Treasury Regulatory Reporting Analyst Core Responsibilities

A Treasury Regulatory Reporting Analyst plays a crucial role in ensuring compliance with financial regulations by preparing and submitting accurate reports to regulatory bodies. This position requires a blend of technical skills, operational expertise, and problem-solving abilities to interpret complex data and collaborate effectively across departments such as finance, risk management, and compliance. Strong analytical skills and attention to detail are essential for success, contributing to the organization's overall financial integrity. A well-structured resume can effectively highlight these qualifications, showcasing the candidate’s ability to bridge functions and support organizational goals.

Common Responsibilities Listed on Treasury Regulatory Reporting Analyst Resume

- Prepare and submit regulatory reports in compliance with applicable laws and regulations.

- Analyze financial data to ensure accuracy and completeness of reports.

- Collaborate with finance, compliance, and risk management teams to gather required information.

- Monitor changes in regulatory requirements and update reporting processes accordingly.

- Assist in the development and implementation of reporting policies and procedures.

- Conduct regular audits of reporting processes to identify areas for improvement.

- Provide support during regulatory examinations and audits.

- Develop and maintain reporting tools and templates for efficiency.

- Train team members on regulatory reporting standards and practices.

- Communicate findings and recommendations to senior management.

- Stay updated on industry trends and best practices in regulatory reporting.

High-Level Resume Tips for Treasury Regulatory Reporting Analyst Professionals

In the competitive field of Treasury Regulatory Reporting, having a well-crafted resume is crucial for standing out to potential employers. Your resume often serves as the first impression you make, and it needs to effectively showcase both your skills and achievements. A strong resume not only highlights your qualifications but also tells a compelling story of your professional journey. For Treasury Regulatory Reporting Analyst professionals, it's essential to create a document that resonates with hiring managers and aligns with the specific demands of the role. This guide will provide practical and actionable resume tips specifically tailored for Treasury Regulatory Reporting Analyst professionals, ensuring you put your best foot forward in your job search.

Top Resume Tips for Treasury Regulatory Reporting Analyst Professionals

- Tailor your resume to align with the job description, using keywords and phrases from the posting.

- Highlight relevant regulatory experience, emphasizing your knowledge of compliance standards and reporting requirements.

- Quantify your achievements, such as the accuracy of reports submitted or improvements made to processes, to demonstrate your impact.

- Include specific software and tools that are relevant to treasury and regulatory reporting, such as SAP, Oracle, or Excel.

- Showcase your analytical skills by detailing past projects or analyses you have conducted that influenced decision-making.

- Incorporate industry certifications or continuing education courses that enhance your qualifications and expertise.

- Emphasize your ability to work collaboratively with cross-functional teams to ensure timely and accurate reporting.

- Keep your resume concise and focused, ideally one page, while still providing enough detail to show your depth of experience.

- Use action verbs to describe your responsibilities and accomplishments, creating an engaging narrative of your career.

- Proofread for errors and ensure consistent formatting, as attention to detail is critical in the regulatory field.

By implementing these tips, you can significantly increase your chances of landing a job in the Treasury Regulatory Reporting Analyst field. A well-structured resume that effectively communicates your skills, experiences, and accomplishments will not only catch the eye of hiring managers but also set you apart from the competition, ultimately leading to more interview opportunities.

Why Resume Headlines & Titles are Important for Treasury Regulatory Reporting Analyst

In the competitive field of Treasury Regulatory Reporting, a well-crafted resume headline or title serves as a critical first impression for hiring managers. This brief yet impactful phrase can succinctly encapsulate a candidate's core qualifications and areas of expertise, immediately drawing attention amidst a sea of applicants. A strong headline should be concise, relevant, and tailored to the specific role being applied for, ensuring it resonates with the job description and highlights the candidate’s unique value proposition. By effectively summarizing key skills and experiences, a compelling headline can significantly enhance the chances of advancing in the application process.

Best Practices for Crafting Resume Headlines for Treasury Regulatory Reporting Analyst

- Keep it concise – Aim for a headline that is no longer than one sentence.

- Be role-specific – Use keywords related to Treasury Regulatory Reporting to align with the job description.

- Highlight key qualifications – Focus on your most relevant skills or accomplishments that pertain to the role.

- Use action-oriented language – Start with strong verbs or impactful phrases to create a sense of urgency.

