Claims Adjuster Core Responsibilities

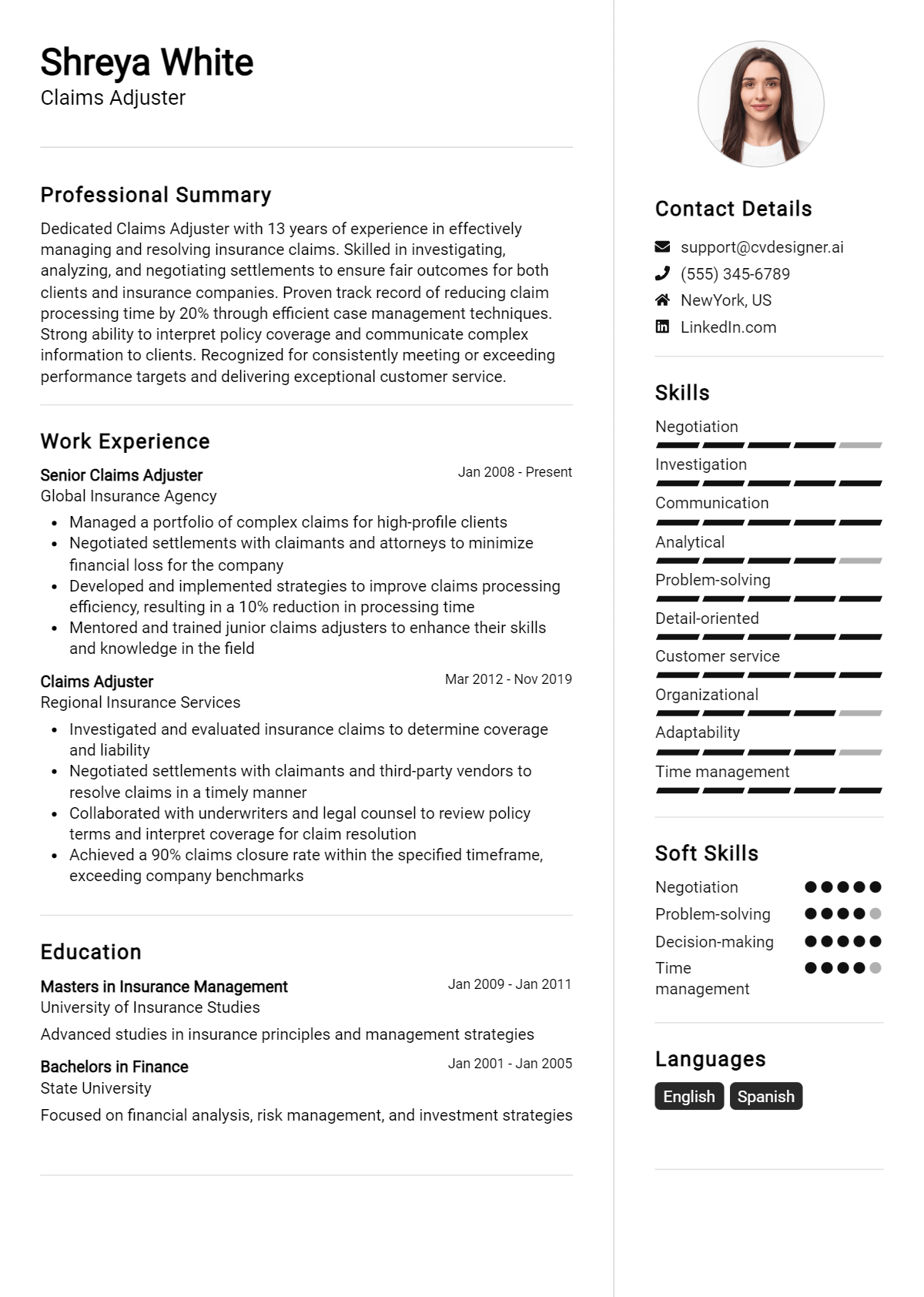

A Claims Adjuster plays a vital role in assessing insurance claims, requiring a blend of technical knowledge, operational expertise, and strong problem-solving skills. They bridge various departments, including underwriting, legal, and customer service, ensuring seamless communication and collaboration. Key responsibilities involve evaluating claims, investigating incidents, and negotiating settlements. Proficient claims adjusters contribute significantly to organizational goals by enhancing customer satisfaction and minimizing costs. A well-structured resume can effectively highlight these qualifications, showcasing a candidate's ability to thrive in this dynamic role.

