Top 29 Hard and Soft Skills for 2025 Equity Trader Resumes

As an equity trader, possessing a diverse set of skills is essential to navigate the fast-paced and ever-changing financial markets. Your resume should highlight your proficiency in analytical thinking, risk management, and market research, among other key competencies. In the following section, we will delve into the top skills that can help you stand out in the competitive field of equity trading, showcasing your ability to make informed decisions and execute trades effectively.

Best Equity Trader Technical Skills

In the fast-paced world of equity trading, possessing the right technical skills is crucial for making informed decisions and executing trades effectively. These skills not only enhance a trader's performance but also demonstrate their capability to leverage technology and data analysis for optimal trading outcomes. Below are some of the top technical skills that can significantly boost an equity trader's resume.

Quantitative Analysis

Quantitative analysis involves using mathematical and statistical models to evaluate financial data and identify trading opportunities. This skill is essential for making data-driven decisions and formulating trading strategies.

How to show it: Include specific examples of models or algorithms you have developed or utilized, and quantify the impact on trading performance, such as percentage increase in returns or reduction in risk.

Technical Analysis

Technical analysis focuses on price movements and trading volumes to forecast future market behavior. Mastery of this skill enables traders to make informed decisions based on historical price patterns.

How to show it: Highlight specific techniques or indicators you are proficient in, and provide metrics that showcase your success rate in predicting market movements.

Risk Management

Risk management involves identifying, assessing, and prioritizing risks followed by coordinated efforts to minimize or control the probability of unfortunate events. It is vital for protecting capital in volatile markets.

How to show it: Demonstrate your experience in developing risk management strategies and quantify how they have successfully minimized losses or maximized gains during market downturns.

Algorithmic Trading

Algorithmic trading employs computer algorithms to execute trades at optimal prices. This skill allows traders to capitalize on market opportunities much faster than manual trading.

How to show it: Describe any algorithms you have developed or used, including their performance metrics, and how they improved trading efficiency or profitability.

Market Research

Conducting thorough market research helps traders understand market trends and economic indicators that influence stock prices. This skill is essential for making informed trading decisions.

How to show it: Detail your research methodologies and the actionable insights derived from them, along with any significant decisions made based on your findings.

Financial Modeling

Financial modeling involves creating representations of a trader's financial performance to forecast future results. It is crucial for evaluating investment opportunities and making strategic decisions.

How to show it: Provide examples of financial models you have built, their accuracy in predicting outcomes, and how they contributed to successful investment decisions.

Portfolio Management

Portfolio management is the art and science of making decisions about investment mix and policy, aligning investments to objectives, and balancing risk against performance.

How to show it: Quantify your portfolio performance metrics, detailing any strategies that led to increased returns or minimized risk during your tenure.

Trading Platforms Proficiency

Proficiency in various trading platforms is essential for executing trades efficiently and accessing market data. Familiarity with these platforms can lead to quicker decision-making.

How to show it: List specific platforms you are experienced with, and mention any certifications or training you have completed related to those platforms.

Excel and Data Analysis

Excel and data analysis skills are paramount for traders to analyze large datasets, create models, and visualize data for better decision-making.

How to show it: Include examples of complex spreadsheets or analyses you have created, and highlight any efficiencies or insights gained from them.

Understanding Market Regulations

A solid understanding of market regulations is essential for compliance and for avoiding legal pitfalls in trading activities. This knowledge ensures ethical trading practices.

How to show it: Demonstrate your awareness of relevant regulations and any training or certifications you have completed to ensure compliance in trading activities.

Best Equity Trader Soft Skills

In the fast-paced world of equity trading, possessing strong soft skills is as crucial as having technical knowledge. These workplace skills not only enhance an individual's ability to make informed decisions but also contribute to effective communication, teamwork, and problem-solving. Highlighting these competencies on your resume can set you apart in a competitive job market.

Effective Communication

Effective communication is vital for equity traders to convey complex information succinctly and clearly to clients, colleagues, and stakeholders.

How to show it: Provide examples of how you successfully communicated market trends or investment strategies, highlighting instances where clear communication led to significant client satisfaction or decision-making.

Analytical Thinking

Analytical thinking enables traders to assess market data, identify trends, and make informed decisions based on quantitative analysis.

How to show it: Quantify your achievements by detailing specific instances where your analytical skills resulted in profitable trades or minimized losses, including percentages or dollar amounts.

Problem-solving

Problem-solving skills allow equity traders to navigate unexpected challenges in the market, developing strategies to mitigate risks and seize opportunities.

