Mortgage Quality Assurance Analyst Core Responsibilities

A Mortgage Quality Assurance Analyst plays a vital role in ensuring compliance and accuracy in mortgage lending processes. Key responsibilities include reviewing loan files, conducting audits, and collaborating with underwriting, compliance, and operations teams to identify and resolve discrepancies. Essential skills encompass technical proficiency in mortgage software, operational insight, and strong problem-solving abilities. These competencies are crucial for meeting organizational goals, and a well-structured resume can effectively highlight these qualifications to prospective employers.

Common Responsibilities Listed on Mortgage Quality Assurance Analyst Resume

- Conduct thorough audits of loan files for compliance and accuracy.

- Collaborate with underwriting and operations teams to enhance processes.

- Identify and resolve discrepancies in mortgage documentation.

- Prepare detailed reports on audit findings and recommendations.

- Ensure adherence to regulatory standards and internal policies.

- Train staff on quality assurance best practices and procedures.

- Monitor industry changes to maintain updated knowledge of compliance requirements.

- Utilize mortgage software for data analysis and reporting.

- Facilitate communication between departments to ensure seamless operations.

- Assist in the development of quality assurance frameworks and strategies.

- Provide insights for continuous improvement initiatives.

High-Level Resume Tips for Mortgage Quality Assurance Analyst Professionals

In the competitive landscape of the mortgage industry, a well-crafted resume is essential for Mortgage Quality Assurance Analyst professionals seeking to make a strong first impression. Your resume serves as your initial introduction to potential employers, and it must effectively showcase both your skills and achievements in a way that aligns with the specific requirements of the role. A compelling resume not only highlights your qualifications but also demonstrates your understanding of the industry's nuances. This guide will provide practical and actionable resume tips tailored to help Mortgage Quality Assurance Analyst professionals stand out in a crowded job market.

Top Resume Tips for Mortgage Quality Assurance Analyst Professionals

- Tailor your resume for each job application by incorporating keywords from the job description.

- Highlight relevant experience in mortgage quality assurance, compliance, and auditing to demonstrate industry knowledge.

- Quantify your achievements with specific metrics, such as error reduction percentages or improved audit completion rates.

- Showcase your familiarity with industry regulations, such as TRID, RESPA, and CFPB guidelines.

- Include any relevant certifications, such as Certified Mortgage Quality Assurance Professional (CMQAP) or others specific to the mortgage industry.

- Emphasize your analytical skills and attention to detail by providing examples of how you have identified and resolved issues in the past.

