39 Budget Analyst Resume Skills That Stand Out in 2025

As a Budget Analyst, showcasing your skills effectively on your resume is crucial to stand out in a competitive job market. Employers look for candidates who possess a strong blend of analytical abilities, financial acumen, and communication skills. In this section, we will outline the top skills that can enhance your resume and demonstrate your qualifications for the role of a Budget Analyst. These skills not only reflect your expertise in budget management but also your ability to contribute to an organization's financial health and strategic planning.

Best Budget Analyst Technical Skills

Technical skills are crucial for a Budget Analyst as they enable professionals to analyze financial data, create budgets, and inform strategic decisions effectively. Mastering these skills not only enhances job performance but also increases employability in a competitive market.

Financial Modeling

Financial modeling is essential for predicting a company’s financial performance based on historical data and future projections. This skill helps Budget Analysts create robust budgets that align with organizational goals.

How to show it: Include specific examples of financial models you’ve developed for budgeting purposes and highlight any impacts on financial decision-making or savings achieved.

Data Analysis

Proficiency in data analysis allows Budget Analysts to interpret complex financial data and identify trends that inform budgeting decisions. This skill is vital for making data-driven recommendations.

How to show it: Demonstrate your ability to analyze data by citing instances where your analysis led to improved budget allocations or cost savings.

Excel Proficiency

Excel is a fundamental tool for Budget Analysts, used for creating spreadsheets, performing calculations, and visualizing data. Advanced Excel skills, including pivot tables and macros, are particularly valuable.

How to show it: List specific Excel functions you are skilled in and provide examples of how you used these functions to enhance financial reporting or budget tracking.

Budgeting Software

Familiarity with budgeting software (like Oracle Hyperion, Adaptive Insights, or SAP BPC) is essential for efficiently managing budgets and forecasts. These tools streamline the budgeting process and improve accuracy.

How to show it: Highlight your experience with specific tools, mentioning any projects where you successfully implemented or utilized budgeting software to achieve results.

Financial Reporting

Creating and analyzing financial reports is a key responsibility for Budget Analysts, aiding in performance evaluation and strategic planning. Accurate reporting ensures stakeholders make informed decisions.

How to show it: Include details about the types of financial reports you’ve generated and how they contributed to strategic initiatives or improved financial performance.

Forecasting

Forecasting skills are vital for predicting future financial trends and budgeting needs. This involves analyzing historical data to make sound financial predictions that guide budget planning.

How to show it: Provide examples of successful forecasts you’ve made and how they influenced budget decisions or organizational strategy.

Cost Analysis

Cost analysis is critical for identifying areas where a budget can be optimized. It helps Budget Analysts evaluate the costs associated with different projects or departments.

How to show it: Highlight instances where your cost analysis led to significant savings or more efficient resource allocation.

Presentation Skills

The ability to present financial data clearly and persuasively is essential for Budget Analysts. Strong presentation skills facilitate effective communication with stakeholders.

How to show it: Share examples of presentations you’ve delivered, especially those that resulted in key budget decisions or stakeholder buy-in.

Regulatory Knowledge

Understanding financial regulations and compliance is crucial for Budget Analysts to ensure that budgets align with legal requirements and organizational policies.

How to show it: Discuss your familiarity with relevant regulations and any instances where your knowledge helped avert compliance issues.

Risk Management

Risk management skills enable Budget Analysts to identify and mitigate financial risks associated with budgets and forecasts, ensuring more reliable financial planning.

How to show it: Include examples of risk assessments you’ve conducted and the strategies you implemented to mitigate identified risks.

Communication Skills

Effective communication is vital for Budget Analysts to relay complex financial information to non-financial stakeholders. Clear communication fosters collaboration and understanding.

How to show it: Provide examples of how your communication skills led to successful collaborations or improved understanding of budgetary issues among team members.

For more insights into showcasing your technical skills, visit Technical Skills.

Best Budget Analyst Soft Skills

In the role of a Budget Analyst, soft skills are just as essential as technical skills. These interpersonal abilities enhance collaboration, communication, and problem-solving, allowing analysts to effectively navigate the complexities of budgeting processes. Highlighting these skills on your resume can set you apart from other candidates and demonstrate your readiness for the challenges of the role.

Analytical Thinking

Analytical thinking is crucial for a Budget Analyst as it enables them to assess complex financial data, identify trends, and make informed decisions.

