Top 24 Derivatives Trader Skills to Put on Your Resume for 2025

As a derivatives trader, possessing a robust skill set is crucial for navigating the complexities of financial markets and making informed decisions. A well-crafted resume should highlight key competencies that demonstrate your ability to analyze market trends, manage risk, and execute trades effectively. In the following section, we will outline the top derivatives trader skills that can enhance your professional profile and increase your chances of landing your desired position in this competitive field.

Best Derivatives Trader Technical Skills

Technical skills are crucial for a Derivatives Trader as they enhance analytical capabilities, improve decision-making, and facilitate effective risk management. These skills enable traders to analyze market conditions, implement strategies, and optimize trading performance. Below are key technical skills that should be highlighted on a Derivatives Trader’s resume.

Quantitative Analysis

Quantitative analysis involves applying mathematical and statistical techniques to evaluate financial instruments and market trends. This skill is essential for assessing risk and predicting market movements.

How to show it: Quantify your experience by mentioning specific models used or statistical methods applied, and demonstrate how these analyses contributed to successful trading outcomes.

Risk Management

Risk management skills enable traders to identify, assess, and mitigate potential risks associated with trading derivatives. A solid understanding of risk management is vital for protecting capital and ensuring long-term profitability.

How to show it: Include examples of risk assessment frameworks you've implemented, along with metrics on loss reduction or improved risk-adjusted returns.

Financial Modeling

Financial modeling is the process of creating representations of a trader's financial performance, helping to forecast future performance based on historical data. Strong modeling skills allow for better investment decisions.

How to show it: Highlight specific models you've built and the insights gained from them, ideally with quantifiable forecasts versus actual results.

Data Analysis

Data analysis skills are crucial for interpreting large datasets to uncover trends and make informed trading decisions. Traders must be adept at using data analytics tools to gain competitive insights.

How to show it: Mention tools and software used for data analysis (e.g., Excel, Python) and how your analyses led to actionable strategies or improved trading performance.

Market Research

Market research skills involve gathering and analyzing data about market conditions, competitors, and economic indicators. This knowledge is vital for making informed trading decisions.

How to show it: Provide examples of research initiatives undertaken, including the impact of your findings on trading strategies or market positioning.

Technical Analysis

Technical analysis encompasses the evaluation of price movements and trading volumes to forecast future price movements. A deep understanding of technical indicators is crucial for short-term trading strategies.

How to show it: List specific technical indicators you are proficient in and describe successful trades that were based on your analysis of these indicators.

Options Pricing Models

Understanding options pricing models, such as the Black-Scholes model, is essential for valuating options and executing trades based on market expectations.

How to show it: Detail your experience with options pricing, including any successful trades that leveraged your understanding of these models.

Algorithmic Trading

Algorithmic trading involves using computer algorithms to execute trades at optimal prices. Knowledge of algorithm development is key for efficiency and speed in trading.

How to show it: Highlight any algorithms you have developed or used, along with metrics on execution speed or improved trading outcomes.

Portfolio Management

Portfolio management skills encompass the strategy of managing a collection of investments to meet specific financial goals while balancing risk and return.

How to show it: Illustrate how you have successfully managed portfolios, including performance metrics and comparisons against benchmarks.

Regulatory Knowledge

A strong understanding of financial regulations governing derivatives trading is critical for compliance and risk management. This ensures adherence to laws while maximizing trading opportunities.

How to show it: Discuss your knowledge of relevant regulations and how this knowledge has helped in navigating compliance challenges in previous roles.

Trade Execution and Management

Trade execution and management skills involve effectively placing and managing trades to optimize execution prices and minimize slippage.

How to show it: Provide examples of trade execution strategies you've employed, along with statistics on execution efficiency and profitability.

Best Derivatives Trader Soft Skills

In the fast-paced world of derivatives trading, possessing strong soft skills is just as important as technical knowledge. These interpersonal skills enable traders to effectively navigate complex market situations, communicate with stakeholders, and work collaboratively within their teams. Developing and showcasing these skills on your resume can significantly enhance your candidacy in this competitive field.

Communication

Effective communication is crucial for a derivatives trader, as it allows you to articulate strategies, market conditions, and risk assessments clearly to clients and team members.

How to show it: Highlight instances where you successfully conveyed complex financial concepts to non-expert audiences or collaborated with team members on trading strategies. Include metrics, such as increased client satisfaction or improved team efficiency.

Problem-solving

The ability to quickly identify and address issues as they arise is vital in trading, where market conditions can change rapidly and unexpected challenges can occur.

