27 Tax Policy Analyst Resume Skills That Stand Out in 2025

As a Tax Policy Analyst, possessing a diverse set of skills is essential for effectively navigating the complexities of tax laws and regulations. This role requires not only a strong foundation in tax policy but also analytical, communication, and research capabilities. In the following section, we will outline the top skills that can enhance your resume and make you a standout candidate in the competitive field of tax policy analysis.

Best Tax Policy Analyst Technical Skills

Technical skills are essential for Tax Policy Analysts as they help in analyzing complex tax laws, evaluating their implications, and proposing effective policy changes. Proficiency in these skills can significantly enhance a candidate's ability to contribute to tax policy development and analysis.

Data Analysis

Data analysis is critical for interpreting tax data, identifying trends, and making informed recommendations. Analysts must be adept at using statistical tools to assess the impact of tax policies.

How to show it: Highlight specific projects where data analysis led to significant policy recommendations or changes.

Tax Law Knowledge

A strong understanding of tax laws and regulations is fundamental for a Tax Policy Analyst. This knowledge ensures that policy recommendations are compliant and effective.

How to show it: Detail relevant coursework, certifications, or specific laws you have worked with in past roles.

Economic Modeling

Economic modeling helps analysts predict the effects of tax policies on the economy. Proficiency in this area allows for robust evaluations of proposed changes.

How to show it: Discuss models you've built or utilized that successfully forecasted the impact of tax legislation.

Statistical Software Proficiency

Familiarity with statistical software (like SAS, R, or Stata) is essential for conducting sophisticated data analyses and simulations relevant to tax policy.

How to show it: List specific software you are proficient in and the analyses performed using those tools.

Quantitative Research

Quantitative research skills are vital for collecting and interpreting numerical data to support policy analysis and recommendations effectively.

How to show it: Provide examples of research projects where quantitative methods were implemented to inform tax policy decisions.

Policy Analysis Techniques

Understanding various policy analysis techniques is crucial for evaluating the effectiveness of tax policies and proposing improvements.

How to show it: Include instances where you applied specific techniques to analyze tax policies and their outcomes.

Report Writing

Strong report writing skills are necessary to articulate findings, analyses, and recommendations clearly and persuasively to stakeholders.

How to show it: Mention published reports or presentations where your writing contributed to policy discussions.

Financial Acumen

A solid understanding of financial principles aids Tax Policy Analysts in assessing the fiscal implications of tax policies on individuals and businesses.

How to show it: Discuss how your financial knowledge influenced your analysis or recommendations on tax policies.

Regulatory Compliance

Knowledge of regulatory compliance ensures that tax policies adhere to existing laws and regulations, minimizing legal risks.

How to show it: Describe your experience in ensuring compliance in policy recommendations or analyses.

Stakeholder Engagement

Engaging with stakeholders is essential for understanding diverse perspectives on tax policies and ensuring successful implementation.

How to show it: Illustrate your experience in facilitating discussions or negotiations with key stakeholders in tax policy.

Project Management

Project management skills are important for leading tax policy projects, coordinating teams, and ensuring timely delivery of analyses and reports.

How to show it: Provide examples of projects you managed, focusing on outcomes and efficiency improvements.

Best Tax Policy Analyst Soft Skills

Soft skills are essential for Tax Policy Analysts as they enhance collaboration, facilitate effective communication, and improve problem-solving capabilities. These interpersonal skills are vital for interpreting complex tax regulations, working with diverse teams, and presenting findings clearly to stakeholders. Below are some of the top soft skills to highlight on your resume.

Communication

Effective communication is crucial for explaining complex tax policies and collaborating with various stakeholders.

How to show it: Include examples of presentations given or reports authored that clearly conveyed tax information.

Analytical Thinking

Analytical thinking allows Tax Policy Analysts to evaluate data, identify trends, and draw meaningful conclusions from tax-related information.

How to show it: Demonstrate this skill by highlighting specific projects where data analysis led to policy recommendations.

Problem-solving

Problem-solving skills are essential for addressing challenges and developing effective tax solutions that benefit stakeholders and comply with regulations.

How to show it: Provide instances where you've successfully navigated complex tax issues and the outcomes achieved.

