Structured Finance Analyst Core Responsibilities

A Structured Finance Analyst plays a crucial role in bridging finance, accounting, and risk management departments. Key responsibilities include analyzing complex financial instruments, developing financial models, and conducting credit risk assessments. Essential skills encompass technical proficiency in financial analysis software, operational insight into market dynamics, and strong problem-solving abilities. Mastering these skills is vital for contributing to the organization's strategic goals. A well-structured resume can effectively highlight these qualifications, making a candidate stand out in a competitive job market.

Common Responsibilities Listed on Structured Finance Analyst Resume

- Conducting thorough credit risk assessments and analysis of structured financial products.

- Developing and maintaining complex financial models to forecast performance.

- Collaborating with cross-functional teams to gather data and insights.

- Preparing detailed reports and presentations for stakeholders.

- Monitoring market trends and regulatory changes affecting structured finance.

- Performing due diligence on potential investment opportunities.

- Assessing the impact of economic factors on structured finance portfolios.

- Participating in negotiations and structuring of financial transactions.

- Assisting in the development of risk management strategies.

- Ensuring compliance with legal and regulatory requirements.

- Utilizing advanced analytical tools to optimize financial performance.

High-Level Resume Tips for Structured Finance Analyst Professionals

In the competitive field of structured finance, a well-crafted resume is not just a document; it’s your first chance to make a lasting impression on potential employers. For Structured Finance Analyst professionals, your resume must effectively showcase your analytical skills, industry knowledge, and past achievements, as these elements are crucial in demonstrating your value to prospective employers. A strong resume can open doors and set the stage for interviews, making it imperative that it reflects both your unique qualifications and the specific requirements of the roles you are pursuing. This guide will provide practical, actionable resume tips tailored specifically for Structured Finance Analyst professionals, helping you stand out in a crowded job market.

Top Resume Tips for Structured Finance Analyst Professionals

- Tailor your resume to each job description by incorporating relevant keywords and phrases that match the requirements of the position.

- Highlight your relevant experience in structured finance, including roles in financial modeling, risk assessment, and asset-backed securities.

- Quantify your achievements wherever possible, using specific metrics to demonstrate your contributions, such as increased revenue or improved efficiency.

- Showcase your industry-specific skills, such as knowledge of financial regulations, credit analysis, and investment strategies.

- Include any relevant certifications, such as Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM), to validate your expertise.

- Optimize the format of your resume for clarity and readability, using bullet points and consistent formatting to guide the reader's eye.

- Emphasize teamwork and collaborative projects, as structured finance often involves working with cross-functional teams.

- Keep your resume concise, ideally one page, focusing on the most relevant information that aligns with the job you are applying for.

