26 Best Skills to Put on Your Portfolio Manager Resume [2025]

As a Portfolio Manager, possessing a diverse skill set is crucial to effectively manage investments and deliver optimal results for clients. A well-crafted resume that highlights your key competencies can set you apart in a competitive job market. In the following section, we will outline the top skills that should be included in your resume to showcase your qualifications and enhance your appeal to potential employers.

Best Portfolio Manager Technical Skills

Technical skills are crucial for a Portfolio Manager, as they demonstrate the ability to analyze financial data, manage investments, and optimize portfolio performance. Highlighting these skills on your resume can set you apart from other candidates and showcase your proficiency in managing assets effectively.

Financial Analysis

Financial analysis involves evaluating financial data to make informed investment decisions. This skill is essential for assessing the performance and potential of assets.

How to show it: Include specific examples of analyses conducted and their impact on portfolio performance.

Risk Management

Risk management entails identifying, assessing, and prioritizing risks to minimize potential losses. This skill is vital for protecting portfolio value.

How to show it: Quantify how you mitigated risks in previous roles, such as by reducing volatility or loss percentages.

Asset Allocation

Asset allocation is the strategic distribution of investments across various asset classes to optimize returns. Mastery of this skill can significantly influence portfolio performance.

How to show it: Detail your allocation strategies and their effectiveness in achieving targeted returns.

Investment Strategy Development

Investment strategy development involves creating a comprehensive plan to guide investment decisions based on market trends and investor goals.

How to show it: Highlight successful strategies you developed and the resultant portfolio growth or performance metrics.

Performance Evaluation

Performance evaluation includes assessing the effectiveness of investment strategies and individual assets over time to inform future decisions.

How to show it: Provide examples of how your evaluations led to actionable insights or strategy adjustments.

Financial Modeling

Financial modeling is the process of creating a numerical representation of a portfolio's performance, which aids in forecasting and decision-making.

How to show it: Discuss specific models you built and their impact on investment decisions or projections.

Market Research

Market research involves gathering and analyzing information about market conditions, trends, and competitors to make informed investment choices.

How to show it: Illustrate how your research informed investment decisions that led to profitability.

Data Analysis Tools

Proficiency in data analysis tools, such as Excel, R, or Python, is critical for analyzing financial data and modeling scenarios effectively.

How to show it: List specific tools used and how they contributed to your analytical capabilities.

Portfolio Optimization

Portfolio optimization is the process of adjusting the asset mix to maximize returns while minimizing risk based on investor objectives.

How to show it: Share examples of portfolio adjustments you made and the resulting performance enhancements.

Regulatory Knowledge

Understanding financial regulations and compliance requirements is essential for managing portfolios within legal parameters.

How to show it: Highlight your familiarity with relevant regulations and how you ensured compliance in your portfolio management practices.

Performance Reporting

Performance reporting involves compiling and presenting portfolio performance data to stakeholders, ensuring transparency and accountability.

How to show it: Provide examples of reports you created that influenced stakeholder decisions or improved communications.

Best Portfolio Manager Soft Skills

Soft skills are essential for Portfolio Managers as they enhance interpersonal interactions, facilitate effective team collaboration, and drive successful project outcomes. These skills help in navigating complex situations, fostering relationships with stakeholders, and ensuring that portfolio objectives align with organizational goals.

Communication

Effective communication is crucial for conveying ideas, strategies, and updates clearly to team members and stakeholders.

How to show it: Highlight instances where clear communication led to successful project outcomes or stakeholder satisfaction.

Problem-solving

Portfolio Managers often face challenges that require innovative solutions; strong problem-solving skills enable them to address issues proactively.

How to show it: Provide examples of how you identified problems and implemented solutions that resulted in measurable improvements.

Time Management

Managing multiple projects simultaneously demands excellent time management skills to prioritize tasks effectively and meet deadlines.

How to show it: Demonstrate your ability to manage competing priorities by citing specific projects completed on time.

Teamwork

Collaboration with diverse teams is essential for achieving portfolio goals, making teamwork a vital soft skill.

How to show it: Share examples of successful teamwork that led to enhanced portfolio performance or team achievements.