- Avoid jargon – Ensure the language is clear and accessible to all readers, including HR professionals.

- Tailor for each application – Customize your headline for each job to reflect the specific requirements of the position.

- Showcase measurable achievements – If possible, include figures or statistics that demonstrate your impact in previous roles.

- Maintain professionalism – Ensure the tone is formal and appropriate for the finance industry.

Example Resume Headlines for Treasury Regulatory Reporting Analyst

Strong Resume Headlines

Detail-Oriented Treasury Regulatory Reporting Analyst with 5 Years of Experience in Compliance and Risk Management

Results-Driven Analyst Specializing in Regulatory Reporting and Financial Risk Assessment

Experienced Treasury Professional with Proven Record in Streamlining Regulatory Processes and Enhancing Reporting Accuracy

Weak Resume Headlines

Analyst Looking for Opportunities

Finance Professional with Various Skills

Strong headlines are effective because they are specific, focused, and convey a clear message about the candidate's qualifications and expertise relevant to the Treasury Regulatory Reporting Analyst role. They use industry-specific terminology and highlight key skills and achievements that align with the job description, making them stand out to hiring managers. In contrast, weak headlines fail to impress because they lack specificity, do not convey any meaningful information about the candidate's strengths, and come across as generic. This leaves hiring managers with little incentive to explore the candidate's resume further.

