27 Insurance Data Analyst Resume Skills That Stand Out in 2025

As an Insurance Data Analyst, possessing the right skills is crucial for effectively interpreting complex data sets and providing actionable insights that can drive strategic decisions within the insurance industry. In this section, we will outline the top skills that should be highlighted on your resume to showcase your expertise and make you stand out to potential employers. Whether you are a seasoned professional or just starting your career, these skills will help you demonstrate your value in this dynamic field.

Best Insurance Data Analyst Technical Skills

Technical skills are crucial for an Insurance Data Analyst as they form the backbone of data analysis, enabling professionals to derive insights that drive strategic decisions. Mastery of these skills not only enhances analytical capabilities but also improves the efficiency and accuracy of the analysis in the insurance industry.

Data Analysis

Data analysis involves inspecting, cleansing, transforming, and modeling data to discover useful information. For an Insurance Data Analyst, this skill is essential for identifying trends and patterns that inform risk assessment and pricing strategies.

How to show it: Quantify your experience by mentioning specific projects where your data analysis led to cost savings or improved operational efficiency. Use percentages or dollar amounts to highlight your impact.

Statistical Analysis

Statistical analysis is critical for understanding complex data sets and making data-driven predictions. It helps Insurance Data Analysts assess risk and forecast future claims, which is vital for pricing policies accurately.

How to show it: Include examples of statistical models you have developed and the outcomes they influenced, such as changes in underwriting processes or claim management strategies.

Data Visualization

Data visualization skills enable analysts to present data in graphical formats, making it easier to understand and communicate insights to stakeholders. This skill is vital in conveying complex findings succinctly.

How to show it: Highlight specific tools you’ve used for data visualization, such as Tableau or Power BI, and provide examples of how your visualizations have facilitated decision-making.

SQL Proficiency

SQL (Structured Query Language) proficiency is fundamental for querying and managing databases. For Insurance Data Analysts, strong SQL skills allow for efficient data retrieval and manipulation, which is critical in analysis tasks.

How to show it: Detail your experience with writing complex SQL queries and the data sets you have worked with, emphasizing how your SQL skills improved data processing times.

Predictive Modeling

Predictive modeling uses statistical techniques to forecast outcomes based on historical data. This skill is crucial for Insurance Data Analysts to predict future claims and customer behavior, aiding in strategic planning.

How to show it: Describe specific predictive models you have created and their results, such as improved accuracy in risk assessments or fraud detection rates.

Excel Advanced Functions

Advanced Excel functions, including pivot tables, VLOOKUP, and macros, are essential for performing complex calculations and data analysis. Mastery of Excel can greatly enhance efficiency in reporting and data manipulation.

How to show it: Specify the types of analyses you have performed using Excel and the impact of your findings on business decisions, providing metrics where possible.

Data Mining

Data mining involves extracting patterns from large data sets using techniques such as clustering, classification, and association. This skill helps Insurance Data Analysts uncover hidden trends that can inform policy development.

How to show it: Illustrate your data mining projects, detailing the techniques used and the insights gained that contributed to business objectives.

Risk Analysis

Risk analysis is the process of identifying and assessing potential risks that could negatively impact the organization. For Insurance Data Analysts, this skill is vital in developing strategies to mitigate those risks.

How to show it: Provide examples of risk assessments you have conducted and the resulting strategies implemented to minimize potential losses.

Insurance Industry Knowledge

Having a solid understanding of insurance products, regulations, and market trends is essential for an effective Insurance Data Analyst. This knowledge allows for more relevant analysis and insights.

How to show it: Highlight your experience in the insurance sector, mentioning specific products or regulations you are familiar with and how this knowledge has informed your analyses.

Programming Skills (Python/R)

Proficiency in programming languages such as Python or R is increasingly important for data manipulation, analysis, and automation of tasks. These languages are widely used in data science, including insurance analytics.

How to show it: Discuss programming projects you have completed, focusing on how they improved processes or analytical accuracy within insurance-related tasks.

Best Insurance Data Analyst Soft Skills

In the fast-paced world of insurance, technical expertise is essential, but soft skills are equally important for an Insurance Data Analyst. These interpersonal skills enable analysts to communicate effectively, collaborate with team members, and approach problem-solving with a creative mindset. Showcasing these skills on your resume can make you a more attractive candidate to potential employers.

Communication

Effective communication is crucial for an Insurance Data Analyst as it allows for the clear presentation of complex data insights to stakeholders. This skill helps in articulating findings and recommendations in an understandable manner.

How to show it: Highlight instances where you presented data findings to non-technical audiences or collaborated with cross-functional teams. Use metrics to showcase the impact of your communication on project outcomes.

Problem-solving

Problem-solving skills enable Insurance Data Analysts to identify issues within data sets and develop actionable solutions. This skill is vital for diagnosing trends and enhancing data accuracy.

