25 Resume Skills to Use on Your Senior Tax Associate Resume in 2025

As a Senior Tax Associate, possessing a robust set of skills is essential for navigating the complexities of tax regulations and providing valuable insights to clients. This section highlights the top skills that can enhance your resume and demonstrate your expertise in the field of taxation. Whether you are preparing tax returns, conducting audits, or advising clients on tax planning strategies, showcasing these skills will position you as a knowledgeable and capable professional in the competitive landscape of tax services.

Best Senior Tax Associate Technical Skills

Technical skills are crucial for a Senior Tax Associate as they enable professionals to navigate complex tax regulations, optimize tax strategies, and ensure compliance. Mastery of these skills not only enhances job performance but also contributes to career advancement and organizational success.

Tax Compliance

Understanding and adhering to federal, state, and local tax laws is essential for ensuring that all tax filings are accurate and timely.

How to show it: Highlight specific tax compliance projects you've managed and their successful outcomes.

Tax Planning

Tax planning involves analyzing financial situations to minimize tax liabilities and maximize savings, which is critical for effective financial management.

How to show it: Quantify savings generated through tax planning strategies implemented for clients or the organization.

Research and Analysis

Proficiency in researching tax laws and regulations allows Senior Tax Associates to provide accurate advice and identify opportunities for tax savings.

How to show it: Detail instances where your research led to significant tax savings or compliance improvements.

Financial Reporting

Understanding financial statements and their implications for tax obligations is vital for accurate tax reporting and planning.

How to show it: Include examples of how your insights from financial reports influenced tax strategies.

Tax Software Proficiency

Familiarity with tax preparation and reporting software is essential for efficient tax filing and compliance management.

How to show it: List specific software tools used and any certifications achieved in tax software.

Attention to Detail

A keen eye for detail is necessary for identifying discrepancies and ensuring the accuracy of tax filings.

How to show it: Share examples of how your attention to detail prevented costly errors or audits.

Communication Skills

Effective communication is vital for conveying complex tax information to clients and collaborating with team members.

How to show it: Describe situations where your communication skills facilitated client understanding or improved team collaboration.

Risk Assessment

Assessing potential tax risks and developing strategies to mitigate them is a key responsibility for Senior Tax Associates.

How to show it: Illustrate how your risk assessment strategies protected the organization from potential financial liabilities.

Regulatory Knowledge

Staying informed about changes in tax regulations is essential for ensuring compliance and advising clients accurately.

How to show it: Highlight any professional development or training related to recent tax law changes.

Project Management

Managing multiple tax projects simultaneously requires strong organizational and project management skills.

How to show it: Provide examples of successful projects completed on time and within budget.

Client Relationship Management

Building and maintaining strong client relationships is key to understanding their needs and providing tailored tax solutions.

How to show it: Quantify client retention rates and satisfaction scores achieved through your efforts.

Best Senior Tax Associate Soft Skills

In the competitive field of tax accounting, technical expertise is essential, but soft skills are equally important for a Senior Tax Associate. These skills enable professionals to navigate the complexities of client relationships, provide clear communication, and effectively manage their time and resources. Here are some of the top soft skills to highlight on your resume:

Communication

Effective communication is vital for conveying complex tax information to clients and team members. As a Senior Tax Associate, the ability to articulate financial strategies clearly can significantly enhance client satisfaction and team collaboration.

How to show it: Highlight experiences where you successfully explained tax concepts to clients or contributed to team discussions that improved project outcomes.

Problem-solving

Senior Tax Associates often face unexpected challenges that require innovative solutions. This skill is crucial for identifying issues and developing strategies that comply with tax regulations while maximizing client benefits.

How to show it: Detail specific instances where you resolved complex tax issues or improved processes that resulted in measurable benefits.

Time Management

Managing multiple clients and deadlines is a key aspect of a Senior Tax Associate's role. Strong time management skills ensure that projects are completed efficiently and accurately, minimizing stress and maximizing productivity.

How to show it: Provide examples of how you prioritized tasks and met tight deadlines while maintaining high-quality work.

Teamwork

Collaboration is essential in tax accounting, where working with colleagues and clients can enhance the accuracy and effectiveness of services provided. A Senior Tax Associate should foster a positive team environment.

How to show it: Showcase your role in team projects and any contributions that led to successful outcomes, emphasizing collaboration.

