27 Claims Adjuster Resume Skills That Stand Out in 2025

As a Claims Adjuster, possessing the right skills is crucial for effectively evaluating and processing insurance claims. In this section, we will outline the top skills that employers look for when hiring a claims adjuster. Highlighting these skills on your resume can significantly enhance your chances of landing the job and excelling in your role. Whether you're a seasoned professional or new to the field, understanding these key competencies will help you demonstrate your value in the industry.

Best Claims Adjuster Soft Skills

In the fast-paced and detail-oriented field of claims adjusting, soft skills are essential for success. These skills, which encompass interpersonal and communication abilities, are crucial for effectively managing claims, interacting with clients, and collaborating with colleagues. Highlighting these skills on your resume can set you apart from other candidates and demonstrate your capability to navigate the complexities of the role.

Communication

Strong communication skills are vital for claims adjusters, as they need to clearly explain policies, procedures, and claim statuses to clients and colleagues.

How to show it: Include examples of how you've successfully communicated complex information to clients or team members, and quantify outcomes such as improved client satisfaction or reduced misunderstandings.

Problem-solving

Claims adjusters often face unexpected challenges that require quick thinking and effective solutions to resolve issues efficiently.

How to show it: Demonstrate your problem-solving skills by detailing specific instances where you identified issues and implemented successful resolutions, ideally with measurable results.

Time Management

Managing multiple claims and adhering to deadlines is crucial in the claims process, making time management a key skill for adjusters.

How to show it: Highlight your ability to prioritize tasks effectively, referencing specific examples of how you met deadlines while handling a high volume of claims.

Teamwork

Collaboration with other professionals, including underwriters and legal teams, is essential for ensuring accurate claims processing.

How to show it: Provide examples of successful team projects or collaborations, emphasizing your role and contributions to achieving team goals.

Attention to Detail

Precision is critical in claims adjusting, as even minor errors can lead to significant repercussions for clients and the company.

How to show it: Showcase your meticulous nature by detailing instances where your attention to detail improved outcomes or reduced errors in claims processing.

Empathy

Understanding clients' emotions and perspectives is key to providing compassionate service, especially during stressful situations.

How to show it: Share examples of how you have demonstrated empathy in client interactions, perhaps by resolving conflicts or enhancing client satisfaction.

Negotiation

Negotiation skills are important when discussing settlements with clients and ensuring fair outcomes for all parties involved.

How to show it: Highlight specific instances where your negotiation efforts led to successful settlements, including any quantifiable savings or benefits achieved.

Adaptability

The ability to adapt to changing regulations, technologies, and client needs is crucial in the ever-evolving insurance landscape.

How to show it: Provide examples of how you've successfully adapted to new processes or challenges, showcasing your flexibility and willingness to learn.

Critical Thinking

Claims adjusters must analyze complex information and make informed decisions, making critical thinking a must-have skill.

How to show it: Illustrate your critical thinking abilities with real-life examples where your analysis led to improved claims outcomes.

Customer Service Orientation

A strong customer service focus helps claims adjusters build rapport with clients and enhance their overall experience.

How to show it: Share metrics such as improved customer satisfaction scores or positive feedback from clients to demonstrate your commitment to service excellence.

Conflict Resolution

Claims adjusters often deal with disputes and must resolve conflicts effectively to maintain positive relationships with clients.

How to show it: Detail successful conflict resolution strategies you've employed, including outcomes that benefited both the client and the organization.

Organizational Skills

Organizational skills are necessary for managing documentation and maintaining accurate records throughout the claims process.

How to show it: Highlight your ability to keep organized documentation and records, referencing any systems or tools you used to enhance efficiency.

Analytical Skills

The ability to analyze data and trends is important for assessing claims and determining appropriate settlements.

How to show it: Provide examples where your analytical skills led to insightful conclusions or improved claim processing efficiency.</

