Treasury Accountant Core Responsibilities

A Treasury Accountant plays a crucial role in managing an organization’s financial resources, bridging the finance, accounting, and operations departments. Key responsibilities include cash flow management, investment analysis, and risk assessment, requiring strong technical skills in financial software and analytical tools. Operational expertise ensures efficient treasury operations, while problem-solving abilities facilitate quick responses to financial challenges. Mastering these skills not only drives organizational goals but also enhances the effectiveness of a well-structured resume, showcasing a candidate's qualifications.

Common Responsibilities Listed on Treasury Accountant Resume

- Manage daily cash flow and liquidity forecasting.

- Prepare and analyze financial reports related to treasury activities.

- Monitor and manage investment portfolios.

- Conduct risk assessments and implement hedging strategies.

- Coordinate with banks and financial institutions for financing needs.

- Ensure compliance with regulatory requirements and internal policies.

- Develop and maintain treasury management systems.

- Support the budgeting and financial planning processes.

- Collaborate with cross-functional teams to optimize cash management.

- Perform variance analysis on cash and investment performance.

- Assist in audits related to treasury functions.

- Identify opportunities for process improvements within treasury operations.

High-Level Resume Tips for Treasury Accountant Professionals

In the competitive landscape of finance and accounting, a well-crafted resume is paramount for Treasury Accountant professionals seeking to make a lasting impression. Often the first point of contact with potential employers, your resume serves not only as a summary of your skills and experiences but also as a reflection of your professionalism and attention to detail. It is essential that this document effectively showcases your achievements and expertise in treasury management, accounting principles, and financial analysis. In this guide, we will provide practical and actionable resume tips specifically tailored for Treasury Accountant professionals, ensuring that your resume stands out in a crowded job market.

Top Resume Tips for Treasury Accountant Professionals

- Tailor your resume to each job description by incorporating relevant keywords and phrases that align with the specific requirements of the role.

- Highlight your relevant experience in treasury functions, such as cash management, liquidity forecasting, and investment strategy.

- Quantify your achievements with specific metrics, such as cost savings, process improvements, or revenue growth, to illustrate your impact in previous roles.

- Showcase industry-specific skills, including familiarity with treasury management systems, financial modeling, and regulatory compliance.

- Utilize a clean and professional format, making it easy for hiring managers to read and navigate your resume.

- Include a summary statement that succinctly captures your key qualifications and career goals relevant to treasury accounting.

- List relevant certifications, such as Certified Treasury Professional (CTP) or Certified Public Accountant (CPA), to enhance your credibility.

- Demonstrate your analytical skills by detailing your experience with financial reporting, risk management, and forecasting methodologies.

- Incorporate soft skills that are valuable for Treasury Accountants, such as communication, teamwork, and problem-solving abilities.

By implementing these tips, you can significantly enhance your chances of landing a job in the Treasury Accountant field. A polished and strategically crafted resume will not only highlight your qualifications but also position you as a strong candidate capable of contributing to the financial success of an organization.

Why Resume Headlines & Titles are Important for Treasury Accountant

In the competitive field of treasury accounting, a well-crafted resume headline or title serves as a crucial first impression for hiring managers. This succinct phrase acts as a beacon, drawing attention to a candidate’s most relevant qualifications and setting the tone for the entire resume. A strong headline encapsulates the candidate's key strengths—such as their expertise in cash management, financial analysis, or compliance—allowing hiring managers to quickly assess their suitability for the role. By being concise, relevant, and directly aligned with the job description, an impactful headline can significantly enhance a candidate's chances of standing out in a crowded applicant pool.

Best Practices for Crafting Resume Headlines for Treasury Accountant

- Keep it concise: Aim for a headline that is brief yet informative, ideally no more than 10 words.

- Be role-specific: Use terminology and keywords that are directly related to treasury accounting.

- Highlight key strengths: Focus on your most significant skills or accomplishments relevant to the position.

- Use action words: Start with strong verbs or active phrases to convey dynamism and competence.

- Tailor to the job: Customize your headline for each application to reflect the specific requirements of the role.

- Avoid jargon: Use clear language that is easily understood by those outside your field.

- Showcase your value: Emphasize what you can bring to the organization rather than just your qualifications.

- Maintain professionalism: Ensure that the tone of the headline aligns with the level of the position you are applying for.

Example Resume Headlines for Treasury Accountant

Strong Resume Headlines

Seasoned Treasury Accountant Specializing in Cash Flow Optimization

Results-Driven Treasury Professional with 5+ Years in Financial Risk Management

Expert in Treasury Operations & Compliance with Proven Track Record

Dynamic Financial Analyst Focused on Enhancing Liquidity Management Strategies

Weak Resume Headlines

Accountant Seeking Job

Experienced Professional Looking for Opportunities

The strong resume headlines are effective because they provide a clear and compelling snapshot of the candidate's expertise, making an immediate impact on hiring managers. Each of these headlines is tailored, specific, and showcases the individual’s strengths. In contrast, the weak headlines fail to impress due to their vagueness and lack of detail. They do not communicate any unique qualifications or value propositions, making it easy for hiring managers to overlook them in favor of more engaging candidates.

Writing an Exceptional Treasury Accountant Resume Summary

A well-crafted resume summary is essential for a Treasury Accountant as it serves as the first impression for hiring managers, quickly capturing their attention. This brief yet impactful introduction showcases the candidate's key skills, relevant experience, and notable accomplishments that align with the job role. A strong summary not only highlights what makes a candidate a perfect fit but also sets the tone for the rest of the resume. It should be concise, engaging, and tailored specifically to the job description to enhance the chances of being noticed in a competitive job market.

Best Practices for Writing a Treasury Accountant Resume Summary

- Quantify achievements to demonstrate impact, such as "Reduced cash handling discrepancies by 30% through improved reconciliation processes."

- Focus on key skills relevant to treasury accounting, including financial analysis, cash management, and risk assessment.

- Tailor the summary for the specific job description to address the employer's needs directly.

- Use action verbs to convey a sense of proactiveness and results-driven attitude.

- Keep it concise, ideally 2-3 sentences, to maintain the reader's attention.

- Highlight any relevant certifications, such as CPA or CFA, that add credibility to your expertise.

- Include industry-specific terminology to show familiarity with the field.

- Convey your career goals and how they align with the company's mission or objectives.

Example Treasury Accountant Resume Summaries

Strong Resume Summaries

Detail-oriented Treasury Accountant with over 5 years of experience managing cash flow and optimizing investment strategies. Successfully reduced operational costs by 20% through strategic cash management and risk mitigation techniques.

Results-driven Treasury Accountant with expertise in financial forecasting and liquidity management. Played a pivotal role in increasing cash reserves by 25% over two fiscal years, ensuring organization stability during market fluctuations.

Dedicated Treasury Accountant with a proven track record of improving financial reporting accuracy. Increased the efficiency of the month-end closing process by 40% by implementing automated reconciliation systems, leading to timely financial decisions.

Weak Resume Summaries

Experienced accountant looking for a job in treasury. I have done some work with cash management.

Treasury professional with a background in finance. I am seeking an opportunity to grow my career in this field.

The examples above illustrate the distinction between strong and weak resume summaries. Strong summaries effectively quantify achievements and highlight specific skills, demonstrating a clear impact on previous roles. They are tailored to convey relevance to the Treasury Accountant position, making them compelling to hiring managers. In contrast, weak summaries are vague, lack measurable outcomes, and do not provide enough detail to engage the reader, ultimately failing to showcase the candidate's qualifications effectively.

