28 Skills to Include in Your 2025 Commodities Trader Resume with Examples

As a Commodities Trader, possessing a diverse set of skills is essential to navigate the complexities of the market and make informed trading decisions. The right combination of analytical abilities, market knowledge, and interpersonal skills can set you apart in this competitive field. In the following sections, we will outline the top skills that should be highlighted in your resume to showcase your expertise and value as a commodities trader.

Best Commodities Trader Technical Skills

In the fast-paced world of commodities trading, possessing a strong set of technical skills is crucial for success. These skills not only enhance a trader's ability to analyze market trends and make informed decisions but also demonstrate their competency to potential employers. Below are some of the top technical skills that every commodities trader should showcase on their resume.

Market Analysis

Understanding market dynamics and the factors affecting commodity prices is essential. This skill allows traders to predict price movements and make strategic decisions.

How to show it: Include specific examples of market analysis techniques you've used, such as technical analysis or fundamental analysis, and quantify the success of your predictions, such as percentage profit over a defined period.

Risk Management

Effective risk management strategies protect traders from significant losses. This skill involves assessing potential risks and implementing strategies to mitigate them.

How to show it: Highlight your experience with various risk management tools and techniques, and provide data on how these strategies resulted in reduced losses or improved profit margins.

Quantitative Analysis

Quantitative analysis involves using mathematical and statistical methods to evaluate trading strategies and market conditions. This skill is vital for making data-driven decisions.

How to show it: Demonstrate your proficiency in quantitative analysis by mentioning specific models or tools you have used, along with examples of how they improved your trading outcomes.

Technical Analysis

This skill focuses on analyzing price charts and indicators to forecast future price movements. It is essential for short-term trading strategies.

How to show it: Provide examples of specific technical indicators you have utilized, and quantify the accuracy of your predictions based on these analyses.

Fundamental Analysis

Fundamental analysis evaluates the intrinsic value of commodities based on economic, industry, and company data. Understanding these factors is crucial for long-term investment strategies.

How to show it: Describe your experience with fundamental analysis, including key economic indicators you monitor, and illustrate how this analysis led to successful trades.

Trading Platforms

Proficiency in trading platforms and software is essential for executing trades efficiently and analyzing market data.

How to show it: List the trading platforms you are familiar with, and provide examples of how your expertise in these platforms has improved your trading efficiency or effectiveness.

Data Interpretation

The ability to interpret complex data sets is critical for making informed trading decisions and identifying market trends.

How to show it: Showcase specific instances where your data interpretation skills led to successful trades, and include metrics to illustrate the impact of your decisions.

Regulatory Knowledge

Understanding the regulations governing commodities trading is essential for compliance and risk management.

How to show it: Detail your knowledge of relevant regulations and how you have ensured compliance in your trading practices, demonstrating your commitment to ethical trading.

Negotiation Skills

Strong negotiation skills are vital for securing favorable terms in transactions and managing contracts.

How to show it: Provide examples of successful negotiations you have conducted, including the outcomes and any quantifiable benefits achieved as a result.

Financial Modeling

Financial modeling helps traders forecast potential outcomes and assess the viability of investment opportunities.

How to show it: Discuss the financial models you have developed or used, and include metrics that demonstrate their effectiveness in predicting market movements.

Portfolio Management

Managing a diverse portfolio is crucial for balancing risk and return. This skill involves making strategic investment decisions based on market conditions.

How to show it: Illustrate your portfolio management experience by providing data on performance metrics, such as annual returns or risk-adjusted performance.

By incorporating these technical skills into your resume, you can effectively communicate your qualifications as a commodities trader. For more information on enhancing your resume with technical skills, visit [Technical Skills](https://resumedesign.ai/technical-skills/).

Best Commodities Trader Soft Skills

In the fast-paced world of commodities trading, possessing strong soft skills is just as important as having technical knowledge. These interpersonal skills can significantly enhance a trader's ability to navigate complex market conditions, collaborate with teams, and build relationships with clients and stakeholders. Here are some essential soft skills that every successful commodities trader should highlight on their resume.