Common Responsibilities Listed on Claims Adjuster Resume

- Evaluate and analyze insurance claims to determine validity.

- Conduct thorough investigations, including interviewing claimants and witnesses.

- Review police reports, medical records, and other relevant documentation.

- Negotiate settlements with claimants and legal representatives.

- Prepare detailed reports outlining findings and recommendations.

- Maintain accurate records of claims and correspondence.

- Collaborate with various departments to resolve claims issues.

- Stay updated on industry regulations and best practices.

- Provide excellent customer service to claimants throughout the process.

- Manage multiple claims efficiently and meet deadlines.

- Utilize claims management software to track and manage cases.

- Assess damages and estimate repair costs for property claims.

High-Level Resume Tips for Claims Adjuster Professionals

In the competitive field of claims adjustment, a well-crafted resume can be the key that unlocks career opportunities. As the first impression a potential employer has of you, your resume needs to effectively showcase not only your skills but also your notable achievements in the industry. It should tell a compelling story of your professional journey and demonstrate why you are the ideal candidate for the position. This guide will provide practical and actionable resume tips specifically tailored for Claims Adjuster professionals, ensuring you present yourself in the best light possible.

Top Resume Tips for Claims Adjuster Professionals

- Tailor your resume to match the specific job description by incorporating relevant keywords and phrases.

- Highlight your relevant experience, focusing on positions that involved claims assessment, investigation, and negotiation.

- Quantify your achievements with metrics, such as the percentage of claims processed accurately or the amount of money saved through your assessments.

- Showcase your industry-specific skills, such as knowledge of insurance policies, regulatory compliance, and customer service excellence.

- Include certifications relevant to claims adjusting, such as the Associate in Claims (AIC) or Certified Claims Professional (CCP).

- Utilize a clean and professional format that enhances readability and draws attention to key points.

- Incorporate a strong summary statement at the top of your resume that encapsulates your qualifications and career goals.

- List any software proficiency, particularly claims management systems, to demonstrate your tech-savviness in the role.

- Emphasize your ability to communicate effectively with clients and stakeholders, showcasing your negotiation and interpersonal skills.

By implementing these tips, you can significantly increase your chances of landing a job in the Claims Adjuster field. A polished and targeted resume will not only highlight your strengths but also demonstrate your commitment to the profession, making you stand out in a crowded job market.

Why Resume Headlines & Titles are Important for Claims Adjuster

In the competitive landscape of the insurance industry, a Claims Adjuster plays a critical role in evaluating and settling claims on behalf of insurance companies. Crafting an effective resume is essential for job seekers in this field, and one key element that can set a candidate apart is the resume headline or title. A strong headline or title serves as the first point of contact for hiring managers, allowing candidates to succinctly convey their primary qualifications and expertise in just a few words. An impactful headline can grab attention immediately, making it more likely for the resume to be read in detail. Therefore, creating a concise and relevant headline that reflects the specifics of the Claims Adjuster role is vital for standing out in a crowded applicant pool.

Best Practices for Crafting Resume Headlines for Claims Adjuster

- Keep it concise—aim for one impactful phrase.

- Focus on role-specific keywords relevant to Claims Adjuster duties.

- Highlight key skills, certifications, or years of experience.

- Use action-oriented language to convey a proactive approach.

- Be specific about the type of claims expertise you possess.

- Avoid jargon or overly complex language that may confuse readers.

- Tailor your headline for each job application to align with the job description.

- Ensure that the tone matches the professionalism of the industry.

Example Resume Headlines for Claims Adjuster

Strong Resume Headlines

"Detail-Oriented Claims Adjuster with 5+ Years of Experience in Property Damage Assessment"

“Certified Claims Adjuster Specializing in Complex Liability Cases and Negotiation Strategies”

“Results-Driven Claims Adjuster with Proven Track Record in Reducing Claim Settlement Times”

Weak Resume Headlines

“Claims Adjuster Looking for Opportunities”

“Experienced Professional”

Strong headlines are effective because they provide a clear and concise summary of the candidate’s qualifications while using specific language that resonates with the role of a Claims Adjuster. They highlight relevant experience and skills, making it easy for hiring managers to quickly assess the applicant's fit for the position. In contrast, weak headlines fail to impress because they lack specificity and do not convey any real value or differentiation. Generic titles may lead hiring managers to overlook the resume altogether, as they do not provide any compelling reason to engage further with the application.

