23 Corporate Tax Analyst Skills for Your Resume in 2025

As a Corporate Tax Analyst, possessing a diverse set of skills is crucial for effectively navigating the complexities of tax regulations and compliance. A well-rounded skill set not only enhances your ability to analyze and interpret tax laws but also empowers you to provide valuable insights and recommendations to your organization. In the following section, we will explore the top skills that can strengthen your resume and set you apart in the competitive field of corporate tax analysis.

Best Corporate Tax Analyst Technical Skills

In the dynamic field of corporate taxation, possessing the right technical skills is essential for success. A Corporate Tax Analyst must navigate complex tax laws, analyze financial data, and ensure compliance, making these skills critical for effective performance. Below are some of the top technical skills that can enhance a Corporate Tax Analyst's resume.

Tax Compliance and Regulations

Understanding federal, state, and international tax laws is fundamental for ensuring compliance and avoiding penalties. This skill enables analysts to keep the organization aligned with current regulations.

How to show it: Highlight specific experiences where you ensured compliance for previous employers, mentioning any penalties avoided or successful audits completed.

Tax Research and Analysis

Conducting thorough tax research helps in identifying opportunities for tax savings and understanding implications of tax legislation changes. This skill is crucial for strategic decision-making.

How to show it: Provide examples of tax research projects you led and quantify the potential savings or strategic advantages gained for the organization.

Data Analysis and Interpretation

Being able to analyze and interpret financial data is vital for making informed tax-related decisions. This skill allows analysts to derive insights from large datasets.

How to show it: Use specific metrics or results from your analysis that contributed to business decisions or improved tax positions.

Tax Software Proficiency

Familiarity with tax preparation and compliance software is essential for efficiently managing tax filings and calculations. This skill increases productivity and accuracy in tax reporting.

How to show it: List the specific software you are proficient in and describe how you utilized it to streamline processes or improve reporting accuracy.

Financial Reporting

Understanding financial statements and their implications for tax reporting is crucial for a Corporate Tax Analyst. This skill helps in identifying tax liabilities and opportunities.

How to show it: Demonstrate your experience with financial reports by citing examples where your analysis influenced tax strategies or reporting outcomes.

Project Management

Managing tax-related projects ensures timely and accurate completion of tax filings and compliance tasks. This skill is important for coordinating between departments and meeting deadlines.

How to show it: Highlight your role in managing specific tax projects, detailing timelines, team coordination, and outcomes achieved.

Communication Skills

Effective communication is critical for conveying complex tax information to stakeholders. This skill aids in ensuring all parties understand tax implications and compliance requirements.

How to show it: Provide examples of presentations or reports you created that successfully communicated tax strategies or outcomes to non-tax professionals.

Knowledge of International Taxation

In a globalized business environment, understanding international tax laws and treaties is vital for multinational corporations. This skill helps in managing cross-border tax issues.

How to show it: Detail experiences dealing with international tax matters, including any specific results achieved in reducing tax liabilities or ensuring compliance.

Attention to Detail

Tax analysis requires a high level of precision to avoid costly errors. This skill is crucial for reviewing documents and ensuring all tax filings are accurate.

How to show it: Highlight instances where your attention to detail prevented errors or facilitated successful audits or filings.

Regulatory Change Management

Staying updated with changes in tax legislation is necessary for compliance and strategic planning. This skill enables analysts to proactively adjust strategies in response to new regulations.

How to show it: Provide examples of how you adapted to recent regulatory changes and the impact your adjustments had on the company's tax position.

Risk Assessment

Evaluating tax-related risks and developing strategies to mitigate them is essential for protecting the organization from potential liabilities. This skill is vital for proactive tax management.

How to show it: Quantify the risks you assessed and the measures implemented to mitigate them, providing insights into your strategic foresight.

For more information on how to effectively present your technical skills, check out [Technical Skills](https://resumedesign.ai/technical-skills/).

Best Corporate Tax Analyst Soft Skills

In the fast-paced world of corporate tax analysis, possessing strong soft skills is just as crucial as having technical expertise. These interpersonal and organizational skills enable Corporate Tax Analysts to navigate complex projects, communicate effectively with stakeholders, and work collaboratively within teams. Highlighting these skills on your resume can set you apart from other candidates and demonstrate your ability to contribute to a successful corporate environment.

Communication

Effective communication is essential for Corporate Tax Analysts, as they must convey complex tax regulations and findings to non-specialist stakeholders.

How to show it: Highlight experiences where you successfully presented tax findings to management or collaborated with cross-functional teams. Use metrics to demonstrate improved understanding or compliance rates.

