Top 27 Commercial Banker Resume Skills with Examples for 2025

As a Commercial Banker, possessing the right set of skills is crucial for success in this competitive field. A strong skill set not only enhances your ability to serve clients effectively but also positions you as a valuable asset within your organization. In the following section, we will explore the top skills that should be highlighted on your resume, helping you to stand out to potential employers and advance your career in commercial banking.

Best Commercial Banker Technical Skills

In the competitive field of commercial banking, possessing the right technical skills is crucial for success. These skills not only enhance a banker's ability to serve clients effectively but also contribute to the overall efficiency and profitability of the banking institution. Highlighting these skills on your resume can set you apart from other candidates and demonstrate your readiness for the role.

Financial Analysis

Financial analysis is the ability to assess the financial health of clients and businesses through various metrics. This skill is essential for making informed lending decisions and offering sound financial advice.

How to show it: Quantify your experience by showcasing specific analyses you've conducted, such as "Conducted financial analysis for 50+ businesses, resulting in a 20% increase in loan approvals."

Risk Assessment

Risk assessment involves identifying potential risks in lending and investment decisions. This skill helps commercial bankers mitigate losses and make strategic decisions that align with the bank's risk appetite.

How to show it: Demonstrate your expertise by mentioning specific risk assessments you've performed, including outcomes like "Implemented risk assessment strategies that reduced default rates by 15%."

Credit Analysis

Credit analysis is the process of evaluating a borrower's creditworthiness. This skill is critical for determining loan eligibility and establishing appropriate lending terms.

How to show it: Highlight achievements such as "Performed credit analysis on over 100 clients, leading to a 30% reduction in loan default incidences."

Portfolio Management

Portfolio management involves overseeing a collection of loans and investments to optimize returns while minimizing risks. This skill is vital for ensuring the bank's financial stability.

How to show it: Show your impact by stating "Managed a loan portfolio worth $10 million, achieving a consistent annual return of 8%."

Regulatory Compliance

Understanding regulatory compliance ensures that all banking operations adhere to laws and regulations. This skill is crucial for maintaining the bank's reputation and avoiding fines.

How to show it: Include examples like "Ensured 100% compliance with federal regulations, resulting in zero penalties during audits."

Financial Modeling

Financial modeling involves creating representations of a bank's financial performance. This skill aids in forecasting and strategic planning, providing insights for decision-making.

How to show it: Quantify your modeling skills with statements such as "Developed financial models that improved forecasting accuracy by 25%."

Sales and Relationship Management

Building and maintaining relationships with clients is essential for driving business. This skill enhances client satisfaction and loyalty, leading to increased revenue.

How to show it: Highlight your success with metrics like "Expanded client base by 50% through effective relationship management strategies."

Data Analysis

Data analysis enables commercial bankers to interpret market trends and client behaviors, aiding in strategic decision-making. This skill is essential for identifying opportunities and threats in the market.

How to show it: Present your data analysis achievements, such as "Utilized data analytics to identify trends, leading to a 15% increase in targeted marketing effectiveness."

Negotiation Skills

Negotiation skills are crucial for structuring deals that satisfy both the bank and the client. This ability can significantly impact the bank's profitability and client satisfaction.

How to show it: Quantify your negotiation success with statements like "Negotiated loan terms that resulted in a 10% increase in profitability for the bank."

Customer Service Excellence

Providing exceptional customer service fosters long-term relationships and enhances client retention. This skill is vital for addressing client needs and resolving issues efficiently.

How to show it: Demonstrate your customer service capabilities by stating "Achieved a 95% customer satisfaction rating through proactive service initiatives."

Market Knowledge

Having in-depth knowledge of the financial market trends and economic conditions allows bankers to make informed decisions that align with current market dynamics.

How to show it: Illustrate your market knowledge by mentioning "Monitored economic trends, successfully advising clients on investment opportunities that increased returns by 20%."

For a comprehensive approach to showcasing your abilities, consider exploring more about Technical Skills that can enhance your resume

Best Commercial Banker Soft Skills

In the competitive world of commercial banking, possessing strong soft skills is just as important as having technical knowledge. These workplace skills enable bankers to build relationships, understand client needs, and navigate complex financial situations. Highlighting these skills on your resume can help you stand out as a candidate who is not only knowledgeable but also capable of delivering exceptional service in a client-focused environment.