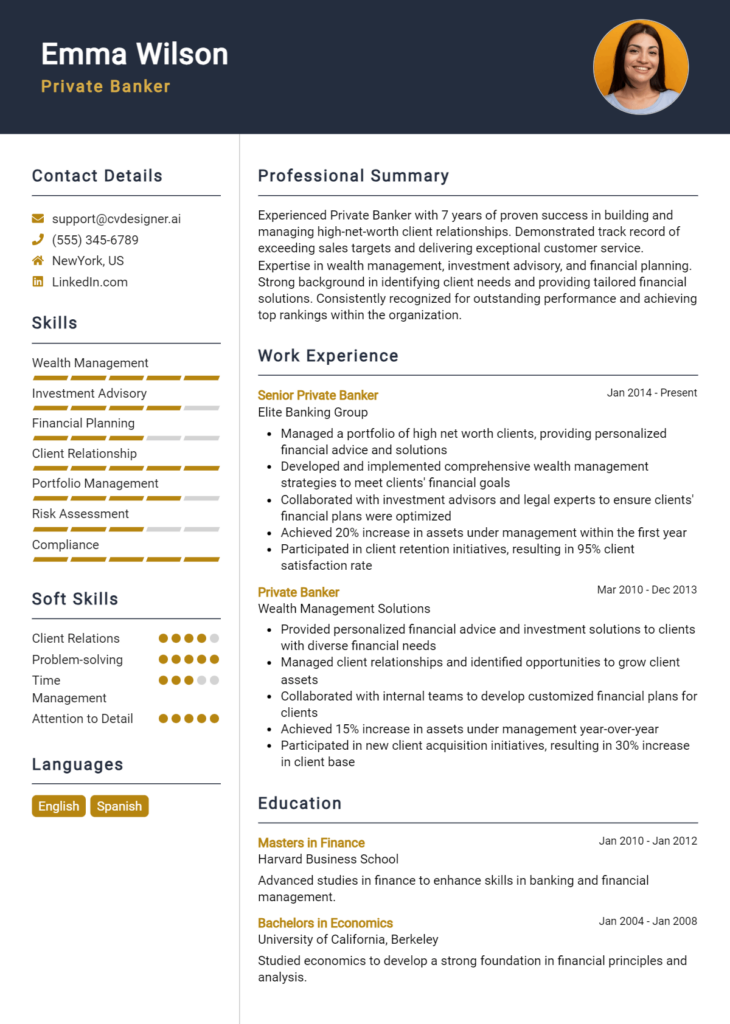

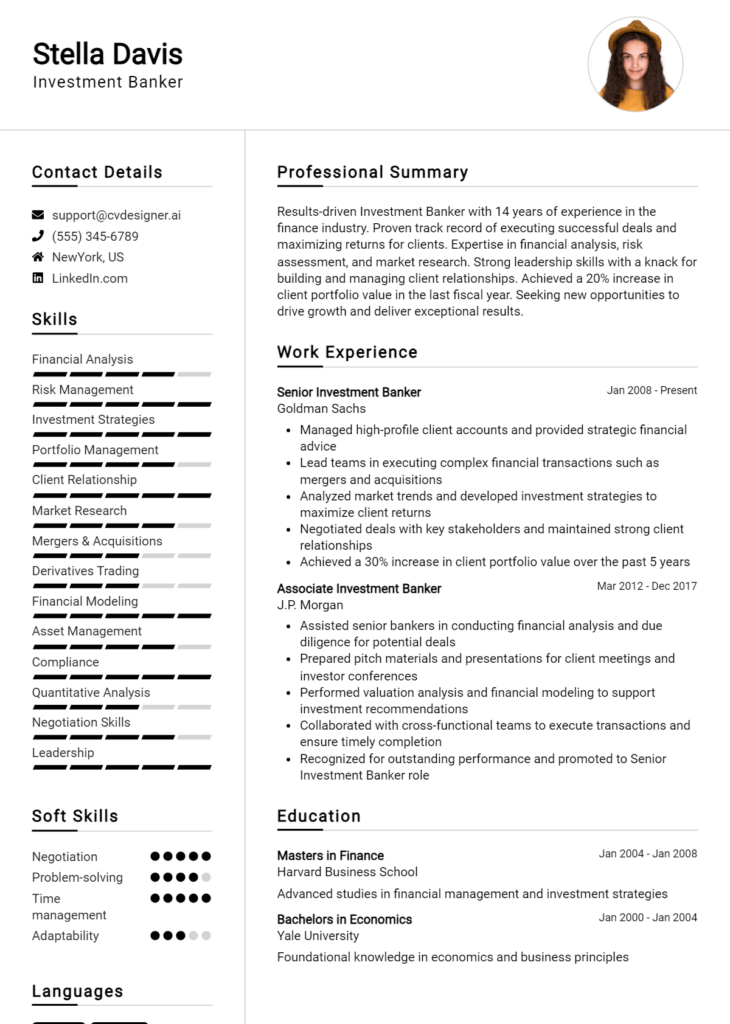

- Incorporate a professional summary at the top of your resume that succinctly captures your experience and career objectives.

By implementing these tips, you can significantly enhance your resume’s effectiveness and increase your chances of landing a job in the structured finance analyst field. A tailored, achievement-focused resume will not only attract the attention of hiring managers but also effectively communicate your qualifications, making you a compelling candidate in this specialized industry.

Why Resume Headlines & Titles are Important for Structured Finance Analyst

In the competitive landscape of structured finance, a resume headline serves as the first impression a hiring manager will have of a candidate. These concise and impactful phrases encapsulate the applicant’s key qualifications and areas of expertise, making it essential for them to stand out. A strong resume headline can effectively grab the attention of hiring managers, providing a quick overview of the applicant's skills and experiences relevant to the structured finance analyst role. Crafting a compelling headline that is both relevant and specific to the job being applied for can significantly enhance a resume's visibility and appeal, setting the stage for a deeper evaluation of the candidate's qualifications.

