Top 27 Mortgage Compliance Specialist Resume Skills with Examples for 2025

As a Mortgage Compliance Specialist, having the right skills is essential to navigate the complex landscape of mortgage regulations and ensure adherence to all legal requirements. In this section, we will outline the top skills that are highly valued in the mortgage compliance field. These competencies not only enhance your effectiveness in the role but also strengthen your resume, making you a more attractive candidate to potential employers. Let's explore the key skills that can set you apart in this critical profession.

Best Mortgage Compliance Specialist Technical Skills

In the dynamic world of mortgage compliance, possessing relevant technical skills is crucial for ensuring adherence to regulations and industry standards. These skills not only enhance a Mortgage Compliance Specialist's ability to perform their duties effectively but also demonstrate their expertise and value to potential employers. Below are some essential technical skills that should be highlighted on your resume.

Regulatory Knowledge

Understanding federal and state regulations such as RESPA, TILA, and HMDA is vital for compliance in the mortgage industry. This knowledge helps in monitoring and implementing compliance strategies.

How to show it: Include specific regulatory frameworks you are familiar with and detail how you ensured compliance in previous roles, such as reducing violations by a certain percentage.

Loan Processing Software Proficiency

Familiarity with loan processing software like Encompass or Calyx is essential for managing documentation and ensuring compliance throughout the loan lifecycle.

How to show it: List the specific software you have used, and describe how your expertise improved processing times or reduced errors in your previous positions.

Data Analysis Skills

The ability to analyze data trends related to compliance findings is crucial for identifying potential issues and making informed decisions.

How to show it: Provide examples of how your data analysis led to actionable insights, such as identifying non-compliance patterns that resulted in policy changes.

Risk Management

Understanding risk assessment methodologies helps in identifying, evaluating, and mitigating compliance risks in mortgage lending.

How to show it: Demonstrate your experience in risk management by detailing specific projects where you successfully mitigated risks and enhanced compliance measures.

Attention to Detail

This skill is crucial for reviewing legal documents, identifying discrepancies, and ensuring all information complies with regulations.

How to show it: Highlight instances where your attention to detail led to the discovery of errors that could have resulted in compliance issues, quantifying the potential impact.

Communication Skills

Clear communication is essential for conveying compliance requirements and collaborating with various stakeholders, including lenders, borrowers, and regulators.

How to show it: Describe your experience in training teams or presenting compliance findings to stakeholders, emphasizing the positive outcomes of your communication efforts.

Document Management Systems

Proficiency in using document management systems ensures that all compliance documents are accurately stored and easily retrievable for audits.

How to show it: Mention the specific document management systems you have utilized and how you streamlined document retrieval processes in your previous roles.

Compliance Auditing

Experience in conducting internal audits helps in identifying compliance weaknesses and implementing corrective actions to ensure adherence.

How to show it: Detail your auditing experience, including the number of audits conducted and improvements made as a result of your findings.

Project Management

Managing compliance projects effectively ensures that initiatives are completed on time and within budget, while meeting regulatory requirements.

How to show it: Illustrate your project management experience by providing specific examples of projects you led, including timelines, budgets, and outcomes.

Training and Development

Ability to develop and deliver training materials on compliance topics is important for educating staff and fostering a culture of compliance.

How to show it: Discuss your experience in creating training programs, including the number of employees trained and any improvements in compliance awareness or performance.

Customer Service Orientation

A strong focus on customer service is essential for addressing borrower inquiries and ensuring a smooth loan process while maintaining compliance.

How to show it: Provide examples of how your customer service skills resolved compliance-related issues and enhanced borrower satisfaction.

Best Mortgage Compliance Specialist Soft Skills

In the dynamic field of mortgage compliance, soft skills play an essential role in ensuring that professionals effectively navigate regulations and work collaboratively within their teams. These workplace skills not only enhance individual performance but also contribute to the overall efficiency and integrity of the lending process. Below are some of the top soft skills that Mortgage Compliance Specialists should highlight on their resumes.

Attention to Detail

Attention to detail is crucial for Mortgage Compliance Specialists, as they must meticulously review documents and regulations to ensure compliance with laws and policies.

How to show it: Include specific examples where your attention to detail led to the identification of potential issues or errors. Quantify the impact, such as reducing compliance breaches by a certain percentage.

Communication

Effective communication is vital for conveying complex compliance information to various stakeholders, including clients, lenders, and regulatory bodies.

How to show it: Demonstrate your communication skills by providing examples of successful presentations or training sessions you conducted, and quantify the number of participants or the positive feedback received. For more tips, check our section on Communication.

