Top 24 Tax Technology Specialist Skills to Put on Your Resume for 2025

As a Tax Technology Specialist, having the right set of skills is crucial for navigating the complex landscape of tax compliance and technology integration. This role demands a blend of technical proficiency and tax knowledge to optimize processes, ensure accuracy, and leverage the latest technological advancements. In this section, we will outline the top skills that are essential for any Tax Technology Specialist looking to enhance their resume and stand out in this competitive field.

Best Tax Technology Specialist Technical Skills

In the evolving landscape of tax compliance and technology, possessing the right technical skills is crucial for a Tax Technology Specialist. These skills not only enhance efficiency but also ensure accurate tax reporting and compliance in a complex regulatory environment. Below are some essential technical skills that can significantly boost your resume.

Data Analysis

Data analysis involves interpreting and analyzing tax data to support decision-making processes and ensure compliance. This skill is fundamental for identifying trends and discrepancies in tax reporting.

How to show it: Highlight specific projects where you used data analysis tools to improve tax reporting accuracy or efficiency.

Tax Software Proficiency

Expertise in tax software such as SAP, Oracle, or QuickBooks is essential for managing tax data, automating processes, and ensuring accurate tax calculations.

How to show it: List the tax software you are proficient in and describe how you optimized its use in your previous roles.

Automation Tools

Knowledge of automation tools like Alteryx or UiPath helps streamline tax processes, reducing manual effort and minimizing errors in tax compliance tasks.

How to show it: Describe projects where you implemented automation tools to enhance workflow efficiency and reduce processing time.

Database Management

Understanding how to manage and manipulate databases is crucial for storing, retrieving, and analyzing tax-related data effectively.

How to show it: Include examples of database management systems you have used and the impact on your team's tax processes.

Regulatory Knowledge

Familiarity with tax regulations and compliance requirements is vital for ensuring that tax practices adhere to current laws and standards.

How to show it: Mention specific regulations you have worked with and any compliance improvements you facilitated.

Excel Mastery

Advanced Excel skills, including pivot tables, VLOOKUP, and macros, are essential for performing complex calculations and analyzing tax data efficiently.

How to show it: Quantify your expertise by detailing how your Excel skills led to significant time savings or improved accuracy in tax reporting.

Programming Skills

Knowledge of programming languages such as Python or R can enhance your ability to analyze tax data and automate repetitive tasks.

How to show it: Provide examples of how your programming skills helped solve specific tax-related problems or improved processes.

Cloud Computing

Experience with cloud-based tax solutions allows for better collaboration and access to real-time data across teams and locations.

How to show it: Highlight your experience with specific cloud computing platforms and the benefits they brought to your tax operations.

Cybersecurity Awareness

Understanding cybersecurity principles is important for protecting sensitive tax information and ensuring compliance with data protection regulations.

How to show it: Discuss any initiatives you led or participated in to enhance data security in tax processes.

Project Management

Project management skills are essential for overseeing tax technology implementations and ensuring projects meet deadlines and budget constraints.

How to show it: Detail specific projects you managed, focusing on outcomes such as improved efficiency or successful tax audits.

Business Intelligence Tools

Proficiency in business intelligence tools such as Tableau or Power BI can help visualize tax data and generate insightful reports for decision-making.

How to show it: Showcase specific reports or dashboards you created and the insights that led to better strategic decisions.

Best Tax Technology Specialist Soft Skills

In the rapidly evolving field of tax technology, possessing strong soft skills is as crucial as technical expertise. Soft skills enable Tax Technology Specialists to effectively communicate, collaborate, and navigate complex challenges that arise in their roles. These skills enhance problem-solving capabilities and foster a productive work environment, ultimately contributing to successful project outcomes and client satisfaction.

Communication

Effective communication is vital for Tax Technology Specialists as they must convey complex tax concepts and technology solutions to both technical and non-technical stakeholders.

How to show it: Highlight instances where you successfully explained technical tax solutions to clients or team members, emphasizing clarity and understanding.

Problem-solving

As a Tax Technology Specialist, strong problem-solving skills allow you to analyze issues, identify solutions, and implement effective strategies to overcome challenges that arise in tax technology projects.

How to show it: Provide examples of complex tax challenges you resolved and the impact of your solutions on project success or client satisfaction.

Time Management

Time management is essential in managing multiple projects and deadlines in tax technology, ensuring timely delivery of services and solutions.