How to show it: Provide examples of how you resolved trading challenges or optimized strategies under pressure. Quantify your results, such as percentage increases in profit or reductions in risk exposure.

Time Management

Effective time management allows traders to prioritize tasks, manage multiple trades simultaneously, and make timely decisions in a fast-moving environment.

How to show it: Demonstrate your ability to meet deadlines, manage multiple trading strategies, or lead projects within specific time frames. Use metrics to illustrate your efficiency, like reduced time spent on trade execution.

Teamwork

Collaboration is essential in trading environments where team dynamics can influence decision-making and overall performance. Being a team player can foster a productive atmosphere.

How to show it: Include examples of collaborative projects or initiatives where your contribution led to improved team performance or outcomes. Mention any leadership roles or team achievements.

Adaptability

The ability to adapt to changing market conditions and unexpected events is crucial in the derivatives trading space, where flexibility can lead to better opportunities.

How to show it: Share instances where you successfully adapted your trading strategies in response to market changes. Highlight measurable outcomes like profit increases or risk mitigation.

Analytical Thinking

Traders must analyze vast amounts of data and market information to make informed decisions. Strong analytical skills help in evaluating risks and opportunities effectively.

How to show it: Provide examples of how your analytical skills contributed to successful trades or investment decisions. Quantify your impact, such as improved returns or risk assessments.

Decision-making

Quick and informed decision-making is vital in trading, where the ability to act decisively can mean the difference between profit and loss.

How to show it: Detail specific decisions that led to successful outcomes or mitigated losses. Use metrics to showcase the effectiveness of your decision-making process.

Attention to Detail

In derivatives trading, overlooking details can lead to significant financial consequences. A keen eye for detail ensures accuracy in trades and analysis.

How to show it: Highlight your meticulous approach to data analysis or trade execution. Include instances where your attention to detail prevented errors and saved money.

Negotiation Skills

The ability to negotiate effectively can lead to better trade terms and financial outcomes, making it a key skill for successful traders.

How to show it: Provide examples of successful negotiations that resulted in favorable terms or deals. Quantify the financial impact of these negotiations.

Emotional Intelligence

Emotional intelligence helps traders manage stress, read market sentiments, and communicate effectively under pressure, enhancing overall trading performance.

How to show it: Share experiences where your emotional intelligence led to better team dynamics or improved client relationships. Highlight any positive outcomes attributable to your interpersonal skills.

Networking

Building strong relationships within the industry can provide valuable insights and opportunities, making networking an essential skill for traders.

How to show it: Detail your participation in industry events, professional organizations, or online trading communities. Illustrate the benefits gained from these connections, such as new clients or partnerships.

