Treasury Relationship Manager Core Responsibilities

A Treasury Relationship Manager plays a pivotal role in connecting various departments, ensuring seamless communication between finance, operations, and risk management. This professional is responsible for managing banking relationships, optimizing cash flow, and developing strategies to mitigate financial risks. Essential skills include technical proficiency in treasury management systems, operational insights, and strong problem-solving abilities. Mastering these skills is vital for aligning with the organization's financial goals, and a well-structured resume can effectively highlight these qualifications, showcasing the candidate's value.

Common Responsibilities Listed on Treasury Relationship Manager Resume

- Manage and cultivate relationships with banking partners and financial institutions.

- Analyze cash flow forecasts and optimize liquidity management strategies.

- Implement treasury management systems and processes to enhance operational efficiency.

- Develop risk management policies and practices to safeguard company assets.

- Collaborate with finance and accounting teams to ensure accurate reporting.

- Monitor market trends to identify opportunities for cost savings and investment.

- Conduct regular reviews of banking services and negotiate terms and fees.

- Prepare and present financial reports to senior management and stakeholders.

- Ensure compliance with regulatory requirements and internal policies.

- Provide strategic insights on cash management and funding strategies.

- Facilitate cross-departmental collaboration to address financial challenges.

- Train and mentor junior staff on treasury functions and best practices.

High-Level Resume Tips for Treasury Relationship Manager Professionals

In the competitive field of finance, where every detail counts, a well-crafted resume serves as a candidate's first impression on potential employers. For Treasury Relationship Manager professionals, this document is not just a list of job experiences; it is a powerful marketing tool that must effectively convey both skills and achievements. A strong resume should reflect a candidate's unique qualifications, showcase their proficiency in managing relationships, and demonstrate their understanding of treasury functions. In this guide, we will provide practical and actionable resume tips specifically tailored for Treasury Relationship Manager professionals, ensuring that your resume stands out in the hiring process.

Top Resume Tips for Treasury Relationship Manager Professionals

- Tailor your resume to the job description by incorporating relevant keywords and phrases that align with the specific requirements of the Treasury Relationship Manager role.

- Highlight your relevant experience in treasury management, client relationship building, and financial analysis to showcase your expertise.

- Quantify your achievements by using specific metrics such as percentage increases in client satisfaction, revenue growth, or cost savings that you have directly contributed to.

- Focus on key industry-specific skills such as cash management, risk assessment, liquidity forecasting, and regulatory compliance to demonstrate your knowledge in the field.

- Include a summary statement at the top of your resume that succinctly captures your professional background and key qualifications as a Treasury Relationship Manager.

- Utilize bullet points for clarity and brevity, making it easy for hiring managers to quickly scan your resume for important information.

- Incorporate relevant certifications, such as Certified Treasury Professional (CTP) or Chartered Financial Analyst (CFA), to enhance your credibility and expertise.

- Showcase your soft skills, such as communication, negotiation, and problem-solving abilities, which are essential for effective relationship management.

- Keep the format clean and professional, ensuring that your resume is visually appealing and easy to read.

By implementing these tips, Treasury Relationship Manager professionals can significantly increase their chances of landing a job in this competitive field. A well-structured resume not only highlights your qualifications but also tells a compelling story of your professional journey, making it easier for potential employers to envision you as the ideal candidate for their team.

Why Resume Headlines & Titles are Important for Treasury Relationship Manager

In the competitive field of treasury management, a Treasury Relationship Manager plays a critical role in overseeing an organization's financial relationships and liquidity strategies. Crafting an impactful resume headline or title is essential for candidates applying for this position, as it serves as the first impression to hiring managers. A strong headline can capture attention immediately, summarizing a candidate's key qualifications in a concise and relevant manner. It should reflect the specific skills and experiences that align with the job, making it easier for recruiters to identify top talent at a glance.

Best Practices for Crafting Resume Headlines for Treasury Relationship Manager

- Keep it concise: Aim for a headline that is no longer than 10 words.

- Be role-specific: Tailor the headline to the Treasury Relationship Manager position.

