26 Best Skills to Put on Your Volatility Arbitrage Trader Resume [2025]

As a Volatility Arbitrage Trader, possessing a robust set of skills is essential for navigating the complexities of the financial markets. This role demands a keen understanding of market dynamics, quantitative analysis, and risk management strategies. In the following section, we will explore the top skills that can enhance your resume and demonstrate your expertise in volatility trading, enabling you to stand out in this competitive field.

Best Volatility Arbitrage Trader Technical Skills

Technical skills are crucial for a Volatility Arbitrage Trader as they enable effective analysis, strategy development, and risk management in a fast-paced trading environment. Mastery of these skills can significantly enhance trading performance and profitability.

Statistical Analysis

Statistical analysis involves the use of mathematical techniques to interpret data and identify trends, which is essential for predicting market movements and pricing volatility.

How to show it: Detail your experience with specific statistical software and mention any models or analyses that led to successful trades.

Financial Modeling

Financial modeling is the process of creating representations of a trader’s financial performance, allowing for scenario analysis and forecasting of volatility outcomes.

How to show it: Include examples of financial models you developed and how they improved decision-making or trading strategies.

Risk Management

Risk management encompasses strategies to identify, assess, and mitigate risks associated with trading activities, crucial for maintaining capital and maximizing returns.

How to show it: Highlight specific risk management strategies you've implemented and their impact on portfolio stability.

Quantitative Analysis

Quantitative analysis involves the use of mathematical and statistical techniques to evaluate investment opportunities and market conditions, essential for making informed trading decisions.

How to show it: Describe quantitative methods you applied in trading and the results achieved through these analyses.

Algorithmic Trading

Algorithmic trading is the use of computer algorithms to execute trades based on predefined criteria, allowing for speed and efficiency in volatile markets.

How to show it: Demonstrate your experience with algorithmic trading platforms and any algorithms you developed that produced profitable results.

Market Research

Market research involves gathering and analyzing information about market conditions and competitors to inform trading strategies and decisions.

How to show it: Provide examples of market research projects you've conducted and how they influenced your trading approach.

Options Pricing Models

Options pricing models, such as Black-Scholes, are used to determine the fair value of options, critical for identifying profitable trading opportunities.

How to show it: Discuss your proficiency with options pricing models and any successful trades based on your analysis.

Data Visualization

Data visualization is the graphical representation of information and data, which helps traders quickly interpret complex information and make informed decisions.

How to show it: Showcase your ability to create visual reports and dashboards that facilitated better understanding of market trends.

Statistical Software Proficiency

Proficiency in statistical software (e.g., R, Python, MATLAB) is vital for analyzing large datasets and performing complex calculations necessary for trading strategies.

How to show it: List the statistical software tools you're proficient in and specific projects where you applied these skills.

Time Series Analysis

Time series analysis involves statistical techniques to analyze time-ordered data points, which is crucial for forecasting volatility and market trends.

How to show it: Explain how you utilized time series analysis in your trading strategies to enhance predictive accuracy.

Portfolio Management

Portfolio management focuses on managing a collection of investments to maximize returns while minimizing risk, essential for a successful trading career.

How to show it: Detail your experience managing portfolios and any measurable performance improvements achieved.

Best Volatility Arbitrage Trader Soft Skills

In the fast-paced world of volatility arbitrage trading, possessing strong soft skills is just as critical as having technical expertise. These skills enable traders to navigate complex market dynamics, communicate effectively, and make informed decisions under pressure. Below are some of the top soft skills that can significantly enhance a Volatility Arbitrage Trader's effectiveness.

Analytical Thinking

Analytical thinking allows traders to assess market conditions, identify patterns, and make data-driven decisions. This skill is crucial for evaluating various trading strategies and their potential risks and rewards.

How to show it: Highlight specific analytical tools or methodologies used to derive insights from market data.

Communication

Effective communication is vital for sharing insights with team members and stakeholders. A trader must articulate complex ideas simply and clearly to facilitate informed decision-making.

How to show it: Include instances where you successfully communicated strategies or results to colleagues or clients.

Problem-solving

Traders face numerous challenges, from unexpected market movements to technical failures. Strong problem-solving skills enable them to develop quick, effective solutions to minimize losses.

How to show it: Provide examples of challenges faced and the specific solutions implemented that led to positive outcomes.