How to show it: Provide examples of specific problems you encountered in data analysis and describe the solutions you implemented. Use quantifiable results to demonstrate the effectiveness of your problem-solving abilities.

Time Management

Effective time management allows Insurance Data Analysts to prioritize tasks, meet deadlines, and manage multiple projects without sacrificing quality. This skill is essential for managing workloads efficiently.

How to show it: Showcase your ability to handle competing deadlines by detailing how you organized your tasks. Include specific examples of projects completed on time or ahead of schedule, emphasizing your organizational strategies.

Teamwork

Teamwork is vital for Insurance Data Analysts as they often collaborate with various departments to gather insights and drive decisions. Being a team player enhances the overall performance of analytical projects.

How to show it: Share experiences where you worked within a team to achieve a common goal. Highlight your role and contributions, and quantify the success of the project as a result of effective collaboration.

Adaptability

In the insurance sector, data and regulations frequently change. Adaptability enables Insurance Data Analysts to adjust their strategies and methods in response to new challenges and opportunities.

How to show it: Illustrate how you adapted to changes in data sources, tools, or regulations in past roles. Provide examples of new strategies you implemented and the positive outcomes that resulted.

Attention to Detail

Attention to detail is essential for Insurance Data Analysts to ensure the accuracy and integrity of data analysis. This skill helps in identifying errors that could lead to significant financial implications.

How to show it: Provide examples of how your attention to detail prevented errors and improved data quality, including any audits or reviews you conducted that resulted in enhanced accuracy.

Critical Thinking

Critical thinking allows Insurance Data Analysts to evaluate data sources, question assumptions, and draw logical conclusions. This skill is crucial for making informed recommendations based on data analysis.

How to show it: Describe situations where your critical thinking led to innovative solutions or insights. Use specific examples and any measurable outcomes to highlight the effectiveness of your thought process.

Negotiation Skills

Negotiation skills can be beneficial for Insurance Data Analysts when working with stakeholders to reach agreements on data priorities or project scopes. This skill helps in achieving mutually beneficial outcomes.

How to show it: Share instances where you successfully negotiated project requirements or timelines with stakeholders. Quantify the impact of these negotiations on project efficiency or results.

Creative Thinking

Creative thinking encourages Insurance Data Analysts to explore unconventional solutions and innovative approaches to data challenges. This skill fosters a culture of innovation in data analysis.

How to show it: Provide examples where your creative thinking led to unique solutions or process improvements. Highlight any projects that benefited from your innovative ideas.

Emotional Intelligence

Emotional intelligence enables Insurance Data Analysts to understand and manage their own emotions and those of others. This skill is crucial for effective collaboration and conflict resolution within teams.

How to show it: Illustrate your emotional intelligence by detailing situations where you navigated interpersonal challenges successfully. Highlight how your approach fostered positive team dynamics or outcomes.

Organizational Skills

Organizational skills are essential for Insurance Data Analysts to maintain structured workflows, manage data sets, and ensure that all tasks are completed efficiently and accurately.