Communication Skills

Effective communication is essential for a Commercial Banker, as it involves conveying complex financial information clearly to clients and colleagues. Strong verbal and written communication fosters trust and understanding.

How to show it: Include examples of how you successfully communicated financial concepts to clients or presented at meetings. Quantify your achievements, such as increasing client satisfaction scores or closing deals through effective presentations.

Problem-solving

Commercial Bankers often encounter challenging financial situations that require innovative solutions. Strong problem-solving skills enable bankers to analyze issues, assess risks, and devise effective strategies to meet client needs.

How to show it: Highlight specific instances where you identified a problem and implemented a solution. Use metrics to demonstrate the successful outcomes of your problem-solving efforts.

Time Management

In a fast-paced banking environment, managing time efficiently is crucial. Commercial Bankers must prioritize tasks, meet deadlines, and balance multiple client accounts simultaneously.

How to show it: Provide examples of how you successfully managed multiple projects or accounts. Use quantifiable results to illustrate how your time management led to increased productivity or client satisfaction.

Teamwork

Collaboration with colleagues from various departments is a key aspect of a Commercial Banker’s role. Strong teamwork skills allow bankers to work effectively with others to achieve common goals and deliver comprehensive solutions to clients.

How to show it: Share examples of successful projects that required teamwork. Highlight your specific contributions and the positive results achieved through collaborative efforts.

Adaptability

The financial landscape is constantly changing, and Commercial Bankers must be adaptable to thrive. Being open to new ideas and flexible in approach is vital for meeting evolving client needs.

How to show it: Illustrate your adaptability by sharing experiences where you successfully adjusted to changes, whether in client demands or market conditions. Highlight any positive outcomes that resulted from your flexibility.

Negotiation Skills

Commercial Bankers often negotiate terms and pricing with clients. Strong negotiation skills can lead to better deals for both the bank and the client, fostering long-term relationships.

How to show it: Provide specific examples of successful negotiations, detailing the context and the results achieved. Quantify the impact of your negotiation skills on business outcomes.

Attention to Detail

In banking, precision is key. Attention to detail ensures accuracy in financial documentation and reduces the risk of costly errors.

How to show it: Discuss instances where your attention to detail prevented errors or improved processes. Use metrics to quantify the effectiveness of your meticulousness.

Relationship Management

Building and maintaining strong relationships with clients is fundamental for Commercial Bankers. Effective relationship management fosters trust and loyalty, leading to repeat business.

How to show it: Share examples of how you nurtured client relationships and the positive outcomes that resulted. Highlight metrics, such as client retention rates or satisfaction scores, to demonstrate your effectiveness.

Critical Thinking

Critical thinking is essential for evaluating financial information and making sound decisions. It allows Commercial Bankers to assess risks and identify opportunities for clients.

How to show it: Describe situations where your critical thinking skills led to beneficial decisions or strategies. Quantify the outcomes to showcase your analytical abilities.

Customer Service Orientation

A strong customer service orientation is vital for Commercial Bankers, as they are often the first point of contact for clients. Providing excellent service leads to enhanced client satisfaction and loyalty.

How to show it: Highlight your contributions to client service initiatives and any recognition received or metrics that demonstrate improved client satisfaction as a result of your efforts.

Sales Skills

Sales skills are important for Commercial Bankers as they often need to promote banking products and services. Being persuasive and understanding client needs can drive revenue growth.

How to show it: Provide examples of successful sales initiatives you led or contributed to, detailing how you met or exceeded sales targets.

Best Commercial Banker Technical Skills

In the competitive field of commercial banking, possessing technical skills is essential for success. These skills not only demonstrate a candidate's ability to perform specific tasks but also highlight their analytical capabilities and understanding of financial systems. Below are some key technical skills that commercial bankers should consider including on their resumes.

Financial Analysis

Financial analysis involves assessing the viability, stability, and profitability of a business or project. This skill is crucial for evaluating loan applications and investment opportunities.

How to show it: Quantify your experience by stating the number of financial analyses conducted, the types of businesses analyzed, and any successful outcomes resulting from your assessments.