Communication

Effective communication skills are vital for a commodities trader to convey market insights and strategies clearly to clients and colleagues.

How to show it: Include examples of presentations delivered, reports written, or negotiations conducted. Quantify your impact by stating how your communication improved team efficiency or client satisfaction.

Problem-Solving

Commodities traders often face unexpected challenges. Strong problem-solving skills allow them to analyze situations quickly and develop effective solutions.

How to show it: Demonstrate your problem-solving ability by describing specific situations where you successfully identified and addressed issues. Use metrics to showcase the outcomes of your solutions.

Time Management

With multiple trades and market analyses to juggle, excellent time management skills are essential for prioritizing tasks and meeting deadlines.

How to show it: Highlight how you managed multiple projects, prioritized tasks, and met tight deadlines. Include any tools or methods used to enhance your time management skills.

Teamwork

Collaboration with various departments and stakeholders is crucial in trading environments, making teamwork a key soft skill for traders.

How to show it: Provide examples of successful collaborative projects or initiatives, emphasizing your role and contribution to team success. Mention any positive feedback received from team members.

Adaptability

The commodities market can be unpredictable, and traders must adapt quickly to changing conditions and new information.

How to show it: Share instances where you successfully adapted to market changes or new trading strategies. Quantify your adaptability by discussing the outcomes of your flexible approach.

Analytical Thinking

Analytical thinking enables a commodities trader to assess market trends and data effectively, leading to informed decision-making.

How to show it: Highlight your experience with data analysis and market research. Provide specific examples of how your analytical skills led to successful trades or improved strategies.

Negotiation

Strong negotiation skills help traders secure the best possible deals and terms in a competitive market.

How to show it: Detail your negotiation experiences by discussing specific deals you closed, including the terms achieved and how they benefited your organization.

Emotional Intelligence

Emotional intelligence helps traders manage their emotions and understand the emotional dynamics of the market and their clients.

How to show it: Provide examples of how your emotional intelligence contributed to successful client relationships or team dynamics, emphasizing improved outcomes as a result.

Attention to Detail

Attention to detail is crucial for traders to avoid costly mistakes and to ensure accuracy in trade execution and reporting.

How to show it: Discuss specific instances where your attention to detail prevented errors or led to successful outcomes. Consider quantifying the impact of your diligence.

Resilience

Resilience allows traders to cope with the pressures of the market, bounce back from losses, and maintain a positive outlook.

How to show it: Share stories of challenges faced in trading and how you overcame them. Highlight any lessons learned and how they improved your trading approach.

Networking

Building a strong professional network can open doors to new opportunities and insights in the commodities market.

How to show it: Include details about industry events attended, professional associations joined, or key relationships built that have positively impacted your trading career.

For more information on enhancing your resume with soft skills, visit our [Soft Skills](https://resumedesign.ai/soft-skills/) page. Explore specific skills like [Communication](https://resumedesign.ai/communication-skills/), [Problem-solving](https://resumedesign.ai/problem-solving-skills/), [Time Management](https://resumedesign.ai/time-management-skills/), and [Teamwork](https://resumedesign.ai/teamwork-skills/) to showcase your full potential as a commodities trader.

Best Commodities Trader Technical Skills

Technical skills are essential for a Commodities Trader as they enable professionals to analyze market data, make informed decisions, and effectively manage risk. Possessing a robust set of technical skills can significantly enhance a trader's ability to navigate the complexities of commodity markets, optimize trading strategies, and achieve superior performance.

Market Analysis

Market analysis involves evaluating various commodities, understanding market trends, and predicting price movements based on economic indicators. This skill is crucial for making informed trading decisions.

How to show it: Include specific examples of how your market analyses led to successful trades or strategies. Quantify your results, such as percentage gains on trades after conducting thorough market analysis.

Risk Management

Risk management is the process of identifying, assessing, and prioritizing risks followed by coordinated efforts to minimize, monitor, and control the probability of unfortunate events. This skill ensures that traders protect their investments and manage exposure effectively.

