26 Best Skills to Put on Your Indirect Tax Manager Resume [2025]

As an Indirect Tax Manager, possessing a diverse set of skills is essential for navigating the complexities of tax regulations and ensuring compliance across various jurisdictions. Highlighting these skills on your resume not only demonstrates your expertise in indirect tax management but also showcases your ability to effectively contribute to your organization's financial health. In the following section, we will outline the top skills that are crucial for success in this role, helping you to stand out in the competitive job market.

Best Indirect Tax Manager Technical Skills

Technical skills are crucial for an Indirect Tax Manager, as they ensure compliance with tax regulations and contribute to effective tax planning. Mastery of these skills allows professionals to navigate complex tax laws, optimize tax positions, and mitigate risks associated with indirect taxes such as sales tax, VAT, and GST. Below are some essential technical skills that should be highlighted on your resume.

Tax Compliance and Reporting

This skill involves ensuring that the organization complies with all relevant tax regulations and accurately reporting tax liabilities to government authorities.

How to show it: Highlight specific instances where you successfully managed tax compliance projects or audits, detailing the outcomes or savings achieved for the company.

Indirect Tax Legislation Knowledge

Understanding the current laws and regulations governing indirect taxes is essential for any Indirect Tax Manager to ensure compliance and avoid penalties.

How to show it: Include certifications or courses completed related to indirect tax legislation, and mention any instances where your knowledge contributed to successful tax strategies.

Tax Technology Proficiency

Familiarity with tax automation software and ERP systems is vital for streamlining tax processes and enhancing efficiency in tax management.

How to show it: Detail the specific software you have used, and quantify improvements in efficiency or accuracy resulting from your use of these technologies.

Data Analysis and Interpretation

Being able to analyze and interpret financial data is essential for assessing tax liabilities and identifying opportunities for tax savings.

How to show it: Provide examples of analyses you conducted that led to significant tax savings or improved compliance, along with the metrics involved.

Risk Management

Identifying and mitigating risks associated with indirect taxes is crucial to protecting the organization from potential issues and penalties.

How to show it: Describe specific risk management strategies you implemented and the measurable impact they had on reducing exposure to tax liabilities.

Audit Coordination

Coordinating and managing tax audits require strong organizational skills and a thorough understanding of tax records and documentation.

How to show it: List any audits you have successfully led or supported, emphasizing the results achieved and any issues resolved during the process.

Cross-Functional Collaboration

Working with various departments, such as finance, legal, and operations, is key to ensuring comprehensive tax compliance and strategy alignment.

How to show it: Illustrate your experience collaborating with different teams, including the outcomes of those collaborations, to demonstrate your teamwork and communication skills.

Policy Development

Developing and implementing tax policies helps organizations maintain compliance and manage indirect tax risks effectively.

How to show it: Discuss any tax policies you have created or revised, and the positive effect they had on compliance or operational efficiency.

International Tax Knowledge

Understanding international tax laws and treaties is important for organizations operating globally to manage indirect tax obligations effectively.

How to show it: Highlight any experience you have with international tax matters, including specific projects or collaborations that demonstrate your expertise in this area.

Financial Acumen

A strong grasp of financial principles and practices is essential for evaluating tax impacts on business decisions and overall financial health.

How to show it: Quantify your contributions to financial planning or decision-making processes where your tax insights were instrumental in achieving business goals.

Best Indirect Tax Manager Soft Skills

In the ever-evolving landscape of indirect taxation, soft skills play a pivotal role in an Indirect Tax Manager's ability to navigate complex challenges and collaborate effectively with various stakeholders. While technical knowledge is essential, soft skills such as communication, problem-solving, and teamwork are equally crucial for success in this role. Here are some of the top soft skills that can enhance your resume as an Indirect Tax Manager.

Communication

Effective communication skills are vital for an Indirect Tax Manager to convey complex tax regulations and strategies to team members, clients, and stakeholders clearly and persuasively.

How to show it: Highlight specific instances where you successfully communicated tax concepts to non-tax professionals, facilitated training sessions, or prepared reports that led to informed decision-making. Use metrics to showcase improvements in understanding or compliance as a result of your communication efforts.

Problem-solving

Being a proactive problem-solver enables an Indirect Tax Manager to identify issues before they escalate, providing innovative solutions to complex tax challenges.

How to show it: Provide examples of situations where you addressed significant tax issues, detailing the strategies you implemented and the positive outcomes that followed. Quantify your achievements to demonstrate your effectiveness in resolving problems.

