Commodities Trader Core Responsibilities

A Commodities Trader is pivotal in navigating the complexities of global markets, requiring a blend of technical acumen, operational efficiency, and strong problem-solving skills. They analyze market trends, develop trading strategies, and manage risk, thus acting as a bridge between finance, logistics, and regulatory departments. Their expertise ensures the organization meets its goals for profitability and sustainability. A well-structured resume highlighting these skills and experiences can significantly enhance their job prospects.

Common Responsibilities Listed on Commodities Trader Resume

- Analyze market data and trends to inform trading strategies.

- Execute buy and sell orders for commodities in various markets.

- Monitor and manage risk exposure across trading positions.

- Collaborate with logistics and supply chain teams for optimal delivery.

- Develop financial models to predict market movements.

- Maintain relationships with brokers and exchanges.

- Prepare reports on trading performance and market conditions.

- Ensure compliance with regulatory standards and internal policies.

- Utilize trading platforms and software for data analysis.

- Negotiate contracts and pricing with suppliers and customers.

- Conduct research on economic indicators affecting commodity prices.

- Support the development of trading strategies that align with organizational goals.

High-Level Resume Tips for Commodities Trader Professionals

In the competitive field of commodities trading, a well-crafted resume is essential for making a strong first impression on potential employers. Your resume serves as the initial touchpoint, offering a glimpse into your skills, experiences, and accomplishments. It must effectively reflect your expertise in the dynamic world of commodities, showcasing not just what you have done, but how well you have done it. This guide will provide practical and actionable resume tips specifically tailored for Commodities Trader professionals, helping you to stand out in a crowded job market and secure the opportunities you seek.

Top Resume Tips for Commodities Trader Professionals

- Tailor your resume to each job description, emphasizing the skills and experiences that match the specific requirements of the position.

- Highlight relevant experience in commodities trading, including specific markets you have worked in and the types of commodities you are familiar with.

- Quantify your achievements with specific metrics, such as percentage gains, trading volume, or profit margins to demonstrate your impact.

- Showcase industry-specific skills, such as risk management, market analysis, and trading strategies, to align with the expectations of potential employers.

- Include certifications and licenses that are relevant to the commodities trading field, such as Series 3 or CFA, to enhance your credibility.

- Utilize industry jargon and terminology appropriately to demonstrate your deep understanding of the commodities market.

- Incorporate action verbs to convey a sense of proactivity and results-driven mentality in your work history.

- Keep your resume concise, ideally one page, focusing on the most relevant experiences and skills to capture the reader's attention quickly.

- Consider including a summary statement at the top of your resume that encapsulates your trading philosophy and key accomplishments.

By implementing these tips, you can significantly increase your chances of landing a job in the commodities trading field. A focused and polished resume will not only reflect your qualifications but also convey your passion for the industry, making you a more attractive candidate to potential employers.

Why Resume Headlines & Titles are Important for Commodities Trader

In the competitive field of commodities trading, a well-crafted resume is essential for standing out among a pool of candidates. Resume headlines and titles serve as the first impression for hiring managers, providing a snapshot of a candidate's qualifications and expertise at a glance. A strong headline can immediately capture attention, succinctly summarizing key skills, experiences, or accomplishments in a single impactful phrase. It is crucial that the headline be concise, relevant, and tailored specifically to the job being applied for, as this sets the tone for the entire resume and enhances the likelihood of being noticed in a crowded job market.

Best Practices for Crafting Resume Headlines for Commodities Trader

- Be concise: Keep the headline short and to the point, ideally under 10 words.

- Utilize industry-specific terminology: Incorporate jargon that resonates with commodities trading.

- Highlight key qualifications: Focus on your top skills or achievements relevant to the position.

- Be role-specific: Tailor the headline to reflect the specific job title you are applying for.

- Use action verbs: Start with strong action verbs to convey confidence and dynamism.

- Include quantifiable achievements: Whenever possible, add numbers or metrics to illustrate your impact.

- Avoid generic phrases: Steer clear of clichés and vague descriptors that don’t add value.

- Research the company: Align your headline with the company’s values and needs to demonstrate fit.

