Top 27 Financial Compliance Officer Resume Skills with Examples for 2025

As a Financial Compliance Officer, possessing a robust set of skills is essential to navigate the complex landscape of financial regulations and ensure adherence to legal standards. This section highlights the top skills that are crucial for success in this role, enabling you to build a compelling resume that showcases your expertise in maintaining compliance and mitigating risks within an organization.

Best Financial Compliance Officer Technical Skills

In the role of a Financial Compliance Officer, possessing robust technical skills is crucial for ensuring adherence to financial regulations and standards. These skills enable professionals to identify compliance risks, manage audits, and implement effective compliance programs. Highlighting these skills on your resume can significantly enhance your candidacy in the competitive financial industry.

Regulatory Knowledge

This skill involves understanding and interpreting financial regulations and compliance laws that govern the industry, such as Sarbanes-Oxley, Dodd-Frank, and AML regulations.

How to show it: Detail specific regulations you are familiar with and provide examples of how you ensured compliance within your organization, such as implementing new policies or training staff.

Risk Assessment

Risk assessment is the ability to identify potential compliance risks and evaluate their impact on the organization’s operations and reputation.

How to show it: Quantify your contributions by describing how you conducted risk assessments that led to a reduction in compliance incidents or improved risk management strategies.

Data Analysis

This skill encompasses the ability to analyze financial data for compliance purposes, ensuring accuracy and integrity in reporting and operations.

How to show it: Include examples of data analysis projects where your findings directly contributed to compliance improvements or risk mitigation efforts, highlighting any specific metrics or outcomes.

Audit Management

Audit management involves overseeing internal and external audits, ensuring that all compliance protocols are followed and that findings are addressed promptly.

How to show it: Share details about the number of audits you managed, the audit results, and any corrective actions taken that enhanced compliance processes.

Policy Development

This skill refers to the ability to develop, implement, and update compliance policies and procedures that align with regulatory requirements and industry best practices.

How to show it: Describe specific policies you created or revised, emphasizing the impact on compliance adherence and any measurable improvements in compliance metrics.

Compliance Monitoring

Compliance monitoring includes the systematic tracking of compliance activities and the effectiveness of internal controls to ensure ongoing adherence to regulations.

How to show it: Provide examples of monitoring tools or systems you implemented, along with statistics showing improved compliance rates or early detection of issues.

Training and Education

This skill involves developing and delivering training programs to ensure that staff understands compliance requirements and the importance of adherence.

How to show it: Quantify the number of training sessions conducted and the percentage of employees who completed them, along with any subsequent compliance improvements.

Ethical Standards

Understanding and promoting ethical standards in business practices is essential for a Financial Compliance Officer to foster a culture of integrity.

How to show it: Highlight initiatives you led to promote ethical behavior and compliance culture within your organization, including any measurable outcomes or recognition received.

Legal Research

This skill entails conducting thorough research on legal regulations and compliance issues to provide accurate guidance and recommendations.

How to show it: Describe specific instances where your legal research led to significant compliance decisions or changes in policy, including any quantifiable results.

Technical Proficiency

Proficiency in compliance software and financial systems is vital for efficiently managing compliance data and reports.

How to show it: List the specific software and tools you are skilled in, and provide examples of how you used these tools to improve compliance processes or reporting accuracy.

Communication Skills

Strong communication skills are necessary for clearly conveying compliance requirements and collaborating with various stakeholders within the organization.

How to show it: Highlight instances where your communication efforts led to enhanced understanding or implementation of compliance measures, showcasing any feedback received or improvements noted.

Best Financial Compliance Officer Soft Skills

Soft skills are essential in the role of a Financial Compliance Officer, as they complement the technical knowledge required to navigate complex regulations and ensure adherence to compliance standards. These interpersonal skills enable professionals to communicate effectively, solve problems, manage time efficiently, and work collaboratively with various stakeholders. Highlighting these skills on your resume can significantly enhance your appeal to potential employers.

Attention to Detail

Attention to detail is crucial for a Financial Compliance Officer, as it ensures that all financial documents and reports are accurate and comply with regulations.

How to show it: Provide examples of how your meticulous nature led to error-free audits or compliance reports. Quantify your achievements by mentioning the percentage of error reduction you achieved in past roles.

Communication

Effective communication is vital for conveying complex compliance information to diverse audiences, including non-financial stakeholders.

How to show it: Showcase instances where your communication skills facilitated understanding among team members or clients. Reference presentations, reports, or training sessions you conducted. Learn more about communication skills.