How to show it: Describe particular challenges you faced in trading scenarios and how your solutions directly impacted financial outcomes, showcasing your ability to think quickly under pressure.

Time Management

Time management skills are essential for prioritizing tasks and making timely decisions that can significantly affect trading outcomes.

How to show it: Highlight your ability to manage multiple trades and deadlines effectively, citing specific achievements where efficient time management led to increased productivity or profits.

Teamwork

Teamwork is crucial in trading environments where collaboration with analysts, brokers, and other traders enhances overall trading strategies and performance.

How to show it: Share examples of successful collaborative projects or trading teams you were part of, emphasizing your role and the positive outcomes achieved through teamwork.

Adaptability

Adaptability is key for traders to respond to fluctuating market conditions and adjust strategies accordingly.

How to show it: Provide examples of how you adapted your trading strategies in response to market changes, detailing the outcomes to demonstrate your flexibility and resilience.

Attention to Detail

Attention to detail is critical in equity trading, where small errors can lead to significant financial loss.

How to show it: Discuss instances where your meticulous nature helped avoid costly mistakes or led to the identification of profitable opportunities through careful analysis.

Emotional Intelligence

Emotional intelligence enables traders to manage their emotions and understand the emotional drivers behind market movements.

How to show it: Illustrate how your emotional intelligence has helped you maintain composure during volatile market conditions and make rational decisions that benefited your trading outcomes.

Negotiation Skills

Negotiation skills are essential for traders to secure the best possible deals and terms when executing trades.

How to show it: Highlight successful negotiations you’ve conducted, detailing the benefits gained and how your negotiation skills contributed to better trading conditions.

Resilience

Resilience is important for equity traders to cope with the inevitable ups and downs of the market while maintaining a positive outlook.

How to show it: Share your experiences of overcoming setbacks in trading and how your resilience led to future successes, providing quantifiable outcomes where possible.

Critical Thinking

Critical thinking helps traders assess situations logically and make well-informed decisions based on evidence rather than emotions.

How to show it: Provide examples of how your critical thinking led to sound investment choices and successful trades, emphasizing your decision-making process and results.