Example Resume Headlines for Commodities Trader

Strong Resume Headlines

Expert Commodities Trader with 10+ Years of Experience in Risk Management

Results-Driven Trader Specializing in Oil and Gas Markets with Proven Track Record

Dynamic Commodities Analyst with Expertise in Market Forecasting and Trading Strategies

Senior Commodities Trader: Achieved 25% ROI Through Strategic Commodity Investments

Weak Resume Headlines

Trader Looking for Opportunities

Experienced Professional in Finance

Seeking a Position in Commodities Trading

The strong resume headlines are effective because they convey specific qualifications and achievements that immediately communicate the candidate's value to potential employers. They use precise language and highlight relevant experience, making it clear why the candidate is a strong fit for the role. In contrast, the weak headlines lack specificity and fail to provide any compelling information about the candidate's background or skills, making them forgettable and less likely to attract attention. A powerful headline should not only reflect the candidate's strengths but also resonate with the needs of the hiring organization.

Writing an Exceptional Commodities Trader Resume Summary

A well-crafted resume summary is essential for a Commodities Trader, as it serves as the first impression for hiring managers. A strong summary succinctly highlights key skills, relevant experience, and notable accomplishments, allowing candidates to quickly capture the attention of potential employers. By concisely conveying their value proposition, candidates can effectively differentiate themselves in a competitive job market. Tailoring the summary to the specific job description ensures that the candidate's qualifications align with the employer's needs, making it an impactful introduction to the resume.

Best Practices for Writing a Commodities Trader Resume Summary

- Quantify Achievements: Use numbers and statistics to demonstrate success in trading strategies, risk management, or revenue generation.

- Focus on Key Skills: Highlight specific skills relevant to commodities trading, such as market analysis, negotiation, and technical analysis.

- Tailor to Job Description: Customize the summary to reflect the requirements and language used in the job posting.

- Be Concise: Aim for 2-4 sentences that deliver impactful information without unnecessary details.

- Showcase Relevant Experience: Include industries or commodities you have worked with to add context to your expertise.

- Highlight Unique Selling Points: Emphasize what sets you apart, such as certifications, specialized training, or unique insights into market trends.

- Use Active Language: Employ strong action verbs to convey your accomplishments and contributions effectively.

- Maintain Professional Tone: Ensure the summary reflects professionalism, aligning with industry standards.

Example Commodities Trader Resume Summaries

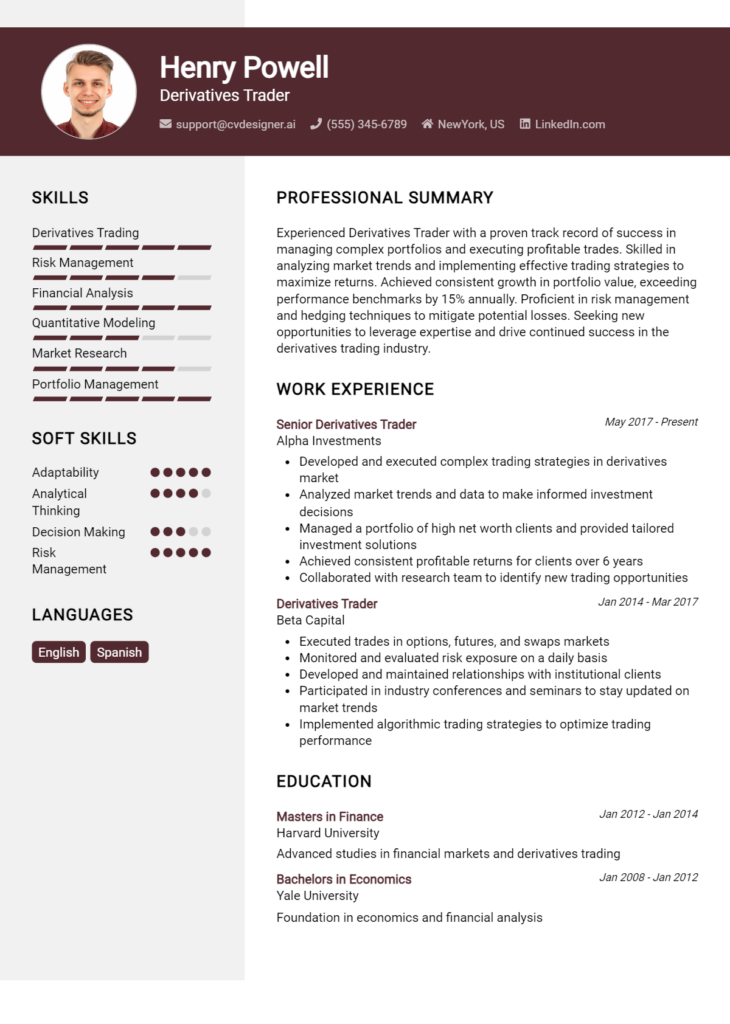

Strong Resume Summaries

Dynamic Commodities Trader with over 8 years of experience in managing multi-million-dollar portfolios, achieving an average annual return of 15%. Expertise in agricultural commodities with a proven track record of leveraging market data to inform trading strategies and reduce risk exposure.