Writing an Exceptional Claims Adjuster Resume Summary

A well-crafted resume summary is crucial for a Claims Adjuster seeking to stand out in a competitive job market. This brief yet impactful statement serves as an introduction, providing hiring managers with a snapshot of the candidate's key skills, relevant experience, and notable accomplishments. A strong summary quickly captures attention by highlighting qualifications that align with the specific requirements of the job, making it easier for potential employers to recognize the candidate's suitability for the role. Therefore, it should be concise, engaging, and tailored to the job description to maximize its effectiveness.

Best Practices for Writing a Claims Adjuster Resume Summary

- Quantify Achievements: Use numbers to showcase your impact, such as the number of claims processed or the percentage of claims resolved successfully.

- Focus on Skills: Highlight specific skills that are directly relevant to the role, such as negotiation, risk assessment, and knowledge of insurance policies.

- Tailor the Summary: Customize your summary for each job application to reflect the requirements and language found in the job description.

- Be Concise: Keep your summary brief, ideally between 2-4 sentences, to ensure it is quick to read and impactful.

- Use Action Words: Start with strong action verbs to convey confidence and assertiveness in your capabilities.

- Highlight Relevant Experience: Mention specific roles or industries you have worked in that relate directly to claims adjusting.

- Showcase Problem-Solving Abilities: Emphasize any experience in resolving complex claims or disputes effectively.

- Maintain Professional Tone: Use professional language that reflects your expertise and understanding of the industry.

Example Claims Adjuster Resume Summaries

Strong Resume Summaries

Results-driven Claims Adjuster with over 5 years of experience managing a diverse portfolio of property and casualty claims. Successfully resolved 95% of claims within 30 days, contributing to a 20% increase in customer satisfaction ratings.

Detail-oriented Claims Adjuster with a proven track record of handling over 300 claims annually. Expertise in negotiating settlements and conducting thorough investigations, resulting in a 30% reduction in disputed claims.

Dedicated Claims Adjuster with 7 years of experience in the insurance industry, specializing in fraud detection and risk assessment. Recognized for identifying fraudulent claims, saving the company over $500,000 in potential losses.

Weak Resume Summaries

Experienced Claims Adjuster looking for a job in the insurance field. Skilled in processing claims and working with clients.

Claims Adjuster with a background in insurance. Interested in helping with claims and ensuring customer satisfaction.

The strong resume summaries are effective because they provide specific achievements, quantify results, and highlight relevant skills that align closely with the role of a Claims Adjuster. In contrast, the weak summaries lack detail, do not quantify accomplishments, and appear generic, failing to demonstrate a clear understanding of the job requirements or the unique contributions the candidate can make.

Work Experience Section for Claims Adjuster Resume

The work experience section of a Claims Adjuster resume is vital as it serves as the platform for candidates to demonstrate their technical skills, leadership capabilities, and commitment to delivering high-quality results. This section allows applicants to highlight their proficiency in evaluating claims, managing team dynamics, and adhering to industry standards. By quantifying achievements and aligning their experiences with the requirements of the insurance sector, candidates can effectively showcase their value to potential employers and differentiate themselves in a competitive job market.

Best Practices for Claims Adjuster Work Experience

- Focus on quantifiable results, such as the number of claims processed or percentage of claims resolved within a specific timeframe.

- Highlight specific technical skills relevant to the claims process, including software proficiency and regulatory knowledge.

- Demonstrate leadership by mentioning any roles in team management or training new hires.

- Use action verbs to convey a sense of initiative and proactivity in your work.

- Align your experiences with industry standards to show familiarity with best practices in claims adjustment.

- Include collaborative projects or initiatives that illustrate your ability to work effectively with cross-functional teams.

- Tailor your work experience to reflect the specific requirements and responsibilities outlined in the job description.

- Keep your statements clear and concise to maintain the reader's attention and convey your accomplishments effectively.

Example Work Experiences for Claims Adjuster

Strong Experiences

- Successfully managed a caseload of over 200 claims per month, achieving a 95% resolution rate within industry-standard timelines.

- Implemented a new claims processing software that reduced average processing time by 30%, enhancing team efficiency and client satisfaction.

- Led a team of five adjusters during a high-volume claims period, coordinating efforts that resulted in a 20% increase in claims handled without compromising quality.