Time Management

Time management is vital for prioritizing tasks, meeting deadlines, and ensuring that analyses are completed efficiently.

How to show it: Highlight your ability to manage multiple projects simultaneously while meeting all deadlines.

Teamwork

Teamwork is necessary for collaborating with colleagues from finance, law, and policy backgrounds to create comprehensive tax strategies.

How to show it: List examples of collaborative projects that resulted in successful tax initiatives.

Attention to Detail

Attention to detail is critical when analyzing tax documents and ensuring compliance with regulations.

How to show it: Provide examples of how your meticulous nature has prevented errors or improved accuracy in reports.

Research Skills

Strong research skills are necessary for staying updated on tax laws and understanding their implications on policies.

How to show it: Include details of research projects that contributed to policy development or analysis.

Adaptability

Adaptability is essential for responding to changes in tax legislation and adjusting analyses accordingly.

How to show it: Share examples of how you have quickly adapted to new regulations and their impacts on tax policy.

Negotiation Skills

Negotiation skills are important for working with government officials and stakeholders to advocate for favorable tax policies.

How to show it: Provide specific instances where your negotiation led to positive outcomes in tax discussions.

Critical Thinking

Critical thinking is vital for evaluating the implications of tax policies and assessing their effectiveness.

How to show it: Highlight situations where your critical analysis led to significant policy insights or changes.

Interpersonal Skills

Interpersonal skills enhance relationships with colleagues and stakeholders, fostering a collaborative work environment.

How to show it: Share examples of successful collaborations or partnerships that improved tax analysis or policy.