- Highlight key skills: Incorporate essential skills relevant to treasury management.

- Include relevant experience: Mention years of experience or notable achievements.

- Use action verbs: Start with strong verbs to convey a sense of proactivity.

- Avoid jargon: Use clear language that can be easily understood by all readers.

- Focus on value: Emphasize how your expertise can benefit potential employers.

- Align with job description: Mirror keywords and phrases found in the job posting.

Example Resume Headlines for Treasury Relationship Manager

Strong Resume Headlines

Dynamic Treasury Relationship Manager with 10+ Years in Liquidity Management

Results-Driven Treasury Expert Specializing in Risk Mitigation and Cash Flow Optimization

Strategic Treasury Relationship Manager: Enhancing Financial Performance through Effective Partnerships

Accomplished Treasury Professional with Proven Track Record in Stakeholder Engagement

Weak Resume Headlines

Treasury Manager Looking for Opportunities

Experienced Professional in Finance

Seeking Treasury Position

The strong headlines are effective because they immediately convey the candidate's specific expertise, years of experience, and value proposition, making them memorable and relevant to hiring managers. In contrast, the weak headlines lack specificity and fail to differentiate the candidate from others, often coming across as generic and uninspiring. A well-crafted headline not only captures attention but also sets the tone for the rest of the resume, encouraging further exploration of the candidate's qualifications.

