27 Sales Tax Specialist Resume Skills That Stand Out in 2025

As a Sales Tax Specialist, possessing the right skills is crucial for navigating the complex landscape of sales tax compliance and regulations. This section highlights the top skills that can enhance your effectiveness in this role and make your resume stand out to potential employers. From analytical abilities to knowledge of tax software, these skills are essential for ensuring accurate reporting and compliance in sales tax matters.

Best Sales Tax Specialist Technical Skills

Technical skills are essential for a Sales Tax Specialist, as they enable professionals to navigate complex tax regulations, analyze data accurately, and ensure compliance with state and federal laws. Highlighting these skills on your resume can set you apart from other candidates and demonstrate your expertise in the field.

Tax Compliance Knowledge

This skill involves understanding and applying state and local tax laws to ensure compliance and minimize risks associated with tax audits.

How to show it: Detail specific tax codes you have navigated and the compliance rates achieved under your oversight.

Data Analysis

Data analysis skills help in interpreting financial data and using it to identify tax liabilities and opportunities for savings.

How to show it: Include examples of how your analysis led to tax savings or improved accuracy in filings.

Tax Software Proficiency

Familiarity with tax software tools like SAP, Oracle, or Intuit is crucial for efficient tax preparation and reporting.

How to show it: List the specific software you’ve used and any certifications you hold related to those tools.

Sales Tax Calculation

Understanding how to accurately calculate sales tax for various transactions is critical to ensure proper tax collection.

How to show it: Quantify the volume of transactions managed and the accuracy rate of tax calculations.

Regulatory Research

This skill involves keeping up-to-date with changing tax laws and regulations that affect the business.

How to show it: Provide examples of how your research has influenced company policy or compliance strategies.

Attention to Detail

A Sales Tax Specialist must have a keen eye for detail to avoid costly errors during tax preparation and reporting.

How to show it: Highlight instances where your attention to detail prevented errors or saved the company from penalties.

Financial Reporting

Ability to prepare accurate financial reports that reflect tax liabilities and ensure transparency in financial practices.

How to show it: Include specific reports you’ve prepared and their impact on financial decision-making.

Communication Skills

Effective communication is necessary for explaining tax regulations and compliance requirements to non-tax professionals.

How to show it: Share examples of training sessions or presentations you’ve conducted on tax topics.

Project Management

Project management skills help in coordinating tax-related projects and managing deadlines efficiently.

How to show it: Describe tax projects you’ve led and the outcomes achieved within set timelines.

Problem-Solving Skills

Ability to identify tax-related issues and develop effective solutions is vital for maintaining compliance and minimizing tax burdens.

How to show it: Provide examples of specific problems you resolved and the financial impact of your solutions.

Cross-Functional Collaboration

Working with various departments to ensure cohesive tax strategies and compliance across the organization is essential.

How to show it: Mention departments you've collaborated with and the success of joint initiatives.

Best Sales Tax Specialist Soft Skills

Soft skills are essential for a Sales Tax Specialist as they enhance communication, collaboration, and problem-solving abilities in a fast-paced and detail-oriented environment. These skills not only improve personal effectiveness but also contribute to the overall success of a team and organization.

Attention to Detail

Attention to detail is crucial for accurately managing tax filings and ensuring compliance with regulations. A Sales Tax Specialist must meticulously review documents and data to avoid costly errors.

How to show it: Highlight specific instances where your attention to detail prevented mistakes or saved the company money.

Communication

Effective communication is key in conveying complex tax information to clients and team members. A Sales Tax Specialist must be able to explain tax concepts clearly and concisely.

How to show it: Provide examples of presentations or reports you created that simplified tax issues for stakeholders. [Learn more about Communication skills](https://resumedesign.ai/communication-skills/)

Problem-Solving

Sales Tax Specialists often face challenges that require innovative solutions. Strong problem-solving skills enable them to navigate tax complexities and find effective resolutions.

How to show it: Describe specific problems you encountered and the creative solutions you implemented to resolve them. [Explore more on Problem-solving skills](https://resumedesign.ai/problem-solving-skills/)

Time Management

Time management is essential for meeting filing deadlines and managing multiple tax-related tasks efficiently. A Sales Tax Specialist must prioritize effectively to ensure timely compliance.

