23 good skills to put on resume for Structured Products Trader in 2025

As a Structured Products Trader, showcasing your skills effectively on your resume is crucial for standing out in a competitive job market. This role requires a unique blend of analytical abilities, market knowledge, and trading acumen. Below, we outline the essential skills that can enhance your resume and demonstrate your expertise in structured products trading.

Best Structured Products Trader Technical Skills

Technical skills are crucial for a Structured Products Trader, as they enable professionals to analyze complex financial instruments, assess market risks, and make informed trading decisions. Highlighting these skills on your resume can significantly enhance your candidacy in a competitive job market.

Financial Modeling

Financial modeling is essential for predicting the future performance of structured products by analyzing historical data and market trends.

How to show it: Quantify your experience by stating the number of models developed and their impact on trading decisions.

Risk Management

Understanding and managing risk is vital for traders to protect portfolios against market volatility and unexpected losses.

How to show it: Include metrics such as reduced loss percentages or successful risk mitigation strategies.

Quantitative Analysis

Quantitative analysis involves using mathematical and statistical techniques to evaluate investment opportunities and risks associated with structured products.

How to show it: Detail specific quantitative methods used and the outcomes achieved through their application.

Market Research

Conducting thorough market research helps traders understand market dynamics and identify profitable trading opportunities.

How to show it: Highlight the frequency of research reports produced and their influence on trading strategies.

Portfolio Management

Effective portfolio management is key to balancing risk and return, ensuring structured products align with investment goals.

How to show it: Provide examples of portfolio performance improvements under your management, including returns achieved.

Derivatives Trading

Expertise in derivatives trading is essential for structured products, as they often include options and swaps to enhance returns.

How to show it: Share your trading volume or successful strategies implemented in derivatives markets.

Regulatory Compliance

Understanding regulatory frameworks ensures that trading practices adhere to legal standards, thus protecting the firm from penalties.

How to show it: List training or certifications obtained and describe their application in maintaining compliance.

Asset Valuation

Proficiency in asset valuation is crucial for accurately pricing structured products and determining their fair market value.

How to show it: Include instances where valuation techniques directly influenced trading outcomes or pricing strategies.

Excel & Financial Software

Advanced skills in Excel and financial software are vital for modeling, analysis, and real-time trading operations.

How to show it: List specific software used and any advanced functions or macros developed for trading efficiency.

Negotiation Skills

Strong negotiation skills are important for securing favorable terms and pricing in structured product transactions.

How to show it: Provide examples of successful negotiations that resulted in significant cost savings or improved terms.

Data Analysis

Data analysis skills enable traders to extract actionable insights from large datasets, enhancing decision-making processes.

How to show it: Demonstrate specific projects where data analysis led to informed trading decisions or optimized strategies.

Best Structured Products Trader Soft Skills

In the competitive field of structured products trading, possessing strong soft skills is just as crucial as technical expertise. These workplace skills enable traders to navigate complex market dynamics, collaborate effectively with teams, and communicate insights to stakeholders. Below are key soft skills that every structured products trader should highlight on their resume.

Communication

Effective communication is vital for conveying complex financial concepts to clients and colleagues. Traders must articulate their strategies and insights clearly.

How to show it: Highlight instances where you successfully presented trading strategies or collaborated on team projects.

Problem-solving

The ability to analyze data and identify solutions is essential in a fast-paced trading environment where market conditions can change rapidly.

How to show it: Provide examples of how you resolved trading challenges or improved processes to enhance efficiency.

Time Management

Traders must prioritize tasks effectively to meet tight deadlines and manage multiple trading strategies simultaneously.

How to show it: Demonstrate your ability to manage competing priorities and meet critical deadlines in your past roles.

Teamwork

Collaboration with analysts, portfolio managers, and other traders is essential to develop and execute successful trading strategies.

How to show it: Include examples of successful collaborative projects and your role in team achievements.

Adaptability

The financial markets are unpredictable; thus, traders must adapt quickly to new information and changing market conditions.

How to show it: Share experiences where you successfully adapted strategies in response to market shifts.

