Risk and Compliance Officer Core Responsibilities

A Risk and Compliance Officer plays a critical role in ensuring that an organization adheres to legal standards and internal policies. Key responsibilities include assessing risks, developing compliance programs, and collaborating across departments to implement effective strategies. The role demands strong technical knowledge, operational insight, and problem-solving skills to navigate complex regulatory environments. These competencies are essential in achieving the organization’s goals by mitigating risks and enhancing operational efficiency. A well-structured resume can effectively highlight these qualifications, showcasing the candidate's ability to contribute significantly to the organization's success.

Common Responsibilities Listed on Risk and Compliance Officer Resume

- Conduct regular risk assessments to identify vulnerabilities.

- Develop and implement compliance policies and procedures.

- Monitor adherence to regulations and internal controls.

- Provide training and guidance to staff on compliance matters.

- Prepare reports for senior management and regulatory bodies.

- Collaborate with legal and operational teams to address compliance issues.

- Investigate and resolve compliance-related incidents.

- Stay updated on industry trends and regulatory changes.

- Maintain documentation for audits and regulatory reviews.

- Evaluate third-party vendors for compliance risks.

- Assist in the development of risk mitigation strategies.

- Facilitate communication between departments regarding compliance initiatives.

High-Level Resume Tips for Risk and Compliance Officer Professionals

In today's competitive job market, a well-crafted resume is crucial for Risk and Compliance Officer professionals looking to make a lasting impression on potential employers. Your resume serves as the first glimpse into your professional capabilities, making it essential that it effectively showcases both your skills and achievements. It should not only reflect your qualifications but also demonstrate your understanding of the industry’s complexities and regulatory environments. This guide will provide practical and actionable resume tips specifically tailored for Risk and Compliance Officer professionals, ensuring that your application stands out among the rest.

Top Resume Tips for Risk and Compliance Officer Professionals

- Tailor your resume to the specific job description by using relevant keywords and phrases found in the posting.

- Highlight your experience in risk assessment, compliance audits, and regulatory reporting to demonstrate your expertise.

- Quantify your achievements by including specific metrics, such as reduced compliance violations or improved risk assessment processes.

- Include industry-specific skills such as knowledge of legal frameworks, risk management software, and data analysis tools.

- Showcase certifications relevant to the field, such as Certified Compliance & Ethics Professional (CCEP) or Certified Risk Management Professional (CRMP).

- Utilize a clean and professional format that makes it easy for hiring managers to read and navigate your resume.

- Incorporate examples of collaboration with cross-functional teams to illustrate your ability to work in multifaceted environments.

- Use action verbs to begin bullet points that describe your responsibilities and accomplishments, enhancing the impact of your statements.

- Keep your resume concise, ideally one page, ensuring only the most relevant information is included.

Implementing these tips can significantly improve your chances of landing a position in the Risk and Compliance Officer field. A well-structured resume not only highlights your qualifications but also communicates your proactive approach to compliance and risk management, setting you on the path to success in your job search.

Why Resume Headlines & Titles are Important for Risk and Compliance Officer

In the competitive field of risk and compliance, having a well-crafted resume is essential for standing out to potential employers. One of the first elements that hiring managers notice is the resume headline or title. A strong headline serves as a powerful introduction, summarizing a candidate's key qualifications in just a few impactful words. It not only captures attention but also conveys relevance to the specific role being applied for. A concise and targeted headline can set the tone for the entire resume, making it imperative for candidates to choose their words carefully to reflect their expertise in risk management and compliance.

Best Practices for Crafting Resume Headlines for Risk and Compliance Officer

- Keep it concise: Aim for a headline that is brief yet informative, ideally one to two lines.

- Be role-specific: Tailor the headline to reflect the specific position of Risk and Compliance Officer.

- Highlight key qualifications: Emphasize your most relevant skills and experiences that align with the job description.

- Use impactful language: Choose strong action verbs and definitive adjectives to convey confidence and capability.

- Avoid jargon: Ensure the language is clear and accessible to all potential readers, including HR personnel.

- Include measurable achievements: If possible, incorporate quantifiable results to demonstrate your effectiveness.

- Stay professional: Maintain a formal tone that reflects the seriousness of the role and industry.

- Update regularly: Revise your headline to match the requirements of each job application.