Credit Risk Assessment

Credit risk assessment is the process of analyzing a borrower's creditworthiness. It enables bankers to make informed lending decisions and manage potential financial risks.

How to show it: Highlight specific metrics, such as the percentage of loans approved based on your assessments and the default rates of those loans.

Loan Structuring

Loan structuring involves designing loan products that meet the needs of clients while aligning with the bank's risk management policies. This skill is essential for providing tailored financial solutions.

How to show it: Include examples of complex loans you structured, the satisfaction of clients, and the impact on the bank's portfolio.

Financial Modeling

Financial modeling is the process of creating representations of a company's financial performance. This skill is vital for forecasting future performance and assessing the implications of various financial scenarios.

How to show it: Demonstrate your expertise by mentioning specific models you've built, their applications, and any projections that were successfully achieved.

Regulatory Compliance Knowledge

Understanding regulatory compliance is essential for commercial bankers to ensure that all transactions meet legal and ethical standards. It helps to protect the bank from potential penalties and reputational damage.

How to show it: Detail your experience with specific regulations, any compliance audits you have passed, and any initiatives you took to improve compliance within your team.

Data Analysis and Interpretation

Data analysis allows commercial bankers to interpret financial data and market trends effectively. This skill aids in making data-driven decisions that can enhance profitability and operational efficiency.

How to show it: Provide examples of data sets you analyzed, insights gained, and how those insights influenced business decisions or strategies.