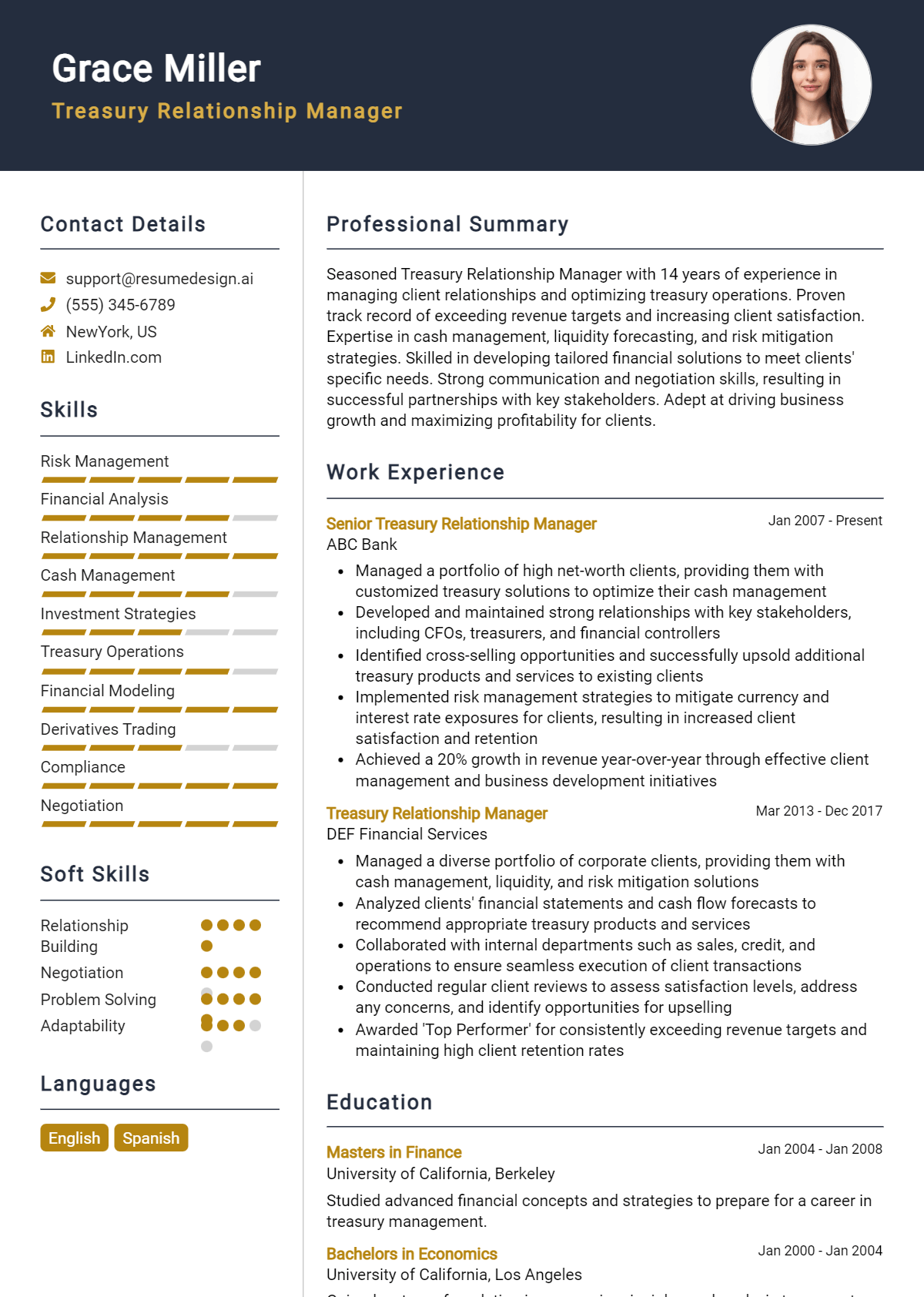

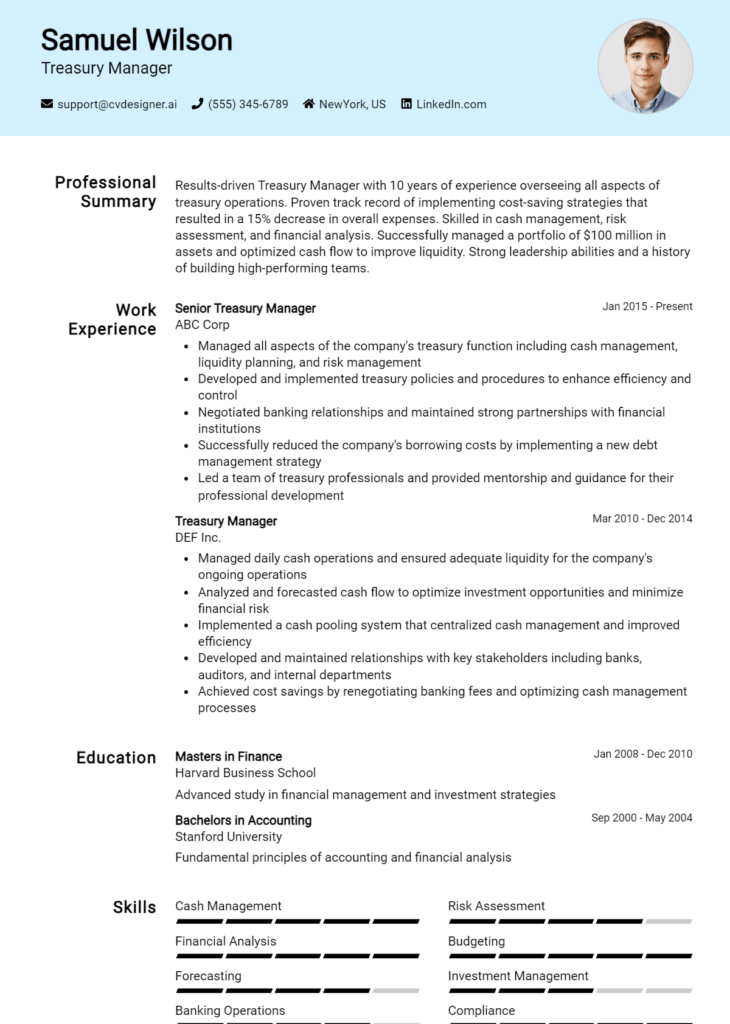

Writing an Exceptional Treasury Relationship Manager Resume Summary

A well-crafted resume summary is essential for a Treasury Relationship Manager, as it serves as the first impression for hiring managers. This brief yet impactful paragraph succinctly encapsulates the candidate’s key skills, relevant experience, and significant accomplishments, aligning them with the specific requirements of the job. By doing so, a strong summary not only captures the attention of hiring managers but also sets the tone for the rest of the resume. It should be concise and tailored to highlight the most pertinent information for the role, ensuring that the candidate stands out in a competitive job market.