How to show it: Quantify how you managed multiple projects or deadlines and the results of your efforts. [Read about Time Management skills](https://resumedesign.ai/time-management-skills/)

Teamwork

Collaboration with other departments is vital for a Sales Tax Specialist. Teamwork skills facilitate smooth interactions with finance, legal, and operational teams to ensure cohesive tax strategies.

How to show it: Share examples of successful projects that required teamwork and your role in achieving the goals. [Discover more on Teamwork skills](https://resumedesign.ai/teamwork-skills/)

Analytical Thinking

Analytical thinking allows a Sales Tax Specialist to assess data, identify trends, and make informed decisions based on tax regulations and financial implications.

How to show it: Demonstrate how your analytical skills contributed to better tax strategy or compliance outcomes.

Adaptability

The tax landscape is constantly changing, and adaptability is critical for staying current with regulations and adjusting practices accordingly.

How to show it: Provide examples of how you adapted to changes in tax laws or company policies.

Critical Thinking

Critical thinking enables Sales Tax Specialists to evaluate situations logically and make sound decisions that align with legal and financial standards.

How to show it: Highlight instances where your critical thinking led to improved processes or compliance.

Interpersonal Skills

Building strong relationships with clients and colleagues is essential for effective collaboration and successful tax management.

How to show it: Share how your interpersonal skills helped foster positive relationships and improved teamwork.

Organizational Skills

Strong organizational skills help Sales Tax Specialists manage documentation and track deadlines efficiently, ensuring compliance with tax regulations.

How to show it: Describe your system for organizing tax documents and how it contributed to efficiency.

Negotiation Skills

Negotiation skills are important for discussing tax matters with clients and authorities, ensuring fair and beneficial outcomes.

How to show it: Provide examples of successful negotiations you conducted that saved money or improved terms.

How to List Sales Tax Specialist Skills on Your Resume

Effectively listing your skills on a resume is crucial to catch the attention of potential employers. Highlighting relevant skills in the right sections can make a significant difference in your job application. There are three main sections where skills can be showcased: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