How to show it

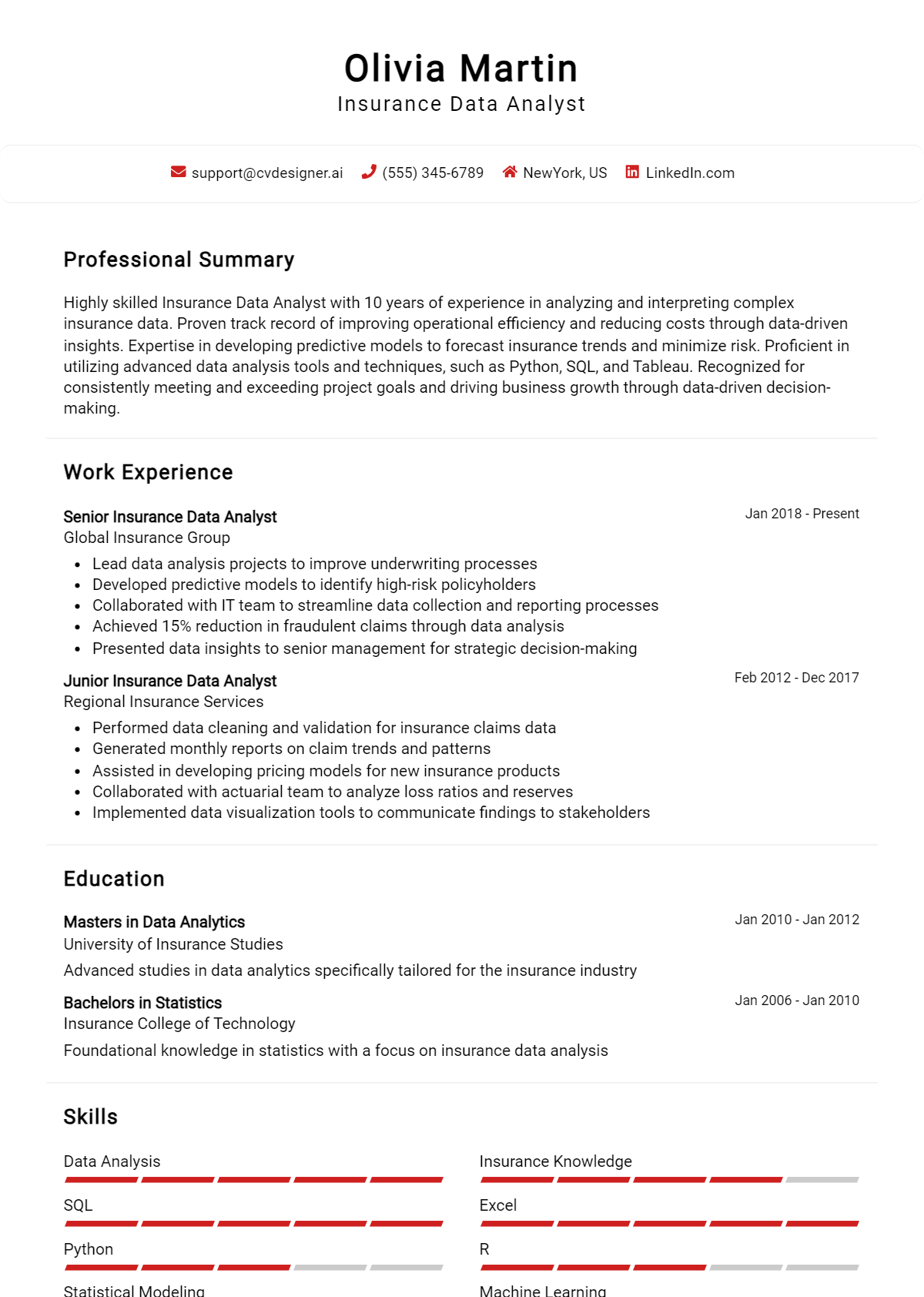

How to List Insurance Data Analyst Skills on Your Resume

Effectively listing your skills on a resume is crucial to stand out to employers in the competitive field of insurance data analysis. Highlighting your skills in various sections—such as the Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter—can give recruiters a comprehensive view of your qualifications.

for Resume Summary

Showcasing your Insurance Data Analyst skills in the introduction section allows hiring managers to quickly grasp your qualifications. This brief overview sets the tone for the rest of your resume.

Example

Experienced Insurance Data Analyst with expertise in data analysis, risk assessment, and statistical modeling. Proven track record of utilizing data visualization tools to enhance decision-making processes and improve operational efficiency.

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how your Insurance Data Analyst skills have been applied in real-world scenarios. Tailoring your experience to match specific skills mentioned in job listings can significantly boost your chances of getting noticed.

Example

- Conducted comprehensive data analysis to identify trends and provide actionable insights, improving claim processing efficiency by 20%.

- Developed and implemented statistical models to assess risk, resulting in a 15% reduction in fraudulent claims.

- Collaborated with cross-functional teams to enhance data visualization methodologies, facilitating better communication of key findings.

- Utilized strong analytical skills to monitor performance metrics and recommend process improvements.

for Resume Skills

The skills section can showcase both technical and transferable skills. A balanced mix of hard and soft skills enhances your overall qualifications and makes you a more appealing candidate.

Example

- Data Analysis

- Statistical Modeling

- Risk Assessment

- Data Visualization

- SQL & Database Management

- Excel Proficiency

- Problem Solving

- Communication Skills

for Cover Letter

A cover letter allows you to expand on the skills mentioned in your resume and provide a personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate your fit for the role.

Example

In my previous role, my data analysis and statistical modeling skills helped streamline our risk assessment processes, leading to a 30% decrease in operational costs. I am excited about the opportunity to bring this expertise to your team and further enhance your data-driven decision-making capabilities.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job and makes your application more compelling.

The Importance of Insurance Data Analyst Resume Skills

In the competitive field of insurance data analysis, showcasing relevant skills on your resume is crucial for capturing the attention of recruiters and hiring managers. A well-crafted skills section not only highlights your qualifications but also aligns your expertise with the specific requirements of the job. By emphasizing the right skills, candidates can effectively demonstrate their value and readiness to contribute to an organization's success.

- Clear Communication: Effective communication skills are essential for an Insurance Data Analyst, as they need to convey complex data insights to non-technical stakeholders. Highlighting your ability to articulate findings will set you apart.

- Technical Proficiency: Familiarity with data analysis tools and programming languages like SQL, Python, or R is crucial. Showcasing these technical skills demonstrates your capability to handle large datasets and perform in-depth analyses.