Results-driven Commodities Trader skilled in technical analysis and risk management, successfully increasing profit margins by 25% in the last fiscal year. Proficient in identifying market trends and executing high-stakes trades across energy and metals sectors.

Strategic Commodities Trader with extensive knowledge in futures and options trading, recognized for generating $2M in revenue through innovative hedging strategies. Strong analytical skills complemented by a deep understanding of global markets and economic indicators.

Weak Resume Summaries

Experienced trader looking for a new opportunity in commodities trading.

I have worked in finance for several years and am interested in commodities trading.

The examples of strong summaries effectively showcase quantifiable achievements and specific skills relevant to the Commodities Trader role, demonstrating the candidate's ability to deliver results and adapt to market dynamics. In contrast, the weak summaries lack specificity, fail to highlight measurable outcomes, and appear generic, making it difficult for hiring managers to assess the candidate’s qualifications and fit for the position.

Work Experience Section for Commodities Trader Resume

The work experience section is a critical component of a Commodities Trader resume, as it not only highlights the candidate's relevant technical skills but also demonstrates their capacity to manage teams and deliver high-quality trading products. Recruiters seek evidence of successful past performance, making it essential for candidates to quantify their achievements and align their experiences with industry standards. This section serves as a platform to showcase not only individual contributions but also collaborative efforts within teams, positioning the candidate as a well-rounded professional in the commodities trading field.

Best Practices for Commodities Trader Work Experience

- Emphasize relevant technical skills, such as market analysis, risk management, and trading strategies.

- Quantify achievements with specific metrics, such as profit margins, volume traded, or percentage growth.

- Highlight leadership roles and team management experiences to showcase collaboration and mentoring abilities.

- Use industry-specific terminology to demonstrate familiarity with commodities trading practices.

- Tailor experiences to align with job descriptions, focusing on skills and achievements that match the requirements.

- Include any relevant certifications or training that enhance your credibility in the field.

- Provide context for accomplishments to illustrate the challenges faced and how they were overcome.

- Stay concise and focused, ensuring clarity and impact in each bullet point.

