24 Winning Career Objectives for Derivatives Trader in 2025

As a derivatives trader, setting clear and achievable career objectives is crucial for navigating the complexities of the financial markets. These objectives not only guide personal and professional development but also enhance trading strategies and risk management techniques. In this section, we will explore the top career objectives that can help derivatives traders excel in their roles, fostering growth and success in an ever-evolving industry.

Career Objectives for Fresher Derivatives Trader

- Motivated recent finance graduate seeking to leverage analytical skills and knowledge of derivatives markets to contribute effectively as a Derivatives Trader in a dynamic trading environment.

- Aspiring Derivatives Trader with a strong foundation in quantitative analysis and risk management, aiming to apply innovative trading strategies to maximize profitability for a reputable financial institution.

- Detail-oriented and passionate finance professional eager to enter the derivatives trading field, utilizing strong mathematical skills and market knowledge to support trading operations and enhance team performance.

- Enthusiastic about derivatives trading and committed to continuous learning, aiming to gain hands-on experience and contribute to a team focused on strategic trading initiatives and risk assessment.

- Analytical thinker with a keen interest in derivatives markets, seeking a challenging position as a Derivatives Trader to develop trading strategies and make data-driven decisions for optimal results.

- Recent finance graduate with internship experience in trading, looking to apply theoretical knowledge and practical skills in a fast-paced derivatives trading role to achieve significant financial outcomes.

- Dedicated and results-oriented individual seeking to kickstart a career as a Derivatives Trader, leveraging strong communication skills and market insights to foster collaboration and drive trading success.

- Ambitious finance professional eager to contribute to a trading desk as a Derivatives Trader, utilizing problem-solving abilities and technical skills to navigate complex market dynamics and enhance profitability.

- Entry-level Derivatives Trader with a strong academic background in finance and investment strategies, aiming to utilize analytical expertise and passion for trading in a challenging and rewarding role.

- Goal-driven individual with a solid understanding of financial instruments, seeking to embark on a derivatives trading career, aspiring to learn from experienced traders and contribute to trading success.

- Proactive and analytical recent graduate seeking to join a forward-thinking financial firm as a Derivatives Trader, aiming to apply strong quantitative skills and market knowledge to optimize trading strategies.

Career Objectives for Experienced Derivatives Trader

- Results-driven derivatives trader with over 5 years of experience seeks to leverage analytical skills and market insights to optimize trading strategies and enhance portfolio performance in a dynamic trading environment.

- Experienced derivatives trader aiming to utilize advanced quantitative analysis and risk management techniques to drive profitability and minimize exposure, while contributing to a collaborative and innovative trading team.

- Detail-oriented derivatives trader with a strong track record of successful trades seeks to apply comprehensive market knowledge and strategic thinking in a challenging role that fosters professional growth and financial success.

- Goal-oriented derivatives trader looking to enhance trading strategies through cutting-edge technology and data analysis, while actively contributing to team objectives and fostering a positive trading culture.

- Dynamic derivatives trader with expertise in global markets aims to leverage strong negotiation skills and market acumen to develop profitable trading solutions and drive business growth within a leading financial institution.

- Proven derivatives trader with a passion for market trends and analytics seeks to join an innovative firm where I can apply my skills in developing risk-adjusted trading strategies that align with corporate goals.

- Experienced derivatives trader committed to maximizing returns through effective risk assessment and trading strategies, looking to join a forward-thinking firm that values strategic innovation and collaboration.

- Skilled derivatives trader with a focus on regulatory compliance and risk management seeks a leadership role to mentor junior traders while driving operational efficiency and achieving superior trading results.

- Accomplished derivatives trader with a robust understanding of market dynamics aims to contribute to an elite trading team by implementing data-driven strategies and enhancing overall trading performance.

- Strategic derivatives trader with strong analytical skills seeks to optimize trading processes and enhance risk management practices, while fostering a culture of continuous improvement and collaboration within the trading team.

- Dedicated derivatives trader poised to bring expertise in financial instruments and market analysis to a challenging role, aiming to achieve superior performance outcomes and drive organizational success.

Best Career Objectives for Derivatives Trader

- Results-driven Derivatives Trader with 5+ years of experience in managing risk and optimizing trade strategies, seeking to leverage analytical skills and market knowledge to enhance trading performance at a leading financial institution.