Analytical Thinking

Analytical thinking allows a Financial Compliance Officer to assess financial data, identify trends, and make informed decisions regarding compliance strategies.

How to show it: Highlight specific projects where your analytical skills led to successful compliance initiatives or identified potential risks. Use metrics to demonstrate the impact of your analyses.

Problem-solving

Problem-solving is essential for addressing compliance-related challenges and developing solutions that align with regulatory standards.

How to show it: Detail instances where you resolved compliance issues, outlining the steps you took and the positive outcomes achieved. Use quantitative data to emphasize your success. Discover more on problem-solving skills.

Time Management

Time management is vital in balancing multiple compliance tasks, meeting deadlines, and prioritizing work effectively.

How to show it: Share examples of how you managed competing deadlines or streamlined processes to improve efficiency. Consider using specific timeframes to illustrate your capabilities. Explore time management tips.

Teamwork

Teamwork fosters collaboration among compliance teams and other departments, ensuring a unified approach to regulatory adherence.

How to show it: Provide examples of successful collaborations on compliance projects, highlighting your role in achieving team goals. Include metrics that reflect teamwork outcomes. Learn more about teamwork skills.

Adaptability

Adaptability enables Financial Compliance Officers to adjust to changes in regulations and business environments quickly.

How to show it: Discuss situations where you successfully adapted to new compliance requirements or organizational changes. Quantify the results of your adaptability in terms of improved compliance rates.

Critical Thinking

Critical thinking helps Financial Compliance Officers evaluate situations, assess risks, and make sound judgments regarding compliance practices.

How to show it: Highlight examples of how your critical thinking led to improved compliance strategies or risk assessments. Emphasize the outcomes of your decisions with quantifiable results.

Interpersonal Skills

Interpersonal skills are essential for building relationships with colleagues, clients, and regulatory bodies.

How to show it: Provide examples of how you effectively engaged with stakeholders to promote compliance initiatives, mentioning any feedback or positive responses received.

Leadership

Leadership skills empower Financial Compliance Officers to guide compliance teams and influence organizational culture regarding compliance standards.

How to show it: Detail any leadership roles you've held, emphasizing your contributions to compliance projects and the development of team members. Include metrics on team performance improvements.

Negotiation Skills

Negotiation skills are valuable for resolving conflicts related to compliance issues and reaching agreements with stakeholders.

How to show it: Share examples of successful negotiations you conducted, focusing on the outcomes and any benefits realized as a result. Quantify the impact when possible.

How to List Financial Compliance Officer Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to potential employers, particularly in a specialized field like financial compliance. There are three main sections where you can highlight your skills: Resume Introduction, Work Experience, and Skills Section.

for Summary

Showcasing your Financial Compliance Officer skills in the introduction section gives hiring managers a quick overview of your qualifications and expertise. This can set the tone for the rest of your resume.