Adaptability

The ability to adjust to changing circumstances is critical, especially in dynamic environments where portfolio strategies may need to evolve.

How to show it: Illustrate situations where you adapted to change and how it positively impacted project outcomes.

Leadership

Strong leadership skills enable Portfolio Managers to inspire and guide teams toward achieving common objectives.

How to show it: Provide examples of how you led a team through a challenging project or initiative.

Negotiation

Negotiation skills are vital for securing resources, managing stakeholder expectations, and ensuring successful project delivery.

How to show it: Detail specific negotiations you've conducted and their outcomes, particularly those that benefited the portfolio.

Critical Thinking

Critical thinking allows Portfolio Managers to analyze data effectively and make informed decisions that align with strategic objectives.

How to show it: Showcase instances where your analytical skills led to significant insights or decisions that improved portfolio performance.

Emotional Intelligence

Emotional intelligence helps Portfolio Managers understand and manage their own emotions and those of others, fostering better relationships.

How to show it: Provide examples of how your emotional intelligence has helped resolve conflicts or improve team dynamics.

Attention to Detail

Attention to detail is essential for monitoring portfolio performance and ensuring accuracy in reporting and analysis.

How to show it: Highlight achievements where your attention to detail led to identifying key insights or avoiding significant errors.

Networking

Building and maintaining professional relationships is crucial for Portfolio Managers to gather insights and leverage opportunities.

How to show it: Discuss how your networking efforts have led to beneficial partnerships or opportunities for the portfolio.

