28 Skills to Include in Your 2025 Mortgage Reporting Analyst Resume with Examples

As a Mortgage Reporting Analyst, possessing the right skills is crucial to effectively analyze and report on mortgage data. This role requires a blend of analytical, technical, and communication skills to ensure accurate reporting and compliance with industry standards. In the following section, we will outline the top skills that can enhance your resume and set you apart in this competitive field.

Best Mortgage Reporting Analyst Technical Skills

Technical skills are crucial for a Mortgage Reporting Analyst as they enable effective data analysis, reporting, and compliance with industry regulations. Proficiency in these areas aids in the generation of accurate reports, which are essential for decision-making processes within the mortgage industry.

Data Analysis

Data analysis skills are vital for interpreting complex datasets related to mortgage applications, approvals, and trends. Analysts must be able to identify patterns and insights that can inform business strategies.

How to show it: Detail specific projects where you analyzed data to influence business decisions, including any software tools you used and the outcomes achieved.

SQL Proficiency

SQL (Structured Query Language) is essential for querying databases to extract and manipulate data. A strong understanding of SQL allows analysts to generate reports and perform data validation efficiently.

How to show it: Highlight your experience with SQL by mentioning specific queries or reports you created, along with the impact this had on reporting accuracy or efficiency.

Excel Expertise

Excel remains a critical tool for financial analysis and reporting. Advanced functions, pivot tables, and data visualization capabilities enhance an analyst's ability to present data clearly and effectively.

How to show it: Include examples of complex spreadsheets or dashboards you built, emphasizing any efficiencies gained or insights derived from your work.

Regulatory Knowledge

A deep understanding of mortgage regulations and compliance standards is necessary to ensure that reports meet legal requirements. This skill helps analysts avoid potential legal issues and maintain organizational integrity.

How to show it: Discuss any certifications or training you have received in regulatory compliance, along with specific instances where your knowledge contributed to compliance success.

Reporting Tools

Familiarity with various reporting tools, such as Tableau, Power BI, or Crystal Reports, is essential for creating visual representations of data that aid in decision-making processes.

How to show it: Describe your experience with specific tools, including the types of reports you generated and how they were utilized by stakeholders.

Attention to Detail

Attention to detail is crucial for ensuring the accuracy of reports and data analysis. This skill minimizes errors in critical financial documents and enhances overall reporting quality.

How to show it: Provide examples of how your attention to detail led to the identification of discrepancies or improvements in reporting processes.

Financial Acumen

Understanding financial principles, mortgage products, and market trends enables analysts to provide valuable insights that can drive business strategy and improve performance.

How to show it: Illustrate how your financial acumen has contributed to project success or improved reporting accuracy, using quantifiable results where possible.

Data Visualization

The ability to create clear and impactful visual representations of data enhances communication and aids in the interpretation of complex information for stakeholders.

How to show it: Include examples of visual reports or presentations you created, detailing how they influenced decision-making processes within the organization.

Project Management

Project management skills are essential for overseeing reporting projects from initiation to completion, ensuring timely delivery and alignment with business objectives.

How to show it: Mention specific projects you managed, your role in guiding them, and the outcomes achieved, including any metrics that demonstrate project success.

Statistical Analysis

Statistical analysis techniques are important for interpreting data trends and making predictions that inform mortgage-related decisions and policies.

How to show it: Describe any statistical methods you employed in your analysis, highlighting the impact of your findings on business strategies or outcomes.

Best Mortgage Reporting Analyst Soft Skills

In the role of a Mortgage Reporting Analyst, possessing strong soft skills is just as crucial as having technical expertise. These interpersonal skills enhance collaboration, problem-solving, and communication, which are vital for delivering accurate reports and insights in the fast-paced mortgage industry. Here are some essential soft skills to highlight on your resume:

Communication

Effective communication skills are essential for Mortgage Reporting Analysts to convey complex data and findings to stakeholders clearly and concisely.

How to show it: Include examples of reports or presentations where you successfully communicated data insights. Highlight any feedback received from team members or management that demonstrates your ability to convey information effectively. You can also mention specific tools used for communication, such as data visualization software.

Problem-Solving

Strong problem-solving skills enable Mortgage Reporting Analysts to identify issues within data sets and develop actionable solutions to improve reporting processes.

How to show it: Describe instances where you identified a reporting error and how you resolved it. Use metrics to showcase the impact of your solutions, such as time saved or increased accuracy in reports.