Example Resume Headlines for Risk and Compliance Officer

Strong Resume Headlines

Dynamic Risk and Compliance Officer with 10+ Years of Industry Experience in Regulatory Adherence

Results-Driven Compliance Specialist Focused on Risk Mitigation and Policy Implementation

Certified Risk Management Professional with a Proven Track Record in Enhancing Operational Compliance

Strategic Risk Analyst with Expertise in Developing Comprehensive Compliance Frameworks

Weak Resume Headlines

Just Another Risk and Compliance Officer

Experienced Professional in Compliance

The strong headlines are effective because they convey specific skills, experiences, and achievements that are relevant to the role of a Risk and Compliance Officer. They establish the candidate as a serious contender by providing a clear value proposition. In contrast, the weak headlines fail to impress as they lack specificity and do not highlight the candidate's unique qualifications, making them easily forgettable in a sea of applications. A compelling resume headline can make all the difference in capturing the attention of hiring managers and leading to further consideration for the position.

Writing an Exceptional Risk and Compliance Officer Resume Summary

A well-crafted resume summary is essential for a Risk and Compliance Officer, as it serves as the first impression for hiring managers. This brief yet impactful section of a resume quickly captures attention by highlighting key skills, relevant experience, and notable accomplishments that align with the demands of the role. A strong summary not only showcases the candidate's qualifications but also conveys their understanding of the specific requirements of the position they are applying for. It should be concise, engaging, and tailored to the job description, ensuring that the candidate stands out in a competitive job market.

Best Practices for Writing a Risk and Compliance Officer Resume Summary

- Quantify Achievements: Use specific numbers or percentages to demonstrate the impact of your work.

- Focus on Skills: Highlight key skills relevant to risk management and compliance, such as regulatory knowledge and analytical abilities.

- Tailor the Summary: Customize your summary for each job application, incorporating keywords from the job description.

- Be Concise: Keep your summary to 3-5 sentences, making every word count.

- Showcase Relevant Experience: Mention industries you've worked in and any specific compliance frameworks you are familiar with.

- Highlight Certifications: Include relevant certifications, such as Certified Risk Management Professional (CRMP) or Certified Compliance and Ethics Professional (CCEP).

- Use Action-Oriented Language: Begin sentences with strong action verbs to convey a sense of proactivity.

- Demonstrate Problem-Solving Skills: Mention instances where you've successfully identified and mitigated risks.