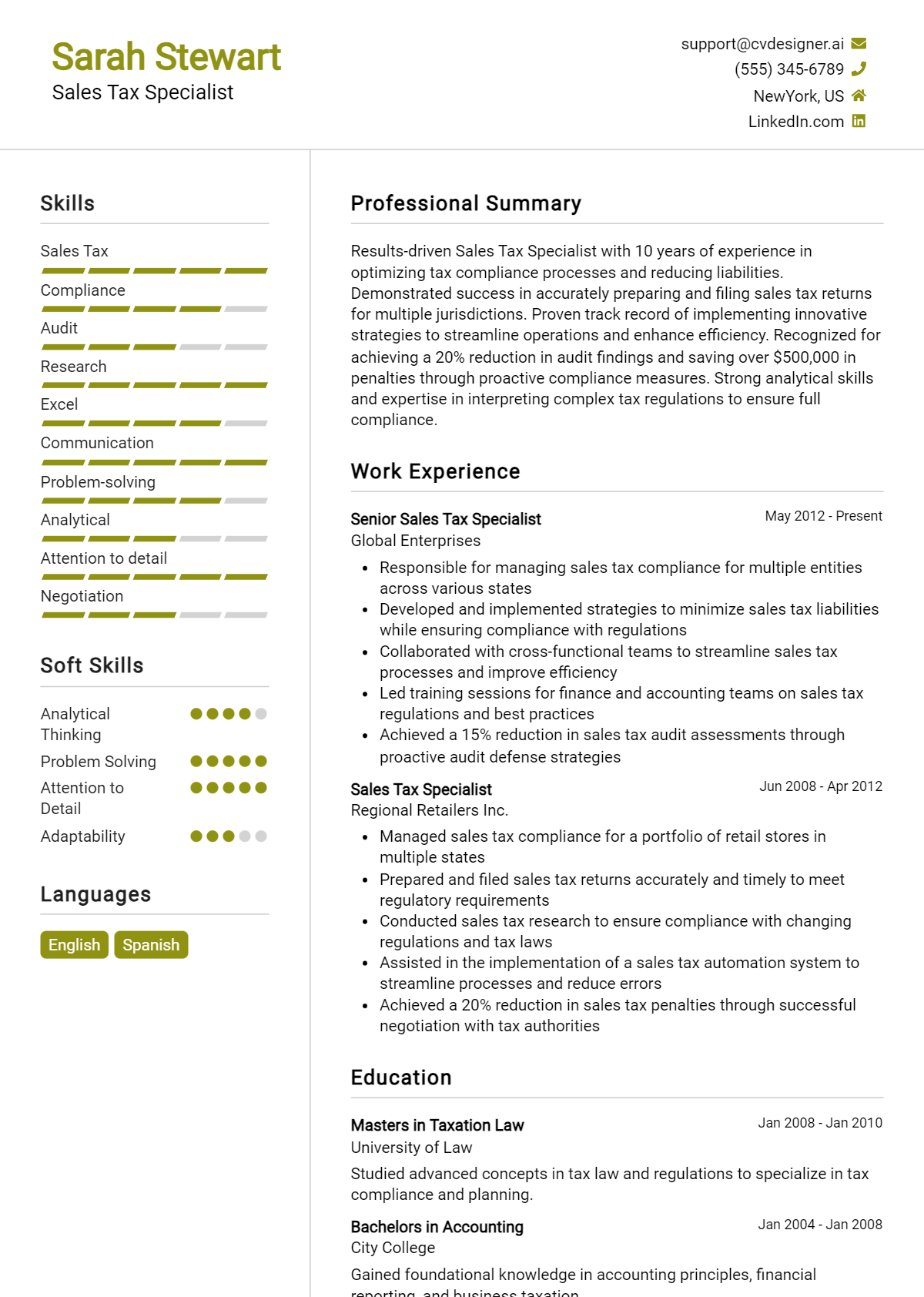

for Resume Summary

Showcasing your Sales Tax Specialist skills in the introduction section provides hiring managers with a quick overview of your qualifications. This initial impression can set the tone for the rest of your resume.

Example

Proficient in sales tax compliance and regulatory analysis, I am a detail-oriented Sales Tax Specialist with over 5 years of experience in tax reporting and audit support. My expertise in cross-border taxation has consistently contributed to my previous employers' success.

for Resume Work Experience

The work experience section is the perfect opportunity to demonstrate how your Sales Tax Specialist skills have been applied in real-world scenarios. This is where you can provide concrete examples of your contributions and achievements.

Example

- Managed and streamlined the sales tax compliance process, reducing filing errors by 30%.

- Collaborated with cross-functional teams to implement effective audit strategies that improved tax reporting accuracy.

- Conducted comprehensive regulatory research to ensure adherence to evolving state and local tax laws.

- Provided training and support to junior staff on best practices in tax compliance and reporting.

for Resume Skills

The skills section can showcase both technical and transferable skills. It's essential to include a balanced mix of hard and soft skills to present yourself as a well-rounded candidate.

Example

- Sales Tax Compliance

- Regulatory Analysis

- Tax Reporting

- Audit Support

- Cross-Border Taxation

- Attention to Detail

- Problem Solving

- Communication Skills

for Cover Letter

A cover letter provides an opportunity to expand on the skills mentioned in your resume and add a more personal touch to your application. Highlighting 2-3 key skills that align with the job description can effectively illustrate your suitability for the role.

Example

In my previous role, my expertise in sales tax compliance allowed me to identify discrepancies that saved the company $50,000 in potential fines. Furthermore, my strong communication skills enabled me to effectively liaise with tax authorities, ensuring smooth audit processes and fostering positive relationships.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job.

The Importance of Sales Tax Specialist Resume Skills

In the competitive field of sales tax compliance and management, highlighting relevant skills on your resume is crucial for standing out to recruiters. A well-crafted skills section not only showcases your qualifications but also aligns your expertise with the specific requirements of the job. By emphasizing your capabilities, you can demonstrate your value and readiness to contribute effectively to an organization.

- Demonstrating proficiency in tax regulations and compliance is essential. Employers seek candidates who understand the intricacies of sales tax laws to ensure their business operations remain within legal boundaries.

- Analytical skills are vital for a Sales Tax Specialist. Highlighting your ability to analyze data and identify discrepancies can show potential employers that you can effectively manage audits and assessments.

- Attention to detail cannot be overstated in this role. A strong skills section showcasing meticulousness can assure recruiters that you will handle tax filings accurately and prevent costly errors.

- Knowledge of relevant software and tools is increasingly important. Listing experience with tax preparation software can give you an edge, as it indicates your ability to adapt to the technology used in the industry.