How to show it: Highlight specific instances where your analytical skills led to improved budgeting outcomes or cost savings. Use quantitative data to illustrate your impact, such as percentage increases in efficiency or reductions in unnecessary expenditures.

Communication

Strong communication skills are vital for conveying complex financial information to stakeholders who may not have a financial background.

How to show it: Provide examples of successful presentations or reports you created that clarified budgetary issues. Mention any feedback received from team members or management that underscores your ability to communicate effectively. For further insights, check our dedicated section on Communication.

Problem-solving

Budget Analysts frequently encounter unexpected financial issues, making problem-solving skills essential for developing viable solutions quickly.

How to show it: Detail specific challenges you faced in previous roles and the innovative solutions you implemented. Quantify the results, such as how much time or money your solutions saved. For more tips, explore our section on Problem-solving.

Time Management

Effective time management allows Budget Analysts to meet tight deadlines while maintaining accuracy in their work.

How to show it: Share examples of how you prioritized tasks during peak budgeting periods, including any specific tools or techniques you used to stay organized. Highlight any projects completed ahead of schedule. For more insights, visit our article on Time Management.

Teamwork

Collaboration with various departments is crucial for gathering accurate data and ensuring a unified approach to budget management.

How to show it: Discuss your role in team projects and how your contributions led to successful outcomes. Mention any cross-departmental collaborations and the positive impact they had on the budgeting process. You can find more on this in our section about Teamwork.

Attention to Detail

Attention to detail is essential for spotting inconsistencies and ensuring accuracy in financial reports and budgets.

How to show it: Provide examples of how your attention to detail helped prevent errors in financial documents or led to better budget forecasts. Use specific figures to illustrate your contributions.

Adaptability

Adaptability is important in a rapidly changing financial environment, enabling Budget Analysts to adjust their strategies as needed.

How to show it: Share experiences where you successfully adapted to changes in financial regulations or organizational shifts. Highlight measurable outcomes that resulted from your flexibility.

Interpersonal Skills

Interpersonal skills facilitate effective collaboration and the ability to build relationships with colleagues and stakeholders.

How to show it: Discuss instances where your interpersonal skills helped resolve conflicts or foster teamwork. Quantify the positive impact of your relationships on project outcomes.

Critical Thinking

Critical thinking allows Budget Analysts to evaluate various financial scenarios and make sound recommendations based on data analysis.

How to show it: Include examples of decisions you made based on critical analysis and the results that followed. Use specific metrics to showcase your success.

Negotiation Skills

Negotiation skills are beneficial for Budget Analysts when working with vendors or negotiating budget allocations with management.

How to show it: Describe any successful negotiations you were involved in, including the outcomes and benefits to the organization. Quantify the savings or improvements achieved through your negotiation efforts.