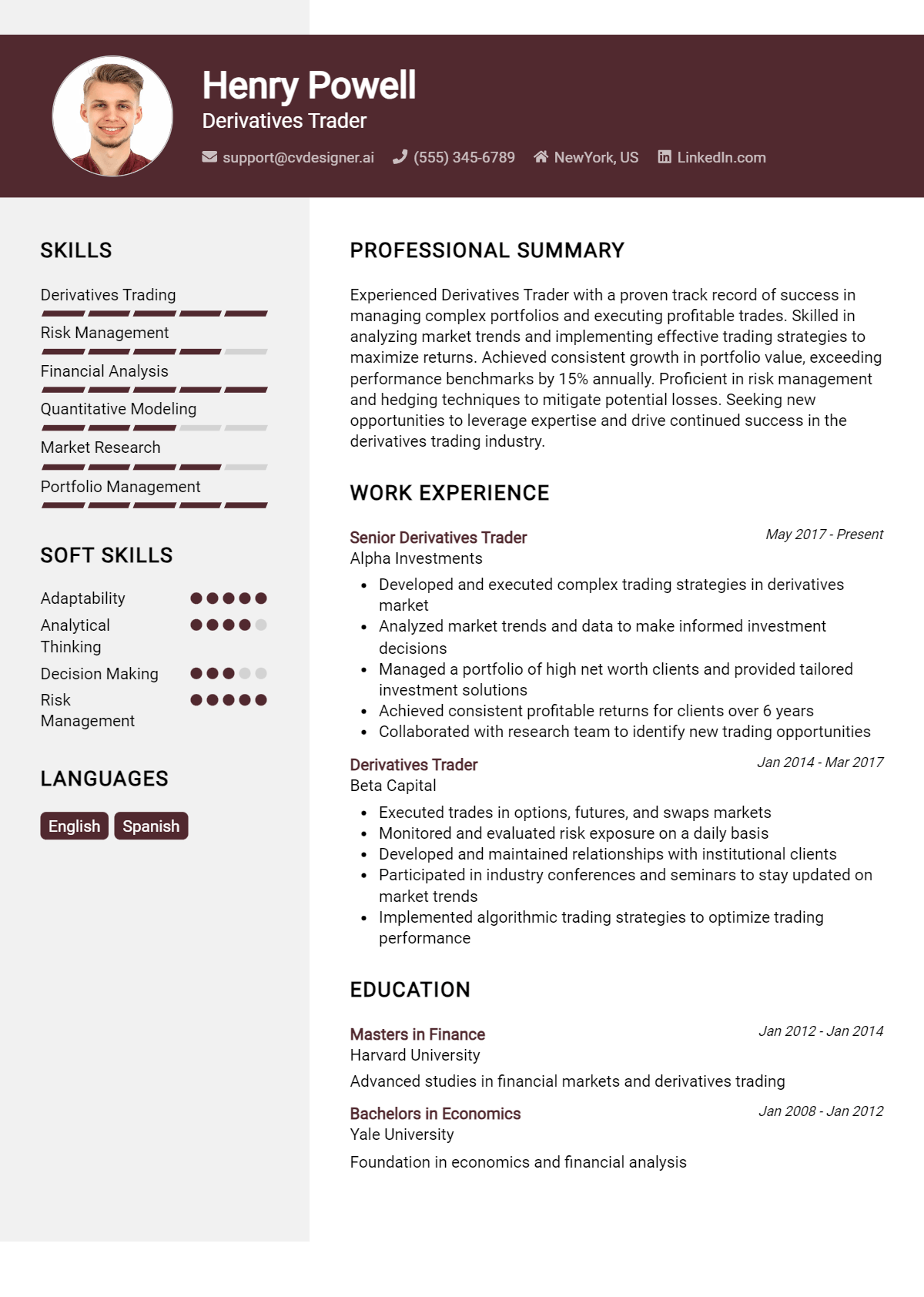

How to List Derivatives Trader Skills on Your Resume

Effectively listing your skills on a resume is crucial to capturing the attention of potential employers. A well-structured resume highlights your qualifications, making it easier for hiring managers to see your fit for the role. There are three main sections where you can showcase your skills: Resume Introduction, Work Experience, and Skills Section.

for Summary

Showcasing your Derivatives Trader skills in the introduction section provides hiring managers with a quick overview of your qualifications and sets the tone for the rest of your resume.

Example

As a dedicated Derivatives Trader with expertise in risk management and market analysis, I have consistently achieved superior results through strategic trading and team collaboration. My analytical skills and attention to detail enable me to navigate complex financial markets effectively.

for Work Experience

The work experience section is the perfect opportunity to demonstrate how your Derivatives Trader skills have been applied in real-world scenarios, showcasing the impact you've made in previous roles.

Example

- Executed complex derivative trades, utilizing quantitative analysis to inform decisions and optimize profits.

- Collaborated with teams to develop risk management strategies, resulting in a 15% reduction in trading losses.

- Trained junior traders on the use of trading platforms and market research tools, enhancing team performance.

- Utilized strong communication skills to present market insights and trading strategies to senior management.

for Skills

The skills section can showcase both technical and transferable skills, emphasizing a balanced mix of hard and soft skills that strengthen your overall qualifications.

Example

- Market Analysis

- Risk Management

- Quantitative Analysis

- Trading Platforms Proficiency

- Communication Skills

- Team Collaboration

- Financial Modeling

- Attention to Detail

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in their resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate how these skills have positively impacted your previous roles.

Example

In my previous role, my strong market analysis skills enabled me to identify lucrative trading opportunities, leading to a 20% increase in portfolio performance. Additionally, my expertise in risk management has consistently minimized losses, ensuring sustainable growth for my team and clients.

Encourage candidates to link the skills mentioned in their resume to specific achievements in their cover letter, reinforcing their qualifications for the job.

The Importance of Derivatives Trader Resume Skills

In the highly competitive field of derivatives trading, showcasing relevant skills on your resume is crucial for capturing the attention of recruiters and hiring managers. A well-crafted skills section not only highlights your qualifications but also demonstrates your alignment with the specific job requirements. This targeted approach can significantly enhance your chances of landing an interview and ultimately securing the position.

- Effective communication skills are essential for a Derivatives Trader, as they must articulate complex financial concepts and strategies to clients and team members. Clear communication helps in establishing trust and ensuring all stakeholders are on the same page.

- Analytical skills are paramount in this role, as traders must analyze vast amounts of market data to make informed decisions. The ability to interpret trends and patterns can give traders a competitive edge in executing profitable trades.