Best Practices for Crafting Resume Headlines for Structured Finance Analyst

- Keep it concise—aim for one impactful sentence.

- Incorporate relevant keywords from the job description.

- Highlight specific skills or experiences that align with the role.

- Use action-oriented language to convey dynamism.

- Be specific about the area of expertise within structured finance.

- Avoid generic phrases that do not add value.

- Tailor the headline for each application to match the job requirements.

- Consider including quantifiable achievements to add credibility.

Example Resume Headlines for Structured Finance Analyst

Strong Resume Headlines

Dynamic Structured Finance Analyst with 5+ Years of Experience in Asset-Backed Securities.

Detail-Oriented Analyst Specializing in Risk Assessment and Financial Modeling.

Results-Driven Structured Finance Expert with Proven Track Record in Portfolio Optimization.

Weak Resume Headlines

Finance Professional Looking for Opportunities.

Structured Finance Analyst with Experience.

Strong headlines are effective because they are specific, action-oriented, and directly relevant to the job being applied for, clearly communicating the candidate's strengths and unique qualifications. In contrast, weak headlines fail to impress due to their vagueness and lack of distinctiveness, leaving hiring managers with little insight into the applicant's capabilities or suitability for the role. By ensuring that headlines are compelling and tailored to the position, candidates can significantly increase their chances of making a memorable first impression.