Best Practices for Writing a Treasury Relationship Manager Resume Summary

- Quantify achievements: Use numbers and metrics to demonstrate your impact and success in previous roles.

- Focus on relevant skills: Highlight specific skills that are directly applicable to treasury management and relationship building.

- Tailor the summary: Customize your summary for each job application to align with the job description and company values.

- Highlight industry knowledge: Showcase your understanding of treasury operations, financial markets, and regulations.

- Use action-oriented language: Start with strong verbs to convey a sense of proactivity and results-driven attitude.

- Keep it concise: Aim for 3-5 sentences that deliver maximum impact without unnecessary fluff.

- Include soft skills: Mention interpersonal skills that are vital for relationship management, such as communication and negotiation.

- Reflect your career objectives: Ensure your summary conveys your professional goals and how they align with the company's vision.

Example Treasury Relationship Manager Resume Summaries

Strong Resume Summaries

Results-driven Treasury Relationship Manager with over 10 years of experience in optimizing cash flow and enhancing banking relationships. Successfully reduced operational costs by 20% through strategic negotiation of service fees and improved cash management practices.

Dynamic financial professional specializing in treasury operations, with a proven track record of managing portfolios exceeding $500 million. Expert in developing tailored financial solutions that increase client satisfaction and retention rates by 30%.

Accomplished Treasury Relationship Manager with a strong background in risk management and compliance. Led a project that improved financial forecasting accuracy by 15%, enabling better strategic decision-making for clients.

Weak Resume Summaries

Experienced Treasury Manager with skills in finance and banking. Seeking to leverage my knowledge in a new position.

Dedicated professional looking for a Treasury Relationship Manager role where I can use my experience in treasury management.

The strong resume summaries are effective because they provide quantifiable achievements and specific skills relevant to the Treasury Relationship Manager role, demonstrating the candidate’s value. In contrast, the weak summaries lack detail and impact, failing to convey the candidate's unique qualifications or any measurable contributions, making them less compelling to hiring managers.