How to show it: Demonstrate your risk management capabilities by detailing strategies you implemented and the outcomes, such as reduced losses or improved risk-adjusted returns. Use numerical data to back your statements.

Technical Analysis

Technical analysis involves using historical price data and trading volume to forecast future price movements. It is essential for short-term traders to identify trends and entry/exit points.

How to show it: Highlight specific technical indicators or charting tools you are proficient in, and provide examples of how your analysis contributed to successful trades. Use metrics from past performance to illustrate your expertise.

Financial Modeling

Financial modeling encompasses creating representations of a trader's financial performance, which aids in forecasting and valuation. This skill allows traders to assess the potential profitability of various commodities.

How to show it: Describe any financial models you've built or utilized, including the tools used (like Excel or specialized software). Provide quantifiable outcomes or improvements resulting from your modeling efforts.

Trading Platforms Proficiency

Proficiency in trading platforms is vital for executing trades, monitoring market conditions, and managing portfolios. Familiarity with these tools enhances efficiency and decision-making speed.

How to show it: List the trading platforms you are skilled in and detail your experience, including any specific features you utilized to enhance trading performance. Mention any achievements correlated with your platform expertise.

Quantitative Analysis

Quantitative analysis involves the use of mathematical and statistical methods to evaluate trading opportunities and make data-driven decisions. This skill is essential for optimizing trading strategies.

How to show it: Provide examples of quantitative models or analyses you have developed, along with the results achieved. Use statistics to quantify the effectiveness of your quantitative approaches.

How to List Commodities Trader Skills on Your Resume

Effectively listing your skills on a resume is crucial to standing out to employers in a competitive job market. Highlighting your qualifications in a clear and impactful way allows hiring managers to quickly see your potential value. There are three main sections where your skills can shine: Resume Introduction, Work Experience, and Skills Section.