Analytical Thinking

Analytical thinking allows Corporate Tax Analysts to interpret data and identify trends, enabling informed decision-making for tax strategies.

How to show it: Provide examples of how you analyzed tax data to uncover savings or efficiencies. Quantify the financial impact of your analyses in your resume.

Problem-Solving

Problem-solving skills are critical when addressing tax-related challenges and developing innovative solutions that comply with regulations.

How to show it: Describe specific situations where you resolved compliance issues or optimized tax processes. Include measurable outcomes to illustrate your effectiveness.

Attention to Detail

Attention to detail ensures accuracy in tax filings and compliance with regulations, reducing the risk of costly errors.

How to show it: Share instances where your meticulous approach prevented errors or led to successful audits. Use percentages or figures to showcase your impact.

Time Management

Time management is vital for meeting deadlines, especially during tax season when multiple projects occur simultaneously.

How to show it: Illustrate your ability to prioritize tasks and meet tight deadlines. Mention specific projects where your time management led to successful outcomes.

Teamwork

Teamwork fosters collaboration among tax professionals and other departments, ensuring smooth operations and comprehensive tax strategies.

How to show it: Include examples of collaborative projects, emphasizing your role in achieving team goals. Quantify any successes that resulted from effective teamwork.

Adaptability

Adaptability is critical in a constantly changing regulatory environment, allowing Corporate Tax Analysts to adjust strategies as needed.

How to show it: Provide examples of how you adapted to new tax laws or changes in company policy. Highlight any positive results of your flexibility.

Research Skills

Strong research skills are essential for keeping up with evolving tax laws and identifying applicable strategies for the organization.

How to show it: Demonstrate your ability to conduct thorough research by citing specific instances where your findings shaped tax strategies. Detail any significant insights gained.

Critical Thinking

Critical thinking enables Corporate Tax Analysts to assess situations logically and make decisions based on sound reasoning.

How to show it: Detail experiences where your critical thinking led to effective tax solutions or strategic planning. Use examples that showcase your thought process and outcomes.

Negotiation Skills

Negotiation skills are important for working with external auditors and regulatory bodies, ensuring favorable outcomes for the company.

How to show it: Include examples of successful negotiations that resulted in advantageous agreements or settlements. Quantify the benefits to the organization.

Interpersonal Skills

Interpersonal skills facilitate strong relationships with colleagues and clients, promoting a collaborative work environment.

How to show it: Showcase your ability to develop rapport with stakeholders by describing collaborative projects or successful interactions. Highlight feedback received from team members.