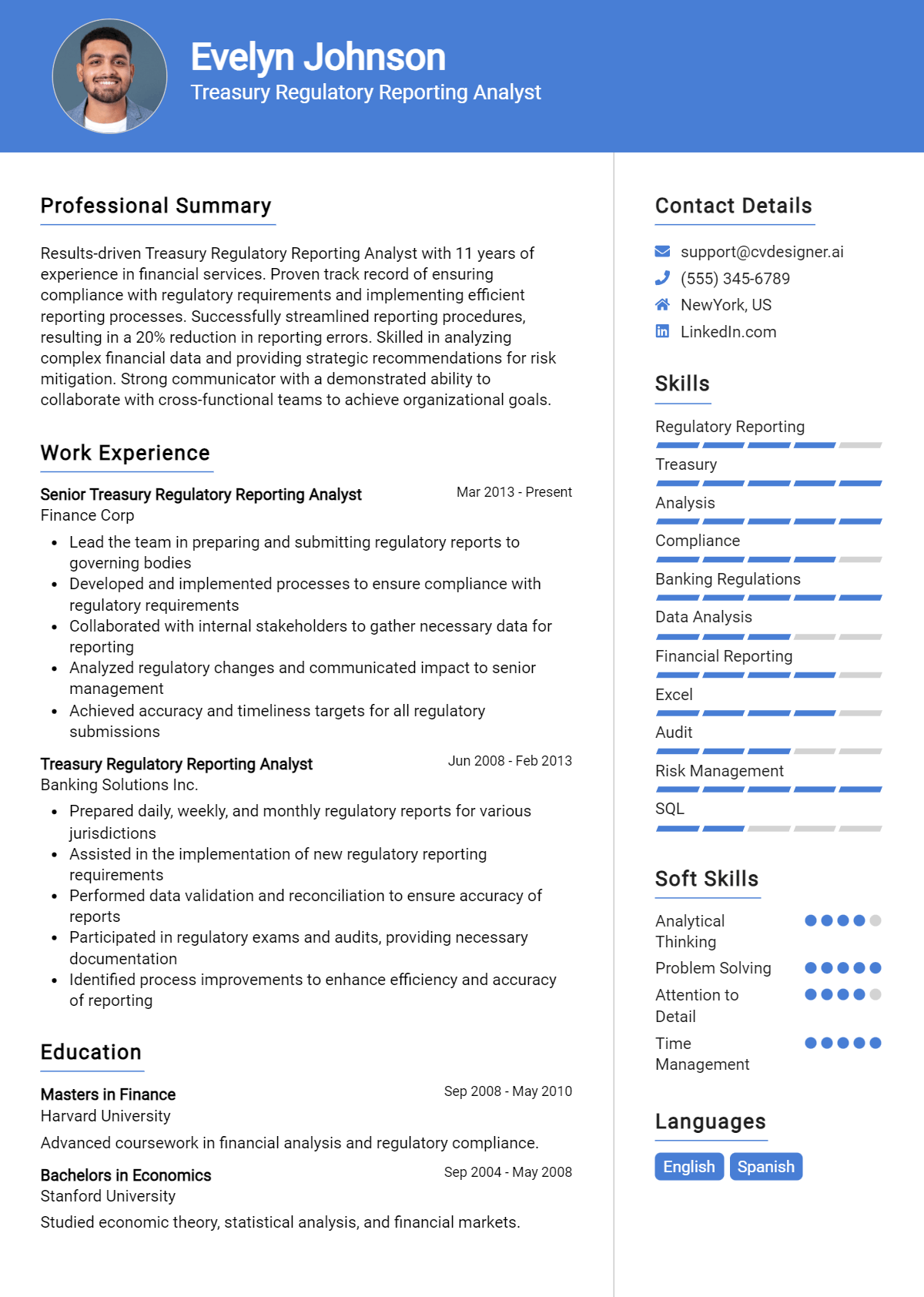

Writing an Exceptional Treasury Regulatory Reporting Analyst Resume Summary

A well-crafted resume summary is crucial for a Treasury Regulatory Reporting Analyst, as it serves as the first impression for hiring managers who are quickly sifting through numerous applications. A strong summary succinctly highlights the candidate's key skills, relevant experience, and notable accomplishments, effectively capturing the attention of recruiters. This section should be concise yet impactful, tailored specifically to the job description to demonstrate a clear alignment with the employer's needs. By doing so, candidates can significantly increase their chances of standing out in a competitive job market.

Best Practices for Writing a Treasury Regulatory Reporting Analyst Resume Summary

- Quantify Achievements: Use numbers to showcase your accomplishments, such as the amount of funds managed or percentage improvements made.

- Focus on Relevant Skills: Highlight key skills related to treasury and regulatory reporting, such as financial analysis, compliance knowledge, and data management.

- Tailor the Summary: Customize the summary for each application, reflecting the specific requirements and language of the job description.

- Use Action Verbs: Start sentences with powerful action verbs to create a dynamic tone, such as "managed," "developed," or "analyzed."

- Keep it Concise: Aim for 3-5 sentences to ensure the summary remains impactful without overwhelming the reader.

- Highlight Industry Experience: Mention relevant experience in treasury operations or regulatory compliance to establish credibility.

- Showcase Soft Skills: Include essential soft skills such as attention to detail, analytical thinking, and problem-solving abilities.

- Include Certifications: If applicable, mention relevant certifications or educational qualifications that enhance your profile.

Example Treasury Regulatory Reporting Analyst Resume Summaries

Strong Resume Summaries

Dynamic Treasury Regulatory Reporting Analyst with over 5 years of experience in managing compliance for multi-billion dollar financial portfolios. Successfully improved reporting accuracy by 30% through the implementation of automated financial systems, ensuring adherence to regulatory standards.

Detail-oriented professional with a proven track record in regulatory reporting and risk management. Spearheaded the development of a new reporting framework that reduced processing time by 40%, enhancing overall operational efficiency.

Results-driven Treasury Analyst with expertise in financial compliance and data analysis. Achieved a 25% reduction in reporting errors while managing a $3 billion treasury portfolio, contributing to enhanced financial performance and regulatory compliance.

Weak Resume Summaries

Experienced analyst looking for a role in treasury reporting. I have skills in finance and enjoy working with numbers.

Dedicated professional with knowledge of regulatory reporting. Seeking to leverage my experience in a new opportunity.

The examples of strong resume summaries are considered effective because they include specific achievements, quantifiable results, and relevant skills tailored to the Treasury Regulatory Reporting Analyst role. They demonstrate the candidate's value and impact within their previous positions. In contrast, the weak summaries lack detail, specificity, and measurable outcomes, making them less engaging and informative for hiring managers.