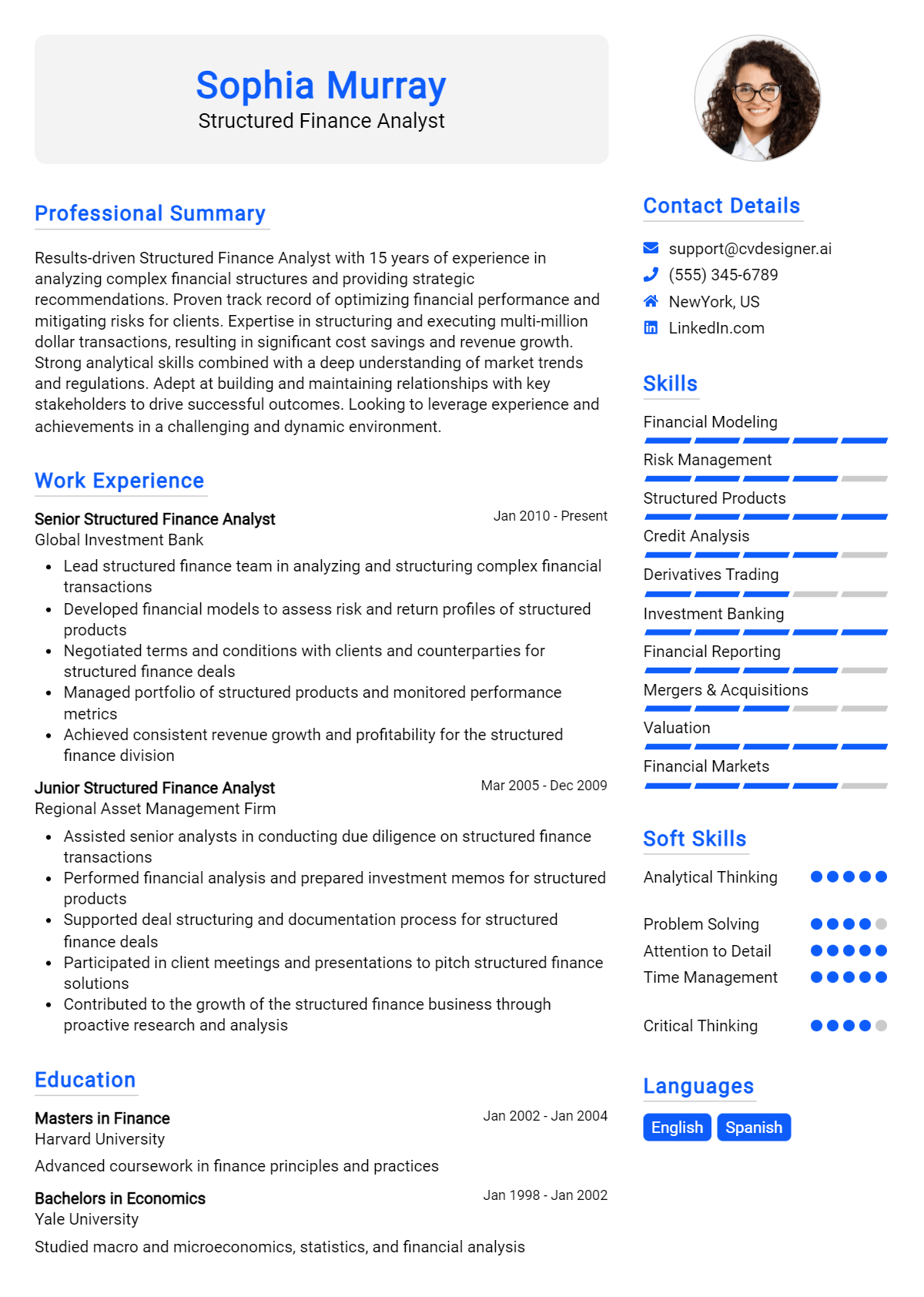

Writing an Exceptional Structured Finance Analyst Resume Summary

A resume summary is a critical component for a Structured Finance Analyst, as it serves as the first impression for hiring managers. A well-crafted summary not only captures attention but also succinctly highlights key skills, relevant experience, and significant accomplishments that align with the position. Given the competitive nature of the finance industry, a strong summary must be concise yet impactful, tailored specifically to the job being applied for, ensuring that it resonates with hiring managers and sets the candidate apart from others.

Best Practices for Writing a Structured Finance Analyst Resume Summary

- Quantify Achievements: Use numbers and percentages to highlight your successes and impact in previous roles.

- Focus on Relevant Skills: Highlight skills that are particularly pertinent to structured finance, such as financial modeling, risk assessment, and data analysis.

- Tailor to Job Description: Customize your summary to reflect the specific requirements and keywords mentioned in the job listing.

- Keep it Concise: Aim for 2-4 sentences that deliver your message clearly and effectively.

- Use Action Verbs: Start sentences with strong action verbs to convey confidence and proactivity.

- Highlight Industry Knowledge: Demonstrate your understanding of structured finance products and market trends.

- Showcase Certifications: If applicable, mention relevant certifications, such as CFA or CMT, to add credibility.

- Emphasize Team Collaboration: Mention teamwork and collaboration skills, as structured finance often involves working with cross-functional teams.

Example Structured Finance Analyst Resume Summaries

Strong Resume Summaries

Results-driven Structured Finance Analyst with over 5 years of experience in developing and executing financial models that improved forecasting accuracy by 30%. Proficient in risk assessment and management, leading to a 25% increase in project profitability.

Detail-oriented financial professional with a proven track record in structuring complex financial transactions. Successfully facilitated $200 million in asset-backed securities, enhancing investor confidence and market presence.

Strategic thinker with expertise in credit analysis and financial structuring, demonstrated by a 40% reduction in default rates through comprehensive risk evaluation and mitigation strategies. Strong communicator skilled in collaborating with stakeholders to achieve project goals.

Weak Resume Summaries

Finance professional with experience in financial analysis and reporting. Seeking a challenging position in structured finance.

Analyst with strong skills in finance looking to work in structured finance. Interested in contributing to team success.

The examples provided illustrate the differences between strong and weak resume summaries. The strong summaries effectively quantify accomplishments, specify key skills, and directly relate to the structured finance role, making them compelling to hiring managers. In contrast, the weak summaries are vague, lack specific achievements, and do not tailor the candidate’s experience to the job, making them less impactful and memorable.

