Top 26 Fixed Income Trader Resume Summaries in 2025

As a Fixed Income Trader, setting clear career objectives is essential for navigating the complexities of the financial markets and achieving long-term success. These objectives not only help in honing trading skills and expertise but also guide professional growth and development within the industry. In this section, we will explore the top career objectives specifically tailored for Fixed Income Traders, providing insights into what drives success in this dynamic field.

Career Objectives for Fresher Fixed Income Trader

- Detail-oriented finance graduate seeking to leverage strong analytical skills and knowledge of bond markets as a Fixed Income Trader, with a focus on maximizing returns and managing risks effectively.

- Motivated individual aiming to contribute to a dynamic trading team by utilizing quantitative analysis and market research skills to identify profitable fixed income trading opportunities.

- Recent finance graduate with internship experience in asset management, looking to start a career as a Fixed Income Trader, eager to apply academic knowledge in real-world trading environments.

- Aspiring Fixed Income Trader with strong numerical proficiency and a keen interest in financial markets, dedicated to developing strategic trading decisions based on thorough market analysis.

- Highly motivated finance professional seeking to enhance trading strategies and execute fixed income trades, aiming for continuous learning and growth in a fast-paced trading environment.

- Ambitious graduate with a solid foundation in financial analysis and portfolio management, seeking to join a reputable firm as a Fixed Income Trader to help optimize trade execution and yield analysis.

- Enthusiastic finance graduate with exceptional research skills, aiming to support trading operations as a Fixed Income Trader, focusing on expanding knowledge in bond valuation and risk assessment.

- Results-driven individual looking to launch a career in fixed income trading, leveraging strong communication skills and a passion for financial markets to contribute to team success and client satisfaction.

- Goal-oriented recent graduate with a background in economics, aspiring to develop expertise in fixed income trading while contributing to a collaborative and innovative trading team.

- Dedicated finance enthusiast eager to apply theoretical knowledge in fixed income markets as a trader, aiming to enhance trading performance and achieve optimal risk-adjusted returns.

Career Objectives for Experienced Fixed Income Trader

- Aiming to leverage over 10 years of trading experience to optimize fixed income portfolios, enhancing returns while managing risk in volatile markets.

- Seeking a challenging role as a Fixed Income Trader to utilize expertise in credit analysis and market trends to drive profitable trading strategies.

- Desiring to apply advanced quantitative skills and market insight to improve trading performance and client satisfaction within a dynamic investment firm.

- Looking to contribute to a leading financial institution by utilizing comprehensive knowledge of fixed income securities and macroeconomic indicators.

- To join a forward-thinking organization where I can apply my strong analytical skills and trading acumen to maximize fixed income investment strategies.

- Motivated to enhance trading operations by implementing innovative risk management techniques and improving execution efficiency in fixed income markets.

- Aiming to collaborate with teams to develop robust fixed income trading strategies, leveraging strong communication and negotiation skills to deliver results.

- Seeking to drive profitability as a Fixed Income Trader by utilizing extensive market research and proprietary trading algorithms in a collaborative environment.

- Desiring to utilize my deep understanding of interest rate movements and credit risk to contribute to the success of a top-tier investment firm.

- Looking to use my expertise in fixed income derivatives to enhance trading strategies while mentoring junior traders in best practices and market analysis.

- Passionate about achieving superior returns by integrating ESG factors into fixed income trading strategies within a progressive financial institution.

Best Career Objectives for Fixed Income Trader

- Results-driven Fixed Income Trader with over five years of experience in managing diverse portfolios seeks to leverage analytical skills and market insights to optimize trading strategies for increased profitability and risk management.

- Detail-oriented Fixed Income Trader aiming to utilize extensive knowledge of bond market dynamics and quantitative analysis to enhance trading performance and contribute to the firm’s overall success in capital markets.

- Ambitious Fixed Income Trader with a strong background in credit analysis and risk assessment, seeking to apply expertise in fixed income securities to drive strategic trading decisions and maximize returns for clients.

- Dynamic Fixed Income Trader with a proven track record of executing high-volume trades and developing innovative strategies seeks to join a forward-thinking firm to enhance trading efficiency and profitability.

- Dedicated Fixed Income Trader with comprehensive experience in analyzing interest rate trends and economic indicators, looking to leverage skills in portfolio management and trading execution to support institutional investors.

- Proficient Fixed Income Trader committed to utilizing advanced market analysis techniques and strong negotiation skills to improve trade execution and contribute to successful investment strategies within a dynamic trading environment.

- Results-oriented Fixed Income Trader eager to apply expertise in derivatives and structured products to develop tactical trading plans that align with client objectives and market conditions for optimal performance.

- Strategic thinker and Fixed Income Trader with a solid foundation in macroeconomic analysis, seeking to implement risk-adjusted trading strategies that enhance portfolio performance while minimizing exposure to market volatility.

- Experienced Fixed Income Trader with a focus on emerging markets, aiming to leverage analytical capabilities and deep market knowledge to identify lucrative investment opportunities and drive sustainable growth.