Work Experience Section for Treasury Accountant Resume

The work experience section of a Treasury Accountant resume is critical as it provides potential employers with insights into the candidate's technical skills, leadership capabilities, and overall ability to deliver high-quality financial products. This section serves as a platform for candidates to demonstrate their expertise in treasury management, cash flow forecasting, and financial analysis. By quantifying achievements and aligning experiences with industry standards, candidates can effectively showcase their contributions and value to prospective employers, making a compelling case for their candidacy.

Best Practices for Treasury Accountant Work Experience

- Highlight specific technical skills relevant to treasury accounting, such as cash management, risk assessment, and financial reporting.

- Quantify achievements with metrics, such as percentage improvements in cash flow or reductions in costs.

- Emphasize leadership experiences, including team management and project oversight.

- Showcase collaboration with other departments or stakeholders to enhance financial processes.

- Use action verbs to convey a sense of proactivity and impact.

- Tailor experiences to match the job description and industry requirements.

- Include any relevant certifications or professional development related to treasury functions.

- Keep descriptions concise and focused on results and achievements.

Example Work Experiences for Treasury Accountant

Strong Experiences

- Led a team of five in optimizing cash management processes, resulting in a 20% reduction in idle cash and saving the company $150,000 annually.

- Developed and implemented a new cash forecasting model that improved accuracy by 30%, enabling better financial planning and risk management.

- Collaborated with cross-functional teams to streamline financial reporting, reducing the month-end close process by five days.

- Managed a treasury project that automated payment processing, decreasing transaction errors by 40% and enhancing vendor relationships.

Weak Experiences

- Responsible for cash management tasks in my previous job.

- Worked on various financial reports without specifying the impact.

- Participated in team meetings regarding treasury functions.

- Assisted in preparing budgets and forecasts, but did not detail any outcomes.

The examples labeled as strong are considered effective because they clearly articulate specific achievements, quantify results, and demonstrate the candidate's ability to lead and collaborate. They provide concrete evidence of the individual's contributions to the organization. Conversely, the weak experiences lack specificity and measurable outcomes, making it difficult for potential employers to assess the candidate's impact or expertise in treasury accounting.

Education and Certifications Section for Treasury Accountant Resume

The education and certifications section of a Treasury Accountant resume plays a crucial role in showcasing the candidate's academic background and professional qualifications. This section not only highlights the degrees earned and any relevant coursework completed, but it also emphasizes industry-recognized certifications that validate the candidate's expertise in financial management and treasury operations. By including details about specialized training and ongoing education, candidates can demonstrate their commitment to continuous learning and professional development, which are vital in the ever-evolving finance landscape. A well-crafted education and certifications section can significantly enhance a candidate's credibility and alignment with the specific requirements of the Treasury Accountant role.

Best Practices for Treasury Accountant Education and Certifications

- Include relevant degrees such as a Bachelor's or Master's in Finance, Accounting, or Business Administration.

- List industry-recognized certifications, such as Certified Treasury Professional (CTP) or Chartered Financial Analyst (CFA).

- Highlight specific coursework that pertains to treasury management, risk management, or cash flow analysis.

- Provide details about any specialized training programs or workshops attended that are relevant to treasury functions.

- Ensure that the formatting is consistent and the information is easy to read and understand.

- Update this section regularly to include new certifications or courses completed.

- Prioritize the most relevant and advanced credentials to enhance visibility and impact.

- Consider including memberships in professional organizations related to treasury and finance.

Example Education and Certifications for Treasury Accountant

Strong Examples

- Bachelor of Science in Finance, XYZ University, 2018

- Certified Treasury Professional (CTP), Association for Financial Professionals, 2020

- Advanced Cash Management Strategies, Online Certification Course, 2021

- Master of Business Administration (MBA) with a focus in Finance, ABC University, 2022

Weak Examples

- Bachelor of Arts in Philosophy, DEF University, 2017

- Certification in Basic Bookkeeping, 2010

- High School Diploma, GHI High School, 2015

- Outdated certification in Personal Finance, 2018

The strong examples are considered effective because they include relevant degrees and certifications that directly support the qualifications necessary for a Treasury Accountant. They reflect a focus on financial expertise and knowledge essential for the role. In contrast, the weak examples illustrate qualifications that do not align with the treasury function or are outdated, which could detract from the candidate's suitability for the position. By focusing on relevant and current educational credentials, candidates can more effectively position themselves as ideal candidates for a Treasury Accountant role.

Top Skills & Keywords for Treasury Accountant Resume

As a Treasury Accountant, the role is pivotal in managing an organization's financial assets, ensuring liquidity, and mitigating financial risks. A well-crafted resume that highlights relevant skills is essential for standing out in a competitive job market. Employers look for candidates who not only possess technical acumen but also demonstrate strong interpersonal skills. The right combination of hard and soft skills can significantly enhance a Treasury Accountant's ability to analyze financial data, manage cash flow, and collaborate effectively with other departments. By showcasing these skills prominently in your resume, you can effectively convey your qualifications and readiness for the challenges of the role.

Top Hard & Soft Skills for Treasury Accountant

Soft Skills

- Attention to Detail

- Analytical Thinking

- Problem-Solving

- Communication Skills

- Team Collaboration

- Time Management

- Adaptability

- Critical Thinking

- Organizational Skills

- Ethical Judgment

Hard Skills

- Financial Analysis

- Cash Management

- Budgeting and Forecasting

- Risk Management

- Knowledge of Treasury Management Systems

- Accounting Software Proficiency (e.g., QuickBooks, SAP)

- Regulatory Compliance

- Investment Strategies

- Data Analysis and Reporting

- Knowledge of Financial Markets

For more insights on skills and tips on showcasing your work experience, consider exploring the resources available to strengthen your resume further.

Stand Out with a Winning Treasury Accountant Cover Letter

I am writing to express my interest in the Treasury Accountant position at [Company Name] as advertised. With a strong background in financial management and a keen eye for detail, I am excited about the opportunity to contribute to your team's success. My experience in managing cash flow, analyzing financial statements, and implementing effective treasury strategies aligns perfectly with the requirements of this role. I am particularly impressed by [Company Name]'s commitment to innovation and excellence in financial operations, and I am eager to bring my expertise to your esteemed organization.

In my previous role at [Previous Company Name], I successfully managed a portfolio of accounts that required meticulous monitoring and analysis of transactions. I streamlined cash management processes, which resulted in a 20% reduction in operational costs. My ability to collaborate with cross-functional teams has been instrumental in ensuring that financial forecasts are accurate and align with the company's strategic goals. Furthermore, my proficiency in financial software, such as SAP and Oracle, has allowed me to efficiently manage complex financial data and generate reports that support informed decision-making.

I hold a Bachelor’s degree in Accounting and am a Certified Treasury Professional (CTP), which has equipped me with a robust understanding of treasury operations and risk management. I am adept at identifying opportunities for process improvements and have a proven track record of implementing solutions that enhance efficiency and accuracy. My analytical skills, combined with my passion for financial management, make me a strong candidate for this position.

I am excited about the possibility of joining [Company Name] and contributing to your financial success. I look forward to the opportunity to discuss how my skills and experiences align with the needs of your team. Thank you for considering my application. I hope to speak with you soon.

