Risk Manager Core Responsibilities

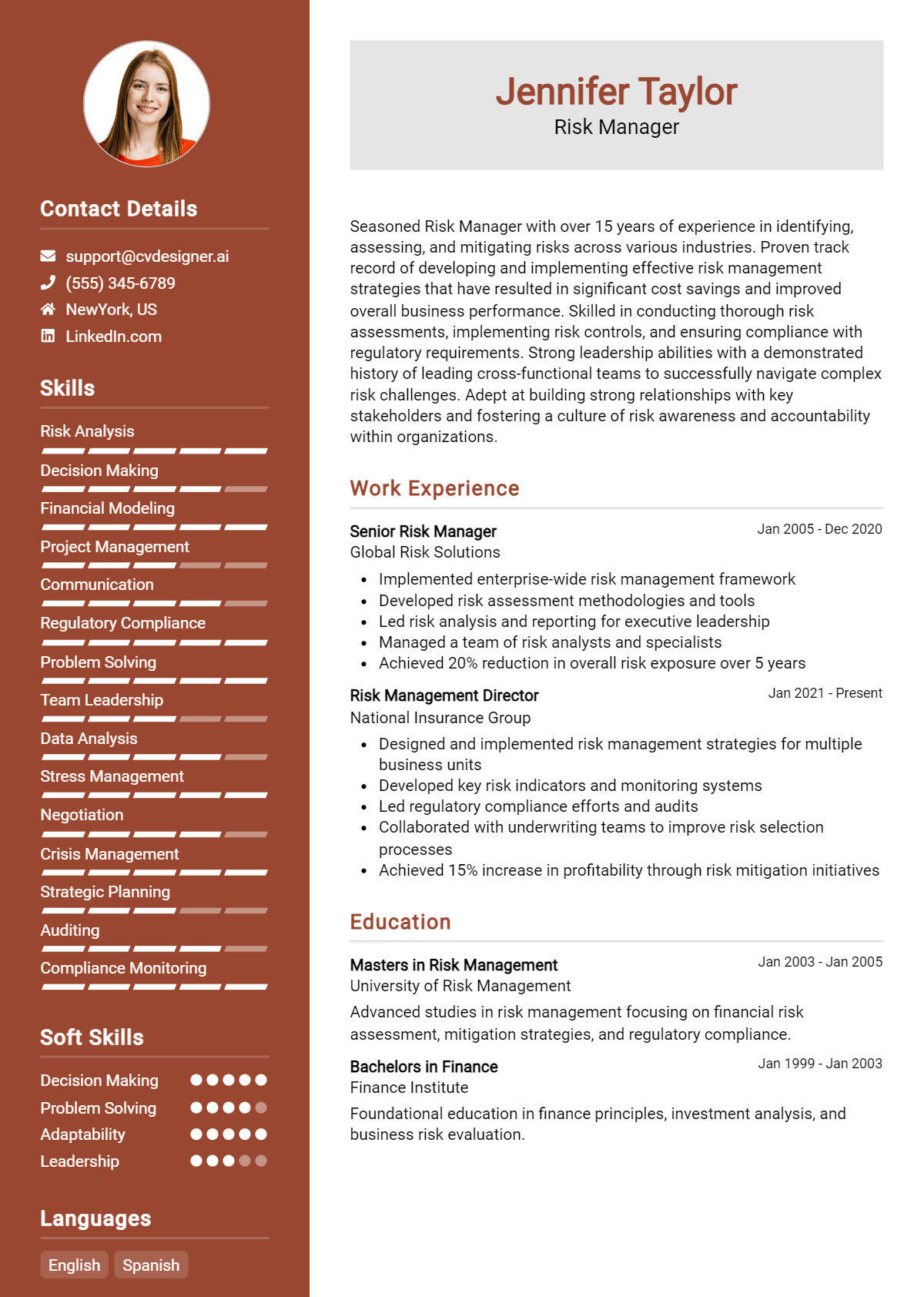

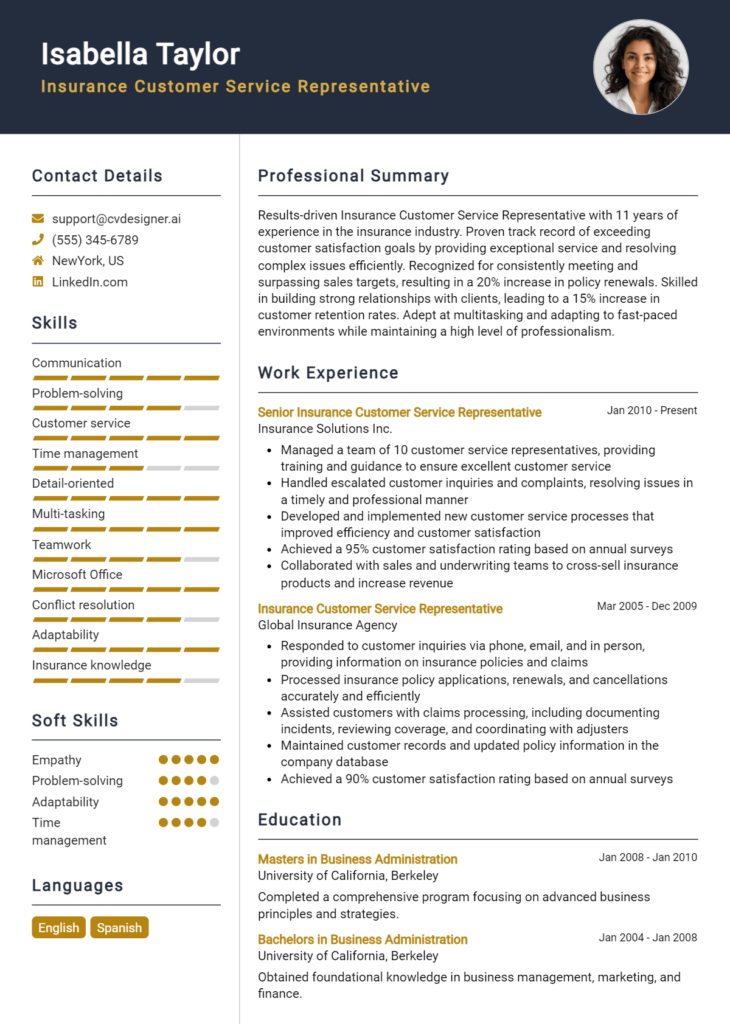

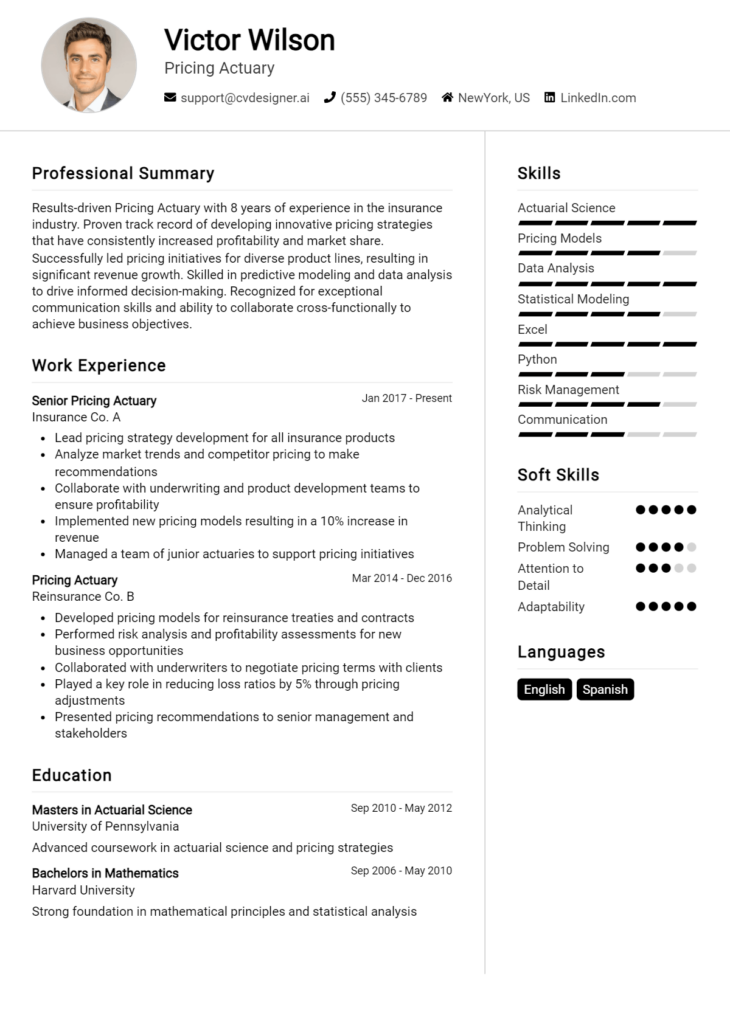

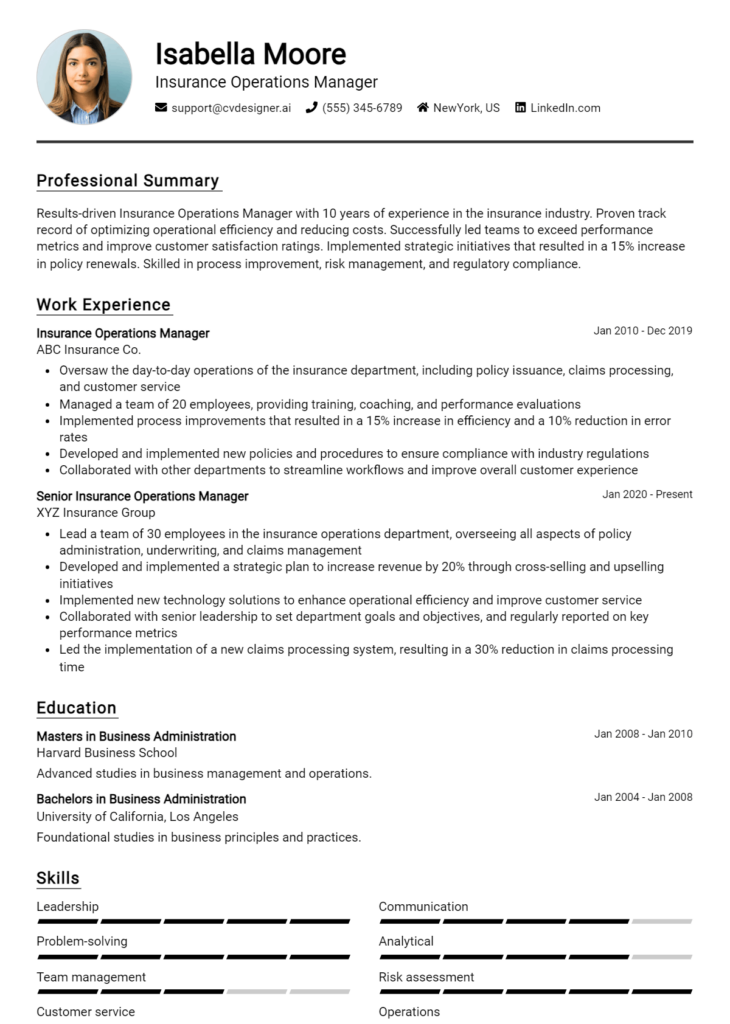

A Risk Manager plays a crucial role in identifying, assessing, and mitigating potential risks that could impact an organization’s operational and financial health. This position requires strong technical knowledge, operational insight, and exceptional problem-solving skills to effectively bridge various departments such as finance, compliance, and operations. By leveraging these skills, a Risk Manager contributes significantly to the organization’s strategic objectives. A well-structured resume can effectively showcase these qualifications, demonstrating the candidate's capability to enhance risk management practices.