Time Management

Time management is vital for managing multiple reporting deadlines and ensuring timely delivery of accurate reports in the mortgage sector.

How to show it: Provide examples of how you prioritized tasks to meet tight deadlines. Mention any tools or techniques you used to organize your workload, and quantify how your time management improved project delivery timelines.

Teamwork

Collaboration with cross-functional teams is key for Mortgage Reporting Analysts, as they often work with various departments to gather data and insights.

How to show it: Highlight specific projects where you collaborated with team members or other departments. Include details on your role within the team and any successful outcomes that resulted from your collaboration.

Attention to Detail

Attention to detail is critical for ensuring the accuracy and reliability of mortgage reports, as even minor errors can lead to significant consequences.

How to show it: Share examples of how your attention to detail improved report accuracy or reduced errors. Consider mentioning specific metrics or audit results that demonstrate your diligence in quality control.

Analytical Thinking

Analytical thinking allows Mortgage Reporting Analysts to interpret complex data, recognize patterns, and derive meaningful insights for stakeholders.

How to show it: Include examples of data analysis projects where your insights led to informed decision-making. Quantify the outcomes of your analysis, such as cost savings or improved processes.

Adaptability

Adaptability helps Mortgage Reporting Analysts respond effectively to changing regulations, technologies, and organizational needs.

How to show it: Describe situations where you successfully adapted to new processes or tools. Highlight any training or certifications you pursued to enhance your skills in response to industry changes.

Critical Thinking

Critical thinking enables Mortgage Reporting Analysts to evaluate information rigorously and make sound decisions based on data.

How to show it: Provide instances where your critical thinking skills led to insightful conclusions or recommendations. Highlight any specific methodologies you applied in your analysis.

Interpersonal Skills

Strong interpersonal skills foster effective relationships with colleagues, clients, and stakeholders, facilitating smoother collaboration.

How to show it: Share examples of how you built rapport with team members or stakeholders. Mention any initiatives you led that improved team dynamics or communication.

Organizational Skills

Organizational skills help Mortgage Reporting Analysts manage their workload efficiently and keep track of multiple reporting requirements.

How to show it: Detail your methods for keeping organized, whether through software, checklists, or project management tools. Highlight how these organizational skills enabled you to meet deadlines consistently.

Conflict Resolution

Conflict resolution skills are crucial for handling disagreements or misunderstandings that may arise during the reporting process.

How to show it: Provide examples of conflicts you successfully mediated or resolved. Discuss the approaches you took and the positive outcomes that followed.

For more information on enhancing your resume with soft skills, check out our resources on Soft Skills, Communication, <a href="https://resumedesign