- Detail-oriented trader with a strong background in derivatives and risk assessment, aiming to utilize advanced quantitative analysis skills to develop innovative trading strategies that drive profitability and minimize risk exposure.

- Dynamic finance professional with expertise in trading options and futures, looking to contribute to a fast-paced trading desk by applying strong analytical abilities and market insights to maximize returns on investments.

- Passionate Derivatives Trader with a proven track record of generating significant profits through strategic trading decisions, eager to join a reputable firm to further enhance skills in market analysis and risk management.

- Ambitious trading professional with extensive knowledge of derivatives markets, seeking to apply my quantitative skills and experience in a challenging role that promotes growth and innovative trading solutions.

- Skilled Derivatives Trader with expertise in financial modeling and market research, aiming to join a progressive financial firm to maximize trading strategies and deliver exceptional results in a competitive environment.

- Proactive trader with significant experience in analyzing market trends and executing trades, seeking a challenging position to leverage strong decision-making skills and contribute to team success in the derivatives market.

- Experienced Derivatives Trader with a solid foundation in econometrics and risk assessment, dedicated to maximizing portfolio performance while minimizing exposure through strategic trade execution.

- Analytical and results-oriented Derivatives Trader with a focus on risk management and financial analysis, aspiring to become a key player in a dynamic trading team to drive successful trading outcomes.

- Strategic thinker with a robust understanding of market dynamics, looking to utilize my expertise in derivatives trading to contribute effectively to a leading financial institution's success and growth.

- Dedicated finance professional with comprehensive knowledge of derivatives products, eager to apply strong analytical and trading skills to identify profitable opportunities and enhance the trading desk's overall performance.

