28 Skills to Include in Your 2025 Mortgage Data Analyst Resume with Examples

As a Mortgage Data Analyst, possessing the right skills is essential for success in this dynamic field. This role requires a unique blend of analytical prowess, financial acumen, and technical expertise to effectively evaluate mortgage data and provide insights that drive strategic decision-making. In the following section, we will outline the top skills that should be highlighted on your resume to showcase your qualifications and attract potential employers.

Best Mortgage Data Analyst Technical Skills

In the competitive field of mortgage data analysis, possessing strong technical skills is essential for effectively managing and interpreting complex datasets. These skills not only enhance your ability to analyze mortgage trends and risks but also improve your efficiency in reporting and decision-making processes. Below are some of the top technical skills that can elevate your resume and demonstrate your competence as a Mortgage Data Analyst.

Data Analysis Tools

Proficiency in data analysis tools like Excel, SQL, and R is crucial for analyzing large datasets and extracting meaningful insights.

How to show it: Highlight specific projects where you utilized these tools, mentioning any key metrics you improved through your analysis.

Statistical Analysis

Understanding statistical methods and techniques is vital for interpreting data trends and making informed decisions based on quantitative analysis.

How to show it: Include examples of how you applied statistical analysis to solve real-world problems, quantifying your outcomes.

Data Visualization

Creating visual representations of data through tools like Tableau or Power BI helps stakeholders grasp complex information quickly.

How to show it: Provide samples of dashboards or reports you created, emphasizing the impact they had on decision-making.

Predictive Modeling

Expertise in predictive modeling techniques allows you to forecast future trends and identify potential risks in mortgage portfolios.

How to show it: Discuss specific models you developed, including their accuracy and how they affected business strategies.

Database Management

Strong knowledge of database management systems (DBMS) is essential for organizing and maintaining large volumes of mortgage data.

How to show it: Detail your experience with database maintenance and any improvements you made to data retrieval processes.

Financial Modeling

Creating financial models helps in assessing loan performance and understanding the financial implications of various mortgage products.

How to show it: Describe financial models you developed, including their applications and any significant findings.

Risk Analysis

Conducting risk analysis is critical in identifying and mitigating potential losses within mortgage lending.

How to show it: Share instances where your risk analysis led to actionable insights that reduced exposure or improved compliance.

Programming Skills

Knowledge of programming languages such as Python or Java can streamline data manipulation and automate repetitive tasks.

How to show it: List projects where you implemented automation and the time savings or efficiency improvements realized.

Data Governance

Understanding data governance principles ensures that data integrity and security are maintained throughout the data lifecycle.

How to show it: Explain your contributions to data governance initiatives and how they improved compliance and data quality.

Data Warehousing

Experience with data warehousing solutions is important for effectively storing and retrieving large datasets efficiently.

How to show it: Highlight your role in data warehousing projects, focusing on enhancements made to data accessibility.

ETL Processes

Proficiency in Extract, Transform, Load (ETL) processes is key for preparing data for analysis by ensuring it is clean and organized.

How to show it: Discuss specific ETL projects, detailing the improvements in data quality and analysis times achieved.

Best Mortgage Data Analyst Soft Skills

In the competitive field of mortgage data analysis, possessing a strong set of soft skills is crucial for success. These workplace skills not only enhance a candidate's ability to analyze data effectively but also improve collaboration with teams, facilitate better communication with clients, and contribute to problem-solving initiatives. Below are some essential soft skills that every Mortgage Data Analyst should highlight on their resume.

Communication

Effective communication is vital for Mortgage Data Analysts as they need to convey complex data insights to stakeholders clearly and concisely.

How to show it: Demonstrate your communication skills by providing examples of presentations or reports you’ve created that led to informed decisions. Quantify how your communication improved project outcomes or stakeholder engagement.

Problem-solving

Mortgage Data Analysts often face challenges that require innovative solutions. Strong problem-solving skills enable them to analyze data discrepancies and propose actionable insights.

How to show it: Highlight specific instances where you identified a problem and implemented a solution that resulted in improved efficiency or reduced costs. Use metrics to quantify your success.

Time Management

With multiple projects and deadlines, effective time management is essential for Mortgage Data Analysts to prioritize tasks and ensure timely delivery of analyses.

How to show it: Provide examples of how you managed your workload in a fast-paced environment, focusing on the successful completion of projects ahead of deadlines. Include any tools or techniques that helped you stay organized.