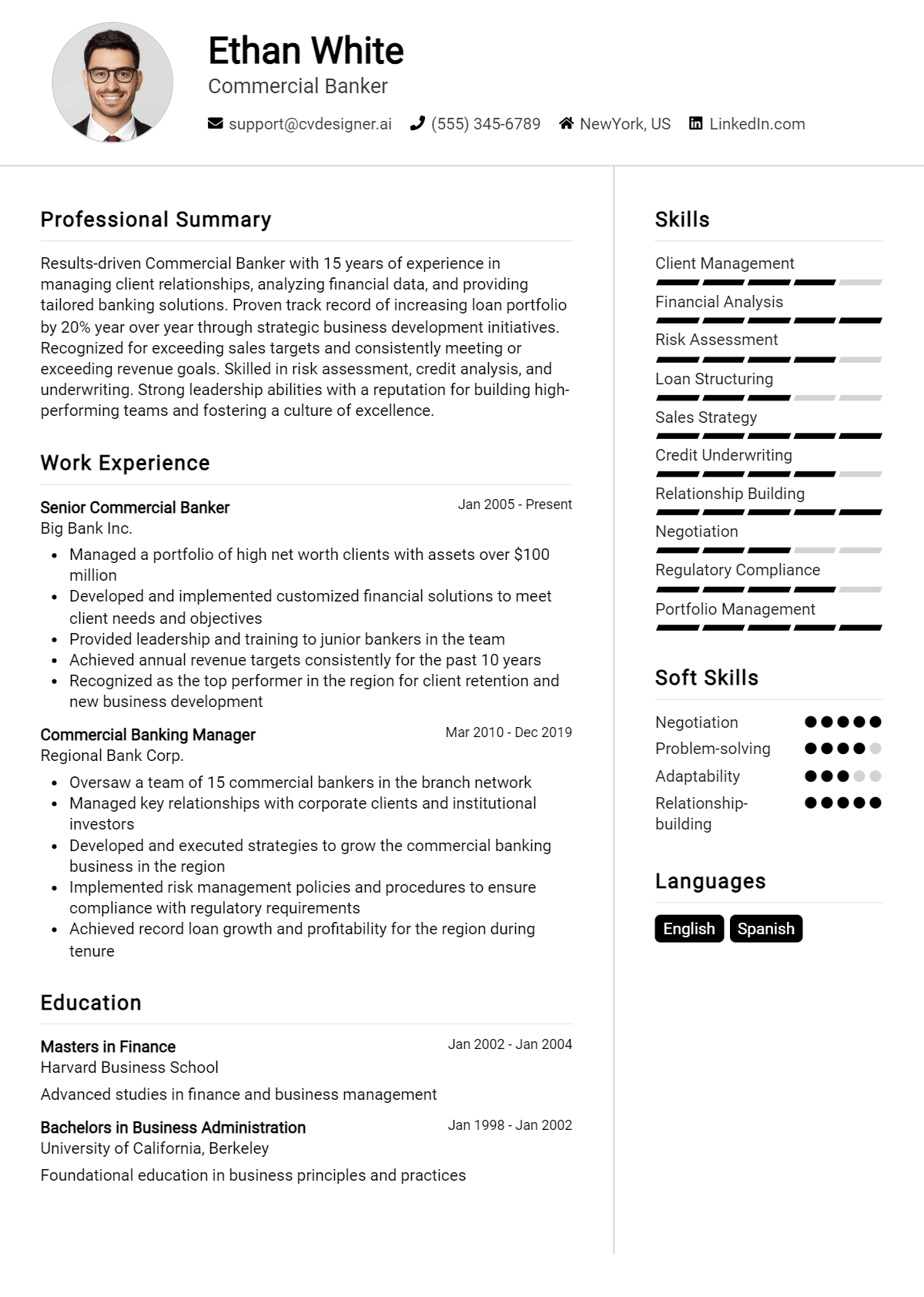

How to List Commercial Banker Skills on Your Resume

Effectively listing skills on your resume is crucial for standing out to employers in the competitive field of commercial banking. Your skills should be highlighted in three main sections: Resume Introduction, Work Experience, and Skills Section. This approach provides a comprehensive view of your qualifications and capabilities.

for Summary

Showcasing Commercial Banker skills in the introduction (objective or summary) section gives hiring managers a quick overview of your qualifications and sets the tone for the rest of your resume.

Example

Dedicated Commercial Banker with expertise in financial analysis, client relationship management, and risk assessment. Proven track record in developing tailored banking solutions that enhance client satisfaction and drive revenue growth.

for Work Experience

The work experience section provides the perfect opportunity to demonstrate how your Commercial Banker skills have been applied in real-world scenarios. Use this section to match your experience with the specific skills mentioned in job listings.

Example

- Managed a portfolio of high-value clients, utilizing relationship management and negotiation skills to increase client retention by 20%.

- Conducted financial analyses to identify opportunities for clients, resulting in a 15% increase in loan approvals.

- Developed and executed risk assessment strategies to mitigate potential losses, enhancing the bank's profitability.

- Provided training to junior staff on compliance regulations and customer service best practices, improving team performance.

for Skills

The skills section can either showcase technical or transferable skills. Emphasize a balanced mix of hard and soft skills to strengthen your overall qualifications.

Example

- Financial Analysis

- Client Relationship Management

- Risk Assessment

- Negotiation Skills

- Compliance Regulations

- Customer Service Excellence

- Strategic Planning

- Market Research

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate how those skills have positively impacted your previous roles.

Example

In my previous role, my strong financial analysis skills enabled me to identify profitable investment opportunities, leading to a 30% revenue increase for our division. Additionally, my expertise in client relationship management fostered long-term partnerships, significantly enhancing customer loyalty and satisfaction.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job.

The Importance of Commercial Banker Resume Skills

In the competitive landscape of banking, a well-crafted resume is crucial for aspiring Commercial Bankers. Highlighting relevant skills not only showcases a candidate's qualifications but also demonstrates their alignment with the specific requirements of the role. A strong skills section can capture the attention of recruiters, making it easier for them to identify top candidates who possess the necessary expertise to excel in commercial banking.

- Demonstrating Financial Acumen: Highlighting skills related to financial analysis and risk management shows potential employers that you can effectively assess and manage financial risks, which is a core responsibility of a Commercial Banker.

- Enhancing Client Relationships: Skills in communication and customer service indicate your ability to build and maintain strong client relationships, which is essential for generating business and fostering loyalty in the banking sector.

- Showcasing Analytical Skills: Proficiency in data analysis and interpretation is crucial for making informed lending decisions. Emphasizing analytical skills on your resume can set you apart as a candidate who can leverage data to drive business success.

- Exhibiting Sales and Negotiation Skills: A successful Commercial Banker needs to excel in sales and negotiation. Demonstrating these skills reflects your ability to close deals and persuade clients, which can significantly impact a bank's bottom line.