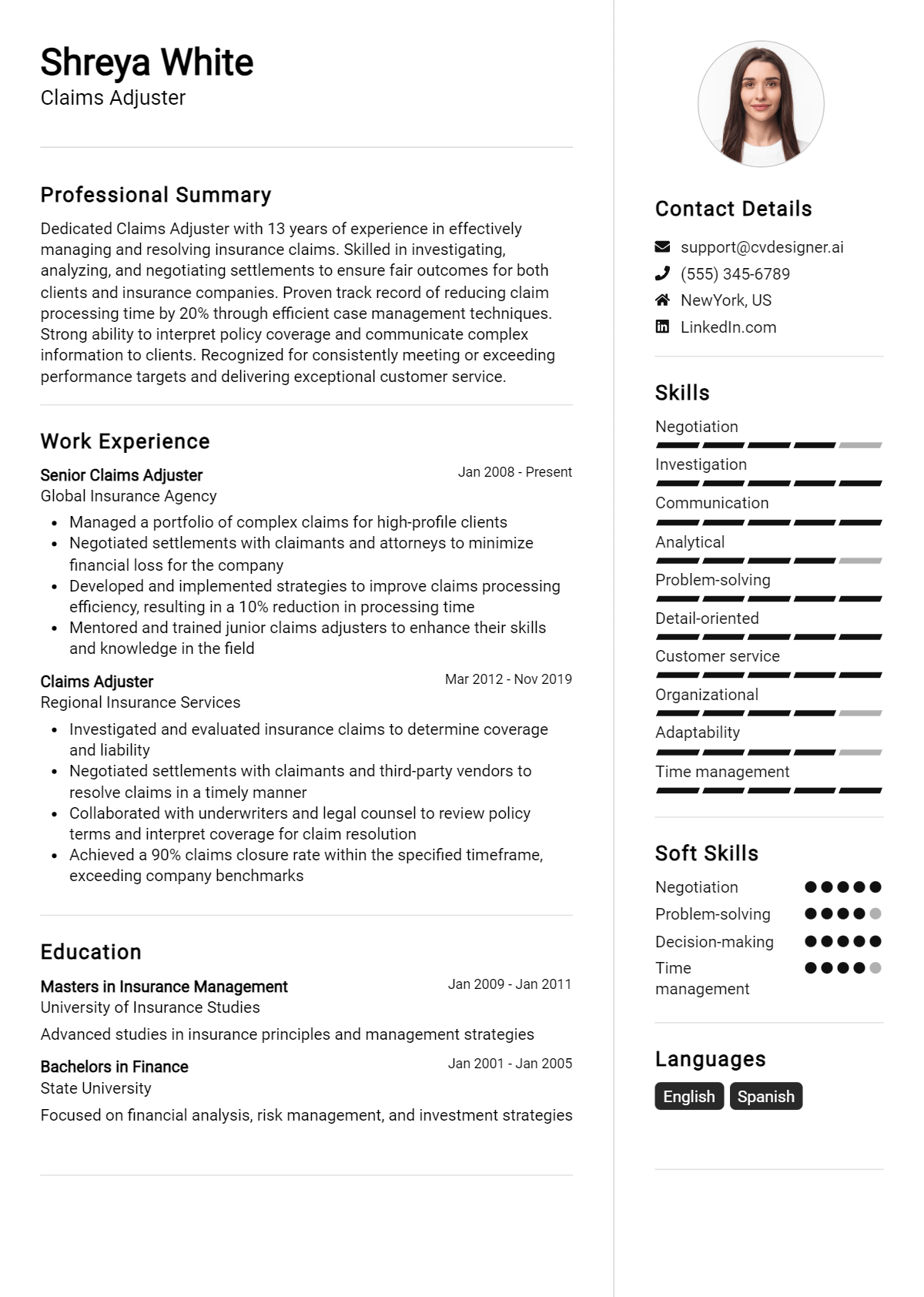

How to List Claims Adjuster Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to employers. The skills you include can make a significant difference in your chances of landing an interview. There are three main sections where skills can be highlighted: Resume Introduction, Work Experience, and Skills Section.

for Summary

Showcasing Claims Adjuster skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications. This approach helps to create a strong first impression.

Example

Detail-oriented Claims Adjuster with expertise in claims processing, investigative analysis, and customer service. Proven track record of resolving disputes efficiently and effectively, ensuring client satisfaction and compliance with regulations.

for Work Experience

The work experience section provides the perfect opportunity to demonstrate how Claims Adjuster skills have been applied in real-world scenarios. This is where you can showcase your accomplishments and the impact of your skills.

Example

- Conducted thorough investigations and analysis of claims, leading to a 20% reduction in fraud cases.

- Utilized strong communication skills to negotiate settlements and resolve disputes between clients and insurance providers.

- Implemented a new claims tracking system that improved processing time by 30%.

- Collaborated with medical professionals to assess and document injury claims accurately.

for Skills

The skills section can either showcase technical or transferable skills. A balanced mix of hard and soft skills should be included to present a well-rounded profile to potential employers.

Example

- Claims Processing

- Investigative Analysis

- Customer Service

- Negotiation Skills

- Attention to Detail

- Time Management

- Problem-Solving

- Regulatory Compliance

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate how those skills have positively impacted previous roles.

Example

As a Claims Adjuster, my strong skills in investigative analysis and customer service have enabled me to resolve complex claims efficiently, enhancing client satisfaction. At my previous role, I successfully reduced claim processing time by 25%, showcasing my dedication to improving operational effectiveness.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job. For more guidance, check out our sections on [skills](https://resumedesign.ai/resume-skills/) and [work experience](https://resumedesign.ai/resume-work-experience/).

The Importance of Claims Adjuster Resume Skills

For aspiring claims adjusters, a well-crafted resume is essential in showcasing their qualifications and expertise. Highlighting relevant skills is crucial as it not only helps candidates stand out to recruiters but also demonstrates how well they align with the specific job requirements laid out by employers. A focused skills section can effectively communicate a candidate's suitability for the role, making it a vital component of the overall resume.