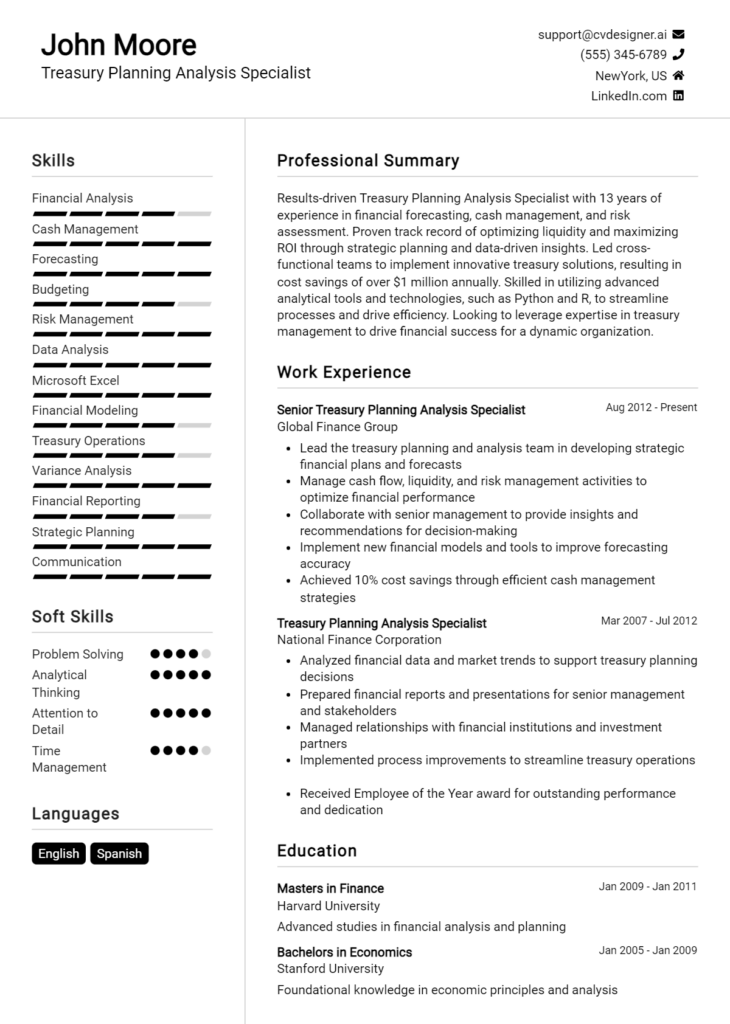

Work Experience Section for Treasury Regulatory Reporting Analyst Resume

The work experience section of a Treasury Regulatory Reporting Analyst resume is critical as it provides potential employers with insight into the candidate's practical application of skills in real-world settings. This section highlights the candidate's technical expertise, their capability to manage teams effectively, and their commitment to delivering high-quality regulatory reporting products. By quantifying achievements and aligning experiences with industry standards, candidates can demonstrate their value and readiness for the role, making this section pivotal in distinguishing themselves from other applicants.

Best Practices for Treasury Regulatory Reporting Analyst Work Experience

- Focus on relevant technical skills such as data analysis, financial modeling, and regulatory compliance.

- Quantify achievements with specific metrics, such as percentage improvements in reporting accuracy or reductions in processing times.

- Highlight leadership experiences, especially in managing teams or projects related to regulatory reporting.

- Showcase collaboration with cross-functional teams, emphasizing effective communication and problem-solving abilities.

- Utilize industry-standard terminology and frameworks to align experience with the expectations of the role.

- Emphasize continuous learning and adaptation to new regulations and reporting requirements.

- Include specific software tools and technologies used in previous roles, demonstrating technical proficiency.

- Keep descriptions concise and focused, ensuring clarity and relevance to the position applied for.

Example Work Experiences for Treasury Regulatory Reporting Analyst

Strong Experiences

- Led a team in the successful implementation of a new regulatory reporting system, resulting in a 30% decrease in report preparation time and a 15% increase in accuracy.

- Developed and maintained comprehensive dashboards that tracked key regulatory metrics, improving data visibility and decision-making processes for senior management.

- Collaborated with compliance teams to streamline reporting processes, achieving a 20% reduction in compliance-related discrepancies over a year.

- Conducted training sessions for cross-departmental staff on regulatory changes, enhancing overall team knowledge and compliance adherence by 25%.

Weak Experiences

- Worked on regulatory reports as part of a team.

- Assisted in managing some compliance tasks.

- Participated in meetings about reporting issues.

- Helped with data entry for regulatory documents.

The examples provided are considered strong because they clearly highlight specific achievements and quantify the impact of the candidate's work in measurable terms. They illustrate leadership and collaboration, showcasing the candidate's ability to drive results effectively. In contrast, the weak experiences lack detail and specificity, failing to convey the candidate's actual contributions or the outcomes of their work, making them less compelling to prospective employers.