Common Mistakes to Avoid in a Treasury Accountant Resume

When crafting a resume for a Treasury Accountant position, it’s crucial to present your qualifications and experience clearly and professionally. However, many candidates fall into common traps that can undermine their chances of securing an interview. Avoiding these pitfalls can significantly enhance your resume and better showcase your skills and suitability for the role. Here are some common mistakes to watch out for:

Generic Objective Statement: Failing to tailor your objective to the specific Treasury Accountant role can make your resume feel impersonal. Instead, focus on how your skills align with the company's needs.

Neglecting Key Skills: Omitting essential treasury-related skills, such as cash flow management, risk assessment, and financial forecasting, can lead to your resume being overlooked by hiring managers.

Inconsistent Formatting: Using different fonts, sizes, or styles throughout your resume can create a disorganized appearance. Stick to a consistent format to ensure readability and professionalism.

Lack of Quantifiable Achievements: Simply listing job responsibilities without quantifying achievements can diminish the impact of your accomplishments. Use specific metrics to demonstrate your contributions, such as “improved cash flow by 20%.”

Overloading with Irrelevant Experience: Including unrelated work experience can distract from your treasury skills. Focus on relevant positions and highlight experiences that illustrate your qualifications for the Treasury Accountant role.

Ignoring Keywords from the Job Description: Failing to incorporate relevant keywords from the job posting can hinder your resume’s chances of passing through applicant tracking systems (ATS). Ensure your resume reflects language used in the job description.

Typos and Grammatical Errors: Even minor mistakes can create a negative impression of your attention to detail. Always proofread your resume multiple times or have someone else review it to catch any errors.

Omitting Professional Development: Not mentioning relevant certifications or training, such as Certified Treasury Professional (CTP) or coursework in finance, can make your resume less competitive. Highlight any ongoing professional development efforts to showcase your commitment to the field.

Conclusion

As a Treasury Accountant, your role is crucial in managing an organization’s finances, ensuring cash flow stability, and optimizing investment opportunities. Throughout this article, we explored the key responsibilities of a Treasury Accountant, including cash management, forecasting, liquidity management, and compliance with financial regulations. We also highlighted the importance of analytical skills, attention to detail, and the ability to work with financial software to streamline processes.

To thrive in this competitive field, it's essential to have a polished and professional resume that effectively communicates your qualifications and experience. As you prepare or update your Treasury Accountant resume, consider utilizing the following resources to enhance your application:

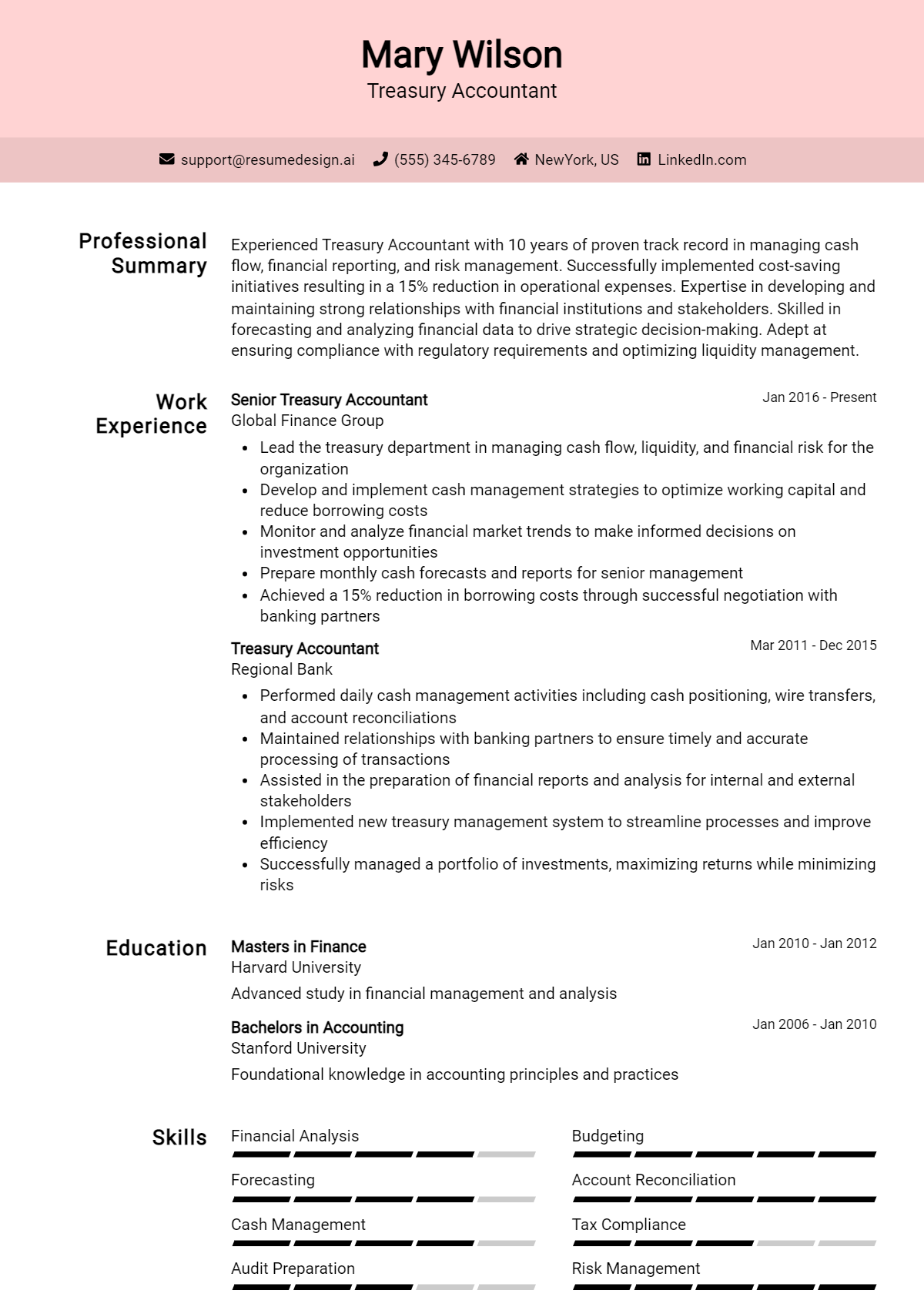

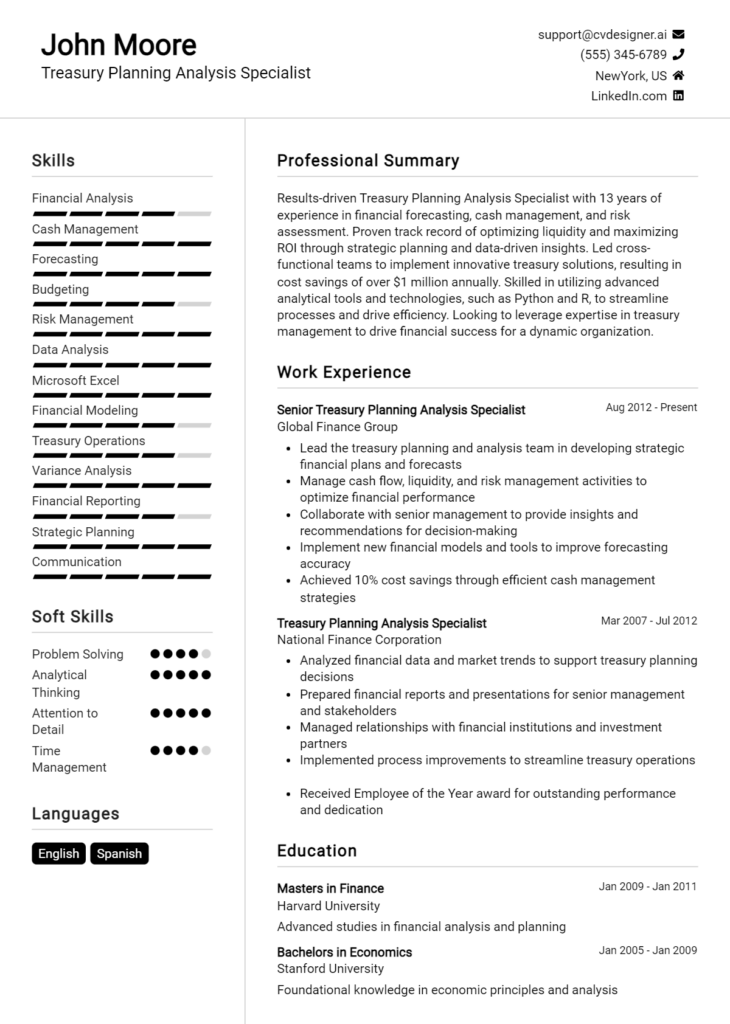

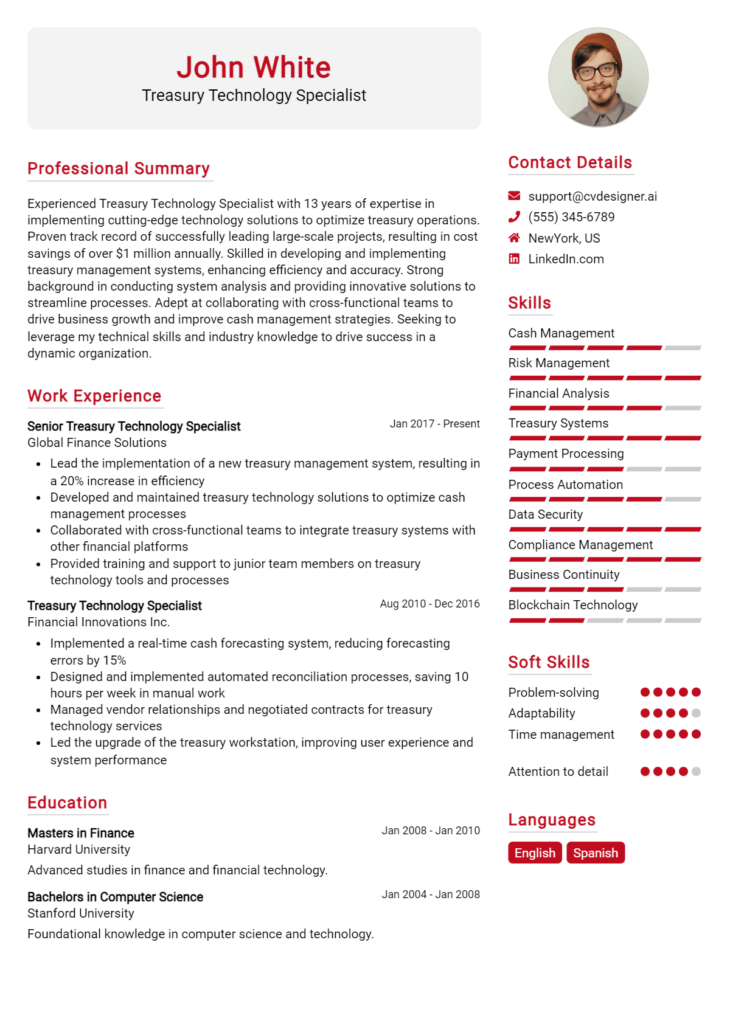

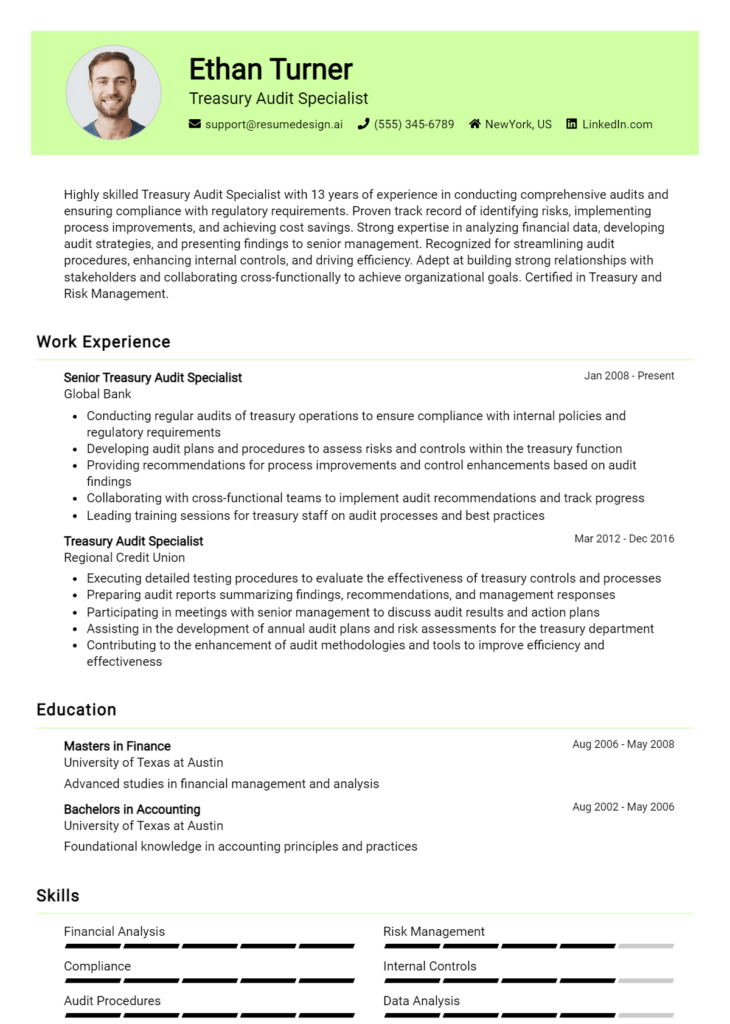

- Explore a variety of resume templates tailored for finance professionals.

- Use the resume builder to create a custom resume that stands out to potential employers.