Problem-Solving

Mortgage Compliance Specialists often encounter unexpected challenges that require innovative solutions to maintain compliance and protect the organization.

How to show it: Share specific instances where you identified a compliance issue and successfully implemented a solution, including any measurable outcomes. For further insights, refer to our guide on Problem-solving.

Time Management

Time management is essential in the fast-paced mortgage industry, where specialists must prioritize tasks to meet deadlines and regulatory requirements.

How to show it: Provide examples of how you managed multiple compliance projects simultaneously, highlighting any deadlines you met or exceeded. For strategies on improving this skill, visit our page on Time Management.

Teamwork

Collaboration with colleagues from various departments is often necessary to ensure compliance across the organization, making teamwork a key skill for Mortgage Compliance Specialists.

How to show it: Highlight examples of successful teamwork in your previous roles, emphasizing collaborative projects and your specific contributions. For more on fostering collaboration, check our section on Teamwork.

Analytical Thinking

Analytical thinking allows Mortgage Compliance Specialists to assess complex regulations and data, ensuring that all aspects of compliance are thoroughly understood and implemented.

How to show it: Demonstrate your analytical skills by providing examples of how you analyzed compliance data or regulations and the resulting improvements or changes made.

Adaptability

The mortgage industry is constantly evolving, and adaptability is essential for Compliance Specialists to stay updated with new regulations and policies.

How to show it: Share experiences where you successfully adapted to regulatory changes or implemented new compliance practices, highlighting the outcomes of your flexibility.

Integrity

Integrity is vital in maintaining trust and ensuring ethical practices within the mortgage industry, reinforcing the importance of compliance.

How to show it: Provide examples of how you demonstrated ethical decision-making in compliance situations, emphasizing the importance of integrity in your work.

Organizational Skills

Strong organizational skills are necessary for managing the extensive documentation and processes involved in mortgage compliance.

How to show it: Detail your organizational methods, such as filing systems or project management techniques, and their effectiveness in improving compliance processes.

Customer Service Orientation

A customer service orientation helps Mortgage Compliance Specialists address client inquiries and concerns while ensuring compliance with regulations.

How to show it: Highlight examples of successful client interactions where you resolved compliance-related issues, including any positive feedback received.

Research Skills

Research skills enable Compliance Specialists to stay informed about changing regulations and industry standards, ensuring continued compliance.

How to show it: Share instances where your research led to improved compliance strategies or practices, quantifying any positive effects on the organization.

How to List Mortgage Compliance Specialist Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to employers, as it provides a snapshot of your qualifications and expertise. There are three main sections where you can highlight your skills: the Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