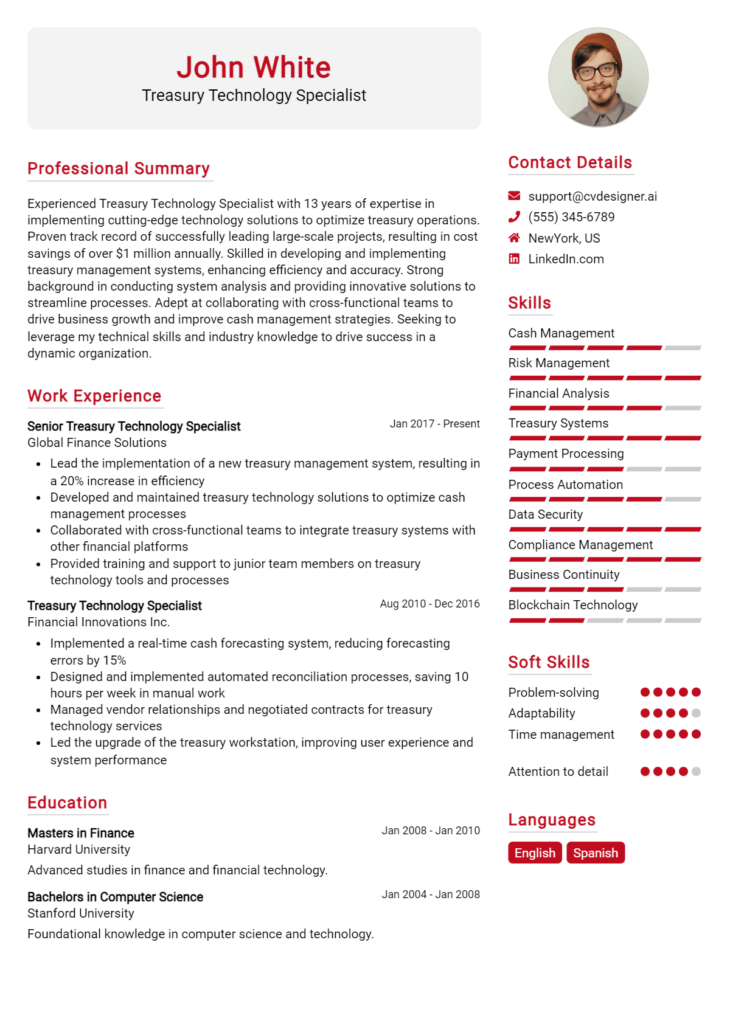

Education and Certifications Section for Treasury Regulatory Reporting Analyst Resume

The education and certifications section of a Treasury Regulatory Reporting Analyst resume is crucial for showcasing the candidate's academic background and credentials relevant to the position. This section not only highlights formal education but also emphasizes industry-recognized certifications and ongoing professional development efforts that are vital in the fast-evolving landscape of financial regulations. By providing relevant coursework, certifications, and specialized training, candidates can significantly enhance their credibility, demonstrating a strong alignment with the demands of the role and a commitment to continuous learning in the field.

Best Practices for Treasury Regulatory Reporting Analyst Education and Certifications

- Focus on relevant degrees, such as Finance, Accounting, or Business Administration.

- Include industry-recognized certifications like CFA, CPA, or FRM.

- Detail any specialized training in regulatory compliance or financial reporting.

- Incorporate relevant coursework that directly relates to treasury management and regulatory frameworks.

- Highlight any ongoing education or professional development activities.

- Ensure to list the most current certifications and degrees to reflect up-to-date knowledge.

- Only include certifications that are relevant to the treasury and regulatory reporting fields.

- Maintain a clear and organized format to enhance readability.

Example Education and Certifications for Treasury Regulatory Reporting Analyst

Strong Examples

- Bachelor of Science in Finance, University of XYZ, Graduated May 2020

- Certified Treasury Professional (CTP), Association for Financial Professionals, Obtained 2021

- Master’s Degree in Accounting, University of ABC, Expected Graduation December 2023

- Relevant Coursework: Financial Risk Management, Regulatory Compliance in Finance, Advanced Financial Reporting

Weak Examples

- Bachelor of Arts in History, University of DEF, Graduated May 2015

- Certification in Basic Accounting, Local Community College, Completed 2018

- Diploma in Office Administration, Institute of GHI, Obtained 2017

- Online Course in General Business Practices, Completed 2022

The strong examples are considered effective because they directly relate to the skills and knowledge required for a Treasury Regulatory Reporting Analyst role, showcasing relevant degrees and certifications that validate the candidate's expertise. In contrast, the weak examples highlight educational qualifications and certifications that lack relevance to the treasury and regulatory reporting field, failing to demonstrate the necessary competencies and alignment with the job requirements.