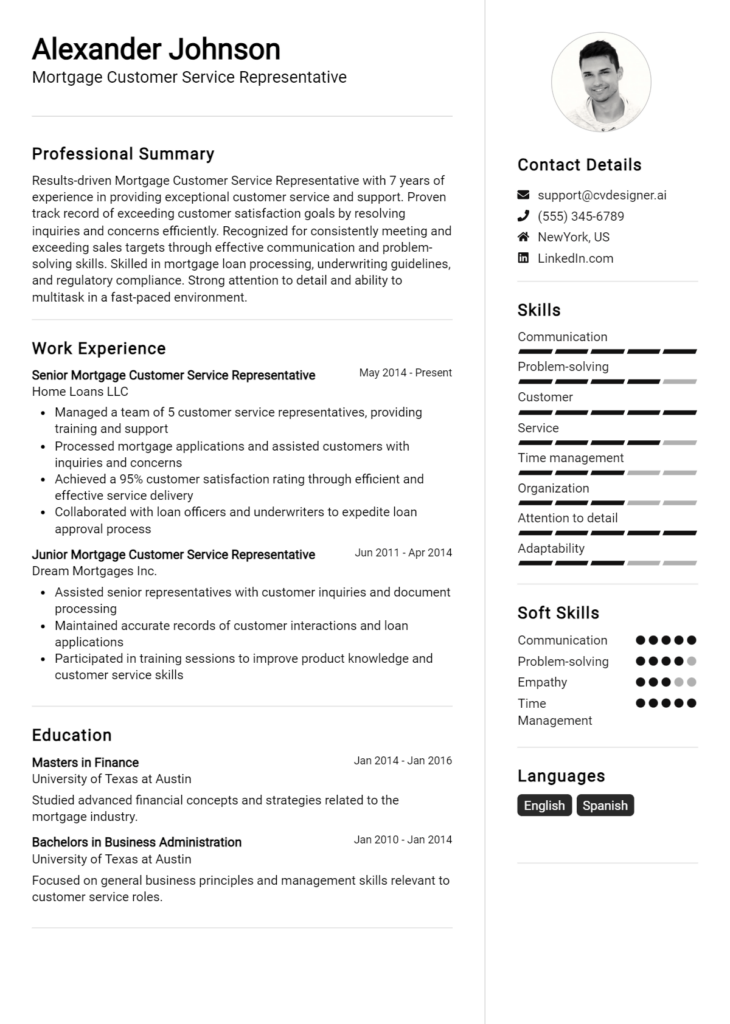

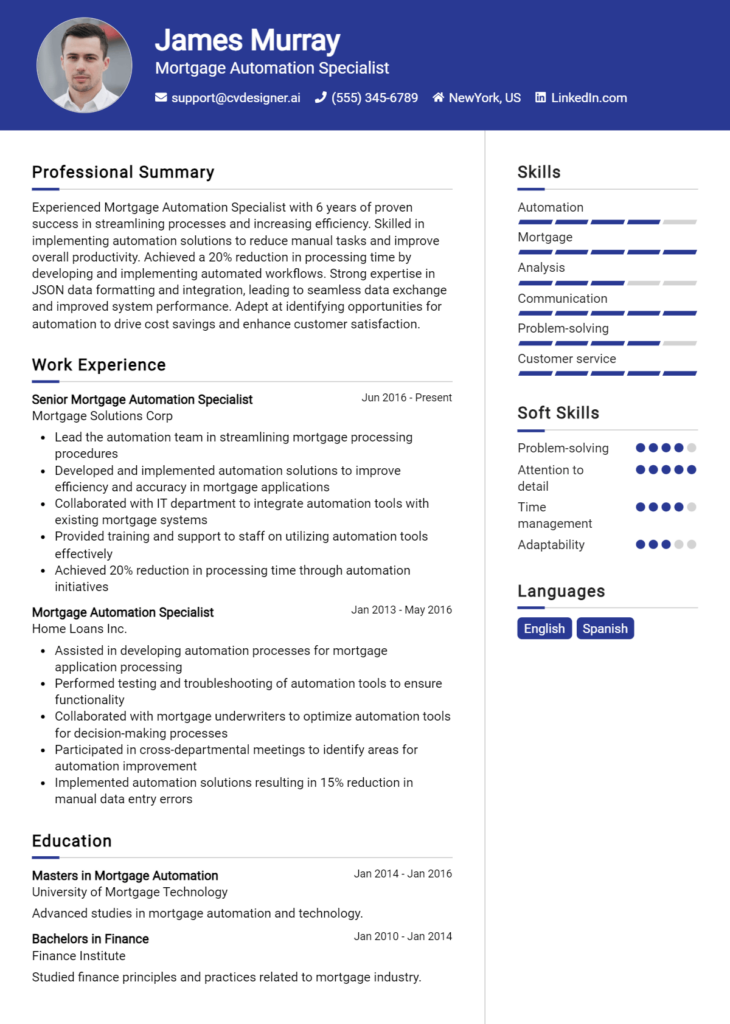

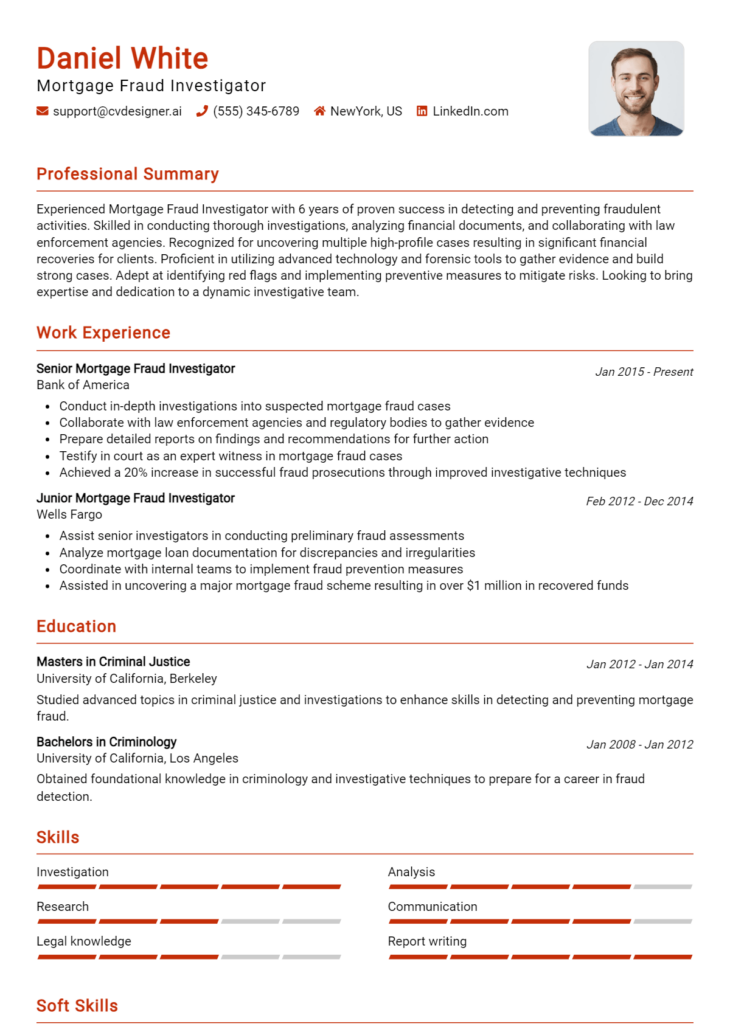

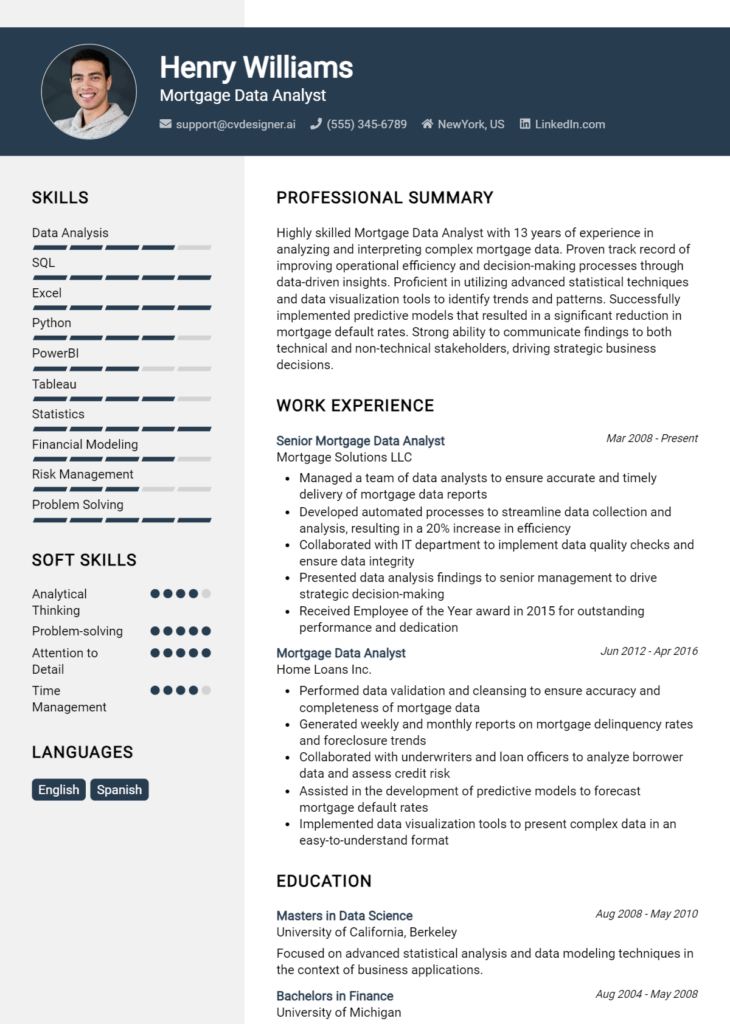