- Risk management is a core competency for any Derivatives Trader. Demonstrating a solid understanding of risk assessment and mitigation strategies on your resume can set you apart from other candidates, showcasing your ability to protect the firm's assets.

- Proficiency in trading software and tools is increasingly important in today's tech-driven market. Highlighting your experience with platforms and analytical tools can illustrate your adaptability and technical expertise, which are critical for success in the role.

- Knowledge of market regulations and compliance is vital for Derivatives Traders. A strong grasp of relevant laws and ethical trading practices not only protects the firm but also assures employers of your professionalism and integrity.

- Quantitative skills, including mathematical proficiency and data analysis, are essential for evaluating pricing models and executing trades. Emphasizing these skills can demonstrate your capability to handle complex financial computations with ease.

- Networking and relationship-building skills are important as well. A successful trader often relies on building connections within the industry to gain insights and foster collaboration, making this a key skill to highlight on your resume.

- Adaptability in a fast-paced environment is crucial for Derivatives Traders. The ability to pivot quickly in response to market changes shows resilience and a proactive approach, qualities that employers highly value.

For more insights and examples, check out these Resume Samples.

How To Improve Derivatives Trader Resume Skills

In the fast-paced and ever-evolving world of finance, it is crucial for derivatives traders to continually enhance their skills to stay competitive and effective. As market conditions change and new financial instruments emerge, traders must adapt and refine their abilities to make informed decisions and execute successful trades. By actively working on skill improvement, traders not only increase their value to employers but also boost their confidence and performance in the marketplace.

- Stay updated on market trends and news by regularly reading financial publications and following relevant online sources.

- Enhance analytical skills by taking courses in quantitative methods, statistics, or data analysis to better interpret market data.

- Practice trading with simulation software to gain hands-on experience without the financial risk associated with real trading.

- Network with other professionals in the industry to exchange insights, strategies, and best practices that can enhance your trading approach.

- Obtain certifications such as the Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM) to demonstrate your expertise and commitment to the field.

- Learn about emerging technologies, such as algorithmic trading and blockchain, to leverage innovative tools and strategies in your trading activities.

- Participate in workshops and seminars focused on derivatives trading to gain knowledge from experts and enhance your skill set.

Frequently Asked Questions

What are the essential skills required for a derivatives trader?

A derivatives trader should possess strong analytical skills, a solid understanding of financial markets, and proficiency in quantitative analysis. Expertise in risk management, trading strategies, and market psychology is crucial. Additionally, strong communication and decision-making abilities are important for effectively collaborating with team members and executing trades under pressure.

How important is knowledge of financial instruments in a derivatives trader's resume?

Knowledge of various financial instruments, including options, futures, and swaps, is vital for a derivatives trader. This expertise allows traders to analyze market trends, assess risks, and develop effective trading strategies. Highlighting this knowledge on a resume demonstrates a candidate's capability to navigate complex financial products and contributes to their overall appeal to potential employers.

What role does risk management play in the skill set of a derivatives trader?

Risk management is a central skill for derivatives traders, as it involves identifying, assessing, and mitigating potential losses in trading positions. A strong foundation in risk management enables traders to employ strategies that protect against adverse market movements, ensuring sustainable profitability. Including risk management expertise on a resume illustrates a trader's ability to prioritize safety while pursuing gains.

Why is proficiency in trading software important for derivatives traders?

Proficiency in trading software and platforms is essential for derivatives traders as it allows them to execute trades efficiently, analyze market data in real-time, and manage portfolios effectively. Familiarity with tools like Bloomberg, Reuters, or specialized trading platforms can enhance a trader's performance and is an important skill to highlight on a resume, demonstrating technical competence in a fast-paced environment.

How can strong mathematical skills benefit a derivatives trader?

Strong mathematical skills are crucial for derivatives traders, as they rely heavily on quantitative analysis to evaluate pricing models, assess risks, and implement trading strategies. A solid grasp of statistics, calculus, and financial mathematics enables traders to make informed decisions based on data-driven insights. Showcasing these mathematical abilities on a resume can significantly enhance a candidate's attractiveness to employers in the finance industry.

Conclusion

Including Derivatives Trader skills in your resume is crucial for effectively communicating your expertise and value to potential employers. By showcasing relevant skills, candidates can distinguish themselves from the competition and demonstrate their capability to contribute to the organization's success. As you refine your skills and tailor your application, remember that a well-crafted resume can open doors to exciting opportunities in the finance industry. Take the time to enhance your profile, utilize resources like resume templates, resume builder, resume examples, and cover letter templates to elevate your job application. The journey to your dream job begins with a strong presentation of your skills!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.