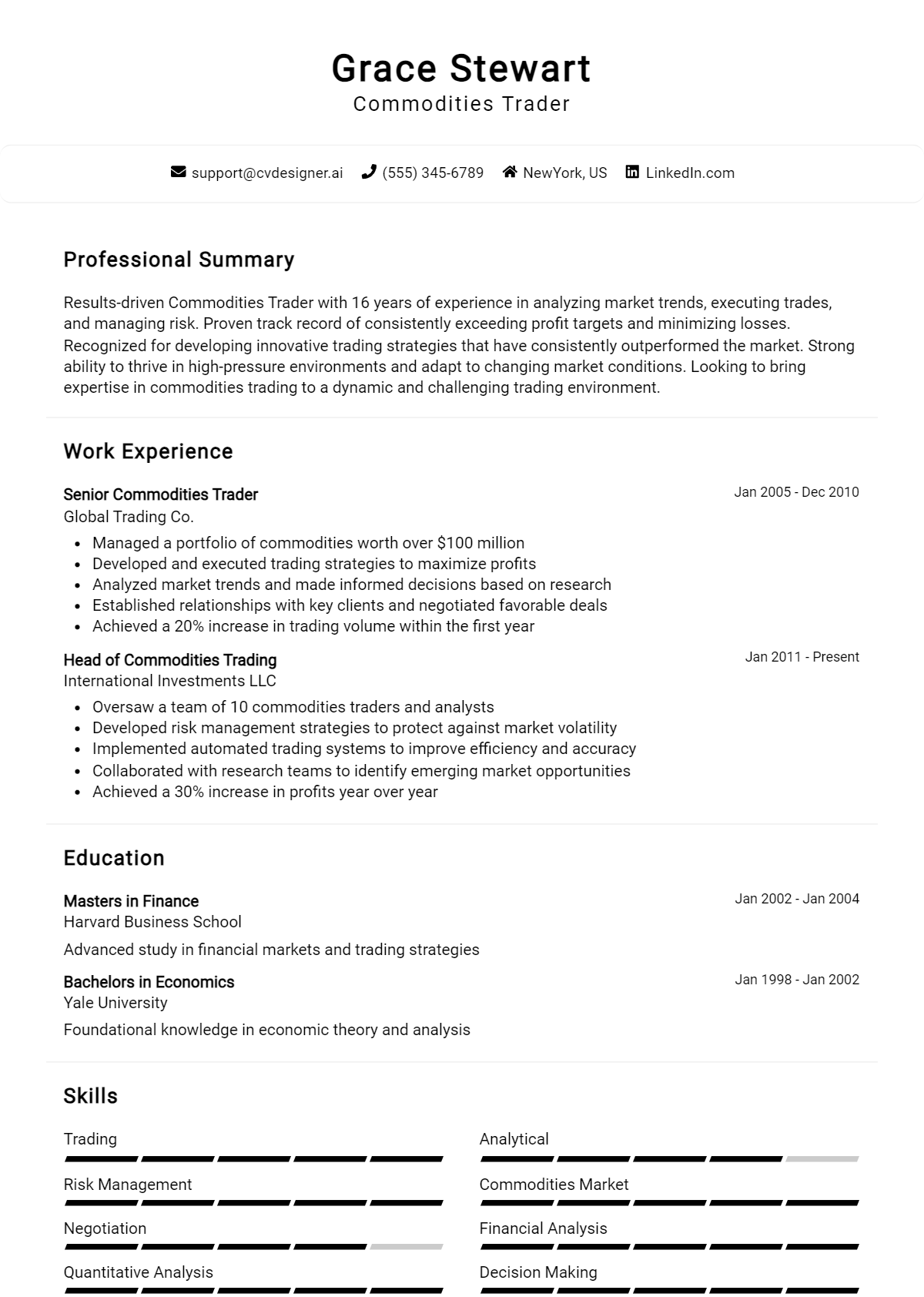

for Summary

Showcasing Commodities Trader skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications and expertise in the field.

Example

Dynamic Commodities Trader with expertise in market analysis, risk management, and portfolio diversification. Proven track record of driving profitability through strategic decision-making and effective communication in fast-paced environments.

for Work Experience

The work experience section is the perfect opportunity to demonstrate how your Commodities Trader skills have been applied in real-world scenarios, showcasing your impact in previous roles.

Example

- Executed trades in agricultural commodities, resulting in a 15% increase in quarterly profits.

- Conducted technical analysis to identify market trends, enhancing strategic decision-making.

- Collaborated with cross-functional teams to develop risk assessment models, mitigating potential losses.

- Utilized advanced trading software to manage a diverse portfolio, achieving consistent outperformance against benchmarks.

for Skills

The skills section can either showcase technical or transferable skills. A balanced mix of hard and soft skills should be included to strengthen your qualifications as a commodities trader.

Example

- Market Analysis

- Risk Management

- Technical Analysis

- Negotiation Skills

- Portfolio Diversification

- Communication Skills

- Financial Modeling

- Data Interpretation

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate how those skills have positively impacted your previous roles.

Example

In my role as a Commodities Trader, I utilized my market analysis skills to identify emerging trends, leading to a 20% increase in our trading portfolio's performance. My background in risk management has equipped me to make informed decisions that minimize losses while maximizing profitability.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job, allowing you to present a compelling case to potential employers. For more insights, explore our sections on skills and work experience.

The Importance of Commodities Trader Resume Skills

In the competitive field of commodities trading, highlighting relevant skills on your resume is crucial for capturing the attention of recruiters. A well-crafted skills section not only showcases your expertise but also aligns your qualifications with the specific requirements of the job. By effectively communicating your abilities, you increase your chances of standing out in a pool of candidates and securing the position you desire.

- Strong analytical skills are essential for a commodities trader as they allow you to interpret market trends and make informed decisions. This capability helps in identifying profitable opportunities and mitigating risks associated with trading.

- Proficiency in financial modeling and valuation techniques is vital, as these skills enable you to assess the worth of various commodities. This knowledge is crucial for making strategic trading decisions that maximize returns.

- Excellent negotiation skills are important for a commodities trader, as they facilitate effective communication with suppliers and buyers. Successful negotiations can lead to better pricing and favorable terms, enhancing profitability.