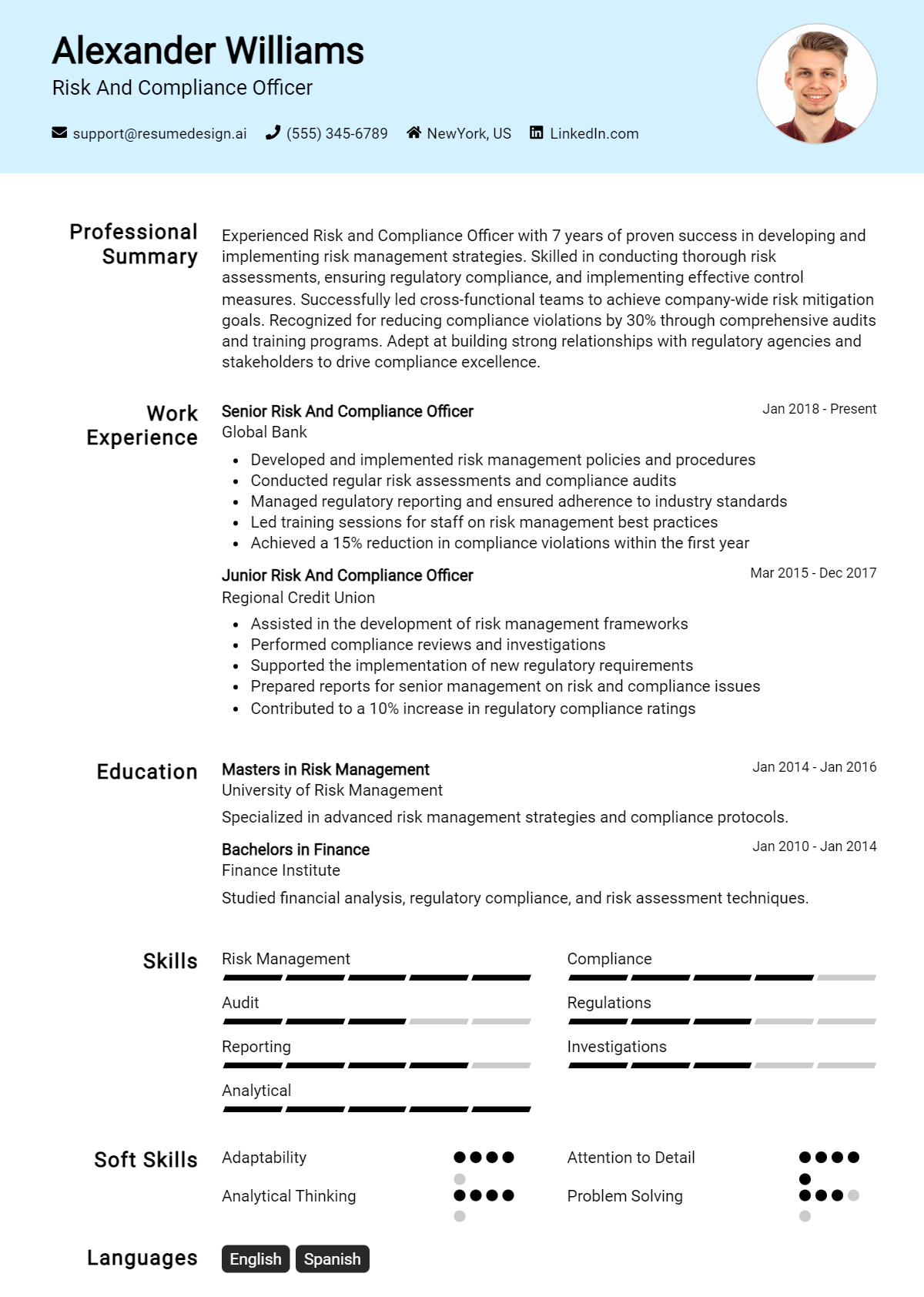

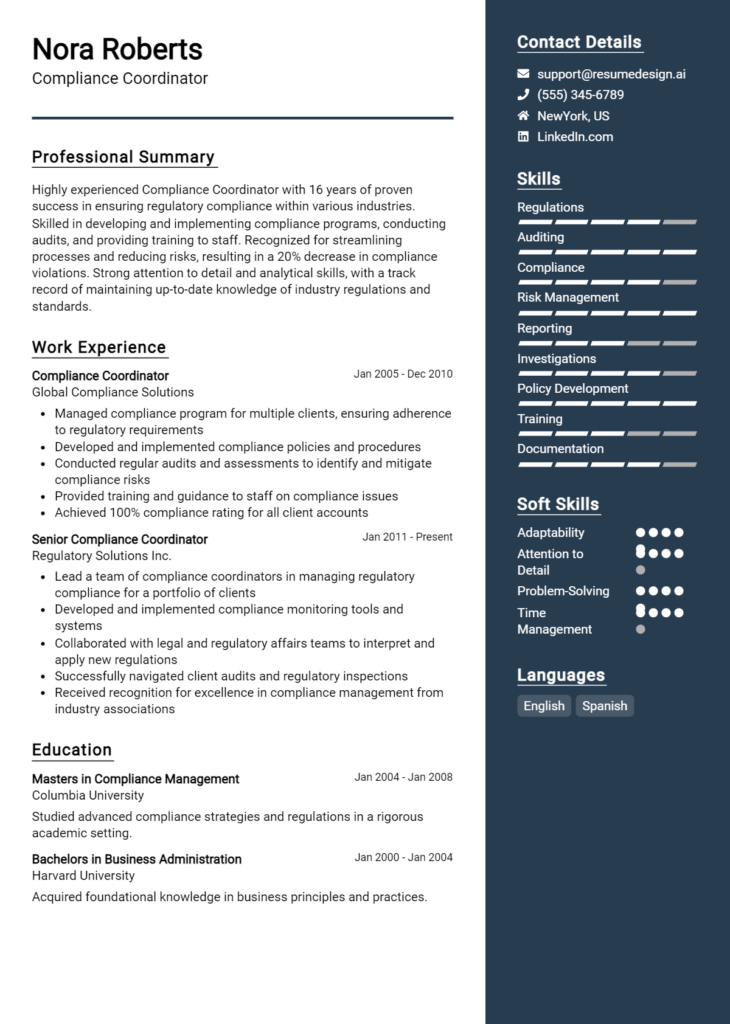

Example Risk and Compliance Officer Resume Summaries

Strong Resume Summaries

Results-driven Risk and Compliance Officer with over 8 years of experience in the financial sector, adept at developing risk assessment frameworks that reduced compliance breaches by 30%. Proven expertise in regulatory reporting and internal audits, complemented by a CRMP certification.