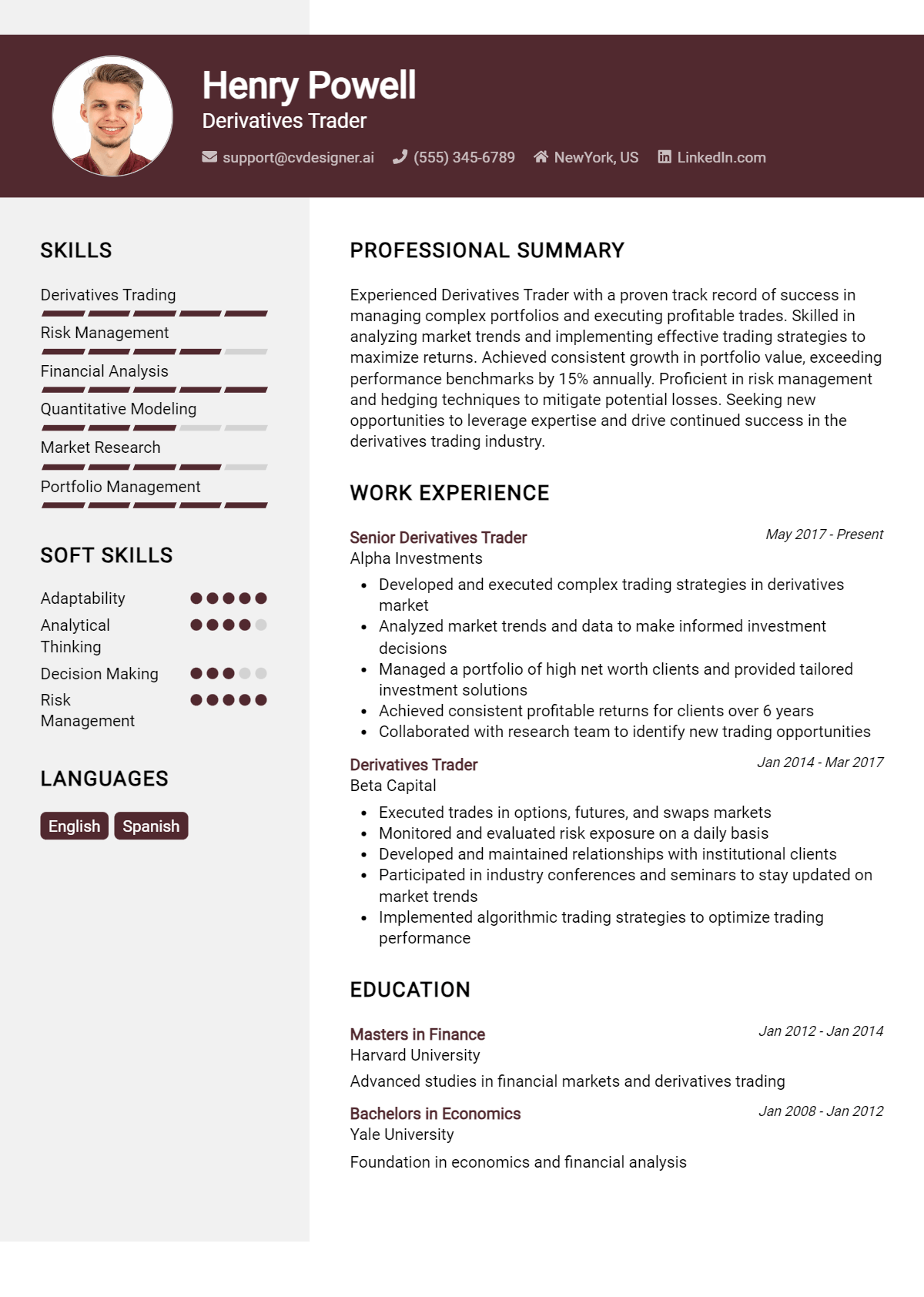

Best Derivatives Trader Resume Summary Samples

- Results-driven Derivatives Trader with over 5 years of experience in options and futures markets. Proven ability to develop strategies that increase portfolio value by 30% year-over-year while managing risk effectively.

- Dynamic Derivatives Trader skilled in market analysis and quantitative modeling. Successfully executed trades that generated a 25% annual return. Adept at using advanced trading software to optimize performance.

- Strategic Derivatives Trader with 7 years of trading experience across multiple asset classes. Specializes in volatility trading and risk management, achieving consistent profits even in turbulent markets.

- Detail-oriented Derivatives Trader with expertise in hedging and arbitrage strategies. Recognized for enhancing trading desk performance by implementing innovative trading algorithms that improved trade execution speed.

- Proficient Derivatives Trader specializing in equity options and commodity futures. Strong analytical skills complemented by a successful track record of minimizing risk and maximizing returns through disciplined trading approaches.

- Accomplished Derivatives Trader with a decade of experience in high-frequency trading environments. Known for leveraging data analytics to identify market trends and execute timely trades that outperformed benchmarks.

- Innovative Derivatives Trader with a focus on emerging markets. Successfully capitalized on market inefficiencies, achieving an average return on investment of 40% over the past three years.

- Experienced Derivatives Trader with a strong background in financial modeling and risk assessment. Demonstrated ability to implement trading strategies that reduced exposure and increased profitability in volatile markets.

- Analytical Derivatives Trader with 6 years of experience managing complex derivative portfolios. Proven success in adapting quickly to market changes and executing strategic trades that align with client objectives.

Writing a resume objective for a Derivatives Trader position is a crucial step in showcasing your qualifications and career aspirations. An effective objective should be concise, tailored to the job, and highlight your key skills and experiences relevant to trading derivatives. To structure your objective, focus on capturing your professional background, your specific interest in derivatives trading, and how you can add value to the prospective employer. A well-crafted objective will make your resume stand out and set the tone for the rest of your application.

How to Write a Derivatives Trader Resume Objective

- Begin with a strong opening statement that clearly states your career goal and the position you are applying for.

- Highlight your relevant experience in trading, risk management, or financial analysis to demonstrate your qualifications.

- Mention specific derivatives products you have experience with, such as options, futures, or swaps, to show your expertise.

- Include any relevant certifications or educational background that adds credibility to your expertise in derivatives trading.

- Emphasize your analytical skills and ability to make informed decisions under pressure as essential traits for a trader.

- Tailor the objective to align with the company's goals or values, showing that you understand their operations.

- Keep it concise, ideally within 1-2 sentences, ensuring it is impactful and easy to read.

Key Skills to Highlight in Your Derivatives Trader Resume Objective

When crafting a resume objective for a Derivatives Trader position, it is crucial to emphasize relevant skills that showcase your expertise and suitability for the role. Highlighting these skills not only helps to grab the attention of hiring managers but also illustrates your ability to navigate the complexities of financial markets effectively.