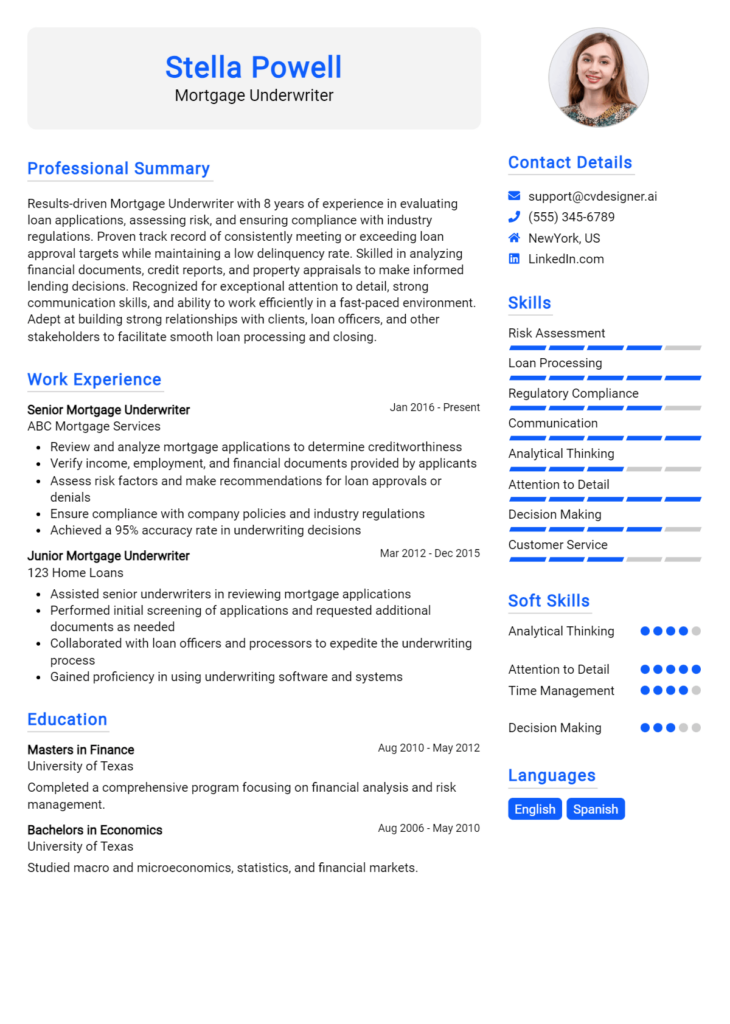

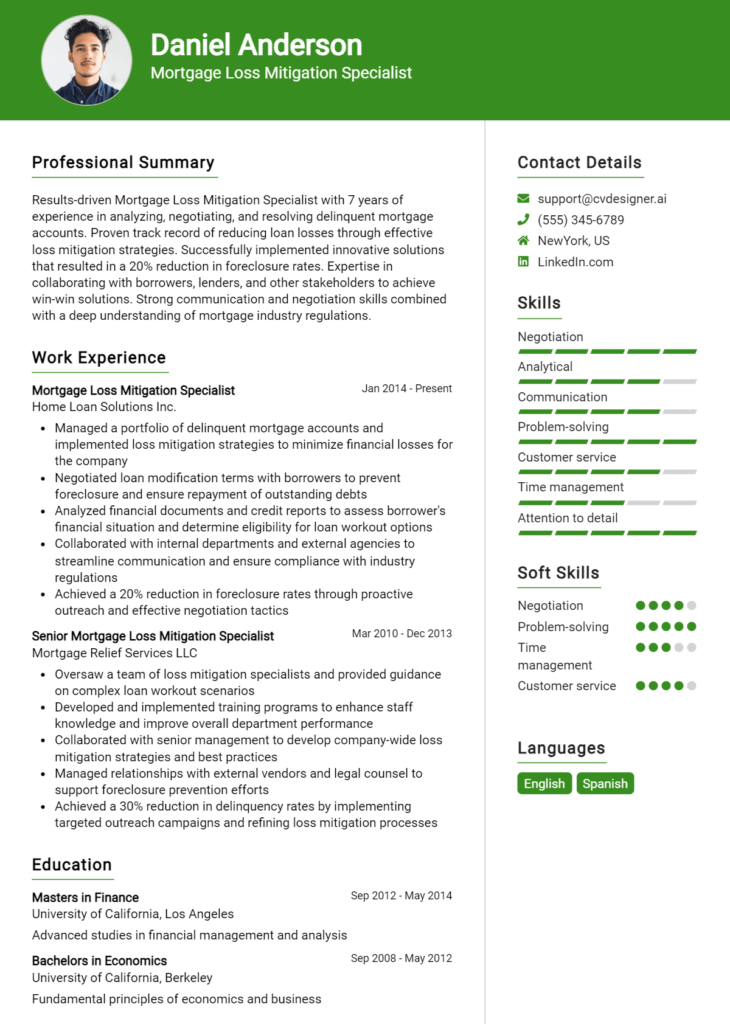

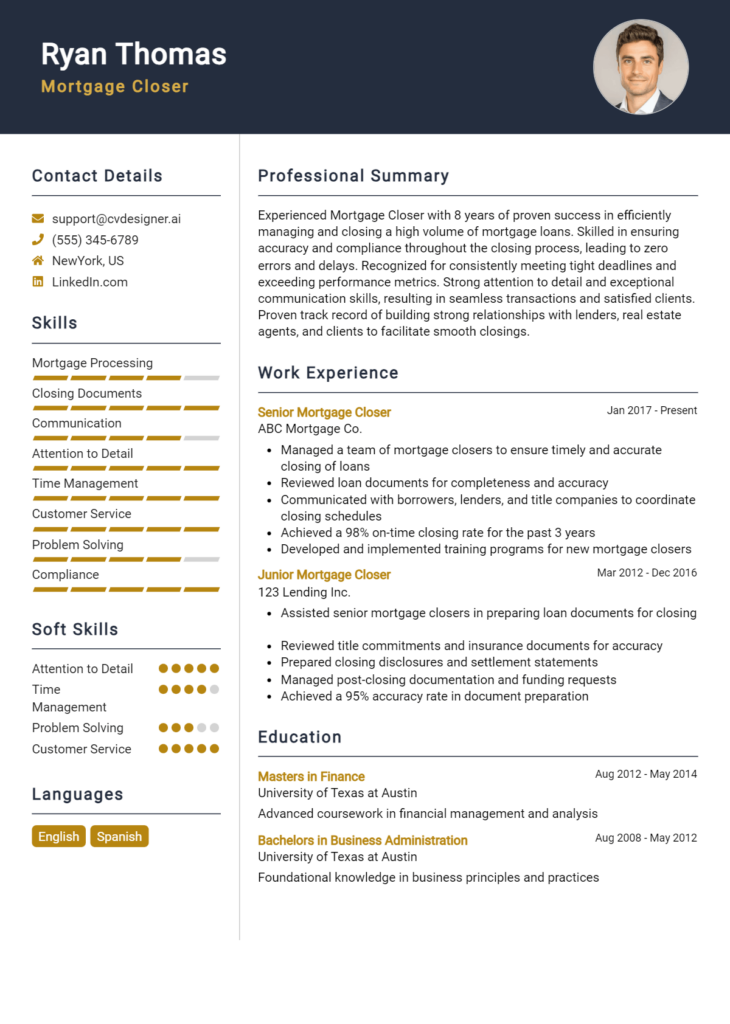

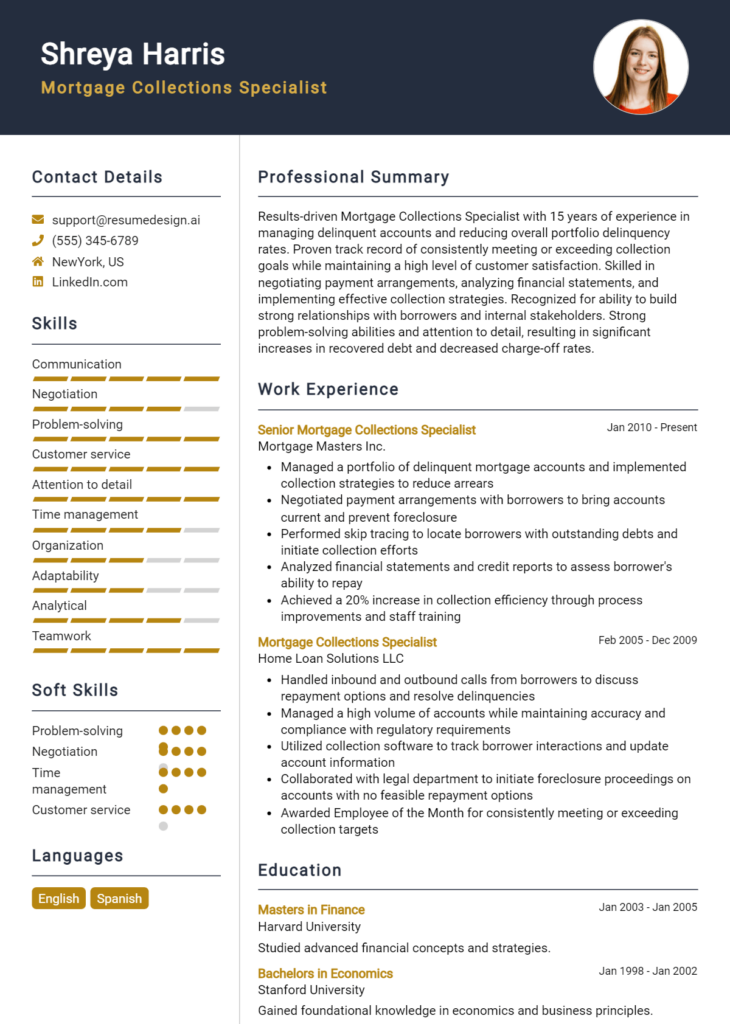

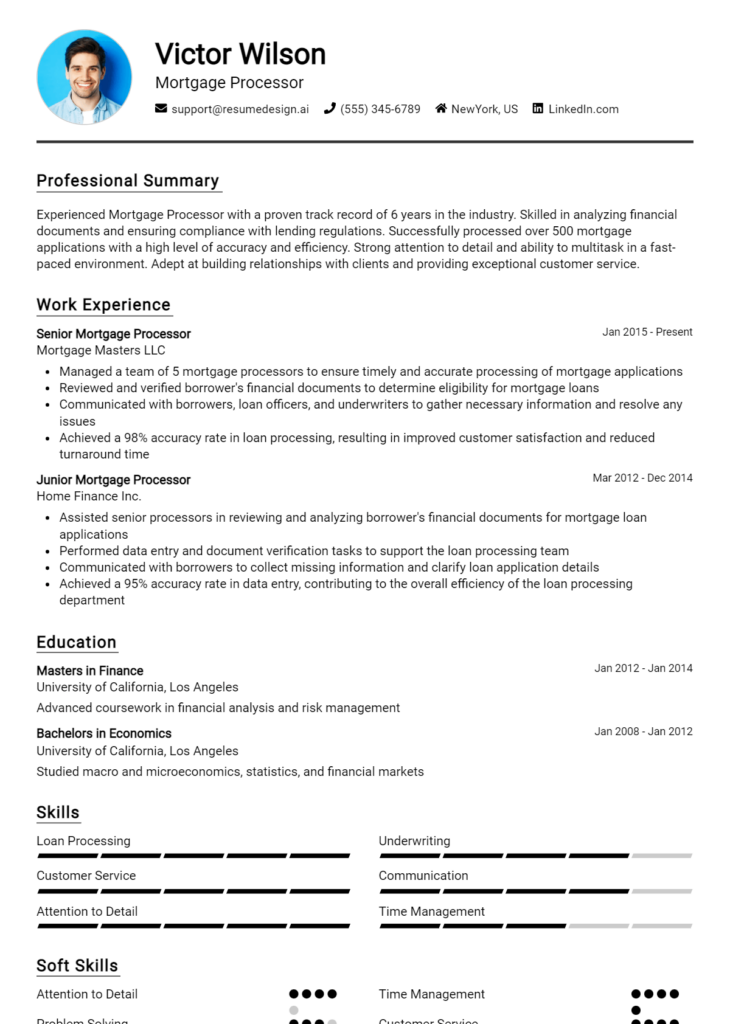