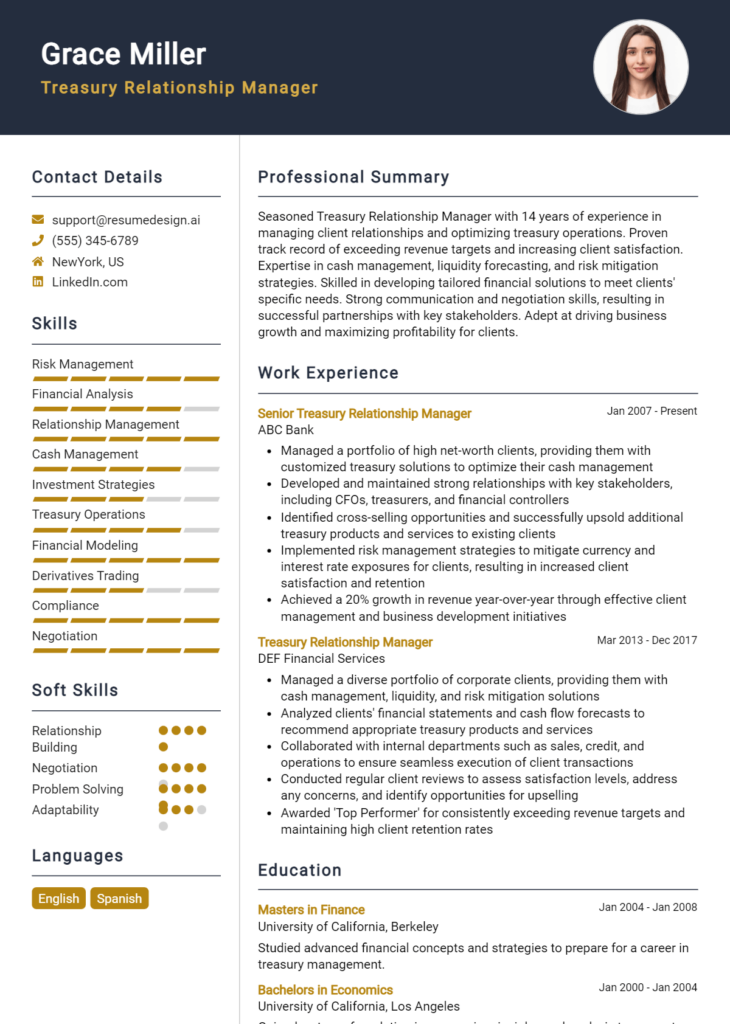

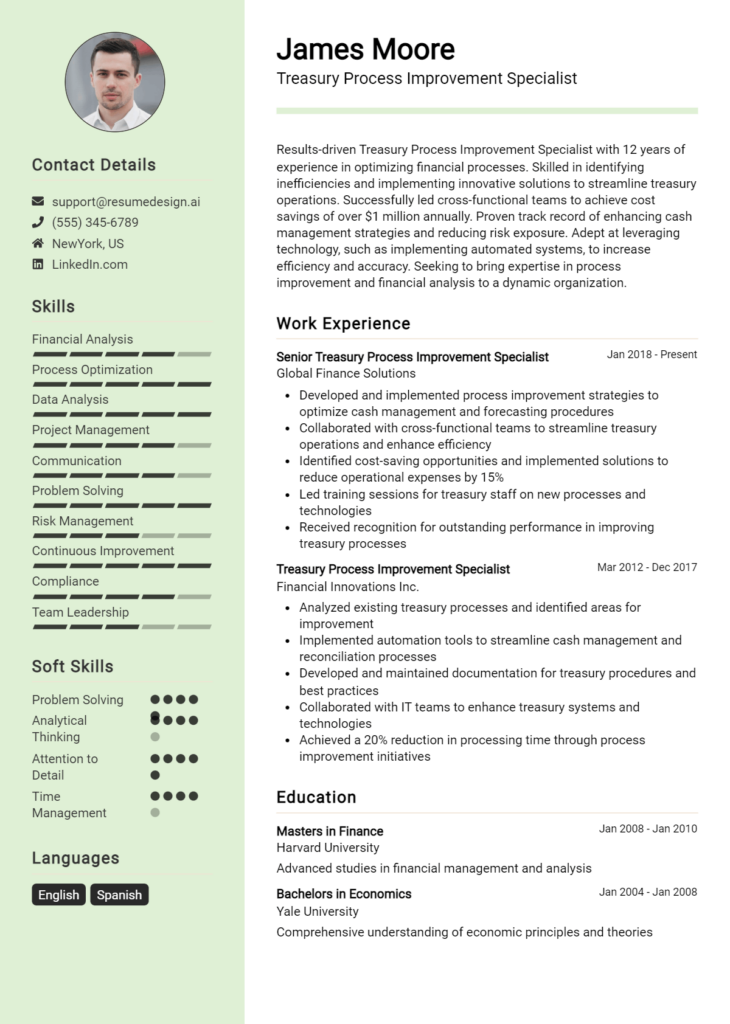

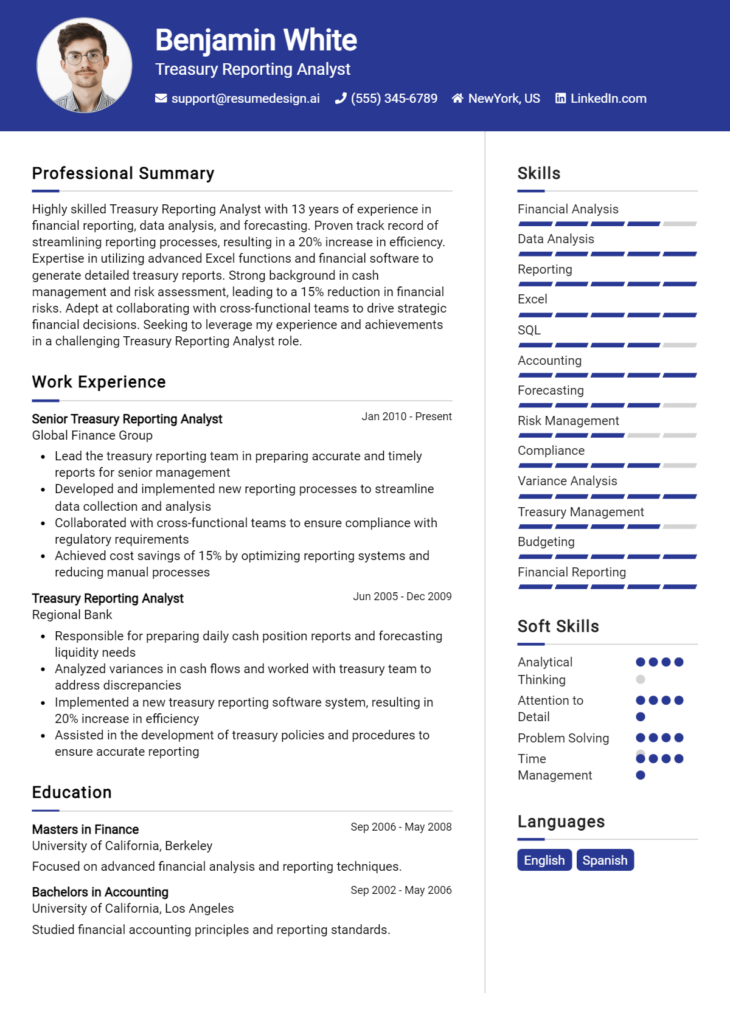

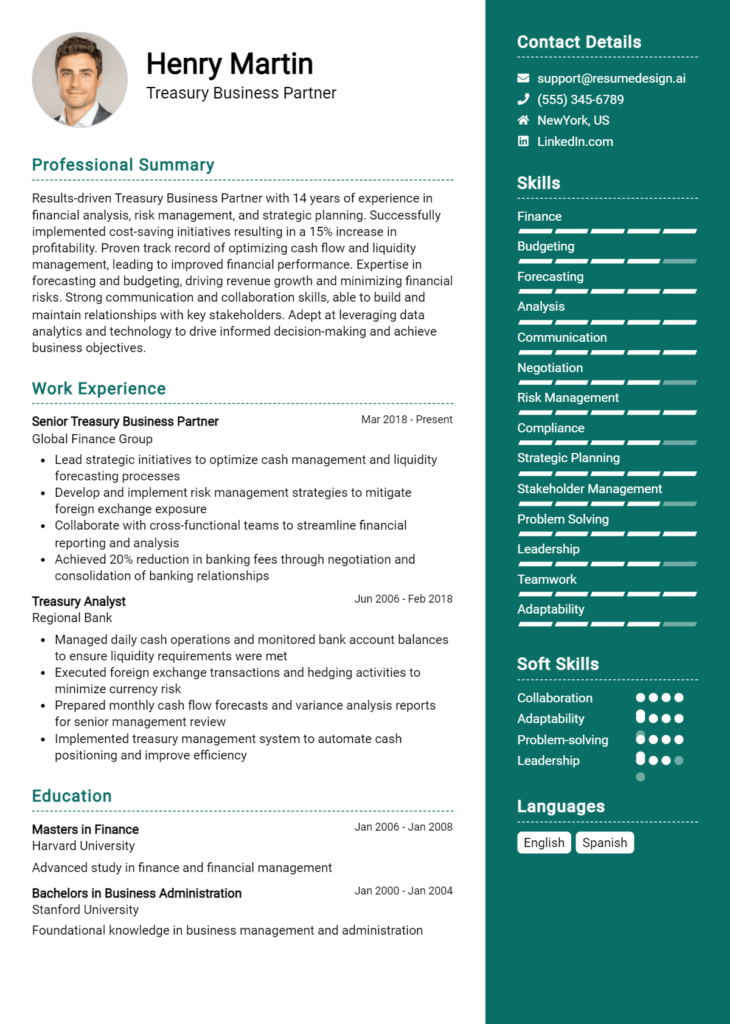

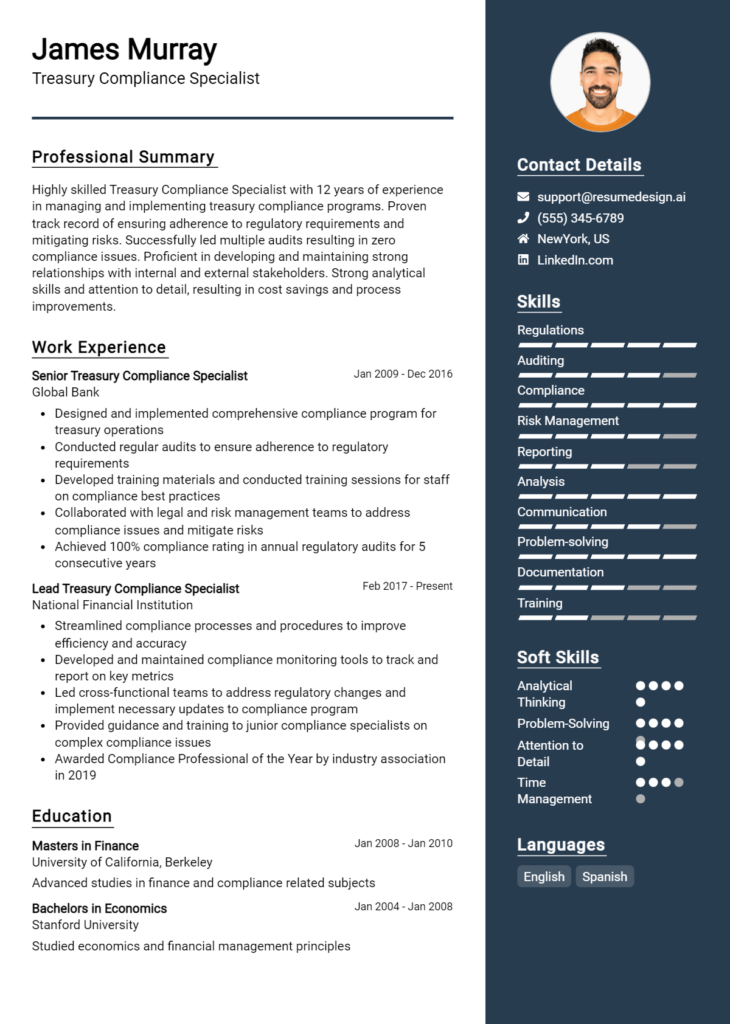

