Top 26 Financial Compliance Officer Resume Summaries in 2025

As the financial landscape continues to evolve, the role of a Financial Compliance Officer has become increasingly vital in ensuring that organizations adhere to regulatory standards and maintain ethical practices. This position requires a keen understanding of financial regulations, risk management, and internal controls. In this section, we will explore the top career objectives that a Financial Compliance Officer should prioritize to advance their professional journey and contribute effectively to their organization's compliance framework.

Career Objectives for Fresher Financial Compliance Officer

- Detail-oriented graduate seeking to leverage analytical skills and knowledge of regulatory frameworks to contribute effectively as a Financial Compliance Officer, ensuring adherence to financial laws and organizational policies.

- Ambitious finance professional aiming to utilize strong problem-solving abilities and understanding of compliance regulations to support the financial integrity of an organization as a Financial Compliance Officer.

- Recent graduate with a keen interest in financial compliance, looking to apply academic knowledge and communication skills to assist in developing and maintaining compliance programs.

- Results-driven individual seeking a Financial Compliance Officer position to utilize skills in risk assessment and regulatory reporting, ensuring that all financial operations comply with applicable laws.

- Enthusiastic finance graduate aspiring to join a dynamic team as a Financial Compliance Officer, dedicated to promoting ethical practices and compliance with financial regulations.

- Motivated fresher with a strong foundation in finance and compliance, eager to contribute to effective risk management strategies as a Financial Compliance Officer in a reputable organization.

- Dedicated finance professional seeking to apply knowledge of compliance standards and regulations in a Financial Compliance Officer role, committed to fostering a culture of integrity and accountability.

- Proactive and detail-oriented recent graduate looking to begin a career as a Financial Compliance Officer, focused on ensuring compliance with laws and regulations to protect organizational interests.

- Recent graduate with a passion for finance and compliance, eager to support compliance initiatives and contribute to the risk management framework as a Financial Compliance Officer.

- Ambitious individual looking to secure a position as a Financial Compliance Officer to apply analytical skills and regulatory knowledge in promoting compliance and mitigating financial risks.

Career Objectives for Experienced Financial Compliance Officer

- Dedicated Financial Compliance Officer with over 8 years of experience seeking to leverage expertise in regulatory adherence and risk management to enhance compliance frameworks in a forward-thinking organization.

- Results-driven compliance professional aiming to utilize strong analytical skills and a comprehensive understanding of financial regulations to mitigate risks and ensure corporate governance within a dynamic financial institution.

- Goal-oriented Financial Compliance Officer with a proven track record in policy development and implementation, looking to contribute to a reputable organization focused on sustainable growth and regulatory excellence.

- Experienced compliance expert seeking to apply extensive knowledge of federal and state regulations to bolster compliance programs and foster a culture of accountability within a progressive financial services firm.

- Ambitious Financial Compliance Officer with a passion for ethics and integrity, aiming to enhance compliance operations through innovative strategies and continuous improvement initiatives in a challenging environment.

- Detail-oriented compliance specialist eager to leverage 10+ years of experience in auditing and regulatory oversight to support a financial institution in achieving compliance objectives and operational efficiency.

- Proactive Financial Compliance Officer looking to utilize deep expertise in risk assessment and mitigation strategies to strengthen compliance measures and safeguard organizational interests in a competitive market.

- Skilled compliance analyst with a focus on data-driven decision-making, seeking a challenging role to implement robust compliance frameworks and support organizational growth through effective risk management.

- Strategic thinker with extensive experience in financial compliance and regulatory reporting, aspiring to drive compliance excellence and ensure adherence to industry standards in a leading financial organization.

- Enthusiastic Financial Compliance Officer committed to continuous professional development, aiming to contribute to an organization’s success through innovative compliance solutions and fostering a culture of compliance awareness.

- Results-oriented compliance professional with strong leadership skills, seeking to develop and mentor teams while ensuring regulatory compliance and enhancing operational practices within a dynamic financial setting.

Best Career Objectives for Financial Compliance Officer

- Detail-oriented financial compliance officer with over five years of experience seeking to ensure regulatory adherence while enhancing the company’s risk management processes and promoting a culture of compliance within the organization.

- Dedicated professional with extensive knowledge in financial regulations, aiming to leverage analytical skills and compliance expertise to support the organization's goals and maintain the highest standards of financial integrity.

- Results-driven compliance officer with a strong background in audit and risk management, seeking to contribute to the development of effective compliance programs that align with organizational objectives and regulatory requirements.