Teamwork

Mortgage Data Analysts often work in teams with other analysts, underwriters, and stakeholders. Strong teamwork skills foster collaboration and improve project outcomes.

How to show it: Discuss your role in team projects, emphasizing your contributions to group efforts and how your collaboration led to successful outcomes. Highlight any leadership roles you took on within teams.

Attention to Detail

Ensuring data accuracy and thoroughness is critical in mortgage analysis, making attention to detail a key skill for success.

How to show it: Illustrate your attention to detail by citing examples where your thorough analysis prevented errors or led to significant insights. Quantify how your diligence improved the accuracy of reports.

Adaptability

The mortgage industry is constantly evolving, and being adaptable allows analysts to navigate changes effectively and embrace new technologies and methodologies.

How to show it: Showcase your adaptability by detailing experiences where you successfully adjusted to new processes or tools, emphasizing your willingness to learn and grow. Provide metrics to illustrate the impact of these changes.

Critical Thinking

Mortgage Data Analysts must evaluate data critically to draw meaningful insights and support strategic decision-making within the organization.

How to show it: Provide examples of how your critical thinking led to innovative solutions or improved data analysis outcomes. Use specific metrics or feedback from stakeholders to validate your contributions.

Interpersonal Skills

Building strong relationships with colleagues and clients is essential for Mortgage Data Analysts, allowing for better collaboration and understanding of client needs.

How to show it: Describe situations where your interpersonal skills played a key role in fostering relationships that led to successful project outcomes. Include any client testimonials or recognition received.

Analytical Thinking

Analytical thinking is at the core of a Mortgage Data Analyst's role, enabling them to interpret data and generate actionable insights that drive business decisions.

How to show it: Highlight specific analytical projects you've worked on, detailing your approach and the results achieved. Quantify the impact of your analyses on business strategy or operational efficiency.

Creativity

Creativity in problem-solving helps Mortgage Data Analysts to think outside the box and come up with innovative solutions to complex data challenges.

How to show it: Provide examples of creative solutions you've developed in past roles, emphasizing how they addressed specific challenges and improved processes. Use metrics to demonstrate the effectiveness of these solutions.

Negotiation

Negotiation skills are important for Mortgage Data Analysts who need to advocate for the best interests of their clients while balancing company goals.

How to show it: Share experiences where your negotiation skills led to favorable outcomes for clients or your organization, including any agreements reached or compromises made that benefited all parties.

How to List Mortgage Data Analyst Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to potential employers. By showcasing your qualifications in the right sections, you can make a strong first impression. There are three main sections where skills can be highlighted: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

