26 Institutional Sales Trader Skills for Your Resume: List Examples

As an Institutional Sales Trader, possessing a robust set of skills is essential for success in this fast-paced and competitive environment. Your ability to effectively communicate, analyze market trends, and build relationships with clients can set you apart from the competition. In the following section, we will outline the top skills that are crucial for your resume, ensuring that you present yourself as a standout candidate in the field of institutional sales trading.

Best Institutional Sales Trader Technical Skills

Technical skills are crucial for Institutional Sales Traders as they navigate complex financial markets and engage with institutional clients. Mastery of these skills not only enhances trading strategies but also builds client trust and drives sales performance. Below are key technical skills that can significantly impact your success in this role.

Market Analysis

Understanding and analyzing market trends, economic indicators, and financial data is essential for making informed trading decisions.

How to show it: Highlight specific instances where your market analysis led to successful trades or investment decisions, preferably with quantitative results such as percentage gains or increased client portfolios.

Quantitative Analysis

The ability to use mathematical models and statistical methods to evaluate financial data and assess risk is vital for effective trading strategies.

How to show it: Include examples of quantitative models you developed or utilized, along with the outcomes such as improved risk assessments or profitability metrics.

Trading Platforms Proficiency

Familiarity with trading platforms, such as Bloomberg, Eikon, or proprietary systems, is necessary for executing trades efficiently and managing client orders.

How to show it: List the trading platforms you are proficient in and describe how your expertise improved trade execution speed or accuracy.

Client Relationship Management

Building and maintaining strong relationships with institutional clients is key to understanding their needs and enhancing sales opportunities.

How to show it: Quantify the growth in client accounts or satisfaction ratings resulting from your relationship management strategies.

Risk Management

Identifying, analyzing, and mitigating risks associated with trading activities ensures the protection of client investments and firm assets.

How to show it: Provide examples of risk management strategies you implemented and the measurable impact they had on reducing losses or enhancing portfolio stability.

Financial Modeling

Creating financial models to project future performance and evaluate investment opportunities is critical for informed decision-making.

How to show it: Detail specific models you developed and the resulting insights or investment strategies that emerged, along with any measurable financial benefits.

Regulatory Knowledge

Understanding the regulatory environment surrounding trading activities helps ensure compliance and reduces the risk of penalties.

How to show it: Demonstrate your knowledge of relevant regulations through examples of compliance initiatives you led and their outcomes.

Sales Strategy Development

Developing and executing effective sales strategies tailored to institutional clients is essential for achieving sales targets.

How to show it: Quantify the success of your sales strategies by showcasing revenue growth or new client acquisition rates resulting from your initiatives.

Advanced Excel Skills

Proficiency in Excel for data analysis, financial modeling, and reporting is fundamental for efficient trading operations.

How to show it: Include specific Excel functions or advanced techniques you utilized to improve reporting accuracy or analysis efficiency, along with the impact on your team's performance.

Communication Skills

Effective communication skills are vital for presenting trading ideas and strategies clearly to clients and stakeholders.

How to show it: Highlight instances where your communication led to successful client engagements or presentations, and quantify the results achieved through those interactions.

Portfolio Management

Managing a diverse portfolio of assets to optimize returns while considering risk tolerance is a key responsibility of an Institutional Sales Trader.

How to show it: Provide data on portfolio performance improvements under your management, focusing on returns versus benchmarks or risk-adjusted returns.

Best Institutional Sales Trader Soft Skills

Soft skills are essential for Institutional Sales Traders as they navigate complex financial landscapes and build lasting relationships with clients. These skills not only enhance communication and collaboration but also foster trust and credibility, which are crucial in driving sales and achieving targets. Below are some of the top soft skills that can elevate your resume and set you apart in this competitive field.

Communication

Effective communication is vital for conveying complex financial information clearly and persuasively to clients and stakeholders.

How to show it: Highlight experiences where you successfully presented financial strategies or client proposals. Use metrics to showcase how your communication improved client understanding or satisfaction.

Problem-Solving

The ability to analyze situations and provide effective solutions is crucial for addressing client concerns and navigating market challenges.

How to show it: Include specific examples where you identified issues and implemented solutions that led to measurable improvements in sales or client retention.