- Proficient financial compliance officer looking to utilize my experience in creating compliance policies and conducting audits to ensure adherence to financial regulations and mitigate potential risks for the organization.

- Ambitious compliance professional with a proven track record in financial service regulations, seeking to enhance compliance frameworks and provide strategic guidance to minimize compliance risks and uphold company reputation.

- Experienced financial compliance officer passionate about developing training programs for staff on compliance best practices, aiming to foster a culture of accountability and ethical behavior within the organization.

- Knowledgeable financial compliance expert with strong analytical skills, aiming to effectively monitor and assess compliance risks while implementing corrective actions to ensure adherence to regulatory standards.

- Skilled in compliance audits and regulatory reporting, I am seeking a financial compliance officer role where I can utilize my attention to detail and problem-solving abilities to support the organization’s compliance initiatives.

- Goal-oriented financial compliance officer with a background in risk assessment, dedicated to implementing proactive compliance measures that align with industry standards and enhance operational efficiency.

- Financial compliance officer with a strong foundation in financial regulations and ethics, seeking to leverage my skills in policy development and risk management to strengthen the organization’s compliance posture.

- Proficient in regulatory compliance and internal controls, I aspire to contribute to a forward-thinking organization by ensuring compliance with laws while fostering transparency and ethical business practices.