- Problem-Solving Abilities: Insurance data analysis often involves identifying trends and anomalies in data. Emphasizing your problem-solving skills illustrates your capacity to tackle challenges and derive actionable insights.

- Attention to Detail: In the insurance industry, accuracy is paramount. Highlighting your meticulousness in data verification and analysis can instill confidence in your potential employers regarding your work quality.

- Statistical Knowledge: A strong foundation in statistics is vital for interpreting data correctly. Showcasing your knowledge in statistical methods will reflect your ability to produce meaningful insights from data.

- Domain Knowledge: Understanding the insurance industry, including regulations and market trends, enhances your analytical abilities. Emphasizing this knowledge can position you as a candidate who not only analyzes data but also comprehends its context.

- Data Visualization: The ability to present data visually through tools like Tableau or Power BI is increasingly important. Highlighting this skill shows your capability to make data accessible and understandable for decision-makers.

- Team Collaboration: Insurance data analysts often work in teams with other professionals. Demonstrating your ability to collaborate effectively can showcase your interpersonal skills and adaptability in a team environment.

For more insights on crafting your resume, check out these Resume Samples.

How To Improve Insurance Data Analyst Resume Skills

In the rapidly evolving field of insurance, it is crucial for Data Analysts to continuously improve their skills to stay competitive and effective. The insurance industry relies heavily on data to make informed decisions, manage risks, and enhance customer experiences. By honing your analytical capabilities, technical proficiencies, and industry knowledge, you can significantly enhance your value as an Insurance Data Analyst and position yourself for career advancement.

- Attend industry-related workshops and seminars to stay updated on the latest trends and technologies in insurance data analysis.

- Take online courses in advanced data analytics techniques, such as machine learning or predictive modeling, to broaden your skill set.

- Practice using data visualization tools like Tableau or Power BI to effectively present your findings and insights.

- Enhance your programming skills by learning languages commonly used in data analysis, such as Python or R.

- Network with other professionals in the field through online forums or local meetups to exchange knowledge and best practices.

- Participate in relevant certification programs, such as the Certified Analytics Professional (CAP) or Chartered Property Casualty Underwriter (CPCU), to validate your expertise.

- Regularly review and analyze case studies in the insurance sector to understand real-world applications of data analysis and improve problem-solving skills.

Frequently Asked Questions

What key skills should be highlighted on an Insurance Data Analyst resume?

When crafting a resume for an Insurance Data Analyst position, it’s essential to highlight skills such as data analysis, statistical software proficiency (e.g., SAS, R, Python), and knowledge of insurance products and regulations. Additionally, showcasing your ability to interpret complex data sets, strong attention to detail, and experience with data visualization tools (like Tableau or Power BI) can make your application stand out.

How important is experience with data management systems for an Insurance Data Analyst?

Experience with data management systems is crucial for an Insurance Data Analyst, as these systems are foundational for collecting, processing, and analyzing data. Familiarity with databases such as SQL, Oracle, or data warehousing solutions demonstrates your ability to efficiently manage large volumes of data, ensuring accurate reporting and informed decision-making.

What role does statistical analysis play in the job of an Insurance Data Analyst?

Statistical analysis is a core component of an Insurance Data Analyst's role, as it enables the extraction of valuable insights from data sets. By applying statistical methods, analysts can identify trends, assess risks, and predict future outcomes, which are vital for underwriting decisions and pricing strategies in the insurance industry.

Should I include programming skills on my resume as an Insurance Data Analyst?

Yes, including programming skills on your resume is highly beneficial for an Insurance Data Analyst. Proficiency in programming languages such as Python or R can enhance your ability to manipulate data, conduct analyses, and automate repetitive tasks. Employers often seek candidates who can leverage these skills to improve data efficiency and accuracy.

What soft skills are valuable for an Insurance Data Analyst?

In addition to technical skills, soft skills are equally important for an Insurance Data Analyst. Strong communication skills are essential for effectively conveying complex data insights to non-technical stakeholders. Additionally, problem-solving abilities, teamwork, and adaptability are crucial for navigating the dynamic nature of the insurance industry and addressing various analytical challenges.

Conclusion

In today's competitive job market, including relevant skills for an Insurance Data Analyst position on your resume is crucial. By showcasing your expertise in data analysis, risk assessment, and industry-specific software, you can effectively differentiate yourself from other candidates and demonstrate the value you bring to potential employers. A well-crafted resume that highlights these skills not only opens doors to new opportunities but also positions you as a strong contender in the hiring process.

As you embark on your journey to refine your skills and enhance your job application, remember that continuous improvement and dedication to your craft will pay off. Invest time in developing your abilities, and you will be well on your way to landing your dream job. For additional resources, check out our resume templates, resume builder, resume examples, and cover letter templates to help you create a standout application.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.