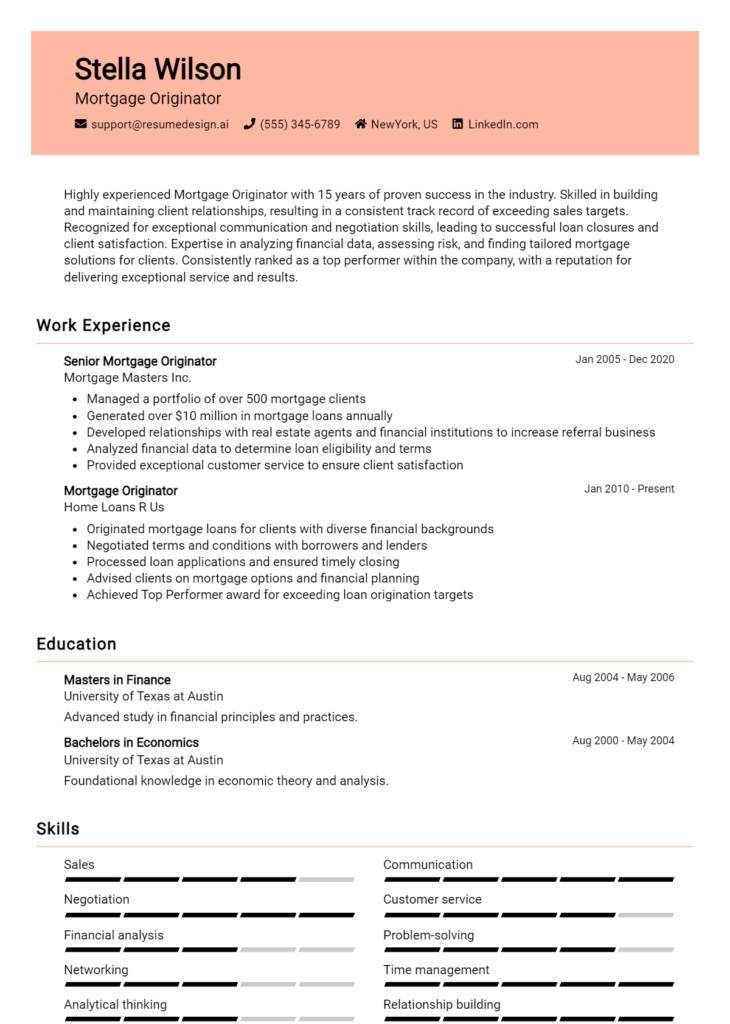

- Utilize a professional format that is easy to read, ensuring your contact information is readily accessible at the top.