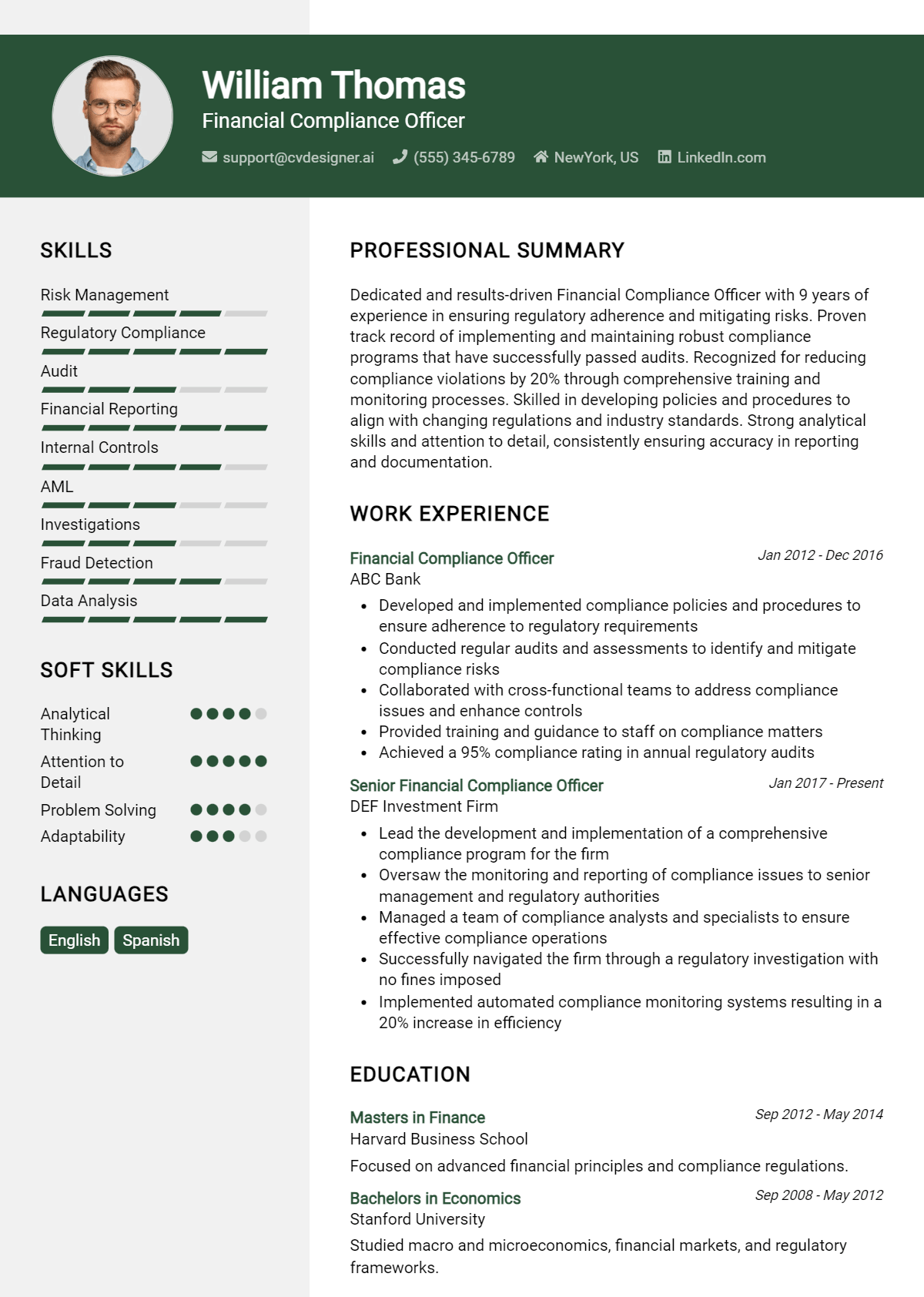

Best Financial Compliance Officer Resume Summary Samples

- Detail-oriented Financial Compliance Officer with over 5 years of experience in regulatory compliance, risk management, and internal audits. Proven track record of developing compliance programs that mitigate risks and improve operational efficiency.

- Results-driven Financial Compliance Officer with expertise in AML regulations and financial reporting. Skilled in conducting audits and implementing policies that ensure adherence to industry standards, contributing to a 20% reduction in compliance violations.

- Proactive Financial Compliance Officer with a solid background in financial analysis and regulatory frameworks. Adept at identifying compliance gaps and implementing corrective actions, leading to improved compliance scores across multiple departments.

- Experienced Financial Compliance Officer with a strong focus on regulatory compliance and corporate governance. Successfully led compliance training initiatives that increased employee awareness and adherence to financial regulations by 30%.

- Dedicated Financial Compliance Officer with 7 years of experience in financial institutions. Expertise in developing compliance strategies that align with legal requirements, resulting in zero regulatory fines during tenure.

- Dynamic Financial Compliance Officer skilled in risk assessment and mitigation. Known for fostering a culture of compliance through effective communication and training, enhancing compliance metrics by 25% within one fiscal year.

- Analytical Financial Compliance Officer with extensive experience in auditing and compliance monitoring. Proven ability to streamline processes and enhance reporting accuracy, significantly reducing the likelihood of compliance breaches.

- Strategic Financial Compliance Officer with experience in implementing compliance frameworks and conducting risk assessments. Successfully managed audits that resulted in commendations from regulatory bodies for exemplary compliance practices.

- Versatile Financial Compliance Officer with a deep understanding of SEC regulations and reporting requirements. Recognized for developing compliance programs that support organizational growth while minimizing regulatory risks.

- Resourceful Financial Compliance Officer with a strong background in financial crime prevention. Expert in KYC and due diligence processes, contributing to enhanced client onboarding procedures and compliance adherence.

Writing a resume objective for a Financial Compliance Officer position is essential for making a strong first impression. An effective objective should clearly articulate your career goals, highlight your relevant skills, and demonstrate your understanding of the financial compliance landscape. To achieve this, focus on specific competencies that align with the job description and emphasize your commitment to maintaining regulatory standards. A well-crafted objective not only showcases your qualifications but also conveys your passion for the role and the value you can bring to the organization.

How to Write a Financial Compliance Officer Resume Objective

- Identify your career goals: Start by clearly defining what you aim to achieve in the role of a Financial Compliance Officer.

- Highlight relevant experience: Mention any past roles or experiences that directly relate to financial compliance and regulatory requirements.

- Showcase key skills: Include specific skills relevant to financial compliance, such as risk assessment, regulatory knowledge, and analytical abilities.

- Align with the job description: Tailor your objective to reflect the language and requirements outlined in the job posting.

- Keep it concise: Limit your objective to 1-2 sentences, ensuring it is direct and to the point.

- Incorporate industry keywords: Use terminology that is common in the financial compliance field to enhance your visibility to applicant tracking systems.

- Express your commitment: Convey your dedication to upholding compliance standards and contributing to the organization’s success.

Key Skills to Highlight in Your Financial Compliance Officer Resume Objective

In the competitive field of financial compliance, it is crucial to highlight relevant skills in your resume objective to capture the attention of hiring managers. By showcasing your expertise and qualifications, you can demonstrate your ability to navigate complex regulatory environments and ensure adherence to compliance standards.