Attention to Detail

Precision is paramount in tax work, where small errors can lead to significant financial consequences. This skill involves meticulously reviewing financial documents and ensuring compliance with tax laws.

How to show it: Include instances where your attention to detail prevented errors or identified discrepancies that resulted in cost savings.

Adaptability

The tax landscape is constantly evolving due to regulatory changes. A Senior Tax Associate must be adaptable to new laws and technology, ensuring their practice remains compliant and competitive.

How to show it: Demonstrate how you've successfully adapted to changes in tax regulations or technology that improved your work processes.

Client Management

Building strong relationships with clients is key to success. This skill involves understanding client needs and providing tailored solutions that enhance client loyalty and satisfaction.

How to show it: Provide examples of how you nurtured client relationships that resulted in repeat business or referrals.

Analytical Thinking

Analyzing complex financial data is at the core of tax-related work. Strong analytical skills enable Senior Tax Associates to identify trends and develop strategies that benefit clients.

How to show it: Share examples of analyses you conducted that led to improved financial outcomes for clients.

Negotiation Skills

Negotiation is often necessary when dealing with tax authorities or clients regarding tax liabilities. A Senior Tax Associate should be able to advocate effectively while maintaining professionalism.

How to show it: Illustrate situations where your negotiation skills led to favorable outcomes for clients or your firm.

Emotional Intelligence

Understanding and managing your emotions, as well as empathizing with clients and colleagues, can enhance workplace dynamics and client interactions. This skill is essential for fostering a supportive work environment.

How to show it: Provide examples of how you handled sensitive client situations or fostered team morale during challenging times.

Critical Thinking

Critical thinking involves evaluating situations logically and making informed decisions. Senior Tax Associates must think critically to navigate complex tax scenarios and regulations.

How to show it: Describe situations where your critical thinking led to the resolution of a challenging tax issue.