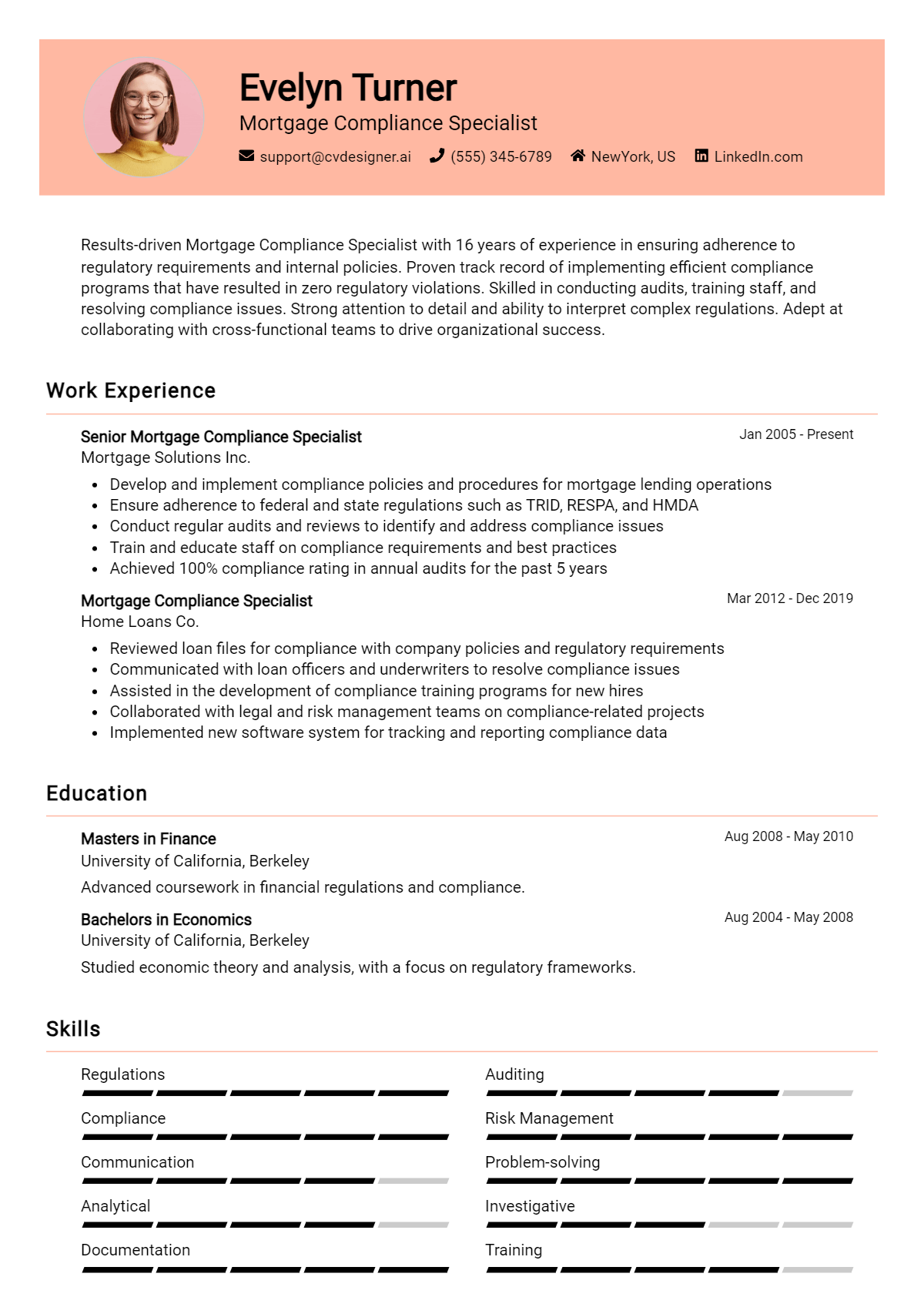

for Resume Summary

Showcasing your Mortgage Compliance Specialist skills in the summary section is essential, as it gives hiring managers a quick overview of your qualifications and expertise.

Example

As a detail-oriented Mortgage Compliance Specialist with strong knowledge of federal regulations and risk management, I excel in ensuring compliance and enhancing operational efficiencies.

for Resume Work Experience

The work experience section is the perfect opportunity to demonstrate how your Mortgage Compliance Specialist skills have been applied in real-world scenarios.

Example

- Conducted compliance audits to ensure adherence to state and federal regulations, resulting in zero violations during annual reviews.

- Collaborated with cross-functional teams to implement risk management strategies, reducing compliance-related issues by 30%.

- Provided training sessions on mortgage regulations for new employees, enhancing team knowledge and performance.

- Developed and maintained documentation for policy changes, ensuring all stakeholders were informed of updates.

for Resume Skills

The skills section can showcase both technical and transferable skills. A balanced mix of hard and soft skills is essential to strengthen your qualifications.

Example

- Regulatory Compliance

- Risk Management

- Attention to Detail

- Analytical Thinking

- Communication Skills

- Team Collaboration

- Problem-Solving

- Project Management

for Cover Letter

A cover letter allows you to expand on the skills mentioned in your resume and offers a personal touch. Highlighting 2-3 key skills that align with the job description can effectively showcase your qualifications.

Example

My experience in regulatory compliance and risk management has allowed me to successfully navigate complex mortgage regulations, leading to significant improvements in operational efficiency at my previous position. I am eager to bring this expertise to your team and contribute to your compliance objectives.

Linking the skills mentioned in your resume to specific achievements in your cover letter will reinforce your qualifications for the job.

The Importance of Mortgage Compliance Specialist Resume Skills

Highlighting relevant skills in a Mortgage Compliance Specialist resume is crucial for candidates aiming to make a strong impression on recruiters. A well-crafted skills section not only showcases a candidate's qualifications but also demonstrates their alignment with the specific requirements of the role. Recruiters often scan resumes for key competencies, making it essential for applicants to emphasize their expertise in compliance regulations, risk management, and industry standards.

- Demonstrating knowledge of mortgage compliance regulations is vital. It shows potential employers that you are well-versed in the legal frameworks governing the mortgage industry, which can significantly reduce the risk of non-compliance.

- Highlighting attention to detail is crucial. Mortgage Compliance Specialists must meticulously review documents and transactions; being able to showcase this skill can set you apart from other candidates who may not emphasize their thoroughness.