Time Management

Strong time management skills are essential for prioritizing tasks and meeting deadlines, especially during critical reporting periods or when navigating multiple projects simultaneously.

How to show it: Detail how you managed competing deadlines, outlining your methods for prioritizing tasks and efficiently allocating resources. Use specific examples to illustrate how your time management improved productivity or compliance.

Teamwork

An Indirect Tax Manager often collaborates with various departments, making teamwork a crucial skill for fostering a cooperative work environment and achieving collective goals.

How to show it: Emphasize your experience working in cross-functional teams, highlighting successful collaborations that led to enhanced tax strategies or improved compliance. Include metrics to show the impact of teamwork on project outcomes.

Adaptability

The ability to adapt to changing regulations and business environments is essential for an Indirect Tax Manager to remain effective and compliant.

How to show it: Demonstrate your adaptability by providing examples of how you adjusted to new tax laws or changes in business processes. Use specific outcomes to illustrate your success in navigating these changes.

Attention to Detail

Attention to detail is critical in tax compliance to ensure accuracy in reporting and adherence to regulations, minimizing the risk of audits and penalties.

How to show it: Highlight instances where your meticulous approach prevented errors or led to improved accuracy in tax filings. Quantify the results to emphasize your commitment to detail.

Analytical Thinking

Analytical thinking enables an Indirect Tax Manager to assess complex tax data and derive insights that inform strategic decisions and compliance initiatives.

How to show it: Share examples where your analytical skills led to cost savings or improved compliance metrics. Use data to illustrate the impact of your analysis on decision-making processes.

Leadership

Leadership skills are essential for guiding teams, mentoring junior staff, and driving initiatives that enhance the efficiency and effectiveness of the tax function.

How to show it: Provide examples of your leadership roles, detailing how you motivated your team and achieved specific goals. Quantify the success of your leadership in terms of team performance or project outcomes.

Negotiation

Negotiation skills are vital for an Indirect Tax Manager when working with tax authorities, suppliers, or internal stakeholders to reach favorable agreements.

How to show it: Detail your experience in negotiations, focusing on the strategies you employed and the results achieved. Use specific examples to illustrate successful outcomes from your negotiation efforts.

Emotional Intelligence

Emotional intelligence helps in understanding and managing interpersonal relationships judiciously and empathetically, which is crucial for team dynamics.

How to show it: Provide examples of how you have navigated challenging interpersonal situations or motivated team members through empathy and understanding. Highlight outcomes that demonstrate your emotional intelligence in action.

Critical Thinking

Critical thinking allows an Indirect Tax Manager to evaluate complex situations, assess risks, and make informed decisions based on comprehensive analysis.

How to show it:

How to List Indirect Tax Manager Skills on Your Resume

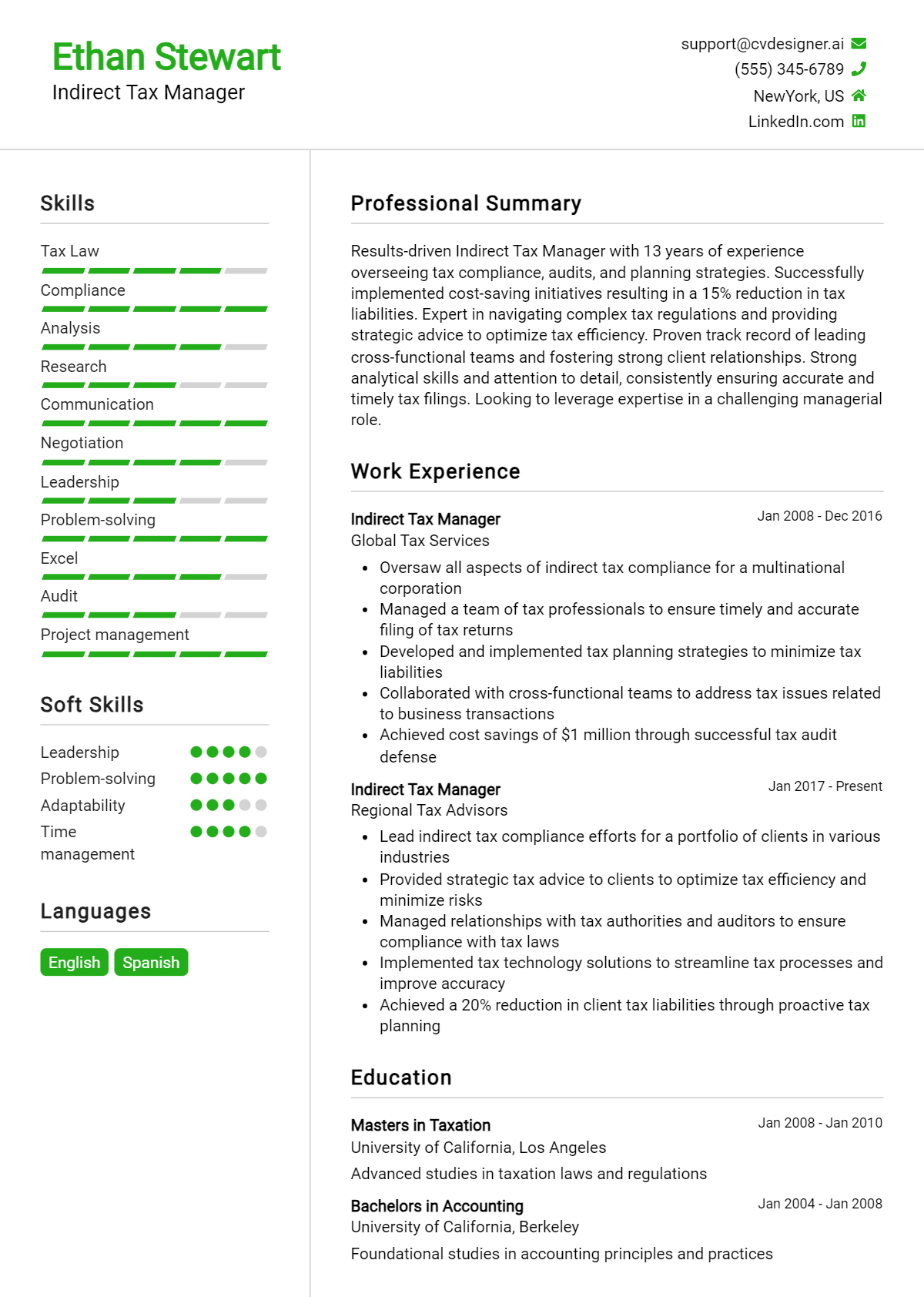

Effectively listing your skills on a resume is crucial for standing out to potential employers. Highlighting your qualifications not only demonstrates your expertise but also aligns your capabilities with the job requirements. Skills can be showcased in three main sections: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

Including Indirect Tax Manager skills in the summary section provides hiring managers with a quick overview of your qualifications. This snapshot can set the tone for the rest of your resume.

Example

As an experienced Indirect Tax Manager, I possess strong analytical and compliance skills, alongside a proven track record in strategic tax planning and risk management, ensuring effective tax solutions for organizations.

for Resume Work Experience

The work experience section is the perfect opportunity to demonstrate how you have applied your Indirect Tax Manager skills in real-world scenarios. This is where you can showcase your accomplishments and contributions.

Example

- Developed comprehensive tax compliance strategies, enhancing overall efficiency by 30% and minimizing audit risks.

- Implemented a new indirect tax processing system that improved accuracy and reduced processing time by 25%.

- Led cross-functional teams to ensure regulatory compliance and timely reporting, resulting in zero penalties.

- Conducted in-depth risk assessments to identify potential tax exposure, providing actionable recommendations to senior management.

for Resume Skills

The skills section can showcase both technical and transferable skills, providing a balanced mix of hard and soft skills. This section reinforces your qualifications as an Indirect Tax Manager.

Example

- Indirect Tax Compliance

- Tax Planning and Strategy

- Analytical Skills

- Risk Management

- Financial Reporting

- Team Leadership

- Communication Skills

- Attention to Detail

for Cover Letter

A cover letter allows you to expand on the skills mentioned in your resume while providing a more personal touch. Highlighting 2-3 key skills that align with the job description can strengthen your application.

Example

With my extensive background in tax compliance and strategic tax planning, I have successfully implemented initiatives that resulted in significant cost savings. My analytical skills allow me to assess complex tax issues and deliver effective solutions that align with business goals.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job.

The Importance of Indirect Tax Manager Resume Skills

When applying for the role of an Indirect Tax Manager, it is crucial to highlight relevant skills on your resume. A well-crafted skills section not only helps candidates to stand out to recruiters but also ensures alignment with the specific job requirements. This alignment makes it easier for hiring managers to see how your expertise can contribute to the organization's goals, ultimately increasing your chances of securing the desired position.

- Demonstrates Expertise: A strong skills section showcases your proficiency in indirect tax laws and regulations, which is essential for managing compliance and minimizing risks within the organization.