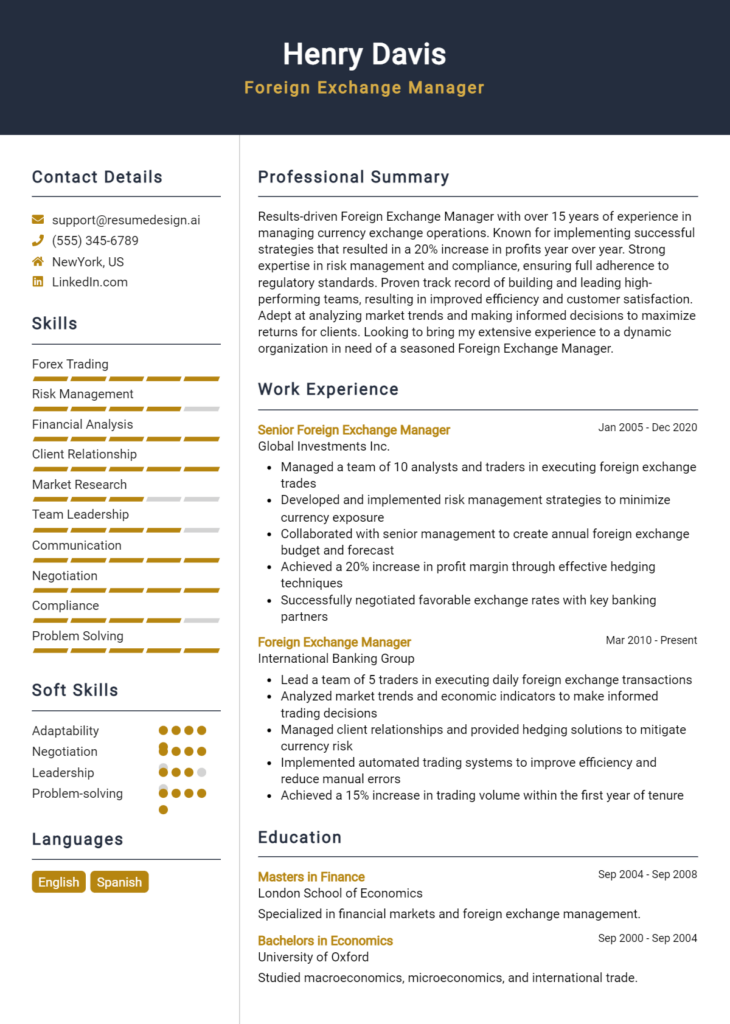

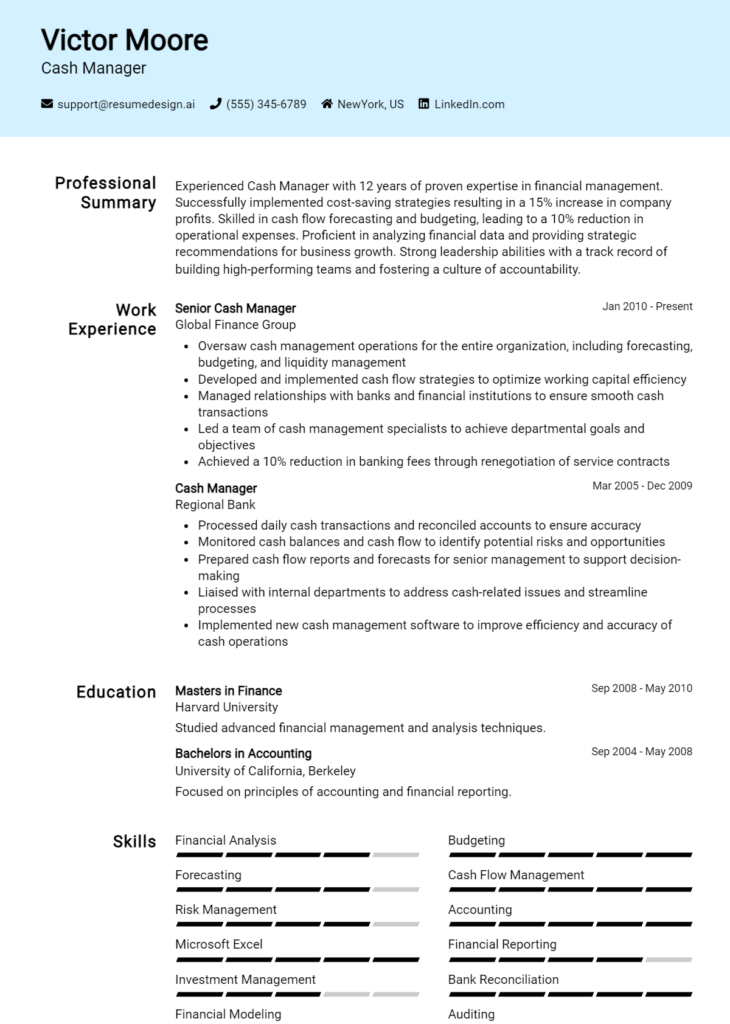

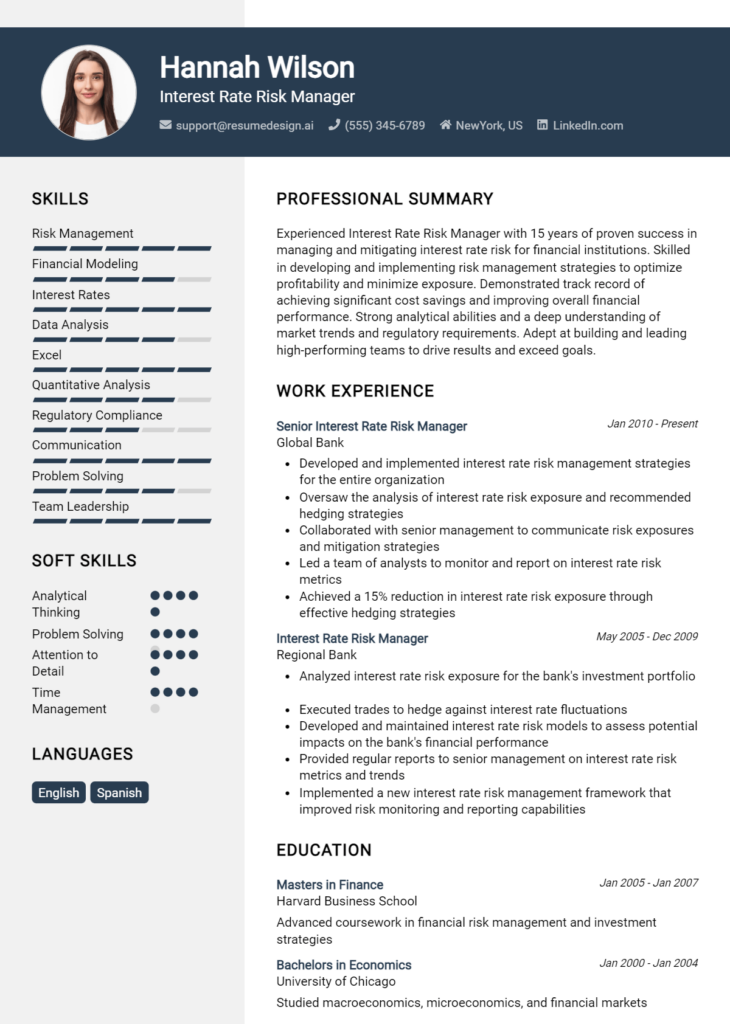

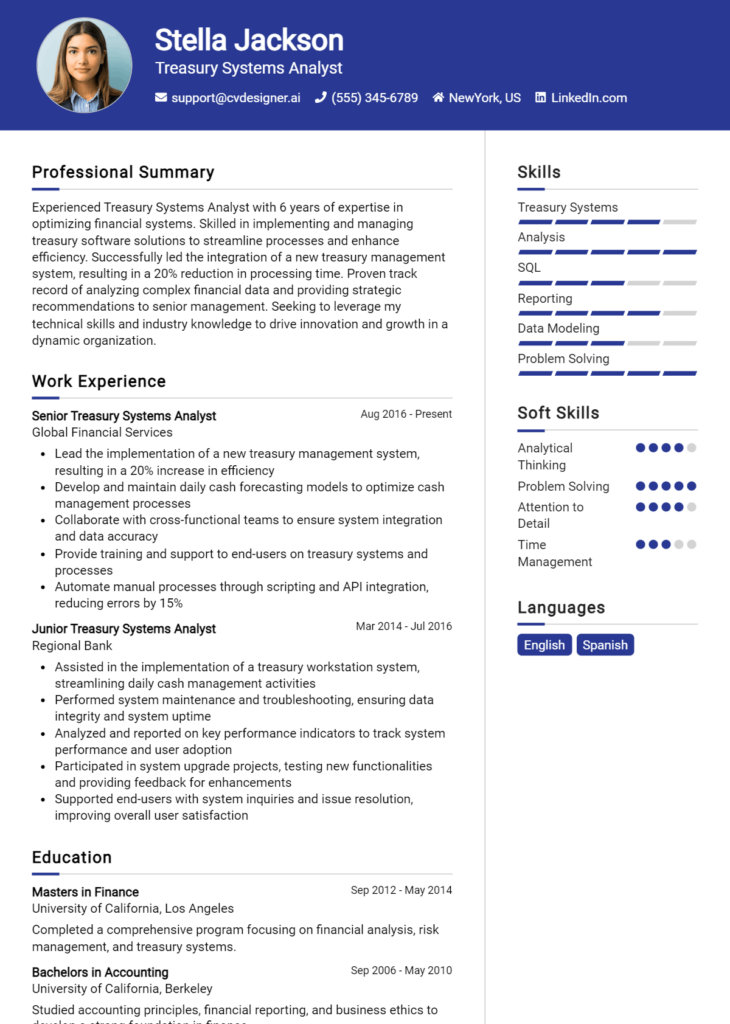

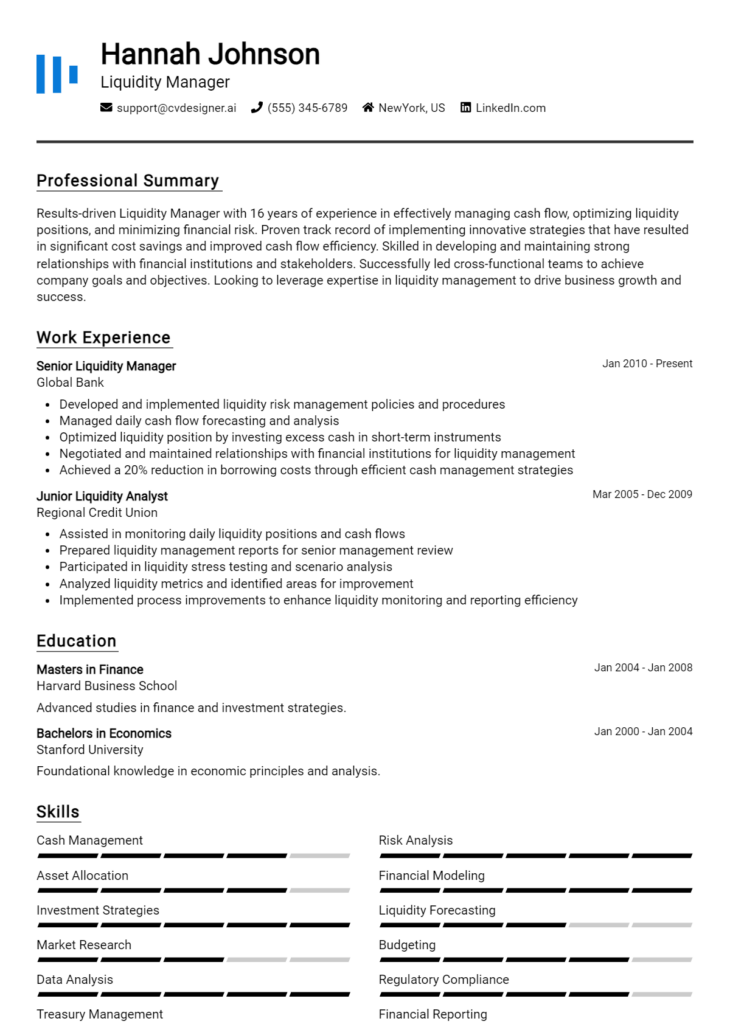

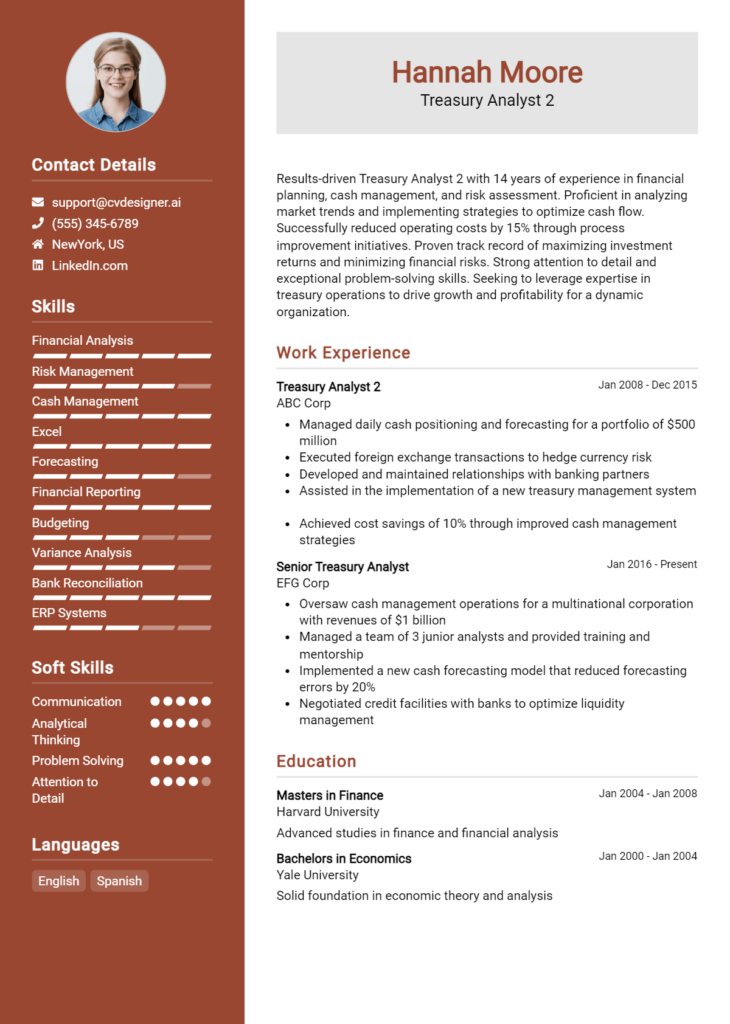