- Effective communication skills are essential for a Mortgage Compliance Specialist. This role often requires collaboration with various departments and stakeholders, making it important to demonstrate your ability to convey complex compliance information clearly.

- Knowledge of auditing processes can enhance your resume. This skill indicates to employers that you can conduct thorough assessments of compliance practices, which is a key responsibility in maintaining regulatory standards.

- Familiarity with compliance software tools is increasingly important. Highlighting your proficiency with these tools can illustrate your ability to adapt to technological advancements in the industry, making you a more attractive candidate.

- Problem-solving skills are essential in navigating compliance challenges. Employers appreciate candidates who can identify issues and develop effective solutions, showcasing initiative and critical thinking abilities.

- Understanding of risk management principles can set you apart. This knowledge demonstrates your capability to assess and mitigate potential compliance risks, which is essential for protecting both the organization and its clients.

- Being able to work under pressure is a key skill in this role. Highlighting your ability to meet tight deadlines while maintaining accuracy in compliance tasks can reassure employers of your reliability.

For additional insights, check out these Resume Samples to enhance your application.

How To Improve Mortgage Compliance Specialist Resume Skills

In the ever-evolving landscape of the mortgage industry, it is crucial for Mortgage Compliance Specialists to continuously enhance their skills. Staying updated with regulatory changes, industry best practices, and technological advancements not only enhances job performance but also strengthens your resume, making you a more attractive candidate for future opportunities. Here are some actionable tips to help you improve your skills in this essential role:

- Attend industry seminars and workshops to gain insights into the latest regulations and compliance trends.

- Enroll in online courses focused on mortgage compliance, risk management, and regulatory frameworks.

- Join professional organizations, such as the Mortgage Bankers Association, to network and access valuable resources.

- Read industry publications and subscribe to relevant newsletters to stay informed about changes and updates.

- Seek mentorship from experienced professionals in the field to gain practical knowledge and advice.

- Practice using compliance software and tools to enhance your technical proficiency and efficiency.

- Participate in mock audits or compliance assessments to improve your analytical skills and attention to detail.

Frequently Asked Questions

What are the key skills required for a Mortgage Compliance Specialist?

A Mortgage Compliance Specialist should possess strong analytical skills, attention to detail, and a comprehensive understanding of mortgage regulations and laws. Proficiency in compliance software and tools is essential, along with excellent communication skills to effectively collaborate with various stakeholders. Additionally, familiarity with risk assessment and management practices is important for ensuring adherence to regulatory requirements.

How important is knowledge of mortgage regulations for this role?

Knowledge of mortgage regulations is crucial for a Mortgage Compliance Specialist, as it forms the foundation of their responsibilities. Staying updated on federal and state laws, such as RESPA, TILA, and the Equal Credit Opportunity Act, is essential for ensuring that all lending practices are compliant. This expertise helps in identifying potential compliance issues and implementing necessary changes to mitigate risks.

What software skills are beneficial for a Mortgage Compliance Specialist?

Proficiency in compliance management software, loan origination systems, and data analysis tools is highly beneficial for a Mortgage Compliance Specialist. Familiarity with Microsoft Excel for data tracking and reporting, as well as document management systems, are important skills that enhance efficiency in monitoring compliance and managing documentation effectively.

How can strong communication skills benefit a Mortgage Compliance Specialist?

Strong communication skills are vital for a Mortgage Compliance Specialist as they need to relay complex regulatory information clearly to various stakeholders, including loan officers, management, and borrowers. Effective communication fosters collaboration within the team and ensures that compliance guidelines are understood and followed, ultimately leading to a smoother lending process and reduced risk of violations.

What role does risk assessment play in mortgage compliance?

Risk assessment is a fundamental aspect of mortgage compliance, as it involves identifying, evaluating, and mitigating potential compliance risks associated with lending practices. A Mortgage Compliance Specialist must regularly conduct risk assessments to analyze processes, detect gaps in compliance, and recommend strategies to enhance overall compliance posture, thereby protecting the organization from legal repercussions and financial losses.

Conclusion

Including Mortgage Compliance Specialist skills in your resume is crucial for demonstrating your expertise and commitment to the field. By showcasing relevant skills, you not only stand out from the competition but also convey the value you can bring to potential employers. A tailored resume can significantly increase your chances of landing the job you desire. Remember, investing time in refining your skills and presenting them effectively can lead to a stronger job application and greater career opportunities.

For additional resources to enhance your job application, explore our resume templates, try our resume builder, check out our resume examples, and create an impactful introduction with our cover letter templates. Let’s take the next step towards your career success!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.