- Regulatory Knowledge

- Risk Assessment

- Financial Reporting

- Internal Controls

- Analytical Skills

- Attention to Detail

- Communication Skills

- Problem-Solving Abilities

Common Mistakes When Writing a Financial Compliance Officer Resume Objective

Crafting an effective resume objective is essential for making a strong first impression, especially in the competitive field of financial compliance. Avoiding common mistakes can significantly enhance the clarity and impact of your objective, helping you stand out to potential employers. Here are some common pitfalls to watch out for:

- Being Too Vague: Using generic statements like "seeking a challenging position" fails to convey your specific goals and qualifications. This lack of clarity can make it harder for employers to see your value and fit for the role.

- Overly Complex Language: Utilizing jargon or overly complex phrases can confuse the reader. A resume objective should be concise and straightforward, highlighting your intentions without unnecessary complexity.

- Focusing on Personal Goals: When the objective emphasizes what you want from the job rather than what you can contribute to the organization, it shifts the focus away from the employer's needs. An effective objective should align your goals with the company’s objectives.

- Neglecting Relevant Skills: Failing to mention key skills or certifications relevant to financial compliance can weaken your objective. Highlighting specific qualifications not only showcases your expertise but also demonstrates your suitability for the position.

- Including Irrelevant Information: Mentioning unrelated experiences or skills can dilute the focus of your resume objective. Staying on topic ensures that the hiring manager can quickly assess your qualifications for the role.

- Making It Too Long: A lengthy objective can overwhelm the reader and lose its impact. Keeping it concise—ideally one to two sentences—ensures that your main points are communicated effectively.

- Using Passive Language: Phrases like "I hope to" or "I would like to" can make you come across as uncertain or unconfident. Strong, active language demonstrates your enthusiasm and assertiveness regarding the position.

Frequently Asked Questions

What is the purpose of a Financial Compliance Officer resume objective?

The purpose of a Financial Compliance Officer resume objective is to provide a brief, focused statement that highlights your career goals and the value you can bring to a potential employer. It serves to quickly convey your intentions and qualifications, catching the hiring manager's eye and encouraging them to read further into your resume. A well-crafted objective can set the tone for your application and differentiate you from other candidates.

What is the ideal length of a Financial Compliance Officer resume objective?

The ideal length of a Financial Compliance Officer resume objective is typically one to two sentences, or around 25-50 words. This concise format allows you to clearly articulate your career goals and relevant skills without overwhelming the reader. Keeping it brief ensures that it captures the attention of hiring managers who often skim resumes for key information.

What should I include in my Financial Compliance Officer resume objective?

Your Financial Compliance Officer resume objective should include your professional title, relevant experience, key skills, and what you hope to achieve in the role. Additionally, it can highlight your commitment to ensuring regulatory compliance and your ability to enhance financial operations. Tailoring this information to align with the specific requirements of the job you are applying for will make your objective more impactful.

What is the difference between a Financial Compliance Officer resume objective and a summary?

A Financial Compliance Officer resume objective focuses on your career goals and what you aim to achieve in the position, while a summary provides a broader overview of your professional background, skills, and accomplishments. The objective is forward-looking, expressing your aspirations, whereas the summary reflects your past experiences and qualifications, making it ideal for showcasing your overall capabilities to potential employers.

How can freshers write an effective Financial Compliance Officer resume objective?

Freshers can write an effective Financial Compliance Officer resume objective by emphasizing their educational background, relevant coursework, internships, or volunteer experiences related to compliance and finance. It’s important to highlight any specific skills, such as attention to detail or analytical abilities, and express a strong desire to learn and contribute to the organization’s compliance efforts. Tailoring the objective to the job description can also demonstrate enthusiasm and fit for the role.

Is it necessary to customize my Financial Compliance Officer resume objective for each job?

Yes, it is essential to customize your Financial Compliance Officer resume objective for each job application. Tailoring your objective to reflect the specific requirements and responsibilities outlined in the job posting shows that you have taken the time to understand the role and how your skills and experiences align with it. This personalization can significantly increase your chances of catching the attention of hiring managers and securing an interview.

Conclusion

In summary, crafting a targeted and impactful resume objective is crucial for Financial Compliance Officer candidates. A well-written objective not only highlights your skills and experiences but also serves as a powerful tool to capture the attention of recruiters, ensuring you make a strong first impression in a competitive job market.

By implementing the tips and examples provided in this guide, you can refine your resume objective to better reflect your qualifications and aspirations. Remember, this is your opportunity to showcase your commitment to financial compliance and your readiness to contribute to potential employers. Take the next step in your job search with confidence!

For additional resources, explore our resume templates, utilize our resume builder, check out various resume examples, and enhance your application with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.