Top 29 Hard and Soft Skills for 2025 Mortgage Loan Officer Resumes

As a Mortgage Loan Officer, showcasing the right skills on your resume is crucial to stand out in a competitive job market. Employers typically look for a blend of technical expertise, interpersonal abilities, and industry knowledge. In the following section, we will outline the top skills that can enhance your resume and help you secure a position in this dynamic field. Whether you're an experienced professional or just starting your career, highlighting these skills can make a significant difference in your job application.

Best Mortgage Loan Officer Technical Skills

As a Mortgage Loan Officer, possessing strong technical skills is essential to navigate the complexities of mortgage products, regulatory requirements, and customer service. These skills not only enhance efficiency but also build trust with clients, enabling you to close loans successfully while ensuring compliance with industry standards. Below are some key technical skills that can set you apart in this competitive field.

Loan Origination Software Proficiency

Expertise in using loan origination software (LOS) is crucial for streamlining the mortgage application process, managing documentation, and facilitating communication with clients and lenders.

How to show it: Highlight specific software you've used, such as Encompass or Calyx, and mention efficiencies gained or errors reduced through your expertise.

Credit Analysis

Understanding and interpreting credit reports is vital for assessing a borrower's creditworthiness, and making informed lending decisions.

How to show it: Include details about your experience in analyzing credit scores and how your insights led to approved loans or improved financing terms.

Regulatory Compliance Knowledge

Familiarity with federal and state mortgage regulations, such as RESPA and TILA, ensures that all lending practices adhere to legal requirements, reducing the risk of penalties.

How to show it: List any compliance training you've completed and describe situations where your knowledge helped avoid compliance issues.

Document Management

Efficient management of documentation is critical for processing loans timely and accurately, including necessary disclosures and closing documents.

How to show it: Quantify your success by mentioning the percentage of documents processed on time or the reduction in processing errors due to your management skills.

Financial Analysis Skills

The ability to analyze financial statements and income sources helps in determining a borrower’s ability to repay the loan and influences loan structuring.

How to show it: Provide examples of how your financial analysis led to securing favorable loan terms or identifying alternative financing solutions for clients.

Customer Relationship Management (CRM) Software

Proficiency in CRM tools enables effective tracking of client interactions and follow-ups, fostering strong relationships and enhancing customer satisfaction.

How to show it: Mention specific CRM platforms you've used and the impact your relationship management had on client retention rates or referral business.

Market Knowledge

Staying updated on current mortgage trends, interest rates, and economic factors allows you to provide clients with informed advice and competitive loan options.

How to show it: Demonstrate your market awareness by referencing specific trends you successfully leveraged to benefit clients or your organization.

Sales Skills

Strong sales skills are essential for effectively converting leads into clients, explaining loan products, and closing deals.

How to show it: Quantify your sales achievements, such as the number of loans closed or percentage increase in sales volume over a specific period.

Risk Assessment

Ability to evaluate the potential risks associated with lending decisions is critical to maintaining the financial health of the lending institution.

How to show it: Share instances where your risk assessments led to informed decisions that minimized losses or improved loan portfolios.

Attention to Detail

A keen eye for detail is necessary for reviewing loan applications, ensuring accuracy in documentation, and preventing costly errors.

How to show it: Highlight your track record of error-free applications or any recognition received for your meticulousness in loan processing.

Networking Skills

Building and maintaining a strong professional network can result in increased referrals and business opportunities.

How to show it: Detail your involvement in industry organizations or events, and quantify any measurable outcomes from your networking efforts.

Best Mortgage Loan Officer Soft Skills

Soft skills are essential for Mortgage Loan Officers, as they enhance interpersonal relationships, improve client interactions, and streamline the overall loan process. These skills enable loan officers to effectively communicate with clients, collaborate with team members, and navigate challenges that arise during loan transactions. Below are key soft skills that are crucial for success in this role.

Communication

Strong communication skills are vital for Mortgage Loan Officers to convey complex loan information clearly and effectively to clients.

How to show it: Highlight experiences where you facilitated discussions with clients or stakeholders, and include metrics such as client satisfaction scores or successful loan closures resulting from your clear communication.

Problem-solving

Being able to identify and resolve issues quickly is crucial when dealing with loan applications, as unexpected challenges often arise.

How to show it: Provide examples of specific problems you encountered in previous roles and how your solutions led to successful outcomes, such as expedited loan approvals or improved client satisfaction.

