Top 24 Fixed Income Trader Skills to Put on Your Resume for 2025

As a Fixed Income Trader, possessing a diverse set of skills is crucial for navigating the complexities of the financial markets. A strong resume should highlight both technical and soft skills that demonstrate your ability to analyze market trends, manage risk, and execute trades effectively. In the following section, we will explore the top skills that can enhance your resume and showcase your qualifications for this dynamic role.

Best Fixed Income Trader Technical Skills

In the competitive field of fixed income trading, possessing the right technical skills is crucial for success. These skills not only enhance a trader's ability to analyze market trends and manage risk but also improve their efficiency in executing trades. When highlighting these skills on your resume, it's important to showcase your expertise and the tangible impact it has had on your trading performance.

Market Analysis

Market analysis involves the evaluation of economic indicators and market trends to make informed trading decisions. A strong understanding of market dynamics is essential for anticipating price movements.

How to show it: Detail specific analytical techniques used and the outcomes of your analyses, such as percentage increases in return on investment (ROI) or successful trades influenced by your market predictions.

Risk Management

Risk management is the process of identifying, assessing, and mitigating potential losses in trading. Effective risk management strategies can protect profits and minimize losses.

How to show it: Quantify how you reduced risk exposure through particular strategies, such as decreasing loss percentages or successfully hedging against market volatility.

Fixed Income Products Knowledge

A comprehensive understanding of fixed income products, including bonds, Treasury securities, and derivatives, is critical for executing trades and advising clients.

How to show it: Highlight your familiarity with specific products and any certifications or courses completed, along with examples of how this knowledge led to successful trading decisions.

Quantitative Analysis

Quantitative analysis utilizes mathematical models and statistical techniques to evaluate investment opportunities and assess risks effectively.

How to show it: Provide examples of quantitative models you developed or used that improved trading strategies, including any measurable results, such as enhanced accuracy in forecasting.

Financial Modeling

Financial modeling involves creating representations of a company's financial performance to aid in decision-making processes. It's vital for assessing the value of fixed income securities.

How to show it: Discuss specific financial models you built and their impact on trading decisions, along with any improvements in forecasting or investment returns.

Portfolio Management

Portfolio management is the art of making investment decisions to maximize returns while adhering to risk tolerance levels. It requires a strategic approach to asset allocation.

How to show it: Illustrate your portfolio management strategies and their outcomes, including growth percentages or performance relative to benchmarks.

Trading Platforms Proficiency

Familiarity with trading platforms is crucial for executing trades efficiently and effectively. This includes knowledge of tools and software that facilitate trading operations.

How to show it: List specific platforms you have experience with, highlighting any efficiencies gained or improvements in trade execution times as a result.

Regulatory Compliance

Understanding regulatory compliance ensures that trading activities align with legal requirements, helping to avoid penalties and maintain market integrity.

How to show it: Provide examples of how you ensured compliance in trading activities and any specific outcomes, such as maintaining a clean compliance record.

Economic Indicators Analysis

Analyzing economic indicators helps traders to assess the broader economic environment and its impact on fixed income securities.

How to show it: Detail specific indicators you tracked and how your insights influenced trading strategies, alongside any resulting performance metrics.

Communication Skills

Effective communication is essential for articulating trading strategies and insights to clients and colleagues, facilitating collaboration and decision-making.

How to show it: Highlight instances where your communication skills led to successful team collaborations or client relationships that resulted in increased trading volume or client satisfaction.

Data Analysis

Data analysis skills enable traders to interpret and utilize large datasets to make informed trading decisions based on empirical evidence.

How to show it: Discuss tools used for data analysis, such as Excel or Python, and provide examples of how data-driven decisions improved trade outcomes.

Best Fixed Income Trader Soft Skills

In the dynamic world of finance, soft skills play a pivotal role in the effectiveness of a Fixed Income Trader. While technical knowledge is essential, the ability to communicate, solve problems, manage time, and work collaboratively can significantly enhance a trader's performance and adaptability in a fast-paced environment. Below are key soft skills that can make a substantial difference in a Fixed Income Trader's career.

Effective Communication

Strong communication skills are essential for articulating complex market trends and strategies to clients and team members.

How to show it: Highlight instances where you successfully communicated investment strategies or market shifts to clients, showcasing your ability to convey complex information clearly. Use metrics to demonstrate improved client understanding or satisfaction resulting from your communication efforts.

Analytical Thinking

The ability to analyze data and trends critically is crucial for making informed trading decisions in the fixed income market.