Time Management

Efficient time management skills enable traders to prioritize tasks, meet deadlines, and respond to market changes promptly.

How to show it: Demonstrate how you successfully managed multiple client accounts or projects, articulating the positive outcomes of your time management strategies.

Teamwork

Collaboration with colleagues and clients is essential for achieving common goals and enhancing overall sales performance.

How to show it: Provide examples of successful team projects or collaborations that resulted in significant sales achievements or improved client relations.

Adaptability

Being adaptable allows traders to adjust strategies in response to market fluctuations and client needs, fostering resilience in a dynamic environment.

How to show it: Share instances where you successfully adapted to unexpected market changes or client requests, highlighting the resulting benefits.

Emotional Intelligence

Emotional intelligence helps traders understand and manage their emotions and those of their clients, leading to better relationship management.

How to show it: Provide examples of how your emotional intelligence contributed to resolving conflicts or building rapport with clients.

Negotiation

Strong negotiation skills are crucial for securing favorable terms and building long-term relationships with clients.

How to show it: Highlight successful negotiations you’ve led, including specifics about the deals closed and the positive outcomes for clients.

Networking

Building a robust professional network is essential for generating leads and fostering client relationships in the sales trading arena.

How to show it: Detail your networking efforts at industry events or through professional associations, emphasizing the tangible benefits gained from these connections.

Analytical Thinking

Analytical thinking enables traders to interpret market data and trends, facilitating informed decision-making.

How to show it: Provide examples of how your analytical skills led to strategic decisions that positively impacted sales or trading outcomes.

Customer Service Orientation

A strong customer service orientation ensures that clients feel valued and supported throughout their trading experience.

How to show it: Discuss instances where you went above and beyond to meet client needs, and quantify the resulting satisfaction or retention rates.

Persuasiveness

Persuasiveness is crucial for influencing clients' decisions and securing buy-ins for trading strategies.

How to show it: Share specific examples of how you successfully persuaded clients to adopt your recommendations, highlighting the outcomes.

How to List Institutional Sales Trader Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to potential employers in a competitive job market. Highlighting your relevant qualifications can help hiring managers quickly understand your fit for the role. There are three main sections where skills can be emphasized: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