- Aligning with Compliance Standards: Knowledge of regulatory compliance and risk management practices is vital in the banking industry. Highlighting these skills shows that you understand the importance of adhering to laws and regulations to protect the bank and its clients.

- Proving Technical Proficiency: Familiarity with banking software and financial modeling tools can enhance your candidacy. Employers value candidates who can quickly adapt to technological systems that streamline banking operations.

- Demonstrating Problem-Solving Abilities: Strong problem-solving skills are essential for addressing client needs and resolving issues that arise in the banking process. Highlighting these abilities can reassure employers of your capability to handle challenges effectively.

- Exhibiting Team Collaboration: Commercial Bankers often work in teams to achieve business objectives. Showcasing skills in collaboration and teamwork can illustrate your ability to work harmoniously with colleagues across various departments.

For more information on crafting an effective resume, visit what is resume.

How To Improve Commercial Banker Resume Skills

In the competitive field of commercial banking, continuously improving your skills is crucial for career advancement and maintaining a strong professional profile. As financial markets evolve and client needs change, staying updated with the latest industry practices and enhancing your skill set can set you apart from other candidates. Here are some actionable tips to help you improve your commercial banker resume skills:

- Engage in continuous education by pursuing relevant certifications such as the Certified Commercial Banker (CCB) or the Chartered Financial Analyst (CFA) designation.

- Attend industry seminars, workshops, and conferences to gain insights into current trends and network with other professionals.

- Seek mentorship from experienced bankers to gain practical knowledge and receive guidance on skill development.

- Stay informed about changes in regulations, financial products, and market conditions by regularly reading industry publications and reports.

- Enhance your analytical skills by practicing financial modeling and analysis through online courses or real-world case studies.

- Improve your communication and relationship-building skills through active participation in client meetings and presentations.

- Utilize technology by becoming proficient in financial software and tools that can streamline banking operations and improve client service.

Frequently Asked Questions

What are the essential skills required for a Commercial Banker?

Essential skills for a Commercial Banker include strong analytical abilities, financial acumen, relationship management, and effective communication. Proficiency in financial modeling, risk assessment, and understanding credit policies are also crucial. Additionally, a Commercial Banker should be adept at using banking software and tools to analyze market trends and customer needs.

How important is customer relationship management for a Commercial Banker?

Customer relationship management is vital for a Commercial Banker as it helps in building and maintaining strong relationships with clients. This skill fosters trust and loyalty, which can lead to repeat business and referrals. A good Commercial Banker must be able to understand client needs, provide tailored financial solutions, and ensure excellent service throughout the banking experience.

What role does risk assessment play in a Commercial Banker's job?

Risk assessment is a crucial aspect of a Commercial Banker's responsibilities, as it involves evaluating the creditworthiness of potential clients and the viability of loan applications. A Commercial Banker must be skilled in identifying potential risks and determining the appropriate measures to mitigate them, ensuring that the bank makes informed lending decisions while maintaining a healthy portfolio.

How can strong analytical skills enhance a Commercial Banker's performance?

Strong analytical skills enable a Commercial Banker to interpret complex financial data, identify trends, and make strategic recommendations. By analyzing market conditions and client financials, a Commercial Banker can offer insightful advice, optimize product offerings, and improve the bank's overall profitability. These skills are essential for making data-driven decisions and crafting effective financial strategies.

What impact does effective communication have on a Commercial Banker's success?

Effective communication is critical for a Commercial Banker, as it facilitates clear interactions with clients, colleagues, and stakeholders. A Commercial Banker must be able to articulate financial concepts in a way that clients can easily understand, negotiate terms, and present financial proposals confidently. Strong communication skills contribute to building rapport, resolving issues, and ultimately ensuring client satisfaction and retention.

Conclusion

Including Commercial Banker skills in your resume is vital for demonstrating your expertise and suitability for the role. By showcasing relevant skills, candidates can distinguish themselves from the competition and present significant value to potential employers. This not only enhances the chances of landing an interview but also reflects a proactive approach to career development.

As you refine your skills and tailor your resume, remember that every effort you make brings you one step closer to your ideal job. Stay motivated and embrace the journey of continuous improvement!

For more resources to help you in your job application process, explore our resume templates, try out our resume builder, check out some resume examples, and don’t forget to craft a compelling cover letter with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.