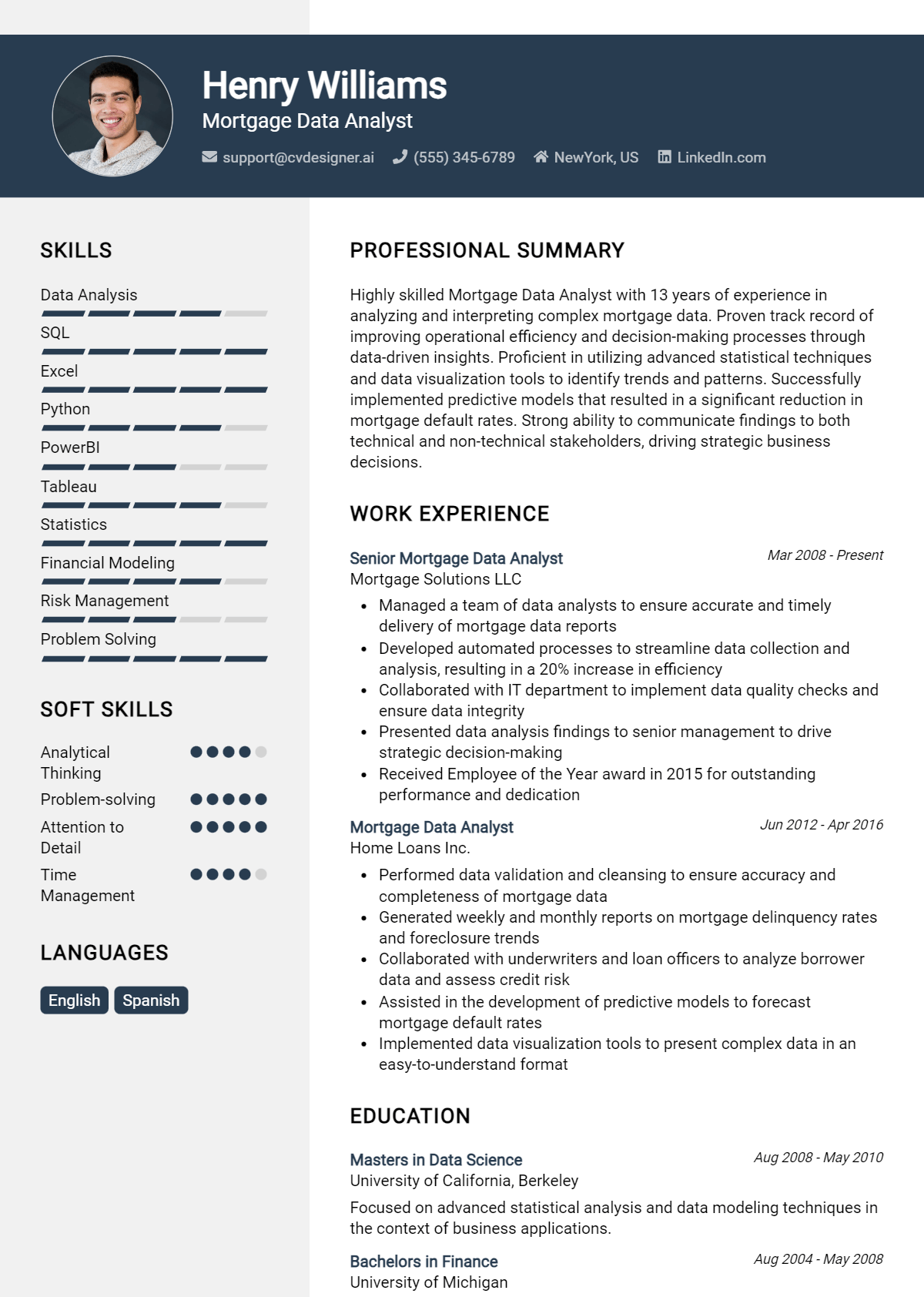

for Resume Summary

Showcasing your Mortgage Data Analyst skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications. This is your chance to make an impact right from the start.

Example

Dynamic Mortgage Data Analyst with expertise in data analysis, risk assessment, and financial modeling. Proven track record of enhancing data integrity and improving loan processing efficiency in fast-paced environments.

for Resume Work Experience

The work experience section is the perfect opportunity to demonstrate how your Mortgage Data Analyst skills have been applied in real-world scenarios. This is where you can show tangible results from your skills.

Example

- Analyzed mortgage data sets to identify trends, resulting in a 15% increase in forecasting accuracy.

- Collaborated with cross-functional teams to develop a risk assessment model that reduced default rates by 20%.

- Utilized SQL for data manipulation and reporting, improving data accessibility for stakeholders.

- Led training sessions on data visualization tools, enhancing team productivity and decision-making.

for Resume Skills

The skills section can showcase both technical and transferable skills. It’s important to include a balanced mix of hard and soft skills that align with the role you are applying for.

Example

- Data Analysis

- Financial Modeling

- SQL and Database Management

- Risk Assessment

- Data Visualization

- Attention to Detail

- Problem-Solving

- Communication Skills

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in their resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate your suitability for the role.

Example

In my previous role, my expertise in financial modeling and risk assessment led to the development of strategies that improved loan approval processes, reducing turnaround times by 25%. I am eager to bring these skills to your team and drive similar outcomes.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job.

The Importance of Mortgage Data Analyst Resume Skills

In the competitive field of mortgage data analysis, showcasing relevant skills on your resume is crucial for capturing the attention of recruiters. A well-crafted skills section not only highlights your qualifications and expertise but also aligns your abilities with the specific requirements of the job. By emphasizing your technical prowess and analytical capabilities, you can effectively differentiate yourself from other candidates and demonstrate your suitability for the role.

- Effective communication skills are vital for a Mortgage Data Analyst, as you will often need to present complex data findings to non-technical stakeholders. Highlighting this skill shows your ability to bridge the gap between data analysis and business decisions.

- Proficiency in data visualization tools is essential for translating raw data into actionable insights. By showcasing your skills in tools like Tableau or Power BI, you demonstrate your ability to make data-driven recommendations that can influence mortgage strategies.

- Strong analytical skills are at the core of a Mortgage Data Analyst's role. By emphasizing your ability to interpret various data sets, you convey your competence in identifying trends and anomalies that could impact mortgage performance.