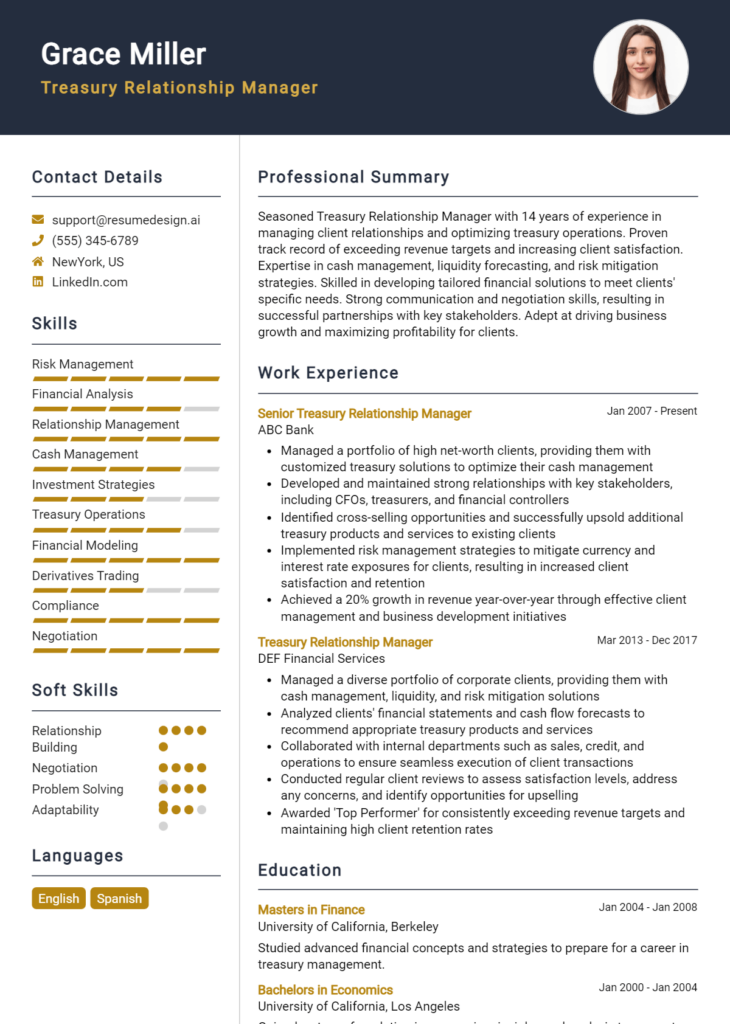

Top Skills & Keywords for Treasury Regulatory Reporting Analyst Resume

In the competitive field of Treasury Regulatory Reporting, showcasing the right combination of skills on your resume is essential for standing out to potential employers. A Treasury Regulatory Reporting Analyst plays a critical role in ensuring compliance with financial regulations and managing risk within an organization. Therefore, highlighting both hard and soft skills can significantly enhance your resume's effectiveness. The right skills not only demonstrate your technical expertise but also your ability to collaborate, communicate, and adapt in a fast-paced financial environment. Employers seek candidates who can navigate complex regulatory landscapes while maintaining a high standard of accuracy and integrity in their reporting processes.

Top Hard & Soft Skills for Treasury Regulatory Reporting Analyst

Soft Skills

- Attention to Detail

- Analytical Thinking

- Communication Skills

- Problem-Solving Ability

- Time Management

- Team Collaboration

- Adaptability

- Critical Thinking

- Interpersonal Skills

- Ethical Judgment

Hard Skills

- Financial Reporting

- Regulatory Compliance Knowledge

- Risk Management

- Data Analysis

- Proficiency in Excel and Financial Software

- Knowledge of GAAP and IFRS Standards

- Treasury Management Systems (TMS) Expertise

- Understanding of Financial Instruments

- Ability to Prepare Regulatory Filings

- Experience with Financial Modeling

By focusing on these essential skills and effectively integrating them into your resume, you can better position yourself as a qualified candidate for the role. Additionally, complementing these skills with relevant work experience will further enhance your appeal to hiring managers in the financial sector.