- Incorporate a summary statement that captures your unique value proposition as a Mortgage Quality Assurance Analyst.

- Highlight soft skills such as communication, teamwork, and problem-solving, which are crucial in the collaborative mortgage environment.

By implementing these tips, you can significantly enhance your resume's effectiveness, increasing your chances of landing a job as a Mortgage Quality Assurance Analyst. A well-structured and targeted resume not only demonstrates your qualifications but also reflects your commitment to the role, making you a more appealing candidate to potential employers.

Why Resume Headlines & Titles are Important for Mortgage Quality Assurance Analyst

In the competitive field of mortgage quality assurance, a well-crafted resume headline or title serves as the first impression for prospective employers. It encapsulates a candidate's core qualifications and career focus in a concise manner, instantly grabbing the attention of hiring managers. A strong headline summarizes key strengths, such as relevant skills or significant achievements, effectively communicating the candidate's value proposition. This strategic element of a resume not only aids in standing out amid a sea of applicants but also sets the tone for the rest of the application, making it crucial to ensure that the headline is both relevant and impactful.

Best Practices for Crafting Resume Headlines for Mortgage Quality Assurance Analyst

- Keep it concise: Aim for one to two lines that quickly convey your expertise.

- Be specific: Use industry-related terms that directly relate to the mortgage quality assurance role.

- Highlight key skills: Include essential skills or certifications that set you apart.

- Use action verbs: Start with a strong action verb to showcase your capabilities.

- Tailor to the job: Customize your headline for each application to match the job description.

- Avoid jargon: Steer clear of overly technical language that may confuse hiring managers.

- Include measurable achievements: If possible, include specific accomplishments or metrics.

- Make it compelling: Use language that creates a sense of urgency or excitement about your candidacy.

Example Resume Headlines for Mortgage Quality Assurance Analyst

Strong Resume Headlines

Detail-Oriented Mortgage Quality Assurance Analyst with 5+ Years of Experience in Compliance and Risk Management

Proven Mortgage Quality Assurance Specialist with a Track Record of Reducing Errors by 30% Through Rigorous Auditing

Certified Mortgage Quality Assurance Analyst Skilled in Streamlining Processes and Enhancing Loan Quality

Results-Driven Mortgage Quality Assurance Expert with a Passion for Ensuring Regulatory Compliance

Weak Resume Headlines

Mortgage Analyst

Experienced Professional Seeking Job

Strong headlines are effective because they convey clear, specific information about the candidate's qualifications and area of expertise, making an immediate impact on hiring managers. They incorporate relevant skills, experience, and measurable achievements that resonate with the job requirements. In contrast, weak headlines lack specificity and relevance, failing to engage potential employers or provide a clear picture of what the candidate can bring to the role. This can result in a missed opportunity to stand out among numerous applicants.

Writing an Exceptional Mortgage Quality Assurance Analyst Resume Summary

A well-crafted resume summary is crucial for a Mortgage Quality Assurance Analyst, as it serves as the first impression for hiring managers. A strong summary quickly captures attention by succinctly showcasing key skills, relevant experience, and notable accomplishments that align with the job requirements. The goal is to create a concise and impactful statement that highlights the candidate's qualifications and sets the tone for the rest of the resume. Tailoring the summary to the specific job being applied for not only demonstrates the candidate's understanding of the role but also their commitment to the position.

Best Practices for Writing a Mortgage Quality Assurance Analyst Resume Summary

- Quantify Achievements: Use specific numbers or metrics to demonstrate the impact of your work.

- Focus on Relevant Skills: Highlight skills that are directly related to mortgage quality assurance and analysis.

- Tailor for the Job Description: Customize the summary to reflect the requirements and responsibilities mentioned in the job posting.

- Keep it Concise: Aim for 2-4 sentences that pack a punch without unnecessary fluff.

- Showcase Industry Knowledge: Mention familiarity with mortgage regulations and compliance standards.

- Highlight Problem-Solving Abilities: Emphasize your capability to identify and resolve issues swiftly.

- Incorporate Keywords: Use industry-specific language and keywords to ensure your resume passes through applicant tracking systems.

- Be Confident: Use assertive language to convey your expertise and qualifications effectively.