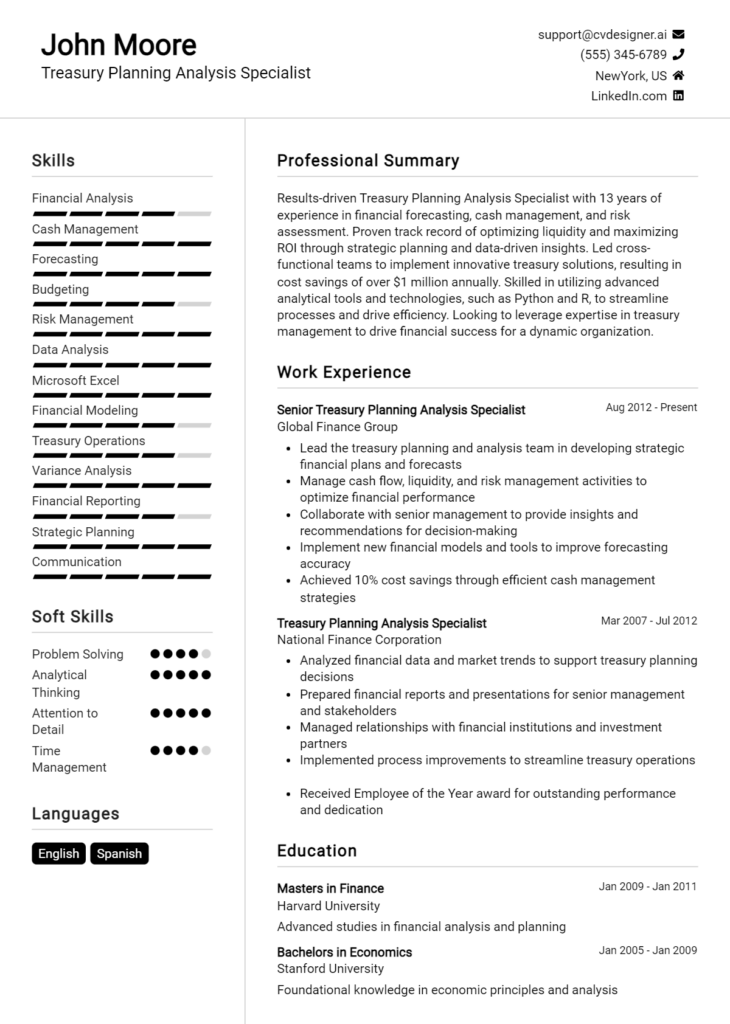

Work Experience Section for Treasury Relationship Manager Resume

The work experience section of a Treasury Relationship Manager resume is critical as it provides potential employers with a comprehensive view of the candidate's background and expertise in the field. This section not only highlights the candidate's technical skills but also demonstrates their ability to manage teams effectively and deliver high-quality financial products. By quantifying achievements and aligning their experience with industry standards, candidates can showcase their value and relevance in a competitive job market. A well-crafted work experience section can make a significant difference in capturing the attention of hiring managers and securing interviews.

Best Practices for Treasury Relationship Manager Work Experience

- Clearly outline roles and responsibilities to demonstrate technical expertise.

- Quantify achievements with specific metrics (e.g., percentage increases in efficiency or revenue).

- Highlight collaboration with cross-functional teams to showcase teamwork and leadership.

- Use industry-specific terminology to align with job descriptions and expectations.

- Focus on outcomes and results rather than just tasks performed.

- Tailor the experience section to match the requirements of the job you are applying for.

- Include relevant certifications or training that enhance your qualifications.

- Keep descriptions concise and focused, ensuring clarity and readability.

Example Work Experiences for Treasury Relationship Manager

Strong Experiences

- Led a team of 5 in implementing a new treasury management system that improved cash flow forecasting accuracy by 30% within the first quarter.

- Negotiated credit facilities with financial institutions resulting in a 15% reduction in borrowing costs, saving the company $500,000 annually.

- Developed and executed a risk management strategy that decreased foreign exchange exposure by 40%, significantly enhancing the financial stability of the organization.

- Collaborated with the finance department to streamline the cash management process, reducing transaction processing times by 25%.

Weak Experiences

- Responsible for managing treasury operations.

- Worked on various projects related to cash management.

- Participated in team meetings to discuss treasury issues.

- Assisted with financial reports and analysis.

The examples listed as strong experiences are considered strong because they provide specific, quantifiable outcomes and demonstrate leadership and collaboration within the treasury function. These statements reflect the candidate's ability to achieve measurable results, which is highly valued in the financial industry. In contrast, the weak experiences lack detail and specificity, making it difficult for potential employers to gauge the candidate's impact and expertise. Vague statements fail to illustrate the candidate's contributions and can diminish the overall effectiveness of the resume.