Common Responsibilities Listed on Risk Manager Resume

- Conducting risk assessments and analyses to identify potential threats.

- Developing and implementing risk management strategies and policies.

- Collaborating with various departments to ensure compliance with regulations.

- Monitoring and reporting on risk exposure and mitigation efforts.

- Organizing training sessions on risk awareness for staff.

- Preparing risk reports for senior management and stakeholders.

- Evaluating and selecting insurance coverage options.

- Staying updated on industry trends and regulatory changes.

- Implementing risk management software and tools.

- Facilitating risk management workshops and meetings.

- Analyzing data to forecast potential risks and vulnerabilities.

High-Level Resume Tips for Risk Manager Professionals

A well-crafted resume is crucial for Risk Manager professionals, as it serves as the first point of contact with potential employers and plays a significant role in shaping their initial impression. In the competitive field of risk management, it is essential that your resume not only highlights your skills but also showcases your achievements in a way that resonates with hiring managers. A strong resume can effectively communicate your ability to identify, assess, and mitigate risks, thereby setting you apart from other candidates. This guide will provide practical and actionable resume tips specifically tailored for Risk Manager professionals, ensuring you present your best self to prospective employers.

Top Resume Tips for Risk Manager Professionals

- Tailor your resume to align with the job description, emphasizing relevant skills and experiences that match the requirements.

- Showcase your experience in risk assessment and management by detailing specific projects or initiatives you've led.

- Quantify your achievements using metrics, such as percentage reductions in risk exposure or successful implementation of risk mitigation strategies.

- Highlight industry-specific skills, such as knowledge of regulatory compliance, risk modeling, or crisis management.

- Include relevant certifications, such as Certified Risk Manager (CRM) or Financial Risk Manager (FRM), to demonstrate your expertise.

- Utilize action verbs to convey your contributions effectively, such as "analyzed," "developed," or "implemented."

- Incorporate a professional summary that succinctly outlines your strengths and what you bring to the table as a Risk Manager.

- Consider adding a section for technical skills, listing software or tools you're proficient in, such as risk management software or data analysis tools.

- Keep your resume concise and focused, ideally one page, to ensure that it captures the attention of hiring managers quickly.

By implementing these tips, Risk Manager professionals can significantly enhance their resumes, making them more appealing to hiring managers and increasing their chances of landing a job in this dynamic field. A polished resume that effectively showcases your skills and achievements can set the stage for successful interviews and career advancement.

Why Resume Headlines & Titles are Important for Risk Manager

In the competitive landscape of risk management, a well-crafted resume headline or title is crucial for making a strong first impression. This brief yet powerful phrase serves as a summary of a candidate's key qualifications and expertise, instantly capturing the attention of hiring managers. A compelling headline not only highlights relevant skills and experiences but also sets the tone for the rest of the resume. It should be concise, directly related to the job being applied for, and convey a sense of professionalism and competence that resonates with potential employers.

Best Practices for Crafting Resume Headlines for Risk Manager

- Keep it concise: Aim for one impactful phrase, ideally under 10 words.

- Be specific: Use terminology and keywords relevant to the risk management field.

- Highlight key strengths: Focus on your top skills or achievements that align with the job description.

- Use action-oriented language: Choose strong verbs that convey your capabilities.

- Tailor your headline: Customize the headline for each position to reflect the specific requirements of the job.

- Include certifications or credentials: If applicable, mention any relevant certifications that enhance your qualifications.

- Avoid jargon: While industry-specific terms are essential, ensure your headline is understandable to a broader audience.

- Showcase achievements: Whenever possible, incorporate quantifiable successes to demonstrate your impact.