Attention to Detail

Precision is key in trading; small errors can lead to significant financial losses. Attention to detail ensures accurate data analysis and transaction execution.

How to show it: Quantify your achievements related to error reduction or enhanced accuracy in trading operations.

Analytical Thinking

Analytical skills enable traders to interpret data, evaluate trends, and make informed decisions based on comprehensive analysis.

How to show it: Provide examples of data-driven decisions that led to successful trades or strategies.

Resilience

The ability to bounce back from losses and maintain composure under pressure is critical in the high-stakes environment of trading.

How to show it: Illustrate how you successfully managed stress and remained focused after setbacks.

Negotiation Skills

Traders often negotiate deals and terms with clients and counterparties; strong negotiation skills can lead to better outcomes.

How to show it: Highlight successful negotiations that resulted in favorable terms or improved client satisfaction.

Critical Thinking

Critical thinking allows traders to assess situations comprehensively, anticipate potential outcomes, and make strategic decisions.

How to show it: Describe scenarios where your critical thinking led to successful trading strategies or risk management.

Leadership

Leadership skills are important for guiding teams, mentoring junior traders, and driving collaborative initiatives.

How to show it: Include examples where you led a project or initiative that improved team performance or culture.

How to List Structured Products Trader Skills on Your Resume

Effectively listing your skills on a resume is crucial for making a strong impression on potential employers. It’s essential to highlight your qualifications in a way that stands out. There are three main sections where skills can be emphasized: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

Showcasing your Structured Products Trader skills in the summary section allows hiring managers to quickly grasp your qualifications. This brief overview should highlight your most relevant skills and experiences.