Time Management

Time management is essential in trading, where timely decisions can have significant financial implications. Traders must prioritize tasks efficiently to capitalize on market opportunities.

How to show it: Describe how you effectively managed multiple trades or projects simultaneously and the results achieved.

Teamwork

Working collaboratively with other traders, analysts, and stakeholders is necessary for success in a trading environment. Teamwork fosters the sharing of ideas and strategies, enhancing overall performance.

How to show it: List any collaborative projects or team successes that showcase your ability to work well with others.

Adaptability

The financial markets are constantly changing, and traders must be able to adapt their strategies accordingly. Adaptability ensures that traders remain effective in volatile conditions.

How to show it: Share experiences where you successfully adapted to shifts in market trends or trading strategies.

Attention to Detail

Attention to detail is crucial for identifying discrepancies and ensuring accuracy in trades. Small mistakes can lead to significant financial losses, making this skill indispensable.

How to show it: Provide examples of how your attention to detail has led to successful trades or error-free reports.

Emotional Intelligence

Emotional intelligence helps traders manage their emotions and understand the emotional dynamics of the market. This skill is vital for making rational decisions rather than impulsive ones during high-stress situations.

How to show it: Discuss how you maintained composure in stressful trading environments and the impact it had on your decision-making.

Negotiation Skills

Negotiation skills are essential for traders, especially when dealing with counterparties or negotiating terms on trades. Effective negotiation can lead to better pricing and improved trading outcomes.

How to show it: Describe specific negotiations you participated in and the successful outcomes achieved.

Critical Thinking

Critical thinking enables traders to evaluate the merits of different trading strategies and make sound judgments based on logical reasoning. This skill is essential for long-term success.

How to show it: Provide examples of how critical thinking influenced your trading decisions and outcomes.

Resilience

Resilience is the ability to bounce back from setbacks and maintain focus on long-term goals. Traders often face losses and must have the mental strength to recover and learn from those experiences.

How to show it: Share stories of how you overcame challenges in trading and what you learned from those experiences.