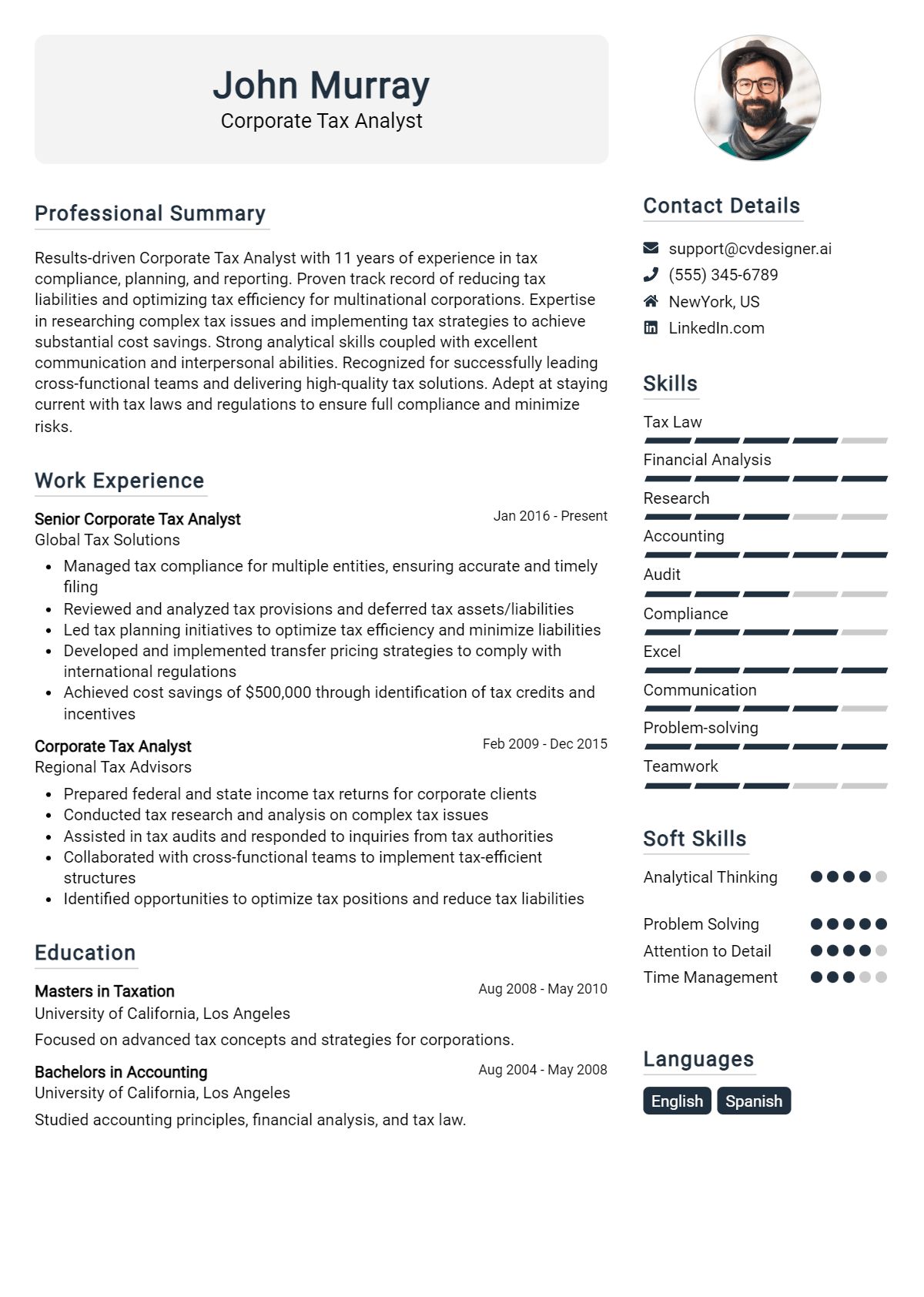

How to List Corporate Tax Analyst Skills on Your Resume

Effectively listing your skills on a resume is crucial for catching the attention of potential employers. Highlighting your qualifications in a clear and organized manner can make a significant difference. There are three main sections where you can showcase your skills: Resume Introduction, Work Experience, and Skills Section.

for Summary

By showcasing your Corporate Tax Analyst skills in the introduction section, you can provide hiring managers with a quick overview of your qualifications and set the tone for the rest of your resume.

Example

As a Corporate Tax Analyst with expertise in tax compliance, financial analysis, and regulatory knowledge, I excel at identifying tax-saving opportunities and improving financial reporting accuracy.

for Work Experience

The work experience section offers an excellent opportunity to demonstrate how your Corporate Tax Analyst skills have been applied in real-world scenarios, showcasing your contributions to previous employers.

Example

- Conducted comprehensive tax research to ensure compliance with federal and state regulations, resulting in a 15% reduction in audit findings.

- Utilized data analysis tools to prepare accurate quarterly and annual tax returns, enhancing reporting efficiency by 20%.

- Collaborated with cross-functional teams to streamline financial reporting processes, improving departmental productivity.

- Trained and mentored junior staff on tax regulations and compliance best practices, fostering a culture of continuous learning.

for Skills

The skills section can effectively showcase both technical and transferable skills. A balanced mix of hard and soft skills should be included to strengthen your overall qualifications.

Example

- Tax Compliance

- Financial Analysis

- Data Interpretation

- Regulatory Knowledge

- Attention to Detail

- Problem-Solving Skills

- Communication Skills

- Team Collaboration

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in their resume, providing a more personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate how those skills have positively impacted your previous roles.

Example

In my previous role, my expertise in tax compliance and financial analysis led to a significant reduction in liabilities and improved reporting accuracy. I am excited about the opportunity to bring this experience to your team and contribute to your company’s success.

Linking the skills mentioned in your resume to specific achievements in your cover letter can reinforce your qualifications for the job.

The Importance of Corporate Tax Analyst Resume Skills

In the competitive landscape of corporate finance, the role of a Corporate Tax Analyst is crucial for ensuring compliance and optimizing tax strategies. Highlighting relevant skills in your resume not only showcases your qualifications but also demonstrates your understanding of the job's demands. A well-crafted skills section can help candidates stand out to recruiters by aligning their expertise with the specific requirements of the role, making a strong case for their candidacy.

- Demonstrates Relevant Expertise: Including specific skills reflects your understanding of corporate tax regulations and practices, which is essential for the role.

- Aligns with Job Requirements: Tailoring your skills to match the job description helps recruiters see that you are a suitable fit for the position.