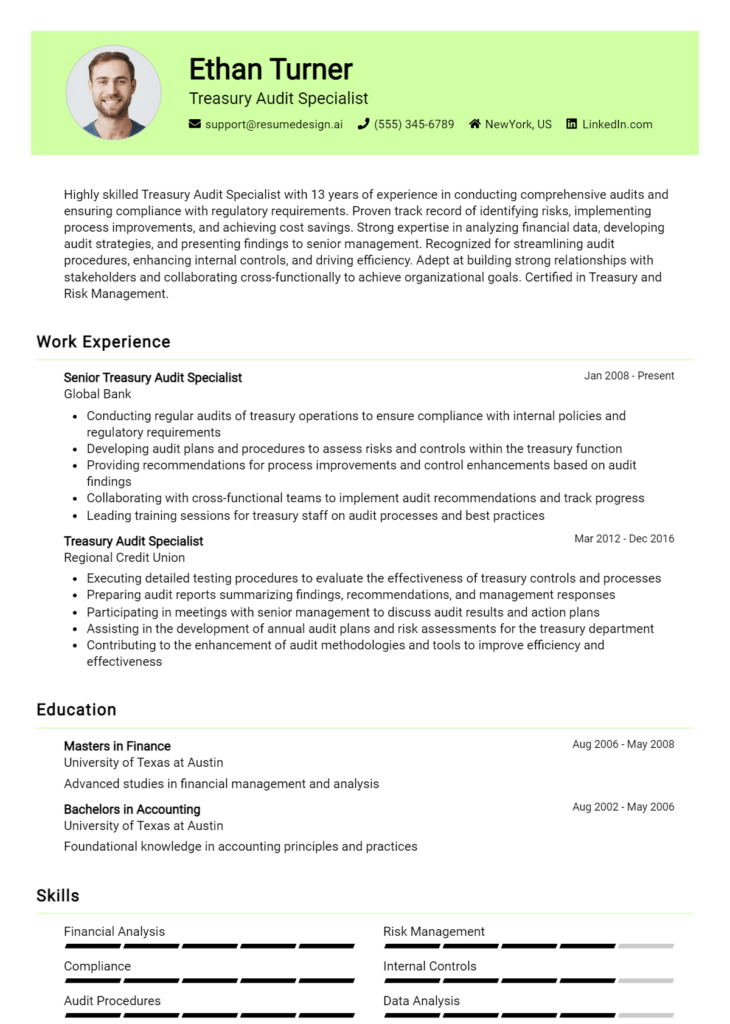

Education and Certifications Section for Treasury Relationship Manager Resume

The education and certifications section of a Treasury Relationship Manager resume is crucial in establishing a candidate's foundational knowledge and expertise in finance and treasury management. This section not only highlights the candidate's academic background but also showcases relevant industry certifications and commitment to continuous learning. By providing details about pertinent coursework, specialized training, and recognized credentials, candidates can significantly enhance their credibility and demonstrate their alignment with the demands of the Treasury Relationship Manager role. A well-articulated education and certifications section reflects a candidate's readiness to navigate the complexities of financial relationships and risk management.

Best Practices for Treasury Relationship Manager Education and Certifications

- Include relevant degrees such as Finance, Banking, or Business Administration to demonstrate foundational knowledge.

- Highlight industry-recognized certifications such as Certified Treasury Professional (CTP) or Chartered Financial Analyst (CFA) to validate expertise.

- Provide a brief description of relevant coursework that aligns with treasury management, such as Risk Management or Financial Analysis.

- List any specialized training or workshops attended that focus on treasury operations or relationship management.

- Prioritize certifications obtained within the last five years to show current knowledge and skills.

- Consider including continuing education courses that demonstrate a commitment to professional development.

- Use clear and concise language to ensure easy readability and emphasize the most relevant qualifications.

- Organize the section in reverse chronological order, starting with the most recent educational achievements and certifications.

Example Education and Certifications for Treasury Relationship Manager

Strong Examples

- MBA in Finance, University of Chicago, 2020

- Certified Treasury Professional (CTP), Association for Financial Professionals, 2021

- Bachelor of Science in Business Administration, Major in Finance, New York University, 2018

- Advanced Risk Management Training, Global Association of Risk Professionals, 2022

Weak Examples

- Associate Degree in Liberal Arts, Community College, 2015

- Certification in Microsoft Excel, Online Course, 2019

- Bachelor of Arts in English Literature, University of California, 2014

- Old certification in Basic Accounting, 2010 (no longer relevant)

The strong examples listed demonstrate relevant educational achievements and certifications that directly align with the skills and knowledge required for a Treasury Relationship Manager. These credentials reflect a solid understanding of finance and treasury management concepts, making the candidate a strong fit for the role. Conversely, the weak examples highlight qualifications that are either unrelated to the treasury field or outdated, thereby failing to enhance the candidate's profile for the position they are applying for. The relevance and recency of educational qualifications are essential in making a compelling case for a candidate's suitability in the treasury domain.