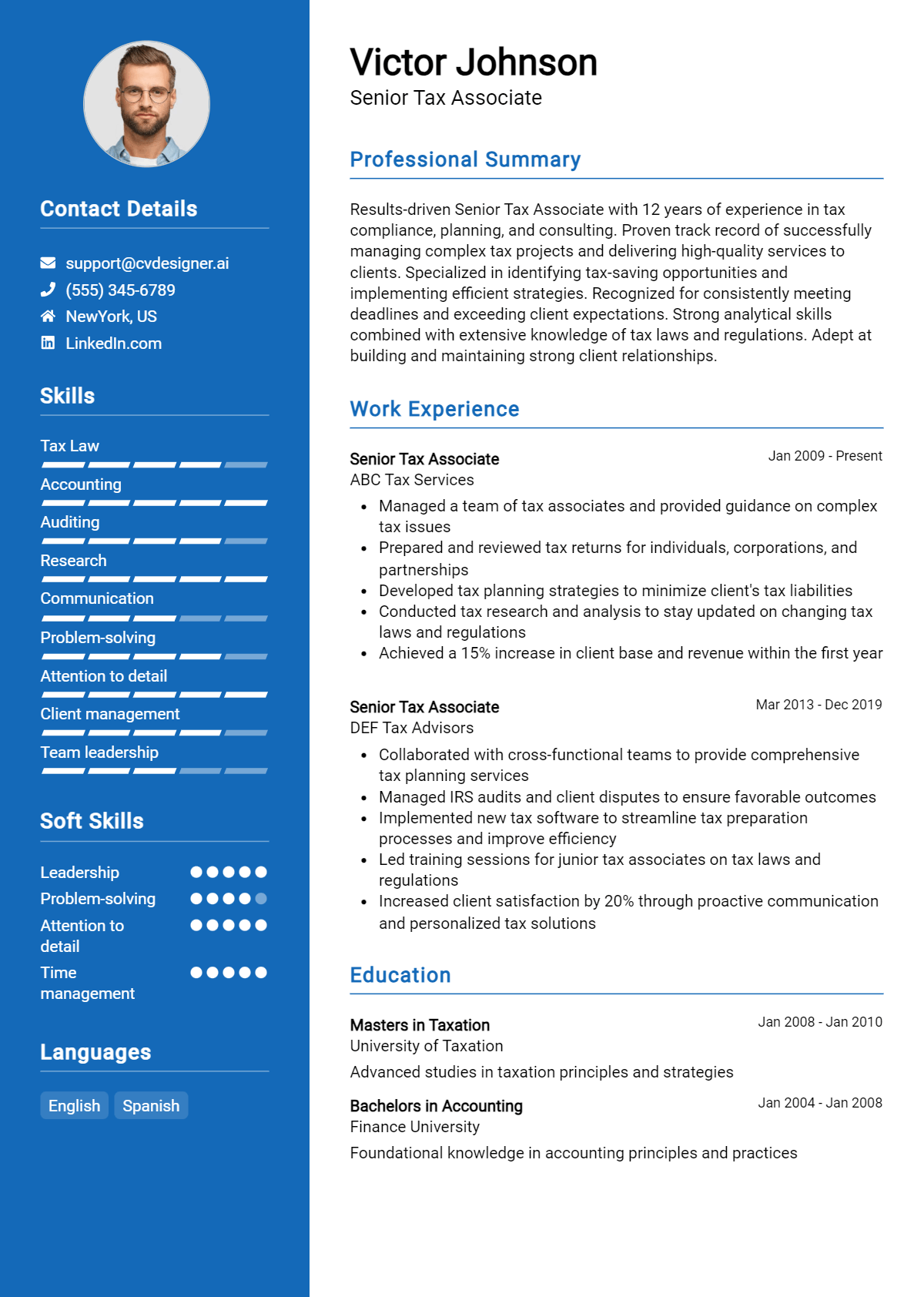

How to List Senior Tax Associate Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to employers in a competitive job market. By strategically highlighting your qualifications, you can draw attention to your expertise as a Senior Tax Associate. There are three main sections where skills can be emphasized: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

Showcasing your Senior Tax Associate skills in the introduction section gives hiring managers a quick overview of your qualifications and sets the tone for the rest of your resume.

Example

As a detail-oriented Senior Tax Associate with expertise in tax compliance and financial analysis, I have successfully managed numerous client portfolios, ensuring accuracy and timely reporting to maximize tax benefits while minimizing liabilities.

for Resume Work Experience

The work experience section is the perfect opportunity to demonstrate how your Senior Tax Associate skills have been applied in real-world scenarios, showcasing your effectiveness in previous roles.

Example

- Prepared and reviewed complex tax returns, applying regulatory knowledge to ensure compliance and reduce audit risks.

- Utilized analytical skills to identify tax-saving opportunities, resulting in an average of 15% savings for clients.

- Led a team in implementing new tax software, improving workflow efficiency by 20%.

- Developed strong relationships with clients through excellent communication and interpersonal skills, enhancing client retention rates.

for Resume Skills

The skills section can showcase both technical and transferable skills. It's important to include a balanced mix of hard and soft skills that reinforce your qualifications for the Senior Tax Associate role.

Example

- Tax Compliance

- Financial Analysis

- Regulatory Knowledge

- Analytical Skills

- Tax Software Proficiency

- Client Relationship Management

- Attention to Detail

- Communication Skills

for Cover Letter

A cover letter allows you to expand on the skills mentioned in your resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate your fit for the position.

Example

In my previous role, my strong analytical skills and tax compliance expertise enabled me to identify significant savings for clients. These skills not only enhanced client satisfaction but also improved the firm’s reputation for delivering exceptional tax services.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job and showcases your impact in previous roles.

The Importance of Senior Tax Associate Resume Skills

Highlighting relevant skills on a Senior Tax Associate resume is crucial for candidates looking to distinguish themselves in a competitive job market. A well-crafted skills section not only showcases a candidate's qualifications but also aligns their expertise with the specific requirements of the job. Recruiters often skim through resumes, and a clear presentation of pertinent skills can capture their attention and increase the chances of landing an interview.

- Demonstrates Expertise: Including relevant skills emphasizes the candidate's proficiency in tax laws, regulations, and compliance, showcasing their ability to handle complex tax situations effectively.

- Aligns with Job Description: Tailoring the skills section to match the job requirements helps candidates present themselves as ideal fits for the position, making it easier for recruiters to see their potential contributions.

- Increases ATS Compatibility: Many companies use Applicant Tracking Systems (ATS) to filter resumes. Incorporating specific keywords related to tax skills can enhance the chances of passing through these automated screenings.