How to show it: Include examples of successful trades that resulted from thorough analysis, emphasizing the methodologies used and the outcomes achieved.

Problem-Solving

Quick and effective problem-solving skills are vital for addressing unexpected challenges in trading environments.

How to show it: Provide specific examples of challenges faced in trading scenarios and detail the innovative solutions you implemented to overcome them, including any quantifiable results.

Time Management

Effective time management enables traders to prioritize tasks efficiently and respond promptly to market changes.

How to show it: Demonstrate your ability to manage competing priorities by describing how you successfully executed multiple trades under tight deadlines, including any metrics that reflect your efficiency.

Teamwork

Collaboration with colleagues is vital for sharing insights and strategies, fostering a cohesive trading environment.

How to show it: Discuss your role in team projects or initiatives and highlight any collaborative trades that led to successful outcomes, using specific metrics to illustrate the impact.

Adaptability

The ability to quickly adjust to market fluctuations and regulatory changes is crucial for success as a Fixed Income Trader.

How to show it: Provide examples of how you adapted trading strategies based on market conditions and the positive results that followed, emphasizing your agility in a changing environment.

Decision Making

Strong decision-making skills are essential for executing trades and managing risk effectively.

How to show it: Share a specific instance where a timely decision led to a profitable outcome, detailing the information and analysis that informed your choice.

Attention to Detail

A keen eye for detail helps traders avoid costly mistakes and ensure compliance with regulations.

How to show it: Highlight experiences where your attention to detail prevented errors or led to significant savings, including measurable outcomes, if applicable.

Emotional Intelligence

Emotional intelligence aids traders in managing stress and understanding market psychology, which is crucial for making sound decisions.

How to show it: Demonstrate instances where your emotional intelligence helped you navigate high-stress situations or improved team dynamics, potentially including feedback from peers or supervisors.

Negotiation Skills

Effective negotiation can lead to better trading terms and outcomes, making it a valuable skill for Fixed Income Traders.

How to show it: Share examples of successful negotiations that resulted in advantageous trades or improved terms, quantifying the benefits gained from those negotiations.

Networking

Building and maintaining a strong network is essential for gaining insights and opportunities in the financial markets.

How to show it: Include details about your participation in industry events, conferences, or professional organizations that expanded your network, emphasizing any resultant opportunities or collaborations.