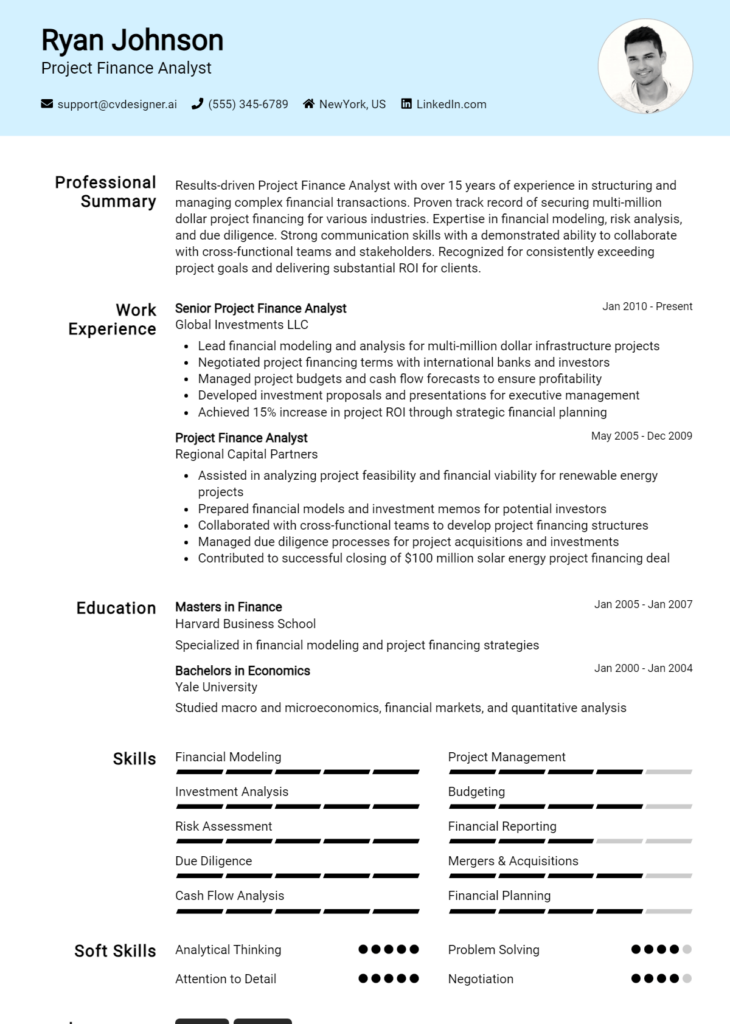

Work Experience Section for Structured Finance Analyst Resume

The work experience section of a Structured Finance Analyst resume is critical in demonstrating a candidate's technical proficiency, leadership capabilities, and commitment to delivering high-quality financial products. This section serves as a platform for candidates to illustrate their hands-on experience with structured finance transactions, risk assessment, and financial modeling while showcasing their ability to lead teams and collaborate effectively. By quantifying achievements and aligning past experiences with industry standards, candidates can present a compelling narrative that highlights their qualifications and readiness for the role.

Best Practices for Structured Finance Analyst Work Experience

- Highlight specific technical skills relevant to structured finance, such as cash flow modeling, securitization, and risk analysis.

- Quantify achievements with metrics (e.g., percentage improvement in revenue, cost reductions, or successful transaction volumes).

- Use action verbs to convey leadership and initiative (e.g., led, developed, executed).

- Include collaborative projects that demonstrate teamwork and cross-functional communication.

- Align experience descriptions with industry standards to resonate with recruiters and hiring managers.

- Tailor the work experience section for each application to reflect the most relevant experiences.

- Incorporate keywords from the job description to enhance visibility in applicant tracking systems.

- Focus on outcomes and impacts rather than just responsibilities when describing previous roles.

Example Work Experiences for Structured Finance Analyst

Strong Experiences

- Led a team of analysts to structure and execute a $150 million securitization transaction, resulting in a 20% increase in funding efficiency.

- Developed complex cash flow models for structured products, which improved forecasting accuracy by 30% and informed strategic investment decisions.

- Collaborated with cross-functional teams to assess risks and optimize investment strategies, contributing to a 15% reduction in portfolio volatility.

- Implemented a new reporting framework that streamlined compliance processes, reducing time spent on audits by 25%.

Weak Experiences

- Assisted in various finance-related tasks without specifying contributions or outcomes.

- Worked on a team but did not clarify the role or impact on project success.

- Involved in financial modeling without detailing the type of models or their applications.

- Participated in meetings and discussions but failed to outline specific contributions or results achieved.

The examples categorized as strong experiences effectively highlight quantifiable outcomes, technical leadership, and collaboration that are crucial in structured finance roles. They provide clear metrics and demonstrate a proactive approach to achieving results. In contrast, the weak experiences lack specificity and measurable achievements, making it difficult for recruiters to assess the candidate's actual impact or expertise in the field. Strong experiences focus on results and contributions, while weak experiences fail to articulate the candidate's value proposition clearly.