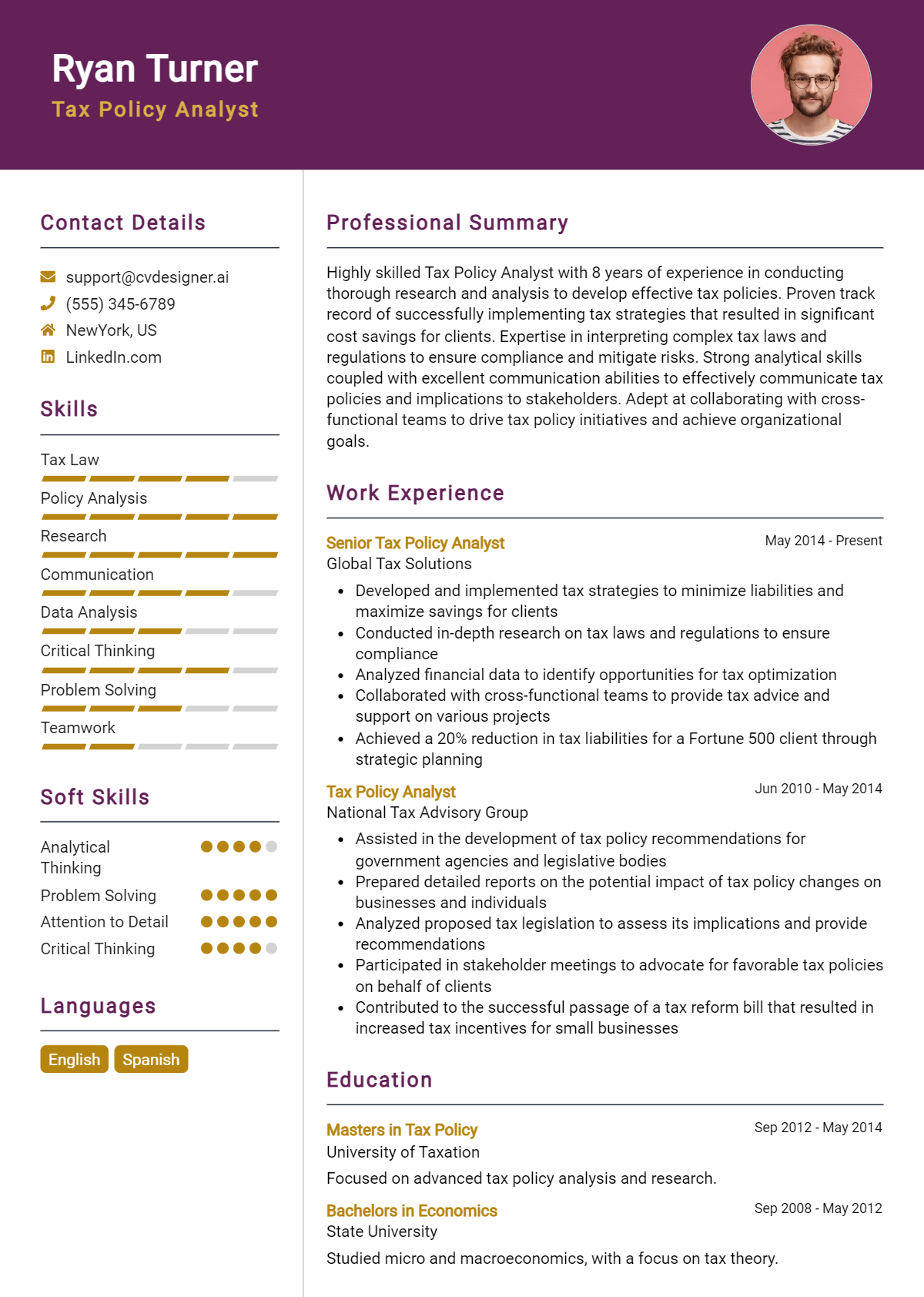

How to List Tax Policy Analyst Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to potential employers. It provides a quick snapshot of your qualifications and helps demonstrate how you meet the job criteria. Skills can be highlighted in three main areas: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

Showcasing your Tax Policy Analyst skills in the summary section gives hiring managers a quick overview of your qualifications, setting the tone for the rest of your resume.

Example

As a dedicated Tax Policy Analyst with expertise in tax legislation, regulatory compliance, and data analysis, I bring over 5 years of experience in optimizing tax strategies and influencing policy decisions.

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how your Tax Policy Analyst skills have been applied in real-world scenarios, showcasing your impact in previous roles.

Example

- Developed comprehensive tax strategies that resulted in a 15% reduction in corporate tax liabilities.

- Conducted in-depth analyses of tax legislation changes, advising senior management on compliance risks and opportunities.

- Collaborated with cross-functional teams to align tax policies with business objectives, improving operational efficiency.

- Facilitated training sessions on tax compliance and policy updates, enhancing team knowledge and adherence.

for Resume Skills

The skills section is an opportunity to showcase both technical and transferable skills. It's essential to include a balanced mix of hard and soft skills that enhance your overall qualifications.

Example

- Tax Legislation Analysis

- Regulatory Compliance

- Data Analysis

- Policy Development

- Strategic Planning

- Communication Skills

- Problem-Solving

- Stakeholder Engagement

for Cover Letter

A cover letter allows you to expand on the skills mentioned in your resume while adding a personal touch. Highlighting 2-3 key skills that align with the job description can effectively illustrate how you've applied those skills in your previous roles.

Example

In my previous position, my strong analytical skills and expertise in regulatory compliance enabled me to identify potential tax savings, resulting in a 20% increase in efficiency. My ability to communicate complex tax policies has consistently benefited cross-functional teams, aligning strategies with company goals.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job, making your application more compelling.

The Importance of Tax Policy Analyst Resume Skills

In today's competitive job market, showcasing the right skills on your resume is crucial for standing out as a Tax Policy Analyst. A well-crafted skills section not only highlights your qualifications but also aligns your experience with the specific demands of the job. Recruiters often sift through numerous applications, and a strong skills section can be the deciding factor that captures their attention and demonstrates your fit for the role.

- Demonstrating analytical skills is essential for a Tax Policy Analyst, as it shows your ability to interpret complex data and provide insights that inform tax policy decisions. Recruiters value candidates who can translate numbers into actionable recommendations.

- Proficiency in relevant software and tools, such as tax preparation software and data analysis programs, is critical. Highlighting these technical skills can set you apart from other applicants who may lack this expertise.

- Strong communication abilities are vital for conveying intricate tax concepts to stakeholders. Candidates who can articulate their findings clearly and persuasively are more likely to succeed in collaborative environments.

- Knowledge of tax laws and regulations is a fundamental skill for any Tax Policy Analyst. Emphasizing your understanding of current legislation demonstrates your capability to contribute effectively to policy development and compliance efforts.