Dynamic professional with 10 years of experience in risk management, skilled in implementing compliance programs that improved operational efficiency by 25%. Recognized for exceptional analytical skills and a deep understanding of GDPR and SOX regulations.

Detail-oriented Risk and Compliance Officer with a track record of enhancing risk mitigation strategies, resulting in a 40% decrease in audit findings. Holds a CCEP certification and proficient in ISO 31000 standards.

Weak Resume Summaries

Experienced risk and compliance officer looking for a new opportunity in a challenging environment.

Compliance officer with knowledge of various regulations and a strong interest in risk management.

The strong resume summaries are considered effective because they include quantifiable outcomes, specific skills relevant to the role, and demonstrate a clear understanding of the compliance landscape. They provide hiring managers with concrete evidence of the candidate's capabilities and achievements. Conversely, the weak summaries lack detail and specificity, making them vague and less impactful. They do not convey any measurable success or demonstrate the candidate's unique qualifications, which can hinder their chances of standing out in the hiring process.

Work Experience Section for Risk and Compliance Officer Resume

The work experience section of a Risk and Compliance Officer resume is crucial as it serves as a demonstration of the candidate's technical skills and their ability to effectively manage teams while delivering high-quality compliance products. This section not only highlights specific roles and responsibilities but also emphasizes achievements that align with industry standards. By quantifying accomplishments and showcasing relevant experience, candidates can illustrate their impact on risk mitigation and compliance adherence, making a compelling case for their candidacy.

Best Practices for Risk and Compliance Officer Work Experience

- Focus on quantifiable results, such as percentage reductions in compliance breaches.

- Highlight specific technical skills relevant to risk management and compliance frameworks.

- Use action verbs to convey leadership and initiative in previous roles.

- Include relevant certifications or training that enhance your credibility.

- Emphasize collaboration with cross-functional teams to achieve compliance goals.

- Tailor your experiences to align with the job description and industry standards.

- Showcase any improvements you made to compliance processes or systems.

- Be concise and ensure clarity in the description of your achievements and responsibilities.