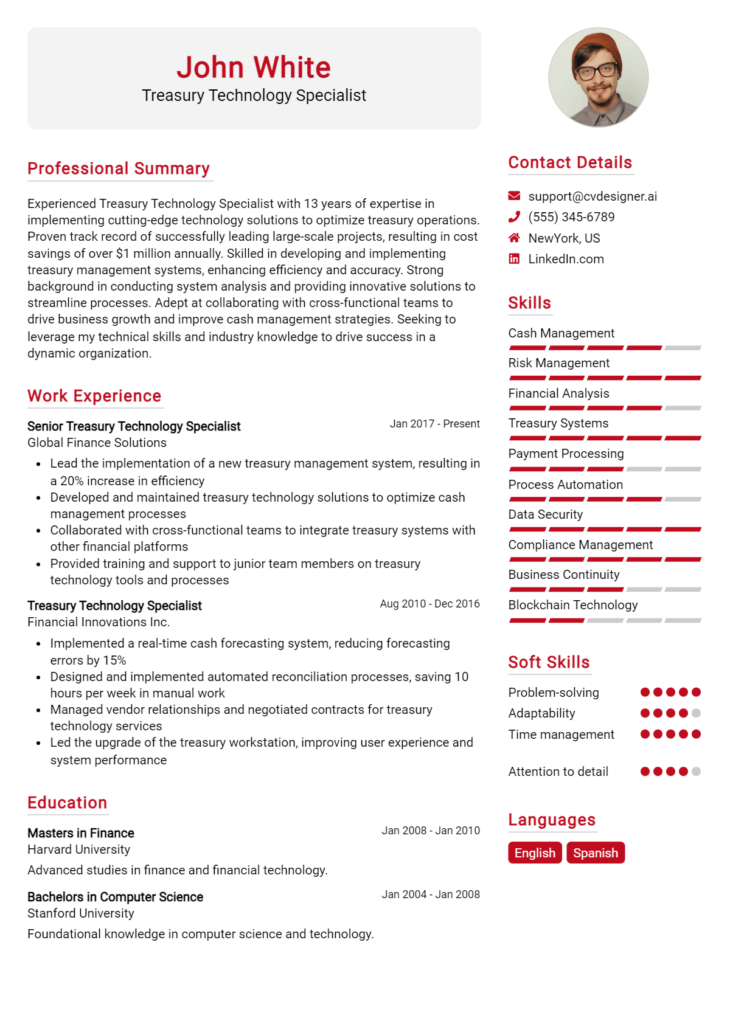

Top Skills & Keywords for Treasury Relationship Manager Resume

As a Treasury Relationship Manager, having the right skills is crucial for effectively managing client relationships and optimizing financial strategies. A well-crafted resume that highlights both hard and soft skills can significantly enhance your chances of landing the job. The blend of these skills not only demonstrates your technical expertise but also showcases your ability to communicate, negotiate, and build lasting relationships with clients. By emphasizing relevant skills, you present yourself as a well-rounded candidate capable of navigating the complexities of treasury management.

Top Hard & Soft Skills for Treasury Relationship Manager

Soft Skills

- Excellent communication skills

- Strong interpersonal abilities

- Problem-solving aptitude

- Negotiation skills

- Attention to detail

- Time management

- Adaptability

- Client-focused mindset

- Team collaboration

- Strategic thinking

Hard Skills

- Financial analysis

- Risk management

- Treasury management systems proficiency

- Cash flow forecasting

- Investment strategies

- Regulatory compliance knowledge

- Financial modeling

- Proficient in Excel and financial software

- Understanding of market trends

- Knowledge of banking products and services

By showcasing these skills on your resume, along with relevant work experience, you will position yourself as a competitive candidate in the treasury management field.

Stand Out with a Winning Treasury Relationship Manager Cover Letter

Dear [Hiring Manager's Name],

I am excited to apply for the Treasury Relationship Manager position at [Company Name], as advertised. With over [X years] of experience in treasury management and client relations, I have honed my ability to build strong relationships with clients while delivering exceptional financial solutions tailored to their unique needs. My background in finance, coupled with my strategic approach to relationship management, positions me well to contribute positively to your esteemed organization.