- Enhances Marketability: A focused skills section boosts your marketability by showcasing your unique qualifications and making your resume more attractive to potential employers.

- Facilitates Quick Screening: Recruiters often scan resumes for key skills; highlighting them can ensure your application passes initial screenings.

- Showcases Problem-Solving Abilities: Skills related to analysis and compliance demonstrate your capability to handle complex tax issues and provide valuable solutions.

- Indicates Professional Development: Listing advanced skills or certifications shows a commitment to continuous learning and staying updated in the field.

- Supports a Strong Narrative: Skills can help weave a coherent story about your professional background, linking your experiences to your potential contributions.

For additional insights and examples, check out these Resume Samples.

How To Improve Corporate Tax Analyst Resume Skills

In the rapidly evolving world of corporate taxation, it's essential for tax analysts to continuously enhance their skills to stay competitive and effectively navigate the complexities of tax laws and regulations. By improving your skills, you not only increase your value to potential employers but also ensure your ability to provide accurate and strategic tax advice. Here are some actionable tips to help you enhance your skills as a Corporate Tax Analyst:

- Stay updated on tax laws and regulations by subscribing to reputable tax journals and attending industry webinars.

- Enhance your analytical skills by engaging in regular practice with tax software and tools commonly used in the industry.

- Develop your communication skills by participating in workshops or courses focused on delivering clear and concise tax-related information to non-tax professionals.

- Network with other tax professionals through industry conferences or local tax associations to share insights and learn about best practices.

- Seek mentorship from experienced tax professionals to gain valuable insights and guidance on complex tax issues.

- Consider obtaining relevant certifications such as the CPA or Enrolled Agent to demonstrate your expertise and commitment to the field.

- Regularly review case studies and real-world scenarios to improve your problem-solving skills and apply theoretical knowledge in practical settings.

Frequently Asked Questions

What are the essential skills for a Corporate Tax Analyst?

A Corporate Tax Analyst should possess strong analytical skills, attention to detail, and proficiency in tax regulations and compliance. Additionally, skills in financial reporting, data analysis, and effective communication are crucial for interpreting tax data and presenting findings to stakeholders. Familiarity with tax software and tools is also valuable to streamline processes and improve accuracy.

How important is knowledge of tax laws for a Corporate Tax Analyst?

Knowledge of tax laws is paramount for a Corporate Tax Analyst, as it forms the foundation for ensuring compliance and minimizing tax liabilities for the corporation. A thorough understanding of federal, state, and international tax regulations allows analysts to navigate complex tax codes, identify potential risks, and advise on tax planning strategies that align with the company's financial goals.

What software skills are beneficial for a Corporate Tax Analyst?

Proficiency in tax preparation and compliance software, such as Intuit ProConnect or Thomson Reuters UltraTax, is highly beneficial for a Corporate Tax Analyst. Additionally, strong skills in Microsoft Excel for data manipulation and analysis, as well as experience with ERP systems, can enhance efficiency in managing tax data and generating reports. Familiarity with data visualization tools may also assist in presenting tax-related insights effectively.

How does analytical thinking play a role in a Corporate Tax Analyst's job?

Analytical thinking is critical for a Corporate Tax Analyst as it enables them to evaluate complex tax situations, assess financial impacts, and devise strategic solutions. This skill helps in identifying patterns in financial data, forecasting tax liabilities, and conducting thorough reviews of tax returns to ensure accuracy and compliance. Strong analytical abilities also support effective problem-solving and decision-making in tax planning and risk management.

What communication skills are necessary for a Corporate Tax Analyst?

Effective communication skills are essential for a Corporate Tax Analyst to convey complex tax concepts to non-tax professionals and collaborate with various departments. This includes the ability to prepare clear and concise reports, deliver presentations, and engage in discussions with stakeholders regarding tax strategies and compliance issues. Strong interpersonal skills also facilitate collaboration with external auditors and tax authorities, enhancing overall operational effectiveness.

Conclusion

Including Corporate Tax Analyst skills in a resume is crucial for demonstrating your expertise and suitability for the role. By showcasing relevant skills, candidates can significantly stand out in a competitive job market, providing added value to potential employers who are looking for individuals that can navigate the complexities of corporate taxation effectively.

As you refine your skills and enhance your resume, remember that preparation and presentation are key to a successful job application. Take the time to explore our resume templates, utilize our resume builder, review resume examples, and check out our cover letter templates to elevate your application. Stay committed to your professional growth, and you will undoubtedly find the opportunity that aligns with your aspirations.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.