- Clear Communication: Effective communication skills are essential for claims adjusters, as they need to convey complex information clearly to clients, attorneys, and other stakeholders. Highlighting this skill shows potential employers that you can manage discussions and negotiations effectively.

- Analytical Thinking: Claims adjusters must assess claims thoroughly, requiring strong analytical skills. By emphasizing your ability to analyze data and identify discrepancies, you demonstrate your capability to make informed decisions based on facts and evidence.

- Attention to Detail: The claims adjustment process requires a meticulous approach, where overlooking minor details can lead to significant repercussions. Showcasing your attention to detail in your resume highlights your commitment to accuracy and thoroughness.

- Problem-Solving Skills: Claims adjusters often face unique challenges that require innovative solutions. By including problem-solving skills on your resume, you indicate your ability to navigate complex situations and find effective resolutions.

- Customer Service Orientation: A strong focus on customer service is crucial in the claims industry. Highlighting your customer service skills reassures employers that you can manage client relationships positively, which is vital for customer retention and satisfaction.

- Negotiation Skills: The ability to negotiate settlements is a key aspect of a claims adjuster's role. Demonstrating your negotiation skills on your resume signals to employers that you can advocate for both the company and the clients effectively.

- Time Management: Claims adjusters often juggle multiple cases simultaneously. Showcasing your time management skills illustrates your ability to prioritize tasks and meet deadlines, which is essential for maintaining productivity in a fast-paced environment.

- Technical Proficiency: Familiarity with claims management software and other digital tools is increasingly important in the industry. Highlighting your technical skills ensures that potential employers know you can adapt to new technologies and streamline processes.

For more information on creating an effective resume, consider visiting what is resume.

How To Improve Claims Adjuster Resume Skills

Continuously improving your skills as a claims adjuster is essential in a rapidly changing industry. Staying updated with the latest regulations, technologies, and best practices not only enhances your performance but also makes you a more competitive candidate in the job market. By refining your skills, you position yourself as a valuable asset to potential employers and increase your chances of career advancement.

- Enroll in professional development courses related to claims adjusting to stay current with industry standards.

- Obtain relevant certifications, such as the Chartered Property Casualty Underwriter (CPCU) designation, to demonstrate your expertise.

- Gain experience by volunteering for additional responsibilities within your organization or through internships.

- Network with other professionals in the field through industry conferences and online forums to exchange knowledge and best practices.

- Stay informed about changes in laws and regulations that affect claims processing by subscribing to industry publications.

- Enhance your analytical and negotiation skills through workshops and practical exercises.

- Utilize technology tools and software relevant to claims management to improve efficiency and accuracy in your work.

Frequently Asked Questions

What are the essential skills required for a Claims Adjuster?

Essential skills for a Claims Adjuster include strong analytical abilities to assess claims accurately, effective communication skills for interacting with clients and stakeholders, and attention to detail for reviewing documentation thoroughly. Additionally, proficiency in negotiation and problem-solving is crucial, as Adjusters often need to mediate between policyholders and insurance companies to reach fair settlements.

How important is customer service experience for a Claims Adjuster?

Customer service experience is highly valuable for a Claims Adjuster, as the role involves frequent interaction with policyholders who may be dealing with stressful situations. Strong customer service skills help Adjusters empathize with clients, manage their expectations, and provide clear information regarding the claims process, ultimately enhancing client satisfaction and trust in the insurance company.

What technical skills should a Claims Adjuster possess?

Claims Adjusters should have solid technical skills, including proficiency in claims management software and familiarity with data analysis tools. Understanding insurance policies and regulations is also vital, as it enables Adjusters to accurately evaluate claims. Additionally, basic computer skills and knowledge of digital communication platforms are important for efficient workflow and documentation.

How can negotiation skills impact a Claims Adjuster's success?

Negotiation skills are critical for a Claims Adjuster, as they often need to reach agreements between the insurer and the claimant. Effective negotiation can lead to fair settlements that satisfy both parties and can help avoid potential disputes. A skilled negotiator can navigate complex conversations, advocate for their company's interests while maintaining a positive relationship with clients, and ultimately contribute to the overall efficiency of the claims process.

What role does attention to detail play in a Claims Adjuster's job?

Attention to detail is paramount for a Claims Adjuster, as even minor oversights can lead to significant errors in claim assessments and settlements. Careful review of documentation, policy terms, and evidence is necessary to ensure that claims are processed accurately and fairly. This skill helps in identifying discrepancies, verifying information, and maintaining compliance with industry regulations, which is essential for minimizing legal risks and ensuring customer satisfaction.

Conclusion

Including Claims Adjuster skills in your resume is crucial for demonstrating your expertise and suitability for the role. By showcasing relevant skills, candidates can distinguish themselves in a competitive job market, providing significant value to potential employers who seek qualified professionals. Remember, refining your skills not only enhances your resume but also boosts your confidence in the job application process. Take the time to invest in your professional development and watch your opportunities grow!

For additional resources, check out our resume templates, utilize our resume builder, explore resume examples, and find the perfect cover letter templates to enhance your application.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.