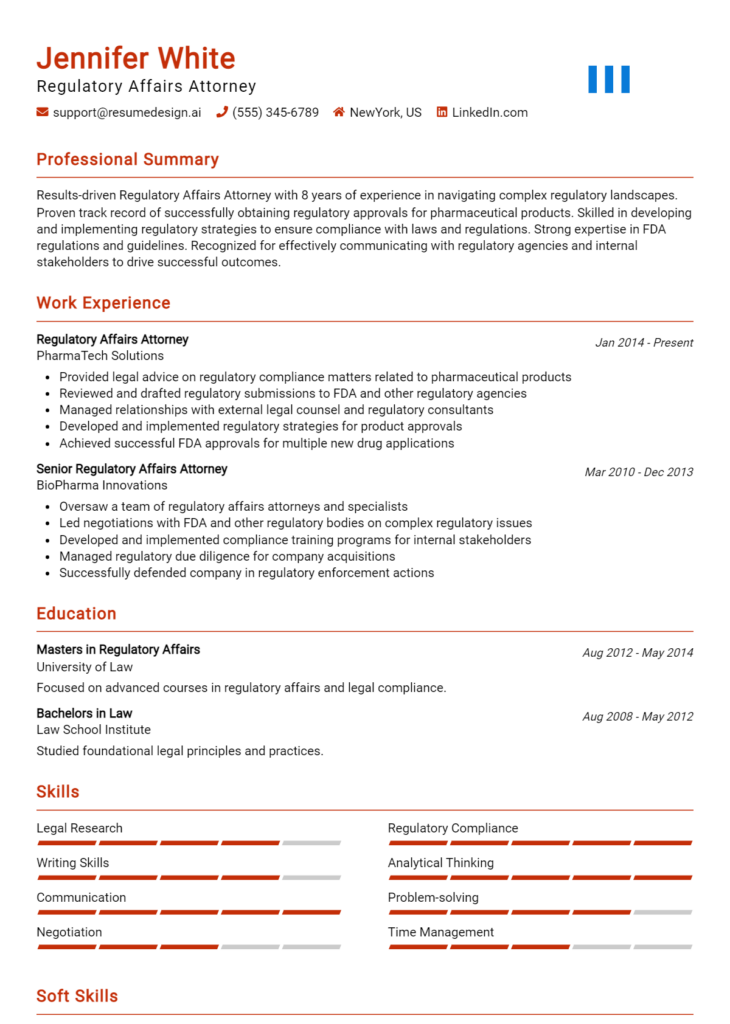

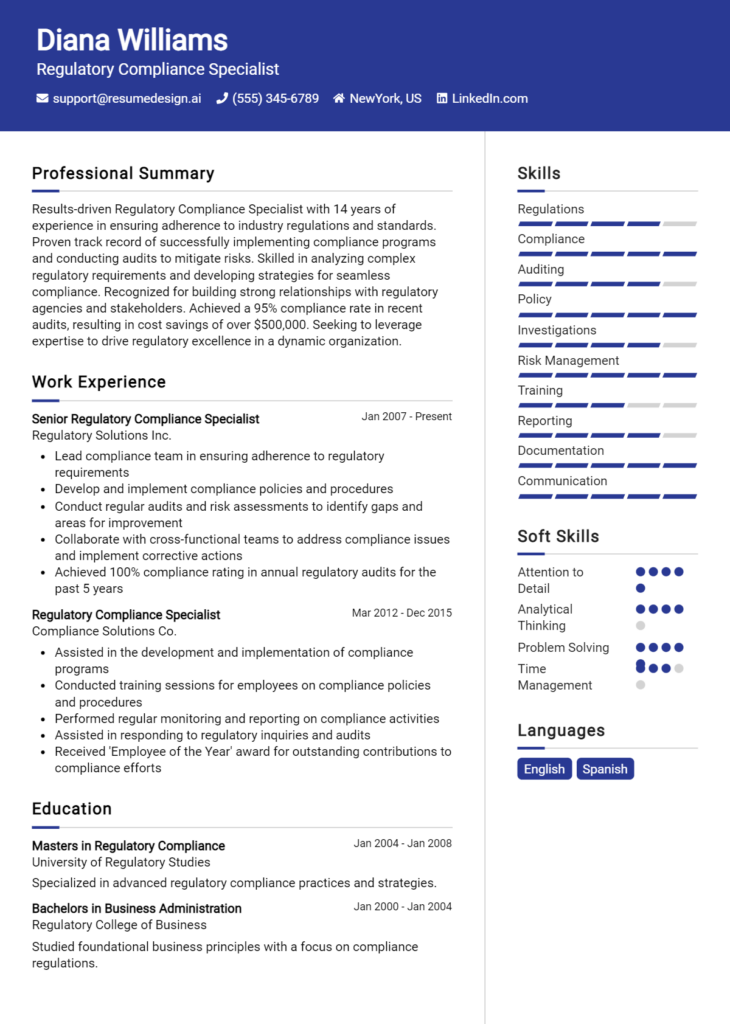

Example Work Experiences for Risk and Compliance Officer

Strong Experiences

- Led a team that reduced compliance risk incidents by 30% over two years through the implementation of a new risk assessment framework.

- Developed and executed a comprehensive training program for staff, resulting in a 40% improvement in compliance knowledge as measured by assessments.

- Collaborated with internal audit teams to streamline reporting processes, which decreased audit preparation time by 25%.

- Utilized advanced data analytics tools to identify compliance trends, leading to proactive risk mitigation strategies and a 20% reduction in regulatory fines.

Weak Experiences

- Responsible for compliance issues.

- Participated in team meetings about risk management.

- Assisted with audits and compliance reviews.

- Helped develop compliance policies.

The examples provided illustrate the difference between strong and weak work experiences. Strong experiences are characterized by specific achievements and quantifiable results that highlight the candidate's impact and technical expertise. In contrast, weak experiences lack detail and measurable outcomes, making them less compelling and failing to demonstrate the candidate's true capabilities in risk and compliance roles.