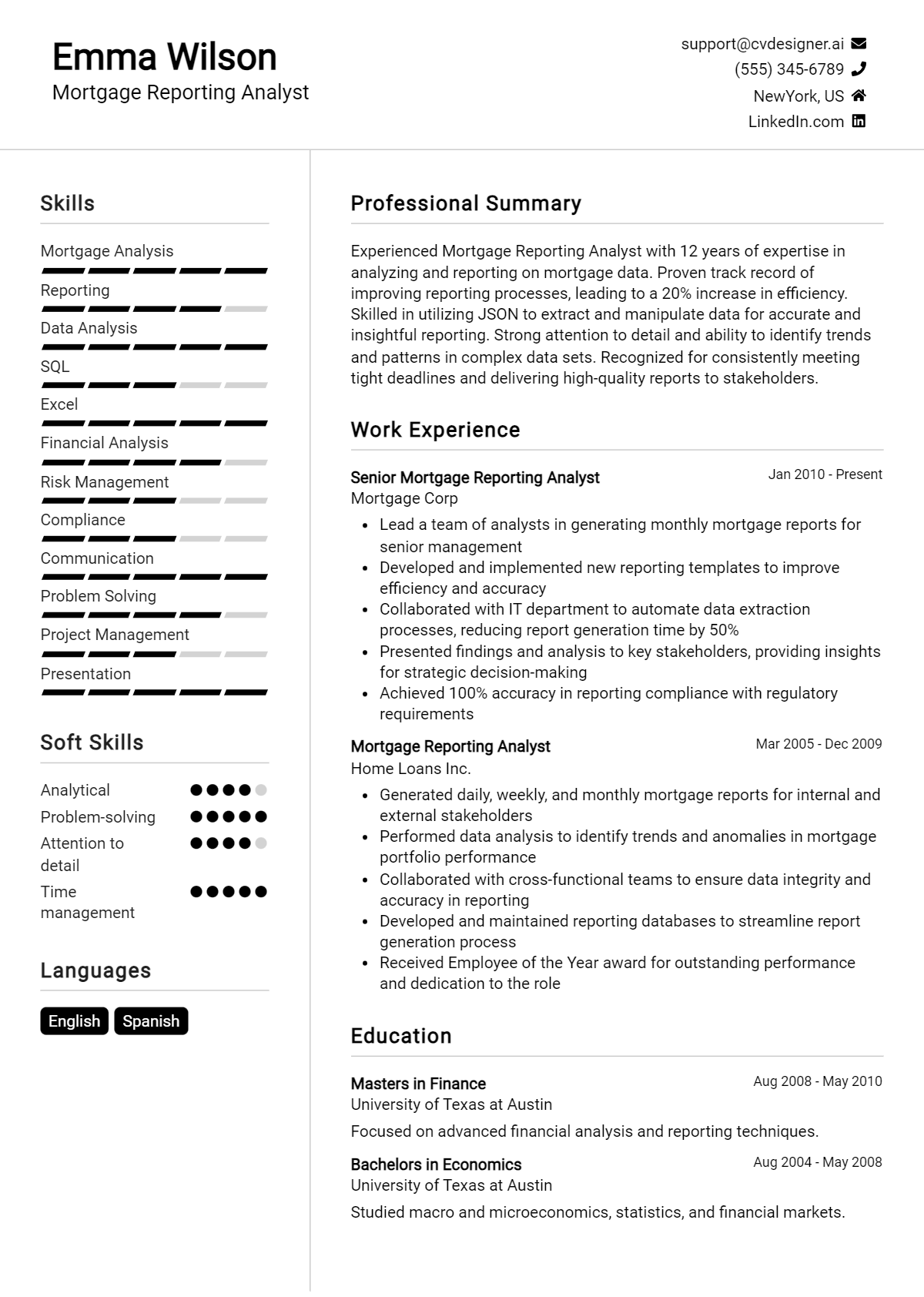

How to List Mortgage Reporting Analyst Skills on Your Resume

Effectively listing your skills on a resume is crucial to stand out to employers, as it provides them with a snapshot of your qualifications. Skills can be highlighted in three main sections: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

Showcasing Mortgage Reporting Analyst skills in your summary section allows hiring managers to quickly understand your qualifications and fit for the role.

Example

Results-driven Mortgage Reporting Analyst with expertise in data analysis, regulatory compliance, and financial reporting. Proven ability to streamline processes and enhance accuracy in mortgage reporting.

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how your Mortgage Reporting Analyst skills have been applied in real-world scenarios.

Example

- Conducted detailed financial data analysis to identify trends and variances, improving reporting accuracy by 15%.

- Collaborated with cross-functional teams to ensure regulatory compliance with mortgage reporting standards.

- Utilized Excel and SQL to automate reporting processes, reducing turnaround time by 25%.

- Provided training on reporting tools and best practices, enhancing team productivity and performance.

for Resume Skills

The skills section can showcase both technical and transferable skills. A balanced mix of hard and soft skills should be included to strengthen your qualifications.

Example

- Data Analysis

- Regulatory Compliance

- Financial Reporting

- Excel Proficiency

- SQL Database Management

- Attention to Detail

- Problem-Solving

- Communication Skills

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in their resumes, providing a more personal touch. Highlighting 2-3 key skills that align with the job description can effectively illustrate your impact in previous roles.

Example

My expertise in data analysis and regulatory compliance has enabled me to streamline mortgage reporting processes, resulting in a 20% increase in accuracy. I am eager to bring my skills to your team, ensuring top-notch reporting standards as the Mortgage Reporting Analyst.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job.

The Importance of Mortgage Reporting Analyst Resume Skills

Highlighting relevant skills on a Mortgage Reporting Analyst resume is crucial for candidates aiming to stand out in a competitive job market. A well-crafted skills section not only showcases a candidate's qualifications but also aligns their expertise with the specific requirements of the position. This alignment increases the likelihood of attracting the attention of recruiters and hiring managers, ultimately leading to better job opportunities.

- Demonstrating analytical proficiency is essential for a Mortgage Reporting Analyst, as it shows an ability to interpret complex data and generate actionable insights that can drive business decisions.