In my previous role at [Previous Company Name], I successfully managed a diverse portfolio of corporate clients, enhancing their treasury operations and optimizing cash management strategies. By collaborating closely with clients, I identified opportunities for process improvements and implemented solutions that resulted in a [specific achievement, e.g., "20% reduction in liquidity risk"]. My proactive approach to relationship building has allowed me to foster long-term partnerships, ensuring client satisfaction and retention in a competitive market. I am particularly drawn to [Company Name] because of its commitment to innovation and excellence in treasury services, and I am eager to bring my expertise in financial analysis and strategic consulting to your team.

Additionally, I possess a strong understanding of the regulatory environment affecting treasury operations, enabling me to assist clients in navigating complex compliance requirements confidently. I believe that effective communication is key to a successful relationship manager, and I pride myself on my ability to convey complex financial concepts in a clear and accessible manner. I am excited about the opportunity to leverage my skills in a dynamic environment like [Company Name], where I can help clients achieve their financial goals while driving the growth of your treasury services.

Thank you for considering my application. I look forward to the opportunity to discuss how my background and skills align with the needs of your team. I am eager to contribute to [Company Name] and help elevate its treasury management offerings to new heights.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Treasury Relationship Manager Resume

When crafting a resume for a Treasury Relationship Manager position, it's essential to present your qualifications and experience in a compelling manner. However, many candidates often make critical errors that can hinder their chances of landing an interview. Understanding these common pitfalls can help you create a more effective resume that highlights your strengths and aligns with the expectations of hiring managers in the finance industry. Here are some mistakes to avoid:

Lack of Specificity: Failing to provide specific examples of your achievements can make your resume bland. Quantify your accomplishments (e.g., "Managed a portfolio worth $100 million") to demonstrate your impact.

Generic Job Descriptions: Using vague job descriptions that could apply to any finance role dilutes the focus of your resume. Tailor your experience to highlight responsibilities and skills that are directly relevant to treasury management.

Ignoring Key Skills: Not showcasing essential skills such as cash management, risk assessment, and financial analysis can leave your resume lacking. Ensure these competencies are prominently featured.

Overly Complex Language: Using jargon or overly complex language can alienate recruiters. Aim for clarity and conciseness to ensure your resume is easily understood.

Neglecting to Highlight Relationships: As a Treasury Relationship Manager, relationship-building is crucial. Failing to mention your success in managing client relationships and partnerships may overlook a key aspect of the role.

Poor Formatting: A cluttered or unprofessional layout can detract from the content of your resume. Use a clean, organized format that enhances readability and allows important information to stand out.

Inconsistent Tense Usage: Mixing past and present tense can confuse readers. Maintain consistency in verb tense, using past tense for previous roles and present tense for current responsibilities.

Omitting Relevant Certifications: Not including relevant certifications, such as Certified Treasury Professional (CTP), can hinder your credibility. Highlight any professional designations that demonstrate your expertise in treasury management.

Conclusion

As a Treasury Relationship Manager, your role is pivotal in maintaining and enhancing relationships with clients, while ensuring effective management of their treasury functions. Key responsibilities include analyzing client needs, providing tailored treasury solutions, and fostering strong connections between the financial institution and its clients. Additionally, staying updated on market trends and regulatory changes is crucial for advising clients effectively.

To excel in this role, it’s important to showcase your expertise in financial analysis, risk management, and client relationship management in your resume. Highlighting relevant achievements and experiences will set you apart from other candidates.

Now is the perfect time to review your Treasury Relationship Manager resume and ensure it reflects your qualifications and accomplishments accurately. Utilize available tools to enhance your job application. Check out resume templates for professionally designed formats, or use the resume builder for a seamless creation process. You can also explore resume examples for inspiration, and don’t forget to craft a compelling cover letter with our cover letter templates. Take action today to improve your chances of landing that coveted role!