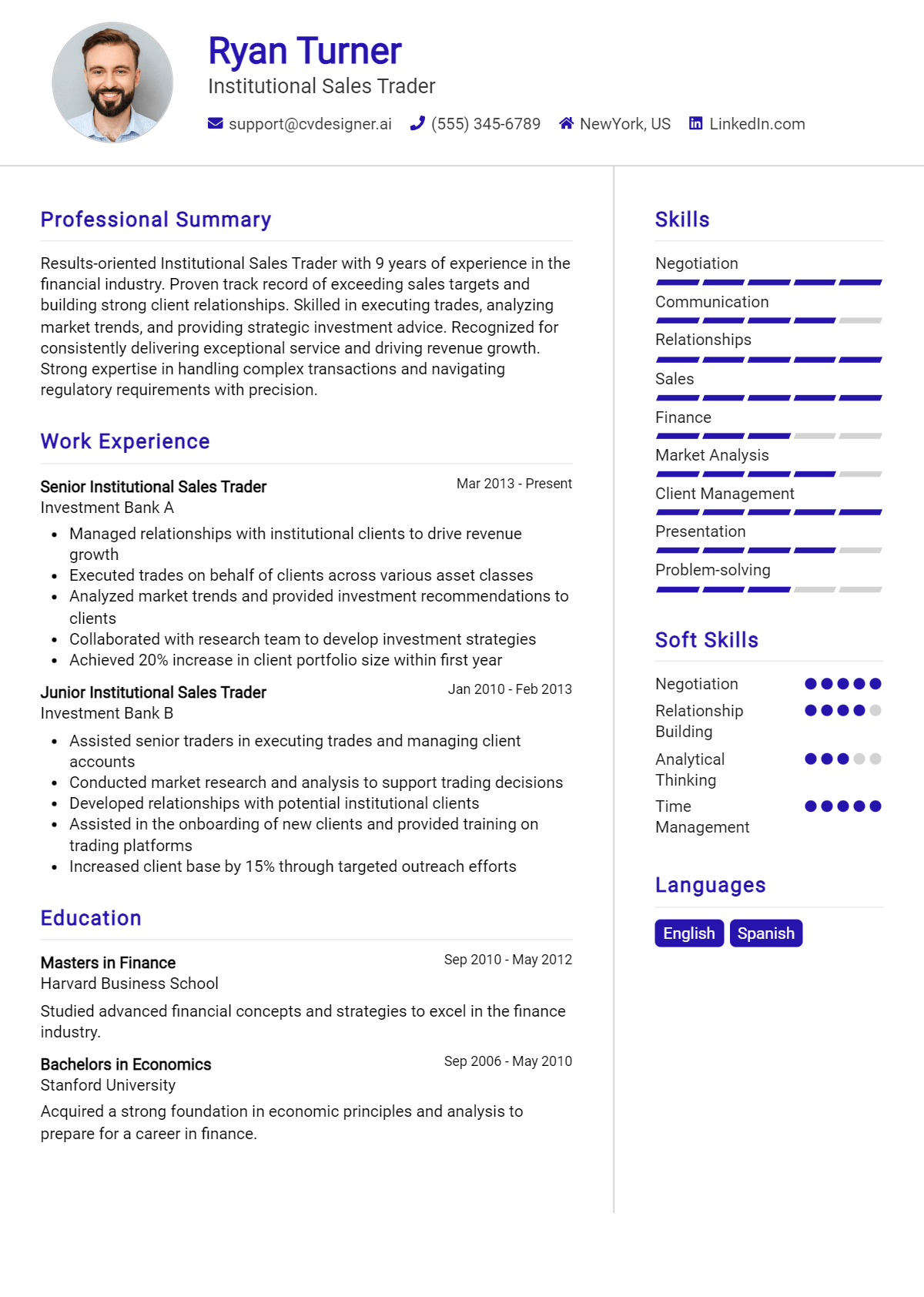

for Resume Summary

Showcasing Institutional Sales Trader skills in the summary section provides hiring managers with a quick overview of your qualifications, setting the stage for the rest of your resume.

Example

Dedicated Institutional Sales Trader with expertise in equity trading, risk management, and client relations. Proven track record in building strong relationships and executing trades effectively to maximize client satisfaction and portfolio performance.

for Resume Work Experience

The work experience section is an excellent opportunity to demonstrate how you have applied your Institutional Sales Trader skills in real-world scenarios. This is where you can highlight your achievements and contributions.

Example

- Executed over 200 trades per day, leveraging market analysis to optimize performance and minimize risks.

- Developed strong relationships with institutional clients, resulting in a 30% increase in portfolio allocations over two years.

- Collaborated with research teams to provide clients with insightful market reports, enhancing their investment strategies.

- Utilized CRM software to track client interactions, improving customer service response times by 25%.

for Resume Skills

The skills section can showcase both technical and transferable skills, emphasizing a balanced mix of hard and soft skills that strengthen your qualifications for the Institutional Sales Trader role.

Example

- Equity Trading

- Risk Management

- Client Relations

- Market Analysis

- Financial Reporting

- Negotiation Skills

- CRM Proficiency

- Portfolio Management

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume, providing a more personal touch. It’s beneficial to highlight 2-3 key skills that align with the job description and explain how these skills have positively impacted your previous roles.

Example

In my previous role, my strong negotiation skills and expertise in risk management allowed me to secure favorable terms for clients, leading to a 15% boost in client retention. I am excited to bring these skills to your organization, where I can create lasting value and drive growth.

Encourage candidates to link the skills mentioned in their resume to specific achievements in their cover letter, reinforcing their qualifications for the job. For more details on how to structure your skills section, check out our guide on Technical Skills and work experience.

The Importance of Institutional Sales Trader Resume Skills

In the competitive landscape of finance, particularly in the role of an Institutional Sales Trader, showcasing relevant skills on your resume is paramount. A well-crafted skills section not only highlights your qualifications but also aligns your experience with the specific requirements of the job. This strategic presentation can significantly enhance your visibility to recruiters, making you a more appealing candidate for potential employers.

- Demonstrates Expertise: A clear display of skills illustrates your expertise in trading and market analysis, reassuring employers of your capability to navigate complex financial environments.

- Aligns with Job Requirements: Tailoring your skills to match the job description shows that you understand the role's demands and can fulfill them, increasing your chances of landing an interview.