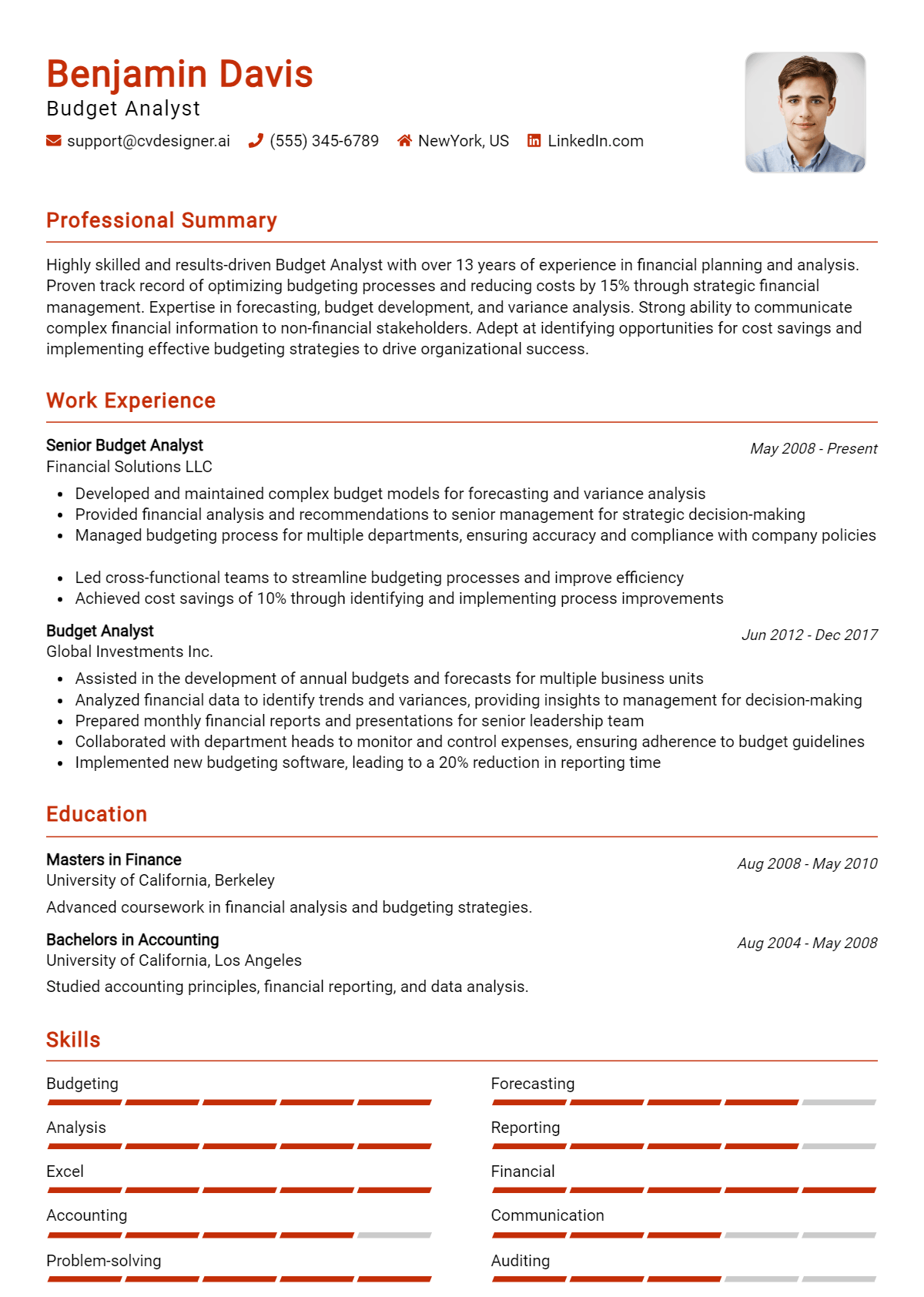

How to List Budget Analyst Skills on Your Resume

Effectively listing your skills on a resume is crucial to capturing the attention of hiring managers. A well-crafted skills section not only highlights your qualifications but also aligns with the job requirements. There are three main sections where you can showcase your skills: Resume Introduction, Work Experience, and Skills Section.

for Summary

Showcasing your Budget Analyst skills in the introduction gives hiring managers a quick overview of your qualifications, setting a strong first impression.

Example

As a detail-oriented Budget Analyst with expertise in financial forecasting, cost analysis, and budget management, I excel in providing data-driven insights and strategic recommendations to enhance organizational efficiency.

for Work Experience

The work experience section is your chance to demonstrate how you've applied your Budget Analyst skills in real-world scenarios, showcasing your impact and value to previous employers.

Example

- Developed and managed annual budgets totaling over $1 million, ensuring compliance with financial regulations.

- Conducted comprehensive cost analysis to identify savings opportunities, resulting in a 15% reduction in operational costs.

- Collaborated with cross-functional teams to forecast financial outcomes, enhancing decision-making processes.

- Implemented a new budget tracking system that improved reporting accuracy by 30%.

for Skills

The skills section can highlight both technical and transferable skills. A balanced mix of hard and soft skills enhances your overall qualifications and appeal to employers.

Example

- Financial Analysis

- Budget Management

- Data Interpretation

- Cost Control

- Strategic Planning

- Communication Skills

- Attention to Detail

- Problem-solving

for Cover Letter

A cover letter allows you to expand on the skills mentioned in your resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can illustrate your fit for the role.

Example

In my previous role, my expertise in financial forecasting and cost analysis enabled my team to make informed budgetary decisions, which improved efficiency and reduced expenses by 20%. I am excited to bring this experience to your organization.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job.

The Importance of Budget Analyst Resume Skills

Highlighting relevant skills on a Budget Analyst resume is crucial for candidates looking to capture the attention of recruiters. A well-crafted skills section not only showcases a candidate's qualifications but also aligns their expertise with the specific job requirements outlined in the job description. By emphasizing the right skills, candidates can effectively demonstrate their value and suitability for the role, setting themselves apart in a competitive job market.

- Effective communication skills are essential for a Budget Analyst, as they need to convey complex financial information clearly to stakeholders. This ability helps in building trust and ensuring that all parties are on the same page.