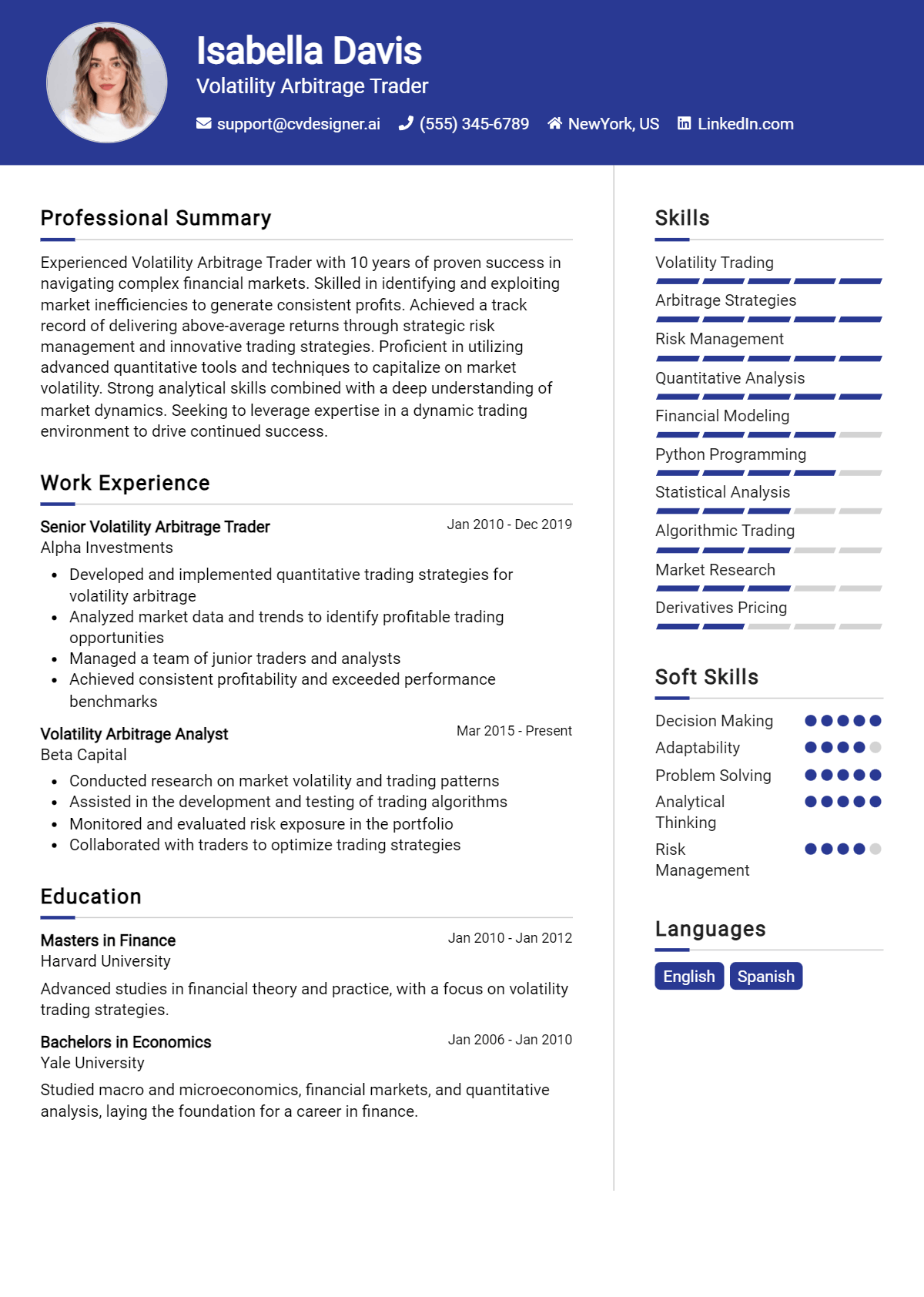

How to List Volatility Arbitrage Trader Skills on Your Resume

Effectively listing your skills on a resume is crucial to making a strong impression on potential employers. Highlighting your qualifications in a clear and organized manner can help you stand out among other candidates. There are three main sections where you can showcase your skills: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

Showcasing your Volatility Arbitrage Trader skills in the introduction section can provide hiring managers with a quick overview of your qualifications and expertise. This approach sets a strong tone for the rest of your resume.

Example

Dynamic Volatility Arbitrage Trader with a proven track record in market analysis and risk management. Adept at implementing innovative trading strategies to maximize profits while minimizing risk exposure.

for Resume Work Experience

The work experience section is an excellent opportunity to demonstrate how your Volatility Arbitrage Trader skills have been applied in real-world scenarios. Tailor your examples to align with the specific skills mentioned in job listings for maximum impact.

Example

- Utilized advanced quantitative analysis to identify profitable trading opportunities in volatile markets.

- Executed trades based on rigorous risk assessment and market trends, achieving a 20% increase in portfolio returns.

- Collaborated with cross-functional teams to develop and implement automated trading strategies.

- Conducted comprehensive performance analysis to refine trading models and enhance decision-making.

for Resume Skills

The skills section can showcase both technical and transferable skills, emphasizing a balanced mix of hard and soft skills. This section is vital for reinforcing your overall qualifications.

Example

- Quantitative Analysis

- Risk Management

- Market Research

- Trading Strategies

- Portfolio Optimization

- Decision-Making

- Communication Skills

- Attention to Detail

for Cover Letter

A cover letter provides the opportunity to expand on the skills mentioned in your resume while adding a personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate your fit for the role and the value you bring.

Example

In my previous role, my expertise in risk management and market analysis led to a significant reduction in trading losses, positively impacting our bottom line. I am excited about the opportunity to leverage these skills to contribute to your team’s success.

By linking the skills mentioned in your resume to specific achievements in your cover letter, you reinforce your qualifications for the job and create a compelling narrative that captures the attention of hiring managers.

The Importance of Volatility Arbitrage Trader Resume Skills

In the competitive landscape of finance, particularly in the niche of volatility arbitrage trading, showcasing relevant skills on your resume is essential. A well-crafted skills section not only highlights your qualifications but also demonstrates your alignment with the specific needs of employers. This alignment helps candidates capture the attention of recruiters, making it easier to progress through the hiring process.

- Strong analytical skills are crucial for a Volatility Arbitrage Trader, as they allow you to assess market conditions and make informed trading decisions. These skills also enable you to analyze complex data sets and identify profitable opportunities.

- Proficiency in quantitative analysis and statistical modeling is vital. This helps traders to develop and implement strategies that exploit price discrepancies in volatile markets, enhancing their ability to generate returns.