- Sets You Apart: In a pool of applicants, a focused skills section helps differentiate you from other candidates, showcasing unique abilities that may be highly relevant to the position.

- Facilitates Quick Assessment: Recruiters often skim resumes for key skills. A well-organized skills section allows for quick assessment of your qualifications, making it easier for them to determine your fit for the role.

- Highlights Continuous Learning: Including skills that reflect ongoing education and professional development illustrates your commitment to staying current in the industry, appealing to employers who value growth.

- Supports Soft Skills: Beyond technical abilities, highlighting interpersonal skills such as communication and negotiation showcases your overall suitability for client-facing roles in trading.

- Enhances Confidence: A strong skills section not only reinforces your qualifications but also boosts your confidence during interviews, as you can clearly articulate your strengths.

For additional guidance, consider reviewing Resume Samples that can help you craft a compelling resume tailored to the Institutional Sales Trader role.

How To Improve Institutional Sales Trader Resume Skills

In the fast-paced world of finance, particularly in institutional sales trading, continuously improving your skills is vital to staying competitive and relevant. As markets evolve and new technologies emerge, enhancing your skill set not only boosts your resume but also enhances your ability to serve clients effectively and make informed trading decisions. Here are some actionable tips to elevate your skills in this critical role:

- Stay updated with market trends by subscribing to financial news outlets and journals.

- Enhance your analytical skills by taking courses in data analysis and financial modeling.

- Network with industry professionals through conferences, webinars, and online forums to gain insights and share best practices.

- Practice negotiation techniques to improve your ability to secure favorable terms for clients.

- Familiarize yourself with trading platforms and software to streamline your trading processes.

- Seek mentorship from experienced traders to gain practical knowledge and career guidance.

- Participate in simulation trading exercises to refine your decision-making skills under pressure.

Frequently Asked Questions

What are the key skills required for an Institutional Sales Trader?

An Institutional Sales Trader should possess strong analytical skills, a deep understanding of financial markets, and excellent communication abilities. They must be adept at executing trades efficiently while maintaining relationships with institutional clients. Proficiency in trading platforms, risk management, and market research is also essential, along with the ability to work under pressure in a fast-paced environment.

How can I highlight my trading experience on my resume?

When highlighting trading experience on your resume, focus on specific achievements such as successful trade executions, volume of trades managed, and any strategies that led to increased profitability. Use quantitative metrics to demonstrate your impact, such as percentage returns or net profits generated. Additionally, mention any relevant certifications and training to bolster your credibility in the field.

What role does communication play in an Institutional Sales Trader's job?

Communication is critical for an Institutional Sales Trader as it involves interacting with clients, understanding their needs, and providing market insights. Effective communication skills enable traders to build trust and rapport with clients, articulate complex financial concepts clearly, and negotiate trades successfully. Additionally, strong communication fosters collaboration with other team members and departments within the firm.

What technical skills should an Institutional Sales Trader possess?

An Institutional Sales Trader should have strong technical skills, including proficiency in trading software and platforms, data analysis tools, and financial modeling. Familiarity with programming languages such as Python or Excel for quantitative analysis can be beneficial. Understanding algorithmic trading and market data feeds is also important, as it helps in making informed trading decisions and optimizing strategies.

How important is market knowledge for an Institutional Sales Trader?

Market knowledge is paramount for an Institutional Sales Trader, as it directly impacts their ability to make informed trading decisions. A thorough understanding of market trends, economic indicators, and geopolitical factors allows traders to anticipate market movements and respond accordingly. Continuous learning and staying updated with market news and developments are essential for maintaining a competitive edge in the fast-evolving financial landscape.

Conclusion

Incorporating relevant Institutional Sales Trader skills in your resume is crucial for demonstrating your expertise and suitability for the role. By showcasing your proficiency in trading strategies, market analysis, and client relations, you can effectively differentiate yourself from other candidates and illustrate the value you bring to potential employers. Remember, a well-crafted resume not only highlights your qualifications but also reflects your commitment to the profession.

As you refine your skills and tailor your application, take the opportunity to leverage resources such as resume templates, resume builder, resume examples, and cover letter templates. Keep pushing your limits and enhancing your abilities; a strong application can lead you to the career of your dreams!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.