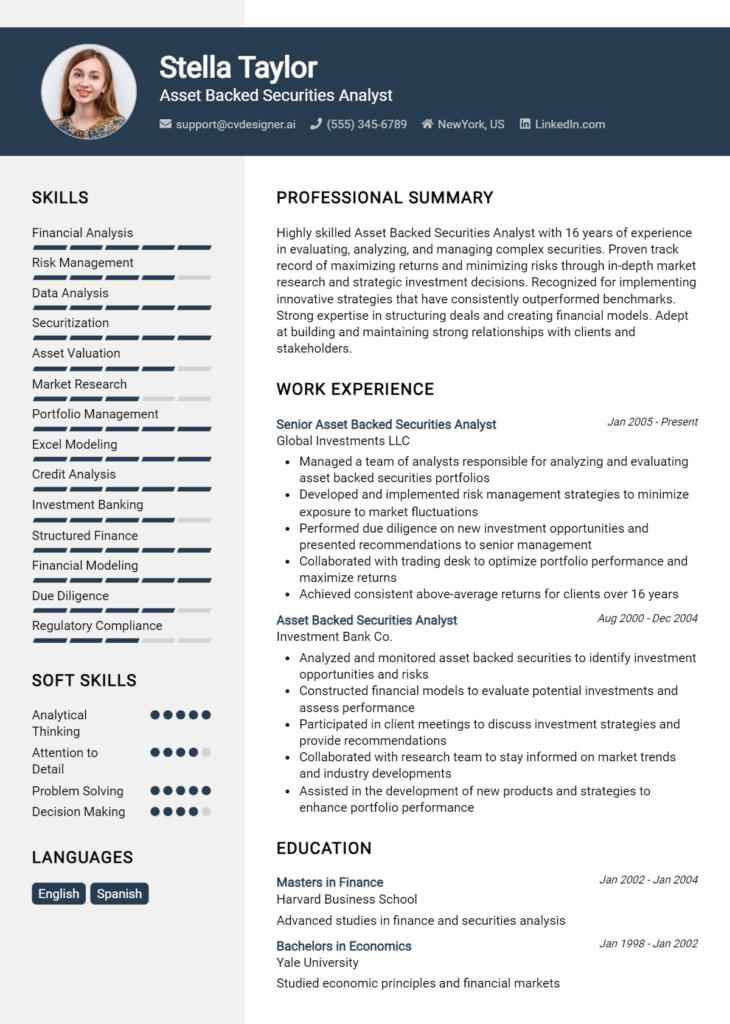

Education and Certifications Section for Structured Finance Analyst Resume

The education and certifications section of a Structured Finance Analyst resume is crucial as it showcases the candidate's academic achievements, relevant industry certifications, and commitment to continuous professional development. This section serves to establish credibility and demonstrates the candidate's alignment with the required skills and knowledge for the role. By highlighting relevant coursework, specialized training, and recognized certifications, candidates can effectively differentiate themselves in a competitive job market and show prospective employers their preparedness for the demands of structured finance analysis.

Best Practices for Structured Finance Analyst Education and Certifications

- Prioritize relevant degrees in finance, economics, or a related field.

- Include industry-recognized certifications such as CFA, FRM, or CFI.

- List specific coursework that directly relates to structured finance, such as securitization or risk management.

- Highlight any advanced degrees, such as a Master's in Finance or MBA.

- Detail any specialized training programs or workshops attended relevant to structured finance.

- Keep the section organized and concise, focusing on recent and relevant information.

- Use clear formatting to enhance readability and draw attention to key credentials.

- Consider including GPA if it is impressive and reflects a strong academic background.

Example Education and Certifications for Structured Finance Analyst

Strong Examples

- M.S. in Finance, Columbia University, 2022

- CFA Level II Candidate, Chartered Financial Analyst Institute

- Certification in Risk Management Assurance (CRMA), 2023

- Relevant Coursework: Securitization, Financial Modeling, and Risk Analysis

Weak Examples

- Bachelor’s Degree in History, University of Chicago, 2010

- Certification in Basic Microsoft Office, 2021

- Online Course: Introduction to Finance (2019)

- High School Diploma, Lincoln High School, 2005

The strong examples are considered effective because they demonstrate relevant advanced degrees, specialized certifications, and targeted coursework that align with the competencies needed for a Structured Finance Analyst role. In contrast, the weak examples lack relevance to the field, showcasing outdated or unrelated educational qualifications and certifications that do not support the candidate's suitability for a structured finance position.