Example Work Experiences for Commodities Trader

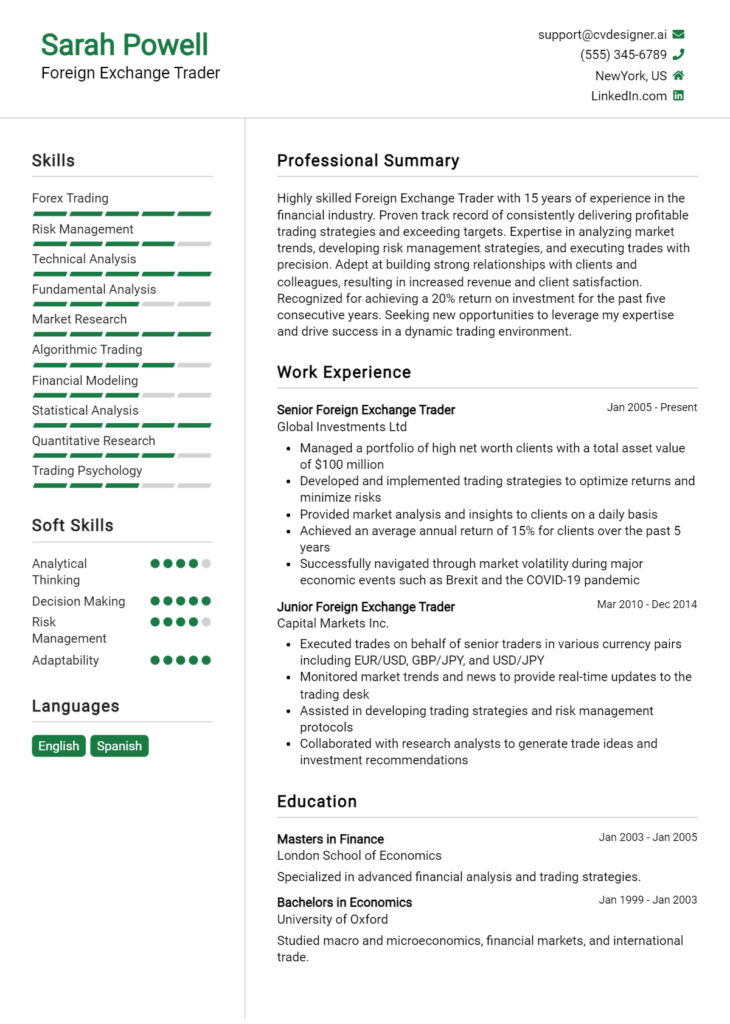

Strong Experiences

- Led a team of 5 traders to achieve a 35% increase in portfolio profitability over two years through strategic market analysis and risk assessment.

- Implemented a new trading algorithm that reduced execution time by 20%, resulting in an average annual profit increase of $1.2 million.

- Collaborated with cross-functional teams to develop a comprehensive risk management framework, successfully minimizing exposure by 15% in volatile markets.

- Negotiated and secured contracts with suppliers that enhanced supply chain efficiency and decreased costs by 10% within six months.

Weak Experiences

- Worked on trading strategies that sometimes produced good results.

- Participated in team meetings and discussions.

- Assisted in executing trades and monitoring market trends.

- Helped in managing client relationships and communication.

The strong experiences listed are considered impactful because they provide clear metrics, demonstrate leadership and collaboration, and show a direct connection to successful outcomes. In contrast, the weak experiences lack specificity and quantifiable results, making them less impressive to potential employers. Strong examples articulate the candidate's contributions and successes in concrete terms, while weak statements fail to convey the candidate's value convincingly.

Education and Certifications Section for Commodities Trader Resume

The education and certifications section of a Commodities Trader resume plays a crucial role in demonstrating the candidate's academic foundation and commitment to professional excellence. This section not only outlines the candidate's formal education but also highlights industry-relevant certifications and ongoing learning efforts that are essential for success in the fast-paced commodities market. By including pertinent coursework, specialized training, and recognized credentials, candidates can significantly enhance their credibility and showcase their alignment with the demands of the job role, making them more attractive to potential employers.

Best Practices for Commodities Trader Education and Certifications

- Ensure all educational qualifications are relevant to finance, economics, or trading.

- Include advanced degrees such as an MBA or Master’s in Finance to demonstrate higher-level expertise.

- Highlight industry-recognized certifications, such as the Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP).

- List relevant coursework that covers commodities markets, risk management, and financial analysis.

- Keep the information concise and focused on qualifications that directly pertain to commodities trading.

- Use clear formatting to make the section easy to read and visually appealing.

- Regularly update the section to reflect any new certifications or educational achievements.

- Include professional development courses or workshops that enhance trading skills.

Example Education and Certifications for Commodities Trader

Strong Examples

- MBA in Finance from the University of Chicago, Graduated 2022

- Chartered Financial Analyst (CFA) Level II Candidate

- Certificate in Commodity Trading from the New York Institute of Finance

- Coursework in Risk Management and Derivatives Trading, University of California, Berkeley

Weak Examples

- Bachelor's Degree in History from State University, Graduated 2010

- Certification in Microsoft Excel (not relevant to trading)

- Online course in Basic Photography (not related to finance or trading)

- High School Diploma from Community High School, Graduated 2006

The strong examples are considered effective because they directly relate to the skills and knowledge required for a Commodities Trader. They showcase advanced education and recognized certifications that enhance credibility in the field. In contrast, the weak examples demonstrate a lack of relevance to the role, as they include degrees and certifications that do not contribute to the skill set necessary for success in commodities trading, thus failing to strengthen the candidate's profile.

Top Skills & Keywords for Commodities Trader Resume

In the competitive field of commodities trading, showcasing the right skills on your resume is crucial for standing out to potential employers. A well-crafted resume should highlight both hard and soft skills that demonstrate your expertise and ability to thrive in a fast-paced trading environment. Hard skills reflect your technical proficiency and understanding of market dynamics, while soft skills reveal your interpersonal abilities and decision-making capability. By effectively integrating these skills into your resume, you can present a well-rounded profile that appeals to recruiters and hiring managers looking for candidates who can navigate the complexities of commodity markets.