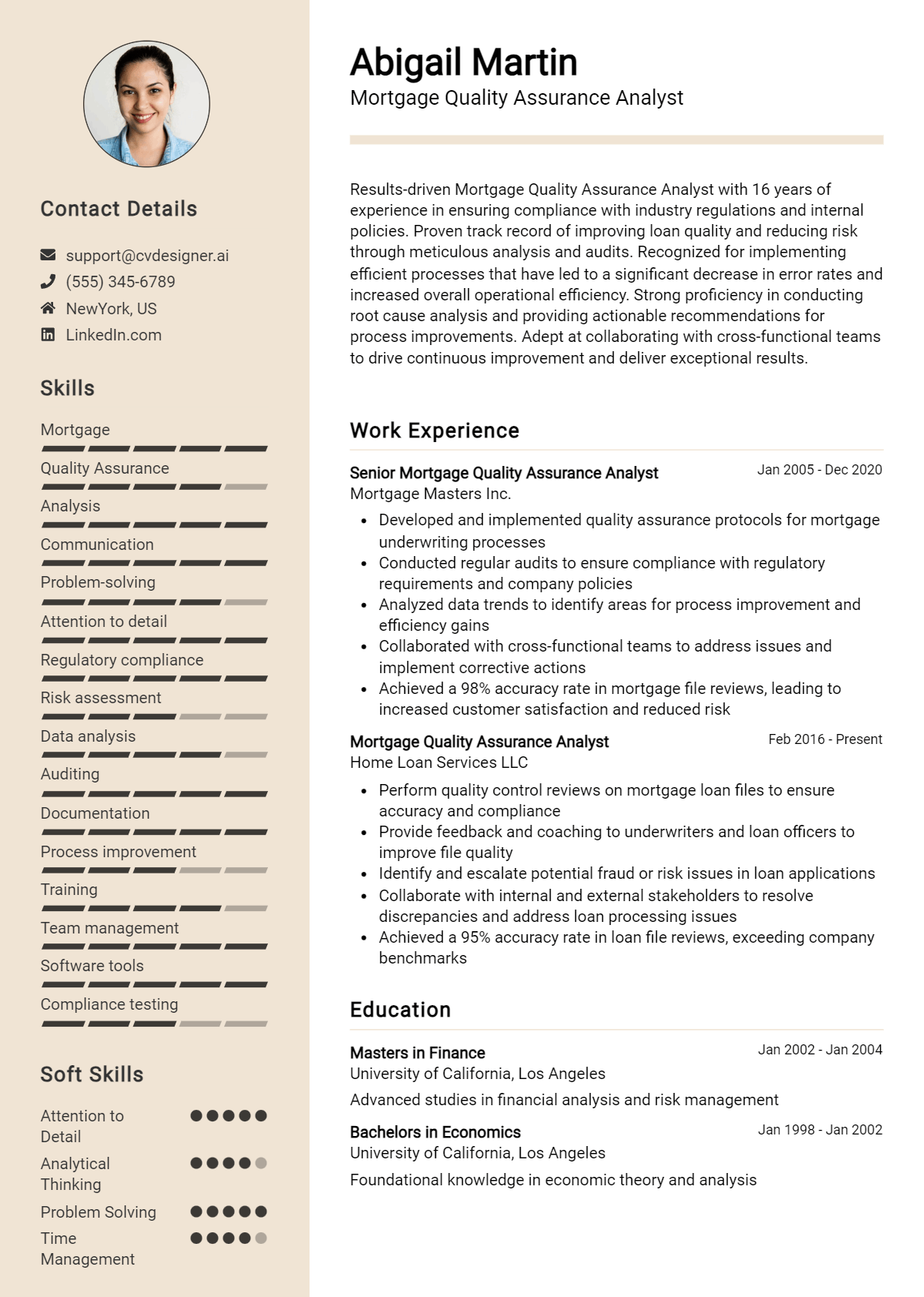

Example Mortgage Quality Assurance Analyst Resume Summaries

Strong Resume Summaries

Detail-oriented Mortgage Quality Assurance Analyst with over 5 years of experience in reviewing and auditing mortgage documents. Successfully reduced compliance errors by 30% through meticulous analysis and process improvements.

Results-driven professional with a proven track record in mortgage quality assurance, having spearheaded a project that enhanced underwriting accuracy by 25%. Expertise in regulatory compliance and risk management.

Dynamic Mortgage Quality Assurance Analyst with 7 years of experience in ensuring loan compliance and accuracy. Played a key role in implementing a new QA system that improved efficiency by 40% and reduced turnaround time.

Weak Resume Summaries

Experienced mortgage analyst with some skills in quality assurance. Looking for a job in the mortgage industry.

A motivated professional seeking a position in mortgage quality assurance. I have worked in various roles and have some knowledge of mortgage processes.

The examples above illustrate the difference between strong and weak resume summaries. Strong summaries effectively highlight specific skills, quantify achievements, and demonstrate direct relevance to the Mortgage Quality Assurance Analyst role. In contrast, weak summaries lack detail and specificity, making them generic and unmemorable. By following best practices, candidates can create impactful summaries that resonate with hiring managers and enhance their chances of landing an interview.

Work Experience Section for Mortgage Quality Assurance Analyst Resume

The work experience section of a Mortgage Quality Assurance Analyst resume is critical as it provides potential employers with insights into the candidate's practical capabilities and hands-on experience in the industry. This section highlights not only the candidate's technical skills related to mortgage quality assurance but also their ability to lead teams and ensure the delivery of high-quality products. By quantifying achievements and aligning experiences with industry standards, candidates can effectively demonstrate their value and suitability for the role, making this section a key component of a compelling resume.

Best Practices for Mortgage Quality Assurance Analyst Work Experience

- Use specific metrics to showcase improvements, such as error reduction percentages and time savings.

- Highlight relevant technical skills, including software and tools used in quality assurance processes.

- Describe leadership roles in projects or teams to emphasize collaboration and management capabilities.

- Align experience descriptions with industry standards and best practices to demonstrate familiarity with relevant regulations.

- Incorporate action verbs that convey proactive involvement and initiative taken on projects.

- Detail cross-functional collaboration efforts with other departments to enhance product quality.

- Showcase continuous improvement efforts, including training or certifications that elevate expertise.

- Be concise yet detailed to maintain clarity while ensuring all relevant experiences are communicated effectively.

Example Work Experiences for Mortgage Quality Assurance Analyst

Strong Experiences

- Led a team of five analysts in a project that reduced loan processing errors by 30%, resulting in a savings of over $100,000 annually.

- Implemented a new quality assurance software tool that improved review efficiency by 40%, enhancing overall team productivity.

- Collaborated with compliance and operations teams to develop a comprehensive training program, leading to a 25% decrease in compliance-related issues.

- Conducted a thorough analysis of existing QA processes, resulting in the redesign of the workflow that decreased review times from 10 days to 5 days.

Weak Experiences

- Worked on quality assurance tasks in various projects.

- Assisted in team efforts to improve mortgage processes.

- Helped with some compliance checks and reviews.

- Participated in meetings to discuss quality assurance issues.

The examples presented illustrate a clear distinction between strong and weak experiences. The strong experiences are characterized by specific, quantifiable outcomes that demonstrate leadership, technical expertise, and collaboration. In contrast, the weak experiences are vague and lack measurable results or concrete contributions, making it difficult for potential employers to assess the candidate's impact and value in previous roles.

Education and Certifications Section for Mortgage Quality Assurance Analyst Resume

The education and certifications section of a Mortgage Quality Assurance Analyst resume is crucial as it underscores the candidate's academic accomplishments and commitment to professional development in the mortgage industry. This section showcases relevant degrees, industry-recognized certifications, and specialized training that align with the responsibilities of a Mortgage Quality Assurance Analyst. By detailing relevant coursework and continuous learning efforts, candidates can significantly enhance their credibility and demonstrate their proficiency in ensuring compliance and quality standards within the mortgage process.

Best Practices for Mortgage Quality Assurance Analyst Education and Certifications

- List only relevant degrees and certifications that pertain to the mortgage and finance industry.

- Include the full name of certifications, the issuing organization, and the date obtained or the expiration date.

- Highlight any specialized training related to quality assurance, risk management, or regulatory compliance.

- Provide details on relevant coursework that demonstrates knowledge of mortgage regulations, underwriting, and quality control processes.

- Use bullet points to enhance readability and make it easy for hiring managers to skim through your qualifications.

- Consider including continuing education credits or workshops that reflect a commitment to staying updated in the field.

- Prioritize certifications that are highly regarded within the mortgage industry, such as those from the Mortgage Bankers Association (MBA) or the American Bankers Association (ABA).

- Be specific about your degree major or focus area if it relates directly to mortgage quality assurance.

Example Education and Certifications for Mortgage Quality Assurance Analyst

Strong Examples

- Bachelor of Science in Finance, University of XYZ, Graduated May 2020

- Certified Mortgage Quality Assurance Professional (CMQAP), Mortgage Bankers Association, Obtained June 2021

- Advanced Certificate in Mortgage Compliance, National Association of Mortgage Professionals, Completed January 2022

- Relevant Coursework: Mortgage Risk Management, Quality Control in Mortgage Lending, and Consumer Financial Protection Bureau Regulations

Weak Examples

- Associate Degree in General Studies, Community College of ABC, Graduated December 2018

- Certification in Microsoft Office Suite, Issued by XYZ Training Center, Obtained March 2019

- Bachelor of Arts in History, University of DEF, Graduated May 2017

- Outdated certification in Loan Processing (2005), no longer recognized in the industry

The strong examples are considered effective because they directly relate to the skills and knowledge required for a Mortgage Quality Assurance Analyst, showcasing relevant degrees and certifications that enhance the candidate's qualifications. In contrast, the weak examples highlight qualifications that are either unrelated to the mortgage industry or outdated, which do not provide value in demonstrating the candidate's readiness for the role.

