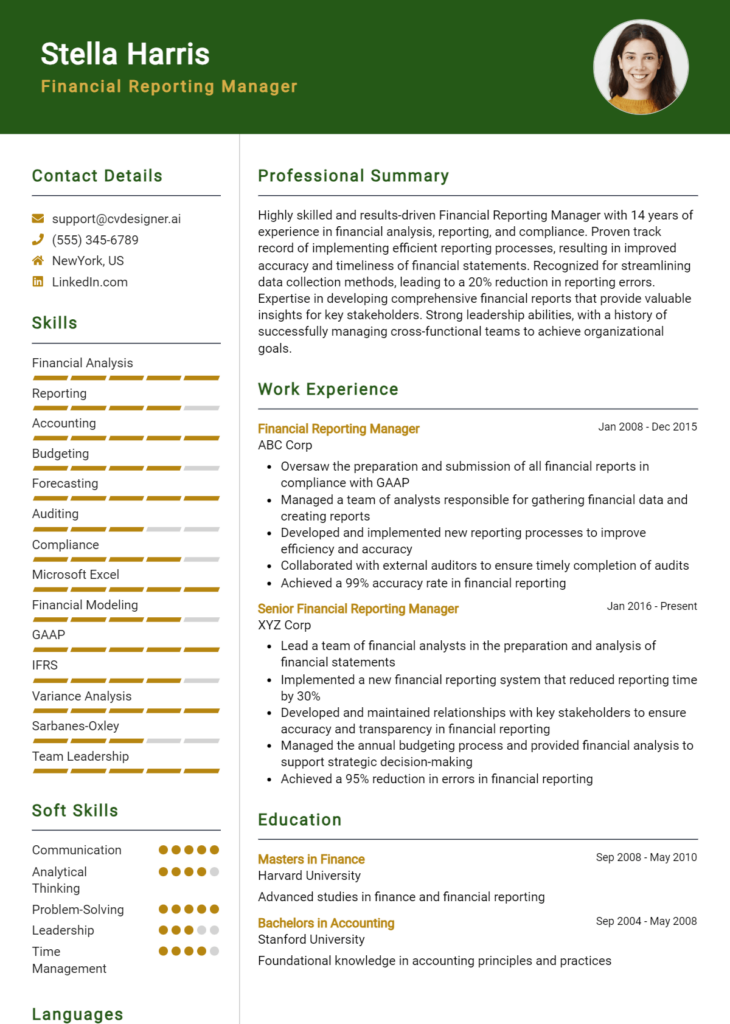

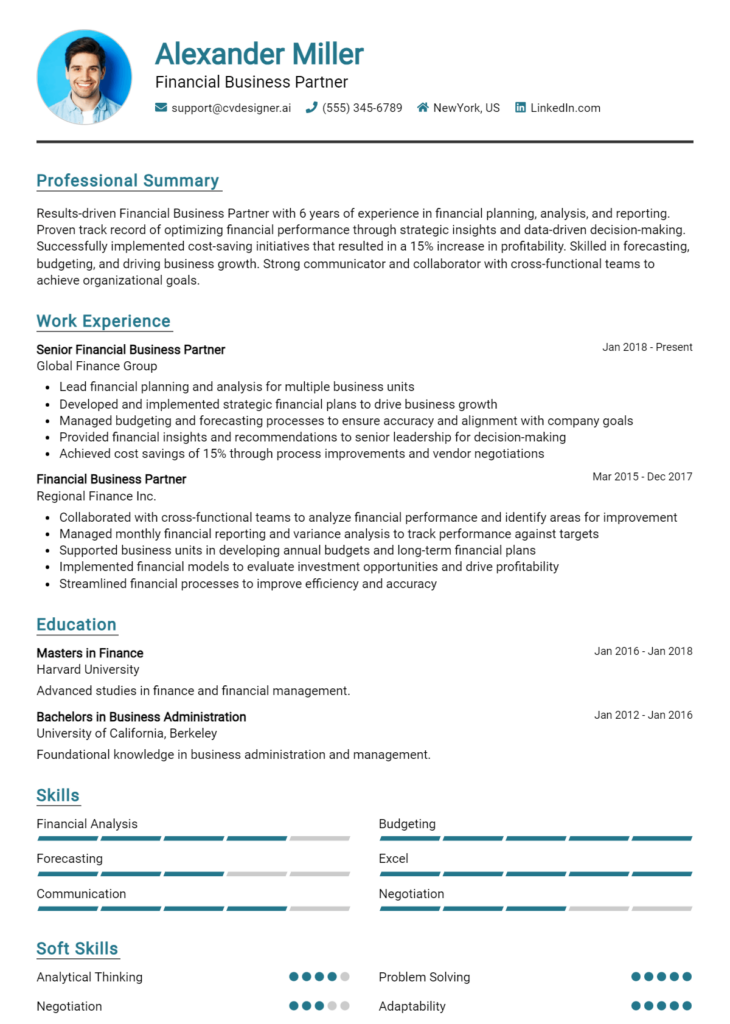

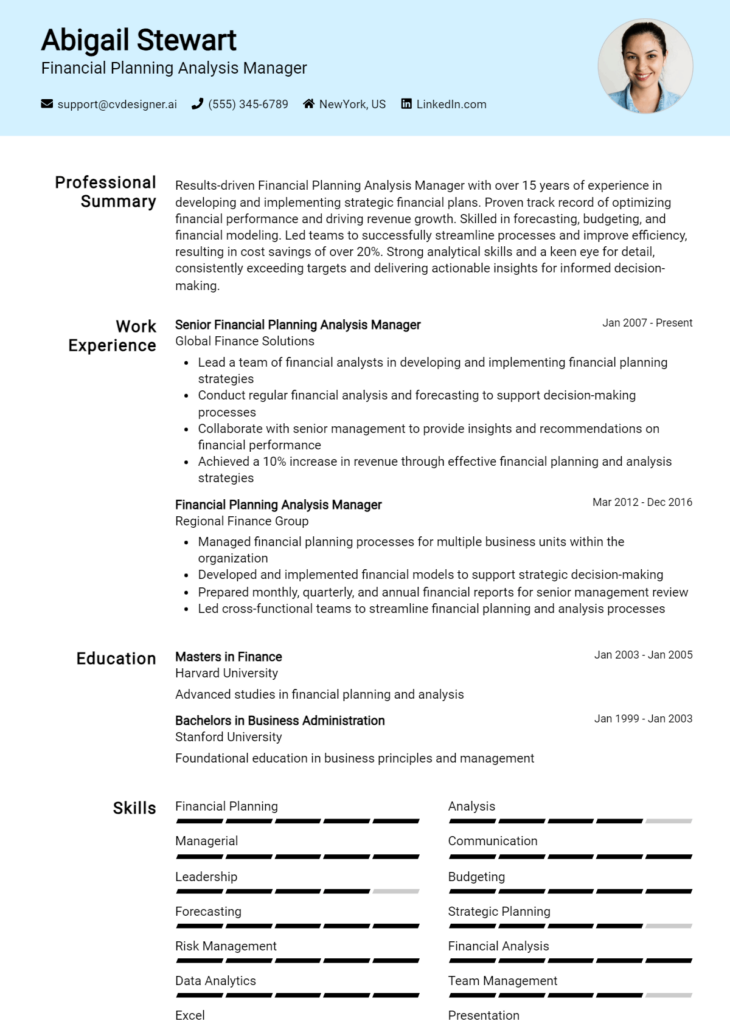

As we have explored the essential qualities and skills that define a successful Financial Planner, it's clear that a well-crafted resume is crucial for standing out in this competitive field. Your resume should effectively highlight your expertise in financial analysis, client relationship management, and strategic planning. Remember to emphasize relevant certifications, such as CFP or CFA, and showcase your ability to customize financial solutions for diverse client needs.

In addition to your qualifications and experience, consider the importance of a professional layout and presentation. A visually appealing resume can make a significant difference in how potential employers perceive your candidacy.

Now is the perfect time to review and enhance your Financial Planner resume. Utilize available tools to streamline this process: explore resume templates that offer professional layouts, try out the resume builder for easy customization, and don't forget to craft a compelling narrative with cover letter templates that align with your resume.

Take action today to ensure your resume reflects your skills and sets you on the path to success in your Financial Planning career!