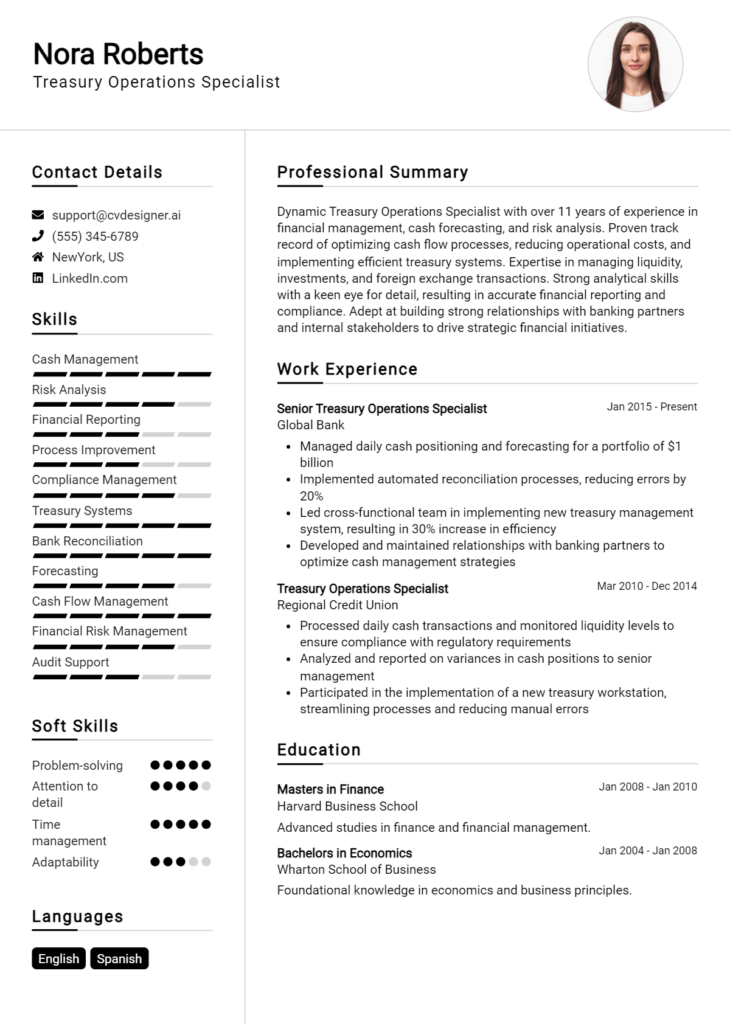

- Review resume examples that showcase successful Treasury Accountant profiles for inspiration.

- Don’t forget to craft a compelling cover letter with the help of our cover letter templates.

Take action today by reviewing and updating your resume to reflect your skills and experiences effectively. Your next career opportunity in treasury accounting could be just around the corner!