Education and Certifications Section for Risk and Compliance Officer Resume

The education and certifications section of a Risk and Compliance Officer resume is crucial for establishing the candidate's qualifications and expertise in the field. This section showcases the candidate's academic background, highlights industry-relevant certifications, and demonstrates a commitment to continuous learning and professional development. By including relevant coursework and specialized training, candidates can significantly enhance their credibility and present themselves as well-aligned with the requirements of the job role, making them more attractive to potential employers.

Best Practices for Risk and Compliance Officer Education and Certifications

- Prioritize relevant degrees such as a Bachelor's or Master's in Finance, Business Administration, or Risk Management.

- Include industry-recognized certifications such as Certified Risk Manager (CRM), Certified Compliance & Ethics Professional (CCEP), or Certified Information Systems Auditor (CISA).

- Highlight specific coursework that directly pertains to risk assessment, compliance regulations, or financial analysis.

- Showcase any specialized training programs, workshops, or seminars that pertain to risk management or compliance.

- Keep the section concise, focusing on the most recent and applicable education and certifications.

- Use clear and professional formatting to enhance readability, such as bullet points and bolding key information.

- Tailor the content to align with the specific job description and industry standards.

- Regularly update this section to reflect new qualifications and ongoing professional development activities.

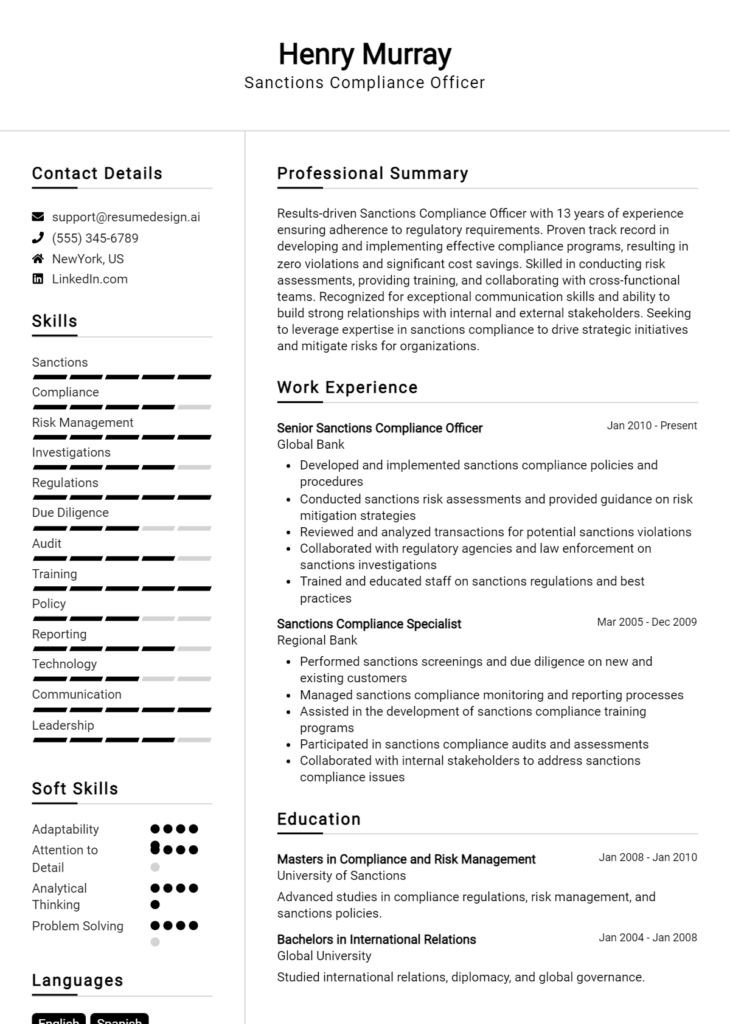

Example Education and Certifications for Risk and Compliance Officer

Strong Examples

- Bachelor of Science in Finance, XYZ University, 2018

- Certified Risk Manager (CRM), Risk Management Society, 2020

- Master of Business Administration (MBA) with a concentration in Compliance, ABC University, 2022

- Certified Compliance & Ethics Professional (CCEP), Compliance Certification Board, 2021

Weak Examples

- High School Diploma, Local High School, 2010

- Certification in Microsoft Office Suite, Online Course, 2019

- Associate Degree in General Studies, Community College, 2015

- Certification in Basic First Aid, Red Cross, 2021

The strong examples are considered effective because they directly relate to the core competencies of a Risk and Compliance Officer, showcasing relevant degrees and certifications that enhance the candidate's qualifications. In contrast, the weak examples lack specificity to the field of risk and compliance, featuring outdated or irrelevant qualifications that do not support the role's requirements. This stark contrast underscores the importance of aligning educational background and certifications with the expectations of potential employers in the industry.