- Research skills are fundamental for staying current with tax trends and changes. A candidate who showcases a commitment to ongoing learning and professional development signals to employers that they are proactive and engaged in their field.

- Problem-solving skills are essential in addressing unique tax challenges and finding innovative solutions. Highlighting your ability to think critically and develop strategies can make you an attractive candidate.

- Experience with stakeholder engagement is important, as Tax Policy Analysts often work with various entities, including government agencies and private organizations. Demonstrating your ability to foster relationships and work collaboratively can enhance your appeal to employers.

- Attention to detail is paramount in tax policy analysis, where precision in data interpretation can have significant consequences. Candidates who emphasize their meticulousness are likely to be seen as trustworthy and reliable.

For more insights and examples, visit Resume Samples.

How To Improve Tax Policy Analyst Resume Skills

In the ever-evolving landscape of tax legislation and policy, it is crucial for Tax Policy Analysts to continuously enhance their skills to remain competitive and effective in their roles. By improving their expertise, analysts can better contribute to their organizations, stay informed about changes in tax laws, and provide valuable insights that influence decision-making. Here are some actionable tips to help you elevate your skill set:

- Stay updated on tax law changes by subscribing to relevant journals and newsletters.

- Participate in professional development courses and workshops focused on tax policy and analysis.

- Network with other professionals in the field through conferences and online forums to share insights and best practices.

- Enhance analytical skills by utilizing data analysis software and tools relevant to tax policy.

- Engage with academic literature on tax policy to deepen your understanding of theoretical frameworks and practical applications.

- Seek mentorship from experienced tax professionals to gain insights and guidance on complex issues.

- Practice writing clear and concise policy briefs to improve communication skills essential for presenting tax analysis findings.

Frequently Asked Questions

What are the key skills required for a Tax Policy Analyst?

A Tax Policy Analyst should possess strong analytical skills to interpret complex tax laws and regulations. Additionally, excellent research abilities are essential for gathering data and understanding the implications of tax policies. Proficiency in quantitative analysis and familiarity with statistical software can enhance the ability to evaluate tax systems. Effective communication skills are also crucial, as analysts must convey findings clearly to stakeholders, including policymakers and the public.

How important is knowledge of tax legislation for a Tax Policy Analyst?

Knowledge of tax legislation is critical for a Tax Policy Analyst, as it forms the foundation of their work. Understanding current and historical tax laws allows analysts to assess their impact on various sectors and propose changes. A comprehensive grasp of federal, state, and local tax codes enables analysts to provide informed recommendations to improve tax efficiency and equity.

What role does data analysis play in tax policy analysis?

Data analysis is a central component of tax policy analysis. Analysts utilize quantitative methods to examine tax data, identify trends, and evaluate the effects of tax policies on different demographics and economic sectors. By interpreting data effectively, Tax Policy Analysts can provide evidence-based insights that inform policy recommendations and help shape future tax legislation.

How can communication skills enhance a Tax Policy Analyst's effectiveness?

Effective communication skills are vital for a Tax Policy Analyst, as they must present complex financial data and policy recommendations in a way that is understandable to non-experts. Strong verbal and written communication abilities enable analysts to prepare reports, deliver presentations, and engage in discussions with stakeholders. This skill set ensures that their analyses are influential and can lead to actionable policy changes.

What software tools are commonly used by Tax Policy Analysts?

Tax Policy Analysts frequently use various software tools to aid in their analysis. Commonly utilized programs include spreadsheet applications like Microsoft Excel for data management and analysis, as well as statistical software such as R or SAS for more advanced quantitative analysis. Familiarity with tax modeling software can also be beneficial, as it allows analysts to simulate the effects of proposed tax changes and evaluate their potential outcomes.

Conclusion

Incorporating the skills of a Tax Policy Analyst into your resume is crucial for showcasing your expertise in a competitive job market. By effectively highlighting relevant skills, you not only differentiate yourself from other candidates but also demonstrate your potential value to prospective employers. A well-crafted resume can serve as a powerful tool in your job search, reflecting your understanding of complex tax regulations and policies.

As you refine your skills and tailor your application, remember that every enhancement you make brings you one step closer to your career goals. Embrace the journey of skill development and watch your job application stand out. For additional resources, check out our resume templates, use our resume builder, explore resume examples, and find guidance with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.