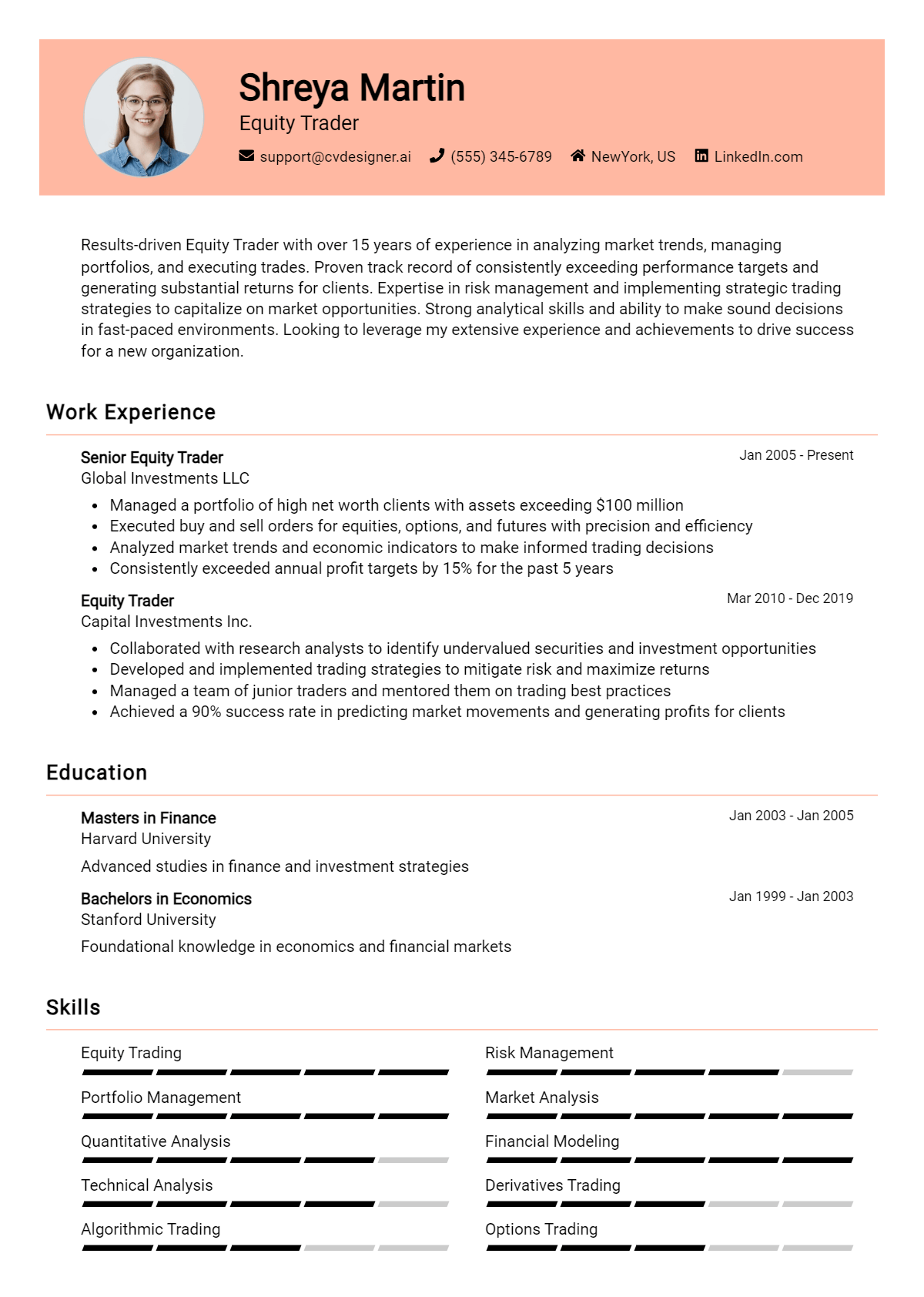

How to List Equity Trader Skills on Your Resume

Effectively listing your skills on a resume is crucial to stand out to potential employers. A well-crafted skills section can highlight your qualifications and match the requirements of the position. There are three main sections where skills can be emphasized: Resume Introduction, Work Experience, and Skills Section.

for Summary

Showcasing your Equity Trader skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications. This can make a significant impact on their decision-making process.

Example

Results-driven Equity Trader with expertise in market analysis, risk management, and portfolio diversification. Proven track record in maximizing profits while minimizing risks.

for Work Experience

The work experience section is the perfect opportunity to demonstrate how your Equity Trader skills have been applied in real-world scenarios. Tailoring this section to match the specific skills mentioned in job listings can make your application more compelling.

Example

- Executed trades with a focus on technical analysis, achieving a 20% increase in portfolio value.

- Utilized quantitative analysis to identify profitable trading opportunities, resulting in consistent returns.

- Collaborated with a team to develop a comprehensive risk management strategy that minimized losses by 15% during market downturns.

- Maintained up-to-date knowledge of market trends and financial instruments, enhancing decision-making processes.

for Skills

The skills section can showcase a mix of technical and transferable skills. Including both hard and soft skills will provide a well-rounded view of your qualifications.

Example

- Technical Analysis

- Risk Management

- Portfolio Diversification

- Market Research

- Quantitative Analysis

- Communication Skills

- Decision-Making

- Time Management

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in their resume, providing a more personal touch. Highlighting 2-3 key skills that align with the job description can illustrate how your skills have positively impacted your previous roles.

Example

In my previous role, my risk management skills contributed to a significant reduction in portfolio volatility, while my market research expertise enabled the identification of high-performing assets. These skills directly translated to a 30% increase in overall returns for our clients, reaffirming my commitment to excellence in trading.

Linking the skills mentioned in the resume to specific achievements in your cover letter will reinforce your qualifications for the job.

The Importance of Equity Trader Resume Skills

In the competitive world of finance, an Equity Trader's resume must effectively showcase a candidate's relevant skills to capture the attention of recruiters. A well-crafted skills section not only highlights the candidate's qualifications but also aligns their expertise with the specific requirements of the role. This alignment is crucial, as it can significantly enhance a candidate's chances of being selected for interviews and ultimately securing the position.

- Demonstrating analytical skills is vital for Equity Traders, as they must interpret complex data and market trends to make informed trading decisions. Highlighting these abilities can show recruiters that the candidate is equipped to navigate the fast-paced trading environment.

- Strong communication skills are essential for Equity Traders who must convey their strategies and insights effectively. A skills section that emphasizes verbal and written communication can illustrate a candidate's ability to collaborate with team members and present their ideas clearly to clients.

- Risk management is a crucial aspect of trading, and outlining skills related to assessing and mitigating risk can set a candidate apart. This demonstrates an understanding of market volatility and a proactive approach to preserving capital.