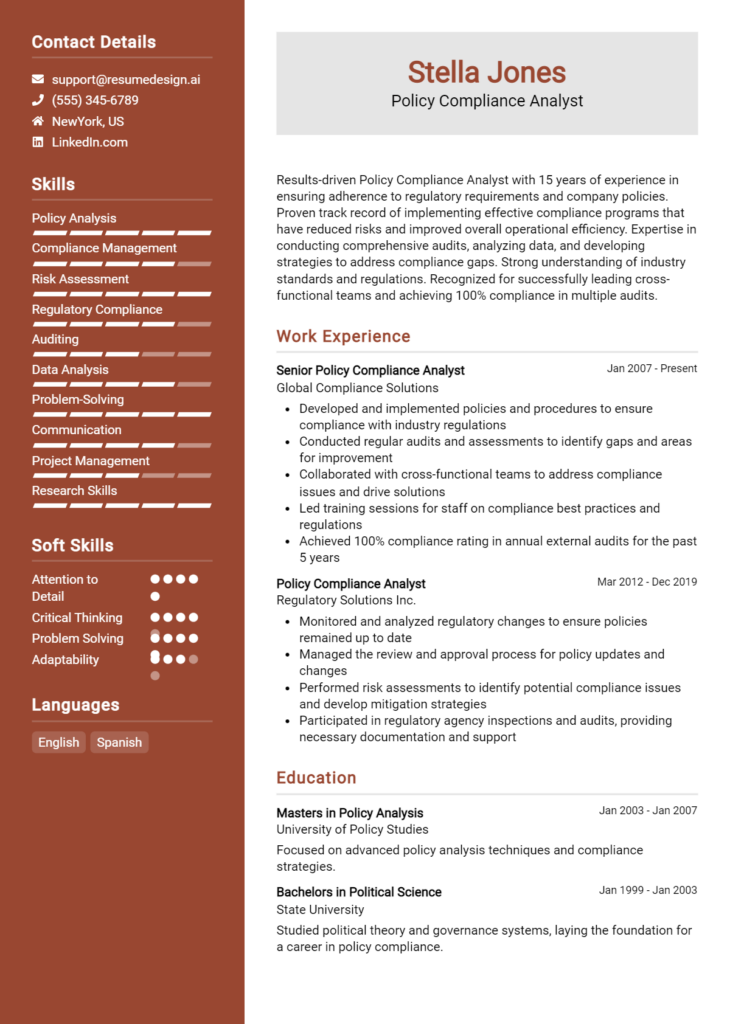

Top Skills & Keywords for Risk and Compliance Officer Resume

As a Risk and Compliance Officer, showcasing the right skills on your resume is crucial for demonstrating your ability to navigate complex regulatory environments and manage organizational risks. Employers look for candidates who possess a blend of technical expertise and interpersonal abilities to effectively oversee compliance frameworks and foster a culture of risk awareness. Highlighting your skills not only sets you apart from other applicants but also provides insight into your potential contributions to the organization. To enhance your resume, consider incorporating both hard and soft skills that align with the demands of the role.

Top Hard & Soft Skills for Risk and Compliance Officer

Soft Skills

- Analytical Thinking

- Attention to Detail

- Problem-Solving

- Strong Communication Skills

- Ethical Judgment

- Leadership Abilities

- Interpersonal Skills

- Adaptability

- Team Collaboration

- Conflict Resolution

Hard Skills

- Regulatory Knowledge (e.g., GDPR, SOX)

- Risk Assessment Techniques

- Compliance Auditing

- Data Analysis Tools (e.g., Excel, SQL)

- Policy Development

- Incident Management

- Knowledge of Industry Standards (e.g., ISO 31000)

- Financial Acumen

- Project Management

- Information Security Principles

By focusing on these skills in your resume, you can effectively convey your qualifications for the role of Risk and Compliance Officer and enhance your chances of securing an interview. Furthermore, detailing your relevant work experience alongside these skills will provide a comprehensive overview of your capabilities and achievements in the field.