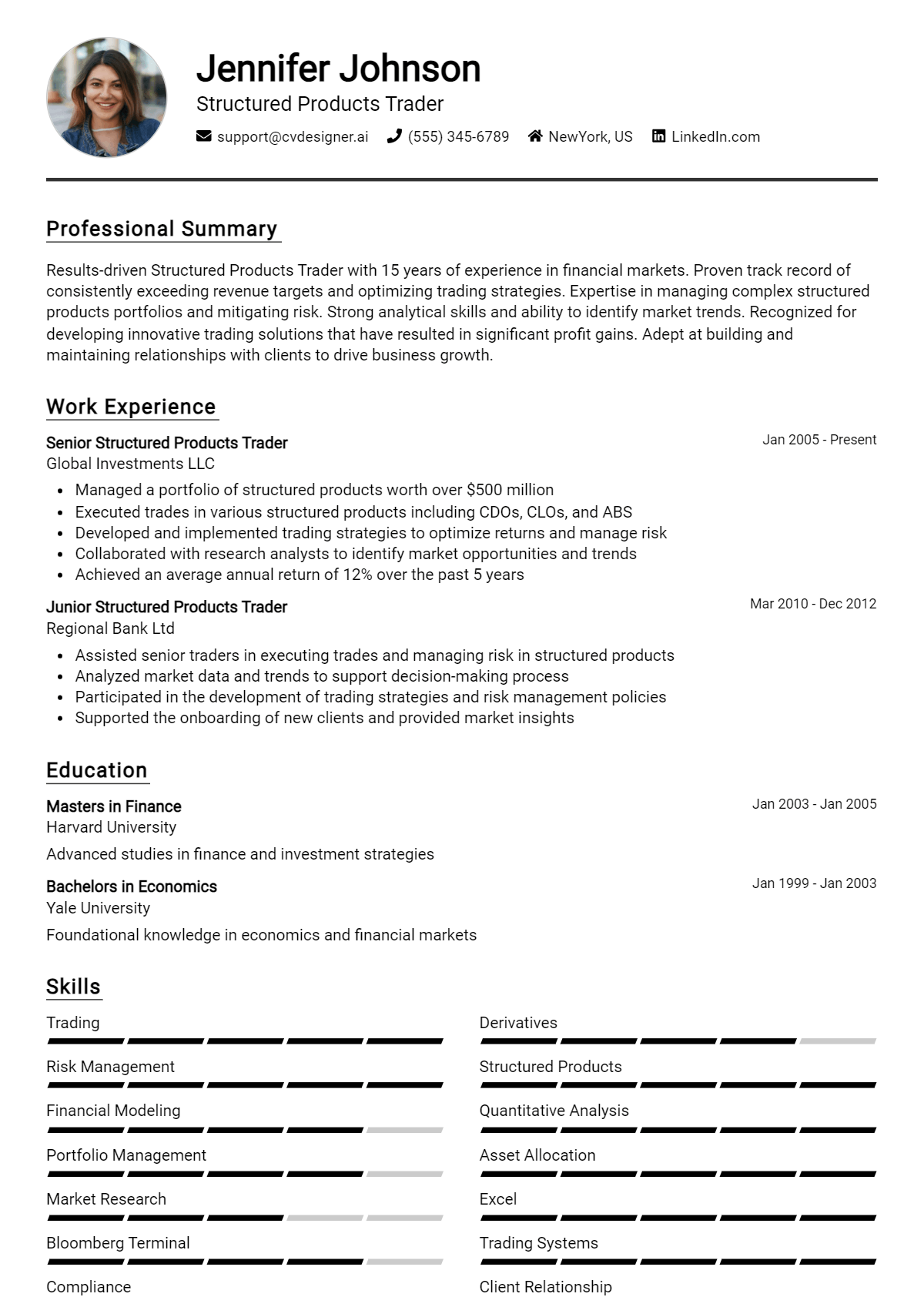

Example

As a dedicated Structured Products Trader with expertise in risk management and market analysis, I have a proven track record of generating profitable trading strategies while maintaining regulatory compliance and fostering client relationships.

for Resume Work Experience

The work experience section provides an excellent opportunity to demonstrate how your Structured Products Trader skills have been applied in real-world scenarios. Use this section to showcase relevant accomplishments and responsibilities.

Example

- Executed trades in complex structured products, enhancing portfolio performance by 15% through strategic market analysis.

- Collaborated with cross-functional teams to develop innovative trading strategies, resulting in a 20% increase in client satisfaction.

- Implemented risk management protocols that decreased potential losses by 30%, ensuring compliance with regulatory standards.

- Trained junior traders on market trends and trading software, fostering a knowledgeable and efficient team environment.

for Resume Skills

The skills section of your resume can showcase both technical and transferable skills. It’s important to include a balanced mix of hard and soft skills to present yourself as a well-rounded candidate.

Example

- Advanced data analysis

- Risk assessment and management

- Market research and forecasting

- Strong negotiation skills

- Regulatory compliance knowledge

- Client relationship management

- Team leadership

for Cover Letter

A cover letter allows candidates to elaborate on the skills listed in their resume while adding a personal touch. It’s a great opportunity to highlight 2-3 key skills that align with the job description and explain their impact in previous roles.

Example

In my previous role, my strong market analysis skills enabled me to identify lucrative trading opportunities that increased revenue by 25%. Additionally, my expertise in risk management has consistently protected the firm from volatile market shifts, ensuring client trust and satisfaction.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job.

The Importance of Structured Products Trader Resume Skills

In the competitive field of finance, particularly in structured products trading, showcasing relevant skills in your resume is crucial. A well-articulated skills section not only highlights your qualifications but also demonstrates your alignment with the specific requirements of the job. This can significantly enhance your visibility to recruiters and increase your chances of landing an interview.

- Structured products trading requires a deep understanding of financial instruments, risk management, and market dynamics. Highlighting these skills shows recruiters that you possess the necessary knowledge to navigate complex financial landscapes.

- Employers look for candidates who can analyze data and trends effectively. By emphasizing your analytical skills, you position yourself as someone capable of making informed trading decisions that can lead to profitability.

- Strong communication skills are essential in this role, as traders must collaborate with various teams and present their strategies clearly. Showcasing these skills demonstrates your ability to work well in a team-oriented environment.

- Attention to detail is critical in trading, where minor errors can lead to significant financial losses. By highlighting your meticulous nature, you provide evidence of your commitment to accuracy and thoroughness.