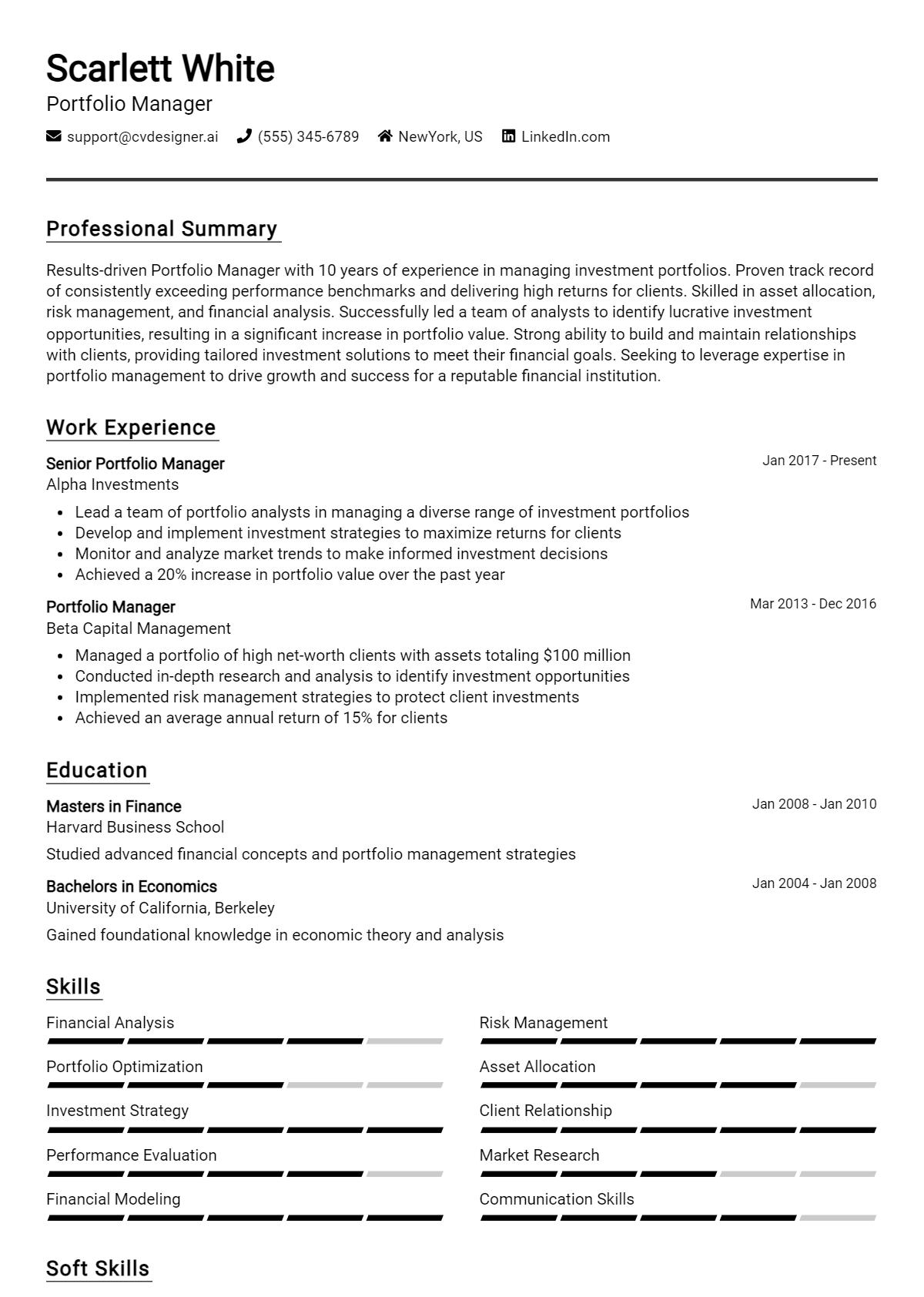

How to List Portfolio Manager Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to employers in a competitive job market. Highlighting your skills in the Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter can provide a comprehensive view of your qualifications and suitability for the Portfolio Manager role.

for Resume Summary

Showcasing Portfolio Manager skills in your summary section gives hiring managers a quick overview of your qualifications and sets the tone for the rest of your resume.

Example

Results-driven Portfolio Manager with expertise in investment strategy, risk management, and financial analysis. Proven track record of optimizing portfolio performance and achieving client satisfaction through strategic asset allocation and market analysis.

for Resume Work Experience

The work experience section provides an excellent opportunity to demonstrate how you have applied your Portfolio Manager skills in real-world scenarios, making your experience more relatable to potential employers.

Example

- Developed and implemented investment strategies that increased portfolio returns by 15% year-over-year.

- Conducted market analysis to identify new investment opportunities, resulting in a 20% expansion of client portfolios.

- Utilized risk management techniques to minimize exposure during market volatility, preserving client assets.

- Collaborated with clients to assess their financial goals and tailor asset allocation, enhancing overall satisfaction.

for Resume Skills

The skills section can showcase both technical and transferable skills. A balanced mix of hard and soft skills is essential for a well-rounded presentation of your qualifications.

Example

- Financial Analysis

- Investment Strategy Development

- Risk Management

- Market Research

- Client Relationship Management

- Strategic Asset Allocation

- Performance Measurement

- Regulatory Compliance

for Cover Letter

A cover letter allows you to expand on the skills mentioned in your resume while providing a personal touch. It’s an opportunity to highlight 2-3 key skills that align with the job description and explain how they have positively impacted your previous roles.

Example

In my previous role, my expertise in investment strategy and risk management enabled me to enhance client portfolios significantly. I effectively communicated these strategies to clients, resulting in a 30% increase in customer retention, which I am eager to replicate in your esteemed organization.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job.

The Importance of Portfolio Manager Resume Skills

In the competitive field of portfolio management, showcasing relevant skills on a resume is crucial for candidates aspiring to land their dream job. A well-crafted skills section not only helps candidates stand out to recruiters but also aligns their qualifications with the specific requirements of the job. By highlighting key competencies, candidates can effectively demonstrate their ability to manage investments, analyze financial data, and make informed decisions that drive portfolio performance.

- Demonstrates Expertise: Highlighting specific skills showcases your expertise in portfolio management, giving potential employers confidence in your ability to perform the job effectively.

- Aligns with Job Requirements: Tailoring your skills to match the job description ensures that you meet the essential criteria sought by employers, increasing your chances of being selected for an interview.

- Sets You Apart: In a pool of candidates with similar educational backgrounds, a strong skills section can differentiate you and make your resume more memorable.

- Builds Credibility: Listing relevant skills reinforces your credibility as a candidate and demonstrates your commitment to the profession, which can impress hiring managers.