- Conducted comprehensive training sessions for new employees, improving their onboarding experience and reducing the ramp-up time by 40%.

Weak Experiences

- Worked on claims processing tasks as assigned.

- Participated in team meetings to discuss claims.

- Handled various claims during my time at the company.

- Assisted in training new employees occasionally.

The examples highlighted as strong experiences demonstrate clear, quantifiable achievements, showcasing the candidate's technical expertise and leadership abilities. These statements provide specific outcomes and illustrate the impact of the candidate's contributions. In contrast, the weak experiences lack detail and specificity, making them vague and unimpressive. They fail to convey the candidate's skills or accomplishments effectively, which could hinder their chances in a competitive job market.

Education and Certifications Section for Claims Adjuster Resume

The education and certifications section of a Claims Adjuster resume is crucial for demonstrating the candidate’s academic background, specialized training, and commitment to professional development. This section not only showcases relevant degrees and certifications but also highlights the candidate's efforts toward continuous learning in the ever-evolving insurance industry. By providing detailed information on relevant coursework, industry-recognized certifications, and specialized training, candidates can significantly enhance their credibility and show alignment with the demands of the role, ultimately making them more appealing to potential employers.

Best Practices for Claims Adjuster Education and Certifications

- Include only relevant degrees and certifications that pertain to claims adjustment or the insurance industry.

- List certifications in order of relevance, starting with the most recognized and applicable to the role.

- Provide details about coursework that directly relates to claims adjusting, such as risk assessment, negotiation, and insurance principles.

- Highlight any ongoing education or professional development courses to showcase commitment to staying current in the field.

- Emphasize advanced or specialized certifications, such as CPCU (Chartered Property Casualty Underwriter) or AIC (Associate in Claims).

- Keep the format clear and organized, using bullet points for easy readability.

- Include the name of the institution and the year of graduation or certification to provide context.

- Avoid listing outdated or irrelevant qualifications that do not enhance your profile as a Claims Adjuster.

Example Education and Certifications for Claims Adjuster

Strong Examples

- Bachelor of Science in Business Administration, Major in Risk Management, XYZ University, 2022

- Certified Claims Professional (CCP), National Association of Claims Professionals, 2023

- Completed coursework in Insurance Law and Ethics, ABC College, 2021

- Associate in Claims (AIC), The Institutes, 2022

Weak Examples

- High School Diploma, Generic High School, 2010

- Certification in Basic Computer Skills, Online Academy, 2019

- Associate Degree in General Studies, Community College, 2015

- Completed an outdated course on Property Management, 2017

The strong examples are considered effective because they highlight relevant degrees and certifications that are directly applicable to the role of a Claims Adjuster, showcasing a focused academic background and specialized training. In contrast, the weak examples lack relevance and do not demonstrate a commitment to the field of claims adjustment, making them less impactful for potential employers who are looking for candidates with specific qualifications that align with the demands of the role.

Top Skills & Keywords for Claims Adjuster Resume

In the competitive field of claims adjusting, showcasing the right skills on your resume is crucial for landing your desired position. Employers seek candidates who not only possess the technical knowledge necessary for the job but also demonstrate essential interpersonal abilities that can enhance team dynamics and client relations. A well-crafted resume that highlights both hard and soft skills will not only showcase your qualifications but also reflect your capability to navigate the complex situations that arise in the claims process. By emphasizing these skills, you can set yourself apart from other applicants and position yourself as a strong contender in the claims adjusting arena.

Top Hard & Soft Skills for Claims Adjuster

Soft Skills

- Strong communication skills

- Attention to detail

- Critical thinking

- Negotiation skills

- Empathy

- Problem-solving abilities

- Time management

- Customer service orientation

- Adaptability

- Team collaboration

- Conflict resolution

- Organizational skills

- Active listening

- Analytical mindset

- Patience

Hard Skills

- Knowledge of insurance policies and regulations

- Claims management software proficiency

- Data analysis and reporting

- Investigative techniques

- Risk assessment

- Financial analysis

- Legal terminology understanding

- Proficiency in Microsoft Office Suite

- Knowledge of industry standards

- Familiarity with medical terminology

- Documentation and report writing

- Ability to assess property damage

- Understanding of claims processing procedures

- Experience with fraud detection

- Statistical analysis methods

- Computer literacy

By ensuring your resume reflects these skills and highlighting relevant work experience, you will present a comprehensive picture of your qualifications, making you a more attractive candidate in the eyes of potential employers.