- Familiarity with trading platforms and financial software is imperative in today's tech-driven market. This expertise ensures that you can efficiently execute trades and analyze market data in real time.

- Risk management skills are critical for safeguarding investments. A competent commodities trader must be able to identify potential risks and develop strategies to minimize their impact on the portfolio.

- Understanding of global economic indicators and their impact on commodity prices is necessary for making strategic trading decisions. This knowledge helps traders anticipate market movements and adjust their strategies accordingly.

- Strong communication skills are vital for collaborating with team members and presenting market insights to stakeholders. Being able to articulate your analysis and recommendations clearly can significantly influence trading strategies.

- Adaptability is key in the fast-paced world of commodities trading. The ability to quickly respond to market changes and adjust strategies accordingly can be the difference between success and failure.

For more information on crafting a compelling resume, you can explore this what is resume page.

How To Improve Commodities Trader Resume Skills

In the fast-paced world of commodities trading, continuous improvement of skills is essential to stay competitive and achieve success. As market dynamics shift and new trading technologies emerge, traders must adapt and enhance their expertise to maximize performance and make informed decisions. By actively seeking to improve your skills, you can not only enhance your resume but also position yourself for better opportunities in this challenging field.

- Participate in trading simulations to practice decision-making in real-time market scenarios.

- Stay updated with market trends and news by subscribing to financial news outlets and industry reports.

- Take advanced courses in financial analysis, risk management, and commodities markets to deepen your knowledge.

- Network with other professionals in the field to share insights and strategies that can enhance your trading approach.

- Utilize trading software and analytics tools to improve your data analysis and forecasting skills.

- Engage in self-reflection and regularly review your trading performance to identify areas for improvement.

- Seek mentorship from experienced traders who can provide guidance and share valuable industry insights.

Frequently Asked Questions

What key skills should be highlighted on a commodities trader resume?

A commodities trader resume should prominently feature analytical skills, risk management expertise, and proficiency in market analysis. Additionally, strong negotiation skills, attention to detail, and the ability to make quick decisions under pressure are essential. Familiarity with trading platforms and financial software also enhances a trader's profile, showcasing technical capabilities alongside trading acumen.

How important is knowledge of market trends for a commodities trader?

Knowledge of market trends is crucial for a commodities trader as it enables them to make informed decisions based on current and projected market conditions. Understanding supply and demand dynamics, geopolitical factors, and economic indicators allows traders to anticipate price movements and adjust their strategies accordingly, ultimately enhancing their trading performance and profitability.

What role does risk management play in trading commodities?

Risk management is a fundamental aspect of commodities trading, as it helps traders limit potential losses and protect their investments. Effective risk management strategies include setting stop-loss orders, diversifying portfolios, and calculating position sizes based on market volatility. A strong emphasis on risk management on a trader's resume demonstrates their ability to navigate the unpredictable nature of commodity markets while safeguarding capital.

How can technical analysis skills benefit a commodities trader?

Technical analysis skills are beneficial for a commodities trader as they provide insights into historical price movements, helping traders identify patterns and potential future trends. Proficiency in using technical indicators, charting tools, and trading algorithms enables traders to make data-driven decisions, improve entry and exit points, and optimize their overall trading strategies.

What soft skills are valuable for a successful commodities trader?

Soft skills such as strong communication, adaptability, and emotional intelligence are invaluable for a successful commodities trader. Effective communication facilitates collaboration with colleagues and clients, while adaptability allows traders to respond to rapidly changing market conditions. Emotional intelligence helps traders manage stress and maintain composure during high-pressure situations, which is essential for making sound trading decisions.

Conclusion

Incorporating Commodities Trader skills into your resume is crucial, as it highlights your expertise in a dynamic and competitive field. By showcasing relevant skills, you not only demonstrate your capabilities but also distinguish yourself from other candidates, providing significant value to potential employers. Take the time to refine your skills and present them effectively, as this can greatly enhance your job application and open doors to new opportunities.

Remember, investing in your skills is an investment in your future. Start crafting your standout resume today with our resume templates, utilize our resume builder, explore resume examples, and don’t forget to create a compelling introduction with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.