- Showcases Adaptability: A diverse skills set indicates your ability to adapt to changing market conditions and investment strategies, a vital trait for successful portfolio management.

- Facilitates Clear Communication: Clearly articulated skills help to communicate your value proposition effectively, making it easier for recruiters to understand what you bring to the table.

- Supports Professional Growth: Identifying and emphasizing skills on your resume can highlight areas for growth and development, guiding your career trajectory in the portfolio management field.

For additional insights and examples, check out these Resume Samples.

How To Improve Portfolio Manager Resume Skills

In the fast-paced world of finance, continuously improving your skills as a Portfolio Manager is essential for staying competitive and delivering optimal results for clients. As market conditions evolve and new investment strategies emerge, a well-rounded skill set can set you apart from other candidates and enhance your effectiveness in managing assets. Here are some actionable tips to help you refine your portfolio management skills.

- Engage in Continuous Learning: Stay updated with the latest trends in finance and investment by enrolling in relevant courses, attending webinars, and reading industry publications.

- Obtain Professional Certifications: Consider earning certifications such as the Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM) to enhance your credibility and technical knowledge.

- Network with Industry Professionals: Join finance-related groups and attend conferences to connect with other professionals, share insights, and learn from their experiences.

- Utilize Financial Software: Familiarize yourself with advanced portfolio management software and tools to improve your analytical capabilities and efficiency in managing investments.

- Practice Risk Management: Regularly analyze and assess risk factors within your portfolio to develop strategies that mitigate potential losses and optimize returns.

- Conduct Performance Reviews: Periodically review your portfolio's performance and learn from past decisions to refine your approach and improve future outcomes.

- Stay Informed About Regulatory Changes: Keep abreast of changes in financial regulations that may impact portfolio management to ensure compliance and informed decision-making.

Frequently Asked Questions

What are the key skills needed for a Portfolio Manager?

Key skills for a Portfolio Manager include strong analytical abilities, risk management expertise, and proficiency in financial modeling. Additionally, excellent communication skills are crucial for articulating investment strategies and maintaining client relationships. A deep understanding of market trends and asset allocation strategies is essential for making informed investment decisions that align with client goals.

How important is financial analysis in a Portfolio Manager's role?

Financial analysis is central to a Portfolio Manager's role, as it enables them to evaluate investment opportunities and assess the performance of existing portfolios. This skill involves analyzing financial statements, understanding economic indicators, and forecasting market trends. Strong financial analysis skills help Portfolio Managers make data-driven decisions that maximize returns while managing risks.

What role does risk management play in portfolio management?

Risk management is a critical component of portfolio management, as it involves identifying, assessing, and mitigating potential losses in investment portfolios. Portfolio Managers must implement strategies to balance risk and return, ensuring that investments align with clients' risk tolerance. This includes diversifying assets, setting stop-loss orders, and continuously monitoring market conditions to protect client interests.

How can a Portfolio Manager demonstrate leadership skills?

A Portfolio Manager can demonstrate leadership skills by effectively managing teams, mentoring junior analysts, and driving collaborative decision-making processes. Leadership in this role also involves taking initiative in developing investment strategies and communicating these strategies clearly to clients and stakeholders. Building trust and providing direction during market volatility are essential traits of a successful leader in portfolio management.

What technical skills are essential for a Portfolio Manager?

Technical skills essential for a Portfolio Manager include proficiency in financial software and tools, such as Bloomberg, Excel, and portfolio management systems. Familiarity with quantitative analysis techniques, data visualization, and algorithmic trading can also enhance a Portfolio Manager's effectiveness. Additionally, understanding regulatory requirements and compliance standards is vital for maintaining ethical investment practices.

Conclusion

Including Portfolio Manager skills in your resume is crucial for effectively showcasing your expertise and experience in managing investment portfolios. By highlighting relevant skills, you not only enhance your chances of standing out among other candidates but also demonstrate your potential value to prospective employers. Remember, a well-crafted resume is your first step towards landing your dream job.

As you refine your skills and tailor your application, stay motivated and focused on your career goals. Each effort you make brings you closer to success. For additional resources, check out our resume templates, utilize our resume builder, explore resume examples, and enhance your application with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.