Stand Out with a Winning Claims Adjuster Cover Letter

Dear Hiring Manager,

I am writing to express my interest in the Claims Adjuster position at [Company Name], as advertised on [where you found the job posting]. With a solid background in claims management and a keen eye for detail, I am confident in my ability to effectively assess and resolve claims while providing exceptional service to clients. My experience in the insurance industry has equipped me with the necessary skills to navigate complex claims processes, ensuring that both the company and its clients achieve satisfactory outcomes.

In my previous role at [Previous Company Name], I successfully handled a diverse range of claims, from property damage to personal injury. I utilized strong analytical skills to evaluate damages, investigate claims thoroughly, and negotiate settlements that aligned with company policies and client expectations. My ability to communicate clearly and empathetically with clients has always been a priority, as I believe that fostering trust and transparency is crucial in this line of work. I take pride in my commitment to thorough documentation and maintaining compliance with regulatory standards, which contributes to the overall efficiency of the claims process.

I am particularly excited about the opportunity to join [Company Name] because of your commitment to innovation and customer satisfaction in the insurance sector. I am eager to bring my expertise in claims adjustment, along with my proactive approach to problem-solving, to your esteemed team. I am confident that my background aligns well with the goals of [Company Name], and I am enthusiastic about the possibility of contributing to your mission in providing exemplary claims service.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences align with the needs of your team. I am eager to bring my passion for claims adjustment and customer service excellence to [Company Name].

Sincerely,

[Your Name]

[Your Contact Information]

[Your LinkedIn Profile or Other Relevant Links]

Common Mistakes to Avoid in a Claims Adjuster Resume

When crafting a resume for a Claims Adjuster position, it's crucial to present your qualifications clearly and effectively. However, many candidates make common mistakes that can hinder their chances of landing an interview. Understanding these pitfalls can help you create a more compelling and professional resume that showcases your skills and experience in the best light. Here are some common mistakes to avoid:

Generic Objective Statements: Using a vague objective statement that doesn't specify your goals or what you bring to the role can make your resume less impactful. Tailor it to the specific Claims Adjuster position you are applying for.

Lack of Relevant Experience: Failing to highlight relevant experience, such as previous jobs in insurance, customer service, or risk assessment, can make it difficult for hiring managers to see your suitability for the role. Ensure you emphasize related positions and responsibilities.

Ignoring Keywords: Many companies use applicant tracking systems (ATS) to filter resumes. Not incorporating industry-specific keywords from the job description can lead to your resume being overlooked. Be sure to align your language with the job listing.

Poor Formatting: A cluttered or overly complex format can detract from your message. Use a clean layout with clear headings and consistent font styles to ensure your resume is easy to read.

Excessive Length: A resume that is too long can overwhelm hiring managers. Aim for a concise one-page format, especially if you have less than ten years of experience, focusing on the most relevant information.

Neglecting Soft Skills: Claims adjusting requires strong interpersonal and communication skills. Failing to mention these qualities can diminish your appeal. Be sure to discuss how your soft skills have contributed to your success in past roles.

Typos and Grammatical Errors: Simple mistakes can create an impression of carelessness. Always proofread your resume multiple times and consider having someone else review it to catch any errors you may have missed.

Lack of Quantifiable Achievements: Generic descriptions of past roles without specific achievements can make your resume less compelling. Use metrics and examples to demonstrate your impact, such as the number of claims processed or improvements in claim resolution times.

Conclusion

As a Claims Adjuster, your role is vital in assessing insurance claims, determining their validity, and ensuring fair settlements. Throughout this article, we’ve explored the essential skills required for this position, including analytical thinking, strong communication abilities, and a keen attention to detail. We’ve also highlighted the importance of understanding various types of insurance policies and the regulations that govern them.

In addition, we discussed the significance of building rapport with clients while maintaining professionalism and integrity. The article emphasized how technological tools can streamline your workflow, and staying updated with industry trends can enhance your effectiveness as a Claims Adjuster.

Now that you have a clearer understanding of what it takes to succeed in this role, it’s time to ensure that your resume reflects your skills and experience effectively. Take a moment to review your Claims Adjuster Resume and consider using available resources to enhance it. You can find helpful resume templates, an intuitive resume builder, and resume examples to inspire your updates. Don't forget to also check out cover letter templates that can complement your application. Make sure your resume stands out to potential employers and showcases your qualifications as a skilled Claims Adjuster.