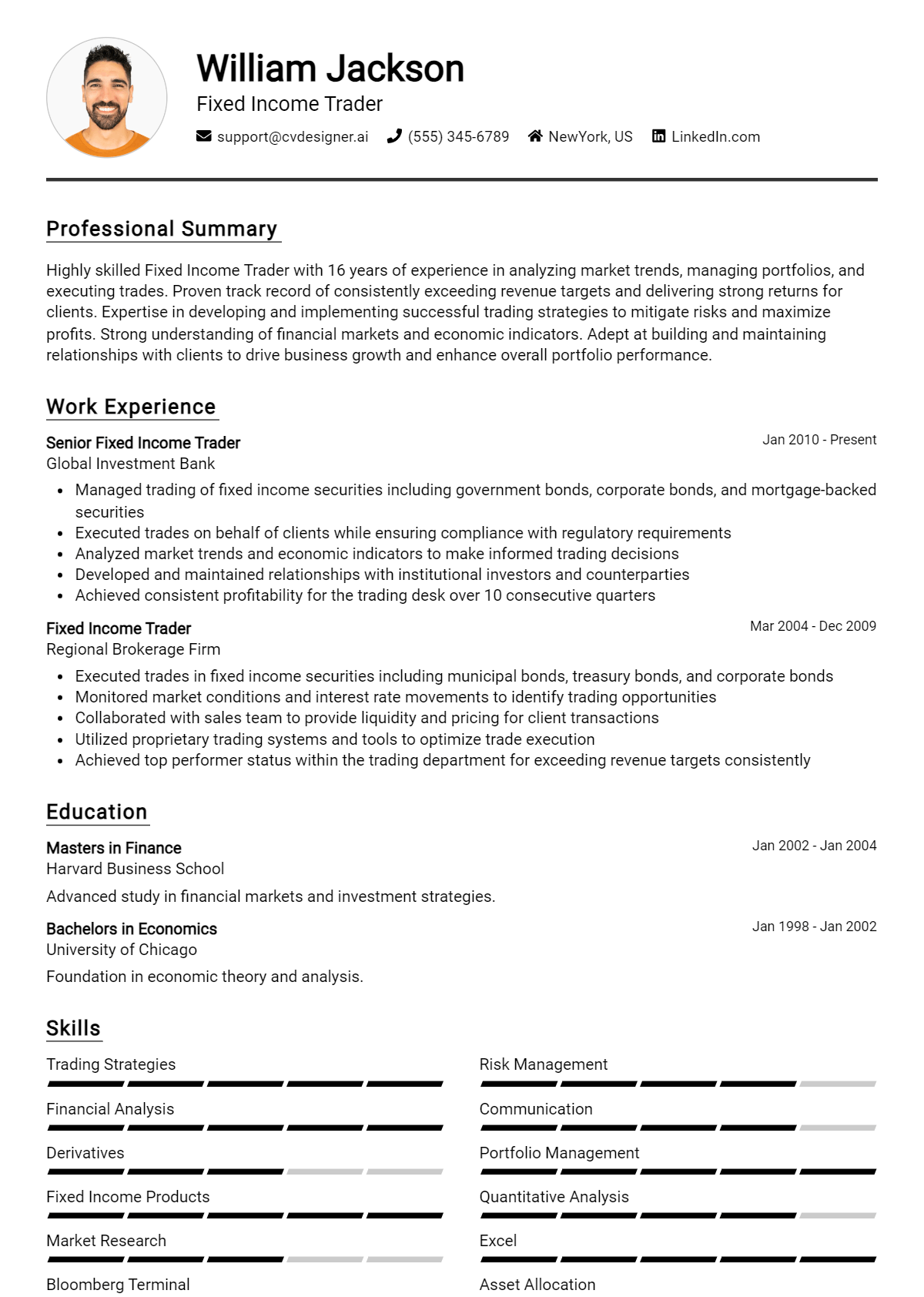

How to List Fixed Income Trader Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to employers in the competitive financial sector. Highlighting your capabilities in Fixed Income Trading can significantly enhance your application. There are three main sections where you can showcase your skills: Resume Summary, Resume Work Experience, and Resume Skills Section, along with your Cover Letter.

for Resume Summary

Including Fixed Income Trader skills in your summary section provides hiring managers with a quick overview of your qualifications and sets the tone for your resume. It’s the first chance to grab their attention.

Example

As a dedicated Fixed Income Trader with expertise in credit analysis and market research, I have successfully managed portfolios that maximize investment returns while minimizing risk exposure. My background in financial modeling further enhances my ability to drive profitable trading strategies.

for Resume Work Experience

The work experience section is your opportunity to demonstrate how your Fixed Income Trader skills have been applied in real-life situations. This is where you can show not just what you know, but how you’ve used those skills effectively.

Example

- Executed trades in corporate bonds, leveraging strong analytical skills to assess market trends.

- Collaborated with cross-functional teams to develop risk management strategies that reduced portfolio volatility by 15%.

- Utilized financial modeling techniques to identify profitable investment opportunities in the fixed income market.

- Maintained up-to-date knowledge of regulatory compliance to ensure all trading activities adhered to industry standards.

for Resume Skills

The skills section allows you to highlight both technical and transferable skills relevant to your role. A balanced mix of hard and soft skills will strengthen your qualifications and appeal to potential employers.

Example

- Credit Analysis

- Market Research

- Financial Modeling

- Risk Management

- Portfolio Management

- Regulatory Compliance

- Strong Communication Skills

- Attention to Detail

for Cover Letter

A cover letter provides an excellent platform to expand on the skills mentioned in your resume and add a personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate both your fit for the role and your past successes.

Example

In my previous role, my strong credit analysis and risk management skills enabled me to minimize losses during market fluctuations, contributing to a 20% increase in overall portfolio performance. I look forward to bringing this expertise to your team to enhance your trading strategies.

Be sure to link the skills you mention in your cover letter to specific achievements from your resume, reinforcing your qualifications for the position.

The Importance of Fixed Income Trader Resume Skills

In the competitive landscape of finance, a Fixed Income Trader must effectively showcase their relevant skills to capture the attention of recruiters. A well-crafted skills section not only highlights the candidate's qualifications but also demonstrates their alignment with the specific demands of the role. By emphasizing pertinent abilities, candidates can distinguish themselves among numerous applicants and present themselves as the ideal fit for the position.

- Strong analytical skills are crucial for a Fixed Income Trader, as they enable candidates to evaluate market trends and make informed decisions based on data. Highlighting this skill shows recruiters that you can interpret complex financial information effectively.

- Proficiency in risk management is essential for minimizing potential losses. Demonstrating experience in assessing and mitigating risks can set you apart, showcasing your ability to safeguard investments while maximizing returns.