Top Skills & Keywords for Mortgage Quality Assurance Analyst Resume

As a Mortgage Quality Assurance Analyst, possessing the right skills is crucial for ensuring compliance, accuracy, and efficiency within mortgage processes. A well-crafted resume that highlights both hard and soft skills can significantly improve your chances of landing an interview. These skills not only showcase your technical abilities but also demonstrate your capacity for critical thinking, attention to detail, and communication prowess. In a highly regulated industry like mortgage lending, these attributes are vital for maintaining high-quality standards and fostering trust with stakeholders.

Top Hard & Soft Skills for Mortgage Quality Assurance Analyst

Soft Skills

- Attention to Detail

- Analytical Thinking

- Problem Solving

- Communication Skills

- Team Collaboration

- Adaptability

- Time Management

- Critical Thinking

- Customer Service Orientation

- Conflict Resolution

- Ethical Judgment

- Initiative

Hard Skills

- Knowledge of Mortgage Regulations

- Quality Control Processes

- Data Analysis Techniques

- Risk Assessment

- Proficiency in Loan Management Software

- Microsoft Excel and Data Reporting

- Documentation Review

- Statistical Analysis

- Compliance Auditing

- Familiarity with Underwriting Guidelines

- Process Improvement Methodologies

- Technical Writing

- Financial Statement Analysis

By focusing on these skills, you can create a compelling resume that effectively communicates your qualifications. Additionally, showcasing relevant work experience will further enhance your profile, allowing potential employers to see how your skills have been applied in real-world scenarios.

Stand Out with a Winning Mortgage Quality Assurance Analyst Cover Letter

I am excited to apply for the Mortgage Quality Assurance Analyst position at [Company Name]. With a robust background in mortgage lending processes and a keen eye for detail, I am confident in my ability to contribute to your team by ensuring compliance and quality in mortgage operations. My experience in analyzing mortgage documentation, identifying discrepancies, and implementing quality assurance measures has equipped me with the skills necessary to enhance the integrity of mortgage products and protect the interests of both the company and its clients.

In my previous role at [Previous Company Name], I was responsible for conducting thorough audits of mortgage files, which involved assessing adherence to regulatory guidelines and internal policies. By collaborating closely with loan officers and compliance teams, I successfully identified and resolved potential issues before they escalated, ensuring a seamless loan process for our clients. My strong analytical capabilities allowed me to compile detailed reports that informed management decisions, leading to improved processes and a significant reduction in compliance-related errors.

I am particularly drawn to the opportunity at [Company Name] because of your commitment to innovation and excellence in the mortgage industry. I am eager to bring my proactive approach to quality assurance and my passion for delivering superior customer service to your organization. I believe that my experience in utilizing advanced quality assessment tools and methodologies will further enhance your team's ability to maintain high standards in mortgage processing.

Thank you for considering my application. I look forward to the possibility of discussing how my skills and experiences align with the goals of [Company Name]. I am enthusiastic about the chance to contribute to your team and help uphold the quality and integrity of your mortgage operations.

Common Mistakes to Avoid in a Mortgage Quality Assurance Analyst Resume

When crafting a resume for a Mortgage Quality Assurance Analyst position, it's crucial to present your skills and experiences in a clear and impactful manner. However, there are several common mistakes that candidates often make, which can detract from their qualifications and reduce their chances of landing an interview. Avoiding these pitfalls can help ensure that your resume effectively showcases your expertise in mortgage quality assurance.

Overly Generic Objective Statement: Using a vague or generic objective statement can make you seem unfocused. Tailor your objective to reflect your specific goals and the value you bring to the position.

Neglecting Relevant Skills: Failing to highlight relevant skills specific to mortgage quality assurance can undermine your application. Be sure to include skills such as data analysis, regulatory compliance, and risk assessment.

Excessive Jargon: While industry-specific terminology is important, overloading your resume with jargon can alienate hiring managers. Use clear language to describe your qualifications and experiences.

Lack of Quantifiable Achievements: Simply listing responsibilities without showcasing your accomplishments can weaken your resume. Use quantifiable metrics to demonstrate how you have improved processes or outcomes in previous roles.

Ignoring Formatting Consistency: Inconsistent formatting can make your resume look unprofessional and difficult to read. Ensure that fonts, bullet points, and headers are uniform throughout the document.

Omitting Keywords from the Job Description: Many organizations use Applicant Tracking Systems (ATS) to screen resumes. Failing to include relevant keywords from the job description can result in your resume being overlooked.

Including Irrelevant Experience: Highlighting unrelated work experience can dilute your qualifications. Focus on roles that demonstrate your expertise in mortgage quality assurance or related fields.

Spelling and Grammar Errors: Typos and grammatical mistakes can create a negative impression and suggest a lack of attention to detail. Always proofread your resume multiple times before submission.

Conclusion

As a Mortgage Quality Assurance Analyst, your role is critical in ensuring compliance and accuracy within mortgage processes. You are responsible for reviewing loans, identifying discrepancies, and implementing quality control measures. Key skills for this position include attention to detail, analytical thinking, and a solid understanding of mortgage regulations and guidelines. Additionally, effective communication skills are essential for conveying findings and recommendations to stakeholders.

In today's competitive job market, having a standout resume is crucial. It's important to highlight your relevant experience, skills, and achievements in a clear and concise manner. If you're preparing to update your resume for a Mortgage Quality Assurance Analyst position, now is the time to take action.

Explore the available resources that can help you craft a compelling resume:

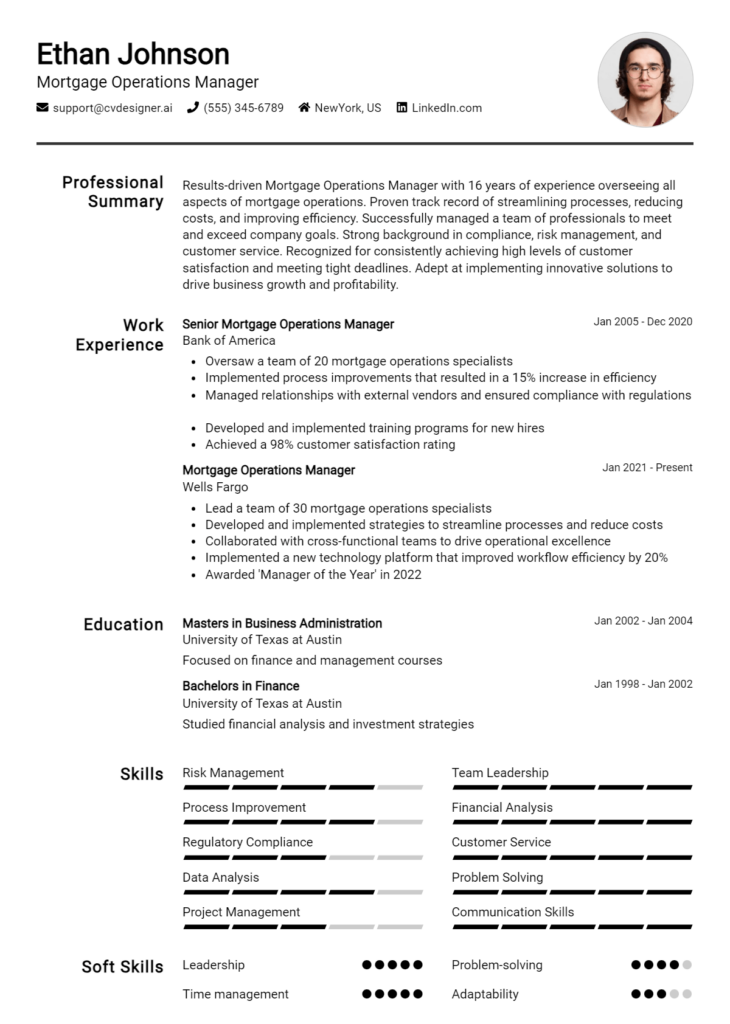

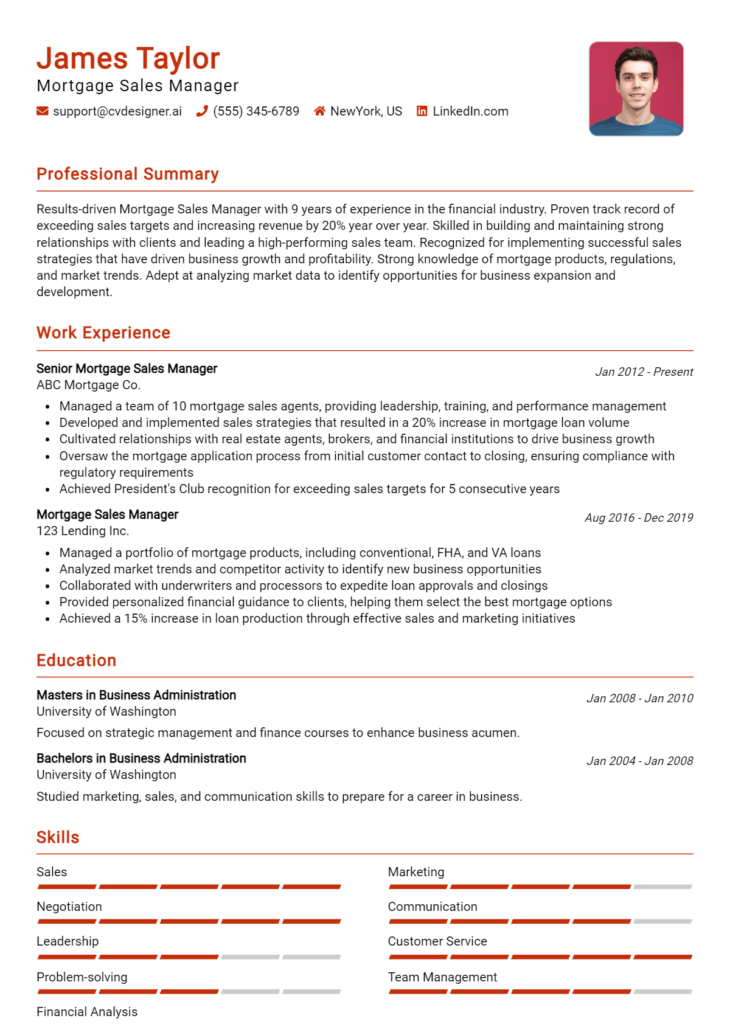

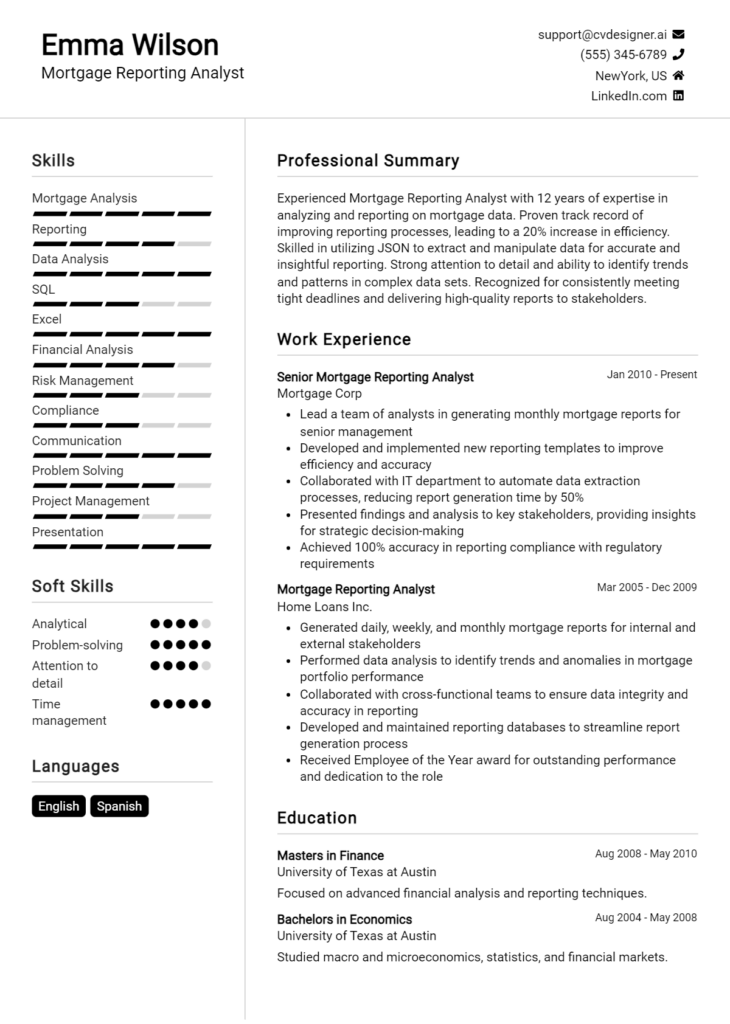

- Check out resume templates to find designs that suit your style.

- Utilize the resume builder for a guided experience in crafting your document.

- Browse resume examples for inspiration and ideas on how to present your qualifications effectively.

- Don’t forget to complement your resume with a strong application by using cover letter templates that can help you articulate your passion for the role.

Take the next step towards your career advancement by reviewing and enhancing your Mortgage Quality Assurance Analyst resume today!