- Strong analytical and quantitative skills

- Proficiency in risk management strategies

- Expertise in financial modeling and forecasting

- Knowledge of derivatives products, including options, futures, and swaps

- Ability to utilize trading software and platforms

- Excellent decision-making and problem-solving skills

- Deep understanding of market trends and economic indicators

- Effective communication and negotiation skills

Common Mistakes When Writing a Derivatives Trader Resume Objective

Crafting a compelling resume objective is vital for standing out in the competitive field of derivatives trading. Avoiding common mistakes can significantly enhance the impact of your objective, making it more likely to catch the attention of hiring managers. Here are some frequent pitfalls to watch out for:

- Being Too Generic: A vague objective fails to showcase your unique skills and aspirations. Tailoring your objective to the specific role demonstrates your genuine interest and alignment with the company's goals.

- Focusing on Personal Goals: It's essential to prioritize what you can offer the employer rather than outlining personal career ambitions. An objective centered around the company's needs highlights your value as a candidate.

- Using Jargon or Technical Language: While derivatives trading involves specific terminology, overloading your objective with jargon can alienate readers. Aim for clarity to ensure that your message resonates with a broader audience.

- Neglecting Quantifiable Achievements: Failing to include measurable successes can weaken your objective. Highlighting quantifiable results from previous roles illustrates your capabilities and sets you apart from other candidates.

- Making It Too Long: A lengthy objective can lose the reader's attention. Keeping your objective concise and focused allows hiring managers to quickly grasp your intent and qualifications.

- Ignoring the Company Culture: Not considering the company's culture in your objective can lead to a disconnect. Researching the organization and reflecting its values in your objective shows that you would be a good cultural fit.

- Overstating Skills or Experience: Exaggerating qualifications can backfire during interviews. It's crucial to remain honest about your skills and experiences to establish trust and credibility with potential employers.

Frequently Asked Questions

What should I include in my derivatives trader resume objective?

Your derivatives trader resume objective should highlight your key skills, relevant experience, and career goals. Focus on your expertise in financial markets, risk management, and trading strategies. Additionally, mention any specific derivatives products you are proficient in, such as options, futures, or swaps, to immediately attract the attention of hiring managers looking for these competencies.

How long should my resume objective be?

Ideally, your resume objective should be concise and to the point, typically no longer than 1-2 sentences. Aim to clearly communicate your professional goals and what you bring to the table without overwhelming the reader. A brief yet impactful objective can set a positive tone for the rest of your resume.

Should I tailor my resume objective for each job application?

Yes, it is highly recommended to tailor your resume objective for each job application. Customizing your objective allows you to align your skills and experiences with the specific requirements of the job you are applying for, demonstrating your genuine interest and suitability for the role. This personalized approach can significantly enhance your chances of standing out among other candidates.

Is it necessary to include a resume objective if I have extensive experience?

While it is not strictly necessary to include a resume objective if you have extensive experience, it can still be beneficial. An objective can serve as a summary of your professional aspirations and help to frame your career trajectory, particularly if you are making a significant shift in your career focus or looking to highlight specific goals within the derivatives trading sector.

What common mistakes should I avoid in my resume objective?

Common mistakes to avoid in your resume objective include being too vague, using generic phrases, or failing to showcase your unique qualifications. Avoid clichés and ensure that your objective is specific to the derivatives trading field, clearly outlining your strengths and career ambitions. Additionally, steer clear of discussing salary expectations or unrelated personal goals, as they can detract from your professional focus.

Conclusion

In summary, crafting a targeted and impactful resume objective is crucial for aspiring Derivatives Traders. This guide has outlined the key elements that make an objective stand out, emphasizing the need to tailor your message to showcase your unique skills and experiences in the finance industry. A well-written objective can significantly enhance your visibility to recruiters, ensuring that you make a strong first impression as you navigate your career in derivatives trading.

We encourage you to take the tips and examples provided and refine your resume objective to reflect your strengths and aspirations. Remember, a compelling objective can serve as your personal marketing tool, setting the tone for the rest of your resume.

For further assistance in crafting your documents, explore our resume templates, utilize our resume builder, review resume examples, and check out our cover letter templates. Good luck with your job search!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.