- Familiarity with trading platforms and financial software is vital in today’s technology-driven market. By listing specific tools you’ve used, you illustrate your readiness to adapt quickly to the company's trading environment.

- Exceptional communication skills are necessary for collaborating with other traders, clients, and stakeholders. Emphasizing your ability to convey complex concepts clearly can enhance your appeal to potential employers.

- Understanding of fixed income products, such as bonds and derivatives, is fundamental for success in this role. Listing your knowledge of various instruments demonstrates your expertise and capability in navigating the fixed income landscape.

- Attention to detail can significantly impact trading outcomes. By highlighting this skill, you show recruiters that you can execute trades accurately and monitor positions closely to avoid costly mistakes.

- Adaptability in a fast-paced environment is crucial for a Fixed Income Trader. Illustrating your ability to thrive under pressure and adjust to market changes can position you as a valuable asset to any trading team.

- Lastly, showcasing strong decision-making skills can reflect your ability to act on opportunities swiftly and efficiently. This quality is highly regarded in the trading world, as timely decisions can lead to substantial gains.

For more examples of effective resumes, visit Resume Samples.

How To Improve Fixed Income Trader Resume Skills

In the fast-paced world of finance, particularly in the realm of fixed income trading, continuous skill enhancement is vital for staying competitive and effective. As market dynamics evolve and new trading strategies emerge, traders must adapt and refine their skill sets. A well-rounded resume that reflects these ongoing improvements can significantly enhance job prospects and professional growth.

- Stay updated with market trends by regularly reading financial news and reports related to fixed income securities.

- Enhance quantitative skills through courses in statistics, financial modeling, or data analysis to better assess market conditions.

- Participate in workshops or webinars focusing on advanced trading strategies and risk management techniques.

- Network with industry professionals to share insights and learn about best practices in fixed income trading.

- Obtain relevant certifications such as the Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM) to bolster your credentials.

- Utilize trading simulation software to practice and refine trading strategies without financial risk.

- Engage in self-assessment and seek feedback from peers or mentors to identify areas for improvement.

Frequently Asked Questions

What key skills should be included in a Fixed Income Trader's resume?

A Fixed Income Trader's resume should highlight skills such as analytical thinking, market knowledge, risk management, quantitative analysis, and strong communication abilities. Additionally, proficiency in trading platforms and financial modeling tools, as well as a solid understanding of economic indicators and interest rate trends, are essential for success in this role.

How important is analytical thinking for a Fixed Income Trader?

Analytical thinking is crucial for a Fixed Income Trader as it allows them to assess market conditions, evaluate the performance of various bonds, and make informed trading decisions. Traders must analyze complex data sets to identify trends, potential risks, and opportunities, ensuring they can navigate the often volatile fixed income markets effectively.

What role does risk management play in a Fixed Income Trader's job?

Risk management is a fundamental component of a Fixed Income Trader's responsibilities, as it involves identifying, assessing, and mitigating potential financial losses. Traders must develop strategies to manage exposure to interest rate fluctuations, credit risk, and market volatility, ensuring that their trading positions align with the firm's risk tolerance and investment goals.

Why are communication skills important for Fixed Income Traders?

Effective communication skills are vital for Fixed Income Traders, as they need to articulate complex market insights and trading strategies to clients, colleagues, and stakeholders. Moreover, strong communication fosters collaboration within teams and enhances the trader's ability to negotiate favorable terms with counterparties and maintain relationships in a fast-paced trading environment.

What technical skills should a Fixed Income Trader possess?

A Fixed Income Trader should be well-versed in various technical skills, including proficiency in trading software and platforms, financial modeling, and data analysis tools. Familiarity with programming languages such as Python or R can provide a competitive edge, enabling traders to automate tasks, analyze large data sets, and develop sophisticated trading strategies that enhance decision-making processes.

Conclusion

Incorporating relevant Fixed Income Trader skills into your resume is crucial for making a lasting impression on potential employers. By showcasing your expertise in areas such as market analysis, risk management, and trading strategies, you not only highlight your qualifications but also demonstrate the value you can bring to an organization. This focused approach helps you stand out in a competitive job market.

As you refine your skills and enhance your resume, remember that each improvement brings you a step closer to your desired job. Stay motivated and committed to developing your professional capabilities for a successful application process. For additional resources, consider exploring our resume templates, using our resume builder, browsing through resume examples, and checking out cover letter templates to further enhance your job application materials.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.