Time Management

Effective time management allows Mortgage Loan Officers to handle multiple clients and deadlines simultaneously without compromising service quality.

How to show it: Quantify your ability to manage time by stating the number of loans processed in a given timeframe and any tools or strategies you implemented to enhance efficiency.

Teamwork

Collaboration with various departments, including underwriting and processing, is essential for the seamless execution of loan transactions.

How to show it: Discuss specific projects where teamwork was essential, emphasizing your role and any measurable improvements in team performance or project outcomes.

Adaptability

The mortgage industry is ever-evolving, and an adaptable Mortgage Loan Officer can adjust to changes in regulations and market conditions.

How to show it: Share instances where you successfully adapted to industry changes or learned new processes quickly, highlighting any positive impact on your performance.

Negotiation

Negotiation skills are important for securing favorable loan terms for clients while ensuring compliance with lending regulations.

How to show it: Include examples of successful negotiations that resulted in beneficial outcomes for clients, such as lower interest rates or reduced fees.

Attention to Detail

Mortgage Loan Officers must meticulously review documents to ensure accuracy and compliance, as errors can lead to significant repercussions.

How to show it: Demonstrate your attention to detail by referencing your track record of error-free loan processing and any commendations received for thoroughness.

Client Focus

Prioritizing the needs and concerns of clients fosters trust and long-term relationships, which are vital in the mortgage industry.

How to show it: Include testimonials or feedback from clients that reflect your commitment to exceptional service and any retention rates that highlight your client-focused approach.

Sales Skills

Mortgage Loan Officers often need to sell loan products to potential clients, making strong sales skills advantageous.

How to show it: Quantify your sales achievements, mentioning the volume of loans closed or percentage increases in client acquisition that resulted from your sales efforts.

Emotional Intelligence

Understanding and managing emotions, both your own and those of clients, is crucial for building rapport and navigating sensitive situations.

How to show it: Provide examples of how your emotional intelligence helped resolve client concerns or improved team dynamics, emphasizing any positive feedback received.

Networking

Building a strong professional network can lead to referrals and new business opportunities, making networking a key skill for loan officers.

How to show it: Highlight any professional associations or community involvement that has led to increased business and provide examples of connections made that resulted in successful referrals.

How to List Mortgage Loan Officer Skills on Your Resume

Effectively listing skills on your resume is crucial to stand out to potential employers. Highlighting your qualifications can make a significant difference in getting noticed. There are three main sections where you can showcase your skills: the Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