- Knowledge of statistical analysis techniques is important for validating data integrity and accuracy. Highlighting this skill illustrates your capability to apply rigorous methodologies to derive meaningful conclusions from mortgage data.

- Familiarity with mortgage industry regulations and compliance standards is crucial. By detailing your understanding of relevant guidelines, you can reassure employers that you can navigate the complexities of the mortgage landscape while ensuring adherence to legal requirements.

- Experience with programming languages such as SQL or Python is increasingly important for data manipulation and analysis. Showcasing these technical skills reflects your ability to handle large datasets and automate processes efficiently.

- Attention to detail is a must-have trait for any Mortgage Data Analyst. Highlighting this skill demonstrates your commitment to accuracy and thoroughness in your work, which is essential for maintaining data integrity.

- Project management skills can also be beneficial, especially when dealing with multiple data initiatives. Emphasizing these capabilities can indicate your ability to manage timelines and deliverables effectively.

For more assistance with crafting your resume, check out these Resume Samples.

How To Improve Mortgage Data Analyst Resume Skills

In the ever-evolving field of mortgage data analysis, continuous improvement of skills is crucial for staying competitive and effective in your role. As the industry adapts to new technologies, regulations, and market trends, enhancing your skill set not only boosts your resume but also increases your value to potential employers. Here are some actionable tips to help you enhance your skills as a Mortgage Data Analyst:

- Stay updated on industry trends by subscribing to relevant financial news outlets and publications.

- Enhance your technical skills by taking online courses in data analysis tools such as SQL, Python, or R.

- Gain proficiency in data visualization tools like Tableau or Power BI to effectively present your findings.

- Participate in webinars and workshops focused on mortgage analytics and industry best practices.

- Network with other professionals in the field to share knowledge and learn from their experiences.

- Seek feedback on your work and be open to constructive criticism to identify areas for improvement.

- Consider obtaining relevant certifications, such as the Certified Mortgage Banker (CMB) designation, to enhance your credibility.

Frequently Asked Questions

What are the key skills required for a Mortgage Data Analyst?

A Mortgage Data Analyst should possess a strong foundation in data analysis, statistical methods, and financial modeling. Proficiency in data visualization tools like Tableau or Power BI is essential, along with advanced Excel skills for data manipulation. Familiarity with mortgage industry regulations and terminology is also crucial, enabling the analyst to interpret data accurately and provide insights that assist in decision-making.

How important is experience with data management software for a Mortgage Data Analyst?

Experience with data management software is highly important for a Mortgage Data Analyst. These tools, such as SQL databases and CRM systems, facilitate the efficient storage, retrieval, and analysis of large datasets. Proficiency in these systems allows analysts to streamline their workflow, ensuring that they can quickly access and manipulate data to produce timely reports and insights for stakeholders.

What analytical techniques should a Mortgage Data Analyst be familiar with?

A Mortgage Data Analyst should be familiar with various analytical techniques, including regression analysis, predictive modeling, and clustering. These methods help in identifying trends, forecasting market changes, and segmenting customers based on their borrowing behaviors. Mastery of these techniques allows the analyst to provide actionable insights that can enhance loan performance and risk assessment.

How does knowledge of mortgage regulations impact a Mortgage Data Analyst's effectiveness?

Knowledge of mortgage regulations is vital for a Mortgage Data Analyst as it ensures compliance and helps mitigate risks associated with lending practices. Understanding regulations such as RESPA, TILA, and HMDA enables the analyst to interpret data within the appropriate legal context, providing accurate reports that adhere to regulatory standards and contribute to informed decision-making within the organization.

What programming languages are beneficial for a Mortgage Data Analyst to know?

For a Mortgage Data Analyst, familiarity with programming languages such as Python or R is beneficial for performing complex data analyses and automating repetitive tasks. These languages offer powerful libraries for data manipulation, statistical analysis, and machine learning, enabling the analyst to derive more sophisticated insights from mortgage data and improve efficiency in their reporting processes.

Conclusion

Incorporating relevant skills as a Mortgage Data Analyst in your resume is crucial for showcasing your expertise and aligning yourself with the needs of potential employers. By highlighting your analytical abilities, attention to detail, and understanding of the mortgage industry, you set yourself apart from other candidates and demonstrate the value you can bring to an organization. Remember, refining your skills not only enhances your resume but also boosts your confidence during the job application process. So take the time to invest in your professional development and present yourself as the ideal candidate.

For additional resources to enhance your job application, check out our resume templates, resume builder, resume examples, and cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.