How to show it: Showcase your ability to prioritize tasks and meet deadlines by mentioning specific projects where you successfully managed time constraints.

Teamwork

Collaboration is key in tax technology, as specialists often work in teams to develop and implement solutions, making teamwork skills invaluable.

How to show it: Detail your experience working in cross-functional teams and how your contributions led to successful outcomes.

Adaptability

Adaptability enables Tax Technology Specialists to adjust to new technologies, regulatory changes, and evolving client needs, ensuring they remain effective in dynamic environments.

How to show it: Provide examples of how you adapted to significant changes within a project or the organization, and the results of your flexibility.

Attention to Detail

Attention to detail is critical in tax technology to ensure accuracy in data analysis, reporting, and compliance with tax regulations.

How to show it: Demonstrate how your meticulous approach led to error-free reports or compliance achievements.

Analytical Thinking

Analytical thinking allows Tax Technology Specialists to dissect complex problems and data sets, leading to informed decision-making and strategic insights.

How to show it: Include examples where your analytical skills led to actionable insights or improved project outcomes.

Negotiation

Negotiation skills are important for Tax Technology Specialists to advocate for resources, timelines, and project scopes effectively when collaborating with clients and stakeholders.

How to show it: Share specific instances where your negotiation skills positively impacted project scope or client relationships.

Critical Thinking

Critical thinking enables specialists to evaluate information objectively and make reasoned judgments, which is essential in tax compliance and technology implementation.

How to show it: Provide examples of how your critical thinking skills helped identify potential issues before they became problems.

Customer Service Orientation

A strong customer service orientation is crucial for understanding client needs and delivering solutions that align with their expectations in tax technology.

How to show it: Highlight experiences where you went above and beyond to meet client needs and the positive feedback received.

Creativity

Creativity in problem-solving allows Tax Technology Specialists to develop innovative solutions that enhance efficiency and effectiveness in tax processes.

How to show it: Mention projects where your creative solutions led to improved processes or technology implementations.