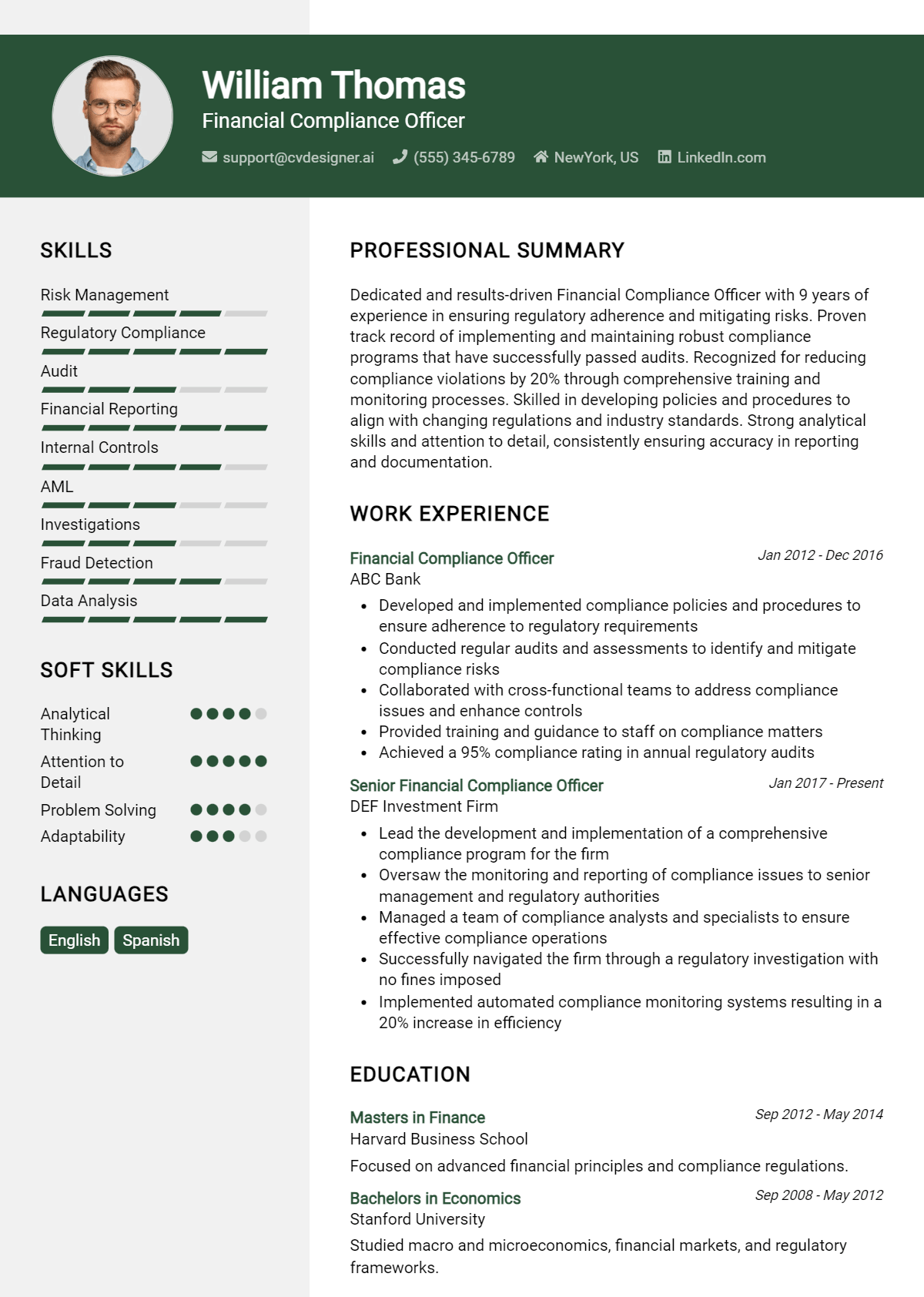

Example

Experienced Financial Compliance Officer with a strong background in regulatory adherence, risk management, and internal auditing. Proven track record of implementing compliance programs that enhance organizational integrity and reduce financial risks.

for Work Experience

The work experience section provides the perfect opportunity to demonstrate how your Financial Compliance Officer skills have been applied in real-world scenarios, showcasing your ability to deliver results.

Example

- Implemented a comprehensive compliance training program that increased employee awareness of regulatory requirements by 40%.

- Conducted detailed internal audits to identify compliance gaps, leading to a 25% reduction in regulatory penalties.

- Collaborated with cross-functional teams to develop risk assessment frameworks that improved risk management processes.

- Monitored and reported on compliance metrics to senior management, facilitating data-driven decision-making.

for Skills

The skills section can either showcase technical or transferable skills. A balanced mix of hard and soft skills should be included to present a well-rounded profile.

Example

- Regulatory Compliance

- Risk Management

- Data Analysis

- Internal Auditing

- Attention to Detail

- Communication Skills

- Problem Solving

- Ethical Judgment

for Cover Letter

A cover letter allows you to expand on the skills mentioned in your resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description will demonstrate your fit for the role.

Example

In my previous role, my strong skills in regulatory compliance and risk management allowed me to identify and mitigate compliance issues proactively, ultimately saving the company significant costs. I am eager to bring this expertise to your team and drive similar successes.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job and provides concrete evidence of your capabilities.

The Importance of Financial Compliance Officer Resume Skills

In the competitive field of financial compliance, showcasing relevant skills on your resume is crucial for capturing the attention of recruiters and hiring managers. A well-crafted skills section not only highlights your qualifications but also aligns your expertise with the specific requirements of the Financial Compliance Officer role. By emphasizing your skills, you can effectively demonstrate your ability to navigate complex regulatory environments and contribute to the organization's compliance objectives.

- Financial compliance requires a keen understanding of regulatory frameworks. Highlighting skills related to laws and regulations can set you apart as a candidate who is well-versed in compliance issues.

- Analytical skills are vital for assessing financial data and identifying potential compliance risks. Emphasizing your analytical abilities can showcase your capacity to make informed decisions based on quantitative information.

- Attention to detail is crucial in compliance roles to ensure that all regulations are met without oversight. By showcasing this skill, you can demonstrate your commitment to accuracy and thoroughness.

- Effective communication skills are necessary for conveying complex compliance requirements to various stakeholders. Highlighting your ability to communicate clearly can illustrate your proficiency in fostering collaboration and understanding within teams.