Example Resume Headlines for Risk Manager

Strong Resume Headlines

Dynamic Risk Manager with 10+ Years of Experience in Financial Services

Certified Risk Management Professional Specialized in Regulatory Compliance

Results-Driven Risk Manager with Proven Track Record in Risk Mitigation

Strategic Risk Management Leader Focused on Operational Excellence

Weak Resume Headlines

Risk Manager Looking for Opportunities

Experienced Professional in Risk Management

The strong headlines are effective because they immediately communicate specific expertise and qualifications that align with the needs of hiring managers. They contain relevant details that speak to the candidate's experience and achievements, making them memorable and impactful. In contrast, the weak headlines lack specificity and fail to convey any unique strengths or accomplishments, making them forgettable and less likely to catch the attention of recruiters. A well-crafted headline can set a candidate apart in a crowded job market, while a generic title may leave them overlooked.

Writing an Exceptional Risk Manager Resume Summary

A well-crafted resume summary is crucial for a Risk Manager, as it serves as the first impression that captures the attention of hiring managers. This brief yet powerful introduction highlights the candidate's key skills, relevant experience, and notable accomplishments, directly aligning with the requirements of the job. A strong summary should be concise and impactful, tailored specifically to the job being applied for, ensuring that it stands out in a competitive job market.

Best Practices for Writing a Risk Manager Resume Summary

- Quantify achievements: Use specific numbers and metrics to showcase your impact in previous roles.

- Focus on key skills: Highlight the most relevant skills that match the job description.

- Tailor the summary: Customize your summary for each application to reflect the specific requirements of the position.

- Emphasize relevant experience: Include your background in risk assessment, management, and strategic planning.

- Use action verbs: Start sentences with strong action verbs to convey decisiveness and leadership.

- Keep it concise: Aim for 3-5 sentences that clearly articulate your value without excessive detail.

- Showcase industry knowledge: Mention familiarity with regulations, compliance, and industry standards to demonstrate expertise.

- Highlight soft skills: Include attributes like communication, problem-solving, and analytical thinking, which are critical for a Risk Manager.

Example Risk Manager Resume Summaries

Strong Resume Summaries

Dynamic Risk Manager with over 10 years of experience in identifying and mitigating operational risks, resulting in a 30% reduction in potential losses. Proven track record in developing risk management frameworks that comply with regulatory standards and enhance organizational efficiency.

Results-oriented Risk Manager with expertise in financial risk assessment and mitigation strategies, having successfully led projects that saved over $1 million in potential losses annually. Skilled in stakeholder engagement and regulatory compliance.

Accomplished Risk Manager with a robust background in cybersecurity risk management, leading initiatives that reduced vulnerabilities by 40% within two years. Strong analytical skills complemented by a proactive approach to risk identification and management.

Weak Resume Summaries

Experienced professional with knowledge in risk management and related fields. I have worked in various environments and can handle different challenges.

Risk Manager with some experience in assessing risks. I am looking for a new opportunity to further my career in this area.

The strong resume summaries are effective because they provide specific achievements, quantifiable outcomes, and relevant skills that directly relate to the Risk Manager role. They present a clear picture of the candidate's capabilities and contributions. In contrast, the weak summaries lack specificity, fail to quantify results, and appear generic, making it difficult for hiring managers to gauge the candidate's true potential and fit for the role.

Work Experience Section for Risk Manager Resume

The work experience section of a Risk Manager resume is crucial as it serves as a platform to showcase the candidate's technical skills, management capabilities, and the ability to deliver high-quality results. This section not only outlines past job responsibilities but also highlights how those experiences align with industry standards. By quantifying achievements and demonstrating relevant expertise, candidates can effectively convey their value to prospective employers. A well-crafted work experience section helps to establish credibility and illustrates the candidate's potential impact within the organization.

Best Practices for Risk Manager Work Experience

- Use specific metrics to quantify achievements (e.g., reduced risks by 30%, managed a team of 10).

- Highlight technical skills relevant to risk management, such as data analysis, compliance, and financial modeling.

- Showcase leadership abilities by detailing team management experiences and project oversight.