- Structured products traders often need to adapt to rapidly changing market conditions. Emphasizing your adaptability and problem-solving abilities indicates that you can thrive in high-pressure situations.

- A strong understanding of regulatory requirements and compliance is vital in trading. Including these skills in your resume reassures employers that you are knowledgeable about the legal frameworks governing financial transactions.

- Technical proficiency with trading platforms and software is increasingly important in today's digital trading environment. Highlighting your technical skills can set you apart from candidates who may lack this expertise.

- Finally, a solid grasp of portfolio management principles can be a game-changer. Showcasing your ability to manage and optimize investment portfolios can attract the attention of potential employers.

For more guidance on crafting an effective resume, check out these Resume Samples.

How To Improve Structured Products Trader Resume Skills

In the fast-paced world of finance, particularly in structured products trading, it is crucial to continuously enhance your skill set. As market conditions evolve and new financial instruments emerge, staying ahead of the curve can set you apart from the competition. A well-rounded skill set not only makes you a more effective trader but also enhances your resume, showcasing your commitment to professional growth and adaptability in this dynamic field.

- Stay updated on market trends by regularly following financial news, reports, and analysis specific to structured products.

- Enhance your quantitative skills through courses in advanced mathematics, statistics, or financial engineering.

- Develop your programming skills by learning languages such as Python or R, which are increasingly used for quantitative analysis and trading strategies.

- Network with industry professionals to gain insights and share knowledge about best practices and emerging trends.

- Engage in simulated trading exercises or platforms to practice strategy development and risk management without financial exposure.

- Seek mentorship from experienced traders to learn practical skills and gain valuable advice on career advancement.

- Consider obtaining relevant certifications, such as the Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM), to bolster your qualifications.

Frequently Asked Questions

What key skills should a Structured Products Trader include in their resume?

A Structured Products Trader should highlight skills such as quantitative analysis, risk management, and financial modeling. Proficiency in programming languages like Python or R for data analysis, strong knowledge of derivatives and structured products, and experience with trading platforms are also essential. Additionally, showcasing communication skills and the ability to work under pressure can greatly enhance a candidate's resume.

How important is knowledge of the financial markets for a Structured Products Trader?

Knowledge of the financial markets is crucial for a Structured Products Trader, as it allows them to understand market dynamics, pricing mechanisms, and the impact of economic indicators on structured products. Familiarity with market trends and instruments enables traders to make informed decisions, develop effective trading strategies, and manage risks effectively, which are vital for success in this role.

What role does risk management play in a Structured Products Trader's job?

Risk management is a fundamental aspect of a Structured Products Trader's job, as it involves evaluating potential losses and implementing strategies to mitigate those risks. Traders must analyze the risk-reward profile of various structured products, consider market volatility, and adjust their portfolios accordingly. Strong risk management skills help traders protect their investments and ensure compliance with regulatory requirements.

Are programming skills necessary for a Structured Products Trader?

Yes, programming skills are increasingly important for a Structured Products Trader. Proficiency in programming languages such as Python, R, or MATLAB enables traders to analyze large datasets, develop pricing models, and automate trading strategies. This technical capability not only improves efficiency but also enhances the trader's ability to innovate and adapt to market changes swiftly.

How can experience with derivatives enhance a Structured Products Trader's effectiveness?

Experience with derivatives is highly beneficial for a Structured Products Trader, as it provides a deep understanding of complex financial instruments. This knowledge allows traders to design and structure innovative products that meet client needs while effectively managing the associated risks. Familiarity with various derivatives also aids traders in assessing market opportunities and making strategic trading decisions that can lead to higher returns.

Conclusion

Including Structured Products Trader skills in your resume is crucial for highlighting your expertise and attracting the attention of potential employers. By showcasing relevant skills, you not only differentiate yourself from other candidates but also demonstrate the value you can bring to an organization. Remember, refining your skills and presenting them effectively can significantly enhance your job application. Stay motivated, continue to develop your abilities, and take the next step towards achieving your career goals.

For additional resources, consider exploring our resume templates, using our resume builder, checking out resume examples, and reviewing our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.