- Relevance to Job Description: Highlighting the right skills allows you to tailor your resume to the specific job description, making it more likely to catch the attention of hiring managers who are looking for candidates that meet their precise needs.

- Competitive Advantage: In a competitive job market, showcasing unique or specialized skills can give you an edge over other candidates, positioning you as a more attractive option for potential employers.

- Reflects Professional Development: Including skills that demonstrate continuous learning and adaptation to changes in tax legislation shows your commitment to professional growth and staying current in the field.

- Facilitates Interview Discussions: By emphasizing key skills on your resume, you provide a solid foundation for discussing your qualifications in interviews, allowing you to elaborate on your experiences and how they relate to the role.

- Alignment with Organizational Goals: Skills that align with the strategic aims of the company can highlight your potential contribution to achieving those objectives, making you a more appealing candidate.

- Improves ATS Compatibility: Many companies use Applicant Tracking Systems (ATS) to filter resumes. Including relevant keywords in your skills section can improve your chances of passing these automated screenings.

- Enhances Professional Image: A well-structured skills section not only organizes your qualifications but also conveys a professional image, demonstrating your attention to detail and commitment to excellence.

For more insights on crafting a compelling resume, check out these Resume Samples.

How To Improve Indirect Tax Manager Resume Skills

In the ever-evolving field of indirect tax, staying ahead of the curve is essential for success. Continuous improvement of skills not only enhances your effectiveness in managing tax compliance and strategy but also boosts your career prospects. An updated skill set reflects your commitment to professional growth and adaptability, which are highly valued in this dynamic environment.

- Participate in relevant workshops and seminars to stay updated on changes in tax laws and regulations.

- Obtain certifications or advanced degrees in tax law, finance, or accounting to deepen your expertise.

- Engage in networking with other tax professionals to share knowledge and best practices.

- Utilize online courses and resources to improve technical skills in tax software and data analysis.

- Read industry publications and journals to keep informed about trends and emerging issues in indirect tax.

- Seek feedback from peers and supervisors to identify areas for improvement and focus on developing those skills.

- Join professional organizations related to tax management to access resources and training opportunities.

Frequently Asked Questions

What are the key skills required for an Indirect Tax Manager?

An Indirect Tax Manager should possess a strong understanding of tax laws and regulations, analytical skills to interpret tax data, and expertise in tax compliance. Additionally, proficiency in accounting software and tax preparation tools is essential. Effective communication skills are also critical, as the role involves liaising with various stakeholders, including government agencies and clients, to ensure accurate tax reporting and compliance.

How important is attention to detail for an Indirect Tax Manager?

Attention to detail is crucial for an Indirect Tax Manager, as even minor errors in tax calculations or documentation can lead to significant financial penalties or compliance issues. The ability to meticulously review and analyze financial reports, tax returns, and transaction data ensures that all tax obligations are met accurately and timely, thereby minimizing risks for the organization.

What software skills are beneficial for an Indirect Tax Manager?

Proficiency in tax software such as SAP, Oracle, or Thomson Reuters is highly beneficial for an Indirect Tax Manager. Knowledge of spreadsheet applications like Microsoft Excel is also important for data analysis and reporting. Familiarity with accounting software and systems that facilitate tax compliance can streamline processes and enhance efficiency in managing indirect tax functions.

How does an Indirect Tax Manager stay updated on tax regulations?

An Indirect Tax Manager must stay informed about the ever-changing landscape of tax laws and regulations by participating in professional development activities, attending tax seminars, and subscribing to tax newsletters. Joining professional organizations, such as the Chartered Institute of Taxation, and engaging in continuous education can also provide valuable insights into regulatory updates and best practices in indirect taxation.

What role does communication play in an Indirect Tax Manager's job?

Communication is a vital skill for an Indirect Tax Manager, as the role involves explaining complex tax concepts to non-tax professionals, collaborating with cross-functional teams, and negotiating with tax authorities. Clear and effective communication ensures that all stakeholders understand tax implications and compliance requirements, which is essential for maintaining strong relationships and achieving organizational goals.

Conclusion

Incorporating the skills of an Indirect Tax Manager in your resume is essential for demonstrating your expertise and value in this specialized field. By effectively showcasing relevant skills, candidates can differentiate themselves from the competition, making a strong impression on potential employers who are seeking qualified professionals. Remember, a well-crafted resume can open doors to new opportunities, so take the time to refine your skills and enhance your application. Embrace the journey of self-improvement, and you will be one step closer to landing your ideal job.

For additional resources, check out our resume templates, utilize our resume builder, explore resume examples, and create compelling documents with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.