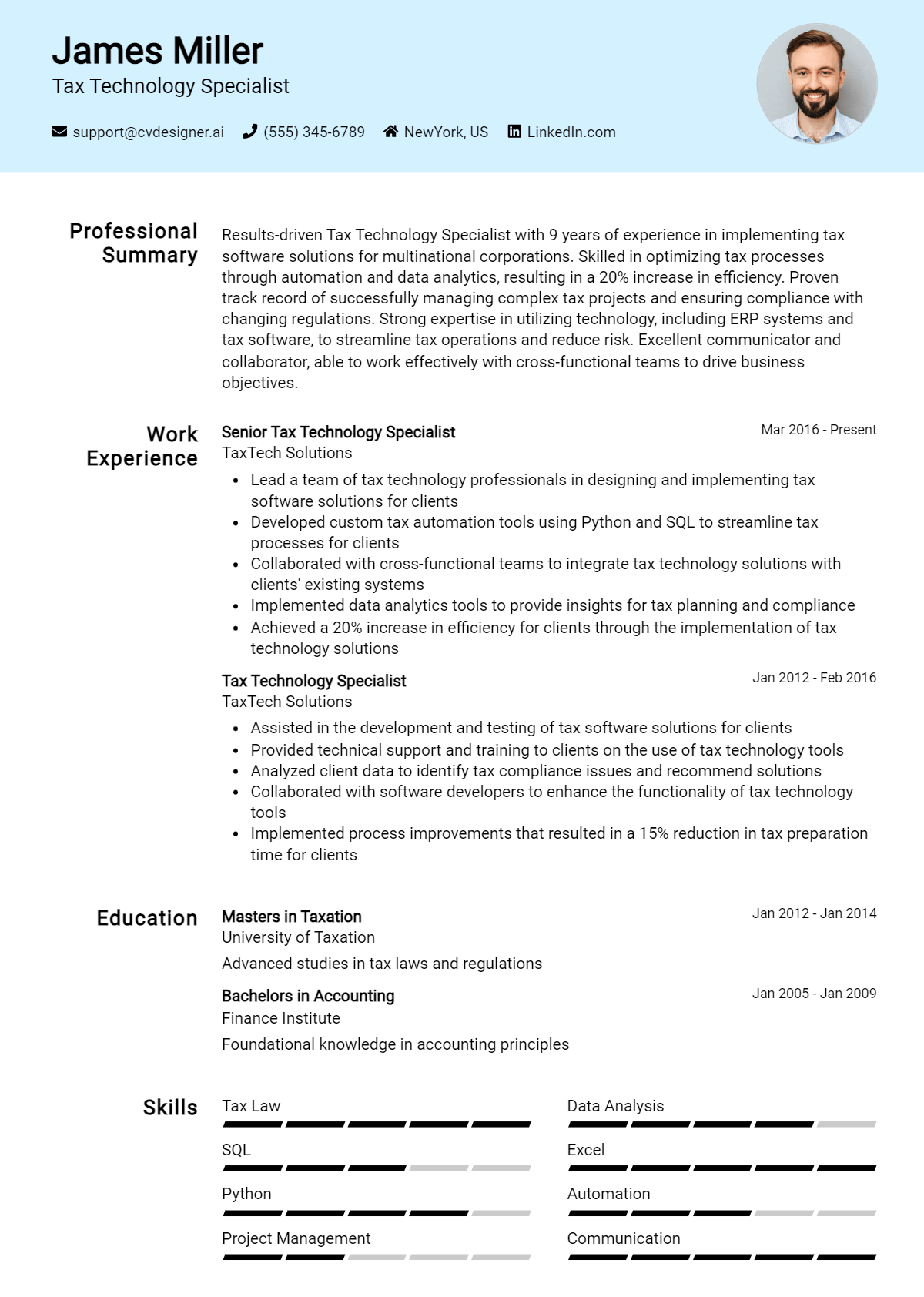

How to List Tax Technology Specialist Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to employers, especially for specialized roles like Tax Technology Specialist. Skills can be highlighted in three main sections: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter. Ensuring that these skills are prominently displayed can significantly enhance your chances of impressing hiring managers.

for Resume Summary

Showcasing your Tax Technology Specialist skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications, setting the tone for the rest of your resume.

Example

Detail-oriented Tax Technology Specialist with expertise in data analytics and compliance automation, skilled in leveraging technology to improve tax processes and enhance operational efficiency. Proven track record of delivering impactful results in fast-paced environments.

for Resume Work Experience

The work experience section is the perfect opportunity to demonstrate how your Tax Technology Specialist skills have been applied in real-world scenarios. This is where you can provide concrete examples of your contributions to previous employers.

Example

- Implemented a new tax compliance software, reducing processing time by 30%.

- Collaborated with cross-functional teams to enhance data integrity, resulting in a 20% increase in reporting accuracy.

- Trained junior staff on data analysis techniques, fostering a culture of continuous improvement.

- Managed system integration projects that streamlined tax filing processes, improving overall efficiency.

for Resume Skills

The skills section can either showcase technical or transferable skills. A balanced mix of hard and soft skills is essential to present a well-rounded candidacy.

Example

- Data Analytics

- Tax Compliance

- Process Automation

- Project Management

- System Integration

- Attention to Detail

- Communication Skills

- Problem-Solving

for Cover Letter

A cover letter allows you to expand on the skills mentioned in your resume and provides a more personal touch. Highlighting 2-3 key skills that align with the job description can effectively demonstrate how those skills have positively impacted your previous roles.

Example

In my previous role, my expertise in data analytics and process automation helped reduce tax preparation time by 25%. By streamlining workflows and enhancing compliance accuracy, I was able to contribute significantly to the team’s success, ensuring timely submissions and improved stakeholder satisfaction.

Be sure to link the skills mentioned in your resume to specific achievements in your cover letter, reinforcing your qualifications for the job.

The Importance of Tax Technology Specialist Resume Skills

In today's competitive job market, the role of a Tax Technology Specialist demands not only technical proficiency but also a nuanced understanding of tax regulations and technology solutions. Highlighting relevant skills on a resume is crucial, as it allows candidates to showcase their qualifications and expertise directly aligned with the job requirements. A well-crafted skills section not only helps candidates stand out to recruiters but also demonstrates their readiness to tackle the complexities of tax technology.

- Showcases Technical Proficiency: A strong skills section highlights a candidate's familiarity with tax software and technology, which are essential tools for a Tax Technology Specialist. This knowledge ensures that the candidate can effectively manage and analyze tax data.

- Demonstrates Problem-Solving Abilities: Including skills related to data analysis and troubleshooting indicates a candidate's capability to identify and resolve issues efficiently, a critical aspect of managing tax technology solutions.

- Aligns with Job Requirements: Tailoring the skills section to reflect the specific requirements of the job posting helps candidates present themselves as ideal fits for the role, making it easier for recruiters to see their potential contributions.