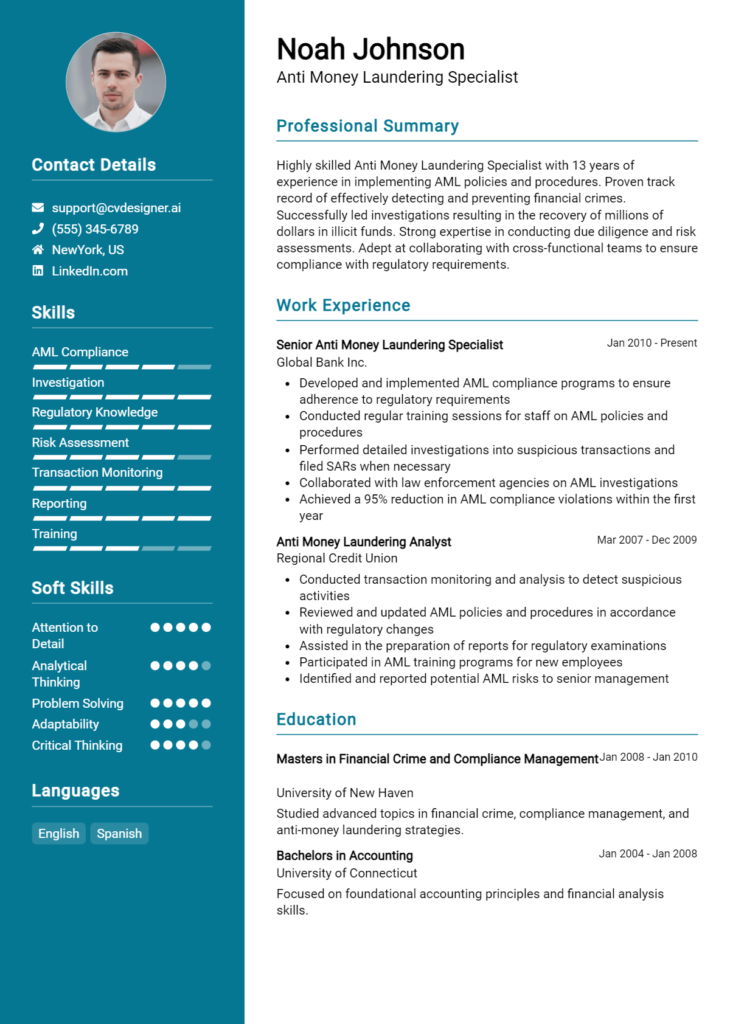

Top Skills & Keywords for Structured Finance Analyst Resume

As a Structured Finance Analyst, having the right skills is crucial for excelling in this complex and dynamic field. A well-crafted resume that highlights both hard and soft skills can set you apart from other candidates and demonstrate your ability to analyze financial data, structure deals, and manage risk effectively. Employers are on the lookout for analysts who possess a strong blend of technical expertise and interpersonal abilities, ensuring they can navigate the intricacies of structured finance while also collaborating with diverse teams. By showcasing your skills effectively, you can enhance your chances of landing interviews and ultimately securing your desired position.

Top Hard & Soft Skills for Structured Finance Analyst

Soft Skills

- Analytical Thinking

- Attention to Detail

- Problem-Solving

- Communication Skills

- Team Collaboration

- Time Management

- Adaptability

- Negotiation Skills

- Critical Thinking

- Initiative

Hard Skills

- Financial Modeling

- Risk Assessment

- Data Analysis

- Knowledge of Structured Products

- Proficiency in Excel and Financial Software

- Understanding of Regulatory Requirements

- Credit Analysis

- Portfolio Management

- Valuation Techniques

- Statistical Analysis

For more insights on how to effectively present your skills and work experience on your resume, explore additional resources that can help you craft a compelling application.

Stand Out with a Winning Structured Finance Analyst Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Structured Finance Analyst position at [Company Name] as advertised on [where you found the job listing]. With a solid background in financial analysis and a strong understanding of structured finance products, I am excited about the opportunity to contribute to your team. My experience in modeling, risk assessment, and market analysis positions me as a strong candidate to help [Company Name] navigate the complexities of structured finance transactions.