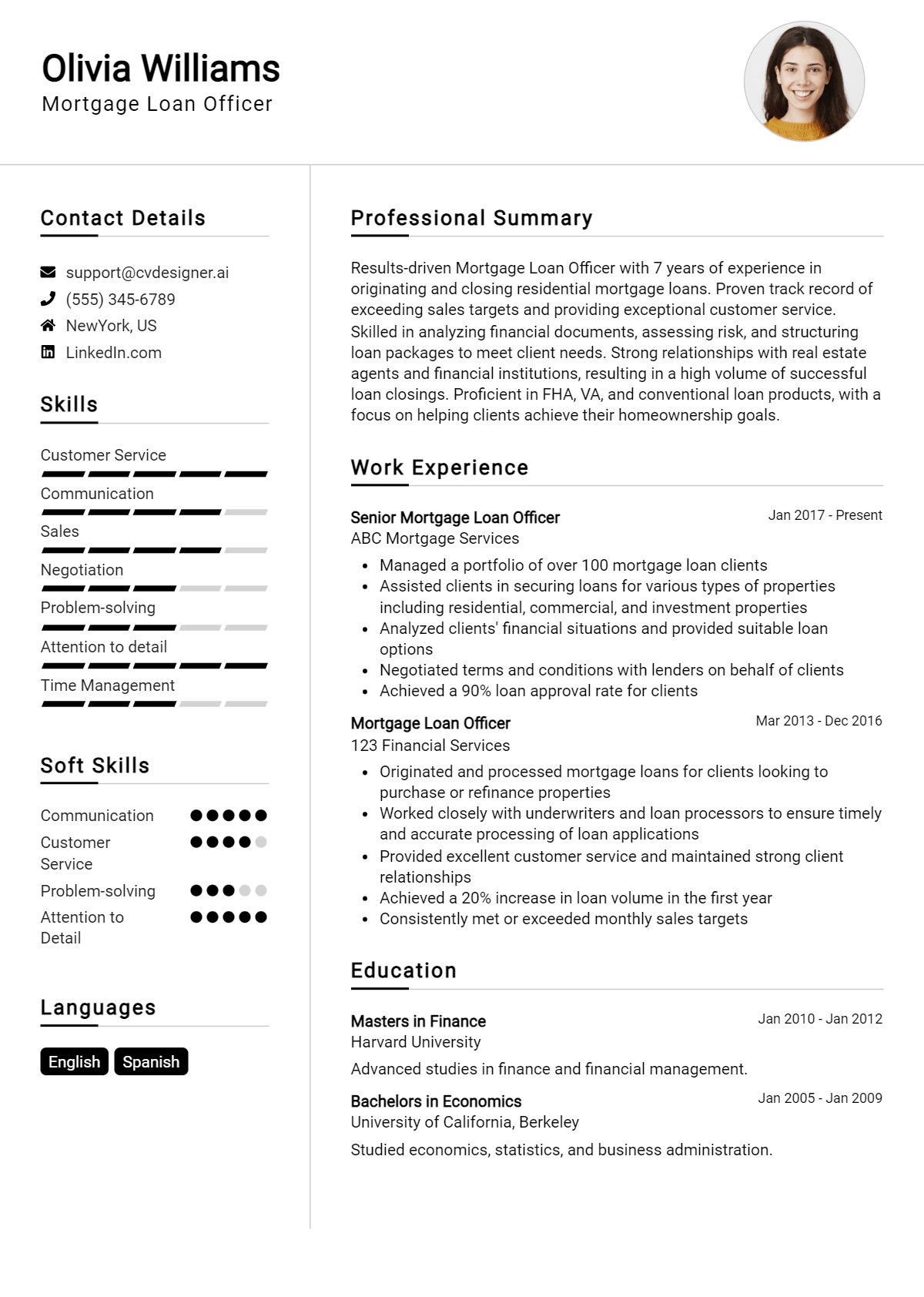

for Resume Summary

Showcasing Mortgage Loan Officer skills in the introduction section allows hiring managers to quickly grasp your qualifications. A well-crafted summary can set the tone for the rest of your resume.

Example

Experienced Mortgage Loan Officer with a proven track record in customer service and financial analysis. Skilled in loan processing and risk assessment, dedicated to guiding clients through the mortgage process to achieve their homeownership goals.

for Resume Work Experience

The work experience section is the perfect opportunity to demonstrate how your Mortgage Loan Officer skills have been applied in real-world scenarios. This is where you can provide actionable examples that resonate with hiring managers.

Example

- Managed a portfolio of over 100 clients, utilizing relationship management skills to improve customer satisfaction ratings by 20%.

- Conducted thorough financial assessments and risk analyses to ensure clients received appropriate loan products.

- Streamlined the loan processing workflow, reducing turnaround time by 15% while maintaining compliance with regulations.

- Trained junior staff on mortgage guidelines and customer service best practices, enhancing team productivity.

for Resume Skills

The skills section can showcase both technical and transferable skills. It's essential to include a balanced mix of hard and soft skills to present a well-rounded profile.

Example

- Loan Origination

- Financial Analysis

- Customer Relationship Management

- Regulatory Compliance

- Problem-Solving

- Effective Communication

- Negotiation Skills

- Time Management

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in their resume while adding a personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate how you are a strong fit for the role.

Example

With my strong background in financial analysis and customer service, I have successfully guided numerous clients through the mortgage process, resulting in a 30% increase in referral business. I am excited about the opportunity to bring my negotiation skills to your team and contribute to your company's success.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job. For more information on how to effectively list your skills, explore Technical Skills and enhance your work experience section.

The Importance of Mortgage Loan Officer Resume Skills

Highlighting relevant skills in a Mortgage Loan Officer resume is crucial for candidates looking to make a strong impression on recruiters. A well-crafted skills section not only showcases a candidate's capabilities but also aligns their qualifications with the specific requirements of the job. This alignment increases the chances of getting noticed in a competitive job market, demonstrating that the candidate possesses the essential skills needed to succeed in the role.

- Effective communication skills are vital for Mortgage Loan Officers as they must convey complex loan information clearly to clients. Strong verbal and written communication helps build trust and ensures that clients fully understand their options.

- Knowledge of financial regulations and compliance is essential to navigate the complexities of the mortgage industry. A candidate who can demonstrate this knowledge shows their ability to adhere to legal standards and protect both the company and client interests.

- Analytical skills are crucial for assessing clients' financial situations and determining suitable loan products. Highlighting these skills reflects a candidate's ability to evaluate data effectively, leading to informed lending decisions.