Stand Out with a Winning Treasury Regulatory Reporting Analyst Cover Letter

Dear Hiring Manager,

I am writing to express my interest in the Treasury Regulatory Reporting Analyst position at [Company Name], as advertised on [Where You Found the Job Posting]. With a robust background in finance and a deep understanding of regulatory frameworks, I am excited about the opportunity to contribute to your esteemed organization. My experience in preparing and submitting regulatory reports, coupled with my analytical skills, positions me as a strong candidate for this role.

In my previous role at [Previous Company Name], I was responsible for the preparation of various regulatory reports, including the FR Y-9C and the Call Report. I closely monitored compliance with evolving regulations, ensuring that all submissions were accurate and timely. My proficiency in data analysis tools, along with my attention to detail, allowed me to identify discrepancies and implement process improvements that enhanced reporting accuracy. I am adept at working collaboratively with cross-functional teams to gather necessary data and communicate complex regulatory requirements effectively.

I am particularly drawn to [Company Name] because of your commitment to excellence and innovation in the financial sector. I admire your proactive approach to regulatory compliance and your emphasis on maintaining high standards of integrity. I am eager to bring my expertise in treasury operations and my passion for regulatory reporting to your team, contributing to your ongoing success in navigating the complexities of financial regulations.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences align with the needs of your team. I am enthusiastic about the prospect of joining [Company Name] and contributing to its mission of financial stewardship and regulatory compliance.

Sincerely,

[Your Name]

[Your Contact Information]

[LinkedIn Profile or Website, if applicable]

Common Mistakes to Avoid in a Treasury Regulatory Reporting Analyst Resume

When crafting a resume for the position of Treasury Regulatory Reporting Analyst, it’s essential to highlight relevant skills and experiences effectively. However, many candidates make common mistakes that can undermine their chances of landing an interview. By being aware of these pitfalls, you can ensure that your resume stands out for the right reasons and accurately reflects your expertise in this critical field.

Neglecting Tailored Content: Failing to customize your resume for the specific role can make it seem generic. Use keywords from the job description to demonstrate your alignment with the position.

Overlooking Compliance Knowledge: Treasury Regulatory Reporting Analysts must be well-versed in compliance regulations. Not showcasing your familiarity with relevant regulations can be a missed opportunity.

Using Jargon Without Context: While industry-specific terminology can demonstrate expertise, overusing jargon without sufficient context may confuse hiring managers who are not familiar with certain terms.

Ignoring Quantifiable Achievements: Simply listing job duties without quantifying your accomplishments can weaken your resume. Use metrics to highlight your impact, such as improved reporting accuracy or efficiency.

Lack of Clear Structure: A cluttered or poorly organized resume can be difficult to read. Ensure your document is well-structured with clear headings and bullet points for easy navigation.

Inadequate Focus on Technical Skills: In the treasury field, technical abilities are critical. Failing to emphasize your proficiency with relevant software and analytical tools can make your application less competitive.

Not Including Relevant Certifications: Certifications such as CFA or FRM can enhance your credibility. Omitting these from your resume may lead to missed opportunities to demonstrate your commitment to professional development.

Forgetting to Proofread: Grammatical errors or typos can create a negative impression. Always proofread your resume to ensure it is polished and professional before submitting.

Conclusion

In conclusion, the role of a Treasury Regulatory Reporting Analyst is vital in ensuring compliance with financial regulations and effective management of an organization’s capital. Key responsibilities include preparing accurate financial reports, analyzing regulatory requirements, and collaborating with various departments to streamline reporting processes. Given the complexity of regulations and the importance of precise reporting, it is essential for professionals in this field to present their skills and experiences effectively on their resumes.

To enhance your chances of landing a position as a Treasury Regulatory Reporting Analyst, take the time to review and update your resume. Utilize available tools such as resume templates to create a professional layout, or explore our resume builder for an easy and efficient way to construct your document. Additionally, check out resume examples to gain inspiration and ensure you highlight the most relevant skills. Don’t forget the importance of a strong introduction; consider using our cover letter templates to make a great first impression. Take action today to refine your application materials and stand out in the competitive job market!