- Proficiency in financial modeling and analysis allows Budget Analysts to create accurate forecasts and budget proposals. Strong analytical skills enable them to interpret data effectively, leading to informed decision-making.

- Attention to detail is a critical skill for Budget Analysts, as even small errors in budgets can lead to significant financial discrepancies. This skill ensures precision in financial reporting and analysis.

- Familiarity with budgeting software and tools is increasingly important as technology evolves. Knowledge of these tools enhances efficiency and accuracy in budget preparation and tracking.

- Strong organizational skills are necessary for managing multiple budgets and deadlines. Effective organization helps Budget Analysts prioritize tasks and ensures that financial reports are submitted on time.

- Problem-solving abilities are vital for addressing financial discrepancies and developing strategies to stay within budget. This skill helps Budget Analysts navigate challenges effectively and propose viable solutions.

- Understanding of regulatory compliance and financial regulations is key for Budget Analysts to ensure that budgets adhere to legal standards. This knowledge minimizes the risk of penalties and enhances the organization’s credibility.

- Collaboration skills allow Budget Analysts to work effectively with various departments, facilitating a comprehensive approach to budgeting. This teamwork fosters a supportive environment for achieving financial goals.

For more information on crafting an effective resume, you can visit this resume resource.

How To Improve Budget Analyst Resume Skills

In the dynamic field of finance, staying ahead of the curve is essential for a Budget Analyst. Continuous improvement of your skills not only enhances your effectiveness in managing budgets but also makes your resume more appealing to potential employers. By honing your abilities, you can adapt to the evolving financial landscape and contribute meaningfully to your organization's success.

- Engage in relevant financial training programs to strengthen your analytical capabilities.

- Familiarize yourself with advanced budgeting software and tools to streamline your processes.

- Attend workshops or webinars focused on financial forecasting and analysis techniques.

- Network with other finance professionals to share insights and best practices.

- Stay updated on industry trends and regulations that affect budgeting practices.

- Obtain certifications such as Certified Government Financial Manager (CGFM) or Certified Management Accountant (CMA) to enhance your credentials.

- Seek feedback from colleagues and supervisors to identify areas for improvement in your analytical approach.

For additional guidance on crafting a compelling resume, consider exploring resources that focus on effective presentation of your skills and experiences.

Frequently Asked Questions

What are the essential skills required for a Budget Analyst?

Essential skills for a Budget Analyst include strong analytical abilities, proficiency in financial modeling, and expertise in data interpretation. Additionally, familiarity with budgeting software, attention to detail, and excellent communication skills are crucial for effectively presenting financial information and collaborating with various departments.

How important is proficiency in Excel for a Budget Analyst?

Proficiency in Excel is vital for a Budget Analyst as it is the primary tool used for financial analysis, data organization, and budgeting tasks. Advanced skills such as pivot tables, VLOOKUP functions, and macros enable analysts to manipulate large datasets efficiently and create comprehensive reports that aid decision-making.

What role does attention to detail play in a Budget Analyst's job?

Attention to detail is critical for a Budget Analyst because even minor discrepancies in financial data can lead to significant errors in budgeting and forecasting. A meticulous approach ensures accuracy in financial reports, compliance with regulations, and the reliability of financial recommendations to management.

What analytical skills should a Budget Analyst possess?

A Budget Analyst should possess strong analytical skills, including the ability to evaluate financial data, identify trends, and make data-driven recommendations. Critical thinking and problem-solving skills are also essential for assessing budget proposals, forecasting future financial performance, and optimizing resource allocation.

How does communication impact the effectiveness of a Budget Analyst?

Effective communication is essential for a Budget Analyst as it enables them to convey complex financial concepts clearly to non-financial stakeholders. Strong verbal and written communication skills facilitate collaboration with team members, presentation of financial reports, and provision of insights that influence strategic business decisions.

Conclusion

Incorporating Budget Analyst skills into your resume is crucial for demonstrating your expertise and value to potential employers. By showcasing relevant skills such as financial analysis, forecasting, and budget management, candidates can effectively differentiate themselves in a competitive job market. Highlighting these competencies not only reflects your proficiency but also illustrates your commitment to contributing positively to an organization’s financial health.

As you prepare your application, remember that refining your skills can significantly enhance your prospects. Invest time in developing your abilities and crafting a standout resume to increase your chances of landing that desired position. For further assistance, explore our resume templates, utilize our resume builder, check out resume examples, and create compelling cover letter templates to elevate your job application journey.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.