- Customer service skills are imperative for Mortgage Loan Officers as they work closely with clients throughout the loan process. Candidates who can showcase their commitment to providing exceptional service will stand out to employers who value client satisfaction.

- Sales skills are important for Mortgage Loan Officers to effectively promote loan products and convert leads into applications. Demonstrating a strong sales background can indicate a candidate's capability to drive business and achieve targets.

- Attention to detail is critical in the mortgage industry, where even minor errors can lead to significant financial repercussions. Candidates who emphasize their meticulous nature will be viewed as reliable professionals who prioritize accuracy.

- Time management skills allow Mortgage Loan Officers to handle multiple clients and deadlines efficiently. Highlighting this ability demonstrates a candidate's capacity to prioritize tasks and maintain productivity in a fast-paced environment.

For more insights and examples, you can check out these Resume Samples.

How To Improve Mortgage Loan Officer Resume Skills

In the competitive field of mortgage lending, continuously improving your skills is essential for career advancement and success. As a Mortgage Loan Officer, staying updated on industry trends, regulations, and customer service techniques can set you apart from the competition and enhance your ability to serve clients effectively. Here are some actionable tips to help you improve your skills:

- Attend industry workshops and seminars to stay current with mortgage regulations and market trends.

- Enroll in online courses focused on financial analysis, customer service, or sales techniques specific to the mortgage industry.

- Network with other professionals in the field to share knowledge and gain insights into best practices.

- Seek mentorship from experienced loan officers to learn from their expertise and gain practical advice.

- Regularly read industry publications and blogs to keep abreast of new developments and tools.

- Practice your communication skills, both written and verbal, to enhance your ability to explain complex mortgage concepts to clients.

- Utilize customer relationship management (CRM) software to improve your organizational skills and client follow-up processes.

Frequently Asked Questions

What are the key skills required for a Mortgage Loan Officer?

A successful Mortgage Loan Officer should possess strong communication and interpersonal skills to effectively interact with clients and lenders. They also need analytical skills to assess financial documents, attention to detail to ensure accuracy in application processing, and problem-solving abilities to navigate potential issues during the loan approval process. Additionally, proficiency in financial software and a solid understanding of mortgage products and regulations are crucial for success in this role.

How important are customer service skills for a Mortgage Loan Officer?

Customer service skills are paramount for a Mortgage Loan Officer, as the role involves guiding clients through the often complex mortgage application process. Building rapport and trust with clients is essential, as they may have questions or concerns about their financial decisions. A Mortgage Loan Officer should be able to listen actively, respond empathetically, and provide clear information that helps clients feel confident in their choices.

What technical skills should a Mortgage Loan Officer have?

Technical skills are essential for a Mortgage Loan Officer, especially proficiency in using mortgage software and tools that facilitate the loan application process. Familiarity with financial analysis software is beneficial for evaluating clients' creditworthiness and financial history. Additionally, understanding data privacy regulations and compliance requirements is critical to ensure that all transactions adhere to legal standards and protect clients' sensitive information.

How does attention to detail play a role in a Mortgage Loan Officer's job?

Attention to detail is vital for a Mortgage Loan Officer, as they must review and verify numerous financial documents, including credit reports, income statements, and tax returns. Small errors can lead to significant issues, potentially delaying the approval process or leading to compliance violations. By meticulously checking each detail, a Mortgage Loan Officer helps ensure that applications are complete and accurate, facilitating a smoother transaction for clients.

What role does knowledge of mortgage products play in a Mortgage Loan Officer's effectiveness?

Knowledge of various mortgage products is crucial for a Mortgage Loan Officer because it enables them to recommend the best options tailored to each client's financial situation and goals. Understanding the differences between fixed-rate, adjustable-rate, FHA, VA, and other loan types allows the officer to guide clients effectively and answer their questions confidently. This expertise not only helps in closing loans successfully but also enhances client satisfaction and trust in the officer's recommendations.

Conclusion

Including Mortgage Loan Officer skills in your resume is crucial for making a strong impression on potential employers. By showcasing relevant skills, candidates not only stand out from the competition but also demonstrate their value to prospective employers in a highly competitive job market. Remember, a well-crafted resume can open doors to exciting opportunities in the mortgage industry.

As you refine your skills and enhance your resume, consider utilizing resources such as resume templates, resume builder, resume examples, and cover letter templates. Keep pushing forward and strive for excellence in your job application process—your next career opportunity is just around the corner!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.