- Familiarity with mortgage industry regulations and compliance standards is critical; it assures employers that candidates can navigate the legal landscape effectively while minimizing risks for the organization.

- Technical skills in reporting software and data management tools signal to recruiters that candidates are capable of efficiently handling large datasets and creating comprehensive reports quickly.

- Strong communication skills are important, as Mortgage Reporting Analysts must often present findings to stakeholders and collaborate with various departments to ensure clarity and alignment on objectives.

- Attention to detail is vital in this role; showcasing this skill on a resume indicates that the candidate can identify discrepancies and ensure accuracy in reporting, which is crucial for financial integrity.

- Problem-solving abilities highlight a candidate's capacity to address challenges that arise in data reporting and analysis, making them a valuable asset in a dynamic work environment.

- Experience with project management can set candidates apart, as it reflects their ability to manage timelines and deliverables effectively, ensuring timely reporting and compliance.

- Knowledge of financial modeling and forecasting techniques can enhance a candidate's appeal, demonstrating their ability to contribute to strategic planning and financial assessments.

For additional guidance on crafting an impressive resume, check out these Resume Samples.

How To Improve Mortgage Reporting Analyst Resume Skills

In the fast-paced world of mortgage reporting, it is essential for professionals to continuously enhance their skills to stay competitive and effective in their roles. The mortgage industry is constantly evolving, with new regulations, technologies, and market conditions affecting reporting processes. By actively improving your skill set, you can increase your value to employers, enhance your career prospects, and contribute more effectively to your team.

- Stay updated on industry regulations and compliance standards to ensure your reports meet current requirements.

- Enhance your analytical skills by taking courses in data analysis and financial modeling.

- Develop proficiency in reporting software and tools such as Excel, SQL, and business intelligence platforms.

- Learn about emerging technologies such as automated reporting solutions and data visualization tools.

- Participate in workshops and webinars to exchange knowledge with other professionals in the field.

- Seek feedback on your reports and presentations to identify areas for improvement and refine your communication skills.

- Engage in networking opportunities to learn about best practices and innovative reporting techniques from peers.

Frequently Asked Questions

What key skills should a Mortgage Reporting Analyst include on their resume?

A Mortgage Reporting Analyst should highlight skills such as data analysis, proficiency in financial software (like Excel and SQL), strong attention to detail, and knowledge of mortgage regulations and compliance standards. Additionally, effective communication skills are essential for presenting complex financial data clearly to stakeholders.

How important is experience with mortgage reporting software for this role?

Experience with mortgage reporting software is crucial for a Mortgage Reporting Analyst, as it enhances the ability to efficiently analyze and interpret large datasets. Familiarity with tools such as Encompass, Black Knight, or other financial reporting systems can significantly improve job performance and streamline reporting processes.

What analytical techniques should a Mortgage Reporting Analyst be familiar with?

A Mortgage Reporting Analyst should be well-versed in analytical techniques such as trend analysis, variance analysis, and predictive modeling. These techniques allow the analyst to identify patterns in mortgage data, assess risk, and provide insights that can influence lending strategies and decision-making.

Are there any specific certifications that would benefit a Mortgage Reporting Analyst?

Certifications such as the Certified Mortgage Banker (CMB) or the Mortgage Bankers Association (MBA) certifications can be beneficial for a Mortgage Reporting Analyst. These credentials demonstrate a commitment to the industry and provide a deeper understanding of mortgage operations, regulations, and best practices.

How can strong communication skills impact a Mortgage Reporting Analyst's effectiveness?

Strong communication skills are essential for a Mortgage Reporting Analyst, as they must convey complex financial data and reports to both technical and non-technical audiences. The ability to present findings clearly and persuasively can lead to better-informed decision-making and foster collaboration among teams within the organization.

Conclusion

Incorporating the skills of a Mortgage Reporting Analyst into your resume is crucial for standing out in a competitive job market. Highlighting relevant skills not only showcases your expertise but also illustrates the value you can bring to potential employers. By effectively communicating your abilities, you position yourself as a strong candidate who can contribute significantly to the organization’s success. Remember, refining your skills and presenting them well can greatly enhance your job application. Take the initiative to improve and tailor your resume, and watch as new opportunities unfold.

For additional resources, explore our resume templates, utilize our resume builder, check out resume examples, and craft an impactful application with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.