- Enhances Marketability: Candidates who emphasize in-demand skills, such as automation and data analytics, can differentiate themselves in the job market, appealing to employers looking for innovative approaches to tax processes.

- Builds Confidence: A comprehensive skills section not only reassures recruiters of a candidate’s capabilities but also boosts the candidate’s confidence when discussing their qualifications during interviews.

- Reflects Continuous Learning: Including skills that demonstrate ongoing professional development showcases a commitment to staying current with industry trends, which is vital in the fast-evolving field of tax technology.

- Facilitates Better Networking: A well-defined skills section can be a conversation starter in networking situations, helping candidates connect with industry professionals who may have valuable insights or opportunities.

- Improves ATS Compatibility: Many organizations use Applicant Tracking Systems (ATS) to filter resumes. Clearly outlining relevant skills increases the chances of passing through these systems, ensuring that resumes land in the hands of hiring managers.

For more insights and examples, visit the Resume Samples page.

How To Improve Tax Technology Specialist Resume Skills

In the rapidly evolving field of tax technology, it is essential for professionals to continuously enhance their skills to stay relevant and effective. As regulations change and technology advances, a Tax Technology Specialist must be equipped with the latest knowledge and tools to navigate complex tax systems efficiently. By improving your skills, you can increase your value to employers, enhance your career prospects, and provide better solutions to clients.

- Stay updated with the latest tax regulations and compliance requirements by subscribing to industry newsletters and attending relevant webinars.

- Enhance your technical skills by taking online courses in data analytics, tax software, and programming languages like SQL or Python.

- Participate in professional associations and networking events to share knowledge and learn from industry peers.

- Gain hands-on experience with various tax technology tools by volunteering for projects or seeking internships that involve tax automation.

- Read books and research papers focused on tax technology trends and best practices to deepen your understanding of the field.

- Seek feedback on your work from colleagues and mentors to identify areas for improvement and set specific goals for skill enhancement.

- Develop strong communication and presentation skills to effectively convey complex tax technology concepts to non-technical stakeholders.

Frequently Asked Questions

What are the key skills required for a Tax Technology Specialist?

A Tax Technology Specialist should possess strong analytical skills, proficiency in tax software, and a solid understanding of tax regulations. Additionally, skills in data analysis, programming languages like SQL or Python, and experience with ERP systems are highly beneficial. Effective communication and project management abilities are also critical, as these professionals often collaborate with various departments to implement tax solutions.

How important is knowledge of tax compliance in this role?

Knowledge of tax compliance is crucial for a Tax Technology Specialist, as it ensures that the technology solutions implemented align with current tax laws and regulations. This understanding helps in identifying areas of risk and ensuring that automated processes are compliant, ultimately minimizing the likelihood of errors and penalties for the organization.

What programming languages should a Tax Technology Specialist be familiar with?

While not always mandatory, familiarity with programming languages such as Python, R, and SQL can significantly enhance a Tax Technology Specialist's effectiveness. These languages are often used for data manipulation, reporting, and automating tax-related processes, making them valuable assets for optimizing tax operations and improving efficiency.

How can data analysis skills benefit a Tax Technology Specialist?

Data analysis skills are essential for a Tax Technology Specialist as they enable the professional to effectively interpret and manipulate large datasets related to tax information. This capability allows for more accurate forecasting, identifying trends, and ensuring compliance, which can lead to better decision-making and strategic planning within the tax function of an organization.

What role does project management play in the responsibilities of a Tax Technology Specialist?

Project management skills are vital for a Tax Technology Specialist, as they often oversee the implementation of new tax technologies and processes. This includes planning, executing, and monitoring projects to ensure they are completed on time and within budget. Strong project management abilities help in coordinating with various stakeholders, managing resources, and mitigating risks associated with tax technology projects.

Conclusion

In today's competitive job market, highlighting your skills as a Tax Technology Specialist on your resume is crucial for standing out to potential employers. By showcasing relevant competencies, you not only demonstrate your expertise but also convey the unique value you bring to the organization. This targeted approach can significantly enhance your chances of securing interviews and landing the job.

So, take the time to refine your skills and tailor your applications. Remember, a well-crafted resume can open doors to exciting career opportunities. For more resources, check out our resume templates, utilize our resume builder, explore resume examples, and don’t forget to create an impressive cover letter with our cover letter templates. Good luck on your job search journey!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.