- Align experiences with industry standards and practices to demonstrate knowledge of current trends.

- Include collaborative efforts with cross-functional teams to exhibit teamwork and communication skills.

- Use action verbs to convey a proactive approach in previous roles (e.g., developed, implemented, optimized).

- Focus on results and outcomes rather than just duties performed to emphasize impact.

- Tailor experiences to the job description, ensuring relevance to the prospective employer's needs.

Example Work Experiences for Risk Manager

Strong Experiences

- Led a cross-functional team in the implementation of a risk assessment framework that identified and mitigated 40% of potential compliance issues within the first year.

- Developed a data analytics tool that improved risk forecasting accuracy by 25%, resulting in more informed decision-making and resource allocation.

- Managed a portfolio of projects with a total budget of $2 million, successfully delivering all on time and within scope while reducing overall risk exposure by 30%.

- Facilitated workshops with senior management to enhance risk awareness across the organization, leading to a 15% increase in employee compliance with risk policies.

Weak Experiences

- Responsible for overseeing risk management activities at the company.

- Worked with various teams to address risk-related issues.

- Assisted in developing risk policies and procedures.

- Participated in meetings to discuss risk management strategies.

The examples categorized as strong experiences demonstrate clear, quantifiable outcomes and specific technical leadership, showcasing the candidate's direct impact on the organization. In contrast, the weak experiences are vague and lack measurable results, failing to convey the candidate's contributions or expertise in risk management. This highlights the importance of specificity and quantification when detailing work experience on a resume.

Education and Certifications Section for Risk Manager Resume

The education and certifications section of a Risk Manager resume is crucial for establishing the candidate's academic foundation and professional credibility in the field of risk management. This section not only highlights the candidate's relevant degree(s) but also showcases any industry-recognized certifications and specialized training that demonstrate a commitment to continuous learning and professional development. By providing pertinent coursework and certifications, candidates can significantly enhance their appeal to potential employers, aligning their qualifications with the demands of the role and underscoring their expertise in managing risks effectively.

Best Practices for Risk Manager Education and Certifications

- Focus on relevant degrees, such as a Bachelor’s or Master’s in Risk Management, Finance, or Business Administration.

- Highlight industry-recognized certifications, such as Certified Risk Manager (CRM) or Project Management Professional (PMP).

- Include specialized training or workshops that enhance risk management skills, such as crisis management or compliance training.

- Provide details on relevant coursework that demonstrates knowledge in areas like financial analysis, risk assessment, and regulatory frameworks.

- Keep the section concise but informative, ensuring clarity in educational achievements and certifications.

- Prioritize recent and relevant credentials to ensure alignment with the current industry standards and practices.

- Use clear formatting and bullet points for easy readability, making it simple for hiring managers to skim through qualifications.

- Consider including ongoing education efforts, such as online courses or seminars, to showcase a commitment to staying updated in the field.

Example Education and Certifications for Risk Manager

Strong Examples

- Bachelor of Science in Risk Management, University of XYZ, 2020

- Certified Risk Manager (CRM), Risk Management Society, 2021

- Master of Business Administration (MBA) with a focus on Financial Risk Management, ABC University, 2022

- Advanced Risk Assessment Training, National Institute of Risk Management, 2023

Weak Examples

- Bachelor of Arts in History, University of ABC, 2015

- Certification in Basic First Aid, Red Cross, 2019

- Online Course in Microsoft Excel, Coursera, 2020

- High School Diploma, XYZ High School, 2010

The examples presented illustrate a clear distinction between strong and weak educational qualifications. Strong examples are directly relevant to the field of risk management, showcasing degrees and certifications that enhance the candidate's expertise and employability. In contrast, weak examples highlight qualifications that are either outdated or unrelated to the position, such as a degree in a non-related field or certifications that do not pertain to risk management, thereby diminishing the candidate's suitability for the role.