- Having a solid understanding of financial instruments and derivatives is essential for a Volatility Arbitrage Trader. This knowledge allows for the effective management of risk and the implementation of sophisticated trading strategies.

- Technical skills, including proficiency in trading platforms and programming languages such as Python or R, can significantly enhance a trader's ability to automate strategies and analyze data efficiently.

- Strong communication skills are important as well, enabling traders to articulate their strategies and findings clearly to team members and stakeholders. This is key in collaborative environments where teamwork is essential to success.

- Adaptability and quick decision-making capabilities are vital in the fast-paced world of trading. The ability to adjust strategies on the fly in response to market changes can set successful traders apart from their peers.

- Lastly, having a solid understanding of risk management principles is critical. This ensures that traders can protect their capital while seeking to exploit volatility in the markets.

For more insights into crafting an effective resume, you can check out various Resume Samples that showcase the skills needed for success in the financial industry.

How To Improve Volatility Arbitrage Trader Resume Skills

In the fast-paced world of finance, the role of a Volatility Arbitrage Trader requires a unique blend of analytical skills, market knowledge, and technical expertise. Continuously improving your skills is essential not only for personal career growth but also for staying competitive in a constantly evolving market. An enhanced skill set can lead to better trading performance, increased opportunities, and greater job security.

- Stay updated on market trends and news by subscribing to financial news platforms and journals.

- Engage in online courses or certifications focused on quantitative finance, options trading, and risk management.

- Practice using trading simulations and paper trading to refine your strategies without financial risk.

- Network with other traders and finance professionals through industry conferences, webinars, and online forums.

- Analyze past trades to identify strengths and weaknesses, and adapt your strategies accordingly.

- Learn programming languages such as Python or R to enhance your analytical capabilities and automate trading strategies.

- Join a trading group or mentorship program to gain insights and feedback from experienced traders.

Frequently Asked Questions

What are the key skills required for a Volatility Arbitrage Trader?

A successful Volatility Arbitrage Trader should possess strong analytical skills, a deep understanding of financial markets, and proficiency in statistical modeling. Additionally, skills in programming languages such as Python or R, as well as experience with trading platforms and financial analysis tools, are essential. The ability to interpret complex data and make quick decisions under pressure is also crucial in this fast-paced role.

How important is quantitative analysis in volatility arbitrage trading?

Quantitative analysis is vital for a Volatility Arbitrage Trader as it allows for the assessment of price discrepancies and the evaluation of potential trading strategies. Traders use quantitative models to analyze historical data, forecast volatility, and manage risk effectively. A strong foundation in statistics and mathematics is therefore essential to develop and implement these models successfully.

What role does risk management play in volatility arbitrage trading?

Risk management is a fundamental aspect of volatility arbitrage trading, as it helps traders to protect their investments and minimize potential losses. Effective risk management strategies include setting stop-loss orders, diversifying portfolios, and continuously monitoring market conditions. Traders must evaluate their risk tolerance and adjust their strategies accordingly to maintain a balanced approach to trading.

How do programming skills enhance the capabilities of a Volatility Arbitrage Trader?

Programming skills significantly enhance a Volatility Arbitrage Trader's capabilities by enabling them to automate trading strategies, analyze large datasets, and develop custom models for volatility prediction. Proficiency in programming languages such as Python, C++, or MATLAB allows traders to create algorithms that can execute trades at optimal times and analyze market trends more efficiently, ultimately leading to better trading decisions.

What educational background is typically beneficial for a Volatility Arbitrage Trader?

A strong educational background in finance, economics, mathematics, or a related field is typically beneficial for a Volatility Arbitrage Trader. Many traders also hold advanced degrees such as a Master's in Finance or an MBA, which can provide a deeper understanding of financial instruments and market dynamics. Additionally, certifications such as CFA or FRM can enhance credibility and demonstrate expertise in risk management and financial analysis.

Conclusion

Incorporating the skills of a Volatility Arbitrage Trader into your resume is crucial for showcasing your specialized expertise in a competitive job market. By highlighting relevant skills, candidates can differentiate themselves and demonstrate their potential value to prospective employers. This not only increases the chances of landing an interview but also positions you as a strong contender in the field of finance and trading.

As you refine your skills and enhance your resume, remember that every step you take brings you closer to your career goals. Embrace the journey of improvement and make use of resources like resume templates, resume builder, resume examples, and cover letter templates to craft an outstanding job application. Keep pushing forward, and success will follow!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.