- Highly motivated Fixed Income Trader with a strong quantitative background and proficiency in financial modeling, looking to join a prestigious firm to contribute to innovative trading solutions and enhanced market positioning.

- Detail-focused Fixed Income Trader with a solid understanding of regulatory frameworks and compliance standards, seeking to ensure adherence to best practices while optimizing trading strategies for client investments.

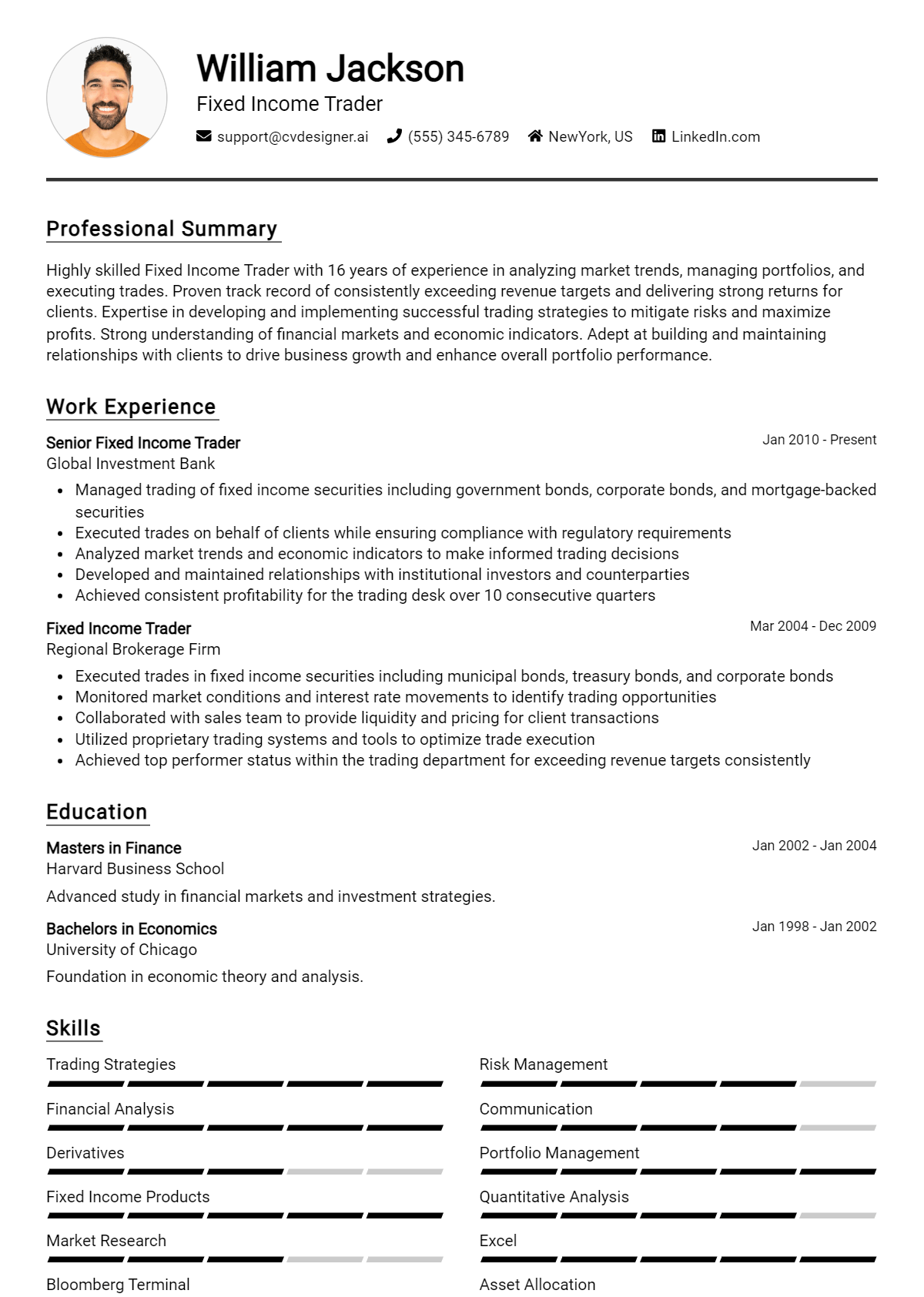

Best Fixed Income Trader Resume Summary Samples

- Results-driven Fixed Income Trader with over 7 years of experience in managing multi-million dollar portfolios. Proven track record of enhancing returns through strategic trades and risk management techniques.

- Dynamic Fixed Income Trader skilled in analyzing market trends and executing trades across various instruments. Recognized for consistently achieving above-benchmark performance and maximizing investor returns.

- Detail-oriented Fixed Income Trader with expertise in credit analysis and bond valuation. Successfully navigated volatile markets to generate significant profits while maintaining risk exposure within acceptable limits.