- Effective communication skills are necessary for collaboration with different departments and external auditors. Emphasizing your ability to convey complex tax information clearly can make you a more attractive candidate.

- Organizational skills are critical for managing multiple tasks and deadlines. By demonstrating your capability to prioritize and manage time effectively, you can illustrate your readiness for the demands of the role.

- Understanding of industry-specific tax practices can set you apart. If you have experience in particular sectors, highlighting this knowledge can attract employers looking for specialized expertise.

- Problem-solving skills are essential for resolving tax-related issues. By showcasing your ability to think critically and find solutions, you can assure recruiters of your effectiveness in this challenging role.

For more insights and examples, check out these Resume Samples.

How To Improve Sales Tax Specialist Resume Skills

Continuous improvement of skills is vital for a Sales Tax Specialist, as the tax landscape is constantly evolving with new regulations, technologies, and methodologies. Staying updated not only enhances job performance but also increases employability and career advancement opportunities. Below are some actionable tips to help you enhance your skills in this field.

- Participate in relevant training and certification programs to deepen your understanding of sales tax laws and regulations.

- Regularly attend industry seminars and workshops to network with other professionals and learn about the latest trends and best practices in sales tax compliance.

- Subscribe to tax-related newsletters and online forums to stay informed about recent changes in tax legislation and emerging issues in the field.

- Utilize tax software and tools to improve your efficiency and accuracy in calculations and reporting.

- Engage in practical experiences, such as internships or project work, to apply theoretical knowledge in real-world scenarios.

- Develop strong analytical skills by practicing data interpretation and problem-solving techniques related to sales tax issues.

- Seek mentorship from experienced professionals in the field to gain insights and advice on navigating complex tax situations.

Frequently Asked Questions

What are the key skills required for a Sales Tax Specialist?

A Sales Tax Specialist should possess strong analytical skills to interpret tax regulations and assess their impact on the business. Proficiency in financial software and databases is essential for managing tax data and preparing reports. Additionally, attention to detail is crucial to ensure compliance and accuracy in tax filings, while effective communication skills are necessary for collaborating with other departments and explaining complex tax concepts to non-experts.

How important is knowledge of state and local tax laws for a Sales Tax Specialist?

Knowledge of state and local tax laws is fundamental for a Sales Tax Specialist, as these regulations can vary significantly and impact how sales tax is calculated and reported. A strong understanding of these laws enables the specialist to ensure compliance, minimize liability, and efficiently manage audits or disputes with tax authorities, making it a critical skill for success in this role.

What role does software proficiency play in a Sales Tax Specialist’s job?

Software proficiency is vital for a Sales Tax Specialist, as they often use specialized tax compliance software and financial systems to analyze data, generate reports, and file returns. Familiarity with popular tools such as Excel, ERP systems, and tax automation software enhances efficiency and accuracy in managing sales tax processes, allowing specialists to focus on strategic tax planning and compliance rather than manual data entry.

How does attention to detail benefit a Sales Tax Specialist?

Attention to detail is crucial for a Sales Tax Specialist, as even minor errors in tax calculations or filings can lead to significant financial repercussions, including penalties and interest. By meticulously reviewing transactions and ensuring the accuracy of data inputs, specialists can effectively mitigate risks and uphold the integrity of the organization’s tax practices, contributing to overall financial health and compliance.

What interpersonal skills are beneficial for a Sales Tax Specialist?

Interpersonal skills are essential for a Sales Tax Specialist, as the role often involves collaboration with various teams, including finance, accounting, and legal departments. Strong communication skills help in articulating tax-related issues and recommendations clearly, while problem-solving abilities are important for addressing tax challenges efficiently. Building relationships with external stakeholders, such as auditors and tax authorities, is also aided by effective interpersonal skills.

Conclusion

Incorporating Sales Tax Specialist skills into your resume is crucial for highlighting your expertise in navigating complex tax regulations and ensuring compliance for businesses. By showcasing relevant skills, candidates can distinguish themselves in a competitive job market, demonstrating their potential value to employers who seek innovative solutions to tax challenges. Take the time to refine your skills and present them effectively, as this can significantly enhance your job application and open doors to exciting career opportunities.

For additional resources to help you craft the perfect application, check out our resume templates, utilize our resume builder, browse through resume examples, and explore our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.