- Technical proficiency with trading platforms and financial software is increasingly important. Candidates who highlight their familiarity with specific tools can reassure recruiters of their ability to hit the ground running in a technology-driven trading environment.

- Detail-oriented candidates are often more successful in trading roles. Skills that emphasize attention to detail can indicate a candidate's ability to spot discrepancies and make precise calculations, which are key in executing trades accurately.

- Knowledge of market regulations and compliance is imperative for Equity Traders, as it ensures they operate within legal frameworks. A skills section that reflects this knowledge can demonstrate a candidate's commitment to ethical trading practices.

- Adaptability is essential in the ever-changing landscape of financial markets. Candidates who highlight their flexibility and ability to adjust strategies based on market conditions can appeal to recruiters looking for resilient team members.

- Lastly, showcasing a strong understanding of economic indicators and their impact on trading decisions can illustrate a candidate's comprehensive market knowledge. This can be a decisive factor for recruiters seeking traders who can anticipate market movements.

For further insights and examples, you can check out these Resume Samples.

How To Improve Equity Trader Resume Skills

In the fast-paced world of equity trading, continuous improvement of skills is paramount for staying competitive and achieving success. The financial markets are constantly evolving, requiring traders to adapt and refine their strategies. By enhancing your skill set, you not only increase your chances of career advancement but also improve your ability to make informed trading decisions that can lead to greater profitability.

- Attend industry seminars and workshops to stay updated on market trends and trading techniques.

- Engage in online courses focused on advanced trading strategies, technical analysis, and market psychology.

- Practice trading with simulated platforms to refine your decision-making skills without financial risk.

- Network with other traders and finance professionals to exchange insights and learn from their experiences.

- Read books and research papers on trading strategies, market behavior, and economic trends to deepen your knowledge.

- Subscribe to financial news outlets and analytical reports to stay informed about market movements and economic indicators.

- Seek mentorship from experienced traders who can provide guidance, feedback, and valuable industry insights.

Frequently Asked Questions

What are the essential skills needed for an equity trader?

Essential skills for an equity trader include strong analytical abilities, proficiency in financial modeling, and a deep understanding of market trends. Traders must also possess excellent decision-making skills, as they often need to make quick and informed choices based on real-time market data. Additionally, strong communication skills are important for collaborating with team members and conveying complex information clearly to clients.

How important is risk management for an equity trader?

Risk management is crucial for an equity trader, as it helps protect capital and ensures long-term profitability. Effective traders use various strategies to assess and mitigate potential risks, including stop-loss orders and diversification of their portfolios. Understanding risk-reward ratios and maintaining discipline in sticking to a predetermined risk strategy are key components of successful trading practices.

What technical skills should an equity trader have on their resume?

On their resume, an equity trader should highlight technical skills such as proficiency in trading platforms (e.g., Bloomberg, E*TRADE), advanced Excel skills for data analysis, and familiarity with programming languages like Python or R for quantitative analysis. Knowledge of technical analysis tools and charting software is also beneficial, as these skills enable traders to make data-driven decisions and identify market trends effectively.

How does emotional intelligence play a role in equity trading?

Emotional intelligence is vital for equity traders, as it influences their ability to manage stress, remain disciplined, and make rational decisions under pressure. Traders with high emotional intelligence can better navigate the emotional rollercoaster of market fluctuations, maintain focus, and avoid impulsive decisions. This skill also aids in building relationships with clients and colleagues, enhancing overall team dynamics and communication.

What educational background is beneficial for an equity trader?

A strong educational background in finance, economics, or business is beneficial for an equity trader. Many traders hold degrees in these fields, but additional qualifications such as a Master’s in Business Administration (MBA) or professional certifications like the Chartered Financial Analyst (CFA) can further enhance their expertise and marketability. Continuous learning through courses on trading strategies and market analysis is also advantageous in staying competitive in the industry.

Conclusion

Including Equity Trader skills in a resume is crucial for demonstrating expertise and capability in the competitive finance sector. By showcasing relevant skills, candidates not only enhance their appeal but also illustrate the unique value they can bring to potential employers. Remember, a well-crafted resume can be a powerful tool in your job search journey.

As you refine your skills and tailor your application, keep pushing yourself to stand out from the crowd. With dedication and the right resources, you can elevate your job application and move closer to your career goals. Explore our resume templates, use our resume builder, check out resume examples, and find the perfect cover letter templates to enhance your application.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.