Top Hard & Soft Skills for Commodities Trader

Soft Skills

- Analytical Thinking

- Strong Communication

- Adaptability

- Negotiation Skills

- Risk Management

- Problem Solving

- Team Collaboration

- Emotional Intelligence

- Time Management

- Strategic Planning

Hard Skills

- Market Analysis

- Financial Modeling

- Technical Analysis

- Data Interpretation

- Trading Platforms Proficiency

- Portfolio Management

- Regulatory Compliance

- Economic Indicators Analysis

- Commodity Pricing Forecasting

- Statistical Analysis

To further enhance your resume, consider exploring additional skills and showcasing relevant work experience that aligns with the demands of a commodities trader role.

Stand Out with a Winning Commodities Trader Cover Letter

Dear Hiring Manager,

I am writing to express my interest in the Commodities Trader position at [Company Name] as advertised. With a robust background in financial markets and a keen understanding of commodity trading dynamics, I am excited about the opportunity to contribute to your team. My experience in analyzing market trends, coupled with my ability to execute trades efficiently, has equipped me with the skills necessary to thrive in this fast-paced environment.

During my tenure at [Previous Company Name], I successfully managed a diverse portfolio of commodities, including energy, metals, and agricultural products. My analytical approach enabled me to identify profitable trading opportunities, resulting in a 20% increase in portfolio returns over two years. I utilized advanced trading software to assess market conditions, monitor price fluctuations, and make data-driven decisions. My strong quantitative skills, combined with a strategic mindset, allowed me to navigate the complexities of the commodities market effectively.

I am particularly drawn to [Company Name] because of its reputation for innovation and leadership in the commodities sector. I am eager to bring my expertise in risk management and market analysis to your organization and contribute to achieving your trading objectives. I thrive in collaborative environments and believe that my proactive communication style will complement your team’s efforts in fostering strong relationships with clients and stakeholders.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences align with the goals of [Company Name]. I am excited about the prospect of joining your team and contributing to your continued success in the commodities trading space.

Sincerely,

[Your Name]

[Your Contact Information]

[Your LinkedIn Profile]

Common Mistakes to Avoid in a Commodities Trader Resume

When crafting a resume for a Commodities Trader position, it’s crucial to present a clear, concise, and compelling narrative of your skills and experiences. However, many candidates make common mistakes that can undermine their chances of securing an interview. Avoiding these pitfalls can significantly enhance your resume’s effectiveness, ensuring that it stands out to hiring managers in the competitive world of commodities trading.

Lack of Quantifiable Achievements: Failing to include specific metrics or data to showcase your trading success can make your accomplishments seem vague. Always quantify your results, such as mentioning percentage increases in profits or volume traded.

Overly Technical Jargon: Using excessive industry jargon can alienate your reader. While some technical terms are necessary, ensure that your resume remains accessible to HR personnel who might not have a trading background.

Ignoring Soft Skills: Commodities trading involves negotiation and interpersonal interactions. Neglecting to highlight soft skills, such as communication and teamwork, can give an incomplete picture of your abilities.

Generic Objective Statements: A one-size-fits-all objective statement fails to capture your unique qualifications. Tailor your objective to the specific role and company, demonstrating your genuine interest and fit for the position.

Poor Formatting and Layout: A cluttered or unprofessional layout can hinder readability. Use clear headings, bullet points, and consistent formatting to make your resume easy to navigate.

Not Updating for Each Application: Sending out the same resume for every job application can be detrimental. Customize your resume for each position by highlighting the most relevant experiences and skills that align with the job description.

Neglecting Professional Development: Failing to mention relevant certifications, training, or ongoing education can make it seem like you’re not committed to your professional growth. Include any relevant courses or certifications, such as CFA or CMT.

Listing Irrelevant Experience: Including unrelated job experiences can distract from your qualifications as a commodities trader. Focus on roles and experiences that directly relate to trading or financial analysis to maintain relevance.

Conclusion

In summary, a successful commodities trader must possess a keen understanding of market dynamics, strong analytical skills, and the ability to make quick decisions under pressure. It is essential to stay informed about global economic trends, geopolitical developments, and supply-demand fluctuations that can impact commodity prices. Networking and building relationships within the industry can also enhance opportunities and provide valuable insights.

To enhance your career prospects as a commodities trader, it’s crucial to have a polished resume that highlights your skills and experiences effectively. We encourage you to take a moment to review and update your Commodities Trader Resume. Explore our variety of resources available to help you craft the perfect resume. Utilize our resume templates for a professional layout, try out our resume builder for easy customization, review resume examples for inspiration, and don't forget to create a compelling cover letter using our cover letter templates. Take action now to ensure you stand out in the competitive field of commodities trading!