Stand Out with a Winning Risk and Compliance Officer Cover Letter

I am writing to express my interest in the Risk and Compliance Officer position at [Company Name], as advertised on [Job Board/Company Website]. With a solid background in risk management and regulatory compliance, I am confident in my ability to contribute effectively to your team and help safeguard the organization against potential risks. My experience in conducting thorough risk assessments, developing compliance frameworks, and implementing robust internal controls aligns perfectly with the requirements of this role.

In my previous position at [Previous Company Name], I led a team that successfully identified and mitigated operational risks, resulting in a 30% reduction in compliance breaches over two years. I have a proven track record of collaborating with cross-functional teams to enhance the understanding of risk and compliance issues and ensure adherence to industry regulations. My analytical skills, coupled with my attention to detail, allow me to assess complex situations and develop practical solutions that not only protect the organization but also facilitate its growth.

I am particularly drawn to [Company Name] because of its commitment to ethical practices and continuous improvement in risk management. I am eager to bring my expertise in monitoring regulatory changes and implementing effective compliance strategies to your organization. I believe that staying ahead of potential risks is vital in today’s rapidly changing business environment, and I am excited about the opportunity to contribute to [Company Name]'s ongoing success in this area.

Thank you for considering my application. I look forward to the possibility of discussing how my skills and experiences align with the goals of your organization. I am enthusiastic about the opportunity to play a key role in strengthening [Company Name]'s risk and compliance framework and supporting its mission to maintain the highest standards of integrity and accountability.

Common Mistakes to Avoid in a Risk and Compliance Officer Resume

When crafting a resume for a Risk and Compliance Officer position, it's crucial to represent your qualifications accurately and effectively. While it's tempting to showcase every credential, many candidates fall into common pitfalls that can undermine their application. Avoiding these mistakes can significantly enhance your resume's chances of standing out to hiring managers and securing an interview. Here are some common missteps to be aware of:

Using Generic Language: Failing to tailor your resume to the specific job description can make it blend in with other applications. Use keywords and phrases from the job listing to demonstrate relevance.

Overloading with Jargon: While industry-specific terminology can showcase expertise, excessive jargon can alienate readers. Strive for clarity and accessibility in your language.

Neglecting Quantifiable Achievements: Stating responsibilities without highlighting measurable outcomes can diminish your impact. Use numbers and specific examples to illustrate your contributions.

Lack of Focus on Compliance Regulations: Omitting relevant compliance frameworks or regulations (like SOX, GDPR, or AML) can signal a gap in knowledge. Ensure you mention your experience with pertinent laws and standards.

Ignoring Soft Skills: Risk and compliance roles require strong interpersonal skills. Failing to highlight abilities like communication, problem-solving, and teamwork can leave your resume one-dimensional.

Inconsistent Formatting: A cluttered or inconsistent layout can detract from your professionalism. Ensure uniformity in font, bullet points, and spacing for a polished appearance.

Omitting Professional Development: Not including certifications, training, or continued education can suggest a lack of commitment to the field. Highlight any relevant credentials to showcase your dedication.

Focusing Too Much on Job Descriptions: Simply listing job duties without demonstrating how you excelled or made an impact in those roles can weaken your narrative. Instead, focus on achievements and how you added value in previous positions.

Conclusion

As a Risk and Compliance Officer, your role is crucial in safeguarding an organization from potential risks while ensuring adherence to legal standards and internal policies. Throughout this article, we explored the key responsibilities associated with this position, including identifying, assessing, and mitigating risks, developing compliance programs, and conducting regular audits. We also highlighted the importance of effective communication and collaboration with various departments to foster a culture of compliance.

In conclusion, if you're looking to advance your career in this field or secure a new position, it's essential to have a strong resume that showcases your skills and experiences effectively. We encourage you to take this opportunity to review your Risk and Compliance Officer resume, ensuring it reflects your capabilities and achievements.

To help you create an impactful resume, consider utilizing available resources such as resume templates, which provide a structured format; a resume builder, for a user-friendly experience in crafting your document; resume examples to inspire your content; and cover letter templates for a comprehensive application package. Take action today to enhance your resume and stand out in the competitive job market!