Top Skills & Keywords for Risk Manager Resume

A well-crafted resume for a Risk Manager position should highlight both hard and soft skills that demonstrate the candidate's ability to identify, evaluate, and mitigate risks effectively. Skills play a crucial role in showcasing a professional's qualifications and expertise in the field of risk management. Employers look for individuals who not only possess technical knowledge but also exhibit strong interpersonal abilities that facilitate collaboration, communication, and decision-making. By strategically incorporating relevant skills into their resumes, candidates can significantly enhance their chances of being noticed by hiring managers and securing interviews. For more insights on how to list these skills, check out our guide on skills and work experience.

Top Hard & Soft Skills for Risk Manager

Soft Skills

- Analytical Thinking

- Problem-Solving

- Communication Skills

- Leadership Qualities

- Attention to Detail

- Time Management

- Adaptability

- Negotiation Skills

- Team Collaboration

- Conflict Resolution

Hard Skills

- Risk Assessment Techniques

- Regulatory Compliance Knowledge

- Data Analysis and Interpretation

- Financial Acumen

- Project Management

- Risk Mitigation Strategies

- Statistical Analysis

- IT Risk Management

- Business Continuity Planning

- Insurance Knowledge

By emphasizing these skills in their resumes, Risk Managers can effectively convey their capacity to handle complex challenges and contribute positively to their organizations’ risk management strategies.

Common Mistakes to Avoid in a Risk Manager Resume

Crafting an effective resume as a Risk Manager is crucial to standing out in a competitive job market. However, many candidates inadvertently make common mistakes that can undermine their qualifications and diminish their chances of securing an interview. Understanding these pitfalls is essential for presenting a polished and professional resume that accurately reflects your skills and experiences in risk management.

Vague Job Descriptions: Providing unclear or overly general descriptions of previous roles can confuse hiring managers about your specific contributions and responsibilities.

Lack of Quantifiable Achievements: Failing to include measurable outcomes or results from your previous positions can make it difficult to gauge your impact. Use metrics to showcase your effectiveness in risk mitigation and management.

Ignoring Relevant Skills: Not tailoring your resume to highlight specific skills relevant to the job description can lead to missed opportunities. Ensure that you emphasize risk assessment, compliance, and analytical skills as per the job requirements.

Excessive Jargon: Overloading your resume with technical jargon or industry-specific language can alienate hiring managers who may not be familiar with all terms. Aim for clarity and simplicity.

Inconsistent Formatting: A messy or inconsistent format can distract from your qualifications. Use clear headings, bullet points, and a professional font to enhance readability.

Too Much Focus on Soft Skills: While interpersonal skills are important, overemphasizing them at the expense of technical skills and relevant experience can weaken your resume. Balance is key.

Neglecting Professional Development: Omitting certifications, ongoing education, or relevant training can make you seem less committed to your profession. Highlight any credentials that demonstrate your dedication to staying updated in the field.

Submitting a Generic Resume: Using the same resume for every application can lead to missed opportunities. Tailor your resume for each position to reflect the specific requirements and culture of the company.

Conclusion

As a Risk Manager, your role is crucial in identifying, analyzing, and mitigating risks that could potentially impact your organization. Throughout this article, we've explored the essential skills and qualifications required for this position, including strong analytical abilities, a deep understanding of risk assessment methodologies, and excellent communication skills. We also highlighted the importance of staying updated with the latest industry regulations and best practices.

In addition, we discussed how certifications, such as the Certified Risk Manager (CRM) or Project Management Professional (PMP), can significantly enhance your credibility and career prospects. Networking within the industry and continuously seeking professional development opportunities were emphasized as key strategies for success.

To ensure you present yourself effectively in the job market, we encourage you to revisit and refine your Risk Manager resume. Highlight your relevant experiences and skills to stand out to potential employers. To assist you in this process, consider utilizing resources available at resume templates, resume builder, resume examples, and cover letter templates. These tools can help you create a polished and professional application that showcases your qualifications and readiness for the challenges ahead. Take action now to elevate your career as a Risk Manager!