- Showcases Problem-Solving Ability: Highlighting analytical skills and attention to detail indicates a candidate's capability to identify tax issues and develop strategic solutions, which is vital in a Senior Tax Associate role.

- Reflects Ongoing Professional Development: Demonstrating a commitment to continuous learning through relevant certifications or updated skills signals to recruiters that the candidate is dedicated to staying current in the ever-evolving field of taxation.

- Facilitates Communication Skills: Including interpersonal and communication skills highlights a candidate’s ability to collaborate with clients and colleagues, which is essential for effectively conveying complex tax information.

- Indicates Adaptability: Mentioning skills related to software tools and technology proficiency can illustrate a candidate’s ability to adapt to the latest tax software, improving efficiency and accuracy in tax preparation.

For additional guidance on crafting a compelling resume, check out these Resume Samples.

How To Improve Senior Tax Associate Resume Skills

In the ever-evolving field of taxation, it is essential for Senior Tax Associates to continuously enhance their skills to stay competitive and effective. As tax laws and regulations change frequently, a commitment to personal and professional growth ensures that you can provide the best service to clients and maintain compliance. Here are several actionable tips to help you improve your skills in this vital role:

- Stay updated on tax laws and regulations by subscribing to industry newsletters and attending webinars.

- Enroll in advanced tax courses or certifications to deepen your knowledge in specialized areas of tax.

- Utilize tax software and tools to improve efficiency and accuracy in tax preparation and reporting.

- Network with other tax professionals through industry associations to share knowledge and best practices.

- Seek mentorship from experienced tax professionals to gain insights and practical advice.

- Practice analytical and problem-solving skills by working on complex tax scenarios and case studies.

- Join online forums or groups focused on tax to engage in discussions and learn from peers.

Frequently Asked Questions

What key skills should be highlighted on a Senior Tax Associate resume?

A Senior Tax Associate resume should prominently feature skills such as proficiency in tax software (e.g., QuickBooks, TurboTax), strong analytical abilities for tax planning and compliance, excellent communication skills for client interactions, and a solid understanding of tax regulations and legislation. Additionally, showcasing experience in preparing and reviewing tax returns, conducting tax research, and providing strategic tax advice can significantly enhance the resume's appeal.

How important is attention to detail for a Senior Tax Associate?

Attention to detail is crucial for a Senior Tax Associate as the role involves navigating complex tax laws and regulations. A minor error in tax calculations or filings can lead to significant financial repercussions for clients and organizations. Highlighting experiences that demonstrate meticulousness in handling tax documents, preparing reports, and conducting audits can set a candidate apart in a competitive job market.

What role does communication play in a Senior Tax Associate position?

Effective communication is vital for a Senior Tax Associate, as the position often requires explaining complex tax concepts to clients who may not have a financial background. Candidates should emphasize their ability to convey information clearly, both in writing and verbally. Additionally, collaboration with team members and stakeholders is essential, making strong interpersonal skills a key component of the job.

Are leadership skills important for a Senior Tax Associate?

Yes, leadership skills are important for a Senior Tax Associate, particularly if the role involves mentoring junior staff or leading projects. Demonstrating experience in guiding teams, managing client relationships, and taking initiative in problem-solving can showcase an applicant's readiness for a senior-level position. Highlighting these leadership capabilities can indicate an ability to drive results and foster a positive team environment.

What types of certifications or education should be included in a Senior Tax Associate resume?

A Senior Tax Associate should include relevant degrees such as a Bachelor’s in Accounting or Finance, as well as certifications like CPA (Certified Public Accountant) or EA (Enrolled Agent). These credentials not only validate expertise in tax regulations but also enhance credibility with clients and employers. Additionally, any ongoing education or specialized tax training should be mentioned to demonstrate a commitment to professional development.

Conclusion

Incorporating the skills of a Senior Tax Associate in your resume is crucial for showcasing your expertise and commitment to the field. By highlighting relevant skills, candidates can effectively differentiate themselves from others and demonstrate the value they can bring to potential employers. Remember, a well-crafted resume not only reflects your qualifications but also serves as a testament to your professionalism and readiness for the role.

As you prepare your job application, take the time to refine your skills and present them confidently. This dedication can significantly enhance your chances of landing your desired position. Explore our resume templates, utilize our resume builder, review resume examples, and consider our cover letter templates to elevate your application and make a lasting impression. Good luck on your journey to success!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.