- Experienced Fixed Income Trader with a strong background in quantitative analysis and algorithmic trading. Demonstrated ability to leverage technology to optimize trading strategies and drive profitability.

- Dedicated Fixed Income Trader with 5+ years of experience in trading government and corporate bonds. Proven ability to build and maintain client relationships while delivering sound investment advice.

- Proficient Fixed Income Trader specializing in interest rate derivatives and structured products. Achieved recognition for outstanding performance in high-pressure environments, consistently meeting or exceeding trading targets.

- Strategic thinker and Fixed Income Trader with extensive knowledge of macroeconomic factors affecting bond markets. Experienced in portfolio management with a focus on risk-adjusted returns.

- Analytical Fixed Income Trader with a strong educational background in finance and economics. Successfully implemented innovative trading strategies that led to improved portfolio performance and client satisfaction.

- Accomplished Fixed Income Trader with a history of using market analytics to inform trading decisions. Proven ability to thrive in fast-paced environments while managing high-value transactions.

When crafting a resume objective for a Fixed Income Trader position, it's essential to focus on your skills, experience, and career goals in a way that aligns with the needs of potential employers. A well-structured objective should be concise, clear, and tailored to the specific job you're applying for. It should highlight your expertise in fixed income markets, your analytical abilities, and your commitment to delivering strong results. By following a few simple guidelines, you can create an impactful resume objective that captures the attention of hiring managers.

How to Write a Fixed Income Trader Resume Objective

- Be Specific: Clearly state the position you are applying for and any relevant specialties within fixed income trading.

- Highlight Relevant Experience: Mention your experience in trading, investment analysis, or related fields, emphasizing any direct experience with fixed income securities.

- Showcase Key Skills: Include skills that are essential for a Fixed Income Trader, such as analytical skills, market knowledge, and risk management.

- Express Career Goals: Briefly outline your professional aspirations and how they align with the company's objectives.

- Keep It Concise: Limit your objective to 1-2 sentences to ensure clarity and maintain the reader's attention.

- Tailor for Each Application: Customize your objective for each job application to reflect the specific requirements and goals of the potential employer.

- Use Action-Oriented Language: Employ strong action verbs to convey your proactive approach and eagerness to contribute to the firm's success.

Key Skills to Highlight in Your Fixed Income Trader Resume Objective

When crafting a resume objective for a Fixed Income Trader position, it is crucial to emphasize relevant skills that showcase your expertise and suitability for the role. Highlighting these skills not only captures the attention of hiring managers but also demonstrates your understanding of the fixed income market and trading strategies. Below are key skills that can enhance your resume objective.

- Strong analytical skills

- Proficiency in financial modeling and valuation

- In-depth knowledge of fixed income securities and market dynamics

- Effective risk management and assessment techniques

- Expertise in trading platforms and software

- Excellent communication and negotiation abilities

- Ability to work under pressure and make quick decisions

- Solid understanding of macroeconomic factors and their impact on bond markets

Common Mistakes When Writing a Fixed Income Trader Resume Objective

A well-crafted resume objective is essential for capturing the attention of hiring managers in the competitive field of fixed income trading. Avoiding common mistakes can significantly enhance the effectiveness of your resume objective, ensuring it communicates your qualifications and career aspirations clearly. Here are some common pitfalls to watch out for:

- Being Vague: Using generic phrases like "seeking a challenging position" fails to specify your goals. This lack of clarity can make your objective forgettable and unconvincing.

- Focusing on Personal Gain: Objectives centered around what you want (e.g., "to advance my career") rather than what you can offer the employer can come off as self-serving. Employers seek candidates who prioritize the company's needs.

- Neglecting Relevant Skills: Omitting key skills related to fixed income trading, such as risk management or market analysis, can weaken your objective. This oversight makes it difficult for potential employers to gauge your fit for the role.

- Using Clichés: Phrases like "hardworking" or "team player" are often overused and lack specificity. They can make your objective sound insincere and unoriginal, diminishing its impact.

- Making It Too Long: An overly lengthy objective can lose the reader's attention. Aim for brevity and focus, ensuring your objective is concise and to the point.

- Ignoring the Company’s Goals: Failing to align your objective with the company's mission or values can signal a lack of research and interest. Tailoring your objective to the specific employer shows initiative and commitment.

- Using Unprofessional Language: Casual language or slang can undermine your professionalism. It's crucial to maintain a formal tone that reflects your understanding of the industry.

Conclusion

In summary, crafting a targeted and impactful resume objective is essential for Fixed Income Traders looking to make their mark in the competitive finance industry. A well-written objective not only highlights your key skills and experiences but also helps you stand out to recruiters, making a strong first impression that can lead to interview opportunities.

As you refine your resume objective, remember that the tips and examples provided can serve as a valuable guide in showcasing your qualifications effectively. Don't hesitate to utilize the resources available, such as our resume templates, resume builder, resume examples, and cover letter templates. With dedication and attention to detail, you can craft an objective that propels you towards your career goals as a Fixed Income Trader.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.