- Experience with compliance software and tools is increasingly important in the financial sector. By including these technical skills, you can show your readiness to utilize modern solutions for compliance management.

- Problem-solving skills are essential for addressing compliance issues as they arise. By emphasizing your problem-solving abilities, you can indicate your proactive approach to managing challenges in the compliance landscape.

- Time management skills are vital in ensuring that compliance reports and audits are completed on schedule. Showcasing your ability to prioritize tasks can demonstrate your effectiveness in a fast-paced environment.

- Understanding of risk management principles is key for a Financial Compliance Officer. Highlighting your knowledge in this area can position you as a candidate who can proactively mitigate compliance risks.

For more insights and examples, check out these Resume Samples.

How To Improve Financial Compliance Officer Resume Skills

In the rapidly evolving landscape of finance and regulations, it is imperative for Financial Compliance Officers to continuously enhance their skills. Keeping up-to-date with industry standards, regulatory changes, and best practices not only strengthens your resume but also ensures that your organization remains compliant and mitigates risks effectively. Here are some actionable tips to improve your skills:

- Participate in relevant certifications and training programs, such as Certified Compliance & Ethics Professional (CCEP) or Certified Regulatory Compliance Manager (CRCM).

- Stay informed about current laws and regulations by subscribing to industry newsletters, attending webinars, and following compliance-related blogs.

- Engage in networking opportunities with other compliance professionals to share insights and best practices.

- Develop strong analytical skills by practicing financial analysis and learning data interpretation techniques to identify compliance issues.

- Enhance your knowledge of risk management strategies to better assess and mitigate potential compliance risks.

- Improve your communication skills to effectively convey compliance requirements and policies to various stakeholders within the organization.

- Seek feedback on your performance from supervisors and colleagues to identify areas for improvement and set personal development goals.

Frequently Asked Questions

What are the key skills required for a Financial Compliance Officer?

A Financial Compliance Officer should possess strong analytical skills, attention to detail, and a thorough understanding of financial regulations and laws. Additionally, effective communication skills are essential for conveying compliance requirements to various stakeholders, as well as the ability to interpret complex legal documents. Proficiency in risk assessment and management, along with familiarity with compliance software, further enhances a candidate's qualifications for this role.

How important is regulatory knowledge for a Financial Compliance Officer?

Regulatory knowledge is paramount for a Financial Compliance Officer as it forms the foundation of their responsibilities. They must stay updated with local, national, and international regulations affecting the financial sector to ensure that their organization adheres to all legal requirements. This knowledge not only helps in preventing compliance breaches but also supports the development of internal policies that align with regulatory standards.

What role does risk assessment play in compliance?

Risk assessment is a critical component of a Financial Compliance Officer's duties. It involves identifying, analyzing, and mitigating financial risks that could impact the organization's compliance status. By conducting thorough risk assessments, Compliance Officers can prioritize areas that require immediate attention and implement necessary controls to minimize potential violations, thus safeguarding the organization's reputation and financial integrity.

How can a Financial Compliance Officer improve their resume skills?

A Financial Compliance Officer can improve their resume skills by pursuing relevant certifications, such as Certified Compliance and Ethics Professional (CCEP) or Certified Anti-Money Laundering Specialist (CAMS). Gaining hands-on experience through internships or entry-level positions in compliance or audit functions also enhances practical skills. Additionally, staying informed about industry trends and participating in professional development workshops can further strengthen a candidate's expertise and appeal in the job market.

What soft skills are beneficial for a Financial Compliance Officer?

Soft skills play a vital role in the effectiveness of a Financial Compliance Officer. Strong interpersonal skills are necessary for building relationships with colleagues and regulators, as well as for fostering a culture of compliance within the organization. Critical thinking and problem-solving abilities allow Compliance Officers to navigate complex regulatory challenges, while adaptability helps them respond to the ever-evolving financial landscape. Furthermore, strong organizational skills are crucial for managing multiple compliance tasks efficiently.

Conclusion

Including Financial Compliance Officer skills in a resume is crucial for demonstrating your expertise in maintaining regulatory standards and managing financial risks. By showcasing relevant skills, candidates can differentiate themselves in a competitive job market, highlighting their value to potential employers who seek professionals capable of ensuring compliance and fostering organizational integrity.

As you refine your skills and tailor your application, remember that a strong resume can open doors to exciting career opportunities. Stay motivated and leverage resources like resume templates, resume builder, resume examples, and cover letter templates to enhance your job application and make your mark in the financial compliance field.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.