In my previous role at [Previous Company Name], I successfully managed a portfolio of structured finance assets, conducting comprehensive credit analysis and developing financial models to assess performance and risk. I collaborated closely with cross-functional teams to structure financing solutions tailored to clients’ needs while ensuring compliance with regulatory requirements. My analytical skills, coupled with my proficiency in data analysis tools such as Excel and Python, allowed me to identify trends and make data-driven recommendations that optimized our investment strategies.

I am particularly drawn to [Company Name] because of its commitment to innovation in the finance sector and its reputation for excellence. I am eager to bring my skills in structured finance, along with my passion for developing effective financial solutions, to your team. I am confident that my proactive approach and attention to detail will enable me to contribute significantly to [Company Name]'s projects and client relationships.

Thank you for considering my application. I look forward to the opportunity to discuss how my background and skills can align with the goals of [Company Name]. I am excited about the possibility of joining your esteemed team and contributing to the success of your structured finance initiatives.

Sincerely,

[Your Name]

[Your LinkedIn Profile or Contact Information]

Common Mistakes to Avoid in a Structured Finance Analyst Resume

When crafting a resume for a Structured Finance Analyst position, it's essential to present your qualifications and experience in a clear and compelling manner. However, many candidates make common mistakes that can detract from their overall effectiveness. Avoiding these pitfalls can significantly enhance your chances of landing an interview by ensuring that your resume stands out to hiring managers in a competitive job market.

Lack of Tailoring: Failing to customize your resume for the specific job description can result in missed opportunities. Highlight the skills and experiences that directly align with the requirements of the role.

Overly Technical Jargon: Using excessive industry jargon without clear explanations can alienate hiring managers who may not be familiar with every term. Strive for clarity by balancing technical language with accessible explanations.

Vague Job Descriptions: Providing unclear or generic descriptions of past roles can leave employers questioning your actual contributions. Use specific metrics and accomplishments to demonstrate your impact in previous positions.

Ignoring Soft Skills: Focusing solely on technical skills and neglecting to mention soft skills can be a mistake. Structured finance analysts often require strong communication, teamwork, and problem-solving abilities, which should be highlighted.

Inconsistent Formatting: A poorly formatted resume can be difficult to read and may give an impression of disorganization. Use consistent fonts, bullet points, and headings to create a professional appearance.

Omitting Relevant Experience: Failing to include relevant internships, projects, or coursework can weaken your application. Ensure that all applicable experiences are included, even if they are not traditional job roles.

Neglecting Education and Certifications: Not highlighting relevant educational qualifications or certifications, such as CFA or FRM, can be a missed opportunity to showcase your expertise. Always place emphasis on these credentials if they relate to structured finance.

Being Overly Lengthy or Too Concise: Striking the right balance in resume length is crucial. A resume that's too lengthy may overwhelm recruiters, while a very concise one might not provide enough detail. Aim for a one-page format while ensuring all key points are effectively communicated.

Conclusion

As a Structured Finance Analyst, your role is pivotal in assessing and managing complex financial instruments, including asset-backed securities, mortgage-backed securities, and structured investment vehicles. Key responsibilities often include conducting financial modeling, analyzing market trends, and evaluating the risk associated with different financial structures. Additionally, you must possess a strong understanding of financial regulations and practices, as well as the ability to communicate effectively with stakeholders.

In summary, excelling as a Structured Finance Analyst requires a blend of analytical skills, financial acumen, and strategic thinking. As you refine your expertise in this dynamic field, it's essential to ensure that your resume reflects your qualifications and achievements accurately.

We encourage you to take a moment to review your Structured Finance Analyst resume. Consider utilizing valuable resources available to help you enhance your application materials. Explore our resume templates, which provide a solid foundation for showcasing your skills and experiences. If you're looking for a more personalized approach, our resume builder can guide you through crafting a standout resume tailored to the structured finance sector. Additionally, check out our resume examples for inspiration and insights into effective presentation styles. Lastly, don't forget to complement your resume with a compelling introduction using our cover letter templates.

Take the next step in your career by ensuring your resume effectively communicates your capabilities as a Structured Finance Analyst.